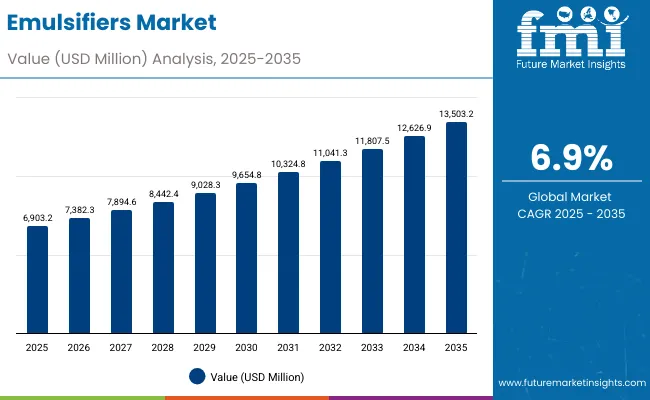

The Global Emulsifiers Market is expected to record a valuation of USD 6,903.2 million in 2025 and USD 13,503.2 million in 2035, with an increase of USD 6,600.0 million, which equals a growth of 193% over the decade. The overall expansion represents a CAGR of 6.9% and nearly a 2X increase in market size.

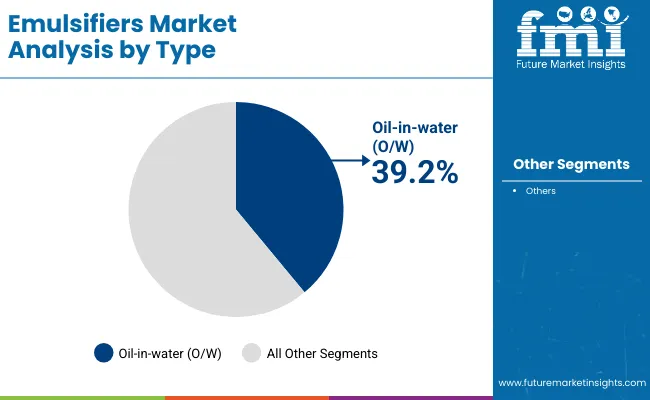

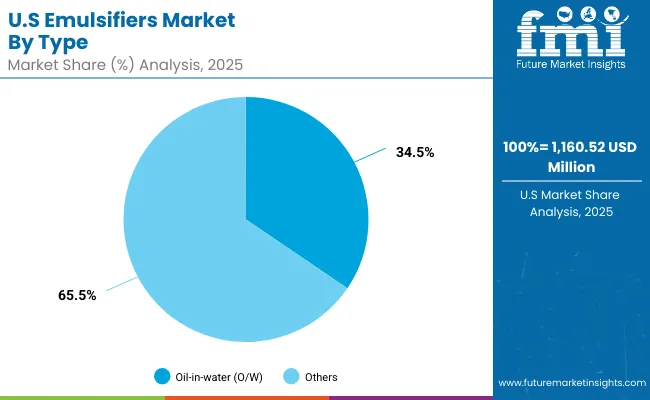

During the first five-year period from 2025 to 2030, the market increases from USD 6,903.2 million to USD 9,654.8 million, adding USD 2,751.6 million, which accounts for 41.7% of the total decade growth. This phase records steady adoption in skincare creams, hair conditioners, and sun care products, driven by consumer demand for multifunctional emulsifiers and the growing popularity of natural and PEG-free formulations. Oil-in-water emulsifiers dominate this period as they cater to over 39.2% of applications requiring stable textures, effective hydration, and long shelf-life.

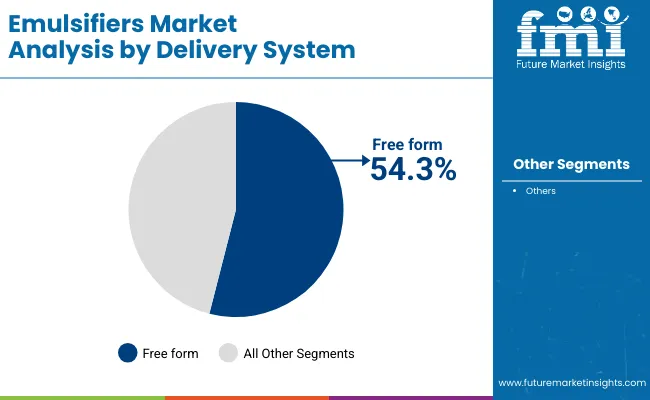

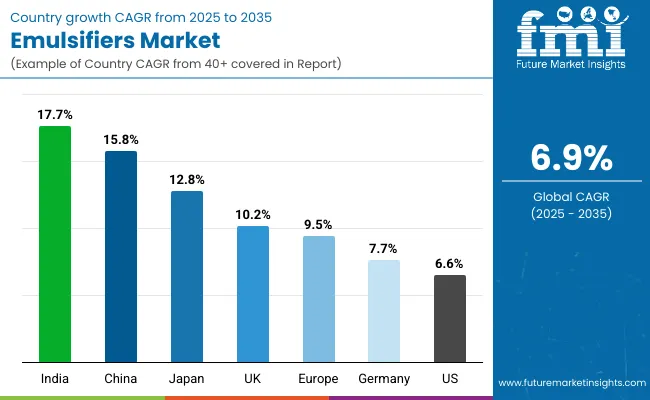

The second half from 2030 to 2035 contributes USD 3,848.4 million, equal to 58.3% of total growth, as the market jumps from USD 9,654.8 million to USD 13,503.2 million. This acceleration is powered by widespread deployment of high-performance emulsifiers in advanced pharmaceutical topical formulations and hair & scalp care. Demand for free form delivery systems, which hold 54.3% share in 2025, will be reinforced by rising adoption of bio-based solutions and encapsulated formats in premium cosmetics. East Asia and South Asia & Pacific drive much of this growth, with India (17.7% CAGR) and China (15.8% CAGR) emerging as the fastest-expanding consumer hubs.

Global Emulsifiers Market Key Takeaways

| Metric | Value |

|---|---|

| Global Emulsifiers Market Estimated Value in (2025E) | USD 6,903.2 million |

| Global Emulsifiers Market Forecast Value in (2035F) | USD 13,503.2 million |

| Forecast CAGR (2025 to 2035) | 6.90% |

From 2020 to 2024, the Global Emulsifiers Market grew steadily as demand expanded in personal care and pharmaceutical formulations. During this period, the competitive landscape was dominated by leading chemical companies controlling nearly 25-30% of revenue, with players focusing on advanced blends of synthetic and natural emulsifiers. Competitive differentiation relied on clean-label positioning, stability performance, and compatibility with multifunctional actives, while PEG-free and natural alternatives gained traction as a premium sub-category. Service-based innovations such as pre-blended and encapsulated delivery formats were in early stages, contributing less than 15% of the total market value.

Demand for emulsifiers will expand to USD 6,903.2 million in 2025, and the revenue mix will shift as natural & PEG-free products grow to over 25% share. Traditional chemistry leaders face rising competition from sustainable-focused innovators offering plant-based lecithin and polyglyceryl blends. Major global suppliers are pivoting to hybrid models, integrating encapsulation and multifunctional delivery systems to retain relevance. Emerging entrants specializing in bio-based platforms, pre-blended solutions, and pharmaceutical-grade emulsifiers are gaining share. The competitive advantage is moving away from commodity emulsification alone to ecosystem strength, sustainable sourcing, and end-use application versatility.

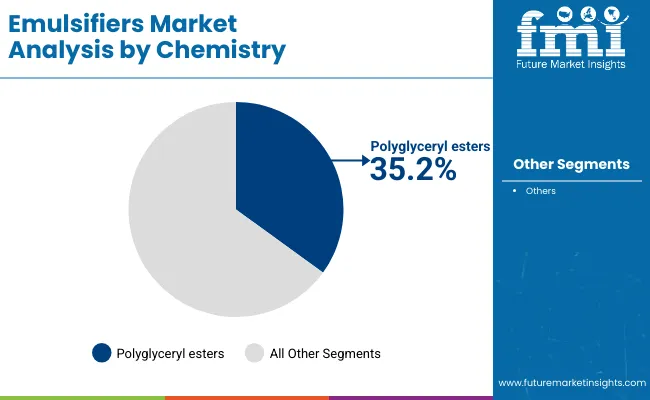

Advances in formulation science have enabled emulsifiers to deliver improved stability, enhanced sensory experience, and compatibility with active ingredients across personal care and pharmaceutical products. Oil-in-water emulsifiers have gained popularity due to their suitability for skincare creams, hair conditioners, and sun care applications. The rise of polyglyceryl esters has contributed to clean-label trends, offering biodegradable, PEG-free options with excellent safety profiles. Industries such as cosmetics, healthcare, and haircare are driving demand for emulsifiers that can deliver multifunctional benefits like hydration, texture enhancement, and active delivery.

Expansion of natural emulsifiers and encapsulated delivery systems has fueled market growth. Innovations in liquid and pre-blended emulsifier formats and growing adoption of bio-based chemistry are expected to open new opportunities. Segment growth is expected to be led by oil-in-water type emulsifiers, polyglyceryl esters in chemistry, and free form systems in delivery categories, due to their broad versatility and adaptability across consumer and therapeutic applications.

The market is segmented by type, chemistry, delivery system, physical form, application, end use, and region. Types include oil-in-water (O/W), water-in-oil (W/O), cold-process, and natural & PEG-free, highlighting the diversity in formulation requirements. Chemistry classification covers lecithin-based, fatty acid esters, polyglyceryl esters, and sucrose esters, with polyglyceryl esters dominating due to their sustainability and consumer acceptance. Based on delivery system, the segmentation includes free form, pre-blended, and encapsulated emulsifiers to cater to flexibility in end-use industries. In terms of physical form, categories encompass liquid, powder, and pellets for varied application needs. Applications include skincare creams & lotions, hair conditioners, color cosmetics, and sun care, which collectively account for the majority of personal care demand. End-use industries include personal care, pharmaceutical topical, and hair & scalp care. Regionally, the scope spans North America, Europe, East Asia, South Asia & Pacific, Latin America, and the Middle East & Africa.

| Type | Value Share % 2025 |

|---|---|

| Oil-in-water (O/W) | 39.2% |

| Others | 60.8% |

The oil-in-water (O/W) segment is projected to contribute 39.2% of the Global Emulsifiers Market revenue in 2025, making it the largest type category. This dominance is attributed to its extensive use in skincare creams, lotions, and pharmaceutical topical products where water is the continuous phase. O/W emulsifiers provide excellent hydration, quick absorption, and smooth texture, which makes them indispensable in premium cosmetic formulations.

Growth is also supported by consumer preference for lighter, non-greasy products that deliver enhanced sensory benefits. These emulsifiers are widely adaptable, allowing formulators to integrate actives such as vitamins and botanicals without compromising stability. Their versatility extends to sun care and haircare, where they improve spreadability and performance under diverse conditions.

With the expansion of clean-label and PEG-free trends, O/W emulsifiers are being increasingly formulated with natural and sustainable ingredients. Their balance of performance, safety, and consumer acceptance ensures that O/W will remain the backbone of the type segment throughout the forecast period.

| Chemistry | Value Share % 2025 |

|---|---|

| Polyglyceryl esters | 35.2% |

| Others | 64.8% |

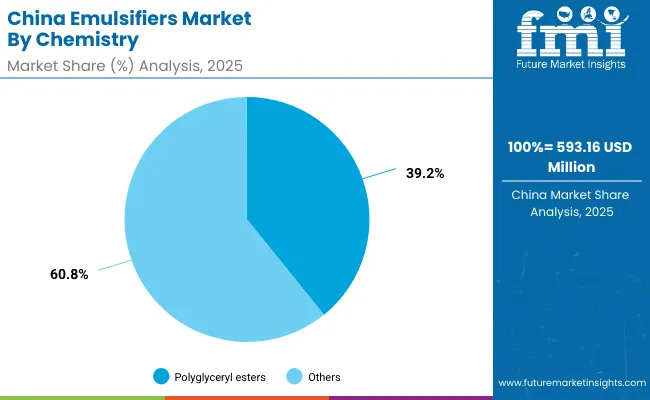

The polyglyceryl esters segment is projected to account for 35.2% of the Global Emulsifiers Market in 2025, making it the leading chemistry category. Their rise is fueled by the increasing demand for natural, biodegradable, and PEG-free emulsifiers that align with global sustainability goals. These esters are derived from renewable raw materials and are particularly favored in clean beauty and organic-certified formulations.

Their multifunctional benefits, such as mildness, skin compatibility, and stability across a wide pH range, have expanded their usage in both skincare and pharmaceutical topical applications. Polyglyceryl esters also exhibit strong emulsifying capacity, making them suitable for high-load formulations where actives need stable delivery.

As consumers and regulatory bodies push for safer and environmentally responsible alternatives, polyglyceryl esters stand out as the preferred choice. With growing investment in bio-based ingredients and expanding adoption in premium and mass-market categories, this chemistry type is expected to retain its leadership over the forecast horizon.

| Delivery System | Value Share % 2025 |

|---|---|

| Free form | 54.3% |

| Others | 45.7% |

The free form delivery system is projected to dominate with 54.3% of the Global Emulsifiers Market revenue in 2025, reinforcing its role as the most widely used format. This leadership stems from its straightforward integration into manufacturing processes, cost-effectiveness, and flexibility across multiple applications. Free form emulsifiers are especially popular in personal care and haircare, where they are blended directly into formulations without the need for pre-processing.

The segment’s growth is further supported by its adaptability in both mass-market and specialized formulations. Manufacturers rely on free form emulsifiers to maintain efficiency while delivering consistent product performance. Their accessibility and ease of use make them a preferred choice for companies of all sizes, from global leaders to regional players.

While encapsulated and pre-blended systems are gaining momentum in premium and niche markets, free form remains dominant due to its scalability and wide acceptance. As cost optimization and formulation efficiency continue to be key priorities, free form emulsifiers are expected to maintain their commanding position throughout the forecast period.

Rising Demand for Natural & PEG-Free Formulations

A major growth driver is the accelerating consumer shift toward natural and PEG-free emulsifiers. With polyglyceryl esters already commanding 35.2% share in 2025, demand is expanding across skincare, sun care, and haircare categories where clean-label, plant-derived emulsifiers are seen as safer and more sustainable. Regulatory pressures in Europe and increasing awareness in Asia-Pacific are reinforcing this trend. Multinational cosmetic brands are reformulating legacy products to replace synthetic emulsifiers, creating significant growth opportunities for suppliers that can scale natural alternatives.

Expanding Applications in Pharmaceutical Topicals

The pharmaceutical topical segment is becoming a high-value driver for emulsifier adoption. Growth in dermatological therapies, wound healing products, and transdermal drug delivery is accelerating demand for emulsifiers that ensure active stability and skin compatibility. Oil-in-water (O/W) emulsifiers, in particular, are widely applied to improve solubility and penetration of APIs in creams and ointments. With global healthcare expenditure rising and innovation in advanced topical formulations increasing, emulsifiers are playing a pivotal role in bridging cosmetic and therapeutic product development.

High Cost of Sustainable and Bio-Based Ingredients

While natural and bio-based emulsifiers are driving growth, their high cost compared to traditional petrochemical-based alternatives remains a challenge. The production of polyglyceryl esters, lecithin-based, or sucrose esters often involves complex processing and reliance on certified raw materials, which increases input costs. This pricing gap limits their penetration in cost-sensitive regions like Latin America and South Asia, where formulators often opt for cheaper conventional emulsifiers.

Stability and Compatibility Challenges in Complex Formulations

Emulsifiers are often tasked with stabilizing high-load formulations containing multiple active ingredients, fragrances, and preservatives. In advanced skincare or pharmaceutical topicals, ensuring long-term stability without phase separation or texture compromise can be difficult. Incompatibility between natural emulsifiers and certain actives can lead to reformulation delays, increased R&D costs, and slower time-to-market, particularly for clean-label products that avoid synthetic stabilizers.

Surge in Encapsulated and Pre-Blended Delivery Systems

Although free form emulsifiers dominate with 54.3% share in 2025, encapsulated and pre-blended formats are gaining rapid traction. These systems simplify production workflows for manufacturers while enhancing stability, controlled release, and performance in premium formulations. Adoption is particularly strong in color cosmetics and advanced haircare, where pre-blends reduce complexity and ensure consistency across product batches. This trend reflects a shift toward convenience-driven, value-added emulsifier solutions.

Strong Growth in Asia-Pacific with China and India Leading

Geographically, the strongest trend is the double-digit CAGR in Asia-Pacific, led by India (17.7%) and China (15.8%). The region’s expanding middle-class population, rising disposable income, and booming beauty and personal care industries are fueling demand for advanced emulsifiers. Local brands are increasingly aligning with global clean beauty trends, integrating PEG-free and bio-based emulsifiers into mainstream offerings. This regional momentum is reshaping the global competitive landscape, pushing suppliers to localize production and tailor portfolios to diverse Asian consumer preferences.

| Country | Estimated CAGR (2025-2035) |

|---|---|

| China | 15.8% |

| USA | 6.6% |

| India | 17.7% |

| UK | 10.2% |

| Germany | 7.7% |

| Japan | 12.8% |

| Europe | 9.5% |

Emerging economies in Asia are positioned as the most dynamic growth centers for the Global Emulsifiers Market. India, with a projected CAGR of 17.7%, leads globally, driven by booming personal care consumption, rising disposable incomes, and a surge in domestic beauty and wellness brands integrating natural emulsifiers. China follows closely at 15.8%, benefiting from its expanding pharmaceutical topical sector and rising demand for high-performance emulsifiers in premium skincare and haircare. Japan, with a CAGR of 12.8%, reflects a market that emphasizes innovation, safety, and multifunctionality, supported by the country’s strong R&D culture and consumer preference for advanced formulations. Together, these markets highlight the accelerating momentum of Asia-Pacific, which is expected to outpace other regions in both adoption speed and innovation.

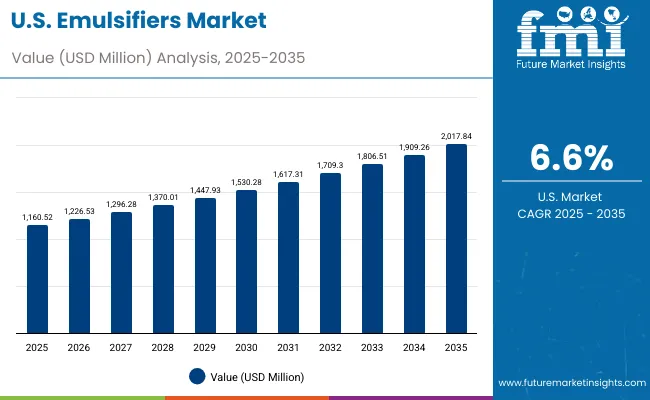

Developed markets such as the USA (6.6% CAGR), Germany (7.7%), and the UK (10.2%) continue to expand but at comparatively moderate rates, reflecting maturity and already high penetration of emulsifiers in personal care and pharmaceutical products. Europe overall is expected to grow at 9.5%, supported by strict regulatory frameworks that favor natural and PEG-free emulsifiers, aligning with consumer sustainability expectations. The USA market, despite slower growth, remains highly valuable due to its scale and innovation-led demand, particularly in premium skincare and dermatology products. These country-level dynamics illustrate a global market where mature economies provide stability, while Asia’s rapid expansion reshapes competitive strategies and supply chain priorities for emulsifier manufacturers.

| Year | USA Emulsifiers Market (USD Million) |

|---|---|

| 2025 | 1160.52 |

| 2026 | 1226.53 |

| 2027 | 1296.28 |

| 2028 | 1370.01 |

| 2029 | 1447.93 |

| 2030 | 1530.28 |

| 2031 | 1617.31 |

| 2032 | 1709.30 |

| 2033 | 1806.51 |

| 2034 | 1909.26 |

| 2035 | 2017.84 |

The Global Emulsifiers Market in the United States is projected to grow at a CAGR of 6.6%, driven by strong demand in personal care and pharmaceutical topicals. Oil-in-water (O/W) emulsifiers command 34.5% of the USA market, owing to their dominance in creams and lotions where smooth texture and hydration are critical. Growth is supported by dermatology-driven formulations, particularly in anti-aging and medicated skincare. Pharmaceutical topical applications are expanding steadily, supported by innovations in wound care, dermatological therapies, and advanced transdermal products. Haircare remains another steady contributor, with conditioners and scalp treatments relying on stable emulsification for performance.

The Global Emulsifiers Market in the United Kingdom is expected to grow at a CAGR of 10.2% through 2035, supported by broad adoption in skincare and haircare formulations. Natural and PEG-free emulsifiers are seeing significant momentum as UK consumers prioritize sustainability and safety in cosmetics. The market is also seeing demand from color cosmetics and sun care, with multifunctional emulsifiers supporting stability, spreadability, and skin-feel enhancement. Regulatory frameworks in the UK encourage the replacement of synthetic emulsifiers with biodegradable alternatives, creating strong opportunities for suppliers of polyglyceryl and sucrose esters.

India is witnessing rapid growth in the Global Emulsifiers Market, which is forecast to expand at a CAGR of 17.7% through 2035 the fastest among all countries. Demand is fueled by the rise of domestic beauty brands, particularly in skincare creams, lotions, and herbal haircare products. Expanding middle-class consumption and increasing adoption in tier-2 and tier-3 cities are boosting volume growth. Pharmaceutical topical formulations, particularly in dermatology and therapeutic creams, are adding further momentum. The market is also benefiting from India’s strong tradition in herbal and ayurvedic formulations, where natural emulsifiers are integrated into modern delivery systems.

The Global Emulsifiers Market in China is expected to grow at a CAGR of 15.8%, positioning it as one of the fastest-expanding national markets. Growth is led by color cosmetics, sun care, and advanced skincare products that rely on polyglyceryl esters, which already account for 39.2% of China’s emulsifier demand in 2025. Pharmaceutical topical adoption is accelerating with the expansion of dermatology-focused therapies. Local beauty brands are scaling production of affordable emulsifier-based formulations, while global multinationals are investing in premium segments. Strong urbanization, rising disposable income, and preference for multifunctional, clean-label emulsifiers further support growth.

| Country | 2025 Share (%) |

|---|---|

| USA | 16.8% |

| China | 8.6% |

| Japan | 5.0% |

| Germany | 11.1% |

| UK | 5.8% |

| India | 3.5% |

| Europe | 15.8% |

| Country | 2035 Share (%) |

|---|---|

| USA | 14.9% |

| China | 9.3% |

| Japan | 6.1% |

| Germany | 9.6% |

| UK | 5.2% |

| India | 4.3% |

| Europe | 14.5% |

| USA By Type | Value Share % 2025 |

|---|---|

| Oil-in-water (O/W) | 34.5% |

| Others | 65.5% |

The Global Emulsifiers Market in the United States is projected at USD 1,160.52 million in 2025, with oil-in-water (O/W) emulsifiers holding 34.5% of the market. Their dominance comes from their widespread use in skincare creams, lotions, and hair conditioners, where they ensure stability, hydration, and consumer-preferred texture. Pharmaceutical topical formulations are also a key growth driver, particularly in dermatology and wound care, where emulsifiers improve solubility and delivery of active ingredients.

Growth in the USA is further supported by a rising preference for clean-label, PEG-free formulations, though cost pressures continue to limit mass-market penetration. Regulatory scrutiny on ingredient safety is steering formulators toward polyglyceryl esters and lecithin-based blends, while premium brands emphasize sustainability and multifunctionality. The steady CAGR of 6.6% reflects a mature but innovation-driven market, where new product launches in anti-aging skincare and medicated creams will continue to sustain demand.

| China By Chemistry | Value Share % 2025 |

|---|---|

| Polyglyceryl esters | 39.2% |

| Others | 60.8% |

The Global Emulsifiers Market in China is valued at USD 593.16 million in 2025, led by polyglyceryl esters with 39.2% share. Their dominance reflects the rapid adoption of natural, PEG-free emulsifiers aligned with China’s booming clean beauty movement. High-performance emulsifiers are essential in China’s expanding skincare and color cosmetics segments, where stability, smooth sensory profiles, and consumer safety are critical purchase drivers.

The pharmaceutical topical sector is another fast-growing application, with demand for emulsifiers in advanced dermatological products increasing. Local brands are scaling affordable emulsifier-based formulations, while multinationals continue to dominate the premium segment with encapsulated and multifunctional systems. With a forecast CAGR of 15.8%, China is expected to more than double its market size by 2035, becoming one of the largest contributors to global emulsifier demand.

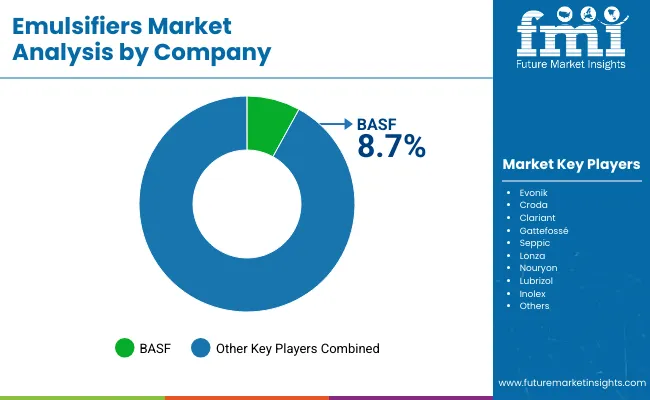

| Company | Global Value Share 2025 |

|---|---|

| BASF | 8.7% |

| Others | 91.3% |

The Global Emulsifiers Market is moderately fragmented, with leading multinational suppliers and regional specialists competing across diverse applications. BASF leads globally with 8.7% share in 2025, driven by its broad emulsifier portfolio spanning personal care, haircare, and pharmaceutical solutions. Competitors such as Evonik, Croda, Clariant, and Gattefossé emphasize sustainable and bio-based innovations, with polyglyceryl esters and sucrose esters gaining strong traction as PEG-free alternatives. Their strategies focus on balancing performance with regulatory compliance, particularly in Europe where sustainability mandates are strictest.

Specialized players including Seppic, Lonza, Nouryon, and Lubrizol are investing in delivery systems, offering pre-blended and encapsulated emulsifiers to enhance convenience and formulation efficiency. This is particularly relevant in premium cosmetics and dermatology, where stability and controlled release are critical. The competitive landscape is shifting from commodity emulsification toward integrated solutions, where suppliers differentiate on sustainability, multifunctionality, and technical support. With Asia-Pacific driving demand growth, many global leaders are localizing production and partnering with regional formulators to strengthen their market position.

Key Developments in Global Emulsifiers Market

| Item | Value |

|---|---|

| Quantitative Units | USD Million |

| Type | Oil-in-water (O/W), Water-in-oil (W/O), Cold-process, and Natural & PEG-free |

| Chemistry | Lecithin-based, Fatty acid esters, Polyglyceryl esters, and Sucrose esters |

| Delivery System | Free form, Pre-blended, and Encapsulated |

| Physical Form | Liquid, Powder, and Pellets |

| Application | Skincare creams & lotions, Hair conditioners, Color cosmetics, and Sun care |

| End-use Industry | Personal care, Pharmaceutical topical, and Hair & scalp |

| Regions Covered | North America, Europe, East Asia, South Asia & Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | BASF, Evonik , Croda , Clariant , Gattefossé , Seppic , Lonza , Nouryon , and Lubrizol |

| Additional Attributes | Dollar sales by type, chemistry, and end-use industry; demand growth in clean-label and PEG-free emulsifiers; rising adoption in pharmaceutical topical formulations; expansion of free form and pre-blended systems; regional dynamics influenced by beauty and wellness consumption trends; increasing R&D in natural and biodegradable chemistry; innovation in multifunctional emulsifiers for personal care and dermatology applications. |

The Emulsifiers Market is estimated to be valued at USD 6,903.2 million in 2025.

The market size for the Global Emulsifiers Market is projected to reach USD 13,503.2 million by 2035.

The Global Emulsifiers Market is expected to grow at a 6.9% CAGR between 2025 and 2035.

The key product types in the Global Emulsifiers Market are Oil-in-water (O/W), Water-in-oil (W/O), Cold-process, and Natural & PEG-free emulsifiers.

In terms of chemistry, Polyglyceryl esters are expected to command 35.2% share of the Global Emulsifiers Market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Emulsifiers in Personal Care Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Emulsifiers, Stabilizers, and Thickeners Market Size and Share Forecast Outlook 2025 to 2035

Co-Emulsifiers Market Size and Share Forecast Outlook 2025 to 2035

Food Emulsifiers Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Bitumen Emulsifiers Market Size and Share Forecast Outlook 2025 to 2035

Squalane-Based Emulsifiers Market Size and Share Forecast Outlook 2025 to 2035

Demand for Food Emulsifiers in EU Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA