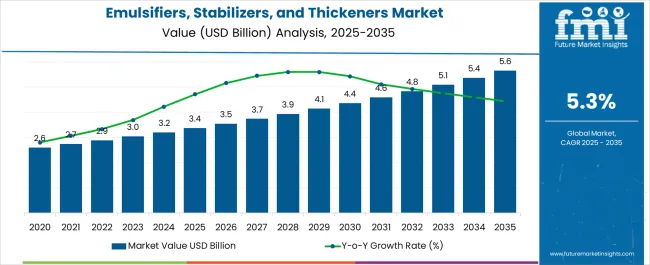

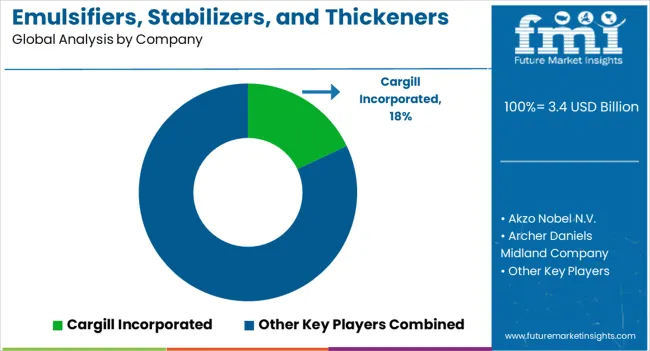

The Emulsifiers, Stabilizers, and Thickeners Market is estimated to be valued at USD 3.4 billion in 2025 and is projected to reach USD 5.6 billion by 2035, registering a compound annual growth rate (CAGR) of 5.3% over the forecast period.

The market shows consistent growth over the forecast period, with steady annual increases in value. Between 2025 and 2030, the market grows from USD 3.4 billion to USD 4.4 billion, contributing an incremental USD 1 billion in growth. This period represents a CAGR of 5.1%, driven by increasing demand for these additives in food processing, beverages, and nutraceuticals. As food manufacturers focus on improving texture, quality, and shelf life, the demand for emulsifiers, stabilizers, and thickeners has grown significantly. From 2030 to 2035, the market sees accelerated growth, expanding from USD 4.4 billion to USD 5.6 billion, an increase of USD 1.2 billion.

This period shows a CAGR of 5.6%, driven by the growing trend of clean-label products, advancements in food technology, and increasing consumer preference for healthier, more natural food options. The demand for innovative ingredients and the rising popularity of functional foods also fuel this growth. The CAGR of 5.3% overall highlights a stable and robust expansion of the market, supported by continuous innovation and expanding applications of emulsifiers, stabilizers, and thickeners across multiple industries, including food, beverages, and nutraceuticals.

| Metric | Value |

|---|---|

| Emulsifiers, Stabilizers, and Thickeners Market Estimated Value in (2025 E) | USD 3.4 billion |

| Emulsifiers, Stabilizers, and Thickeners Market Forecast Value in (2035 F) | USD 5.6 billion |

| Forecast CAGR (2025 to 2035) | 5.3% |

The EST market is experiencing notable expansion, driven by increasing consumption of processed foods, growing demand for texture-optimized formulations, and rising clean-label initiatives in food production. Manufacturers are using these ingredients to enhance shelf life, improve product stability, and ensure consistent quality across large-scale food and beverage applications.

Additionally, the convergence of plant-based diets and allergen-free formulations has accelerated the adoption of multifunctional additives that align with regulatory standards and consumer expectations. With improved extraction technologies and bio-based sourcing, companies are able to offer high-performance thickeners and stabilizers tailored for vegan, gluten-free, and organic product categories.

Continued innovation in formulation science is expected to support EST market growth across the global F&B and personal care industries.

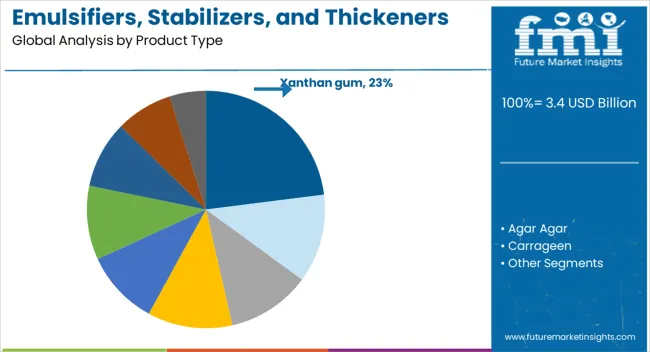

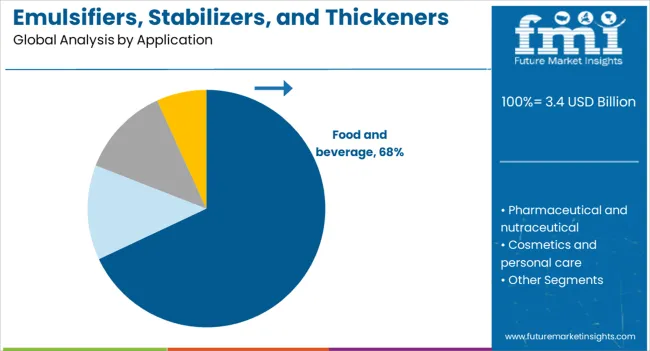

The emulsifiers, stabilizers and thickeners market is segmented by product type, application, and geographic regions. By product type, the emulsifiers, stabilizers, and thickeners market is divided into Xanthan gum, Agar Agar, Carrageen, Pectin, Corn starch, Guar gum, Arrowroot, Instant clear gel, and Others. In terms of application, the emulsifiers, stabilizers, and thickeners market is classified into Food and beverage, Pharmaceutical and nutraceutical, Cosmetics and personal care, and Others (e.g., industrial applications). Regionally, the emulsifiers, stabilizers and thickeners industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Xanthan gum is expected to account for 23.00% of the total EST market share by 2025, making it one of the leading product types in this segment. Known for its superior thickening and stabilizing properties, xanthan gum is widely used in sauces, dressings, dairy alternatives, and gluten-free baked goods.

Its heat stability, pH tolerance, and compatibility with other hydrocolloids make it highly versatile across both food and industrial applications. The increasing demand for vegan and allergen-free texturizers, especially in North America and Europe, has bolstered the use of xanthan gum in clean-label product development.

Moreover, its microbial fermentation-based production method supports non-GMO and sustainable sourcing initiatives.

The food and beverage segment is projected to dominate the EST market with a 68.00% revenue share by 2025. This leading position is driven by the widespread usage of emulsifiers, stabilizers, and thickeners in dairy, bakery, confectionery, beverages, sauces, and ready-to-eat products.

These additives are essential in achieving the desired mouthfeel, viscosity, and emulsion stability while reducing fat and sugar content in health-conscious formulations. As global food manufacturers aim to meet evolving dietary preferences and shelf-life requirements, the role of EST ingredients in product innovation and quality assurance is becoming increasingly critical.

Demand is especially strong in processed and convenience food segments, supported by growth in urban populations and on-the-go consumption patterns.

Emulsifiers, stabilizers, and thickeners are essential ingredients in the food, beverage, pharmaceuticals, and cosmetic industries, providing crucial functionalities in texture, consistency, and preservation. These ingredients are widely used to enhance product quality, improve shelf life, and stabilize mixtures. Demand for emulsifiers, stabilizers, and thickeners has risen due to growing consumer preference for convenience foods, processed products, and clean-label formulations. As consumers seek healthier and more sustainable alternatives, manufacturers are focusing on innovative and natural ingredient solutions to meet the demand for clean-label products.

The rising demand for convenient, processed foods and beverages has significantly contributed to the growth of emulsifiers, stabilizers, and thickeners. Consumers are increasingly seeking food options that offer convenience without compromising quality or taste, leading to greater reliance on these ingredients to maintain texture, consistency, and product stability. Simultaneously, the shift toward clean-label products made with recognizable, natural ingredients is driving innovation in emulsifiers and stabilizers. As consumers become more health-conscious, demand for plant-based, organic, and functional foods continues to rise, which in turn fuels the need for emulsifiers and stabilizers that align with these dietary preferences. This growing focus on healthier formulations is shaping the market's development.

The rising cost of raw materials, especially for plant-based and natural emulsifiers, stabilizers, and thickeners, presents a significant challenge for manufacturers. Sourcing high-quality, sustainable ingredients can result in higher production costs, which can be passed on to consumers, affecting price-sensitive markets. Regulatory hurdles also complicate the development and approval process for new ingredients. Stringent regulations surrounding the safety and efficacy of food additives require manufacturers to undergo rigorous testing, compliance, and certification processes, increasing both the time and cost to bring products to market. Concerns about the potential health risks associated with synthetic ingredients further complicate regulatory scrutiny, especially as consumer demand shifts towards cleaner and more natural formulations. These combined challenges can slow innovation and market penetration.

Significant growth opportunities exist as the demand for plant-based and functional foods continues to rise. The increasing popularity of plant-based dairy alternatives, vegan snacks, and functional beverages creates a need for specialized emulsifiers, stabilizers, and thickeners that can replicate the texture and stability of traditional products. These ingredients are essential for creating plant-based alternatives that mimic the mouthfeel and consistency of dairy, meats, and other animal-based products. The growing interest in functional foods, including probiotics, fiber-enriched products, and immune-boosting formulations, presents an opportunity for manufacturers to create innovative products that cater to consumer health trends. As consumers demand healthier, more natural food options, the market for clean-label, plant-based emulsifiers and thickeners is expanding rapidly, providing room for innovation and growth.

The clean-label trend continues to influence the development of emulsifiers, stabilizers, and thickeners, with consumers increasingly demanding products made from simple, natural ingredients. This trend is prompting manufacturers to focus on plant-based, non-GMO, and natural alternatives to traditional synthetic ingredients. Technological advancements in the extraction and formulation of emulsifiers from plant sources are helping to meet these consumer demands, while also improving product performance and stability. There is growing interest in functional ingredients that provide added health benefits, such as enhanced gut health and improved digestion. The shift toward healthier food options, along with innovations in ingredient technology, is reshaping the emulsifier and stabilizer landscape, encouraging the development of more versatile, cleaner, and health-focused solutions for the food and beverage industry.

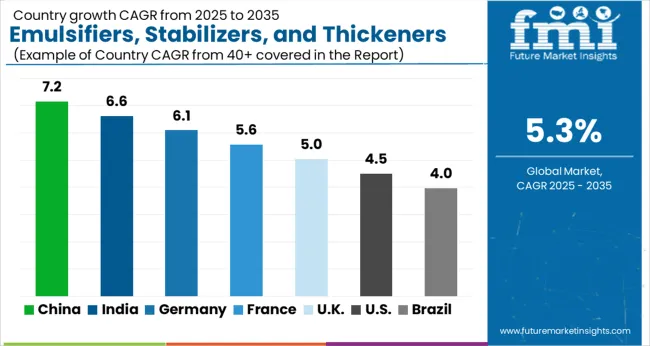

| Country | CAGR |

|---|---|

| China | 7.2% |

| India | 6.6% |

| Germany | 6.1% |

| France | 5.6% |

| UK | 5.0% |

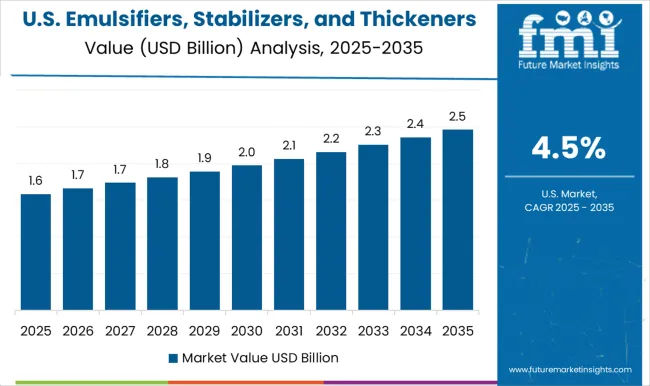

| USA | 4.5% |

| Brazil | 4.0% |

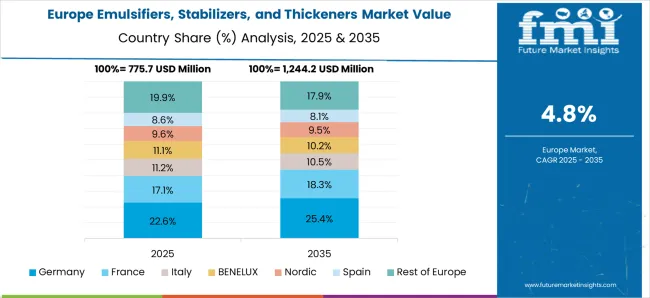

The emulsifiers, stabilizers, and thickeners market is projected to grow at a CAGR of 5.3% from 2025 to 2035. The global market is expected to increase from USD 3.4 billion in 2025 to USD 5.6 billion by 2035. Among the top five profiled markets, China leads at 7.2%, followed by India at 6.6%, while France posts 5.6%, the United Kingdom records 5.0%, and the United States stands at 4.5%. These growth rates reflect significant demand for emulsifiers, stabilizers, and thickeners driven by rising industrial food and beverage applications, especially in emerging economies like China and India, which are experiencing increased urbanization and dietary changes. The analysis spans over 40 countries, with the top countries shown below.

China is projected to grow at a CAGR of 7.2% through 2035, driven by its rapidly expanding food and beverage sector, where emulsifiers, stabilizers, and thickeners are extensively used to improve the texture, viscosity, and shelf stability of products. The country’s growing population and evolving consumer preferences for packaged foods, dairy, beverages, and bakery products are accelerating the demand for these ingredients. China's focus on modernization and innovation in food technology, coupled with a growing interest in health-conscious food options, continues to drive market growth. The government’s support for food processing industries also strengthens the sector’s demand for advanced emulsification and stabilization technologies.

India is expected to grow at a CAGR of 6.6% through 2035, driven by the expanding food and beverage industry, where emulsifiers, stabilizers, and thickeners play a key role in enhancing product texture, stability, and shelf life. The country’s rapidly growing middle class and changing consumer preferences toward processed and convenience foods are further fueling the demand for these ingredients. India's growing dairy, bakery, and beverage sectors are expected to be key contributors to the market. Additionally, increased awareness of food quality and the expansion of the packaged food industry in both urban and rural regions continue to drive adoption.

France is projected to grow at a CAGR of 5.6% through 2035, with demand for emulsifiers, stabilizers, and thickeners driven by the food and beverage sector, particularly in dairy, bakery, and sauces. French consumers have high expectations for the texture and quality of food products, making stabilizers and thickeners essential ingredients. The country’s strong focus on high-quality, premium food products further accelerates the adoption of advanced emulsification techniques. The demand for organic and clean-label food products also fuels the growth of emulsifiers and stabilizers, as manufacturers innovate to meet consumer preferences.

The United Kingdom is expected to grow at a CAGR of 5.0% through 2035, with demand driven by the increasing need for food innovation and quality in the bakery, dairy, and beverage sectors. As consumers continue to demand more convenient and processed food options, emulsifiers, stabilizers, and thickeners play a critical role in meeting these expectations for texture, consistency, and shelf life. Additionally, the UK food industry’s shift toward clean-label and functional food products boosts demand for natural and innovative emulsifiers. Regulatory standards related to food safety and quality also support the continued growth of the market.

The United States is projected to grow at a CAGR of 4.5% through 2035, with demand primarily driven by the processed food and beverage industry. USA manufacturers are increasingly incorporating emulsifiers, stabilizers, and thickeners to meet consumer demands for better texture, shelf life, and convenience. The popularity of ready-to-eat, bakery, dairy, and beverage products supports the market. As consumers focus more on health and clean-label products, the need for natural and clean ingredients in emulsifiers and stabilizers continues to rise. Innovations in food technology, along with stricter food safety regulations, contribute to the steady growth of the USA market.

The emulsifiers, stabilizers, and thickeners market is highly competitive, driven by global ingredient suppliers offering a wide range of solutions to the food and beverage, pharmaceutical, cosmetic, and industrial sectors. Cargill Incorporated leads the market with a diverse portfolio of emulsifiers, stabilizers, and thickeners, focusing on clean-label products and solutions for improved texture and shelf life in food products.

BASF SE and DuPont Nutrition & Health are also key players, providing high-performance ingredients used in various applications, including food, personal care, and pharmaceuticals, with an emphasis on innovation and sustainable sourcing. Akzo Nobel N.V. and Evonik Industries AG supply a range of emulsifiers and stabilizers tailored to meet the growing demand for natural and organic products, especially in the food and beverage industry.

Archer Daniels Midland Company and Corbion N.V. are prominent in the market, focusing on bio-based emulsifiers and stabilizers, driving growth in plant-based, clean-label formulations. Kerry Inc. and Koninklijke DSM N.V. provide innovative stabilizer and emulsifier solutions, with a focus on functional ingredients for nutritional and texture applications in processed foods, dairy, and beverages.

Stepan Company specializes in emulsifiers and thickeners for both the food and personal care markets, emphasizing performance and sustainability in ingredient design. Competitive differentiation is based on product functionality, formulation flexibility, clean-label certifications, and natural or plant-based alternatives to conventional chemical ingredients.

Barriers to entry include the need for advanced formulation expertise, stringent regulatory standards, and established customer relationships. Strategic priorities include the development of plant-based, allergen-free, and sustainable emulsifiers and stabilizers to meet the growing demand for healthier and environmentally friendly products.

| Item | Value |

|---|---|

| Quantitative Units | USD 3.4 Billion |

| Product Type | Xanthan gum, Agar Agar, Carrageen, Pectin, Corn starch, Guar gum, Arrowroot, Instant clear gel, and Others |

| Application | Food and beverage, Pharmaceutical and nutraceutical, Cosmetics and personal care, and Others (e.g., industrial applications) |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Cargill Incorporated, Akzo Nobel N.V., Archer Daniels Midland Company, BASF SE, Corbion N.V., DuPont Nutrition & Health, Evonik Industries AG, Kerry Inc., Koninklijke DSM N.V., and Stepan Company |

| Additional Attributes | Dollar sales by product type (emulsifiers, stabilizers, thickeners) and end-use segments (food and beverage, personal care, pharmaceuticals, industrial). Demand dynamics are influenced by increasing consumer demand for clean-label products, healthier formulations, and the rise of plant-based diets, especially in the food and beverage industry. Regional trends indicate strong growth in North America and Europe, driven by health-conscious consumer preferences, while Asia-Pacific is expanding due to rising disposable incomes and demand for processed foods. Innovation trends include the development of multifunctional emulsifiers and stabilizers that offer texture improvement, viscosity control, and shelf-life extension. Environmental considerations focus on sourcing sustainable raw materials, reducing carbon footprints in manufacturing processes, and improving the biodegradability of emulsifiers and stabilizers. |

The global emulsifiers stabilizers and thickeners market is estimated to be valued at USD 3.4 billion in 2025.

The market size for the emulsifiers stabilizers and thickeners market is projected to reach USD 5.6 billion by 2035.

The emulsifiers stabilizers and thickeners market is expected to grow at a 5.3% CAGR between 2025 and 2035.

The key product types in emulsifiers stabilizers and thickeners market are xanthan gum, agar agar, carrageen, pectin, corn starch, guar gum, arrowroot, instant clear gel and others.

In terms of application, food and beverage segment to command 68.0% share in the emulsifiers stabilizers and thickeners market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Emulsifiers Market Size and Share Forecast Outlook 2025 to 2035

Emulsifiers in Personal Care Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Stabilizers Market

Co-Emulsifiers Market Size and Share Forecast Outlook 2025 to 2035

Food Stabilizers Market Size and Share Forecast Outlook 2025 to 2035

Food Emulsifiers Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Beer Stabilizers Market Size and Share Forecast Outlook 2025 to 2035

Evaluating Food Stabilizers Market Share & Provider Insights

Heat Stabilizers Market Report - Growth & Forecast 2025 to 2035

Food Thickeners Market Analysis – Trends & Forecast 2025 to 2035

Meat Stabilizers Blends Market Trends - Source & Function Analysis

Soil Stabilizers Market

Bakery Stabilizers Market Size and Share Forecast Outlook 2025 to 2035

Marine Stabilizers Market Size and Share Forecast Outlook 2025 to 2035

Polymer Stabilizers Market Size and Share Forecast Outlook 2025 to 2035

Vaccine Stabilizers Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Bitumen Emulsifiers Market Size and Share Forecast Outlook 2025 to 2035

UK Food Stabilizers Market Insights – Demand, Size & Industry Trends 2025–2035

Emulsion Stabilizers Market Size and Share Forecast Outlook 2025 to 2035

USA Food Stabilizers Market Analysis – Size, Share & Forecast 2025–2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA