The ASEAN Licorice Root market is set to grow from an estimated USD 256.0 million in 2025 to USD 573.5 million by 2035, with a compound annual growth rate (CAGR) of 8.4% during the forecast period.

| Attributes | Value |

|---|---|

| Estimated ASEAN Industry Size (2025E) | USD 256.0 million |

| Projected ASEAN Value (2035F) | USD 573.5 million |

| Value-based CAGR (2025 to 2035) | 8.4% |

The Asian Economic Community licorice root market is experiencing considerable growth, attributable to its extensive use in food and beverage, pharmaceutical, and cosmetic industries. Root licorice which is the mother nature of a sweetener and a medicine has been used for ages in traditional remedies, candies, and herbal formulations.

The ever-increasing awareness of consumers on the use of natural and plant-based products, mainly in health and wellness, has been a significant contributor to the demand for licorice root and its derivatives. It is mainly found in foods such as functional foods, dietary supplements, and herbal teas, where its anti-inflammatory, antioxidant, and digestive properties are most appreciated.

Additionally, its application as a natural sweetener and flavoring agent in the confectionery and beverage industries continues to be a factor that increases the demand for this product.

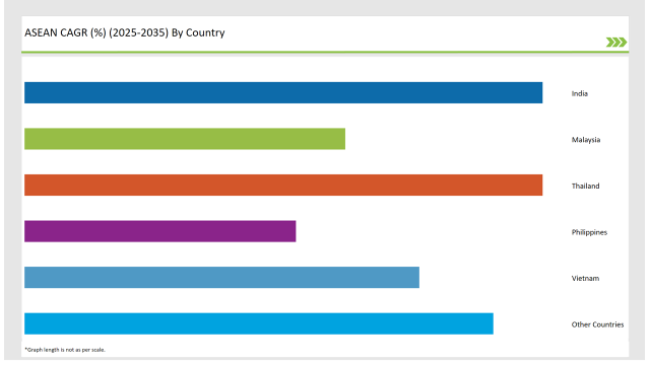

Some of the ASEAN countries like India, Malaysia, and Thailand have a very important role in the licorice root market. India, which has a strong tradition of Ayurveda and is rising in herbal product exports, is a dominating player. Malaysia and Thailand are supplied with food products and cosmetics that integrate licorice root extracts into their compositions more frequently.

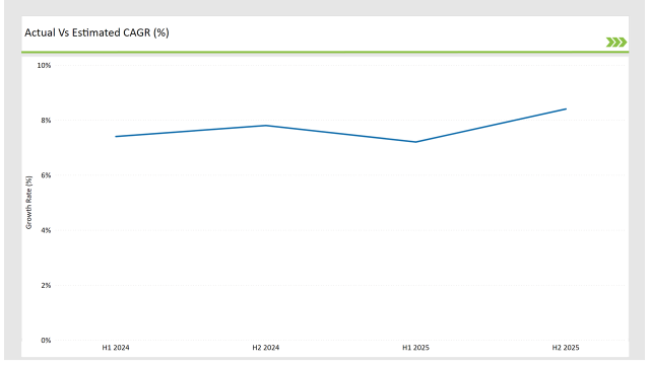

The table below provides a detailed comparative assessment of the changes in the compound annual growth rate (CAGR) over six months for the base year (2024) and the current year (2025) specifically for the ASEAN Licorice Root market.

This semi-annual analysis highlights crucial shifts in market dynamics and outlines revenue realization patterns, providing stakeholders with a more precise understanding of the growth trajectory within the year. The first half of the year, H1, covers January to June, while the second half, H2, spans July to December.

H1 signifies the period from January to June, and H2 Signifies the period from July to December.

For the ASEAN Licorice Root market, the sector is predicted to grow at a CAGR of 7.4% during the first half of 2024, with an increase to 7.8% in the second half of the same year. In 2025, the growth rate is anticipated to slightly decrease to 7.2% in H1 but is expected to rise to 8.4% in H2.

This pattern reveals a decrease of 20 basis points from the first half of 20234to the first half of 2025, followed by an increase of 20 basis points in the second half of 2025 compared to the second half of 2023.

| Date | Development/M&A Activity & Details |

|---|---|

| February 2024 | Thailand-based HerbalGlow launched an organic skincare line featuring licorice root extract for brightening and anti-aging. |

| June 2024 | India’s AyurHerbs introduced a new range of licorice-infused herbal teas, targeting functional beverage markets in ASEAN. |

| September 2024 | Malaysia’s PharmaNature expanded its licorice root cultivation program to meet the rising demand for pharmaceutical-grade extracts. |

| November 2024 | Global ingredient supplier NaturePure announced a partnership with Indonesian farmers to produce sustainable licorice root. |

| January 2024 | Vietnamese company GreenEssence debuted a licorice root dietary supplement line for immunity and digestive health. |

Growing Demand for Natural and Organic Products

A substantial shift toward plant-based and vegan eating has become a major market-influencing The increasing demand for natural and organic products is the major driving trend that is influencing the ASEAN licorice root market most. As consumers are turning toward plant-based and chemical-free alternatives in food, cosmetics, and health care products, licorice root has been the most preferred ingredient ever since due to its wider applicability as well as its numerous health benefits.

The natural sweetening properties of licorice root are the reason for its popularity in the formulations of clean-label foods and beverages. Many manufacturers are substituting licorice root extracts which are natural for artificial sweeteners that were previously used in herbal teas, candies, and syrups to be in line with customer preferences for natural ingredients.

The product's organic variants are also becoming more and more popular among consumers who are highly concerned about their health and are willing to spend more to get the product without chemicals.

Expanding Applications in Functional Foods and Beverages

The functional foods and beverages section where licorice root finds itself is on the increase mainly because of its health-promoting characteristics and natural skill of taste. As health-conscious customers turn to preventive healthcare and functional diets the rise of licorice root in routine products has become very noticeable.

Licorice root extracts are also used in herbal teas, energy drinks, and flavored water because of the unique taste and health that is offered by them. These products' anti-inflammatory and digestive properties make them a main ingredient in treatments aimed at gut health and detoxification. The recent trend of immunity-boosting drinks has helped in supplying the demand for licorice root in wellness drinks and herbal infusions.

In the bakery, licorice root is a natural sweetener and flavor modifier for candies, lozenges, and syrups. Its presence in sugar-free confectioneries is equal to the increasing demand for healthier, low-sugar foods. Licorice-flavored candies and chewing gums are especially popular in Southeast Asia due to their traditional appeal and distinctive flavor.

The following table shows the estimated growth rates of the top four markets. These countries are set to exhibit high consumption, recording high CAGRs through 2035.

Licorice root has become a mainstream product in the herbal medicine and wellness sectors in India due to the constant influence of the country's ancient Ayurvedic. The flourishing trend of natural and holistic health care has led to the average consumption of bowel licorice root in the production of dietary supplements, herbal teas, and functional foods.

Indian economy is also actively involved with the licorice root and its derivatives by providing them to the global market with a certificate of the extracts for food and pharmaceutical use.

The endorsement of traditional medicines through the government's initiatives such as AYUSH (Ayurveda, Yoga & Naturopathy, Unani, Siddha, and Homeopathy) together with the launching further take the licorice root market to a higher level.

Malaysia's licorice root market is mainly powered by the food processing and pharmaceutical industries that enjoy good performance. Licorice root is an ingredient that is often found in herbal teas, and confectioneries, and a component of some lozenges thus it is congruent with the demand the country has for functional and natural products.

Additionally, the market huges the government for its emphasis on promoting the halal-certified herbal product market which is also a factor that raises market growth.

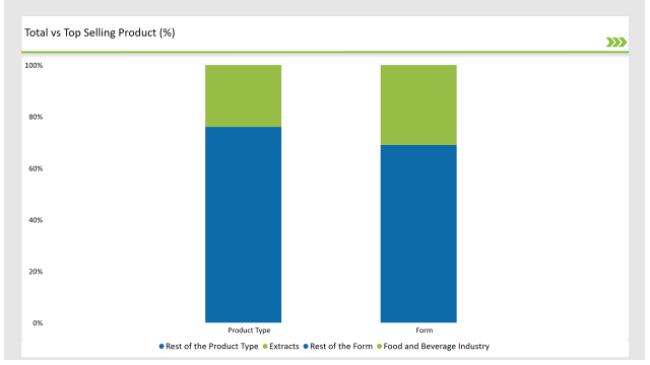

% share of Individual categories by Product Type and Form in 2025

Licorice root extracts into the leading product form in the ASEAN market.

The ASEAN market has developed licorice root extracts into the leading product form, mainly thanks to their versatility and wide range of applications. Such extracts are obtained from the root of the Glycyrrhiza glabra plant and are characterized by their special sweet flavor, which is as much as 50 times sweeter than sucrose.

This property of licorice root extracts has made it easy for the products to be a natural sweetener in a multitude of different food and beverage commodities, thus allowing producers to cut back on the use of artificial sweeteners and sugar, and at the same time, to improve flavor characteristics.

In the food sector, licorice extracts frequently find their way into herbal teas, candies, and baked goods, where they not only yield a sweet flavor but also a distinctive taste desired by consumers who advocate for the use of natural ingredients. The increasing demand for clean-label products has in turn driven the need for licorice extracts, which are preferred by consumers nowadays as they are seen to be healthier and more natural.

The food and beverage industry stands out as the largest end-use segment for licorice root,

The food and beverage segment has proven to be not only the largest end-use segment for licorice root but also the most capitalizing site for it as a flavorful and health-promoting additive.

The use of licorice root in food products has a history of centuries, and its special taste makes it a successful addition to various types of products. From herbal teas to confectioneries, licorice root is usually used to develop both functional and indulgent products that are the choice of different consumers.

In the beverage industry, herbal teas are very often flavored with licorice root, when it is not only sweetens the drink but also contributes a dense and differentiated taste, which makes the tea even more pleasant to drink.

The rise in the demand for herbal and functional drinks with healthier elements brought about the increased order of licorice root due to consumers wanting products that are both tasty and healthy. Furthermore, licorice root in soft drinks and alcoholic beverages can be a common ingredient that serves to deliver a distinct experience.

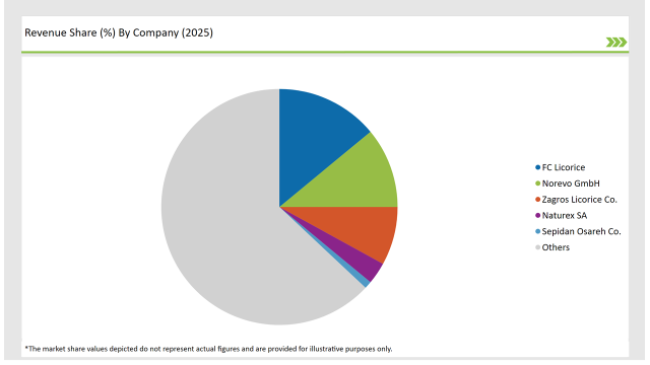

2025 Market share of ASEAN Licorice Root suppliers

Note: The above chart is indicative

The ASEAN licorice root market is a very fierce market où global and domestic brands are struggling for their share. Leader companies of the international level, like NaturePure and BioHerb Solutions, run the business with their portfolio while being the main players in the pharmaceutical and food-grade licorice extract segments.

On the contrary, local companies such as AyurHerbs in India and HerbalGlow in Thailand are growing very fast by selling their herbal teas and through the production of cosmetic goods.

As per Form, the industry has been categorized into Roots, Extracts, Blocks, Powder, Paste, Others

As per End Use, the industry has been categorized into Snack Foods, Ready Meals, Food Service, Bakery, Soups & Sauces, Others

Industry analysis has been carried out in key countries of India, Malaysia, Thailand, Philippines, Vietnam, and other ASEAN Countries.

The ASEAN Licorice Root market is projected to grow at a CAGR of 8.4% from 2025 to 2035.

By 2035, the market is expected to reach an estimated value of USD USD 573.5 million.

India are key Country with high consumption rates in the ASEAN Licorice Root market.

Leading manufacturers include Nestlé, FrieslandCampina, Fonterra, and Kraft Heinzothers are the key players in the ASEAN market.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

ASEAN Automotive Bearings Market Size and Share Forecast Outlook 2025 to 2035

ASEAN Automotive Aftermarket Analysis - Size, Share, and Forecast Outlook 2025 to 2035

ASEAN and Gulf Countries MAP & VSP Packaging Market Size and Share Forecast Outlook 2025 to 2035

ASEAN Flexible Plastic Packaging Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

ASEAN Human Milk Oligosaccharides Market Report – Size, Demand & Growth 2025–2035

ASEAN Probiotic Ingredients Market Outlook – Growth, Size & Forecast 2025–2035

ASEAN Food Additives Market Insights – Growth, Demand & Forecast 2025–2035

ASEAN Chitin Market Analysis – Trends, Demand & Forecast 2025–2035

ASEAN Bakery Mixes Market Outlook – Size, Share & Forecast 2025–2035

ASEAN Non-Alcoholic Malt Beverages Market Trends – Demand & Forecast 2025–2035

ASEAN Animal Feed Alternative Protein Market Insights – Demand, Size & Industry Trends 2025–2035

ASEAN Chickpea Protein Market Trends – Growth, Demand & Forecast 2025–2035

ASEAN Automotive Turbocharger Market Outlook – Share, Growth & Forecast 2025–2035

ASEAN Food Testing Services Market Analysis – Size, Share & Forecast 2025–2035

ASEAN Food Emulsifier Market Report – Trends, Demand & Industry Forecast 2025–2035

ASEAN Yeast Market Report – Trends, Demand & Industry Forecast 2025–2035

ASEAN Green and Bio-based Polyol Market Growth – Trends, Demand & Innovations 2025–2035

ASEAN Natural Food Color Market Outlook – Share, Growth & Forecast 2025–2035

ASEAN Coated Fabrics Market Insights – Demand, Size & Industry Trends 2025–2035

ASEAN Barite Market Analysis – Size, Share & Forecast 2025–2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA