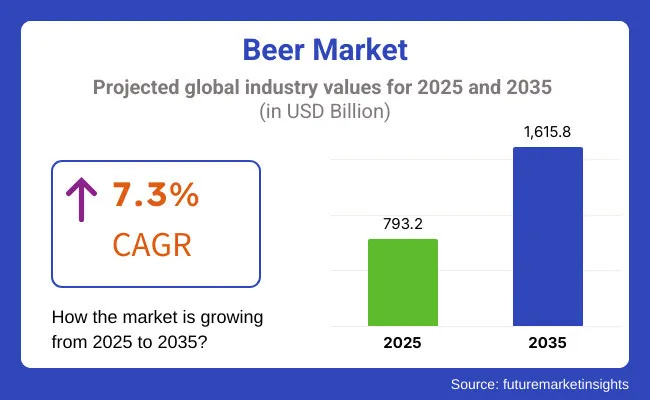

The global beer market is projected to reach USD 1,615.8 billion by 2035, registering a steady CAGR of 7.3% during the forecast period 2025 to 2035. The market is valued at USD 793.2 billion in 2025. Rising demand for craft, low-alcohol, and non-alcoholic beer variants, coupled with ongoing innovations in brewing technology, are fueling growth. The market is also being reshaped by evolving consumer preferences, with premiumization and health-conscious options gaining traction across urban demographics.

In terms of consumption patterns, lager continues to dominate global sales, supported by its clean profile and broad appeal across traditional and emerging beer markets. Meanwhile, ale and stout varieties are witnessing increased demand in regions with strong craft beer culture, such as North America and Western Europe. Ale’s warmer fermentation and fuller flavors make it especially popular among microbrewery enthusiasts.

Convenience, portability, and sustainability are influencing packaging preferences, with canned beer emerging as the leading format. In fact, over 50% of global beer is now sold in cans, largely due to their lightweight nature, recyclability, and ability to preserve flavor. Bottled beer still holds relevance in premium and imported segments, while returnable glass formats are gaining popularity among eco-conscious consumers.

From a production standpoint, macrobreweries dominate with nearly 70% of global volume, although craft and microbreweries are growing rapidly. These smaller operations are catering to local tastes, experimenting with flavors, and often commanding higher margins due to their artisanal positioning.

Hypermarkets and supermarkets are the primary sales channel, contributing 35% of global beer revenue. However, digitalization is reshaping distribution dynamics. Online retail, direct-to-consumer subscriptions, and taproom sales are gaining momentum, particularly in urban areas where convenience and personalization are key drivers.

Innovations such as AI-assisted fermentation, blockchain for ingredient traceability, and smart dispensers are transforming backend operations. At the same time, increasing emphasis on low-carbon brewing and biodegradable packaging is addressing regulatory and consumer pressure on sustainability.

The global beer market has been comprehensively segmented to provide granular insights across multiple dimensions. By product type, the market includes Ale, Lager, Stouts, and Others. Packaging formats analyzed in this report include Can, Bottle, Glass, and Others. Based on production methods, the beer market is segmented into Macrobrewery, Microbrewery, Craft Brewery, and Others. Distribution is studied through both Direct and Indirect channels, with sub-segments including Hypermarkets/Supermarkets, Convenience Stores, Specialty Stores, Independent Retailers, and Online Retailers.

Lager is expected to maintain its dominant position in the global beer market, commanding an estimated 45% share in 2025. Its crisp flavor, longer shelf life, and mass appeal have made it the go-to beer type across both mature and emerging economies. From large-scale macrobreweries to regional players, lagers continue to define beer consumption norms globally due to their scalability and accessibility.

While ales and stouts are rising in popularity, particularly in niche and premium segments, lager maintains widespread acceptance owing to its clean profile and consistent taste. Most international brands rely on lager-based formulations to serve high-volume, mainstream demand. Light lagers and pilsners are particularly popular among consumers seeking lower alcohol content and a more refreshing experience.

Key Highlights:

Cans are projected to dominate the global beer packaging landscape in 2025, accounting for nearly 50% of total sales. Their rise reflects shifting consumer priorities toward convenience, portability, and environmental responsibility. Cans are lightweight, easily recyclable, and offer better protection against light and oxygen, preserving the flavor and freshness of the beer longer than traditional bottles.

This packaging format is especially favored by craft brewers and large-scale producers alike for its cost-effectiveness and logistical benefits. Cans are increasingly preferred in e-commerce and on-the-go consumption scenarios, making them highly adaptable to modern retail environments and changing drinking habits.

Key Highlights:

Macrobreweries are projected to hold the lion’s share of global beer production, commanding approximately 70% of the market in 2025. These large-scale operations cater to mass-market demand with standardized production processes, extensive distribution networks, and strong brand portfolios. Their dominance is rooted in efficiency, scalability, and cost control, enabling them to supply consistent beer at competitive prices across global markets.

While microbreweries and craft brewers continue to gain attention for flavor innovation and local appeal, their combined volume still trails far behind macrobrewers. That said, macrobreweries are adapting by launching craft-style lines, acquiring boutique brands, and investing in sustainability and advanced brewing automation.

Key Highlights:

Hypermarkets and supermarkets are expected to remain the dominant distribution channel in the beer market, holding an estimated 35% share in 2025. These large-format retail outlets provide consumers with easy access to a wide range of beer brands, including mass-market lagers, premium imports, and increasingly, craft offerings. Their ability to offer volume discounts, product variety, and seasonal promotions makes them the preferred channel for everyday beer purchases.

As beer consumption continues to rise across both developed and developing markets, retailers are expanding their chilled beer sections and exclusive brand tie-ups. At the same time, hypermarkets serve as a key venue for sampling campaigns and new product launches.

Key Highlights:

The United States is projected to remain the largest beer market globally, driven by its expansive craft beer ecosystem, strong brand loyalty, and continuous product innovation. South Korea is set to emerge as the fastest-growing market, posting a CAGR of 7.6% from 2025 to 2035, spurred by the rise of local microbreweries and AI-enhanced brewing methods. The United Kingdom will benefit from its deep-rooted pub culture and expanding demand for low- and no-alcohol beers, growing at 7.1% CAGR.

The European Union-led by Germany, France, and Italy-will continue to favor premium and sustainable beer offerings, expanding at 7.2% CAGR. Meanwhile, Japan, despite demographic headwinds, will see niche growth in night-use and functional beers, registering a modest 7.4% CAGR thanks to high per capita spending and tech innovation in brewing.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 7.5% |

| UK | 7.1% |

| Germany | 3.9% |

| France | 4.3% |

| Japan | 7.4% |

The USA beer market is forecast to expand at a CAGR of 7.5% from 2025 to 2035, remaining the largest contributor to global beer revenues. While overall consumption has stabilized in recent years, the shift toward premium, craft, and low-alcohol options is reshaping the competitive landscape. The presence of major players like Anheuser-Busch InBev, Molson Coors, and a thriving ecosystem of over 9,000 craft breweries ensures a highly diversified offering. Technological innovations, including AI-assisted brewing and D2C subscription models, are enhancing consumer engagement and driving repeat purchases. Moreover, beer tourism and seasonal brews continue to attract a broad demographic.

Sales of beer in UK are anticipated to grow at a CAGR of 7.1% between 2025 and 2035. With a robust pub culture and increasing demand for both craft and alcohol-free beer, the UK presents a mature yet dynamic landscape. A notable rise in health-conscious consumption has fueled interest in low-calorie and zero-alcohol beer, while local breweries are capitalizing on unique flavor innovations. E-commerce and home-delivery beer services are gaining prominence, especially post-pandemic, redefining traditional purchase behavior.

Germany’s sales are expected to grow at a CAGR of 3.9% from 2025 to 2035. As one of the world’s most iconic brewing nations, Germany continues to drive demand for traditional lagers and pilsners while slowly integrating craft-style innovations. Regional breweries are still dominant, with strong consumer loyalty toward heritage brands. However, eco-conscious consumption patterns are encouraging a shift toward biodegradable packaging and organically sourced ingredients.

France’s sales are forecast to expand at a CAGR of 4.3% between 2025 and 2035, supported by rising demand for organic, gluten-free, and skin-sensitive beer formulations. Though traditionally a wine-centric country, France is seeing strong adoption of craft and specialty beers, particularly in urban and millennial segments. Health-conscious trends and EU regulations are reinforcing a move toward low-alcohol and eco-friendly beers.

Japan’s beer industry is projected to grow at a CAGR of 7.4% during the forecast period. Despite demographic challenges such as a declining birth rate and aging population, the market is buoyed by high per capita spending and innovation in brewing technology. Companies like Asahi and Kirin are leading with ultra-thin cans, AI fermentation, and night-use beer formats. The trend toward fusion beers blending sake elements and health-centric formulations is redefining category boundaries.

The global beer market is characterized by a mix of tier-1 multinational brewers and a growing number of tier-2 and tier-3 regional and craft-focused players. Tier-1 companies such as Anheuser-Busch InBev, Heineken N.V., Carlsberg Group, and Molson Coors dominate international markets with broad portfolios that span premium, mainstream, and non-alcoholic variants. These players are investing heavily in AI-powered brewing, sustainability initiatives, and digital sales infrastructure to defend their position and meet evolving consumer expectations.

Tier-2 companies and regional brewers are disrupting traditional volume-driven models by focusing on localization, flavor experimentation, and small-batch production. These players are especially prominent in North America, Western Europe, and emerging Asian craft clusters. Strategic alliances, including retail collaborations, brewpub expansions, and direct-to-consumer launches, are helping them extend reach without high capex.

In parallel, the rise of private label beer brands-offered by major retailers-has reshaped margin dynamics. Meanwhile, innovation in packaging (nitrogen-infused cans, resealable bottles) and formulations (gluten-free, probiotic-infused, and botanical brews) is blurring category lines and enhancing consumer engagement.

| Report Attributes | Details |

|---|---|

| Market Size (2025) | USD 793.2 billion |

| Projected Market Size (2035) | USD 1,615.8 billion |

| CAGR (2025 to 2035) | 7.3% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Forecast Period | 2025 to 2035 |

| Quantitative Units | USD Billion for Revenue |

| Product Types Analyzed | Ale, Lager, Stouts, Others |

| Packaging Formats Analyzed | Can, Bottle, Glass, Others |

| Production Types Analyzed | Macrobrewery, Microbrewery, Craft Brewery, Others |

| Distribution Channels Analyzed | Direct, Indirect (Hypermarkets, Online, etc.) |

| Regions Covered | North America, Latin America, Europe, Asia Pacific, Middle East & Africa |

| Countries Covered | United States, United Kingdom, Germany, France, Japan, South Korea and 40+ countries |

| Key Players Included | Anheuser-Busch InBev, Heineken N.V., Carlsberg Group, Molson Coors, China Resources Beer |

| Additional Attributes | Market share by segment, regional demand trends, eco-packaging impact, AI brewing innovation |

The global beer market is valued at USD 793.2 billion in 2025 and projected to reach USD 1,615.8 billion by 2035.

Lager is expected to lead the beer market by product type, holding a 45% share in 2025.

South Korea is the fastest growing beer market, expected to register a CAGR of 7.6% from 2025 to 2035.

Hypermarkets and supermarkets dominate beer distribution, capturing 35% of global sales in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Beer Fermenter Market Size and Share Forecast Outlook 2025 to 2035

Beer Stabilizers Market Size and Share Forecast Outlook 2025 to 2035

Beer Bottles Market Size and Share Forecast Outlook 2025 to 2035

Beer Dispensers Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Beer Pasteurization Equipment Market Size and Share Forecast Outlook 2025 to 2035

Beer Glass Chillers Market Size and Share Forecast Outlook 2025 to 2035

Beer Packaging Market Size, Share & Forecast 2025 to 2035

Beer Keg System Market Forecast & Outlook for 2025 to 2035

Beer Dispensing Machine Market Trends - Growth, Demand & Analysis 2025 to 2035

Beer Line Cooling System Market Trend Analysis Based on System, Application, and End-Use, and Region 2025 to 2035

Beer Line Cleaning Kit Market Trend Analysis Based on Product, End-User, Type, and Region 2025 to 2035

Beer Filter System Market insights by Equipment Type, Type, Filtration Process, Application, and Region 2025 to 2035

Beer Bottling Kit Market Insights by Equipment, Application, Mode of Operation, Distribution Channel, and Region 2025 to 2035

Market Share Insights for Beer Bottles Providers

Competitive Overview of Beer Glassware Market Share

Assessing Beer Canning Machines Market Share & Industry Trends

Beer Brewing Machine Market

Beer Cans Market

PVPP Beer Stabilizer Market Size and Share Forecast Outlook 2025 to 2035

Root Beer Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA