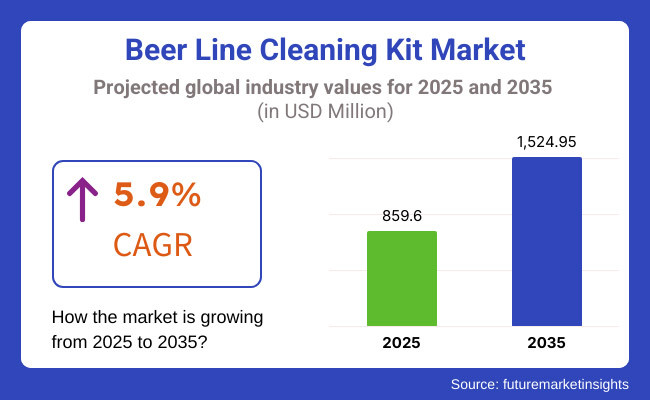

The global beer line cleaning kit market is anticipated to grow from USD 859.6 Million in 2025 to USD 1,524.95 Million in 2035 at a CAGR of 5.9% during the forecast period. Growth in the market is significantly attributed to growing beer production and consumption across the globe and an elevated focus on keeping the surroundings clean and avoiding beer-spoiling bacteria.

Beer line cleaning kits are important for the maintenance of beer quality through the removal of bacteria and sediment that can lead to off flavors. The beer line cleaning kits industry grew steadily in 2024 driven by the rising beer consumption, especially in developing industries.

The demand for superior draught beer and the enforcement of rigid hygiene standards resulted in a sudden increase in the adoption of beer line cleaning solutions among restaurants, bars, and breweries. Online channels also continued to expand, making the kits widely available to consumers globally.

Entering 2025 and the future, the industry will derive the advantage of new cleaning technologies, such as automated and environmentally friendly cleaning solutions. The increasing demand for craft beer and microbreweries will also further drive the demand for successful beer line maintenance. The growth of the food service and hospitality sectors will further increase the demand for these cleaning kits.

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Constant growth & increasing hygiene awareness: The industry expanded with beer drinking growing all over the world. Bars, restaurants, and breweries were especially concerned with hygiene, leading to higher demand for cleaning kits to ensure the quality of beer and avoid spoilage. | Stricter Hygiene Norms & Clean Tech Solutions: With increasing focus on quality assurance, the industry will see more sophisticated automated and green cleaning solutions minimize labor involvement and maintain cleanliness consistency. |

| Craft Beer & Microbreweries Expansion: Increased demand for regular and effective beer line maintenance was caused by the growth of small-scale breweries. Online sales platforms also picked up, providing easier access to cleaning kits. | Growth of Premium Draught & Green Solutions: Increased consumer demand for quality, preservative-free draught beer will drive the demand for effective cleaning solutions. The use of environment-friendly, biodegradable cleaners will also be more widely accepted. |

| Influence of Pandemic & Supply Chain Reconfigurations: The COVID-19 pandemic first upended supply chains and slowed demand temporarily. Nevertheless, recovery was robust, and companies adjusted by switching to e-commerce and direct-to-consumer platforms. | Expansion into Emerging Sectors & Supply Chain Strengthening: Latin American and African countries are likely to become new growth centers. In the meantime, better supply chains and logistics will make delivery and access to cleaning kits quicker across the globe. |

The industry of beer line cleaning kits comes under the segment of food and beverage hygiene and maintenance equipment, which is a sub-segment of the wider hospitality and food service equipment sector. It closely relates to industries of beer making, distribution, and serving, influencing bars, breweries, restaurants, and home-brewing systems.

The beer line cleaning kit business competes within the broader food and beverage services sector, hence subject to consumer beer drinking patterns, hospitality development, and policy change. Growing demand for high-end draught beer and specialty breweries across the globe has been driven by demand for efficient beer line maintenance systems.

Increased economic growth among emerging economies and increasing disposable incomes have contributed to increased beer consumption, thereby driving demand for cleaning kits indirectly. Additionally, the stringent hygiene protocols in developed economies, especially the North American and European sectors, are compelling enterprises to invest in sophisticated cleaning technology.

The industry also gains due to the rising use of environmentally-friendly and automatic cleaning systems with sustainability gaining ground across industries. In spite of these challenges, the future of the industry will be determined by technological innovation, regulatory requirements, and changing consumer preference for cleaner, better-quality beer.

Beer line cleaning kits come in small system and large system sizes, suited for various business requirements. Small systems are likely to continue to be in demand from craft breweries, independent pubs, and homebrewers that need compact and economical solutions.

They are simple to use and service, thus suited for small beer tap businesses. The trend of microbreweries and specialty beer-serving facilities is on the rise and will continue to fuel demand for small system kits. Large systems are favored by high-turnover bars, restaurants, and breweries that have more than one beer line.

As beer consumption increases and regulations about hygiene get tougher, companies will spend more on cutting-edge large-system solutions. These installations guarantee frequent and rigorous cleaning, ensuring contamination is avoided and beer quality is maintained.

Automation will be important in the expansion of large systems, as it saves labor and boosts efficiency. With quality assurance becoming the top priority for bars and breweries, both small and large system kits will witness increasing demand. The move toward more efficient, user-friendly, and automated cleaning solutions will be the key to industry developments in the forecast period.

Small businesses like independent bars, cafes, and microbreweries will still lead demand for inexpensive and convenient cleaning kits. These are usually small-scaled, needing small-system or manual solutions in order to keep them hygienic and with good beer quality. Increased craft beer culture and homebrewing activities will continue to fuel the use of these cleaning solutions, particularly through online platforms that provide convenience and affordability.

Medium-sized businesses, such as chain restaurants and regional breweries, require more intense and frequent cleaning with higher beer turnover. Several of them will implement semi-automatic systems, finding a middle ground between price and effectiveness. Harsher sanitation requirements and customer interest in premium draught beer will encourage companies to invest in effective and efficient cleaning systems.

Major corporations, including large breweries, beer distributors, and hotel chains, count on automated cleaning kits to maintain efficiency and compliance. They handle heavy volumes of beer on numerous taps, requiring labor-saving measures. With the quality of beer having a direct impact on reputation, these businesses will focus on innovative, technologically advanced cleaning systems that provide consistency, cleanliness, and convenience of operation.

Manual beer line cleaning kits continue to be favored by small businesses, homebrewers, and independent bars because they are cost-effective and effective. Manual kits offer an easy yet effective method of keeping beer lines clean, which makes them a desirable choice for low-resource businesses.

Although automation is becoming more popular, manual kits will continue to have a strong presence in the industry, particularly among businesses with low beer turnover and limited budgets. Automatic cleaning kits are increasingly popular, especially with medium to large enterprises that need regular and labor-saving solutions.

Automatic cleaning kits simplify the cleaning process, minimizing downtime and maximizing sanitation levels. Programmable cycles, environmentally friendly cleaning agents, and self-rinsing systems are essential features that will fuel adoption. As companies focus on hygiene and efficiency, automated kits will be critical in sustaining high beer quality with minimal labor. The increasing emphasis on automation and technological advancements will keep on dictating the way forward for beer line maintenance

The United States is anticipated to dominate the industry of beer line cleaning solutions holding an approximate share of 40% of overall sales. Key factors driving the need for sophisticated cleaning systems include the extensive craft movement in the USA, plus the emergence of several brewpubs, bars, and taprooms.

Both customers and management are increasingly being aware of how beer freshness is an indicator of overall quality. To ensure sanitary standards, the latter is consequently opting for automation and high-efficient cleaning kits. Increased sustainability efforts' impact is also likely to create industry trends in which breweries and bars look for green, chemical-free cleaning chemicals that comply with environmental policies.

Technological developments are also paving the way in America, with establishments channeling smart beer line cleaning sets based on sensors and automated planning that easy out the maintenance process. Large pub chains and breweries are transforming to fully automated, AI-backed cleaning systems that reduce labor dependency and guarantee consistent beer quality at multiple outlets.

In the United Kingdom, pub culture remains the primary reason propelling the demand for beer line cleaning kit. Both conventional and contemporary craft breweries are targeting on beer hygiene and maintenance to ensure flavor integrity.

Furthermore, authorities like the British Beer & Pub Association (BBPA) are compelling outlets to adapt more efficient and sustainable cleaning products to cater to the rising concerns of sanitation. Automation is being widely recognized as pub chains and breweries seek to maximize labor costs and improve efficiency.

Growing focus towards sustainability is also escalating the uptake of low-water and biodegradable cleaning agents. Moreover, as the UK underwent a transition towards premium draught and low-alcohol beer consumption, companies will eventually integrate to cleaning agents that preserve purity and eradicate bacterial contamination. Online channels of distribution are making cleaning kits readily available to small companies and independent bars, so industry growth can be sustained during the next ten years.

Germany's beer brewing culture is steeped in tradition, but the efforts at modernization are changing the beer line cleaning industry. The nation accounts for almost 40% of Europe's industry share, fueled by adherence to hard and fast beer purity laws (Reinheitsgebot) and strong enthusiasm for premium quality draught beer.

Large breweries, particularly those involved in participation in beer festivals and export channels, are early adopters of high-performance automated cleaning kits to maintain standardized levels of hygiene. Smaller, family-run breweries and neighborhood taverns are also making more investments in effective cleaning solutions to preserve beer quality and prolong keg life.

The popularity of biodegradable and environmentally friendly cleaning formulas is consistent with Germany's focus on sustainability, so green technology solutions are an area of interest for the industry. With increasing exports of beer and local demand holding steady, the demand for manual and automated cleaning kits will also increase, and Germany will continue to lead the way in brewing industry sanitation technology.

The South Korean beer sector is also undergoing a remarkable evolution, with the number of high-end bars, craft breweries, and Western bars on the rise driving demand for beer line cleaning products. Shifting consumer inclination towards fresh and quality beer has led bars and restaurants to adopt routine maintenance solutions to avoid microbial contamination and preserve flavor consistency.

With South Korea's busy urban life, companies are preferring automated cleaning kits that save downtime and man-hours. Self-cleaning and AI-powered cleaning systems are increasingly becoming popular, particularly in upscale establishments and international beer outlets.

The growing government interest in food safety regulations is also nudging companies toward more stringent cleaning processes, strengthening demand for effective and long-term cleaning products. With increasing premium draught beer consumption and beer tourism, the industry can look forward to a decade of sustained growth.

Japanese beer culture is evolving, with consumers demanding premium, craft, and alcohol-free beers. The change has put more focus on hygiene and maintenance of quality, increasing the demand for beer line cleaning kits among bars, izakayas, and breweries.

Strong standards of food and beverage safety in Japan, enforced by institutions like the Japan Food Research Laboratories, ensure that a routine of beer line cleaning is critical for businesses. Large breweries and beer-serving outlets are quickly embracing state-of-the-art cleaning technology, with a preference for automated systems with intelligent scheduling and self-rinsing capabilities.

With Japan's aging population, there is increased demand for labor-saving automated products that reduce human interaction. Japan's emphasis on green business initiatives supports the increased use of sustainable, chemical-free cleaning agents, which positions Japan at the forefront of innovative beer maintenance solutions. With the growth of premium beer consumption, companies will keep investing in high-efficiency cleaning systems to satisfy consumer demands.

China's brewing industry is rapidly evolving, with the beer line cleaning kit sector expecting a 6.3% CAGR in the period from 2025 to 2035. High-quality maintenance demands are driven by growth in brewpubs, foreign beer chains, and consumption of premium beer.

As there are more stringent government regulations imposed on food and beverage hygiene, companies are allocating capital to optimize cleaning kits as a means to adhere to security requirements and sustain product consistency. The emergence of intelligent, AI-based beer line cleaning kits is revolutionizing the business, particularly in big bars, breweries, and beer chains.

Shanghai, Shenzhen, and Beijing are at the forefront of this revolution, with companies focusing on automated, low-maintenance products. The trend towards e-commerce and direct-to-consumer sales is also increasing the availability of cleaning kits for small and medium-sized businesses. With consumer demand increasing and beer culture growing more refined, the need for sophisticated, environmentally friendly cleaning agents will only continue to make China a leading force in this sector.

India's beer sector is growing steadily with the help of growing urbanization, an increasing youth population, and expanding social acceptance of beer. With growing numbers of brewpubs, restaurants, and bars, demand for efficient beer line cleaning products is also gaining momentum.

More and more customers are preferring premium draught beer, and that is encouraging businesses to upgrade the hygiene levels so that beer can remain fresh and of high quality. Regulations imposed by the Food Safety and Standards Authority of India (FSSAI) are likely to fuel demand for sophisticated cleaning kits, especially in upscale pubs, breweries, and hospitality chains.

Automation is in its nascent stages, but bigger breweries and multinational beer companies are already adopting semi-automated cleaning systems to optimize operations. Online platforms are also making cleaning kits more accessible, especially for small business owners. With the industry growing up and hygiene being at the forefront, India is in line for a dramatic leap forward in beer line maintenance solutions within the next decade.

Future Market Insights (FMI) conducted a comprehensive survey with major stakeholders in the beer line cleaning solutions industry, including breweries, pub owners, equipment manufacturers, and suppliers.

The survey an indicated increasing focus on automation and sustainability, with more than half of the respondents stating that they are currently looking for environmentally friendly and automated cleaning solutions to improve efficiency and lower operational expenses.

The survey also pointed to a major trend towards AI-based and intelligent cleaning technologies. Large brewery and high-end beer chain stakeholders indicated keen interest in implementing self-cleaning systems with real-time monitoring, minimizing the need for manual labor while maintaining consistent beer quality.

Medium and small enterprises also indicated a desire for affordable hybrid solutions that blend manual and automatic elements to find a balance between affordability and effectiveness. Another critical takeaway from the survey was the impact of government regulation and compliance guidelines on purchasing decisions.

The participants from nations that have strict food and beverage safety legislation, like Germany, the UK, and Japan, cited increased urgency in spending on state-of-the-art cleaning systems. India and South Korea, however, demonstrated increased awareness but remain in the process of moving toward more formalized hygiene practices. Lastly, FMI’s survey confirmed that online sales channels are rapidly influencing procurement patterns.

| Countries | Regulatory Impact on Beer Line Cleaning Solutions |

|---|---|

| United States | Food and Drug Administration (FDA) and Alcohol and Tobacco Tax and Trade Bureau (TTB) implement rigorous sanitation guidelines for breweries and drinking establishments. Beer lines are cleaned regularly to avoid contamination. Most states enforce specific cleaning frequencies, prompting businesses to invest in effective automated equipment. |

| United Kingdom | British Beer & Pub Association (BBPA) suggests the cleaning of beer lines a minimum of once a week for maintaining quality. Even the UK Food Standards Agency (FSA) enforces tough hygiene standards on beer-selling businesses, prompting broad use of approved cleaning agents. |

| Germany | Following Reinheitsgebot (Beer Purity Law) and EU hygienic regulations, breweries implement rigorous sanitation routines. Compliance checks are conducted during inspections, inducing companies to invest in state-of-the-art cleansing technologies. Due to Germany's push for sustainability, emphasis is being placed on green solutions as well. |

| South Korea | The Food Sanitation Act regulates cleanliness standards for beer-serving establishments and mandates regular cleaning of beer lines. The administration is encouraging high-tech cleaning practices, which means more automated systems are being used in urban South Korea. |

| Japan | Japan's Food Sanitation Law mandates rigorous cleanliness standards from all beer-serving businesses. Some businesses opt to invest in beer lines that automatically clean themselves as a means to adhere to safety standards. Increasing non-chemical cleaning solutions dovetail with Japan's green-minded policies. |

| China | The State Administration for Market Regulation (SAMR) has rolled out stricter sanitation regulations for food and beverage outlets. Beer outlets are now required to follow more frequent cleaning cycles, creating demand for high-efficiency cleaning kits. |

| India | The Food Safety and Standards Authority of India (FSSAI) has put in place hygiene compliance standards for beer outlets, although enforcement is region-dependent. With increasing regulations, bigger breweries and chains are investing in organized cleaning solutions. |

The beer line cleaning solutions industry will grow as beer consumption increases, hygiene laws become stricter, and technology improves. One of the main opportunities is the implementation of automated and AI-based cleaning systems, cutting labor costs while being efficient.

Environmentally friendly cleaning agents also offer a solid growth path, with growing demand for biodegradable, chemical-free cleaning solutions aligning with sustainability objectives. The rise in microbreweries and craft breweries across the world is another factor, as these establishments need regular cleaning to ensure beer quality.

The developing sectors in Asia and Latin America present untapped opportunities because of increased urbanization and increasing beer culture. R&D investments in intelligent, self-cleaning technologies that can be integrated with IoT-based monitoring systems should be made by companies.

Increased product offerings with green solutions will appeal to regulatory changes and consumer trends. Focused marketing efforts aimed at small enterprises and high-end beer suppliers can boost industry penetration. Also, partnership with breweries, pubs, and regulatory authorities can generate long-term revenue. With a focus on efficiency, sustainability, and accessibility, companies can gain a competitive advantage in this changing business landscape.

The sector for beer line cleaning solutions is still fairly fragmented, with both traditional companies and new entrant startups. Though multinational giants dominate the sector, regional and specialty brands continue to find niches by promoting environmentally friendly and technologically advanced solutions.

The industry is slowly experiencing consolidation as big companies purchase small ones in order to grow their product offerings and international presence. During 2024, the sector witnessed various strategic mergers, acquisitions, and collaborations with a view to driving product innovation and industry reach.

Major producers entered into collaborations with breweries and hospitality groups for exclusive supply contracts. Others purchased smaller, technology-oriented cleaning solution companies and added AI and IoT-based automation capabilities to their offerings.

Also on the rise were sustainability-oriented partnerships between cleaning kit makers and environmentally friendly chemical companies as a response to growing environmental issues. New players are challenging the industry by using AI-based automated cleaning solutions and formulating biodegradable, chemical-free cleaning solutions.

Startups are going directly to consumers through e-commerce sites, providing subscription-based cleaning products for breweries and pubs. They are also placing their bets on affordable hybrid solutions for small and medium enterprises that will enable them to shift from manual to automated cleaning solutions. These moves are making startups firm contenders against the incumbent brands.

It prevents bacteria buildup, preserves flavor, and keeps draught systems running smoothly.

Automated self-cleaning systems, eco-friendly agents, and AI-powered monitoring are revolutionizing the process.

Stricter hygiene laws worldwide are pushing businesses toward advanced, compliant cleaning solutions.

Consider system size, cleaning frequency, eco-friendliness, and whether you prefer manual or automated options.

Yes, e-commerce makes it easier to compare products, access reviews, and find cost-effective solutions.

Table 1: Global Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Volume (MT) Forecast by Region, 2018 to 2033

Table 3: Global Value (US$ Million) Forecast by Product, 2018 to 2033

Table 4: Global Volume (MT) Forecast by Product, 2018 to 2033

Table 5: Global Value (US$ Million) Forecast by End User, 2018 to 2033

Table 6: Global Volume (MT) Forecast by End User, 2018 to 2033

Table 7: Global Value (US$ Million) Forecast by Type, 2018 to 2033

Table 8: Global Volume (MT) Forecast by Type, 2018 to 2033

Table 9: North America Value (US$ Million) Forecast by Country, 2018 to 2033

Table 10: North America Volume (MT) Forecast by Country, 2018 to 2033

Table 11: North America Value (US$ Million) Forecast by Product, 2018 to 2033

Table 12: North America Volume (MT) Forecast by Product, 2018 to 2033

Table 13: North America Value (US$ Million) Forecast by End User, 2018 to 2033

Table 14: North America Volume (MT) Forecast by End User, 2018 to 2033

Table 15: North America Value (US$ Million) Forecast by Type, 2018 to 2033

Table 16: North America Volume (MT) Forecast by Type, 2018 to 2033

Table 17: Latin America Value (US$ Million) Forecast by Country, 2018 to 2033

Table 18: Latin America Volume (MT) Forecast by Country, 2018 to 2033

Table 19: Latin America Value (US$ Million) Forecast by Product, 2018 to 2033

Table 20: Latin America Volume (MT) Forecast by Product, 2018 to 2033

Table 21: Latin America Value (US$ Million) Forecast by End User, 2018 to 2033

Table 22: Latin America Volume (MT) Forecast by End User, 2018 to 2033

Table 23: Latin America Value (US$ Million) Forecast by Type, 2018 to 2033

Table 24: Latin America Volume (MT) Forecast by Type, 2018 to 2033

Table 25: Europe Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: Europe Volume (MT) Forecast by Country, 2018 to 2033

Table 27: Europe Value (US$ Million) Forecast by Product, 2018 to 2033

Table 28: Europe Volume (MT) Forecast by Product, 2018 to 2033

Table 29: Europe Value (US$ Million) Forecast by End User, 2018 to 2033

Table 30: Europe Volume (MT) Forecast by End User, 2018 to 2033

Table 31: Europe Value (US$ Million) Forecast by Type, 2018 to 2033

Table 32: Europe Volume (MT) Forecast by Type, 2018 to 2033

Table 33: East Asia Value (US$ Million) Forecast by Country, 2018 to 2033

Table 34: East Asia Volume (MT) Forecast by Country, 2018 to 2033

Table 35: East Asia Value (US$ Million) Forecast by Product, 2018 to 2033

Table 36: East Asia Volume (MT) Forecast by Product, 2018 to 2033

Table 37: East Asia Value (US$ Million) Forecast by End User, 2018 to 2033

Table 38: East Asia Volume (MT) Forecast by End User, 2018 to 2033

Table 39: East Asia Value (US$ Million) Forecast by Type, 2018 to 2033

Table 40: East Asia Volume (MT) Forecast by Type, 2018 to 2033

Table 41: South Asia Value (US$ Million) Forecast by Country, 2018 to 2033

Table 42: South Asia Volume (MT) Forecast by Country, 2018 to 2033

Table 43: South Asia Value (US$ Million) Forecast by Product, 2018 to 2033

Table 44: South Asia Volume (MT) Forecast by Product, 2018 to 2033

Table 45: South Asia Value (US$ Million) Forecast by End User, 2018 to 2033

Table 46: South Asia Volume (MT) Forecast by End User, 2018 to 2033

Table 47: South Asia Value (US$ Million) Forecast by Type, 2018 to 2033

Table 48: South Asia Volume (MT) Forecast by Type, 2018 to 2033

Table 49: Oceania Value (US$ Million) Forecast by Country, 2018 to 2033

Table 50: Oceania Volume (MT) Forecast by Country, 2018 to 2033

Table 51: Oceania Value (US$ Million) Forecast by Product, 2018 to 2033

Table 52: Oceania Volume (MT) Forecast by Product, 2018 to 2033

Table 53: Oceania Value (US$ Million) Forecast by End User, 2018 to 2033

Table 54: Oceania Volume (MT) Forecast by End User, 2018 to 2033

Table 55: Oceania Value (US$ Million) Forecast by Type, 2018 to 2033

Table 56: Oceania Volume (MT) Forecast by Type, 2018 to 2033

Table 57: MEA Value (US$ Million) Forecast by Country, 2018 to 2033

Table 58: MEA Volume (MT) Forecast by Country, 2018 to 2033

Table 59: MEA Value (US$ Million) Forecast by Product, 2018 to 2033

Table 60: MEA Volume (MT) Forecast by Product, 2018 to 2033

Table 61: MEA Value (US$ Million) Forecast by End User, 2018 to 2033

Table 62: MEA Volume (MT) Forecast by End User, 2018 to 2033

Table 63: MEA Value (US$ Million) Forecast by Type, 2018 to 2033

Table 64: MEA Volume (MT) Forecast by Type, 2018 to 2033

Figure 1: Global Value (US$ Million) by Product, 2023 to 2033

Figure 2: Global Value (US$ Million) by End User, 2023 to 2033

Figure 3: Global Value (US$ Million) by Type, 2023 to 2033

Figure 4: Global Value (US$ Million) by Region, 2023 to 2033

Figure 5: Global Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 6: Global Volume (MT) Analysis by Region, 2018 to 2033

Figure 7: Global Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 8: Global Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 9: Global Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 10: Global Volume (MT) Analysis by Product, 2018 to 2033

Figure 11: Global Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 12: Global Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 13: Global Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 14: Global Volume (MT) Analysis by End User, 2018 to 2033

Figure 15: Global Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 16: Global Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 17: Global Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 18: Global Volume (MT) Analysis by Type, 2018 to 2033

Figure 19: Global Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 20: Global Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 21: Global Attractiveness by Product, 2023 to 2033

Figure 22: Global Attractiveness by End User, 2023 to 2033

Figure 23: Global Attractiveness by Type, 2023 to 2033

Figure 24: Global Attractiveness by Region, 2023 to 2033

Figure 25: North America Value (US$ Million) by Product, 2023 to 2033

Figure 26: North America Value (US$ Million) by End User, 2023 to 2033

Figure 27: North America Value (US$ Million) by Type, 2023 to 2033

Figure 28: North America Value (US$ Million) by Country, 2023 to 2033

Figure 29: North America Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 30: North America Volume (MT) Analysis by Country, 2018 to 2033

Figure 31: North America Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 32: North America Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 33: North America Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 34: North America Volume (MT) Analysis by Product, 2018 to 2033

Figure 35: North America Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 36: North America Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 37: North America Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 38: North America Volume (MT) Analysis by End User, 2018 to 2033

Figure 39: North America Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 40: North America Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 41: North America Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 42: North America Volume (MT) Analysis by Type, 2018 to 2033

Figure 43: North America Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 44: North America Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 45: North America Attractiveness by Product, 2023 to 2033

Figure 46: North America Attractiveness by End User, 2023 to 2033

Figure 47: North America Attractiveness by Type, 2023 to 2033

Figure 48: North America Attractiveness by Country, 2023 to 2033

Figure 49: Latin America Value (US$ Million) by Product, 2023 to 2033

Figure 50: Latin America Value (US$ Million) by End User, 2023 to 2033

Figure 51: Latin America Value (US$ Million) by Type, 2023 to 2033

Figure 52: Latin America Value (US$ Million) by Country, 2023 to 2033

Figure 53: Latin America Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 54: Latin America Volume (MT) Analysis by Country, 2018 to 2033

Figure 55: Latin America Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 56: Latin America Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 57: Latin America Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 58: Latin America Volume (MT) Analysis by Product, 2018 to 2033

Figure 59: Latin America Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 60: Latin America Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 61: Latin America Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 62: Latin America Volume (MT) Analysis by End User, 2018 to 2033

Figure 63: Latin America Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 64: Latin America Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 65: Latin America Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 66: Latin America Volume (MT) Analysis by Type, 2018 to 2033

Figure 67: Latin America Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 68: Latin America Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 69: Latin America Attractiveness by Product, 2023 to 2033

Figure 70: Latin America Attractiveness by End User, 2023 to 2033

Figure 71: Latin America Attractiveness by Type, 2023 to 2033

Figure 72: Latin America Attractiveness by Country, 2023 to 2033

Figure 73: Europe Value (US$ Million) by Product, 2023 to 2033

Figure 74: Europe Value (US$ Million) by End User, 2023 to 2033

Figure 75: Europe Value (US$ Million) by Type, 2023 to 2033

Figure 76: Europe Value (US$ Million) by Country, 2023 to 2033

Figure 77: Europe Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 78: Europe Volume (MT) Analysis by Country, 2018 to 2033

Figure 79: Europe Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 80: Europe Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 81: Europe Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 82: Europe Volume (MT) Analysis by Product, 2018 to 2033

Figure 83: Europe Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 84: Europe Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 85: Europe Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 86: Europe Volume (MT) Analysis by End User, 2018 to 2033

Figure 87: Europe Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 88: Europe Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 89: Europe Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 90: Europe Volume (MT) Analysis by Type, 2018 to 2033

Figure 91: Europe Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 92: Europe Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 93: Europe Attractiveness by Product, 2023 to 2033

Figure 94: Europe Attractiveness by End User, 2023 to 2033

Figure 95: Europe Attractiveness by Type, 2023 to 2033

Figure 96: Europe Attractiveness by Country, 2023 to 2033

Figure 97: East Asia Value (US$ Million) by Product, 2023 to 2033

Figure 98: East Asia Value (US$ Million) by End User, 2023 to 2033

Figure 99: East Asia Value (US$ Million) by Type, 2023 to 2033

Figure 100: East Asia Value (US$ Million) by Country, 2023 to 2033

Figure 101: East Asia Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 102: East Asia Volume (MT) Analysis by Country, 2018 to 2033

Figure 103: East Asia Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 104: East Asia Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 105: East Asia Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 106: East Asia Volume (MT) Analysis by Product, 2018 to 2033

Figure 107: East Asia Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 108: East Asia Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 109: East Asia Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 110: East Asia Volume (MT) Analysis by End User, 2018 to 2033

Figure 111: East Asia Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 112: East Asia Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 113: East Asia Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 114: East Asia Volume (MT) Analysis by Type, 2018 to 2033

Figure 115: East Asia Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 116: East Asia Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 117: East Asia Attractiveness by Product, 2023 to 2033

Figure 118: East Asia Attractiveness by End User, 2023 to 2033

Figure 119: East Asia Attractiveness by Type, 2023 to 2033

Figure 120: East Asia Attractiveness by Country, 2023 to 2033

Figure 121: South Asia Value (US$ Million) by Product, 2023 to 2033

Figure 122: South Asia Value (US$ Million) by End User, 2023 to 2033

Figure 123: South Asia Value (US$ Million) by Type, 2023 to 2033

Figure 124: South Asia Value (US$ Million) by Country, 2023 to 2033

Figure 125: South Asia Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 126: South Asia Volume (MT) Analysis by Country, 2018 to 2033

Figure 127: South Asia Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 128: South Asia Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 129: South Asia Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 130: South Asia Volume (MT) Analysis by Product, 2018 to 2033

Figure 131: South Asia Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 132: South Asia Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 133: South Asia Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 134: South Asia Volume (MT) Analysis by End User, 2018 to 2033

Figure 135: South Asia Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 136: South Asia Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 137: South Asia Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 138: South Asia Volume (MT) Analysis by Type, 2018 to 2033

Figure 139: South Asia Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 140: South Asia Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 141: South Asia Attractiveness by Product, 2023 to 2033

Figure 142: South Asia Attractiveness by End User, 2023 to 2033

Figure 143: South Asia Attractiveness by Type, 2023 to 2033

Figure 144: South Asia Attractiveness by Country, 2023 to 2033

Figure 145: Oceania Value (US$ Million) by Product, 2023 to 2033

Figure 146: Oceania Value (US$ Million) by End User, 2023 to 2033

Figure 147: Oceania Value (US$ Million) by Type, 2023 to 2033

Figure 148: Oceania Value (US$ Million) by Country, 2023 to 2033

Figure 149: Oceania Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 150: Oceania Volume (MT) Analysis by Country, 2018 to 2033

Figure 151: Oceania Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 152: Oceania Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 153: Oceania Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 154: Oceania Volume (MT) Analysis by Product, 2018 to 2033

Figure 155: Oceania Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 156: Oceania Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 157: Oceania Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 158: Oceania Volume (MT) Analysis by End User, 2018 to 2033

Figure 159: Oceania Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 160: Oceania Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 161: Oceania Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 162: Oceania Volume (MT) Analysis by Type, 2018 to 2033

Figure 163: Oceania Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 164: Oceania Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 165: Oceania Attractiveness by Product, 2023 to 2033

Figure 166: Oceania Attractiveness by End User, 2023 to 2033

Figure 167: Oceania Attractiveness by Type, 2023 to 2033

Figure 168: Oceania Attractiveness by Country, 2023 to 2033

Figure 169: MEA Value (US$ Million) by Product, 2023 to 2033

Figure 170: MEA Value (US$ Million) by End User, 2023 to 2033

Figure 171: MEA Value (US$ Million) by Type, 2023 to 2033

Figure 172: MEA Value (US$ Million) by Country, 2023 to 2033

Figure 173: MEA Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 174: MEA Volume (MT) Analysis by Country, 2018 to 2033

Figure 175: MEA Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 176: MEA Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 177: MEA Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 178: MEA Volume (MT) Analysis by Product, 2018 to 2033

Figure 179: MEA Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 180: MEA Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 181: MEA Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 182: MEA Volume (MT) Analysis by End User, 2018 to 2033

Figure 183: MEA Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 184: MEA Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 185: MEA Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 186: MEA Volume (MT) Analysis by Type, 2018 to 2033

Figure 187: MEA Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 188: MEA Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 189: MEA Attractiveness by Product, 2023 to 2033

Figure 190: MEA Attractiveness by End User, 2023 to 2033

Figure 191: MEA Attractiveness by Type, 2023 to 2033

Figure 192: MEA Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Beer Fermenter Market Size and Share Forecast Outlook 2025 to 2035

Beer Stabilizers Market Size and Share Forecast Outlook 2025 to 2035

Beer Bottles Market Size and Share Forecast Outlook 2025 to 2035

Beer Dispensers Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Beer Pasteurization Equipment Market Size and Share Forecast Outlook 2025 to 2035

Beer Glass Chillers Market Size and Share Forecast Outlook 2025 to 2035

Beer Packaging Market Size, Share & Forecast 2025 to 2035

Beer Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Beer Keg System Market Forecast & Outlook for 2025 to 2035

Beer Dispensing Machine Market Trends - Growth, Demand & Analysis 2025 to 2035

Beer Filter System Market insights by Equipment Type, Type, Filtration Process, Application, and Region 2025 to 2035

Market Share Insights for Beer Bottles Providers

Assessing Beer Canning Machines Market Share & Industry Trends

Competitive Overview of Beer Glassware Market Share

Beer Brewing Machine Market

Beer Cans Market

Beer Bottling Kit Market Insights by Equipment, Application, Mode of Operation, Distribution Channel, and Region 2025 to 2035

Beer Line Cooling System Market Trend Analysis Based on System, Application, and End-Use, and Region 2025 to 2035

Root Beer Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Home Beer Brewing Machine Market Analysis & Forecast 2025-2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA