The global licorice extract market is moderately fragmented due to the diversity of players across multinational corporations, regional leaders, and niche brands. Multinational corporations such as Mafco Worldwide LLC (USA), Norevo GmbH (Germany), and Maruzen Pharmaceuticals Co. Ltd. (Japan) dominate with a 45% market share, leveraging economies of scale and well-established global distribution networks.

Regional players, such as ASEH Licorice (Iran), Zagros Licorice Co. (Iran), and Sanat Products Ltd. (India), represent about 30% of the market, with regional sourcing and customized products.

Niche brands and start-ups, including Licorice Specialties LLC (USA) and Daphnia Biotech (South Korea), are focused on niche applications in food, pharmaceuticals, and cosmetics, representing 25% of the market. The top five companies together account for 45% of the market, indicating a moderately concentrated industry structure.

| Global Market Share 2025 | Industry Share (%) |

|---|---|

| Top Multinationals (Mafco Worldwide LLC, Norevo GmbH, Maruzen Pharmaceuticals Co. Ltd.) | 45% |

| Regional Leaders (ASEH Licorice, Zagros Licorice Co., Sanat Products Ltd.) | 30% |

| Startups & Niche Brands (Licorice Specialties LLC, Daphnia Biotech, Hunan Nutramax Inc.) | 25% |

Multinationals dominate the market though regional players show considerable resilience. Consolidation is going to continue to increase as multinationals acquire small players and streamline their supply chains and expand.

The pharmaceutical segment holds the majority share of 45% driven by the medicinal properties of licorice; key players here include Maruzen Pharmaceuticals and Hunan Nutramax, which address the increasing needs for plant-based therapeutics in North America, Europe, and the increasing trend in Asia-Pacific's traditional medicine systems.

The food and beverage sector (40%) uses licorice as a natural sweetener and flavor enhancer, such as Norevo GmbH serving the European confectionery market and Green Earth Products focusing on herbal teas in India.

The segment is also growing in Asia-Pacific and North America, driven by clean-label and functional food trends. The remaining 15% is cosmetics, tobacco, and nutraceuticals. The skin benefits of licorice make it a staple in East Asian skincare, and its use in North American gut health supplements and Chinese tobacco products.

Powdered licorice extract accounts for 70% of the market share because of its versatility and stability, making it suitable for pharmaceutical tablets, capsules, and dry food formulations. A great focus for manufacturers such as ASEH Licorice and Sanat Products Ltd. is to supply bulk powder to pharmaceutical companies and food processing companies in Europe and Asia.

The powdered form has a higher shelf life, which makes it more convenient for transportation, making it widely accepted in industrial uses. Liquid licorice extract, however, finds usage in applications requiring solubility and ease of incorporation, including beverages and skincare products. Companies like Hunan Nutramax Inc. cater to the herbal tea market, while Korean skincare brands utilize liquid licorice extract for serums and lotions.

The global licorice extract market in 2024 has been significantly contributed by major players and regional players. Multinational companies, for instance, have introduced organic and clean-label product lines. In this way, Mafco Worldwide LLC met the increasing need for sustainable solutions in pharmaceuticals and food applications.

Regional players such as ASEH Licorice have expanded export capacities to reach markets in the Middle East and Europe. On the other hand, niche players concentrated on vegan and plant-based formulations to find space in functional foods and nutraceuticals.

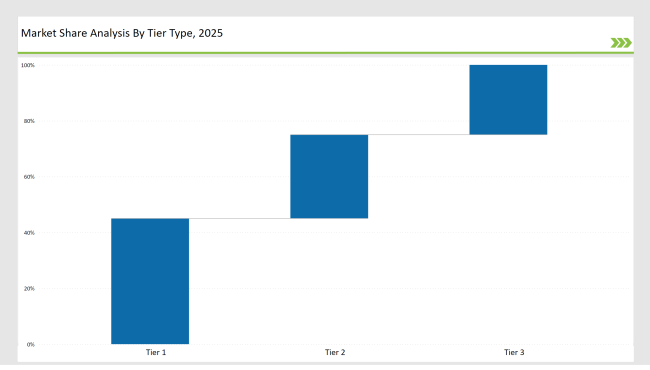

| By Tier Type | Tier 1 |

|---|---|

| Market Share (%) | 45% |

| Example of Key Players | Mafco Worldwide LLC, Norevo GmbH, Maruzen Pharmaceuticals Co. Ltd. |

| By Tier Type | Tier 2 |

|---|---|

| Market Share (%) | 30% |

| Example of Key Players | ASEH Licorice, Zagros Licorice Co., Sanat Products Ltd. |

| By Tier Type | Tier 3 |

|---|---|

| Market Share (%) | 25% |

| Example of Key Players | Licorice Specialties LLC, Daphnia Biotech, Hunan Nutramax Inc. |

| Brand | Key Focus |

|---|---|

| Mafco Worldwide LLC | Focused on organic certifications to meet clean label demands in North America. |

| Norevo GmbH | Partnered with European confectionery brands to supply sustainable licorice extracts. |

| Maruzen Pharmaceuticals Co. Ltd. | Invested in R&D to develop pharmaceutical-grade licorice derivatives |

| ASEH Licorice | Enhanced supply chain efficiency to reduce production costs for Middle Eastern buyers. |

| Zagros Licorice Co | Adopted eco-friendly practices to improve brand reputation in Europe. |

| Hunan Nutramax Inc. | Collaborated with East Asian beverage companies to innovate licorice-based drinks. |

| Sanat Products Ltd. | Expanded production capacity to cater to rising pharmaceutical demand in India. |

| Licorice Specialties LLC | Entered functional foods market with licorice-based snacks targeting health-conscious consumers. |

| Green Earth Products Pvt. Ltd. | Partnered with regional cosmetic brands to promote licorice as a natural ingredient. |

| Daphnia Biotech | Developed vegan licorice extracts for plant-based nutraceutical products in South Korea. |

The pharmaceutical segment is likely to continue its stronghold in the market for licorice. The demand for natural and herbal remedies is gaining momentum worldwide, as people opt for these in place of synthetics.

This opens up scope for companies in developing high-purity licorice extracts for application in ulcer treatment and respiratory care products. This requires investment in cutting-edge extraction and purification technologies, ensuring consistent quality and efficacy for the pharmaceuticals industry's rigorous regulatory standards.

The Asia-Pacific region is the most significant area for cosmetic-grade licorice extracts, primarily in skincare, where the active ingredient is sought after for its anti-aging and brightening abilities. Manufacturers should invest in R&D to come up with high-performance licorice-infused serums, lotions, among other premium skincare offerings, to capitalize on the growing demand for natural and plant-based cosmetics in East Asian markets.

In the European and North American markets, there will be a growing demand for sustainably sourced licorice and ethical supply chain practices. Manufacturers will have to invest in eco-friendly cultivation methods, responsible harvesting techniques, and transparent traceability systems to meet the growing consumer demand for sustainable and socially responsible products.

Obtaining relevant certifications, such as organic, fair trade, or B-Corp, will become essential to demonstrate a commitment to environmental and social stewardship, which will resonate with health-conscious and environmentally aware consumers in these regions.

Major players include Mafco Worldwide LLC, Norevo GmbH, and Maruzen Pharmaceuticals Co. Ltd., collectively holding 45% market share.

The pharmaceutical segment leads with a 45% share, driven by growing demand for herbal medications and therapeutic formulations.

Ethical sourcing and eco-friendly practices are key drivers in Europe and North America, where consumer preference for sustainable products is high.

Powdered licorice extract dominates with 70% market share, favoured for its versatility and long shelf life in pharmaceutical and food products.

Challenges include fluctuating raw material supply, strict regulatory compliance, and competition from synthetic alternatives.

Companies are focusing on vegan-friendly products, advanced extraction technologies, and sustainable practices to capture market share.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Licorice Root Market Analysis by Product form, End use, and Region Through 2035

Licorice Candy Market Analysis - Size, Share & Forecast 2025 to 2035

Key Companies & Market Share in the Licorice Root Sector

Licorice Extract Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

UK Licorice Root Market Insights – Trends, Demand & Growth 2025-2035

UK Licorice Extract Market Trends – Demand, Innovations & Forecast 2025-2035

USA Licorice Root Market Growth – Trends, Demand & Innovations 2025-2035

USA Licorice Extract Market Insights – Size, Share & Industry Growth 2025-2035

ASEAN Licorice Root Market Trends – Demand, Growth & Innovations 2025-2035

ASEAN Licorice Extract Market Trends – Size, Demand & Forecast 2025-2035

Europe Licorice Root Market Analysis – Size, Growth & Forecast 2025-2035

Europe Licorice Extract Market Growth – Trends, Demand & Innovations 2025-2035

Australia Licorice Root Market Report – Growth, Demand & Forecast 2025-2035

Australia Licorice Extract Market Analysis – Size & Industry Trends 2025-2035

Latin America Licorice Root Market Outlook – Size, Share & Industry Trends 2025-2035

North America Licorice Extract Market Size and Share Forecast Outlook 2025 to 2035

Latin America Licorice Extract Market Report – Growth, Demand & Forecast 2025-2035

Extraction Kits Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Extracts and Distillates Market

Sage Extract Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA