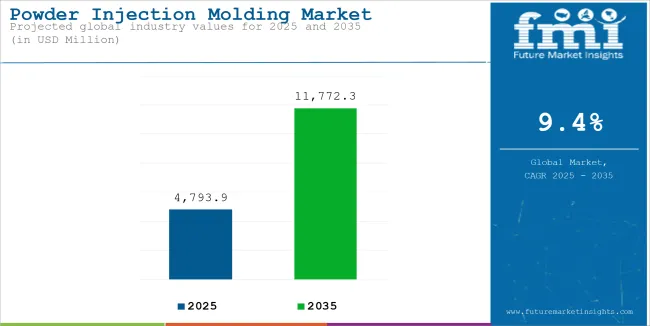

The Powder Injection Molding (PIM) sales are set for robust growth, with a forecast CAGR of 9.4% from 2025 to 2035, building on a historical CAGR of 7.8%. The sales were valued at USD 3,150.6 million in 2020 and is projected to reach USD 4,382 million by 2024, climbing further to USD 4,793.9 million in 2025. By 2035, the industry is expected to exceed USD 11,772.3 million, driven by rising demand for cost-efficient and precision manufacturing solutions in sectors like healthcare, automotive, and electronics.

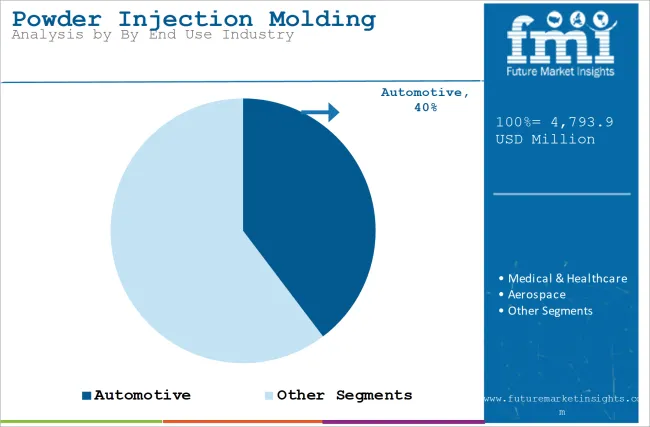

The automotive segment is expected to account for the maximum share in 2025 in the Powder Injection Molding industry, capturing a value share of 39.7%. This is on account of the growing demand for lighter, high-precision components necessary to enhance fuel efficiency and vehicle performance. PIM technology allows the production of complex parts, such as gears and connectors, at a lower cost, which meets the automotive industry's rigid quality and design demands.

| Attributes | Key Insights |

|---|---|

| Estimated Value (2025) | USD 4,793.9 million |

| Projected Size (2035) | USD 11,772.3 million |

| Value-based CAGR (2025 to 2035) | 9.4% |

The PIM industry is gradually considering sustainable manufacturing processes to satisfy demand from environmentally responsible consumers. Adopting energy-effective technologies and eliminating the generation of waste within the manufacturing line are a significant part of these changes. Most manufacturers also embrace recycling for powder metals which saves material wastage and leads a step toward successful circular economy requirements.

Governments around the globe are adopting tighter environmental regulations, which affect the manufacturing industries, among them PIM. For instance, the European Union's Green Deal aims to cut carbon emissions for all sectors. It encourages environment-friendly practices that include energy-efficient production and reuse of materials. In the USA, the EPA has set various standards that stimulate cleaner production methodologies.

According to the EPA, companies embracing green technologies get funding and benefits, which means that production will be gradually shifted toward sustainability. The regulatory pressure on PIM manufacturers is compelling them to invest in technologies that will reduce environmental impact while ensuring compliance. As such, PIM companies are discovering new materials and production methods that meet both regulatory standards and consumer expectations. The industry's ongoing investment in sustainable practices is expected to drive long-term growth.

In the Powder Injection Molding industry, metal powders hold the highest value share of 55.8% in 2025, as it has high density and superior strength with suitability for precision components in several industries. Automotive is the leading end-use segment, which is projected to hold a share of 39.7% in 2025, due to the growing demand for lightweight, durable components in automotive manufacturing.

| Segment | Value Share (2025) |

|---|---|

| Metal Powder (Material Type) | 55.8% |

One of the mostly used material in the PIM is metal powder due to excellent characteristics that fulfill multiple industrial purposes. Stainless steel, titanium, and nickel alloys show considerable mechanical strength along with a significant thermal resistance capability and an ideal corrosion-resistant value. Thus, these alloys and metals have properties that best satisfy the purpose of manufacturing various industrial components and items that work and operate under very extreme environmental conditions, which explains their utility in the aerospace, automobile, and healthcare industries.

The medical industry extensively uses metal powders, primarily titanium and stainless steel, for their excellent biocompatibility and durability. Titanium is preferred because of its resistance to corrosion and compatibility with human tissues in implant applications, whereas stainless steel is used in surgical instruments and dental devices on account of its high strength and ease of sterilization. It is possible to tailor them for specific applications, such as by enhancing properties like hardness or conductivity through alloying.

| Segment | Value Share (2025) |

|---|---|

| Automotive (End Use Industry) | 39.7% |

The global industry for Powder Injection Molding (PIM) is led by the automotive industry. The demand in this industry is growing as it seeks a high-precision, strong, and lightweight component. PIM is therefore ideal for producing intricate parts with excellent material properties. Automotive parts such as gears, fuel injectors, and turbocharger vanes rely on the above-end properties that are achieved through PIM-made parts.

The main trend in the automotive industry is lightweighting, which is to reduce fuel consumption and emissions. PIM allows for the use of materials such as aluminum and titanium alloys that have a high strength-to-weight ratio in the manufacture of lightweight components.

Such materials enable designs with intricate geometries that consume minimal material while still maintaining structural integrity. The near-net-shape capability of PIM also minimizes the amount of secondary processing required, further enhancing efficiency and cost-effectiveness for the automotive manufacturer.

This is the table containing the annualized growth rate for the years running from 2025 through to 2035 of the Powder Injection Molding industry. From the base year of 2024 and into the present year of 2025, it accounts for the way in which the sector's growth curve shifts during both halves of the year, that being H1; January through to June, and H2 period is July through to December.

This study provides industry players with information on how the performance of the sector has changed over time, where emerging events may be communicated. These are the figures of sector growth for each half-year of the period from 2024 to 2025. In H1-2024, an industry grows at a CAGR of 8.9%, and in H2 the growth rate is higher.

| Particular | Value CAGR |

|---|---|

| H1 2024 | 8.9% (2024 to 2034) |

| H2 2024 | 9.4% (2024 to 2034) |

| H1 2025 | 9.0% (2025 to 2035) |

| H2 2025 | 9.7% (2025 to 2035) |

For H1 2025 to H2 2025, the CAGR is anticipated to grow at 9.0% for the first half and relatively at 9.7% for the second half. The sector improved by 10 BPS and 30 BPS in the first and second half respectively.

Aging Population and Personalized Healthcare Driving Bio-Compatible Implant Demand

High demand for biocompatible components as a result of regenerative medicine is a decisive factor in the adoption of Powder Injection Molding (PIM) technologies. PIM is useful for manufacturing complex, high-precision implants such as bone screws and dental prosthetics, which are key to regenerative treatments.

This demand is further driven by the increased aging rate of the world's population and the growing personalized healthcare sector. This leads to the requirement for more joint replacements and dental restorations in patients who are living longer.

According to the World Health Organization, it is projected that by 2050, nearly 22 percent of the world's population will be 60 years or older compared to 12 percent in 2015. Due to this demographic change, the medical device and implant sector is likely to boom due to demand for products particularly designed for aged populations. This efficiency in the production of biocompatible components makes PIM an important technology for meeting the requirements of regenerative medicine as these requirements evolve.

High-Performance Superalloys Transforming Aerospace and Defense Applications Under Extreme Conditions

The aerospace and defense industries demand superalloys of high-temperature resistance for several critical components, such as turbine blades and jet engine parts, which are supposed to possess excellent thermal resistance and mechanical strength. Powder injection molding has now become a viable manufacturing process that can produce complex component designs with the exact material properties desired.

The provision of PIM allows the production of complex geometries that are impossible to obtain through other conventional methods, making it particularly applicable in the production of high-performance parts working in extreme environments.

Besides the USA, other countries are also taking forward their developments in high-temperature superalloys. In India, Mishra Dhatu Nigam Limited, or MIDHANI, developed the SN-41 superalloy, which is a nickel-based precipitation-hardening alloy for aerospace and defense applications at high temperatures. This is one of the landmark achievements in developing indigenous capabilities for high-end applications and contributing to global developments in materials science.

Specialized PIM Equipment and Tooling Pose Challenges For SMEs Globally

High capital investment for Powder Injection Molding (PIM) equipment and precise tooling along with high-tech furnaces for sintering causes large initial investments. Such investment makes it impossible for small and medium-sized enterprises, which often cannot afford this much capital outlay. The huge financial costs associated with creating PIM capabilities might discourage firms from setting up, thereby automatically making them decline their operations.

In addition, the maintenance and upgrading of equipment costs contribute to the financial burden, and as PIM technologies advance, this can lead to a concentration of power among larger enterprises that have the resources to overcome these financial hurdles, potentially leading to imbalances in accessibility and innovation opportunities in the industry. Without cost-reduction strategies or widespread support mechanisms, such high initial investments may continue to hinder the broader adoption of PIM technology.

Precision PIM Parts Advancing Hydrogen Fuel Cells and Storage Systems

The drive towards hydrogen in the world for the clean generation of energy is, therefore increasing demand for highly precise components to form hydrogen fuel cells and storage systems. PIM is gradually proving to be the key manufacturing method for such intricately complex components as nozzles, connectors, and valves that make hydrogen economy strictly demanded.

Such complexity in geometries, which could be fabricated at high precision with PIM, makes it even more suitable for developing components to withstand the special challenges of hydrogen storage and fuel cell technologies.

The USA Department of Energy (DOE) recognizes the strategic value of hydrogen to achieve energy transition goals and has invested heavily to strengthen the hydrogen industry. In September 2024, the DOE announced it would be providing USD 62 million to further the growth of America's hydrogen sector.

Such funds will be dedicated toward projects seeking cost reductions of clean hydrogen, coupled with efforts aimed at increasing manufacturing for the more critical components within hydrogen infrastructure. Such investment contributes to developing critical technologies like PIM, crucial to the manufacture of high-performance parts for use within hydrogen applications.

The Powder Injection Molding (PIM) industry is currently in a robust growth stage, and from 2025 to 2035, the compound annual growth rate (CAGR) is expected to be 9.4%. Its historical CAGR from previous years is at 7.8%, with continuous growth. The value size was estimated at USD 3,150.6 million in 2020 and is expected to grow to USD 4,382 million by 2024.

The industry is expected to reach USD 4,793.9 million in 2025, with a year-on-year growth of 9.1%. By 2035, the value size is expected to exceed USD 11,772.3 million, driven by increased adoption across key industries such as automotive, electronics, and medical devices.

Initially, the short-term slowdown during the COVID-19 pandemic hit industrial operations temporarily and resulted in short-term falls in demand levels. In that period, mainly industries such as automobiles and electronics bore the effects. However, the market bounced back in 2024 to stand at USD 35,106.8 million with PIM beginning to become mainstream in making light, accurate, precision parts.

This recovery, particularly in automobiles, electronics, and healthcare is most pronounced given the increased demand from industries for the manufacture of lower-cost and sustainable production methods.

Following the pandemic, growth in PIM is expected to accelerate, particularly in areas that focus more on sustainability, including electric vehicles, medical devices, and consumer electronics. Further acceleration will be realized from improvements in material science, namely through recyclable powders and energy-efficient production methods, positioning the industry for increased competitiveness throughout the decade ahead.

The PIM market is a combination of large, medium, and small players, all with their roles and market positions. Tier 1 companies form the majority and have a share of 20-25%, generating revenues that exceed USD 300 million. Some of the key players that fall in the Tier 1 category are Höganäs AB, Arburg GmbH + Co KG, and Indo-MIM Pvt. Ltd.

These companies are leaders in terms of advanced technology, production capabilities, and global reach. They cater to high-demand industries such as automotive, aerospace, and healthcare, offering cutting-edge solutions and benefiting from substantial research and development investments.

LPW Technology, Schunk Sintermetalltechnik GmbH, and Advanced Powder Technologies fall into the Tier 2 segment with a value share of 15-20% and revenue of USD 50 million to USD 300 million. Tier 2 players don't have the wide outreach that Tier 1 companies have but specific niches, such as advanced materials and customized solutions for aerospace, medical devices, and automotive industries. Their strong regional presence and ability to innovate within specific market niches help them capture a significant portion of the industry.

Tier 3 companies, which are between 50-60% of the sales, offer revenue of less than USD 50 million. Parmaco GmbH, Team Rapid, Metalpowder & PIM Technologies, Inc., and Vega Industries are some of the companies under this category. These Tier 3 companies focus on regional sectors while developing cost-effective products, mainly targeting local industries with smaller production batches or niche applications. Although they have a smaller value share, they greatly contribute to being flexible and cheap PIM options for local industries.

Powder Injection Molding (PIM) is finding increasing growth in China, the United States, Germany, South Korea, and Brazil due to increasing demand within automotive, aerospace, and health care. As a result, the sales across these regions have seen CAGRs with growing technologies in their manufacturing processes. In addition, growth is rising within these regions because of the adoption of more efficient and sustainable manufacturing methods.

| Countries | Value CAGR (2025 to 2035) |

|---|---|

| China | 8.4% |

| United States | 7.1% |

| Germany | 6.5% |

| South Korea | 5.8% |

| Brazil | 4.9% |

The USA is projected to grow at a CAGR of 7.1%, with an estimated value of USD 1,671.9 million by 2035.

The USA aerospace industry serves as one of the critical factors in advancing the PIM market. With the world's biggest aerospace industry, the United States is in continuous requirement of new and improved manufacturing techniques that have the potential to match the challenges imposed by aircraft and space technology.

PIM stands out for the ability to create lightweight, high-performance parts containing complicated geometries like those of turbine blades, fuel injectors, and precision connectors commonly found in modern aircraft and spacecraft. This capability makes PIM an indispensable tool for aerospace manufacturers facing the challenges of performance, safety, and efficiency.

The aerospace manufacturers in the USA are constantly challenged to increase fuel efficiency and reduce emissions while maintaining structural integrity and performance. PIM is an ideal solution because it allows for the production of parts with excellent thermal resistance and mechanical strength.

In contrast to traditional manufacturing techniques, PIM can produce highly complex parts with minimal material waste, which is increasingly important to the industry. PIM also ensures reliability in the critical components of jet engines, navigation systems, and fuel delivery systems, as minor flaws here can have disastrous consequences.

South Korea is projected to grow at a CAGR of 5.8%, with an estimated value of USD 317.6 million by 2035.

The South Korean Powder Injection Molding (PIM) industry is attributed to the country's global leadership in the electronics industry. This is because the South Korean producers of cutting-edge consumer electronics such as smartphones, tablets, wearables, and advanced home appliances rely more and more on PIM to make the precision components required by these products.

Being an industry that provides high-strength, lightweight, and miniaturized parts, in the form of micro-connectors, camera modules, and even sensor housings, PIM is a perfect fit for this high-competitive yet innovation-driven field.

These heavy investments by the country in R&D and smart manufacturing technologies enhance PIM's role in future electronics production. While companies push boundaries in artificial intelligence, robotics, and wearable tech, PIM continues to offer the material flexibility and precision required for next-generation devices.

With a robust infrastructure and innovation-focused ecosystem, South Korea will remain the center for PIM applications in electronics, leading to demand growth and strengthening its position as a global player in high-tech manufacturing.

Brazil’s industry is expected to grow at a CAGR of 4.9%, reaching a value of USD 328.4 million by 2035.

Industrial machinery in Brazil has been a promising growth driver for the Powder Injection Molding (PIM) sector. As a significant economy in Latin America, Brazil's industrial base supports areas like agriculture, mining, and energy, with the need for high-performance machinery. PIM is increasingly applied in the manufacturing of precision parts, such as gears, bearings, and nozzles, applied in heavy machinery and equipment. These parts require high strength and resistance to wear, which are characteristics that PIM's material can provide.

Brazil's large-scale agribusiness sector is responsible for much of the country's GDP, resulting in increased demand for heavy equipment with enhanced equipment reliability and efficiency to support this business.

In the case of mining and energy, the cost-effective production of wear-resistant parts that could be used in harsh operating conditions is enabled by PIM to support the needs of growing industrial equipment requirements in Brazil.

The key players in the Powder Injection Molding market are focused on developments to cope with the increased demand for precision manufacturing in industries. Such companies are investing in high-end production technologies that help enhance the efficiency and quality of the products while being cost-effective. Through optimization, they can provide better solutions to the ever-changing needs of the automotive, healthcare, and aerospace industries to maintain competitiveness in the industry.

In addition to joint ventures, strategic partnerships, and other collaborations are what leading companies have largely adapted these days. Such collaboration in joint ventures can help combine their respective resources and expertise, thus enabling them to co-develop innovative solutions that meet specific industry requirements. These collaborations help expand product offerings and allow companies to enter new segments, including healthcare devices, automotive components, and other high-performance applications, where Powder Injection Molding is gaining momentum.

Geographical expansion is another major strategy for these companies, especially in emerging sectors where the demand for advanced manufacturing solutions is surfacing rapidly. Expansion into high-growth regions allows companies to increase their customer base, minimize their risk exposure in light of market saturation, and attain benefits of growth opportunities emerging in the region. This focus on regions of growing demand for Powder Injection Molding ensures long-term business growth and strengthens their position in the global industry.

By Material Type, the industry is divided into Ceramic Powders, Metal Powders, and Plastic Powders.

By Technology, the industry is divided into Ceramic Injection Molding (CIM), Metal Injection Molding (MIM), and Plastic Injection Molding (PIM).

By End Use Industry, the industry is divided into Automotive, Medical & Healthcare, Aerospace, Consumer Goods, Industrial Equipment & Machinery, and Others.

The report covers key regions, including North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia, and the Middle East and Africa (MEA).

The sales are expected to grow at a year-on-year (YOY) rate of 9.1% from 2024 to 2025.

The powder injection molding industry is projected to reach USD 4,382 million in 2024.

The powder injection molding sales are expected to grow to USD 11,772.3 million by 2035.

The powder injection molding market is forecasted to grow at a CAGR of 9.4% over the forecast period.

Table 1: Global Powder Injection Molding Market Value (US$ Mn) Forecast by Region, 2017-2032

Table 2: Global Powder Injection Molding Market Value (US$ Mn) Forecast by Type, 2017-2032

Table 3: Global Powder Injection Molding Market Value (US$ Mn) Forecast by End Use, 2017-2032

Table 4: North America Powder Injection Molding Market Value (US$ Mn) Forecast by Country, 2017-2032

Table 5: North America Powder Injection Molding Market Value (US$ Mn) Forecast by Type, 2017-2032

Table 6: North America Powder Injection Molding Market Value (US$ Mn) Forecast by End Use, 2017-2032

Table 7: Latin America Powder Injection Molding Market Value (US$ Mn) Forecast by Country, 2017-2032

Table 8: Latin America Powder Injection Molding Market Value (US$ Mn) Forecast by Type, 2017-2032

Table 9: Latin America Powder Injection Molding Market Value (US$ Mn) Forecast by End Use, 2017-2032

Table 10: Europe Powder Injection Molding Market Value (US$ Mn) Forecast by Country, 2017-2032

Table 11: Europe Powder Injection Molding Market Value (US$ Mn) Forecast by Type, 2017-2032

Table 12: Europe Powder Injection Molding Market Value (US$ Mn) Forecast by End Use, 2017-2032

Table 13: East Asia Powder Injection Molding Market Value (US$ Mn) Forecast by Country, 2017-2032

Table 14: East Asia Powder Injection Molding Market Value (US$ Mn) Forecast by Type, 2017-2032

Table 15: East Asia Powder Injection Molding Market Value (US$ Mn) Forecast by End Use, 2017-2032

Table 16: South Asia & Pacific Powder Injection Molding Market Value (US$ Mn) Forecast by Country, 2017-2032

Table 17: South Asia & Pacific Powder Injection Molding Market Value (US$ Mn) Forecast by Type, 2017-2032

Table 18: South Asia & Pacific Powder Injection Molding Market Value (US$ Mn) Forecast by End Use, 2017-2032

Table 19: MEA Powder Injection Molding Market Value (US$ Mn) Forecast by Country, 2017-2032

Table 20: MEA Powder Injection Molding Market Value (US$ Mn) Forecast by Type, 2017-2032

Table 21: MEA Powder Injection Molding Market Value (US$ Mn) Forecast by End Use, 2017-2032

Figure 1: Global Powder Injection Molding Market Value (US$ Mn) by Type, 2022-2032

Figure 2: Global Powder Injection Molding Market Value (US$ Mn) by End Use, 2022-2032

Figure 3: Global Powder Injection Molding Market Value (US$ Mn) by Region, 2022-2032

Figure 4: Global Powder Injection Molding Market Value (US$ Mn) Analysis by Region, 2017-2032

Figure 5: Global Powder Injection Molding Market Value Share (%) and BPS Analysis by Region, 2022-2032

Figure 6: Global Powder Injection Molding Market Y-o-Y Growth (%) Projections by Region, 2022-2032

Figure 7: Global Powder Injection Molding Market Value (US$ Mn) Analysis by Type, 2017-2032

Figure 8: Global Powder Injection Molding Market Value Share (%) and BPS Analysis by Type, 2022-2032

Figure 9: Global Powder Injection Molding Market Y-o-Y Growth (%) Projections by Type, 2022-2032

Figure 10: Global Powder Injection Molding Market Value (US$ Mn) Analysis by End Use, 2017-2032

Figure 11: Global Powder Injection Molding Market Value Share (%) and BPS Analysis by End Use, 2022-2032

Figure 12: Global Powder Injection Molding Market Y-o-Y Growth (%) Projections by End Use, 2022-2032

Figure 13: Global Powder Injection Molding Market Attractiveness by Type, 2022-2032

Figure 14: Global Powder Injection Molding Market Attractiveness by End Use, 2022-2032

Figure 15: Global Powder Injection Molding Market Attractiveness by Region, 2022-2032

Figure 16: North America Powder Injection Molding Market Value (US$ Mn) by Type, 2022-2032

Figure 17: North America Powder Injection Molding Market Value (US$ Mn) by End Use, 2022-2032

Figure 18: North America Powder Injection Molding Market Value (US$ Mn) by Country, 2022-2032

Figure 19: North America Powder Injection Molding Market Value (US$ Mn) Analysis by Country, 2017-2032

Figure 20: North America Powder Injection Molding Market Value Share (%) and BPS Analysis by Country, 2022-2032

Figure 21: North America Powder Injection Molding Market Y-o-Y Growth (%) Projections by Country, 2022-2032

Figure 22: North America Powder Injection Molding Market Value (US$ Mn) Analysis by Type, 2017-2032

Figure 23: North America Powder Injection Molding Market Value Share (%) and BPS Analysis by Type, 2022-2032

Figure 24: North America Powder Injection Molding Market Y-o-Y Growth (%) Projections by Type, 2022-2032

Figure 25: North America Powder Injection Molding Market Value (US$ Mn) Analysis by End Use, 2017-2032

Figure 26: North America Powder Injection Molding Market Value Share (%) and BPS Analysis by End Use, 2022-2032

Figure 27: North America Powder Injection Molding Market Y-o-Y Growth (%) Projections by End Use, 2022-2032

Figure 28: North America Powder Injection Molding Market Attractiveness by Type, 2022-2032

Figure 29: North America Powder Injection Molding Market Attractiveness by End Use, 2022-2032

Figure 30: North America Powder Injection Molding Market Attractiveness by Country, 2022-2032

Figure 31: Latin America Powder Injection Molding Market Value (US$ Mn) by Type, 2022-2032

Figure 32: Latin America Powder Injection Molding Market Value (US$ Mn) by End Use, 2022-2032

Figure 33: Latin America Powder Injection Molding Market Value (US$ Mn) by Country, 2022-2032

Figure 34: Latin America Powder Injection Molding Market Value (US$ Mn) Analysis by Country, 2017-2032

Figure 35: Latin America Powder Injection Molding Market Value Share (%) and BPS Analysis by Country, 2022-2032

Figure 36: Latin America Powder Injection Molding Market Y-o-Y Growth (%) Projections by Country, 2022-2032

Figure 37: Latin America Powder Injection Molding Market Value (US$ Mn) Analysis by Type, 2017-2032

Figure 38: Latin America Powder Injection Molding Market Value Share (%) and BPS Analysis by Type, 2022-2032

Figure 39: Latin America Powder Injection Molding Market Y-o-Y Growth (%) Projections by Type, 2022-2032

Figure 40: Latin America Powder Injection Molding Market Value (US$ Mn) Analysis by End Use, 2017-2032

Figure 41: Latin America Powder Injection Molding Market Value Share (%) and BPS Analysis by End Use, 2022-2032

Figure 42: Latin America Powder Injection Molding Market Y-o-Y Growth (%) Projections by End Use, 2022-2032

Figure 43: Latin America Powder Injection Molding Market Attractiveness by Type, 2022-2032

Figure 44: Latin America Powder Injection Molding Market Attractiveness by End Use, 2022-2032

Figure 45: Latin America Powder Injection Molding Market Attractiveness by Country, 2022-2032

Figure 46: Europe Powder Injection Molding Market Value (US$ Mn) by Type, 2022-2032

Figure 47: Europe Powder Injection Molding Market Value (US$ Mn) by End Use, 2022-2032

Figure 48: Europe Powder Injection Molding Market Value (US$ Mn) by Country, 2022-2032

Figure 49: Europe Powder Injection Molding Market Value (US$ Mn) Analysis by Country, 2017-2032

Figure 50: Europe Powder Injection Molding Market Value Share (%) and BPS Analysis by Country, 2022-2032

Figure 51: Europe Powder Injection Molding Market Y-o-Y Growth (%) Projections by Country, 2022-2032

Figure 52: Europe Powder Injection Molding Market Value (US$ Mn) Analysis by Type, 2017-2032

Figure 53: Europe Powder Injection Molding Market Value Share (%) and BPS Analysis by Type, 2022-2032

Figure 54: Europe Powder Injection Molding Market Y-o-Y Growth (%) Projections by Type, 2022-2032

Figure 55: Europe Powder Injection Molding Market Value (US$ Mn) Analysis by End Use, 2017-2032

Figure 56: Europe Powder Injection Molding Market Value Share (%) and BPS Analysis by End Use, 2022-2032

Figure 57: Europe Powder Injection Molding Market Y-o-Y Growth (%) Projections by End Use, 2022-2032

Figure 58: Europe Powder Injection Molding Market Attractiveness by Type, 2022-2032

Figure 59: Europe Powder Injection Molding Market Attractiveness by End Use, 2022-2032

Figure 60: Europe Powder Injection Molding Market Attractiveness by Country, 2022-2032

Figure 61: East Asia Powder Injection Molding Market Value (US$ Mn) by Type, 2022-2032

Figure 62: East Asia Powder Injection Molding Market Value (US$ Mn) by End Use, 2022-2032

Figure 63: East Asia Powder Injection Molding Market Value (US$ Mn) by Country, 2022-2032

Figure 64: East Asia Powder Injection Molding Market Value (US$ Mn) Analysis by Country, 2017-2032

Figure 65: East Asia Powder Injection Molding Market Value Share (%) and BPS Analysis by Country, 2022-2032

Figure 66: East Asia Powder Injection Molding Market Y-o-Y Growth (%) Projections by Country, 2022-2032

Figure 67: East Asia Powder Injection Molding Market Value (US$ Mn) Analysis by Type, 2017-2032

Figure 68: East Asia Powder Injection Molding Market Value Share (%) and BPS Analysis by Type, 2022-2032

Figure 69: East Asia Powder Injection Molding Market Y-o-Y Growth (%) Projections by Type, 2022-2032

Figure 70: East Asia Powder Injection Molding Market Value (US$ Mn) Analysis by End Use, 2017-2032

Figure 71: East Asia Powder Injection Molding Market Value Share (%) and BPS Analysis by End Use, 2022-2032

Figure 72: East Asia Powder Injection Molding Market Y-o-Y Growth (%) Projections by End Use, 2022-2032

Figure 73: East Asia Powder Injection Molding Market Attractiveness by Type, 2022-2032

Figure 74: East Asia Powder Injection Molding Market Attractiveness by End Use, 2022-2032

Figure 75: East Asia Powder Injection Molding Market Attractiveness by Country, 2022-2032

Figure 76: South Asia & Pacific Powder Injection Molding Market Value (US$ Mn) by Type, 2022-2032

Figure 77: South Asia & Pacific Powder Injection Molding Market Value (US$ Mn) by End Use, 2022-2032

Figure 78: South Asia & Pacific Powder Injection Molding Market Value (US$ Mn) by Country, 2022-2032

Figure 79: South Asia & Pacific Powder Injection Molding Market Value (US$ Mn) Analysis by Country, 2017-2032

Figure 80: South Asia & Pacific Powder Injection Molding Market Value Share (%) and BPS Analysis by Country, 2022-2032

Figure 81: South Asia & Pacific Powder Injection Molding Market Y-o-Y Growth (%) Projections by Country, 2022-2032

Figure 82: South Asia & Pacific Powder Injection Molding Market Value (US$ Mn) Analysis by Type, 2017-2032

Figure 83: South Asia & Pacific Powder Injection Molding Market Value Share (%) and BPS Analysis by Type, 2022-2032

Figure 84: South Asia & Pacific Powder Injection Molding Market Y-o-Y Growth (%) Projections by Type, 2022-2032

Figure 85: South Asia & Pacific Powder Injection Molding Market Value (US$ Mn) Analysis by End Use, 2017-2032

Figure 86: South Asia & Pacific Powder Injection Molding Market Value Share (%) and BPS Analysis by End Use, 2022-2032

Figure 87: South Asia & Pacific Powder Injection Molding Market Y-o-Y Growth (%) Projections by End Use, 2022-2032

Figure 88: South Asia & Pacific Powder Injection Molding Market Attractiveness by Type, 2022-2032

Figure 89: South Asia & Pacific Powder Injection Molding Market Attractiveness by End Use, 2022-2032

Figure 90: South Asia & Pacific Powder Injection Molding Market Attractiveness by Country, 2022-2032

Figure 91: MEA Powder Injection Molding Market Value (US$ Mn) by Type, 2022-2032

Figure 92: MEA Powder Injection Molding Market Value (US$ Mn) by End Use, 2022-2032

Figure 93: MEA Powder Injection Molding Market Value (US$ Mn) by Country, 2022-2032

Figure 94: MEA Powder Injection Molding Market Value (US$ Mn) Analysis by Country, 2017-2032

Figure 95: MEA Powder Injection Molding Market Value Share (%) and BPS Analysis by Country, 2022-2032

Figure 96: MEA Powder Injection Molding Market Y-o-Y Growth (%) Projections by Country, 2022-2032

Figure 97: MEA Powder Injection Molding Market Value (US$ Mn) Analysis by Type, 2017-2032

Figure 98: MEA Powder Injection Molding Market Value Share (%) and BPS Analysis by Type, 2022-2032

Figure 99: MEA Powder Injection Molding Market Y-o-Y Growth (%) Projections by Type, 2022-2032

Figure 100: MEA Powder Injection Molding Market Value (US$ Mn) Analysis by End Use, 2017-2032

Figure 101: MEA Powder Injection Molding Market Value Share (%) and BPS Analysis by End Use, 2022-2032

Figure 102: MEA Powder Injection Molding Market Y-o-Y Growth (%) Projections by End Use, 2022-2032

Figure 103: MEA Powder Injection Molding Market Attractiveness by Type, 2022-2032

Figure 104: MEA Powder Injection Molding Market Attractiveness by End Use, 2022-2032

Figure 105: MEA Powder Injection Molding Market Attractiveness by Country, 2022-2032

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Powdered Cellulose Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Powdered Soft Drinks Market Size and Share Forecast Outlook 2025 to 2035

Powder Packing Machine Market Size and Share Forecast Outlook 2025 to 2035

Powder Dispenser Market Analysis by Product Type, Size, Dispensing Mode, End-use Industry, and Region through 2025 to 2035

Analysis and Growth Projections for Powder Induction and Dispersion Systems Business

Leading Providers & Market Share in Powder Packing Machines

Key Players & Market Share in Powder Dispenser Manufacturing

Powdered Fats Market – Growth, Demand & Industrial Applications

Powdered Beverage Market Outlook – Growth, Demand & Forecast 2024-2034

Powder Feed Center Market

Powder Funnels Market

Powdered Hand Soap Market

Powder Coating Guns Market

Dry Powder Inhaler Market Size and Share Forecast Outlook 2025 to 2035

Egg Powder Market - Size, Share, and Forecast Outlook 2025 to 2035

Lip Powder Market Analysis by Form, End-User, Sales Channel and Region from 2025 to 2035

Dry Powder Refilling Machine Market

Baby Powder Market - Size, Share, and Forecast 2025 to 2035

Milk Powder Packaging Market Size and Share Forecast Outlook 2025 to 2035

Milk Powder Packaging Machines Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA