In 2025, the Root Beer Market size is estimated at USD 997.1 million and is projected to reach USD 1.7 billion by 2035, reflecting a CAGR of 5.4%. The medium-capacity deionized water systems segment is forecasted to hold a 48% share, while the mixed bed deionization systems category will account for around 32% of the market in 2025.

| Metric | Value |

|---|---|

| Market Size in 2025 | USD 997.1 million |

| Projected Market Size in 2035 | USD 1.7 billion |

| CAGR (2025 to 2035) | 5.4% |

According to People.com (June 2025), Poppi officially reformulated its root beer flavor after widespread consumer backlash, where customers criticized the original version for tasting "disgusting" and "like coins." The company publicly acknowledged this feedback via an Instagram post on June 3, 2025, announcing the launch of its “new and improved” root beer with updated taste and redesigned maroon packaging.

This move followed Poppi's acquisition by PepsiCo in May 2025, as reported by multiple outlets including PR Newswire and MarketWatch. This development reflects the rising impact of direct consumer feedback on product formulation and branding in the global root beer market.

The market’s growth is being stimulated by increasing consumer interest in nostalgic flavors coupled with modern health trends. The demand for craft root beers, often perceived as healthier and more authentic, is contributing to this expansion. Brands are continuously innovating, offering sugar-free, low-calorie, and probiotic-infused variants, to align with evolving health preferences. The unique combination of vanilla, sassafras, and wintergreen in root beer appeals across demographics, ensuring its enduring popularity.

Furthermore, premium and limited-edition launches are enhancing consumer engagement. For example, brands such as Sonic introduced new flavors linked to cultural trends, while ALDI released frozen root beer float products that diversified product formats beyond traditional beverages. These offerings resonate well with both older and younger generations, expanding the root beer category's reach.

From a regional perspective, North America dominates the market due to a deeply rooted cultural association with root beer and a robust distribution network. However, Asia-Pacific is exhibiting the fastest growth owing to increasing urbanization, exposure to Western food products, and growth in e-commerce platforms. In Europe and Latin America, demand is surging as specialty food and beverage outlets introduce craft root beers and artisanal sodas.

Prominent players like Keurig Dr Pepper, A&W Root Beer, Barq’s (Coca-Cola), Mug (PepsiCo), Bundaberg Brewed Drinks, and Sprecher Brewery are actively investing in product development, distribution expansion, and digital marketing. These companies are tapping into consumer preferences for natural ingredients, clean labels, and environmentally sustainable packaging options.

Additionally, the shift toward sustainable manufacturing practices and recyclable packaging materials is becoming a decisive factor in purchasing decisions. Regulatory changes concerning sugar content and artificial additives are also shaping formulation strategies.

The global Root Beer Market is poised for steady growth over the forecast period, driven by flavor innovation, health-conscious product lines, and increased consumer engagement through limited-edition releases and seasonal offerings. These factors are expected to propel the market toward its forecast valuation of USD 1,697.2 million by 2035.

Tables below present data for comparative analysis of shift in CAGR (Change in compound annual growth rate) of global Root Beer Sector over period of six months (2024 & 2025). This comparison is to highlight the significant performance changes and also shows trends that will help in revenue realization which helps the stakeholders to build a perspective on growth direction throughout the financial year. Specifically, H1 refers to the January to June months. H2 from July to December.

| Period | CAGR |

|---|---|

| H1(2024 to 2034) | 5.2% |

| H2(2024 to 2034) | 5.3% |

| H1(2025 to 2035) | 5.4% |

| H2(2025 to 2035) | 5.5% |

The Root Beer Market is projected to grow at a CAGR of 5.4% during the first half (H1) period 2025 to 2035 and by an audacious fractional percentage to 5.5% during the last half (H2) years of the same time frame. For H1, the market will see 20 BPS growth, and for H2, it would be like additional 10 BPS growth in the market.

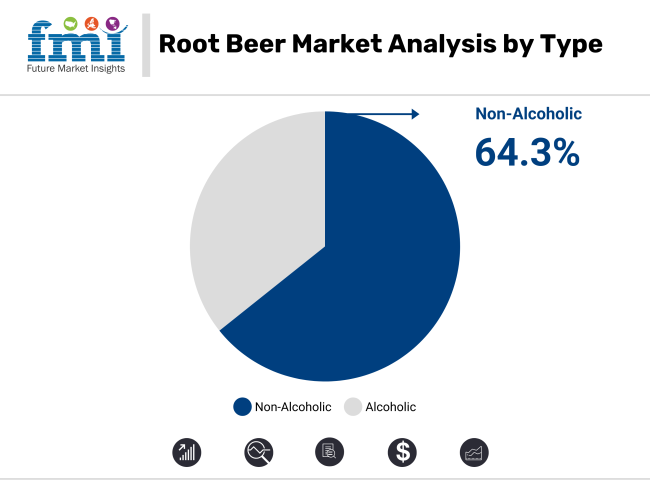

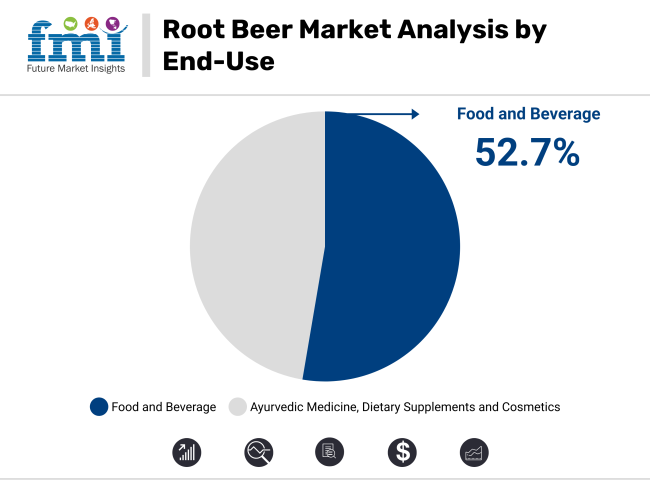

In 2025, the Non-Alcoholic root beer segment will dominate the global Root Beer Market, securing a substantial 64.3% market share due to its widespread cultural acceptance and versatile usage across demographics. The Food and Beverage industry will lead by end-use, contributing 52.7% of the market, driven by the inclusion of root beer flavoring in various consumable products and specialty drinks.

Non-Alcoholic root beer is expected to retain a leading position in the Root Beer Market with a commanding 64.3% market share in 2025. Its broad cultural acceptance-particularly in North America-combined with its suitability for family-friendly consumption, makes it the most preferred segment among consumers worldwide.

Product innovation is driving this dominance, with brands increasingly introducing organic, all-natural, sugar-free, and botanical-infused non-alcoholic root beers. Craft beverage makers are developing microbrewed, artisanal root beers featuring ingredients like agave and honey, transforming the drink into a modern alternative to sugary sodas while retaining its nostalgic appeal.

Beyond traditional beverages, non-alcoholic root beer is finding applications in herbal lozenges, health tonics, gummies, lip balms, and bath products, showcasing its versatility across product categories. This multifunctionality supports its mass-market appeal across age groups and regions.

While the alcoholic root beer segment is emerging in niche markets such as craft alcoholic sodas in North America and Australia, its market share remains significantly smaller compared to its non-alcoholic counterpart, which remains the preferred format across mainstream retail and foodservice channels.

The Food and Beverage segment is set to dominate the Root Beer Market by end-use with a projected 52.7% market share in 2025. Root beer’s rich, distinctive flavor profile secures its central role in ready-to-drink (RTD) soft drinks, mocktails, alcoholic sodas, and frozen desserts such as flavored ice creams.

In the craft beverage sector, breweries and distillers are innovating with root beer-based fermented drinks, kombuchas, and mixers that balance indulgence with functionality. This growing presence is expanding root beer’s appeal beyond conventional sodas into trendy, artisanal beverages demanded by health-conscious and flavor-seeking consumers.

Confectionery and bakery applications are also rising, with gourmet sauces, syrups, glazes, and fillings featuring root beer’s aromatic profile. Additionally, dietary supplements and beauty products now incorporate root beer extracts for their supposed wellness and sensory benefits.

Though its presence in Ayurvedic and traditional medicine remains limited, root beer’s adaptability across food, health, and cosmetic industries suggests potential for broader application. As consumer preferences shift towards natural, multifunctional products, root beer’s versatility positions it as a strategic ingredient for cross-category product innovation in the years ahead.

The Global Behemoths, This segment is led by major, multinational beverage corporations with established brands, significant production capacity, and extensive distribution networks. These are companies that target mainstream consumers and have broad representation in world markets.

Major brands include The Coca-Cola Company (Barq’s Root Beer), PepsiCo (A&W Root Beer), Keurig Dr Pepper (Mug Root Beer) and Henry Weinhard’s. They enjoy the advantages of an established brand name, the scale of production, the distribution to supermarkets and convenience stores, online and foodservice. This company's root beer products come in multiple varieties (regular, diet, and sugar-free) and are proving popular with consumers seeking traditional American soft drinks.

Regional Players, regional soft drink manufacturers and independent beverage companies that specialize in producing gourmet, craft, or local root beer brands. While those companies may not have the global scale of Tier 1 players, they can service regional tastes and focus on small batch production or proprietary recipe development.

Examples include Virgil’s Root Beer, Sprecher Brewing Co. and Boylan Bottling Co. Because while Premium Craft Beverage brands are, in fact, often reliably artisanal, so many evoke natural ingredients and premium flavor profiles. Further to attracting consumers focused on craft goods, Tier 2 players focus on the shift for more organic, handmade and non-GMO products from consumers seeking top quality products that adhere to sustainability.

Local and Small-Scale Producers, while the number of Tier 3 players is small, they produce niche artisanal root beer products on a local basis. They are often artisanal or traditional-style root beer recipes with regional ingredients, and often come with the promise of organic certification. These producers usually cater to local or regional consumers, often through farmer’s markets, specialty food stores and local bars.

And that’s only even remotely possible with some rarefied flavor or minute scale production and a strong sense of whoever-the-brand-is represented, and a strong local-to-them loyalty. Their presence may be modest, but these companies cater to consumers who are growing more interested in real, different and artisanal beverage options that set themselves apart from commodified goods.

Estimated Growth Rates of Top Regions for Root Beer Market 2025 to 2035

| Country | CAGR, 2025 to 2035 |

|---|---|

| USA | 5.2% |

| Canada | 5.3% |

| Germany | 4.9% |

| India | 6.2% |

| China | 5.8% |

| Australia | 5.1% |

The American root beer market remains integral, sustained by a special blend of nostalgic worth, changing consumer preferences, and a renaissance in craft drinks innovation. Root beer has long been a part of American tradition, where it is often connected with heritage brands and regional specialties.

Now the drink is experiencing a revival as consumers clamor for natural, artisanal and small-batch versions. Lite roots beer is but one of the fresh types of non-alcoholic craft brews as obsession with creating unique, sugar-free, organic and herbal craft beverages have hit the "casual drinking" market. Meanwhile, boozy root beers made with spices and brewed in small batches attract a younger adult audience seeking flavorful alternatives to regular beers and ciders.

The root beer market in India is in its infancy but growing at an unprecedented rate as a unique beverage segment with a natural, herbal, and wellness focus. Specifically, Indian consumers urban dwellers, in particular are becoming increasingly interested in alternative beverages that provide digestive health benefits, herbal functionality, and/or Ayurvedic components.

Local producers and nutraceutical brands are launching Ayurvedic root beer formulations, merging traditional botanicals like ashwagandha, ginger and tulsi with Western-style root beer flavor profiles. The use of natural sweeteners and healing roots is in step with country’s fast growing functional food and beverage segment. Seeing the emergence of root beer in cosmetics, dietary supplements, and herbal lozenges, immunity drinks, and Ayurvedic tonics.

With the growing awareness among consumers, both for indigenous wellness and for health trends in meditation around the world, it is foreseen that India will be a new sustainable growth market for root beer, for both beverage and non-beverage applications.

A growing preference among German consumers for such products as botanical beverages, herbal infusions and clean-label soft drinks makes it a strong market for premium and health-oriented root beer products. Although pulled more recently in North America, interest in root beer has swelled in Europe, dovetailing with the craft soda zeitgeist and a growing interest in traditional wellness ingredients.

Non-alcoholic and alcoholic forms of the drinks are being marketed to specialty stores and organic supermarkets. Health-conscious consumers value root beer’s botanical ancestry and traditional use in wellness tonics, underscoring its potential as a flavor in functional beverages, tonics and cosmetics.

China: Growth in Functional Beverages Creates Demand for Herbs

Functional, botanical and low-sugar beverages are all trending in China, and the root beer category is taking off as a result. Urban middle-class consumers are gravitating toward drinks that offer a dual proposition of taste and wellness, and root beer with its herbal roots and graced with roots must seem an ideal option.

Chinese beverage makers have been fermenting with local herbs as ginseng, honeysuckle and schisandra into their root beer to bolster both healthiness and local relevance. Root beer is also gaining traction in dietary supplements and herbal medicine segments, as it is used in functional beverages designed to support digestion and immunity.

Top companies like A&W Root Beer and Barq’s are well-positioned to grow their share of the root beer market with brands, product development, and innovation. By expanding the range of root beer flavors from traditional recipes to craft-style offerings, they have been able to properly shift consumer preference. Diversity attracts a wider range of customers and also allows these companies to compete with other brands in the market.

In addition, these manufacturers have passed on various packaging designs to attract the younger population and convenience. These packaging innovations, ranging from nostalgic glass containers to eco-friendly cans, enhance product presentation and usability, thereby creating and cementing brand loyalty.

The root beer market has received several growth opportunities, notably through strategic alliances and collaborations. Partnering with fast-food chains and restaurants that already exist has allowed top brands to continue to build their brand presence and increase reach through established distribution networks and customer bases.

For instance:

| Report Attributes | Details |

|---|---|

| Market Size (2025) | USD 997.1 million |

| Projected Market Size (2035) | USD 1.7 billion |

| CAGR (2025 to 2035) | 5.4% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | USD million/billion for value and million liters for volume |

| Type Analyzed (Segment 1) | Alcoholic, Non-Alcoholic |

| End-Use Analyzed (Segment 2) | Ayurvedic Medicine, Food & Beverage, Dietary Supplements, Cosmetics |

| Regions Covered | North America, Latin America, Western Europe, Eastern Europe, Balkans & Baltic, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, Middle East & Africa |

| Countries Covered | United States, Canada, Germany, United Kingdom, France, Italy, Spain, Poland, Russia, China, Japan, South Korea, India, Australia, Brazil, Mexico, GCC Countries, South Africa |

| Key Players influencing the Root Beer Market | Craft, A&W Restaurants, Sage Mixology Company, Dr. Pepper Snapple Group, Crazy Uncle, Mill Street Brew Hall, Seagram, Rhineland Brewing Co, Best Damn Brewing Co, Other Prominent Market Player |

| Additional Attributes | Dollar sales by type (alcoholic vs. non-alcoholic), Market share by end-use segment, Growth in food & beverage sector, Demand for dietary supplements, Flavor innovation trends, Regional consumption patterns across Asia & North America |

The Root Beer Market is segmented into Alcoholic and Non-Alcoholic varieties, catering to both traditional soft drink consumers and those seeking alcoholic alternatives.

Root beer finds applications in Ayurvedic Medicine, Food and Beverage, Dietary Supplements, and Cosmetics, reflecting its diverse functional and commercial uses.

Industry analysis has been carried out in key countries of North America, Latin America, Western Europe, Eastern Europe, Balkans & Baltic, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The root beer market is projected to grow at a CAGR of approximately 5.4% during the forecast period from 2025 to 2035.

The market is estimated to reach approximately USD 1.7 billion by 2035, up from USD 997.1 million in 2025.

The non-alcoholic root beer segment is expected to witness significant growth due to the increasing consumer preference for non-alcoholic beverages and health-conscious choices.

Key growth drivers include the rising popularity of craft root beers, increasing demand for low-calorie and sugar-free beverages, and the growing trend of premium and artisanal drinks.

Leading companies in the market include The Coca-Cola Company, Dr Pepper Snapple Group, A&W Brands, Inc., Barq’s, and Reed’s Inc.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Beetroot Powder Market Size and Share Forecast Outlook 2025 to 2035

Beetroot Molasses Market

Analysis and Growth Projections for Arrowroot Starch Market

Ginseng Root Extracts Skincare Market Size and Share Forecast Outlook 2025 to 2035

Chicory Roots Market

Licorice Root Market Analysis by Product form, End use, and Region Through 2035

Key Companies & Market Share in the Licorice Root Sector

Elecampane Root Market Size and Share Forecast Outlook 2025 to 2035

Astragalus Root Extract Market Size and Share Forecast Outlook 2025 to 2035

UK Licorice Root Market Insights – Trends, Demand & Growth 2025-2035

Marshmallow Root Extract Market

USA Licorice Root Market Growth – Trends, Demand & Innovations 2025-2035

ASEAN Licorice Root Market Trends – Demand, Growth & Innovations 2025-2035

Europe Licorice Root Market Analysis – Size, Growth & Forecast 2025-2035

United States Beetroot Supplement Market Size and Share Forecast Outlook 2025 to 2035

Australia Licorice Root Market Report – Growth, Demand & Forecast 2025-2035

Latin America Licorice Root Market Outlook – Size, Share & Industry Trends 2025-2035

Curcuma Longa (Turmeric) Root Extract Market Size and Share Forecast Outlook 2025 to 2035

Beer Fermenter Market Size and Share Forecast Outlook 2025 to 2035

Beer Stabilizers Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA