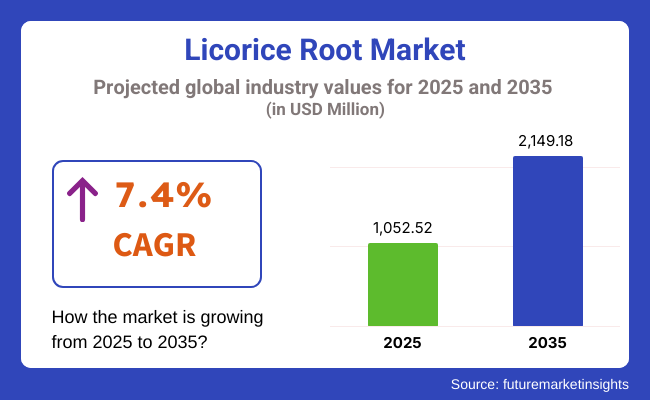

The licorice root market would be USD 1,052.52 million in 2025 and USD 2,149.18 million by the end of 2035, with a growth rate of 7.4% for the years 2025 to 2035.

The driving force behind the market is growing awareness among consumers of herbal ingredients and nature being used within the food, drinks, pharma, and cosmetics industries. Since human beings are not at ease with health problems when they are buying an herbal medicine, even the licorice root has to be followed by its purported medicinal properties anti-inflammatory, antiviral, and digestive.

Companies that are in the licorice root business are also increasing their capacity to meet increased demand. Large businesses are also adopting sustainable agriculture and sourcing methods so that they can provide a sustainable supply chain.

Maruzen Pharmaceuticals and Mafco Worldwide are also going to adopt maximum extraction technology to optimize licorice root extract purity and yield. Moreover, strategic partnerships among farmers and suppliers enable producers to purchase quality raw materials and obtain authenticated details regarding the green and ethical farming practices adopted.

Greater demand for herbal food and medication is driving industry trends to a great extent. Greater demand for herbal medications is moving customers to more herbal drugs, and ingredients of licorice root food and medicine are in greater demand.

Companies are adding licorice root to herbal teas, supplements, and natural sweeteners so they can earn a return on this new trend. Secondly, the cosmetics industry is also shifting towards botanicals, and some cosmetics have licorice root for bleaching as well as anti-aging.

Market participants are also using product innovation to increase their consumer and customer base. Licorice-flavored drinks, organic licorice root powder, and clean-label botanical drugs are witnessing growing adoption through product launches.

As awareness of the benefits of licorice root continues to grow, the market will significantly develop on the back of sustainability, innovation, and increased production capacities.

The table below reflects the comparative six-month CAGR variation between the base year (2024) and the current year (2025) of business for the worldwide licorice root. Comparison shows a substantial difference in performance and reflects trends in achieving revenues, hence providing stakeholders with a better view of the trend in growth over one year.

| Particular | Value CAGR |

|---|---|

| H1 | 7.1% (2024 to 2034) |

| H2 | 7.4% (2024 to 2034) |

| H1 | 7.2% (2025 to 2035) |

| H2 | 7.6% (2025 to 2035) |

The initial six months (H1) are January to June, while the second half of six months (H2) is July to December. During the first half (H1) of the decade-long period 2024 to 2034, the company will increase at a CAGR of 7.1%, while the second half (H2) will have a marginally higher growth rate of 7.4%.

Entering the subsequent era from H1 2025 to H2 2035, the CAGR is also expected to rise to 7.2% in the first half and remain at 7.6% in the second half.

Functional Uses of Herbal Supplements

The licorice root industry is also shifting from conventional uses as customers keep insisting on functional health effects through natural products. The licorice root is used in digestive supplements, stress-relief supplements, and respiratory health products because of its adaptogenic and anti-inflammatory properties.

The trend arises due to increasing gut-consciousness, immunity-support trends, and customers insisting on natural products instead of man-made medicines. Managers are responding with the production of licorice-based products for specific ailments. They are making standardized glycyrrhizin and flavonoid higher content extracts to maximize effects.

Licorice root is also mixed with herbs like turmeric and ginger, which are complementary to each other, to gain overall wellness products. Businesses are even introducing ready-to-drink functional beverages and chewable vitamins, so consumers today prefer using licorice root more because it is more convenient.

Popularity of Licorice Root in Clean-Label Sweeteners

Since there are some persistent artificial sweetener problems, licorice root is being increasingly favored in the clean-label position by beverage and food manufacturers. Its sweetness and combination with other sweeteners such as stevia and monk fruit positions it in the best position to reduce sugar levels in many applications.

Health-oriented consumers are particularly seeking lower-sugar and no-artificial-ingredient products, and demand for sweeteners derived from licorice is positively reinforced by this trend. In the meantime, ingredient companies are streamlining extraction procedures to develop high-purity licorice root sweeteners that have less bitterness.

Licensor companies are also investigating the use of licorice root in dairy-free foods, confectionery, and reduced-calorie beverages. Formulators are also blending licorice root with prebiotic fiber to deliver taste and digestive health, a multitasking ingredient in the sugar-reduction movement.

Supply Chain Resilience Under Raw Material Pressure

Sustained demand expansion by food, pharma, and personal care for licorice root is exerting pressure on the worldwide supply chain. Over-harvesting and degradation of conventional supply zones, along with escalating geopolitical tensions, are driving shortages of supply.

Regulatory issues around pesticide residues and heavy metals in herb material are also stifling the importation of licorice root to important markets such as the USA and Europe. As part of a move to assist in satisfying safe supply, businesses are testing new geographies on which to source and adopt sustainable agriculture.

The producers are seeking to associate with the farmers in newer regions such as Latin America and Eastern Europe to develop new raw material bases. Controlled-environment agriculture and hydroponic agriculture are also being developed to grow licorice root under controlled environments to attain quality consistency and traceability.

Licorice Root Cultivation in Oral & Dermatological Products

Rising demand among consumers for natural personal care products is driving the use of licorice root in oral and dermo-cosmetics. The anti-inflammatory, antibacterial, and skin-whitening abilities of licorice root are placing it in the limelight as a cosmetic ingredient in natural toothpaste, mouthwashes, anti-acne products, and hyperpigmentation products.

With growing awareness about clean beauty and chemical-free oral care, sales of naturally derived products are growing. Personal care companies are formulating personal care products with licorice-flavored toothpaste that can improve gum health and guard enamel.

Skincare companies are adding licorice extract to creams and serums to fight sensitive skin, aging, and dark spots. Companies also have licorice-flavored herbal mouthwashes as a fluoride-free alternative, bearing witness to the trend of organic oral care products.

Fostering Demand for Recovery Beverages & Sports Nutrition

With increasing demand for plant-based and clean-label sports nutritionals, licorice root is increasingly prized for its adaptogenic, cortisol-balancing, and anti-inflammatory properties. Female and male sports women and men and sports individuals are replacing natural equivalents to reboot after exercise, minimize stress, and achieve electrolyte balance, thus positioning licorice root as a rapidly emerging ingredient in functional sporting beverages and performance enhancers.

In addition, licorice's function in supporting the adrenal system and normalizing stress hormones is the most important to its application among athletes placed under intense training programs. Additional evidence shows that licorice root's antioxidant and antimicrobial properties will also support immune system activity, and this is a specific issue of concern for athletes placed under prolonged bodily stress.

Sports nutrition firms are incorporating standardized licorice extracts into energy bars, hydration powders, and plant protein powders for muscle repair and endurance. Functional beverage manufacturers are launching licorice-flavored isotonic drinks, electrolyte-replacement shots, and herbal tonics for natural rehydration and inflammation control.

Sports supplement formulators are also creating new applications for licorice root in collagen-building supplements for joint health support, injury protection, and muscle rebuilding. The trend is also being experienced in plant-based and vegan performance nutrition, where licorice root is blended with ashwagandha, turmeric, and amino acids to create whole recovery formulas.

The world market for licorice root is fragmented with the presence of organized and unorganized players, which affects competition. Large-scale producers with well-established supply networks and small-scale regional producers with specialized requirements control the market.

Systematized players are the market leaders who maintain uniform extraction procedures, quality control tests, and adherence to international standards. They employ costly processing machinery to maintain the highest-quality extracts and consistent glycyrrhizin levels, which make their product suitable for the pharmaceutical, food, and personal care sectors.

Their interconnected distribution enables them to export to the international market, where the supplies go to prime destinations in Asia-Pacific, North America, and Europe. Besides that, organized players focus on sustainability practices, collaborating with farmers to ensure licorice is cultivated sustainably and not over-harvested. Unorganized local players, however, contribute significantly to supplying raw licorice root and half-processed extracts to local industries.

They mainly specialize in enormous farming grounds like China, Iran, Uzbekistan, and Afghanistan, where licorice root is cultivated on a large scale. Because they spend less on operations, the firms can offer their products at low costs and are mostly the first choice among small producers of herbal items.

Despite this, quality inconsistency, traceability, and low regulatory compliance tend to limit them from accessing foreign markets. The battle between organized and unorganized participants is still a force in the international licorice root market, as growing regulatory attention and consumer pressure for quality-oriented products are set to propel further consolidation in the industry.

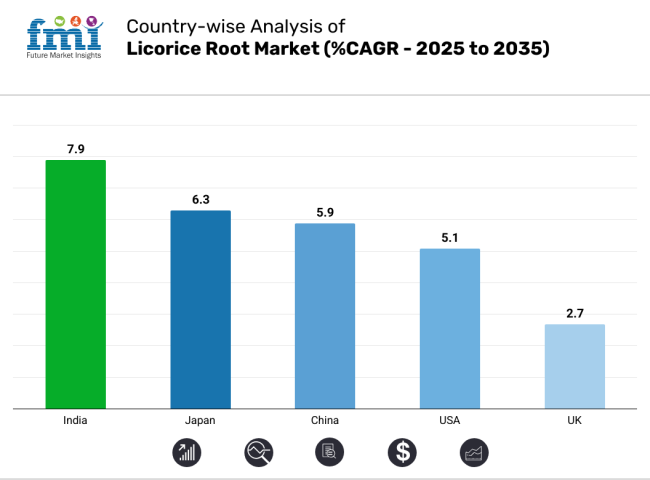

The following table shows the estimated growth rates of the top five territories. These countries are set to exhibit high consumption through 2035.

India's health-conscious licorice root market is expected to experience a strong growth rate of CAGR 7.9% from 2025 to 2035. It is expanding, driven by the positive policy climate for herbal products such as India's open market-pirating Ayurvedic Pharmacopoeia.

The increased prevalence of obesity has been focusing consumers toward using natural products, thus increasing demand for ASEAN licorice root extracts as natural food and beverage sweeteners. Interest in the pharmaceutical uses of licorice root as an anti-inflammatory and antioxidant drug has also fueled its use in traditional medicine and emerging nutraceuticals.

The value of the Japanese licorice root market is expected to grow at a 6.3% compound annual growth rate during the forecast period. The use of licorice is not only in traditional medicine but also has been incorporated as a flavoring spice in food culture.

Licorice root extract is increasingly used in the Japanese cosmetics and beauty industry due to the whitening effect of licorice root extracts. More J-pop culture further introduced more youth cosmetics culture, and there existed a well-developed market for cosmetics with licorice aroma. Even the heavy consumption of licorice root in Japan speaks volumes about its supremacy in the health and lifestyle sector.

China's market size of licorice roots is expected to continue growing at a CAGR of 5.9% for the forecast period 2025 to 2035. As China has one of the biggest bases of production and consumption of licorice roots, it has been interested in tracing the use of licorice as a traditional medicine for addressing medical issues.

Indigenous demand has been kept at a constant level by the mass cultivation of licorice in indigenous traditional medicine. Land cultivation and over-farming issues have brought environmentally friendly practices of agriculture into play.

The right measures have been employed to establish a balance between the overvalued licorice utility in terms of culture and green conservation to ensure that the valued good is still available even in the near future.

| Segment | Value Share (2025) |

|---|---|

| Product Form Extracts | 45.2% |

Licorice extracts hold the highest market share under product types at around 45.2% of the overall market share in 2025. The extracts hold the highest market share because they are the widest product form used in all industries, such as pharma, food and beverages, and cosmetics.

They are denser and contain active constituents, such as glycyrrhizin, and thus they yield the most favorable form to be applied in functional uses. The pharmaceutical industry also relies heavily on licorice extracts for their anti-inflammatory and antiviral actions, especially in herbal drug systems such as Ayurveda and Traditional Chinese Medicine (TCM).

The licorice extracts are also used in food and beverages as a clean-label and plant-based sweetener and flavor ingredient. As more consumers embrace the clean-label and plant-based trend, the market for licorice extracts will continue to evolve at a strong rate.

| Segment | Value Share (2025) |

|---|---|

| End-Use Pharmaceutical Industry | 38.7% |

Pharmaceuticals is the highest revenue-yielding segment, with approximately 38.7% of the total licorice root market in 2025. The global application of licorice root as an indiscriminate treatment for respiratory disease, gastrointestinal disease, and skin disease has established it as a prominent figure in traditional medicine.

Licorice root is a valuable ingredient for cough syrups, herbal tea, and gastro-intestinal medicines due to its sedative and expectorant properties. Increased use of herbal drugs and herbal extracts is influencing the reliance of the pharmaceutical sector on licorice extracts.

In addition, increased research on the positive effects of licorice on liver functions as well as immune function activity is influencing the development of the market. As more herbal drugs receive approval from regulatory agencies, the market share of the pharmaceutical sector will rise even more.

The global market for licorice root extract is becoming more and more competitive with the change in consumer preference and their dollars being invested by companies in producing broader portfolios of products.

Differentiation of products through innovation, improved quality, and mergers to establish a presence in the market is all that business is concerned with, whether diversified local players or multinationals equally sharing in the competitive and dynamic platform of the production of licorice extract.

Global market leaders use their extensive distribution networks and manufacturing plants to create high-purity licorice extracts for pharmaceutical, food, and cosmetic use. Their heavy R&D investments allow the companies to improve extraction processes with enhanced purity and functionality in final products.

Socially responsible manufacturing, sustainable processes, and green supply chain assets are ever more significant drivers that are influencing strategies.

The market is segmented into roots, extracts, blocks, powder, paste, and others, with extracts dominating due to their widespread use in pharmaceuticals and food applications.

The market is categorized into the food and beverage industry, tobacco industry, pharmaceutical industry, cosmetic industry, and dietary supplements, with pharmaceuticals leading due to increasing herbal medicine demand.

The market is analyzed across North America, Latin America, Western Europe, Eastern Europe, South Asia & Pacific, East Asia, Central Asia, Balkan and Baltic countries, Russia and Belarus, and the Middle East & Africa.

The global licorice root market is projected to grow at a CAGR of 7.4% during the forecast period from 2025 to 2035, driven by rising demand across pharmaceutical and food industries.

The estimated market value of the global licorice root industry by 2035 will be USD 2,149.18 million.

The pharmaceutical industry is anticipated to be the fastest-growing segment due to the rising adoption of herbal medicines and the increasing application of licorice extracts in respiratory and digestive treatments.

The market is expanding due to increasing demand for natural sweeteners, the growing popularity of herbal medicines, rising usage in cosmetics, and the expansion of the food and beverage industry.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2019 to 2034

Table 2: Global Market Volume (Tons) Forecast by Region, 2019 to 2034

Table 3: Global Market Value (US$ Million) Forecast by Product Form, 2019 to 2034

Table 4: Global Market Volume (Tons) Forecast by Product Form, 2019 to 2034

Table 5: Global Market Value (US$ Million) Forecast by End-User, 2019 to 2034

Table 6: Global Market Volume (Tons) Forecast by End-User, 2019 to 2034

Table 7: North America Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 8: North America Market Volume (Tons) Forecast by Country, 2019 to 2034

Table 9: North America Market Value (US$ Million) Forecast by Product Form, 2019 to 2034

Table 10: North America Market Volume (Tons) Forecast by Product Form, 2019 to 2034

Table 11: North America Market Value (US$ Million) Forecast by End-User, 2019 to 2034

Table 12: North America Market Volume (Tons) Forecast by End-User, 2019 to 2034

Table 13: Latin America Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 14: Latin America Market Volume (Tons) Forecast by Country, 2019 to 2034

Table 15: Latin America Market Value (US$ Million) Forecast by Product Form, 2019 to 2034

Table 16: Latin America Market Volume (Tons) Forecast by Product Form, 2019 to 2034

Table 17: Latin America Market Value (US$ Million) Forecast by End-User, 2019 to 2034

Table 18: Latin America Market Volume (Tons) Forecast by End-User, 2019 to 2034

Table 19: Western Europe Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 20: Western Europe Market Volume (Tons) Forecast by Country, 2019 to 2034

Table 21: Western Europe Market Value (US$ Million) Forecast by Product Form, 2019 to 2034

Table 22: Western Europe Market Volume (Tons) Forecast by Product Form, 2019 to 2034

Table 23: Western Europe Market Value (US$ Million) Forecast by End-User, 2019 to 2034

Table 24: Western Europe Market Volume (Tons) Forecast by End-User, 2019 to 2034

Table 25: Eastern Europe Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 26: Eastern Europe Market Volume (Tons) Forecast by Country, 2019 to 2034

Table 27: Eastern Europe Market Value (US$ Million) Forecast by Product Form, 2019 to 2034

Table 28: Eastern Europe Market Volume (Tons) Forecast by Product Form, 2019 to 2034

Table 29: Eastern Europe Market Value (US$ Million) Forecast by End-User, 2019 to 2034

Table 30: Eastern Europe Market Volume (Tons) Forecast by End-User, 2019 to 2034

Table 31: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 32: South Asia and Pacific Market Volume (Tons) Forecast by Country, 2019 to 2034

Table 33: South Asia and Pacific Market Value (US$ Million) Forecast by Product Form, 2019 to 2034

Table 34: South Asia and Pacific Market Volume (Tons) Forecast by Product Form, 2019 to 2034

Table 35: South Asia and Pacific Market Value (US$ Million) Forecast by End-User, 2019 to 2034

Table 36: South Asia and Pacific Market Volume (Tons) Forecast by End-User, 2019 to 2034

Table 37: East Asia Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 38: East Asia Market Volume (Tons) Forecast by Country, 2019 to 2034

Table 39: East Asia Market Value (US$ Million) Forecast by Product Form, 2019 to 2034

Table 40: East Asia Market Volume (Tons) Forecast by Product Form, 2019 to 2034

Table 41: East Asia Market Value (US$ Million) Forecast by End-User, 2019 to 2034

Table 42: East Asia Market Volume (Tons) Forecast by End-User, 2019 to 2034

Table 43: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 44: Middle East and Africa Market Volume (Tons) Forecast by Country, 2019 to 2034

Table 45: Middle East and Africa Market Value (US$ Million) Forecast by Product Form, 2019 to 2034

Table 46: Middle East and Africa Market Volume (Tons) Forecast by Product Form, 2019 to 2034

Table 47: Middle East and Africa Market Value (US$ Million) Forecast by End-User, 2019 to 2034

Table 48: Middle East and Africa Market Volume (Tons) Forecast by End-User, 2019 to 2034

Figure 1: Global Market Value (US$ Million) by Product Form, 2024 to 2034

Figure 2: Global Market Value (US$ Million) by End-User, 2024 to 2034

Figure 3: Global Market Value (US$ Million) by Region, 2024 to 2034

Figure 4: Global Market Value (US$ Million) Analysis by Region, 2019 to 2034

Figure 5: Global Market Volume (Tons) Analysis by Region, 2019 to 2034

Figure 6: Global Market Value Share (%) and BPS Analysis by Region, 2024 to 2034

Figure 7: Global Market Y-o-Y Growth (%) Projections by Region, 2024 to 2034

Figure 8: Global Market Value (US$ Million) Analysis by Product Form, 2019 to 2034

Figure 9: Global Market Volume (Tons) Analysis by Product Form, 2019 to 2034

Figure 10: Global Market Value Share (%) and BPS Analysis by Product Form, 2024 to 2034

Figure 11: Global Market Y-o-Y Growth (%) Projections by Product Form, 2024 to 2034

Figure 12: Global Market Value (US$ Million) Analysis by End-User, 2019 to 2034

Figure 13: Global Market Volume (Tons) Analysis by End-User, 2019 to 2034

Figure 14: Global Market Value Share (%) and BPS Analysis by End-User, 2024 to 2034

Figure 15: Global Market Y-o-Y Growth (%) Projections by End-User, 2024 to 2034

Figure 16: Global Market Attractiveness by Product Form, 2024 to 2034

Figure 17: Global Market Attractiveness by End-User, 2024 to 2034

Figure 18: Global Market Attractiveness by Region, 2024 to 2034

Figure 19: North America Market Value (US$ Million) by Product Form, 2024 to 2034

Figure 20: North America Market Value (US$ Million) by End-User, 2024 to 2034

Figure 21: North America Market Value (US$ Million) by Country, 2024 to 2034

Figure 22: North America Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 23: North America Market Volume (Tons) Analysis by Country, 2019 to 2034

Figure 24: North America Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 25: North America Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 26: North America Market Value (US$ Million) Analysis by Product Form, 2019 to 2034

Figure 27: North America Market Volume (Tons) Analysis by Product Form, 2019 to 2034

Figure 28: North America Market Value Share (%) and BPS Analysis by Product Form, 2024 to 2034

Figure 29: North America Market Y-o-Y Growth (%) Projections by Product Form, 2024 to 2034

Figure 30: North America Market Value (US$ Million) Analysis by End-User, 2019 to 2034

Figure 31: North America Market Volume (Tons) Analysis by End-User, 2019 to 2034

Figure 32: North America Market Value Share (%) and BPS Analysis by End-User, 2024 to 2034

Figure 33: North America Market Y-o-Y Growth (%) Projections by End-User, 2024 to 2034

Figure 34: North America Market Attractiveness by Product Form, 2024 to 2034

Figure 35: North America Market Attractiveness by End-User, 2024 to 2034

Figure 36: North America Market Attractiveness by Country, 2024 to 2034

Figure 37: Latin America Market Value (US$ Million) by Product Form, 2024 to 2034

Figure 38: Latin America Market Value (US$ Million) by End-User, 2024 to 2034

Figure 39: Latin America Market Value (US$ Million) by Country, 2024 to 2034

Figure 40: Latin America Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 41: Latin America Market Volume (Tons) Analysis by Country, 2019 to 2034

Figure 42: Latin America Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 43: Latin America Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 44: Latin America Market Value (US$ Million) Analysis by Product Form, 2019 to 2034

Figure 45: Latin America Market Volume (Tons) Analysis by Product Form, 2019 to 2034

Figure 46: Latin America Market Value Share (%) and BPS Analysis by Product Form, 2024 to 2034

Figure 47: Latin America Market Y-o-Y Growth (%) Projections by Product Form, 2024 to 2034

Figure 48: Latin America Market Value (US$ Million) Analysis by End-User, 2019 to 2034

Figure 49: Latin America Market Volume (Tons) Analysis by End-User, 2019 to 2034

Figure 50: Latin America Market Value Share (%) and BPS Analysis by End-User, 2024 to 2034

Figure 51: Latin America Market Y-o-Y Growth (%) Projections by End-User, 2024 to 2034

Figure 52: Latin America Market Attractiveness by Product Form, 2024 to 2034

Figure 53: Latin America Market Attractiveness by End-User, 2024 to 2034

Figure 54: Latin America Market Attractiveness by Country, 2024 to 2034

Figure 55: Western Europe Market Value (US$ Million) by Product Form, 2024 to 2034

Figure 56: Western Europe Market Value (US$ Million) by End-User, 2024 to 2034

Figure 57: Western Europe Market Value (US$ Million) by Country, 2024 to 2034

Figure 58: Western Europe Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 59: Western Europe Market Volume (Tons) Analysis by Country, 2019 to 2034

Figure 60: Western Europe Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 61: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 62: Western Europe Market Value (US$ Million) Analysis by Product Form, 2019 to 2034

Figure 63: Western Europe Market Volume (Tons) Analysis by Product Form, 2019 to 2034

Figure 64: Western Europe Market Value Share (%) and BPS Analysis by Product Form, 2024 to 2034

Figure 65: Western Europe Market Y-o-Y Growth (%) Projections by Product Form, 2024 to 2034

Figure 66: Western Europe Market Value (US$ Million) Analysis by End-User, 2019 to 2034

Figure 67: Western Europe Market Volume (Tons) Analysis by End-User, 2019 to 2034

Figure 68: Western Europe Market Value Share (%) and BPS Analysis by End-User, 2024 to 2034

Figure 69: Western Europe Market Y-o-Y Growth (%) Projections by End-User, 2024 to 2034

Figure 70: Western Europe Market Attractiveness by Product Form, 2024 to 2034

Figure 71: Western Europe Market Attractiveness by End-User, 2024 to 2034

Figure 72: Western Europe Market Attractiveness by Country, 2024 to 2034

Figure 73: Eastern Europe Market Value (US$ Million) by Product Form, 2024 to 2034

Figure 74: Eastern Europe Market Value (US$ Million) by End-User, 2024 to 2034

Figure 75: Eastern Europe Market Value (US$ Million) by Country, 2024 to 2034

Figure 76: Eastern Europe Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 77: Eastern Europe Market Volume (Tons) Analysis by Country, 2019 to 2034

Figure 78: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 79: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 80: Eastern Europe Market Value (US$ Million) Analysis by Product Form, 2019 to 2034

Figure 81: Eastern Europe Market Volume (Tons) Analysis by Product Form, 2019 to 2034

Figure 82: Eastern Europe Market Value Share (%) and BPS Analysis by Product Form, 2024 to 2034

Figure 83: Eastern Europe Market Y-o-Y Growth (%) Projections by Product Form, 2024 to 2034

Figure 84: Eastern Europe Market Value (US$ Million) Analysis by End-User, 2019 to 2034

Figure 85: Eastern Europe Market Volume (Tons) Analysis by End-User, 2019 to 2034

Figure 86: Eastern Europe Market Value Share (%) and BPS Analysis by End-User, 2024 to 2034

Figure 87: Eastern Europe Market Y-o-Y Growth (%) Projections by End-User, 2024 to 2034

Figure 88: Eastern Europe Market Attractiveness by Product Form, 2024 to 2034

Figure 89: Eastern Europe Market Attractiveness by End-User, 2024 to 2034

Figure 90: Eastern Europe Market Attractiveness by Country, 2024 to 2034

Figure 91: South Asia and Pacific Market Value (US$ Million) by Product Form, 2024 to 2034

Figure 92: South Asia and Pacific Market Value (US$ Million) by End-User, 2024 to 2034

Figure 93: South Asia and Pacific Market Value (US$ Million) by Country, 2024 to 2034

Figure 94: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 95: South Asia and Pacific Market Volume (Tons) Analysis by Country, 2019 to 2034

Figure 96: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 97: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 98: South Asia and Pacific Market Value (US$ Million) Analysis by Product Form, 2019 to 2034

Figure 99: South Asia and Pacific Market Volume (Tons) Analysis by Product Form, 2019 to 2034

Figure 100: South Asia and Pacific Market Value Share (%) and BPS Analysis by Product Form, 2024 to 2034

Figure 101: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Product Form, 2024 to 2034

Figure 102: South Asia and Pacific Market Value (US$ Million) Analysis by End-User, 2019 to 2034

Figure 103: South Asia and Pacific Market Volume (Tons) Analysis by End-User, 2019 to 2034

Figure 104: South Asia and Pacific Market Value Share (%) and BPS Analysis by End-User, 2024 to 2034

Figure 105: South Asia and Pacific Market Y-o-Y Growth (%) Projections by End-User, 2024 to 2034

Figure 106: South Asia and Pacific Market Attractiveness by Product Form, 2024 to 2034

Figure 107: South Asia and Pacific Market Attractiveness by End-User, 2024 to 2034

Figure 108: South Asia and Pacific Market Attractiveness by Country, 2024 to 2034

Figure 109: East Asia Market Value (US$ Million) by Product Form, 2024 to 2034

Figure 110: East Asia Market Value (US$ Million) by End-User, 2024 to 2034

Figure 111: East Asia Market Value (US$ Million) by Country, 2024 to 2034

Figure 112: East Asia Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 113: East Asia Market Volume (Tons) Analysis by Country, 2019 to 2034

Figure 114: East Asia Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 115: East Asia Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 116: East Asia Market Value (US$ Million) Analysis by Product Form, 2019 to 2034

Figure 117: East Asia Market Volume (Tons) Analysis by Product Form, 2019 to 2034

Figure 118: East Asia Market Value Share (%) and BPS Analysis by Product Form, 2024 to 2034

Figure 119: East Asia Market Y-o-Y Growth (%) Projections by Product Form, 2024 to 2034

Figure 120: East Asia Market Value (US$ Million) Analysis by End-User, 2019 to 2034

Figure 121: East Asia Market Volume (Tons) Analysis by End-User, 2019 to 2034

Figure 122: East Asia Market Value Share (%) and BPS Analysis by End-User, 2024 to 2034

Figure 123: East Asia Market Y-o-Y Growth (%) Projections by End-User, 2024 to 2034

Figure 124: East Asia Market Attractiveness by Product Form, 2024 to 2034

Figure 125: East Asia Market Attractiveness by End-User, 2024 to 2034

Figure 126: East Asia Market Attractiveness by Country, 2024 to 2034

Figure 127: Middle East and Africa Market Value (US$ Million) by Product Form, 2024 to 2034

Figure 128: Middle East and Africa Market Value (US$ Million) by End-User, 2024 to 2034

Figure 129: Middle East and Africa Market Value (US$ Million) by Country, 2024 to 2034

Figure 130: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 131: Middle East and Africa Market Volume (Tons) Analysis by Country, 2019 to 2034

Figure 132: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 133: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 134: Middle East and Africa Market Value (US$ Million) Analysis by Product Form, 2019 to 2034

Figure 135: Middle East and Africa Market Volume (Tons) Analysis by Product Form, 2019 to 2034

Figure 136: Middle East and Africa Market Value Share (%) and BPS Analysis by Product Form, 2024 to 2034

Figure 137: Middle East and Africa Market Y-o-Y Growth (%) Projections by Product Form, 2024 to 2034

Figure 138: Middle East and Africa Market Value (US$ Million) Analysis by End-User, 2019 to 2034

Figure 139: Middle East and Africa Market Volume (Tons) Analysis by End-User, 2019 to 2034

Figure 140: Middle East and Africa Market Value Share (%) and BPS Analysis by End-User, 2024 to 2034

Figure 141: Middle East and Africa Market Y-o-Y Growth (%) Projections by End-User, 2024 to 2034

Figure 142: Middle East and Africa Market Attractiveness by Product Form, 2024 to 2034

Figure 143: Middle East and Africa Market Attractiveness by End-User, 2024 to 2034

Figure 144: Middle East and Africa Market Attractiveness by Country, 2024 to 2034

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Key Companies & Market Share in the Licorice Root Sector

UK Licorice Root Market Insights – Trends, Demand & Growth 2025-2035

USA Licorice Root Market Growth – Trends, Demand & Innovations 2025-2035

ASEAN Licorice Root Market Trends – Demand, Growth & Innovations 2025-2035

Europe Licorice Root Market Analysis – Size, Growth & Forecast 2025-2035

Australia Licorice Root Market Report – Growth, Demand & Forecast 2025-2035

Latin America Licorice Root Market Outlook – Size, Share & Industry Trends 2025-2035

Root Canal Repair Materials Market Size and Share Forecast Outlook 2025 to 2035

Licorice Extract Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Root Beer Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Licorice Candy Market Analysis - Size, Share & Forecast 2025 to 2035

Industry Share Analysis for Licorice Extract Companies

UK Licorice Extract Market Trends – Demand, Innovations & Forecast 2025-2035

Beetroot Powder Market Size and Share Forecast Outlook 2025 to 2035

USA Licorice Extract Market Insights – Size, Share & Industry Growth 2025-2035

Beetroot Molasses Market

Analysis and Growth Projections for Arrowroot Starch Market

ASEAN Licorice Extract Market Trends – Size, Demand & Forecast 2025-2035

Europe Licorice Extract Market Growth – Trends, Demand & Innovations 2025-2035

Ginseng Root Extracts Skincare Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA