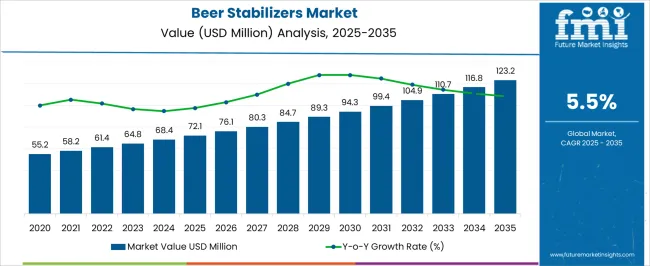

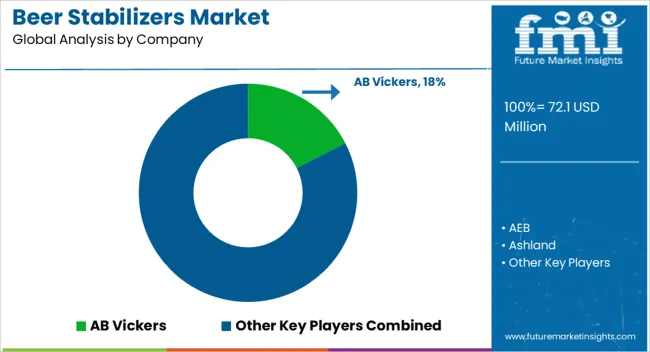

The Beer Stabilizers Market is estimated to be valued at USD 72.1 million in 2025 and is projected to reach USD 123.2 million by 2035, registering a compound annual growth rate (CAGR) of 5.5% over the forecast period. During the early adoption phase (2020–2024), the market expanded from USD 55.2 million to USD 68.4 million as brewers experimented with advanced stabilizers to enhance beer clarity, shelf life, and flavor stability. Early adoption was driven by craft breweries and premium beer producers seeking differentiation through product quality.

Regulatory standards for consistency and quality also encouraged adoption, while cost considerations and limited awareness constrained rapid market penetration. From 2025 to 2030, the market enters a scaling phase, with revenues increasing from USD 72.1 million to approximately USD 94.3 million. Wider adoption occurred as stabilizer formulations became more cost-effective, technologically advanced, and readily available.

Large-scale breweries increasingly integrated stabilizers into production to improve shelf stability and reduce losses, while consumer demand for consistent quality further accelerated market growth. Between 2030 and 2035, the market transitions into consolidation, reaching USD 123.2 million by 2035.

Leading manufacturers strengthened their positions through strategic partnerships, product standardization, and optimized supply chains. Incremental innovations focused on efficiency and sustainability, stabilizing growth. The market matured into a competitive and resilient sector, moving from early experimental adoption to scaling and eventually to a consolidated, efficient industry.

| Metric | Value |

|---|---|

| Beer Stabilizers Market Estimated Value in (2025 E) | USD 72.1 million |

| Beer Stabilizers Market Forecast Value in (2035 F) | USD 123.2 million |

| Forecast CAGR (2025 to 2035) | 5.5% |

The beer stabilizers market is experiencing steady growth, supported by the rising demand for extended shelf life, flavor consistency, and improved haze control across various beer styles. Increasing global beer consumption, coupled with the shift toward premium and craft brews, has elevated the need for advanced stabilization techniques that ensure visual clarity and taste integrity.

Breweries are investing in process efficiency, driving the adoption of stabilizers that reduce production downtime and enhance filtration performance. Regulatory approval of specific stabilizer types for food and beverage use, along with industry emphasis on product transparency and quality assurance, is encouraging wider usage of technically advanced ingredients.

As consumer expectations for product consistency grow, especially in export-driven markets, stabilizers are becoming integral to modern brewing operations. Future adoption is expected to be supported by advancements in regenerative stabilizers and environmentally friendly processing technologies.

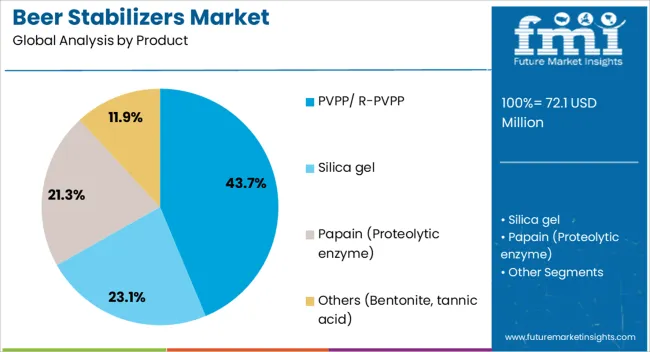

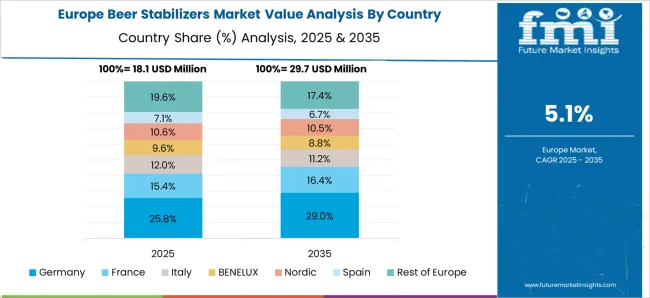

The beer stabilizers market is segmented by product, and geographic regions. By product of the beer stabilizers market is divided into PVPP/ R-PVPP, Silica gel, Papain (Proteolytic enzyme), and Others (Bentonite, tannic acid). Regionally, the beer stabilizers industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

PVPP and its regenerable form, R-PVPP, are projected to account for 43.70% of the total beer stabilizers market revenue in 2025, positioning them as the dominant product category. Their leadership is being driven by superior performance in removing polyphenols and preventing chill haze, which are critical for preserving beer clarity and sensory characteristics during storage.

PVPP offers repeatable and consistent stabilization without affecting flavor profiles, making it highly favored by both large-scale breweries and craft producers. R-PVPP, in particular, is gaining traction for its reusability and cost-effectiveness, aligning with sustainability goals and reducing operational expenditure.

The compatibility of these stabilizers with automated dosing systems and filtration units has further strengthened their utility in high-throughput brewing environments. As consumer demand for visually appealing, stable beers continues to rise, the role of PVPP/R-PVPP in achieving long-term stability without compromise is expected to remain pivotal.

The beer stabilizers market is expanding as breweries seek to improve product clarity, flavor stability, and shelf life. Stabilizers, including natural proteins, polysaccharides, and silica-based compounds, help prevent haze formation and flavor degradation during storage and transport. Rising demand for craft and premium beers is encouraging the adoption of high-performance stabilization solutions. Manufacturers focus on efficient, easy-to-use formulations compatible with diverse beer types, supporting consistent quality and consumer satisfaction across global markets.

Beer stabilizers prevent haze, sediment formation, and flavor loss, ensuring consistent product quality. They interact with proteins and polyphenols, reducing turbidity and maintaining taste over extended periods. By stabilizing color and aroma, breweries can deliver a uniform experience across batches. This is especially important for craft and specialty beers where flavor nuances matter. Improved shelf life allows breweries to expand distribution geographically, reduce waste, and strengthen brand loyalty, supporting broader market adoption of effective stabilization solutions.

Growth in craft and premium beer segments drives demand for specialized stabilizers. Smaller breweries and boutique producers prioritize clarity and flavor preservation to meet consumer expectations. Stabilizers tailored for specific beer styles, including lagers, ales, and wheat beers, enable manufacturers to maintain signature taste and visual appeal. As craft beer production rises globally, breweries seek reliable stabilization techniques that support small-batch consistency without compromising artisanal qualities, creating opportunities for suppliers of advanced stabilizing compounds.

Stabilizer formulations must comply with food safety regulations, labeling requirements, and regional brewing standards. Ingredients need to be approved for consumption and should not negatively affect flavor or appearance. Regulatory compliance ensures that stabilizers can be marketed and used across international markets. Manufacturers invest in validated processes, traceable sourcing, and certified ingredients to meet these standards. Compliance also builds trust among brewers and consumers, supporting widespread adoption while minimizing legal and quality risks in competitive brewing markets.

Manufacturers are developing stabilizers that serve multiple purposes, such as haze prevention, foam retention, and flavor enhancement. Multi-functional solutions simplify processing, reduce additive use, and lower production costs. These products are particularly attractive to large breweries seeking efficiency and smaller producers aiming for consistent quality with minimal intervention. Research into natural and plant-based stabilizers also aligns with consumer preferences for cleaner, minimally processed beverages, further encouraging adoption of advanced stabilizers in diverse brewing applications.

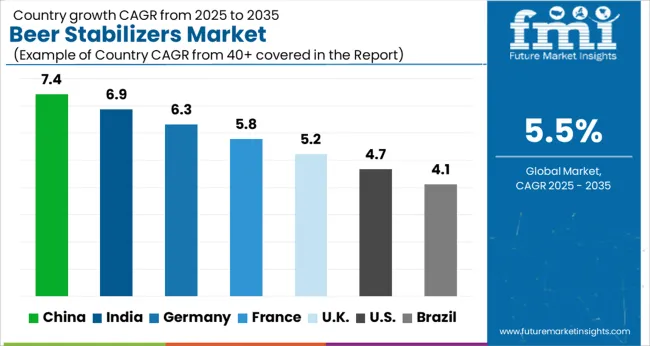

The global beer stabilizers market is projected to grow at a CAGR of 5.5%, driven by increasing demand from breweries and beverage manufacturers. China leads the market with a growth rate of 7.4%, supported by its expanding beer industry and large-scale production facilities. India follows at 6.9%, fueled by rising consumption and modernization of breweries.

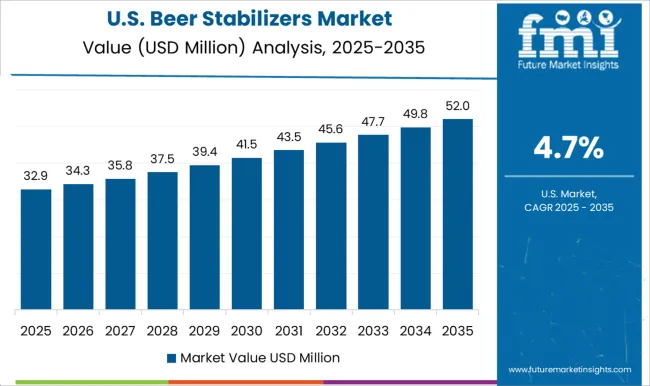

Germany shows steady growth at 6.3%, leveraging its established beer production and export markets. The UK and USA record moderate growth rates of 5.2% and 4.7%, respectively, reflecting stable demand in both craft and commercial beer segments. This report includes insights on 40+ countries; the top countries are shown here for reference.

China leads the beer stabilizers market with a 7.4% growth rate, driven by increasing beer production and rising consumer demand for premium quality beverages. Breweries focus on maintaining beer clarity, taste, and shelf life, which boosts stabilizer adoption. Technological advancements in natural and synthetic stabilizers improve efficiency and reduce costs. Government regulations on food safety encourage breweries to adopt quality-enhancing additives. Rapid urbanization and growth of modern retail channels support market expansion. Local manufacturers invest in research and development to optimize stabilizer formulations. Growing popularity of craft beers and flavored variants further enhances demand. Export opportunities to neighboring Asian countries contribute to market growth. Continuous improvements in supply chains and storage conditions facilitate stabilizer usage.

Beer stabilizers market in India grows at 6.9%, supported by a surge in beer consumption and expanding brewery operations. Compared to Germany, India focuses on cost-effective stabilizer solutions for large-scale breweries. Increasing demand for consistent flavor, foam stability, and extended shelf life drives adoption. Government regulations on food additives ensure product safety. Urbanization and modern retail networks facilitate market penetration. Craft beer trends and flavored beverages boost stabilizer usage. Breweries collaborate with chemical suppliers to enhance additive performance. Growing awareness about product quality and consumer preferences accelerates adoption. Expansion of storage and distribution infrastructure supports market growth.

Germany shows a 6.3% growth rate, driven by the country’s strong beer culture and premium brewing industry. Compared to the UK, Germany emphasizes high-quality stabilizers to maintain flavor, clarity, and foam stability. Breweries adopt advanced natural and synthetic stabilizers to meet strict food safety and quality regulations. Consumer preference for traditional and craft beers encourages precision in additive usage. Technological innovations optimize stabilizer performance and reduce waste. Breweries invest in R&D to improve product consistency. Export of high-quality beer to global markets supports stabilizer demand. Sustainable brewing practices increase reliance on efficient stabilizers. Continuous focus on quality assurance strengthens market growth.

The UK market grows at 5.2%, supported by rising beer consumption and craft brewery expansion. Compared to the USA, the UK emphasizes natural stabilizers and clean-label solutions. Breweries focus on enhancing shelf life, flavor consistency, and foam stability. Technological advancements improve additive performance and efficiency. Government regulations ensure beverage safety and quality. Consumer trends toward premium and flavored beers accelerate adoption. Expansion of modern retail and distribution channels enhances market reach. Collaboration between breweries and chemical suppliers ensures reliable stabilizer supply. Craft beer and small-scale brewery growth further drive demand.

The USA market grows at 4.7%, driven by the expanding craft beer industry and rising premium beer consumption. Compared to China, the USA emphasizes high-quality, natural, and synthetic stabilizers to maintain flavor and clarity. Breweries focus on extended shelf life, foam stability, and consistent taste. Technological innovations in stabilizer formulations improve operational efficiency. Government food safety regulations ensure additive compliance. Growing consumer preference for flavored and craft beers boosts adoption. Breweries invest in R&D and collaborate with suppliers to optimize formulations. Distribution network expansion and modern retail adoption support market growth. Sustainability and quality assurance initiatives further strengthen stabilizer usage.

Multinational leaders such as Ashland, Kerry Group, W.R. Grace, and DSM defend scale advantage by embedding stabilizers within broader brewing chemistry portfolios. Their contracts often include technical warranties on shelf-life and clarity, which discourage brewery switching despite premium pricing. High-margin enzymatic stabilizers are being developed to lower waste and filtration costs, aligning with breweries’ drive for operational efficiency. Product pipelines emphasize oxidative stability and broader temperature tolerance, with messaging directed at large brewers managing long distribution chains.

Specialist firms are seizing opportunities in the craft and premium segment, where stabilizers are marketed less as process aids and more as quality enhancers. Pilot-scale testing kits are offered, enabling craft brewers to trial small quantities before scaling. These firms also highlight allergen-free and non-GMO credentials, leveraging consumer trends toward clean-label beers. The ability to reformulate quickly around flavor-sensitive recipes has created resilience against pricing competition from larger players. Their niche positioning allows premium pricing, while small-batch pack sizes improve accessibility for independent breweries.

Regional suppliers, particularly in Asia, Eastern Europe, and Latin America, pursue cost leadership while bundling stabilizers with adjunct brewing aids like clarifying agents and finings. This bundling reduces procurement complexity for mid-tier breweries and increases stickiness. Their localized sourcing advantage allows faster fulfillment, a critical differentiator for breweries that face seasonal spikes in production. While their formulations lack the sophistication of global rivals, they succeed in cost-sensitive large markets where volume efficiency outweighs premium features. The competitive balance is shifting as consumer preference for natural formulations accelerates. Synthetic stabilizers, though dominant, face gradual pressure from bio-based challengers. Market winners will be those who position stabilizers not as commodity inputs but as enablers of brewing consistency, efficiency, and brand differentiation.

| Item | Value |

|---|---|

| Quantitative Units | USD 72.1 Million |

| Product | PVPP/ R-PVPP, Silica gel, Papain (Proteolytic enzyme), and Others (Bentonite, tannic acid) |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | AB Vickers, AEB, Ashland, BASF, Eaton, ERBSLÖH, Gusmer Beer, PQ Corporation, QINGDAO MAKALL GROUP, and W.R. Grace and Company |

| Additional Attributes | Dollar sales in the Beer Stabilizers Market vary by type including chill-proofing agents, haze inhibitors, and foam stabilizers, application across craft breweries, large-scale breweries, and specialty beer production, and region covering North America, Europe, and Asia-Pacific. Growth is driven by rising craft beer consumption, demand for consistent beer quality, and technological advancements in brewing processes. |

The global beer stabilizers market is estimated to be valued at USD 72.1 million in 2025.

The market size for the beer stabilizers market is projected to reach USD 123.2 million by 2035.

The beer stabilizers market is expected to grow at a 5.5% CAGR between 2025 and 2035.

The key product types in beer stabilizers market are pvpp/ r-pvpp, silica gel, papain (proteolytic enzyme) and others (bentonite, tannic acid).

In terms of , segment to command 0.0% share in the beer stabilizers market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Beer Fermenter Market Size and Share Forecast Outlook 2025 to 2035

Beer Bottles Market Size and Share Forecast Outlook 2025 to 2035

Beer Dispensers Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Beer Pasteurization Equipment Market Size and Share Forecast Outlook 2025 to 2035

Beer Glass Chillers Market Size and Share Forecast Outlook 2025 to 2035

Beer Packaging Market Size, Share & Forecast 2025 to 2035

Beer Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Beer Keg System Market Forecast & Outlook for 2025 to 2035

Beer Dispensing Machine Market Trends - Growth, Demand & Analysis 2025 to 2035

Beer Bottling Kit Market Insights by Equipment, Application, Mode of Operation, Distribution Channel, and Region 2025 to 2035

Beer Filter System Market insights by Equipment Type, Type, Filtration Process, Application, and Region 2025 to 2035

Beer Line Cleaning Kit Market Trend Analysis Based on Product, End-User, Type, and Region 2025 to 2035

Beer Line Cooling System Market Trend Analysis Based on System, Application, and End-Use, and Region 2025 to 2035

Market Share Insights for Beer Bottles Providers

Assessing Beer Canning Machines Market Share & Industry Trends

Competitive Overview of Beer Glassware Market Share

Beer Brewing Machine Market

Beer Cans Market

Stabilizers Market

PVPP Beer Stabilizer Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA