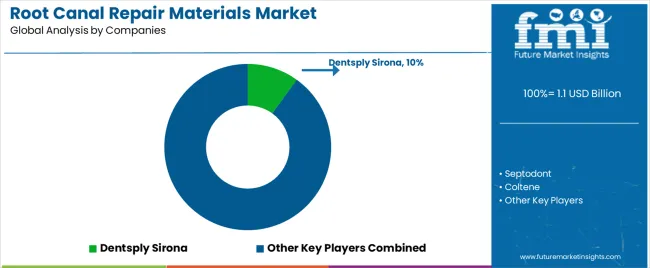

The global root canal repair materials market is valued at USD 1.1 billion in 2025 and is projected to reach USD 1.7 billion by 2035, recording a compound annual growth rate of 4.6 percent. Rolling CAGR from 2025 through 2030 indicates steady mid-term acceleration as the clinical adoption of bioceramic and calcium-silicate formulations expands across dental practices and specialized endodontic centers. The market is shaped by ongoing efforts to improve sealing integrity, biocompatibility, and moisture resistance within restorative applications. Product development focuses on refining pre-mixed, ready-to-use materials that maintain stable handling and dimensional consistency. These innovations align with the shift toward simplified clinical workflows and single-visit endodontic procedures. Research institutions continue to evaluate alternative additives that enhance radiopacity and antimicrobial performance without compromising biological response.

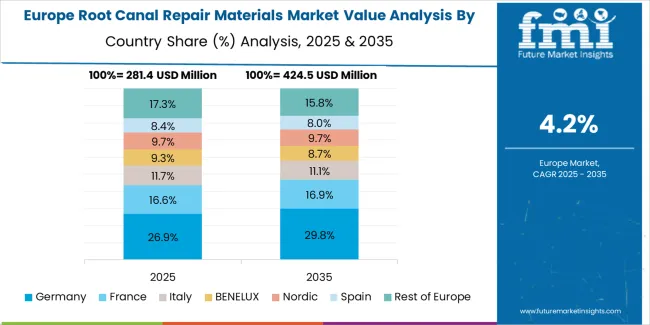

Regional demand patterns show strong replacement cycles in North America and Western Europe, supported by established dental infrastructure and regulatory standardization. In emerging economies, gradual increases in professional training and access to advanced dental care are broadening the customer base. Supply reliability for raw minerals and specialized fillers remains a key operational factor influencing pricing stability. The market’s structural growth reflects consistent reinvestment in dental biomaterials research and incremental performance improvements through 2035.

Between 2025 and 2030, the Root Canal Repair Materials Market is expected to grow from USD 1.1 billion to USD 1.3 billion, marking an increase of USD 0.2 billion and accounting for 45.5% of the total growth anticipated over the decade. This phase will be driven by the rising prevalence of dental disorders, the expansion of restorative dentistry practices, and growing patient awareness of endodontic treatments. Technological innovations in bioceramic and calcium silicate-based materials are improving sealing efficiency and biocompatibility. Manufacturers are increasingly focusing on developing advanced bioactive materials that enhance tissue regeneration and long-term clinical outcomes.

From 2030 to 2035, the market is projected to expand from USD 1.3 billion to USD 1.7 billion, adding USD 0.4 billion, or 54.5% of the decade’s overall increase. This stage will be characterized by the widespread adoption of next-generation biocompatible formulations and regenerative endodontic materials. The integration of nanotechnology, enhanced antimicrobial properties, and smart delivery systems will redefine clinical performance standards. Strategic collaborations between dental material producers and academic research institutions will accelerate innovation, while expanding dental infrastructure in emerging economies will further stimulate market penetration and revenue growth across both developed and developing regions.

| Metric | Value |

|---|---|

| Market Value (2025) | USD 1.1 billion |

| Market Forecast Value (2035) | USD 1.7 billion |

| Forecast CAGR (2025 to 2035) | 4.6% |

The root canal repair materials market is driven by rising global incidence of endodontic infections and the growing preference for biocompatible, high-sealing restorative products among dental professionals. Dental practitioners increasingly adopt advanced repair compounds that promote periapical healing, resist microleakage, and maintain structural integrity within the canal space. Materials such as mineral trioxide aggregate, bioceramics, and resin-modified formulations are gaining prominence due to their enhanced adhesion and bioactivity, which improve long-term treatment outcomes.

Developments in regenerative dentistry and minimally invasive endodontic techniques also influence material selection, with research focusing on compounds that encourage dentin regeneration and reduce postoperative sensitivity. Expanding access to dental care in emerging markets, supported by public health initiatives and insurance reforms, increases procedural volumes and material consumption rates. Manufacturers continue to refine product consistency and working properties through nanotechnology integration and improved delivery systems. However, challenges remain in achieving cost-effective production and maintaining performance stability under variable clinical conditions. Regulatory compliance with biocompatibility and safety standards adds complexity to market entry but strengthens overall product quality. As dental education programs emphasize evidence-based material use, demand for scientifically validated and clinically versatile root canal repair solutions continues to expand across both developed and developing regions.

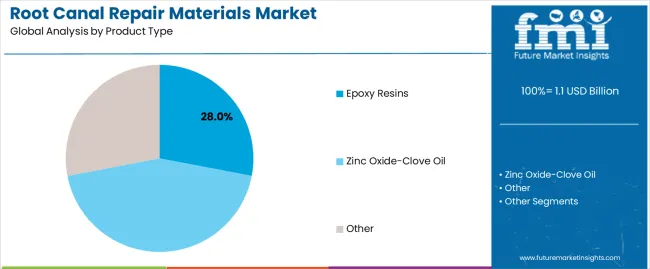

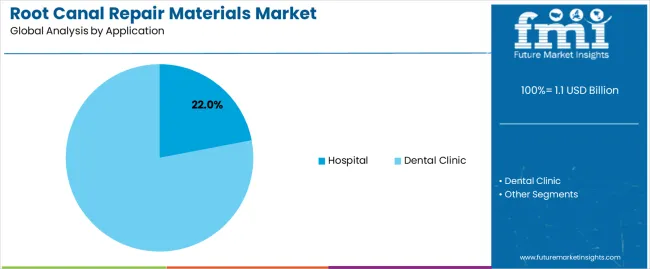

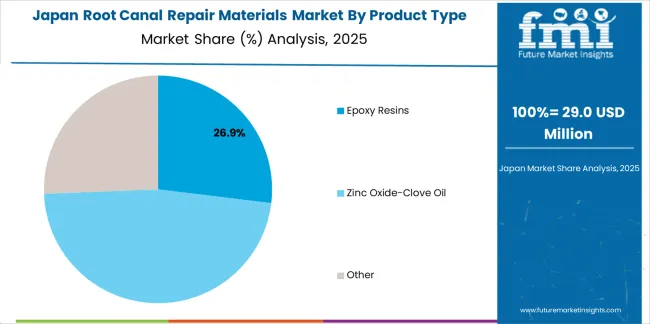

The root canal repair materials market is segmented by product type and application. By product type, the market is divided into epoxy resins, zinc oxide-clove oil, and others. Based on application, it is categorized into hospitals, dental clinics, and others. These segments define the composition preferences and end-use adoption trends shaping the development and utilization of root canal repair materials in dental restoration procedures.

The epoxy resins segment accounts for approximately 28.0% of the global root canal repair materials market in 2025, representing the largest product category. This dominance reflects the material’s strong adhesive characteristics, dimensional stability, and effective sealing capability within dental restorative applications. Epoxy resin-based sealers are preferred for their low solubility, biocompatibility, and durability under physiological conditions encountered during endodontic treatment.

These materials provide consistent sealing of the root canal system, minimizing microleakage and improving long-term treatment outcomes. The segment’s demand is reinforced by its widespread use in combination with gutta-percha filling materials and compatibility with a range of dental instruments and obturation techniques. Manufacturers continue refining resin formulations to enhance flow properties, working time, and ease of removal during retreatment procedures. The adoption of epoxy resin systems is particularly strong across advanced dental practices emphasizing precision and longevity of endodontic restorations. Their proven clinical performance, supported by standardized composition and favorable handling characteristics, ensures the continued prominence of epoxy resins in the market for root canal repair materials globally.

The hospital segment represents about 22.0% of the total root canal repair materials market in 2025, holding the largest share by application. This position is supported by the increasing number of endodontic procedures performed in institutional healthcare environments equipped with advanced dental infrastructure and specialist practitioners. Hospitals maintain consistent procurement of standardized root canal materials to ensure uniform treatment quality and compliance with clinical safety regulations.

Demand within this segment is also driven by multidisciplinary treatment settings where endodontic services are integrated with broader restorative and surgical care. The use of high-performance sealers and fillers, including epoxy and zinc oxide-based materials, supports procedural efficiency and post-treatment reliability. Hospitals often adopt materials verified for biocompatibility and extended shelf life, aligning with centralized purchasing and inventory management systems. Furthermore, training and academic hospitals contribute to steady material utilization due to continuous clinical practice and research activity. The hospital segment remains a key contributor to global demand, reflecting institutional preferences for consistency, product validation, and regulatory adherence in the selection of root canal repair materials.

The root canal repair materials market is expanding in line with increased incidence of dental disorders and rising demand for endodontic treatments. Advances in bioactive and bioceramic materials such as hydraulic calcium silicate cements and mineral trioxide aggregate alternatives improve sealing ability and tissue compatibility. At the same time, cost pressures, regulatory complexities and infrastructure limitations create adoption barriers. A key trend is the shift toward materials with enhanced handling, faster setting, improved durability and digital workflow compatibility. Growth is particularly strong in emerging regions where dental infrastructure is developing and awareness of advanced endodontic care is increasing.

Growth is driven by the increasing prevalence of dental caries, root canal infections and pulp disorders worldwide. As populations age and retain more natural teeth, the demand for effective endodontic treatments rises. In addition, higher awareness of oral health and availability of dental services in emerging markets amplify the need for advanced repair materials. Manufacturers are responding by offering bioactive and regeneratively-oriented materials that support healing and long-term outcomes in root repair and perforation management, which strengthens market uptake.

High costs associated with advanced repair materials and their handling requirements limit deployment in some settings. Some newer materials require careful technique, adequate training and specialised equipment, which may not be available in all dental practices or regions. Regulatory approval processes and the need for robust clinical evidence also slow market entry and expansion. Furthermore, lower-cost conventional materials remain widely used, which reduces urgency for some practitioners to adopt premium alternatives despite performance advantages.

A prominent trend is the development of repair materials that combine bioactivity, improved handling properties and compatibility with digital endodontic workflows. Manufacturers are producing bioceramic-based and calcium-silicate-based systems with faster setting times, better moisture tolerance and enhanced sealing ability. Concurrently, integration of digital imaging, guided endodontics and minimally invasive techniques influences material specifications and usage. Geographic expansion into Asia-Pacific and Latin America, supported by rising dental care infrastructure and simulation-based training, further accelerates adoption of advanced repair materials.

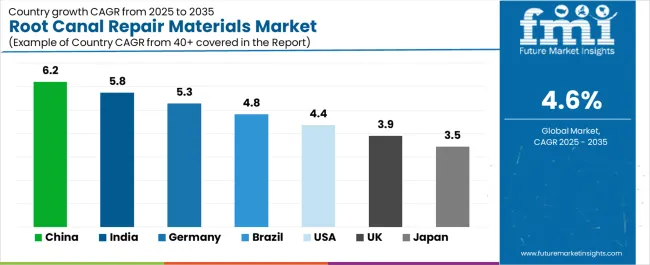

| Country | CAGR |

|---|---|

| China | 6.2% |

| India | 5.8% |

| Germany | 5.3% |

| Brazil | 4.8% |

| USA | 4.4% |

| UK | 3.9% |

| Japan | 3.5% |

The root canal repair materials market is witnessing dynamic growth globally, with China leading at a 6.2% CAGR through 2035, propelled by a rapidly expanding dental care infrastructure, rising cosmetic dentistry demand, and strong manufacturing capabilities. India follows at 5.8%, supported by increasing oral health awareness, affordable treatment access, and growing dental education programs. Germany posts a 5.3% CAGR, driven by precision material engineering and advanced endodontic practices. Brazil records 4.8%, reflecting improved healthcare accessibility and the modernization of dental clinics. The USA maintains steady growth at 4.4%, supported by innovation in bioceramic and composite materials, while the UK (3.9%) and Japan (3.5%) continue to focus on regulatory advancements, product refinement, and sustainable dental material development.

The report covers an in-depth analysis of 40+ countries top-performing countries are highlighted below.

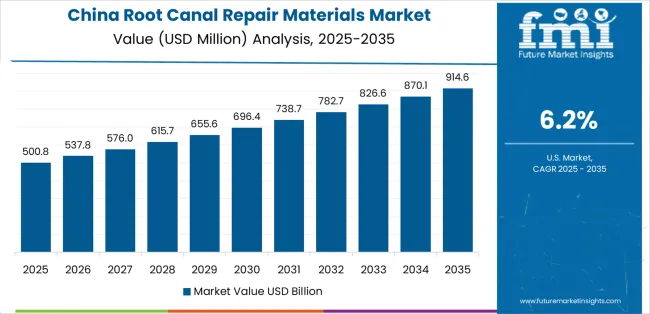

Revenue from root canal repair materials in China is projected to grow at a CAGR of 6.2% through 2035, driven by expansion in dental care facilities, increased awareness of endodontic treatments, and improving access to restorative materials. Public and private investment in oral healthcare is encouraging modernization of dental clinics and academic training centers. Domestic manufacturers are developing biocompatible repair materials to meet international standards. Growth in cosmetic dentistry and preventive care programs continues to support steady market demand.

Revenue from root canal repair materials in India is increasing at a CAGR of 5.8%, supported by the country’s growing dental education infrastructure and rising awareness of oral health. Establishment of new dental colleges and clinical training centers is creating consistent demand for advanced endodontic materials. Government health campaigns emphasizing preventive and restorative dentistry contribute to higher treatment volumes. Manufacturers are expanding distribution networks to address regional disparities in supply.

Revenue from root canal repair materials in Germany is advancing at a CAGR of 5.3%, supported by the country’s established dental technology sector and strong emphasis on clinical precision. Dental clinics and academic institutions maintain high demand for bioactive and durable repair materials suitable for complex endodontic procedures. Manufacturers prioritize product reliability, biocompatibility, and regulatory compliance under European quality frameworks. Continuous research in biomaterials supports product evolution and replacement cycles.

Revenue from root canal repair materials in Brazil is expanding at a CAGR of 4.8%, supported by healthcare modernization and expanding private dental care networks. Increasing patient awareness of restorative procedures and oral hygiene is contributing to rising treatment volumes. Government and private sector initiatives to improve dental service access are promoting procurement of advanced materials. Partnerships with international suppliers are improving availability and technical support.

Revenue from root canal repair materials in the United States is projected to rise at a CAGR of 4.4%, supported by advanced endodontic practices, established dental care infrastructure, and growing focus on minimally invasive treatment. Research in bioceramic and resin-based repair materials continues to improve procedural outcomes. High procedural volume in restorative and cosmetic dentistry sustains steady market consumption. Regulatory emphasis on material safety ensures consistent product quality.

Revenue from root canal repair materials in the United Kingdom is increasing at a CAGR of 3.9%, supported by research collaboration among dental schools, hospitals, and manufacturers. Academic research in bioceramic and composite materials is contributing to new formulations with improved sealing and bioactivity. Adoption across public and private dental clinics remains consistent due to standardized clinical protocols and continuing education programs.

Revenue from root canal repair materials in Japan is growing at a CAGR of 3.5%, supported by the country’s focus on precision dental technology and materials science. Universities and dental manufacturers are developing next-generation repair compounds emphasizing biological compatibility and long-term stability. High clinical standards in restorative procedures ensure consistent material utilization. Research in nanocomposite structures and adhesive properties continues to enhance material performance.

The global root canal repair materials market displays moderate concentration, characterized by established dental materials manufacturers with diversified endodontic portfolios. Dentsply Sirona leads with an estimated 10% market share, supported by its extensive range of bioceramic sealers, obturation systems, and calcium silicate-based repair products. The company’s strength lies in its integration of research, clinical validation, and digital workflow compatibility across endodontic treatment applications. Septodont maintains a strong position through its focus on biocompatible cements and root repair formulations applied in regenerative dentistry.

Coltene and Angelus Odontologia offer specialized solutions emphasizing bioactive compounds and cost-efficient formulations for emerging markets. Ivoclar Vivadent and 3M compete through comprehensive dental material portfolios, applying polymer and resin expertise to root repair technologies. Danaher’s influence is reflected through its subsidiaries in dental imaging and consumables, supporting material performance consistency.

GC Corporation, Heraeus Kulzer, and Shofu deliver restorative and sealing materials with controlled setting characteristics tailored to clinical procedures. VOCO GmbH, Ultradent, and DMG Dental operate within the mid-tier segment, focusing on user-oriented product development, ease of handling, and clinical reliability.

Competition in this market is shaped by advancements in bioactive chemistry, material radiopacity, and moisture tolerance. Strategic differentiation depends on sustained research investment, compatibility with modern obturation techniques, and compliance with global clinical standards governing root canal repair materials.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD billion |

| Type (Product Type) | Epoxy Resins, Zinc Oxide-Clove Oil, Others |

| Application | Hospitals, Dental Clinics, Others |

| Regions Covered | East Asia, Europe, North America, South Asia, Latin America, Middle East & Africa, Eastern Europe |

| Countries Covered | China, India, Germany, Brazil, USA, UK, Japan, and 40+ countries |

| Key Companies Profiled | Dentsply Sirona, Septodont, Coltene, Angelus Odontologia, Ivoclar Vivadent, 3M, Danaher, GC Corporation, Heraeus Kulzer, Shofu, VOCO GmbH, Ultradent, DMG Dental |

| Additional Attributes | Dollar sales by product type and application categories; regional adoption trends across East Asia, Europe, and North America; competitive landscape including global and regional dental material manufacturers; analysis of clinical adoption drivers such as bioactivity, sealing performance, and digital workflow compatibility; insights into material innovation through nanotechnology and regenerative chemistry; evaluation of pricing, production, and regulatory challenges impacting market penetration and compliance. |

The global root canal repair materials market is estimated to be valued at USD 1.1 billion in 2025.

The market size for the root canal repair materials market is projected to reach USD 1.7 billion by 2035.

The root canal repair materials market is expected to grow at a 4.6% CAGR between 2025 and 2035.

The key product types in root canal repair materials market are epoxy resins, zinc oxide-clove oil and other.

In terms of application, hospital segment to command 22.0% share in the root canal repair materials market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Root Beer Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Beetroot Powder Market Size and Share Forecast Outlook 2025 to 2035

Beetroot Molasses Market

Analysis and Growth Projections for Arrowroot Starch Market

Ginseng Root Extracts Skincare Market Size and Share Forecast Outlook 2025 to 2035

Chicory Roots Market

Licorice Root Market Analysis by Product form, End use, and Region Through 2035

Key Companies & Market Share in the Licorice Root Sector

Elecampane Root Market Size and Share Forecast Outlook 2025 to 2035

Astragalus Root Extract Market Size and Share Forecast Outlook 2025 to 2035

UK Licorice Root Market Insights – Trends, Demand & Growth 2025-2035

Marshmallow Root Extract Market

USA Licorice Root Market Growth – Trends, Demand & Innovations 2025-2035

ASEAN Licorice Root Market Trends – Demand, Growth & Innovations 2025-2035

Europe Licorice Root Market Analysis – Size, Growth & Forecast 2025-2035

United States Beetroot Supplement Market Size and Share Forecast Outlook 2025 to 2035

Australia Licorice Root Market Report – Growth, Demand & Forecast 2025-2035

Latin America Licorice Root Market Outlook – Size, Share & Industry Trends 2025-2035

Curcuma Longa (Turmeric) Root Extract Market Size and Share Forecast Outlook 2025 to 2035

Nanomaterials Market Insights - Size, Share & Industry Growth 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA