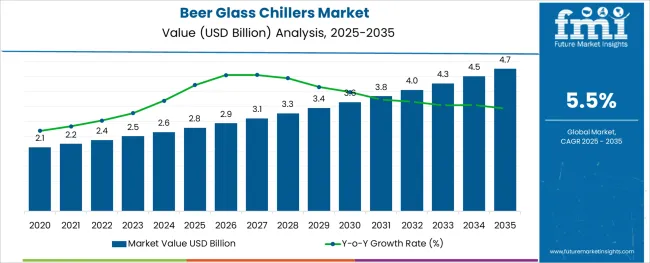

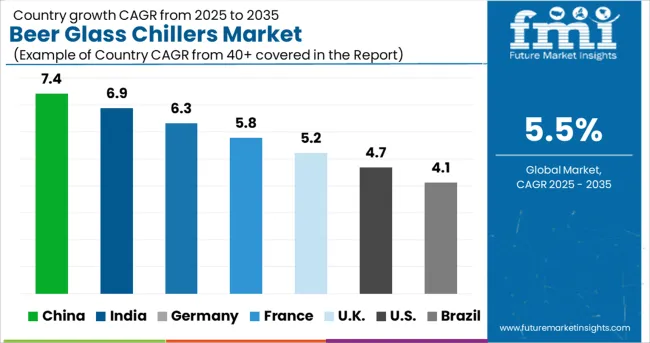

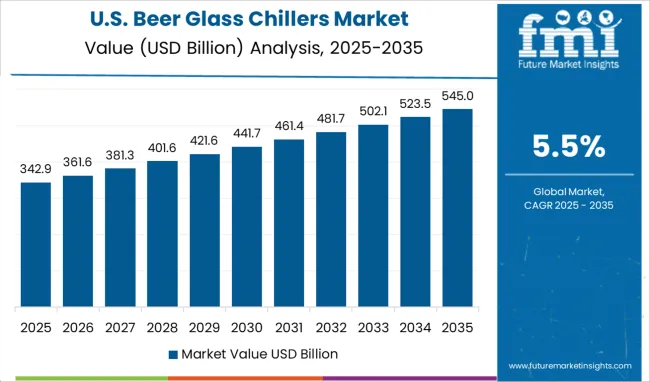

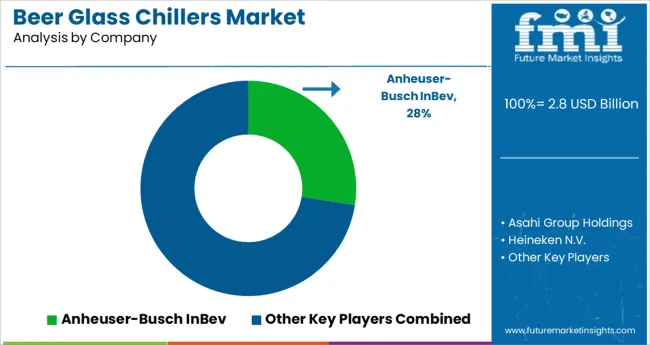

The Beer Glass Chillers Market is estimated to be valued at USD 2.8 billion in 2025 and is projected to reach USD 4.7 billion by 2035, registering a compound annual growth rate (CAGR) of 5.5% over the forecast period.

The beer glass chillers market is gaining traction as breweries, bars, and restaurants increasingly prioritize customer experience and operational efficiency. Rising consumer expectations for perfectly chilled beverages and enhanced presentation have driven widespread adoption of specialized chilling equipment.

Manufacturers are responding with innovations that improve energy efficiency, compactness, and reliability while meeting stringent food safety standards. The market’s future outlook remains positive as commercial establishments continue investing in equipment that supports premiumization and brand differentiation strategies.

Growing hospitality sector expansion and increasing emphasis on reducing operational downtime through robust, easy-to-maintain chillers are paving the way for sustained growth. Advancements in cooling technologies and design aesthetics are expected to open further opportunities, enabling establishments to deliver superior service while optimizing space and cost.

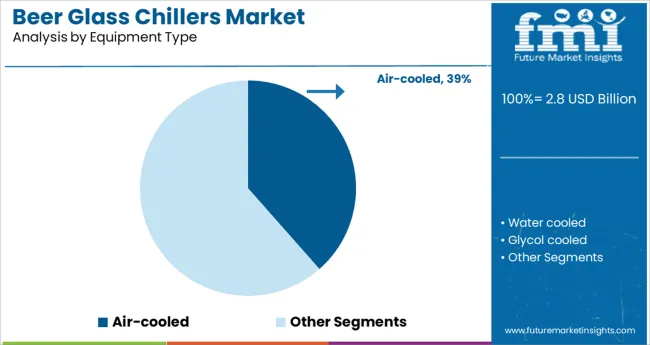

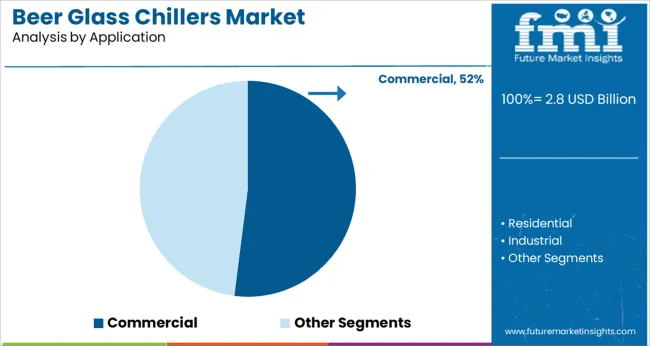

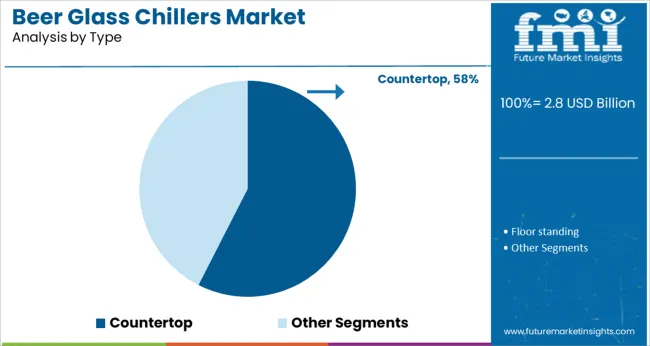

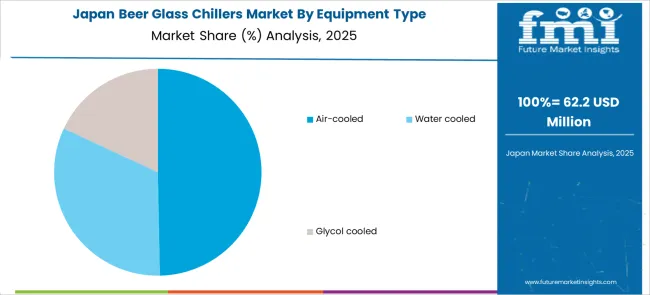

The market is segmented by Equipment Type, Application, Type, and Distribution Channel and region. By Equipment Type, the market is divided into Air-cooled, Water cooled, and Glycol cooled. In terms of Application, the market is classified into Commercial, Residential, and Industrial. Based on Type, the market is segmented into Countertop and Floor standing.

By Distribution Channel, the market is divided into Offline and Online. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

When segmented by equipment type, the air cooled segment is estimated to contribute 38.5% of the market revenue in 2025, maintaining its leadership within this category. This dominance has been attributed to the simplicity, cost efficiency, and ease of installation offered by air cooled units compared to water cooled alternatives.

Their ability to perform effectively without requiring additional plumbing infrastructure has made them highly suitable for establishments with space or utility constraints. Enhanced reliability and lower maintenance requirements have further strengthened their appeal, particularly in high turnover environments where consistent performance is crucial.

Improved designs with quieter operation and better heat dissipation have also contributed to their widespread acceptance, enabling establishments to meet customer expectations while managing operational costs efficiently.

Segmented by application, the commercial segment is projected to hold 52.0% of the market revenue in 2025, solidifying its position as the leading application segment. This leadership has been supported by robust demand from bars, pubs, restaurants, and hotels where customer service quality directly influences revenue.

Investments in premium beverage presentation and the need to maintain consistent serving standards have motivated establishments to adopt dedicated glass chillers. The commercial segment has benefited from rising competition in the hospitality industry, driving businesses to enhance customer satisfaction through differentiated service offerings.

Additionally, operational advantages such as improved hygiene, faster service turnaround, and reduced spoilage have reinforced the value proposition of glass chillers in commercial settings, further entrenching this segment at the forefront of the market.

When segmented by type, the countertop segment is forecast to account for 57.5% of the market revenue in 2025, asserting its leadership in this category. The prominence of countertop chillers has been shaped by their compact footprint, flexibility, and ease of integration into existing service layouts.

These units have been favored for their ability to deliver rapid chilling without consuming excessive space, making them ideal for bars and restaurants with limited back-of-house areas. The convenience of plug-and-play functionality and aesthetically pleasing designs has further enhanced their attractiveness, aligning with the operational needs of fast-paced service environments.

The countertop segment’s ability to balance performance, mobility, and visual appeal has firmly established it as the preferred choice among operators seeking both efficiency and customer-facing elegance.

According to Future Market Insights, the beer glass chiller market thrived at a CAGR of 5.0% to reach USD 1,386.0 million in 2025 from USD 1,140.2 million in 2020, with numerous reasons at play.

Traditionally, the demand for beer glass chillers rose with the growth in the number of leisure and recreational activities, especially in the developed regions. As the trend of wanderlust penetrates developing countries, assisted by the rise in disposable income, the splashes of beer glass chillers market revenue are likely to rise.

Looking to the future, it's clear that beer glass chillers are likely to continue to play an essential role in the world of beer. As understanding pertaining to the science behind brewing and chilling beer continues to grow, it can be expected that these chillers are likely to become even more advanced. Since users are always on the quest for the 'new,' manufacturers eye on the latest technology.

According to research by Future Market Insights, the beer glass chillers market is anticipated to expand at a CAGR of 5.5% over the forecasted period.

The food and beverage industry is a major segment of growth in the beer glass chillers market. The growing popularity of craft beer and the rise in consumption of chilled beverages are key factors driving the demand for beer glass chillers.

Major players in the food and beverage industry are investing heavily in the development of new and innovative products to cater to the growing demand from consumers. For instance, Molson Coors Brewing Company has launched a new line of beer glass chillers under its Miller Chill brand. The company has also partnered with leading retailers such as Walmart and Target to sell its products.

The rising disposable incomes of consumers and their changing preferences are also fuelling the growth of the beer glass chillers market. Increasing health consciousness among consumers is leading them to prefer healthier alternatives, such as craft beer, over traditional beers. This trend is expected to continue over the forecast period.

The growing demand for beer in the Asia Pacific region is the primary driver for the growth of commercial beer glass chillers in commercial and residential segments.

The rise in disposable income and changing lifestyle trends are resulting in increased consumption of beer, which is driving the demand for commercial beer glass chillers. Additionally, the growing hospitality industry in the region is also driving the demand for these products.

The North American and European regions are also expected to witness significant growth during the forecast period due to the presence of a large number of restaurateurs and suppliers in these regions.

Restoration of tourist spots in the United Kingdom region along with the presence of leading craft beer brands.

While the United Kingdom is expected to gain traction during the forecast period. The growth is attributed to the new brands entering the beer equipment markets, such as the beer glass chiller market.

Furthermore, the advanced personalized and ice-specific chiller has been in trend and is likely to replace the regular conventional beer chiller. There are different spaces in the European region in which people prefer their beer to be chilled for long hours.

The rising number of crafted breweries in the USA along with a higher number of youngsters indulging in drinking beer is flourishing the demand for beer glass chillers.

The United States holds the biggest share in the global egg grading machines market. The USA has become the biggest region because of higher alcohol consumption, more FMCG startups, and the presence of different bar and restaurant chains that serve crafted beer at their breweries.

Other than this, the increased awareness around crafted beer and its benefits is also fueling the demand for beer glass chillers. The demand for beer glass chillers is expected to grow in North America as the craft beer industry continues to grow. Craft breweries are expected to account for more than 10% of the total USA beer market by 2035.

This growth is being driven by consumers who are looking for new and interesting flavors.

Soften government regulations around beer drinking coupled with new craft beer mixes are fueling the demand for beer glass chillers.

China is a part of the Asia Pacific region along with being the top emerging economy puts its alcohol consumption at the top. Younger people have started drinking more during the last decade.

New experiments with the beer flavor have started attracting a new consumer base in China. The increased number of bars and restaurants have started adopting beer glass chillers. People who don’t like ice prefer these chillers so that the beer can be consumed without a hitch.

Expanding the Japanese alcohol and beer market along with the rising economic activities in the region has led to market growth.

The new and advanced technology in the FMCG sector enhances the beverage intake experience along with higher restaurant and bar penetration.

The rising demand for craft beer in the urban region with the rising awareness around different types of beers fuel the demand for beer glass chillers. The advent of advanced chillers that are efficient in nature while making beer the coldest, which is increasing their adoption among Gen Z and the millennial populace.

Rising preference for beer amongst Koreans fuels the growth while stringent policies slow down the market’s growth rate.

Flourishing demand for craft beer in the coastal region of South Korea along with rising craft beer startups has led to the rising demand for beer-related equipment such as glasses, snacks, and chillers. Along with these, the higher number of bars in the region have consumed the most from the global beer glasses chiller market.

The increasing demand for beer and the changing consumer preferences are the major factors driving the growth of the beer glass chillers market. The growing trend of microbreweries and home brewing is also fueling the market growth.

Companies try to produce enhanced electric glass chillers with advanced integrated technology. The efficient cooling is the factor all the major players play their cards on.

The leading players in the beer glass chillers market

| Attribute | Details |

|---|---|

| Forecast Period | 2025 to 2035 |

| Historical Data Available for | 2020 to 2025 |

| Market Analysis | million in value |

| Key Regions Covered | North America; Eastern Europe; Western Europe; Japan; South America; Asian Pacific; Middle east and Africa |

| Key Countries Covered | USA, Germany, France, Italy, Canada, United Kingdom, Spain, China, India, Australia |

| Key Segments Covered | Product Type, Mode of operation, Application, Distribution channel, Region |

| Key Companies Profiled | Asahi Group Holdings; Heineken N.V.; Anheuser-Busch InBev; Carlsberg Group; Molson Coors Brewing Company; Diageo Plc.; Zambelli; Lasotherm Technologies; Alphatech Process Equipments |

| Report Coverage | Market Forecast, Company Share Analysis, DROT Analysis, Market Dynamics, Competitive Landscape, Challenges, Strategic Growth Initiatives |

| Customization and Pricing |

Available upon request |

The global beer glass chillers market is estimated to be valued at USD 2.8 billion in 2025.

It is projected to reach USD 4.7 billion by 2035.

The market is expected to grow at a 5.5% CAGR between 2025 and 2035.

The key product types are air-cooled, water cooled and glycol cooled.

commercial segment is expected to dominate with a 52.0% industry share in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Beer Fermenter Market Size and Share Forecast Outlook 2025 to 2035

Beer Stabilizers Market Size and Share Forecast Outlook 2025 to 2035

Beer Bottles Market Size and Share Forecast Outlook 2025 to 2035

Beer Dispensers Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Beer Pasteurization Equipment Market Size and Share Forecast Outlook 2025 to 2035

Beer Packaging Market Size, Share & Forecast 2025 to 2035

Beer Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Beer Keg System Market Forecast & Outlook for 2025 to 2035

Beer Dispensing Machine Market Trends - Growth, Demand & Analysis 2025 to 2035

Beer Line Cooling System Market Trend Analysis Based on System, Application, and End-Use, and Region 2025 to 2035

Beer Line Cleaning Kit Market Trend Analysis Based on Product, End-User, Type, and Region 2025 to 2035

Beer Filter System Market insights by Equipment Type, Type, Filtration Process, Application, and Region 2025 to 2035

Beer Bottling Kit Market Insights by Equipment, Application, Mode of Operation, Distribution Channel, and Region 2025 to 2035

Market Share Insights for Beer Bottles Providers

Assessing Beer Canning Machines Market Share & Industry Trends

Beer Brewing Machine Market

Beer Cans Market

Competitive Overview of Beer Glassware Market Share

Root Beer Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Home Beer Brewing Machine Market Analysis & Forecast 2025-2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA