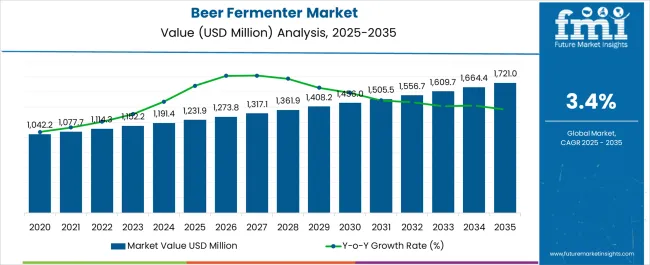

The beer fermenter market is estimated to be valued at USD 1231.9 million in 2025 and is projected to reach USD 1721.0 million by 2035, registering a compound annual growth rate (CAGR) of 3.4% over the forecast period.

Brewery operators evaluate fermenter specifications based on volume capacity, temperature control precision, and cleaning system integration when planning facility expansions or equipment upgrades. Equipment selection involves balancing initial capital investment against operational efficiency gains including reduced labor requirements, improved batch consistency, and enhanced sanitation capabilities that minimize contamination risks during fermentation cycles. Procurement decisions consider vessel construction materials, insulation properties, and automated monitoring systems that enable remote oversight of fermentation parameters throughout production schedules.

Manufacturing processes concentrate on stainless steel fabrication techniques that ensure sanitary surface finishes while maintaining structural integrity under pressure cycling and thermal stress conditions encountered during brewing operations. Equipment manufacturers coordinate with brewery design consultants to specify fermenter configurations that optimize floor space utilization while accommodating glycol cooling systems, sample ports, and transfer piping arrangements required for efficient production workflows. Quality control standards address weld inspection, pressure testing, and surface finishing procedures that validate equipment suitability for food-grade applications.

Installation teams manage coordination between fermenter delivery schedules and facility construction timelines while addressing structural requirements for supporting filled vessel loads and associated utility connections. Cross-functional challenges arise between brewing personnel seeking traditional fermentation approaches and facility engineers implementing automated control systems that monitor pH levels, dissolved oxygen content, and temperature profiles throughout fermentation processes. Maintenance protocols establish cleaning cycles, valve inspection schedules, and cooling system service requirements that preserve equipment functionality while meeting regulatory sanitation standards.

Fermentation vessel manufacturing involves specialized welding certifications and heat treatment processes that ensure material properties meet pressure vessel standards while maintaining corrosion resistance throughout extended operational periods. Production scheduling accommodates custom sizing requirements that vary significantly between small craft operations requiring 10-barrel capacities and industrial breweries specifying 1,000-barrel vessels for high-volume production runs. Component integration addresses cone angles, outlet configurations, and sample valve positioning that influence yeast harvesting efficiency and cleaning accessibility during routine maintenance cycles.

Automation trends emphasize sensor integration for real-time monitoring of specific gravity changes, temperature stratification, and pressure variations that indicate fermentation progress and potential process deviations. Control system programming accommodates recipe management capabilities that store temperature profiles, timing sequences, and alarm parameters for different beer styles while maintaining data logging functions required for quality assurance documentation. Equipment manufacturers develop standardized control interfaces that simplify operator training while supporting integration with existing brewery management systems and production scheduling software.

| Metric | Value |

|---|---|

| Beer Fermenter Market Estimated Value in (2025 E) | USD 1231.9 million |

| Beer Fermenter Market Forecast Value in (2035 F) | USD 1721.0 million |

| Forecast CAGR (2025 to 2035) | 3.4% |

The beer fermenter market is experiencing steady growth driven by the expansion of craft breweries, rising consumer demand for premium and diverse beer varieties, and increasing adoption of advanced brewing equipment. The emphasis on quality control, hygiene, and efficiency in the brewing process has led to wider use of durable and temperature stable fermenters.

Regulatory compliance and industry standards related to food grade materials are also reinforcing the preference for high performance fermenters. Advancements in brewing technology, including automated temperature regulation and digital monitoring, are further enhancing production consistency and scalability.

The outlook remains positive as both established breweries and emerging microbreweries continue to invest in modern fermentation systems to meet evolving consumer preferences and ensure cost effective operations.

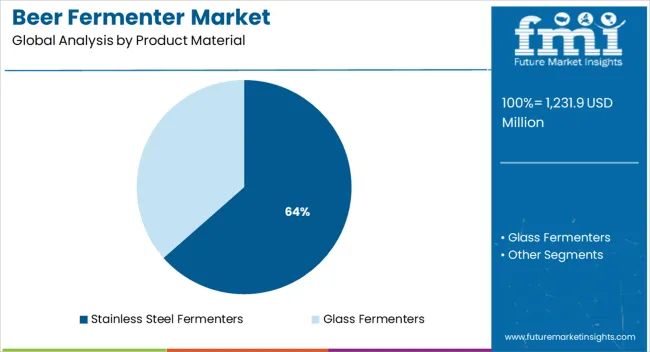

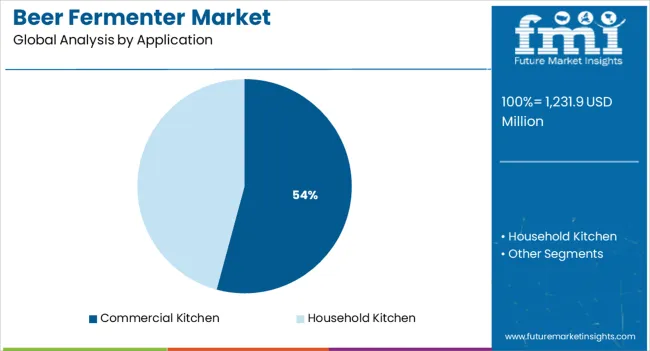

The market is segmented by Product Material and Application and region. By Product Material, the market is divided into Stainless Steel Fermenters and Glass Fermenters. In terms of Application, the market is classified into Commercial Kitchen and Household Kitchen. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The stainless steel fermenters segment is projected to account for 63.50% of the total market revenue by 2025 within the product material category, making it the leading segment. This dominance is driven by the superior durability, ease of cleaning, and resistance to contamination offered by stainless steel, which are critical factors in maintaining the integrity of the brewing process.

Stainless steel fermenters also enable better temperature control, which is essential for achieving desired flavor profiles and product consistency. Their long service life and compatibility with both small scale craft breweries and large scale commercial breweries have reinforced their widespread adoption.

These advantages have firmly positioned stainless steel fermenters as the most preferred product material in the market.

The commercial kitchen segment is expected to hold 54.20% of total market revenue by 2025 within the application category, establishing it as the leading segment. This growth is being supported by the rising trend of on site brewing in restaurants, hotels, and pubs, which seek to offer unique and freshly brewed beer experiences.

Commercial kitchens benefit from compact yet efficient fermenters that provide consistent brewing outcomes and flexibility in batch sizes. Additionally, the growing popularity of brewpub culture and experiential dining has driven investments in fermentation equipment tailored to commercial kitchen setups.

As consumer interest in craft and locally brewed beer continues to expand, the commercial kitchen segment remains central to market growth, supported by its ability to combine hospitality services with customized brewing solutions.

FMI observed a steady CAGR of 4.9% for the global market for beer fermenters from 2020 to 2025. The historical outlook for the global beer fermenter market is positive, with acceleration driven by the rise in consumption of craft beer and the increasing popularity of home brewing.

However, future projections for the market are uncertain due to the potential for a slowdown in expansion due to economic conditions. Changes in consumer preferences cannot be ignored as well. Despite these risks, the global beer fermenter market is expected to continue growing in the coming years, driven by the continued popularity of craft beer and more countries anticipated to legalize home brewing.

FMI’s research has revealed the key factors and trends anticipated to impact the expansion of the beer fermenter market between 2025 and 2035. Expert analysts at FMI have thoroughly assessed them to identify potential market drivers, hindering factors, emerging opportunities, and threats.

The Drivers, Restraints, Opportunities, and Threats identified are as follows:

DRIVERS

RESTRAINTS

OPPORTUNITIES

THREATS

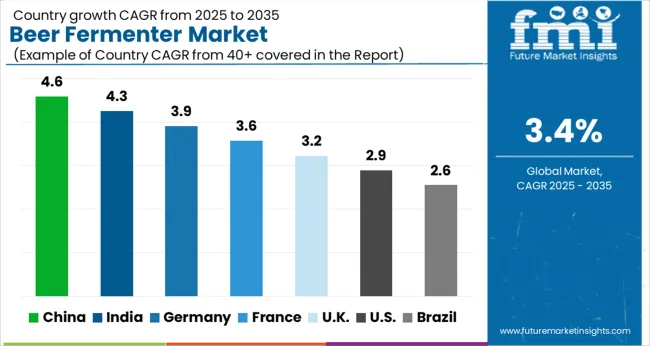

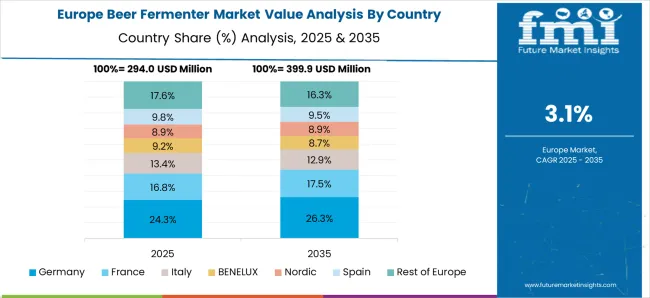

Booming German Beer Culture to Drive Country’s Beer Fermenter Sales in the Coming Years

The beer industry in Germany has been a force to reckon with in Europe due to the cultural significance of beer brewing and consumption in the country. Unsurprisingly, the regional dominance of Germany beer market is contributing to skyrocketing sales of beer fermenters in the country. German companies control over 60% of Europe market for beer fermenters and they are recognized globally for the high quality of their products.

Germany has been brewing beer for centuries, and the country’s beer brewing experience is set to contribute to the acceleration of its beer fermenter market. German beer fermenters are among the most highly-rated in the world, and they are used by several renowned breweries in Europe. German manufacturers offer a wide range of products, from simple home brew setups to large-scale commercial fermenters.

Growing Prominence in Global Beer Market to Secure Gains for China Market for Beer Fermenters

Beer is a popular alcoholic beverage in China and has been for centuries. With a market share of over 50%, it is also one of the most important segments in the country's rapidly growing alcohol industry. While per capita consumption remains relatively low at just over 2 liters per year, total consumption has been increasing steadily, reaching almost 1042.2 billion liters in 2020.

This growth is predicted to be driven by rising living standards, a growing middle class, and favorable demographics, such as a considerable population of young adults. China is also emerging as a prominent player in the global beer industry. Chinese companies have been investing heavily in foreign breweries and now account for 3 of the world's top 5 brewers by volume. They are also increasingly exporting their own products, with exports poised to double between 2025 and 2035.

Microbreweries and Micropubs Expected to Drive Demand for Beer Fermenters in the United Kingdom

The United Kingdom is projected to become a lucrative market for beer fermenter machines between 2025 and 2035. This is due to the increasing popularity of craft beer in the country. Right now, the United Kingdom is home to more than 1,000 breweries, and this number is expected to reflect a rapid rise in the coming years.

In the United Kingdom, microbreweries have risen to prominence due to significant Excise Duty reductions. Prior to the 2000s, microbreweries were next to non-existent in the country. However, in 2002, ideas began to be floated that eventually culminated in policy changes that were supportive of establishing microbreweries and micropubs. Campaign for Real Ale (CAMRA), a voluntary consumer organization, has given credit to the United Kingdom’s microbreweries and micropubs in the recent past for creating ‘real’ ale.

Bucket, Conical, and Unitanks to Generate Considerable Sales of Stainless Steel Fermenters

Stainless steel fermenter sales are gathering momentum as buyers are becoming aware of the advantages of stainless steel over glass. Between 2025 and 2035, FMI expects bucket fermenters, conical fermenters, and unitanks to generate considerable sales in the stainless steel category.

Bucket fermenters come with advanced accessories that allow brewers to control heating, cooling, and pressure transfers. Several stainless steel bucket fermenters are also equipped with spigots that facilitate sampling and gravity readings. Conical stainless steel fermenters are anticipated to register impressive sales from 2025 to 2035 as well, due to their control and configuration features that allow home brewers to experiment with commercial beer brewing processes. The popularity of unitanks is also poised to rise in the commercial sector as they can be used not just for fermentation, but for carbonation as well.

Growing Access to Information to Encourage Individuals to Experiment with Home Brewing

In recent years, FMI’s observations have indicated a surge in the sales of home brewing equipment. This suggests an inclination towards beer brewing at home, especially among high income groups. Beer connoisseurs who appreciate the taste and flavor of authentic beer are anticipated to generate demand for beer fermenters between 2025 and 2035.

Among home brewers, brews such as Dunkelweizen, Dry Irish Stout, Belgian Saison, and American Wheat Ale are gaining in popularity. Across video-streaming and social media platforms, home brewers are sharing their experiences and encouraging people to brew their own beers. This trend is likely to gain more momentum as social media channels register increasing penetration and fuel demand for beer fermenters.

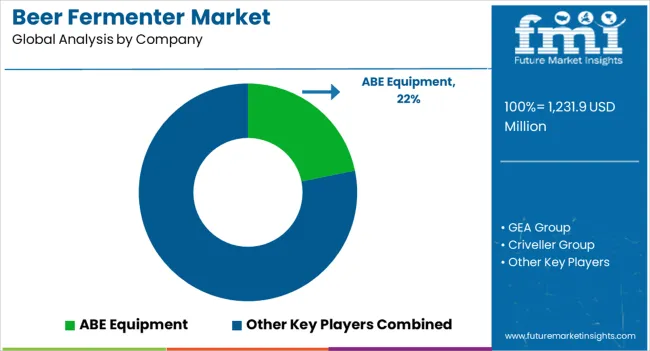

The beer fermenter market is characterized by a diverse group of companies that provide essential equipment for breweries of all sizes, offering fermenters that are critical for the fermentation process in beer production. Key players in the market include ABE Equipment, GEA Group, Criveller Group, MiniBrew, Portland Kettle Works, iGulu, Specific Mechanical Systems, FLECKS Brauhaus Technik GmbH, and BrewBilt Manufacturing, each contributing to the market with advanced and customizable fermentation systems for both craft and large-scale breweries.

ABE Equipment stands out for its innovative and flexible brewing systems, including fermenters tailored to craft breweries, with an emphasis on automation and efficient production. GEA Group, a global leader in industrial process technology, provides highly scalable and energy-efficient fermenters designed for large breweries, integrating advanced automation and control systems to optimize fermentation processes.

Criveller Group and Portland Kettle Works focus on supplying high-quality fermenters to the craft brewing sector, offering customizable options that allow brewers to fine-tune the fermentation process for different styles of beer. MiniBrew and iGulu cater to the small-batch and homebrew markets, providing compact fermenters and complete brewing systems designed for simplicity and ease of use. Specific Mechanical Systems is known for its high-end, stainless-steel fermenters tailored for both small and large breweries, combining precision engineering with advanced cooling and control systems. FLECKS Brauhaus Technik GmbH and BrewBilt Manufacturing also serve niche markets, focusing on custom, quality fermenters that ensure optimal conditions for fermentation, particularly for boutique breweries.

| Attribute | Details |

|---|---|

| Estimated Market Size (2025) | USD 1231.9 million |

| Projected Market Valuation (2035) | USD 1721.0 million |

| Value-based CAGR (2025 to 2035) | 3.4% |

| Forecast Period | 2025 to 2035 |

| Historical Data Available for | 2020 to 2025 |

| Market Analysis | Value (USD million) |

| Key Regions Covered | North America; Latin America; Europe; Asia Pacific; Oceania; Middle East and Africa |

| Key Countries Covered | The United States, Canada, Mexico, Germany, The United Kingdom, France, Italy, Spain, China, Japan, India, South Korea, Australia, Brazil, Argentina, South Africa, United Arab Emirates |

| Key Segments Covered | Product Material, Application, Region |

| Key Companies Profiled | ABE Equipment; GEA Group; Criveller Group; MiniBrew; Portland Kettle Works; iGulu; Specific Mechanical Systems; FLECKS Brauhaus Technik GmbH; BrewBilt Manufacturing |

| Report Coverage | Market Forecast, Company Share Analysis, Competitive Landscape, Drivers, Restraints, Opportunities, and Threats Analysis, Market Dynamics and Challenges, and Strategic Growth Initiatives |

The global beer fermenter market is estimated to be valued at USD 1,231.9 million in 2025.

The market size for the beer fermenter market is projected to reach USD 1,721.0 million by 2035.

The beer fermenter market is expected to grow at a 3.4% CAGR between 2025 and 2035.

The key product types in beer fermenter market are stainless steel fermenters and glass fermenters.

In terms of application, commercial kitchen segment to command 54.2% share in the beer fermenter market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Beer Stabilizers Market Size and Share Forecast Outlook 2025 to 2035

Beer Bottles Market Size and Share Forecast Outlook 2025 to 2035

Beer Dispensers Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Beer Pasteurization Equipment Market Size and Share Forecast Outlook 2025 to 2035

Beer Glass Chillers Market Size and Share Forecast Outlook 2025 to 2035

Beer Packaging Market Size, Share & Forecast 2025 to 2035

Beer Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Beer Keg System Market Forecast & Outlook for 2025 to 2035

Beer Dispensing Machine Market Trends - Growth, Demand & Analysis 2025 to 2035

Beer Bottling Kit Market Insights by Equipment, Application, Mode of Operation, Distribution Channel, and Region 2025 to 2035

Beer Filter System Market insights by Equipment Type, Type, Filtration Process, Application, and Region 2025 to 2035

Beer Line Cleaning Kit Market Trend Analysis Based on Product, End-User, Type, and Region 2025 to 2035

Beer Line Cooling System Market Trend Analysis Based on System, Application, and End-Use, and Region 2025 to 2035

Market Share Insights for Beer Bottles Providers

Assessing Beer Canning Machines Market Share & Industry Trends

Competitive Overview of Beer Glassware Market Share

Beer Brewing Machine Market

Beer Cans Market

Root Beer Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Home Beer Brewing Machine Market Analysis & Forecast 2025-2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA