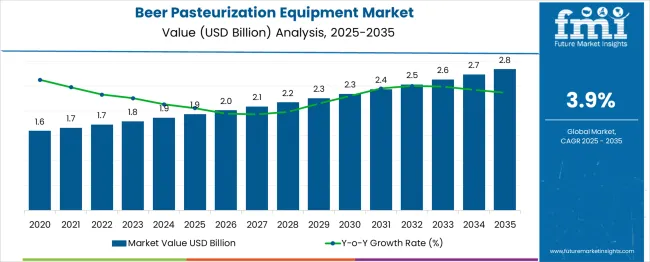

The Beer Pasteurization Equipment Market is estimated to be valued at USD 1.9 billion in 2025 and is projected to reach USD 2.8 billion by 2035, registering a compound annual growth rate (CAGR) of 3.9% over the forecast period.

The beer pasteurization equipment market is exhibiting steady growth as breweries increasingly adopt advanced processing technologies to ensure product stability, safety, and extended shelf life. The shift toward mechanized and automated pasteurization systems has been fueled by rising production volumes, stringent food safety regulations, and the growing demand for consistent quality in packaged beer.

Breweries are investing in energy-efficient and compact equipment designs to minimize operational costs while meeting sustainability targets. Market momentum is further supported by the expansion of premium and craft beer segments, which require reliable pasteurization to preserve taste and freshness.

Innovation in equipment materials, automation controls, and heat recovery systems is paving the way for improved efficiency and higher throughput. Future growth opportunities are expected to arise from emerging markets, where breweries are upgrading from traditional to modern pasteurization technologies to meet both regulatory and consumer expectations.

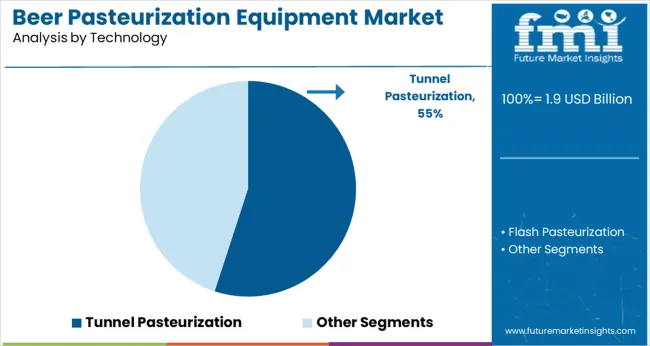

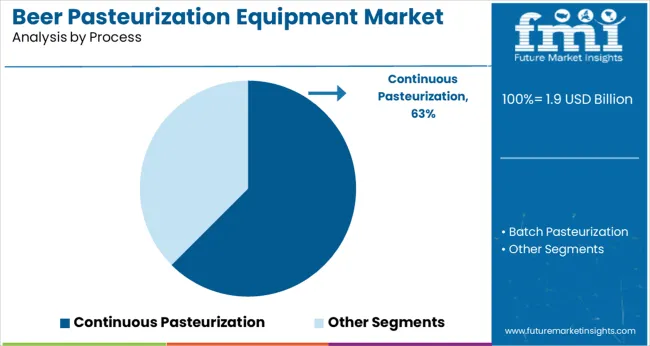

The market is segmented by Technology, Process, and Equipment Type and region. By Technology, the market is divided into Tunnel Pasteurization and Flash Pasteurization. In terms of Process, the market is classified into Continuous Pasteurization and Batch Pasteurization.

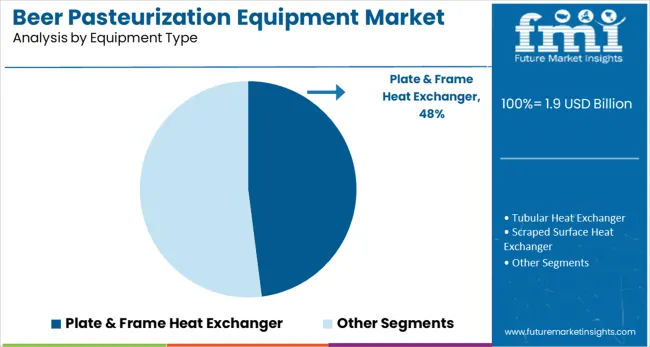

Based on Equipment Type, the market is segmented into Plate & Frame Heat Exchanger, Tubular Heat Exchanger, Scraped Surface Heat Exchanger, and Others. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

When segmented by technology, tunnel pasteurization is projected to hold 55% of the total market revenue in 2025, securing its position as the leading technology segment. This dominance is attributed to its robust capability to deliver uniform and controlled heat treatment across large batches of beer, ensuring microbiological stability without compromising flavor.

The enclosed design of tunnel systems enables continuous processing of bottled and canned products, which has enhanced operational efficiency for medium to large breweries. The segment’s growth has also been supported by its proven reliability, ease of integration into existing production lines, and lower maintenance requirements compared to alternative technologies.

As breweries prioritize consistency and scalability, tunnel pasteurization has remained the preferred choice, offering a balance between cost effectiveness and high throughput.

Segmenting the market by process reveals that continuous pasteurization accounts for 62.5% of the revenue share in 2025, making it the dominant process segment. This leadership has been reinforced by its ability to maintain uninterrupted production flows, minimizing downtime and enhancing productivity.

Breweries have increasingly adopted continuous systems to meet high-volume demands efficiently, while reducing energy and water consumption per unit of output. The process also enables precise temperature control and uniform pasteurization, which contributes to superior product quality and extended shelf life.

The capability of continuous systems to seamlessly integrate with automated bottling and packaging lines has further strengthened their appeal among large-scale producers. Operational cost savings and improved resource utilization have consolidated the segment’s position at the forefront of the market.

In terms of equipment type, the plate and frame heat exchanger segment is expected to command 48% of the market revenue in 2025, positioning it as the leading equipment type.

This prominence stems from its compact design, high heat transfer efficiency, and ease of maintenance, which have made it a preferred choice for breweries seeking efficient and reliable pasteurization solutions. The modular construction of plate and frame systems allows for flexibility in capacity expansion and quick adaptation to varying production needs.

Enhanced cleaning and sanitation features have further increased their adoption by ensuring compliance with strict hygiene standards. Breweries have favored this equipment type for its ability to deliver consistent thermal performance while optimizing energy use, which has reinforced its leading share in the market.

The global beer pasteurization equipment market size increased from USD 1,446.5 million to USD 1,724.9 million between 2020 and 2025, with a CAGR of 4.5%. The historical outlook for the market has been positive, driven by growing concern regarding the safety of beer consumption among consumers and brewers. Another driving factor for the market in the historical period includes a proliferation of pubs, restaurants, and hotels with the availability of alcoholic beverages, including beer, thus creating demand for pasteurizing equipment for beer.

During the forecast period, the global beer pasteurization equipment market is anticipated to grow from USD 1,792.2 billion in 2025 to USD 2,627.5 billion by 2035 with a CAGR of 3.9%. The market is predicted to be propelled by increasing demand for beer owing to evolving lifestyle of people anchored around enjoying new experiences. Additionally, this growth can be attributed to the increasing popularity of craft beer and growing awareness about the high susceptibility of craft beer to contamination, thus boosting the demand for beer pasteurization equipment.

The market is further positively influenced by the rising product innovations and advancements in beer pasteurization equipment to promote precision and efficiency during the pasteurization process.

| Attributes | Details |

|---|---|

| Beer Pasteurization Equipment Market CAGR (2025 to 2035) | 3.9% |

| Beer Pasteurization Equipment Market Size (2025) | USD 1,792.2 million |

| Beer Pasteurization Equipment Market Size (2035) | USD 2,627.5 million |

The market for beer pasteurization equipment is anticipated to be positively influenced by the emerging technologies to pasteurize beer. Emerging non-thermal technologies such as high-pressure homogenization (HPH), thermosensation (TS), high-pressure processing (HPP), and dense phase CO2 (DPCD) treatments exhibit less impact on beer sensory properties and lead to better preservation of freshness of original beer, as opposed to thermally processed beers.

The growing concerns regarding the presence of contaminants in beer that might impact consumers’ health, in addition to the emerging technologies to enhance the beer pasteurization process, are giving rise to the demand for advanced beer pasteurization equipment solutions.

The market is further being aided by the emerging trend of beer tourism, which involves traveling to beer festivals, breweries, or beer-related events that allow attendees to taste and enjoy beer. Thus, driving the sales of beer pasteurization equipment to maintain the beer quality produced on a large scale as well as in microbreweries.

The beer pasteurizing equipment market growth might suffer from the loss of consumers to non-alcoholic beverages. The growing shift towards healthier beverages is expanding the market size of non-alcoholic beverages. Consumers are now preferring non-alcoholic beverages, which are replete with nutrients and have fewer calories, as opposed to alcoholic beverages.

The growing popularity of functional beverages, such as fortified drinks, which is consistent with the on-the-go lifestyle of many people as a result of a hectic lifestyle, is reducing the number of beer consumers seeking weight loss options. Additionally, the evolving beverage industry is developing functional, fortified, and new combinations of beverages to enlarge its customer base, which is likely to hamper the demand for beer, thus negatively impacting the beer pasteurizing equipment market over the forecast period.

Tunnel pasteurization is a type of beer pasteurization in which beer bottles or cans are placed on a conveyor belt that passes through a tunnel where they are exposed to ultraviolet light or heat lamps. Tunnel pasteurization is effective at killing bacteria and other microorganisms that can spoil beer. It is also gentle enough to preserve the flavor and quality of the beer.

Beer pasteurization is the process of heating beer to a high temperature and then cooling it quickly. There are two types of pasteurization batch and continuous.

Batch pasteurization is the most common type of pasteurization for small breweries. The beer is heated in a large tank and then cooled quickly. This process is repeated several times to ensure that all the bacteria are killed. The growing number of small breweries, emerging demand for craft beers, and growing interest and support for local breweries are all contributing to the heightened demand for batch pasteurization over the forecast period.

Continuous pasteurization is used by large breweries. The beer is heated as it flows through a tube. It is then cooled quickly before it reaches the end of the tube. This process ensures that all the bacteria are killed without affecting the taste of the beer. The rising popularity of ‘alcohol socialization’ is positively impacting the growth of large breweries, which is reflected positively in the growing demand for continuous pasteurization methods.

There are several advantages to using a plate and frame heat exchanger for beer pasteurization.

One advantage is that a plate and frame heat exchanger can heat the beer more evenly than some other types of heat exchangers. This is important because it means that all of the beer will be heated to the same temperature, which is necessary for effective pasteurization.

Another advantage of using a plate and frame heat exchanger is that it can be cleaned more easily than some other types of heat exchangers. This is important because it means that the risk of contamination from previous batches of beer is reduced.

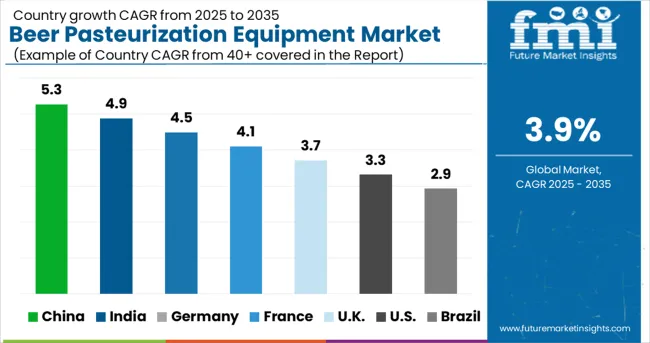

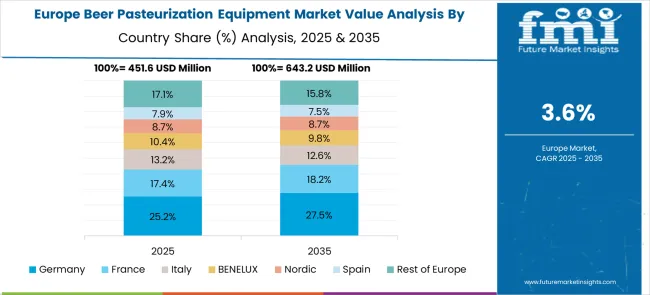

The United Kingdom's beer pasteurization equipment market is predicted to grow at a CAGR of 6.3% between 2025 and 2035. The United Kingdom's market share in beer pasteurization equipment is significant. The country is a leading manufacturer and supplier of this type of equipment. In addition, the United Kingdom has a strong export market for beer pasteurization equipment.

The regional market growth can be attributed to the availability of high-quality beer pasteurization equipment at competitive prices. The country has a long history of manufacturing this type of equipment and has developed a reputation for excellence.

Germany is famous for the celebration of Oktoberfest, which is associated with the consumption of a wide variety of beers. The high popularity of beer in the country can be attributed to its rich traditional history and easy access to beer, thus contributing to its demand in the country. Additionally, the recent increase in the demand for craft beers is also contributing to market growth. Craft beer brewers are experimenting with old favorites, such as pilsners and loggers, to introduce something new in order to capture young consumers.

The India beer pasteurization equipment market is anticipated to grow at a CAGR of 6.4% between 2025 and 2035. India is an important market for beer pasteurization equipment due to the growing demand for beer in the country. The major players in the Indian beer pasteurization equipment market include Seitz, Krones, and GEA. These companies are investing in research and development to develop innovative products that help ensure the sustained quality of beverages.

For instance, ECO-FLASH® FLASH PASTEURIZER by GEA enables stabilization and heat treatment of beer, beer mixes, etc., by discarding spoilage micro-organisms. The product features an entirely integrated cleaning and sterilization function to maintain the highest possible hygiene standards, thus contributing to its demand in the brewing process.

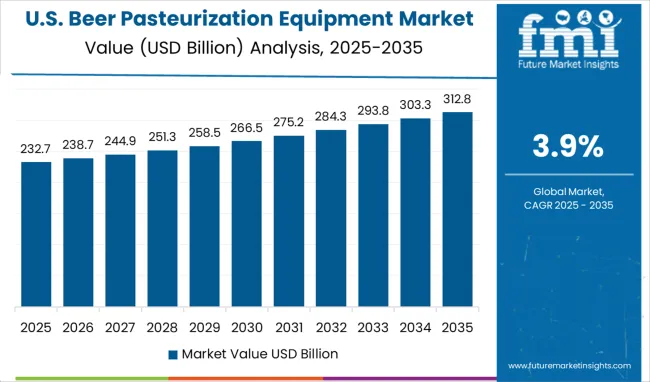

The USA accounted for 37.7% of the global market share, with a value of USD 1.9 million in 2025. The beer pasteurization equipment market in the United States is evolving rapidly. New technologies are being developed and implemented to keep up with the demand for faster, more efficient beer production.

One of the biggest changes has been the introduction of new types of beer pasteurization equipment. These new machines are designed to be more efficient and faster than ever before. This is a major benefit for breweries, as it means they can produce more beer in a shorter amount of time. Additionally, these new machines are also much easier to operate, which is another advantage for breweries.

Another change that has taken place in the beer pasteurization equipment market is the increased focus on energy efficiency, which helps reduce the overall operational costs of beer pasteurizing equipment.

The India beer pasteurization equipment market is anticipated to grow at a CAGR of 6.4% between 2025 and 2035. India is an important market for beer pasteurization equipment due to the growing demand for beer in the country. The major players in the Indian beer pasteurization equipment market include Seitz, Krones, and GEA. These companies are investing in research and development to develop innovative products that help ensure the sustained quality of beverages.

For instance, ECO-FLASH® FLASH PASTEURIZER by GEA enables stabilization and heat treatment of beer, beer mixes, etc., by discarding spoilage micro-organisms. The product features an entirely integrated cleaning and sterilization function to maintain the highest possible hygiene standards, thus contributing to its demand in the brewing process.

Shotgun Seltzer

The firm has headquarters in Texas, USA, and is inspired by classic cocktails with a spin of Texas influence. The company brews beers utilizing natural ingredients, with no preservatives and artificial sweeteners. Shortly after its launch on-premise, including bars, hotels, restaurants, and resorts, the products were made available in retail channels Texas-wide.

Geist

The start-up was established with the help of seed investment and USD 2 million from personal savings by Narayan Manepally for his brewery and related equipment. A large proportion of brewing equipment of Geist is developed in India, and the beer brewed by the company is served at several pubs and restaurants in Bengaluru. The company also has a microbrewery located in Brewsky, which is an upmarket pub and restaurant situated in the garden city.

Simba

Simba is distinct from other beer companies as it develops its own beer at Durg in Chhattisgarh. The beer is prepared in small batches, locus being the recipe and taste of the beer. Additionally, the brand uses real orange peel to infuse the beer with rich flavor. The four variants launched by Simba include Simba Stout, Simba Wit, Lager, and Strong.

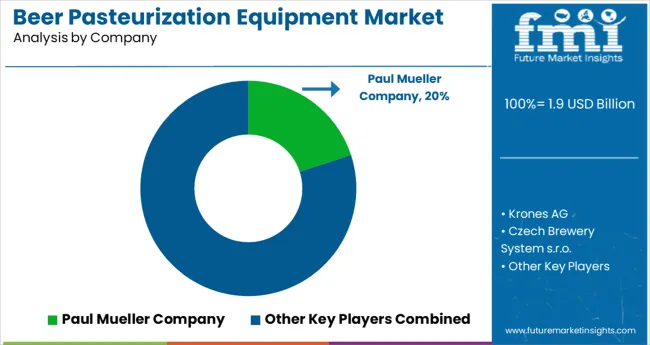

The beer pasteurization equipment market is highly competitive with various international and regional players vying for market share. Key players in the market include Paul Mueller Company, GEA Group, Alfa Laval, and Praj Industries.

The key challenges faced by the players in this market are the high initial investment required and stringent regulations regarding food safety.

| Attribute | Details |

|---|---|

| Forecast Period | 2025 to 2035 |

| Historical Data Available for | 2020 to 2025 |

| Market Analysis | million for Value and Units for Volume |

| Key Regions Covered | North America; Latin America; Europe; Asia Pacific; Oceania; Middle East and Africa (MEA) |

| Key Countries Covered | The USA, Canada, Mexico, Germany, The United Kingdom, France, Italy, Spain, China, Japan, India, South Korea, Australia, Brazil, Argentina, South Africa, UAE |

| Key Segments Covered | Technology, Process, Equipment Type, Region |

| Key Companies Profiled | Krones AG; Czech Brewery System s.r.o.; AMS Beverage Engineering and Services GmbH; Smart Machine Technologies; KHS Group; Paul Mueller Company; GEA Group; Alfa Laval; Praj Industries.; DVC Process Technologists; IDD Process & Packaging; Sacome; spectraa technology solutions pvt. ltd |

| Report Coverage | Company Share Analysis, DROT Analysis, Market Dynamics and Challenges, Strategic Growth Initiatives, Market Forecast, Competitive Landscape, |

| Customization & Pricing | Available upon Request |

The global beer pasteurization equipment market is estimated to be valued at USD 1.9 billion in 2025.

It is projected to reach USD 2.8 billion by 2035.

The market is expected to grow at a 3.9% CAGR between 2025 and 2035.

The key product types are tunnel pasteurization and flash pasteurization.

continuous pasteurization segment is expected to dominate with a 62.5% industry share in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Beer Fermenter Market Size and Share Forecast Outlook 2025 to 2035

Beer Stabilizers Market Size and Share Forecast Outlook 2025 to 2035

Beer Bottles Market Size and Share Forecast Outlook 2025 to 2035

Beer Dispensers Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Beer Glass Chillers Market Size and Share Forecast Outlook 2025 to 2035

Beer Packaging Market Size, Share & Forecast 2025 to 2035

Beer Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Beer Keg System Market Forecast & Outlook for 2025 to 2035

Beer Dispensing Machine Market Trends - Growth, Demand & Analysis 2025 to 2035

Beer Line Cooling System Market Trend Analysis Based on System, Application, and End-Use, and Region 2025 to 2035

Beer Line Cleaning Kit Market Trend Analysis Based on Product, End-User, Type, and Region 2025 to 2035

Beer Filter System Market insights by Equipment Type, Type, Filtration Process, Application, and Region 2025 to 2035

Beer Bottling Kit Market Insights by Equipment, Application, Mode of Operation, Distribution Channel, and Region 2025 to 2035

Market Share Insights for Beer Bottles Providers

Assessing Beer Canning Machines Market Share & Industry Trends

Competitive Overview of Beer Glassware Market Share

Beer Brewing Machine Market

Beer Cans Market

PVPP Beer Stabilizer Market Size and Share Forecast Outlook 2025 to 2035

Root Beer Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA