The global licorice root market operates under a moderately fragmented structure with multinational corporations, regional leaders, startups, and niche brands in the same segment. Around 40% of the total market share is possessed by multinational companies such as Naturex, Martin Bauer Group, and Indena with superior extraction techniques and wide product portfolio offerings.

Regional players such as Sepidan Osareh and ASEH Licorice do well in niche markets and achieve strong deep local penetration; they hold 35% of the overall share. Startups and niche brands are 25% in all, with only Panda Licorice and Wiley Wallaby, focusing on organic and specialty items. The first five firms collective account for close to 35%; the market is moderately concentrated, but there is a lot of space for smaller firms.

| Global Market Share 2025 | Industry Share (%) |

|---|---|

| Top Multinationals (Naturex, Martin Bauer Group, Indena) | 40% |

| Regional Leaders (Sepidan Osareh, ASEH Licorice, Norevo) | 35% |

| Startups & Niche Brands (Panda Licorice, Wiley Wallaby, F&C Licorice) | 25% |

The global licorice root market is relatively moderately fragmented with relatively balanced contributions from the large players and smaller ones.

Roots licorice roots (28.4%) hold a huge share due to their huge consumption in traditional medicine and confectionery. A significant producer like Iran is of strong role for satisfying this demand. The roots are being exported also to pharmaceutical industries across Europe and North America.

Extracts (23.7%) are the most widely used in flavoring and medicinal applications due to their concentrated glycyrrhizin content. Martin Bauer Group is the leader in licorice extract production, serving both food and pharmaceutical markets.

Licorice powder is another growing sub-segment, preferred in dietary supplements for ease of formulation. Paste and blocks, though niche, serve specialized uses in the cosmetics and food industries, especially in premium confectionery.

The major end-use is in the food and beverage segment, accounting for 30.8%, based on demand from natural sweeteners and flavor-enhancing applications. Premium licorice confectionery brands Darrell Lea and Panda Licorice well represent this use.

The tobacco industry accounts for 12.9% of its usage, used as flavor profiles in chewing tobacco and cigarettes, and ASEH Licorice is a big player in the tobacco industry. The pharmaceutical industries apply licorice root with anti-inflammatory as well as its antimicrobial capacity for herbal remedies and throat sores.

Companies in the cosmetic industries are focusing on the skincare properties of anti-aging produced by Bio-Botanica that offers natural solutions for various types of skins. Dietary supplementations are widely applied due to consumer health awareness in society and demands in natural therapeutic medicines.

The year witnessed significant development in the licorice root market, with key players at the forefront of innovation and expansion. Naturex and Martin Bauer Group developed newer lines of products through advanced extraction techniques that met growing demands for premium licorice products.

Licorice root exports by Sepidan Osareh heralded eco-friendly packages, and Panda Licorice sugar-free variants catered to diabetic consumer demands. Regional industry leaders established their dominance in Iran and India by investing in local sourcing and production capacity.

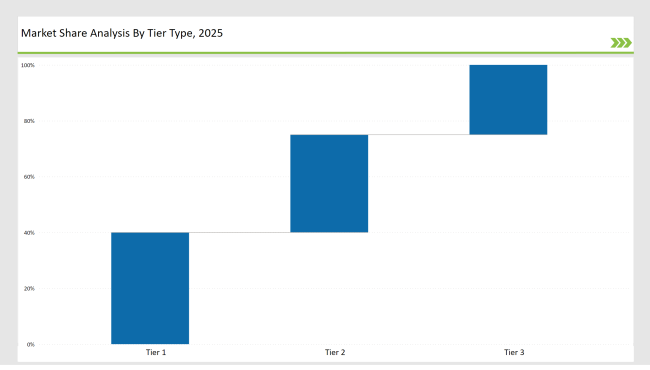

| By Tier Type | Tier 1 |

|---|---|

| Market Share (%) | 40% |

| Example of Key Players | Naturex, Martin Bauer Group, Indena |

| By Tier Type | Tier 2 |

|---|---|

| Market Share (%) | 35% |

| Example of Key Players | Sepidan Osareh, ASEH Licorice, Norevo |

| By Tier Type | Tier 3 |

|---|---|

| Market Share (%) | 25% |

| Example of Key Players | Panda Licorice, Wiley Wallaby, Darrell Lea |

| Brand | Key Focus |

|---|---|

| Naturex | Developed certified organic licorice root extracts for dietary supplements. |

| Martin Bauer Group | Invested in a traceability system for licorice root supply chains. |

| Indena | Launched water-soluble licorice extracts for beverages |

| Norevo | Partnered with confectionery brands to develop innovative licorice flavors. |

| Sepidan Osareh | Introduced premium licorice roots for luxury confectionery. |

| Panda Licorice | Focused on expanding sugar-free product lines. |

| Darrell Lea | Enhanced plant-based product range with new packaging formats. |

| ASEH Licorice | Strengthened partnerships in the tobacco sector for flavored blends. |

| Bio-Botanica | Developed licorice-infused skincare solutions. |

| Wiley Wallaby | Released organic licorice variants in compostable packaging. |

Licorice root has been used for thousands of years as an herbal medicine to promote health benefits, including digestive health and immunity. As interest in natural remedies increases, demand for licorice-based dietary supplements will likely grow.

Manufacturers can take the properties of licorice and develop the product in any specific way: for example, a licorice root extract is good for supporting the digestive system, and there are gummies infused with licorice that promote the immune system. Such supplements can address growing consumer preference for natural health solutions.

The brightening and anti-inflammatory properties of licorice-based ingredients have massive potential for cosmetics. There will be developed North America and European brightening serums, soothing face masks, and anti-aging creams based on licorice as consumers are highly interested in clean beauty and natural products. The health-conscious consumers looking for a natural solution to their skin issues will fuel the growth in the licorice-derived cosmetics market.

The pharmaceutical industry continues in exploring high-potency licorice extract for application in anti-inflammatory drugs, throat lozenges, and more. Regulatory frameworks about developing novel pharmaceutical products in Europe and North America allow manufacturers to expand focus on developing research and innovation on licorice-derived pharmaceutical formulations.

These innovative licorice-based drugs and therapeutic products can meet the unmet medical needs and fuel the growth of the licorice market in the pharmaceutical sector.

Companies like Naturex, Martin Bauer Group, and Indena dominate, collectively holding 30% of the global market share.

Developments include water-soluble extracts, eco-friendly packaging, and pharmaceutical-grade licorice products for therapeutic applications.

Dietary supplements hold approximately 15%, with rising demand for natural remedies driving growth in this segment.

The cosmetics industry accounts for around 12%, focusing on anti-aging and skin-brightening formulations.

The tobacco industry uses licorice extracts for flavor enhancement, contributing 12.9% of market demand globally.

Startups and niche brands account for 20%, driving innovation with organic and specialty licorice products.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Licorice Extract Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Licorice Candy Market Analysis - Size, Share & Forecast 2025 to 2035

Industry Share Analysis for Licorice Extract Companies

Licorice Root Market Analysis by Product form, End use, and Region Through 2035

UK Licorice Extract Market Trends – Demand, Innovations & Forecast 2025-2035

UK Licorice Root Market Insights – Trends, Demand & Growth 2025-2035

USA Licorice Extract Market Insights – Size, Share & Industry Growth 2025-2035

USA Licorice Root Market Growth – Trends, Demand & Innovations 2025-2035

ASEAN Licorice Extract Market Trends – Size, Demand & Forecast 2025-2035

ASEAN Licorice Root Market Trends – Demand, Growth & Innovations 2025-2035

Europe Licorice Extract Market Growth – Trends, Demand & Innovations 2025-2035

Europe Licorice Root Market Analysis – Size, Growth & Forecast 2025-2035

Australia Licorice Extract Market Analysis – Size & Industry Trends 2025-2035

Australia Licorice Root Market Report – Growth, Demand & Forecast 2025-2035

North America Licorice Extract Market Size and Share Forecast Outlook 2025 to 2035

Latin America Licorice Extract Market Report – Growth, Demand & Forecast 2025-2035

Latin America Licorice Root Market Outlook – Size, Share & Industry Trends 2025-2035

Root Beer Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Beetroot Powder Market Size and Share Forecast Outlook 2025 to 2035

Beetroot Molasses Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA