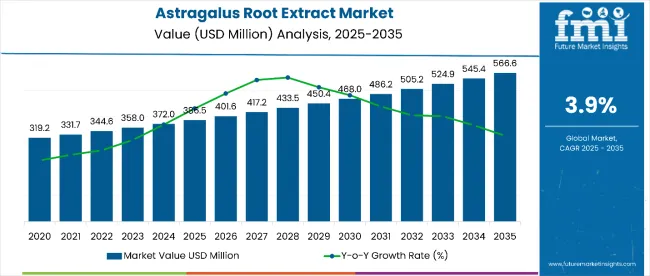

The astragalus root extract market is estimated to be valued at USD 386.5 million in 2025 and is projected to reach USD 566.6 million by 2035, registering a CAGR of 3.9% over the forecast period. The astragalus root extract market is projected to add an absolute dollar opportunity of USD 180.1 million over the forecast period.

| Metric | Value |

|---|---|

| Astragalus Root Extract Market Estimated Value in (2025E) | USD 386.5 million |

| Astragalus Root Extract Market Forecast Value in (2035F) | USD 566.6 million |

| Forecast CAGR (2025 to 2035) | 3.9% |

This reflects a 1.47 times growth at a compound annual growth rate of 3.9%. The market’s evolution is expected to be shaped by rising demand for immune-boosting supplements, traditional medicine acceptance, and growing interest in adaptogenic herbs across pharmaceutical and nutraceutical applications.

By 2030, the market is likely to reach approximately USD 472.4 million, accounting for USD 85.9 million in incremental value over the first half of the decade. The remaining USD 94.2 million is expected during the second half, suggesting a moderately back-loaded growth pattern. Product expansion beyond traditional Chinese medicine applications is gaining traction due to astragalus root’s proven immune-modulating properties and cardiovascular health benefits.

Companies such as Nutragreen Biotechnology Co. and Xi'An Sanwei Biotechnology Co. are advancing their competitive positions through investment in standardized extraction technologies and quality control systems. Certification-led procurement models are supporting expansion into Western pharmaceutical markets, dietary supplement formulations, and functional food applications. Market performance will remain anchored in clinical validation, standardized potency benchmarks, and regulatory compliance frameworks.

The market holds approximately 42% of the traditional herbal extract market, driven by its established immune-enhancing properties and growing acceptance in Western wellness practices. It accounts for around 28% of the adaptogenic supplements market, supported by increasing consumer awareness of stress management and vitality enhancement benefits.

The market contributes nearly 35% to the traditional Chinese medicine extract market, particularly for formulations targeting immune system support and cardiovascular health. It holds close to 24% of the botanical pharmaceutical ingredients market, where standardized astragalus extracts are used for immune modulation and inflammatory response management. The share in the functional food ingredients market reaches about 18%, reflecting its integration into health-focused food and beverage products.

The market is undergoing structural change driven by rising demand for evidence-based natural health solutions and immune system support products. Advanced extraction methods using standardized polysaccharide content and astragaloside IV concentration have enhanced bioavailability, therapeutic efficacy, and quality consistency, making astragalus a viable alternative to synthetic immune modulators. Manufacturers are introducing standardized capsules, liquid extracts, and powder formulations tailored for pharmaceutical and nutraceutical use, expanding their role beyond traditional medicine

The market is segmented by nature, product form, application, distribution channel, and region. By nature, the market is bifurcated into conventional and organic. Based on product form, the market is classified into powder, whole root, and liquid. In terms of application, the market is divided into food and beverage, personal care, and pharmaceuticals.

By distribution channel, the market is bifurcated into online and offline. Regionally, the market is characterized into North America, Latin America, Asia Pacific, Eastern Europe, Western Europe, and Japan.

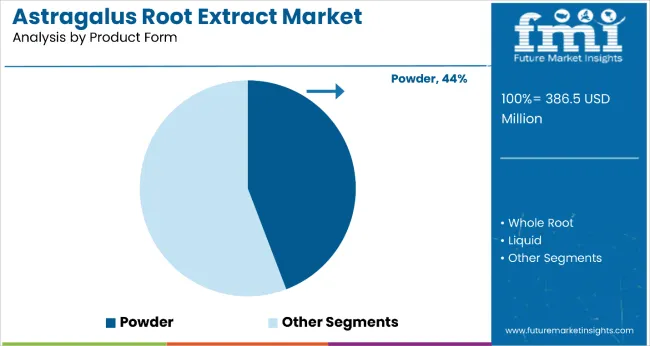

The powder form segment holds a leading 44% market share in the product form category, driven by its versatility, cost-effective manufacturing, and stability advantages in large-scale supplement production. Powdered astragalus root extract is favored for its standardized potency, extended shelf life, and compatibility with multiple delivery formats including capsules, tablets, and functional foods.

It enables precise dosing in pharmaceutical formulations and is commonly used as a bulk ingredient by nutraceutical manufacturers and health food producers. The segment is benefiting from rising demand for standardized herbal extracts that comply with good manufacturing practices and regulatory requirements.

Manufacturers are expanding powder offerings with certified organic variants, standardized polysaccharide levels, and third-party tested formulations to meet pharmaceutical and consumer supplement market needs. As quality standards tighten and clinical validation becomes more central, the powder format is expected to maintain steady growth and strengthen its position as the preferred ingredient type.

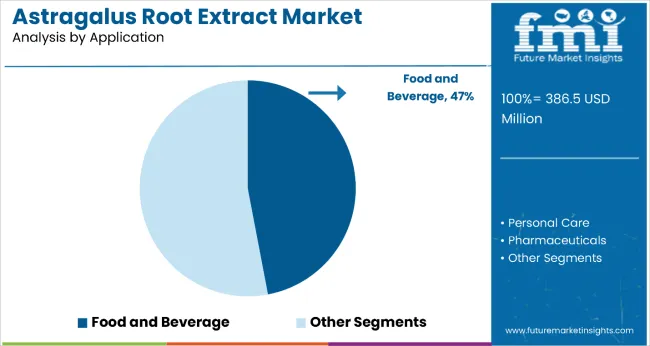

The food and beverage segment dominates the application category with a 47.0% market share in 2025, supported by rising global interest in functional products infused with plant-based ingredients. Astragalus root extract, rich in polysaccharides and flavonoids, is sought after for its immune-supporting, anti-inflammatory, and energy-enhancing benefits, making it a top choice among consumers and manufacturers.

The segment is being propelled by increasing cases of lifestyle-related disorders such as obesity and diabetes, fueling demand for herbal teas, infusions, supplements, and fortified beverages.

Clean-label movement and consumer inclination toward organic nutraceuticals are driving wider adoption of astragalus extract across formulations. In key regions such as Asia-Pacific and North America, innovative product development and functional food retail expansion are expected to keep the food and beverage application at the forefront of market growth.

Astragalus membranaceus roots scientifically validated immune-boosting properties, cardiovascular health benefits, and adaptogenic characteristics make it an attractive ingredient for modern health-conscious consumers seeking natural wellness solutions.

Growing awareness of traditional Chinese medicine principles and preventive healthcare approaches is further propelling adoption, especially among aging populations and individuals with compromised immune systems. Research validating astragalus root’s polysaccharide content and immunomodulatory effects, along with standardized extraction technologies, also enhancing product quality and therapeutic reliability.

As consumer preferences shift toward plant-based health solutions and the global wellness industry expands, the market outlook remains favorable. With increasing integration into mainstream nutraceutical formulations, clinical validation studies, and regulatory acceptance, astragalus root extract is well-positioned to expand across pharmaceutical, dietary supplements, and functional food applications.

From 2025 to 2035, immunomodulation research and clinical validation studies are expected to remain central to market expansion, with standardized extracts gaining acceptance in pharmaceutical applications. Advanced extraction technologies ensuring polysaccharide concentration and astragaloside IV standardization became key differentiators. Growing consumer awareness of traditional Chinese medicine principles and preventive healthcare approaches supported sustained demand growth.

Immune System Support Demand Drives Astragalus Market Growth

The rising focus on immune system enhancement and preventive healthcare has been identified as the primary catalyst for growth in the astragalus root extract market. In 2024, increasing consumer awareness of natural immune modulators led to widespread adoption of astragalus-based supplements among health-conscious populations. By 2025, demand was elevated as healthcare practitioners recommended adaptogenic herbs for immune system resilience and stress management applications.

Clinical Validation and Standardization Create Market Opportunities

In 2024, pharmaceutical companies began integrating standardized astragalus root extracts into immune support formulations, supported by clinical trials demonstrating measurable health benefits. By 2025, advanced extraction technologies were being deployed to ensure consistent polysaccharide concentrations and astragaloside IV standardization, enabling pharmaceutical-grade applications. These implementations demonstrate that astragalus root extract can evolve from a traditional medicine ingredient to a validated therapeutic component.

| Country | CAGR |

|---|---|

| China | 6.2% |

| India | 5.8% |

| Germany | 5.3% |

| France | 4.9% |

| UK | 4.5% |

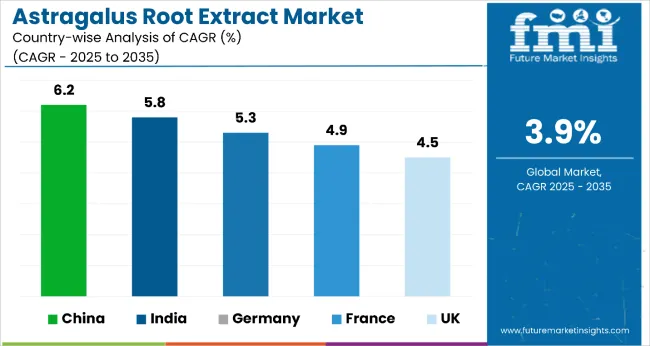

China leads the astragalus root extract market with a CAGR of 6.2%, driven by massive production capacity, government-backed TCM modernization, and GMP-certified exports. India follows with a CAGR of 5.8%, leveraging its Ayurvedic heritage and rapid standardization of extraction processes for export markets.

Germany exhibits a solid 5.3% CAGR, focused on pharmaceutical-grade imports and integration into research-backed health products. France, with a CAGR of 4.9%, is supported by phytotherapy adoption and strict regulatory oversight for botanical supplements. The UK records a CAGR of 4.5%, emphasizing clean-label, vegan, and preventive healthcare solutions.

The report includes an in-depth analysis of 40+ countries; five top-performing OECD countries are highlighted below.

China astragalus root extract market is projected to grow at a CAGR of 6.2% from 2025 to 2035, outperforming the global average by 1.4%. The growth is linked to established cultivation zones in Inner Mongolia, Gansu, and Heilongjiang provinces. Standardized extraction facilities are widely adopted in pharmaceutical and nutraceutical production for both domestic and international markets.

Output has been expanded by government support for traditional Chinese medicine modernization and export promotion programs. Processed extracts are increasingly replacing raw herb exports to capture higher value-added revenues. More than 60% of production is linked to GMP-certified facilities catering to demand in North America, Europe, and Southeast Asia.

Astragalus root extract revenue in India is forecast to grow at a CAGR of 5.8% from 2025 to 2035, ahead of the global average by 1.0%. Northern states, particularly Himachal Pradesh and Uttarakhand, have expanded cultivation and processing of astragalus root for both domestic Ayurvedic medicine and international export markets.

Government-backed clusters are supporting standardized extraction capabilities in Gujarat and Maharashtra. Traditional medicine manufacturers have integrated astragalus into immune support formulations to complement indigenous herbs. Export-grade standardized extracts are gaining traction in European and North American markets.

Astragalus root extract demand in Germany is expected to grow at a CAGR of 5.3% from 2025 to 2035, exceeding the global rate by 0.5%. Growth is centered on pharmaceutical integration and standardized supplement applications in cities such as Munich, Berlin, and Hamburg. Standardized astragalus extracts with verified polysaccharide content are being specified for immune support formulations and pharmaceutical research applications.

Import volumes from China and other Asian suppliers have increased, particularly for GMP-certified and organic-certified extracts. Processed products with European pharmacopoeia compliance are favored under strict quality and safety guidelines.

Sales of astragalus root extract in France are projected to grow at a CAGR of 4.9% from 2025 to 2035, making it one of the most dynamic markets for botanical extracts in Europe. The country is witnessing increased consumer preference for organic and natural health supplements, largely due to growing lifestyle-related diseases such as obesity, diabetes, and cardiovascular disorders.

France’s deep-rooted herbal tradition and preference for phytotherapy have created a favorable ecosystem for botanical extracts. Additionally, the strong regulatory backing from ANSES (the French Agency for Food, Environmental and Occupational Health & Safety) ensures product efficacy and safety, enhancing consumer trust.

The UK astragalus root extract market is expected to grow at a CAGR of 4.5% from 2025 to 2035, driven by a health-conscious population and strong demand for herbal remedies. Consumers in the UK are increasingly seeking clean-label, plant-derived ingredients to support holistic well-being and prevent chronic illnesses like Type 2 diabetes and hypertension.

Astragalus extract has gained significant traction as an ingredient in detox teas, sugar-control supplements, and vegan formulations. With growing NHS advocacy for preventive care, the use of botanical extracts in everyday health management has become mainstream. The UK’s supplement market is also supported by a vibrant e-commerce ecosystem that allows herbal brands to reach consumers directly.

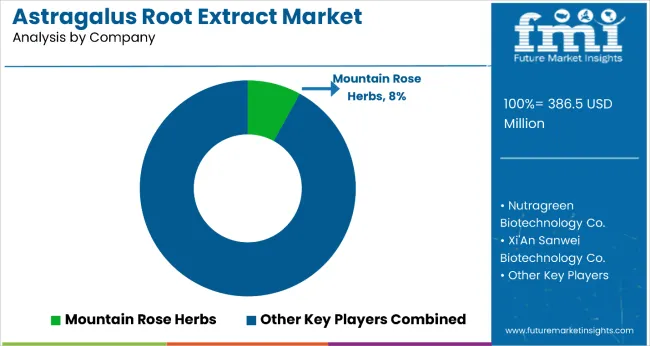

The market is moderately fragmented, featuring a mix of traditional Chinese medicine suppliers and Western nutraceutical manufacturers with varying degrees of vertical integration and quality standardization capabilities. Nutragreen Biotechnology Co. and Xi'An Sanwei Biotechnology Co. lead the manufacturing segment, supplying standardized extracts for pharmaceutical and nutraceutical applications. Their strength lies in GMP certification, consistent quality control, and established relationships with international buyers.

Mountain Rose Herbs and Z Natural Foods LLC differentiate through direct-to-consumer sales and organic certification, including retail-ready packaging and consumer education initiatives that cater to health-conscious supplement users. Martin Bauer Group and Naturex focus on pharmaceutical-grade extracts and standardized formulations, addressing the growing demand for clinically validated ingredients in immune support applications.

Regional players such as Health Genesis, Vita Forte Inc., and VidyaHerbs dominate specific geographic markets while maintaining cost efficiency and rapid response capabilities for regional demand. Meanwhile, Diana Group emphasizes research and development in extraction technologies and bioavailability enhancement, creating value in innovation and scientific validation.

| Item | Value |

|---|---|

| Quantitative Units | USD 386.5 Million |

| Nature | Conventional and Organic |

| Product Form | Powder, Whole Root, and Liquid |

| Application | Food and Beverage, Personal Care, and Pharmaceuticals |

| Distribution Channel | Online and Offline |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa, Australia, and 40+ countries |

| Key Companies Profiled | Nutragreen Biotechnology Co., Xi'An Sanwei Biotechnology Co., Mountain Rose Herbs, Z Natural Foods LLC, Martin Bauer Group, Naturex, Diana Group, Health Genesis, Vita Forte Inc., and VidyaHerbs |

| Additional Attributes | Dollar sales by product form and application sector, growing usage in immune support and cardiovascular health applications for preventive healthcare, stable demand in traditional medicine and pharmaceutical formulations, innovations in standardized extraction and polysaccharide concentration improve bioavailability, therapeutic efficacy, and regulatory compliance |

The global astragalus root extract market is estimated to be valued at USD 386.5 million in 2025.

The market size for the astragalus root extract market is projected to reach USD 566.6 million by 2035.

The astragalus root extract market is expected to grow at a 3.9% CAGR between 2025 and 2035.

The key product types in astragalus root extract market are conventional and organic.

In terms of product form, powder segment to command 58.6% share in the astragalus root extract market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Root Canal Repair Materials Market Size and Share Forecast Outlook 2025 to 2035

Root Beer Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Beetroot Powder Market Size and Share Forecast Outlook 2025 to 2035

Beetroot Molasses Market

Analysis and Growth Projections for Arrowroot Starch Market

Chicory Roots Market

Ginseng Root Extracts Skincare Market Size and Share Forecast Outlook 2025 to 2035

Licorice Root Market Analysis by Product form, End use, and Region Through 2035

Key Companies & Market Share in the Licorice Root Sector

Elecampane Root Market Size and Share Forecast Outlook 2025 to 2035

UK Licorice Root Market Insights – Trends, Demand & Growth 2025-2035

Marshmallow Root Extract Market

USA Licorice Root Market Growth – Trends, Demand & Innovations 2025-2035

ASEAN Licorice Root Market Trends – Demand, Growth & Innovations 2025-2035

Europe Licorice Root Market Analysis – Size, Growth & Forecast 2025-2035

United States Beetroot Supplement Market Size and Share Forecast Outlook 2025 to 2035

Australia Licorice Root Market Report – Growth, Demand & Forecast 2025-2035

Latin America Licorice Root Market Outlook – Size, Share & Industry Trends 2025-2035

Curcuma Longa (Turmeric) Root Extract Market Size and Share Forecast Outlook 2025 to 2035

Extraction Kits Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA