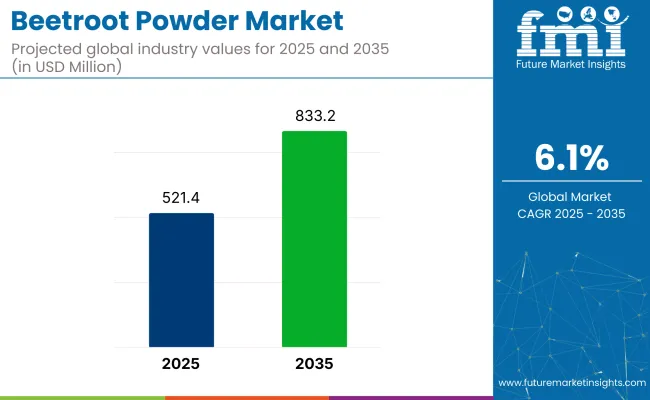

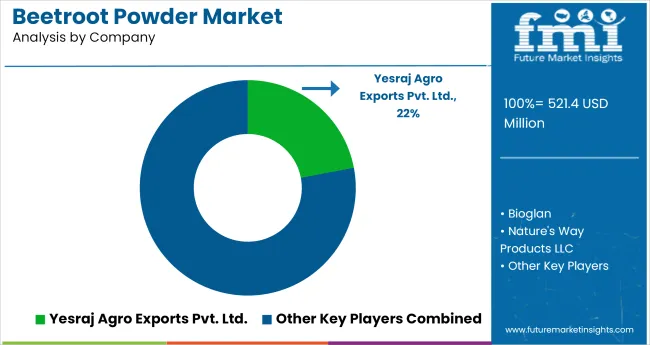

The beetroot powder market is projected to increase from USD 521.4 million in 2025 to USD 833.2 million by 2035, growing at a CAGR of 6.1% over the forecast period. Market demand is gaining momentum, particularly among health-conscious consumers and functional food manufacturers, due to beetroot's nitrate-rich profile and naturally vibrant color.

| Attributes | Description |

|---|---|

| Estimated Market Size (2025E) | USD 521.4 million |

| Projected Market Value (2035F) | USD 833.2 million |

| Value-based CAGR (2025 to 2035) | 6.1% |

North America generated close to USD 182 million in sales last year, with growing demand from pre-workout blends and natural beverage enhancers. In Asia-Pacific, demand is rising at nearly 10% annually, driven by wellness trends in India, Indonesia, and urban China. Manufacturers are adopting freeze-drying and vacuum-drying techniques to retain high nitrate and betalain levels, while eco-friendly packaging formats now cover 32% of retail shelf share.

Beyond supplements, beetroot powder is being used in plant-based burger coloring, natural cosmetic pigments, and probiotic-enriched superfood blends. These diversified applications are turning beetroot powder from a niche superfood into a core ingredient across food, health, and beauty sectors.

As of 2025, the beetroot powder market is being recognized as a steadily growing segment within its broader parent industries. Approximately 3-4% of the global functional food ingredients market is accounted for by beetroot powder, supported by rising demand for antioxidant-rich and natural health boosters.

In the nutraceuticals sector, a share of nearly 2-3% is maintained as beetroot powder continues to be used in blood pressure and cardiovascular formulations. Around 1-2% of the plant-based ingredients market is represented by this product due to its clean-label and vegan positioning. Its share in the dietary supplements market is estimated at 2-3%, while in the food additives space, the contribution reaches about 4-5%.

The industry is gaining strong traction across high-value segments such as organic variants, sports performance applications, and offline retail distribution. The market is being driven by rising health consciousness, plant-based nutritional trends, and demand for clean-label energy supplements.

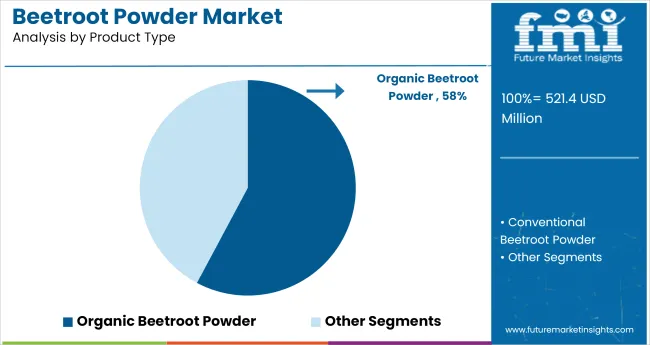

Organic beetroot powder is projected to capture 57.8% of the total market by 2025. Demand is rising as consumers increasingly prefer natural, chemical-free supplements to support cardiovascular health and stamina. Brands are introducing USDA-certified organic variants to meet strict quality standards.

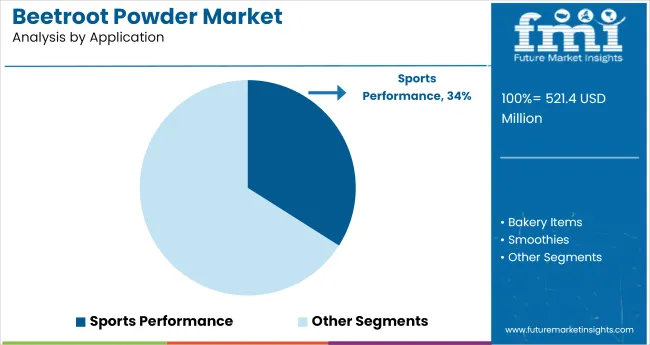

Sports performance is expected to lead application areas, accounting for 34% of the beetroot powder industry in 2025. Endurance athletes and fitness enthusiasts are turning to nitrate-rich beet powder for improved oxygen flow and exercise capacity. This trend is accelerating with the growth of functional sports nutrition.

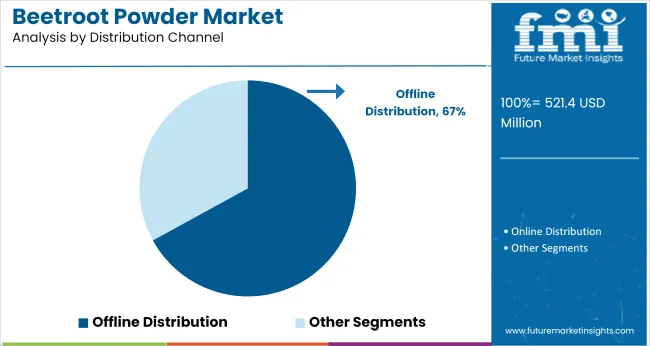

Offline distribution is set to hold a 67% market share in 2025, led by specialty health stores, pharmacies, and supermarkets. Consumers prefer tactile purchasing for supplement products, where they can review labels and consult in-store experts. Brick-and-mortar dominance is especially strong in emerging economies.

The market is expanding as demand rises for natural colorants, clean-label superfoods, and plant-based nutrition. In 2024, global consumption of beetroot powder surpassed 18,000 metric tons, driven by its integration into sports nutrition, bakery mixes, and nutraceuticals.

Strong Demand from Sports Nutrition, Beverages, and Functional Foods

Beetroot powder is increasingly used in pre-workout blends, cardiovascular supplements, and hydration tablets due to its natural nitrate profile. In North America, over 36% of new sports drink launches in 2023 featured beetroot as a primary ingredient. Powdered beet is also favored in dairy-free smoothies, functional gummies, and energy bars for its flavor and anti-inflammatory properties.

Technological Advancements in Drying and Solubility Enhancing Product Performance

Spray-dried and freeze-dried variants are now developed for improved solubility and shelf life. Microencapsulation is being employed to protect nitrate content and reduce caking in humid environments. In 2024, over 45% of new beetroot powder SKUs globally featured instantized or microencapsulated formats.

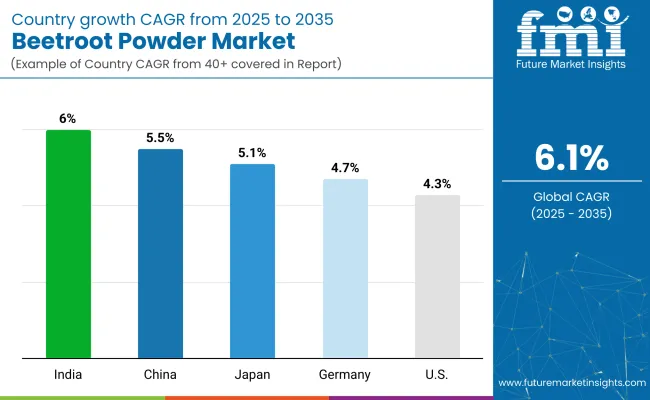

| Country | CAGR (2025 to 2035) |

|---|---|

| India | 6.0% |

| China | 5.5% |

| Japan | 5.1% |

| Germany | 4.7% |

| USA | 4.3% |

The global market is set to expand at a 6.1% CAGR between 2025 and 2035, but country-level performance reveals a widening gap between BRICS and OECD economies. India leads at 6.0%, closely trailing the global average, with rapid scale-up of low-moisture processing units across Gujarat and Andhra Pradesh. BRICS-aligned India now exports over 30% of its beetroot powder to ASEAN markets, driven by rising demand for plant-based nitrates in pre-workout and cardiac health applications.

China, at 5.5%, benefits from vertical integration in Hebei and Shandong, yet still lags the global benchmark due to regulatory delays in functional food approvals. Japan posts a modest 5.1%, with steady demand for clean-label ingredients but limited scale due to aging domestic production infrastructure.

Germany (4.7%) and the USA (4.3%) underperform, constrained by higher energy costs in spray-drying operations and slow reformulation of conventional processed foods, despite growing interest in nitrate-rich wellness products across OECD markets.

The report provides insights across 40+ countries. The five below are highlighted for their strategic influence and growth trajectory.

India’s market is projected to expand at a CAGR of 6.0% through 2035. Rapid urbanization and health awareness are driving demand for beet-based nutraceuticals and drink mixes. Domestic processors in Maharashtra and Karnataka are investing in solar drying and spray drying technologies to preserve nitrate and color quality.

Ayurvedic brands are launching beetroot-infused detox powders and pre-workout supplements. E-commerce platforms are boosting reach in metro and tier-2 cities, where young consumers seek natural endurance boosters and antioxidant-rich ingredients.

China is expected to grow at a CAGR of 5.5% through 2035. Growth is driven by functional food brands promoting beetroot for cardiovascular health, nitric oxide stimulation, and digestive benefits. Cold-pressed juice chains and ready-to-mix beverage firms in Shanghai and Shenzhen are standardizing beetroot powder into daily-use products.

Domestic manufacturers are using vacuum dehydration to retain pigment and bioactivity. Government-backed “dual circulation” policies are also encouraging localized sourcing of superfood ingredients for domestic wellness products.

The market in Japan is projected to grow at a CAGR of 5.1% through 2035. Beetroot powder is gaining traction in the country’s senior health and functional snack segments. Brands are formulating low-sodium miso soups, smoothies, and rice crackers with added beet powder for nitric oxide support. Hokkaido-based suppliers are scaling production using freeze-drying to cater to pharmaceutical-grade clients. Growth is also being supported by health food stores targeting fatigue relief and blood pressure management among aging consumers.

Germany is projected to grow at a CAGR of 4.7% through 2035, with beetroot powder gaining popularity in vegan baking, athletic supplements, and baby nutrition products. Clean-label expectations are encouraging processors to avoid synthetic colorants, making beetroot a favored natural pigment. Organic food manufacturers are sourcing EU-certified beet powder for energy drink mixes and immune support capsules. Cold-chain logistics are being optimized for low-moisture, high-retention powders distributed through pharmacy and organic channels.

The USA market is forecast to grow at a CAGR of 4.3% through 2035. Fitness nutrition and clean-label pre-workout blends are driving core demand. California-based processors are using drum-drying and infrared drying methods to maximize soluble fiber and nitrate preservation. Natural food retailers and subscription-based nutrition companies are leading distribution. Growth is also supported by widespread clinical content promoting beetroot’s benefits in blood flow and stamina, particularly among athletes and aging populations.

The industry is moderately fragmented, with regional and niche players holding strong brand identities. Yesraj Agro Exports dominates the Indian export landscape through bulk contract manufacturing and extensive supply in nutraceuticals and F&B sectors.

Bioglan, a leading Australian brand, focuses on fortified beetroot blends with superfoods, gaining traction in the UK and EU. Nature's Way Products LLC leads in North America, leveraging deep retail distribution across Walgreens and CVS, particularly in fitness supplements.

Super Sprout LLC emphasizes freeze-dried beetroot with high nitrate retention, appealing to elite athletes. Go Superfood and Natures Aid Ltd target the organic consumer segment in Europe through e-commerce and natural health store partnerships, creating high-margin offerings in the clean label space.

| Report Attributes | Details |

|---|---|

| Market Size (2025) | USD 521.4 million |

| Projected Market Size (2035) | USD 833.2 million |

| CAGR (2025 to 2035) | 6.1% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | USD million for market value |

| Types Analyzed (Segment 1) | Conventional, Organic |

| Applications Analyzed (Segment 2) | Sports Performance, Bakery Items, Smoothies, Protein Bars, Energy Drinks |

| Distribution Channels Analyzed (Segment 3) | Online, Offline |

| Regions Covered | North America, Latin America, Europe, East Asia, South Asia, Oceania, Middle East & Africa |

| Countries Covered | United States, Canada, Germany, United Kingdom, France, Japan, China, India, South Korea, Brazil |

| Key Players | Yesraj Agro Exports Pvt. Ltd., Bioglan, Nature's Way Products LLC, Super Sprout LLC & Juices International Pty Ltd., NutraMarks Inc., Radiance Ltd., Go Superfood, Natures Aid Ltd., Botanical Ingredients Ltd, Indigo Herbs Radiance Ltd. |

| Additional Attributes | Dollar sales by type and application, rising demand for natural nitrates in fitness products, expanding retail visibility for organic powders, and growing role in plant-based health and wellness categories. |

The market is segmented into conventional and organic beetroot powder.

Beetroot powder is used as the primary ingredient in sports performance, bakery items, smoothies, protein bars, and energy drinks

Beetroot powder is retailed online and offline

The market is segmented between North America, Latin America, Europe, East Asia, South Asia, Oceania, Middle East & Africa

The global beetroot powder market is estimated to be valued at USD 521.4 billion in 2025.

The market size for the beetroot powder market is projected to reach USD 918.8 billion by 2035.

The beetroot powder market is expected to grow at a 5.8% CAGR between 2025 and 2035.

The key product types in beetroot powder market are conventional and organic.

In terms of application, sports performance segment to command 42.5% share in the beetroot powder market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Powdered Cellulose Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Powdered Soft Drinks Market Size and Share Forecast Outlook 2025 to 2035

Powder Packing Machine Market Size and Share Forecast Outlook 2025 to 2035

Powder Dispenser Market Analysis by Product Type, Size, Dispensing Mode, End-use Industry, and Region through 2025 to 2035

Analysis and Growth Projections for Powder Induction and Dispersion Systems Business

Leading Providers & Market Share in Powder Packing Machines

Key Players & Market Share in Powder Dispenser Manufacturing

Powder Injection Molding Market Growth – Trends & Forecast 2025 to 2035

Powdered Fats Market – Growth, Demand & Industrial Applications

Powdered Beverage Market Outlook – Growth, Demand & Forecast 2024-2034

Beetroot Molasses Market

Powder Feed Center Market

Powder Funnels Market

Powdered Hand Soap Market

Powder Coating Guns Market

Dry Powder Inhaler Market Size and Share Forecast Outlook 2025 to 2035

Egg Powder Market - Size, Share, and Forecast Outlook 2025 to 2035

Lip Powder Market Analysis by Form, End-User, Sales Channel and Region from 2025 to 2035

Dry Powder Refilling Machine Market

Baby Powder Market - Size, Share, and Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA