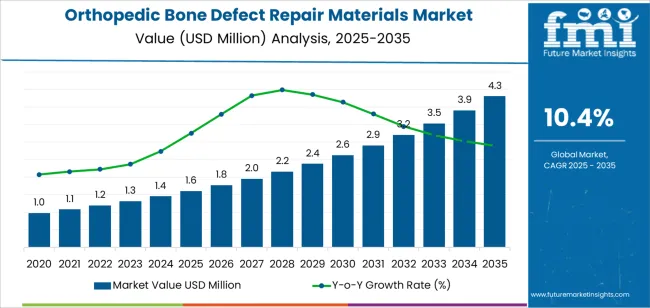

The global orthopedic bone defect repair materials market is projected to reach USD 4.2 million by 2035, reflecting an absolute increase of USD 2.6 million over the forecast period. The market is valued at USD 1.6 million in 2025 and is expected to grow at a robust CAGR of 10.4%. This growth is driven by the rising prevalence of orthopedic conditions such as fractures, osteoporosis, and bone deformities, as well as the increasing demand for advanced materials used in bone defect repair. With the aging global population and the growing number of trauma cases and surgeries, orthopedic bone defect repair materials are gaining widespread use in both clinical and surgical settings.

Orthopedic bone defect repair materials include biomaterials such as bone grafts, scaffolds, and synthetic bone substitutes, which are used to promote bone healing and regeneration in patients suffering from fractures or bone loss. These materials provide structural support, encourage cellular growth, and aid in the natural healing process of bones. The market is seeing increased demand for innovative materials such as bioresorbable scaffolds, 3D-printed bone substitutes, and advanced ceramics that offer better functionality, compatibility, and healing outcomes compared to traditional bone repair methods. As patients and healthcare providers seek more effective solutions, the adoption of these advanced materials is expected to rise.

The orthopedic bone defect repair materials market is also benefiting from advancements in tissue engineering and regenerative medicine. With the development of new techniques such as stem cell-based therapies and growth factor delivery systems, the effectiveness of bone repair materials has significantly improved. The growing trend of minimally invasive surgeries and the use of computer-assisted techniques in orthopedic procedures are contributing to the demand for these materials. The increasing focus on personalized treatment options and improved patient outcomes is further driving the growth of this market.

Between 2025 and 2030, the orthopedic bone defect repair materials market is projected to grow from USD 1.6 million to approximately USD 2.5 million, adding USD 0.9 million, which accounts for about 34.6% of the total forecasted growth for the decade. This period will be characterized by the growing adoption of advanced biomaterials, the rise in trauma and orthopedic surgeries, and innovations in bone repair technologies.

From 2030 to 2035, the market is expected to expand from approximately USD 2.5 million to USD 4.2 million, adding USD 1.7 million, which constitutes about 65.4% of the overall growth. This phase will be marked by the broader integration of tissue engineering solutions, the advancement of regenerative medicine in bone repair, and an increasing focus on personalized care and minimally invasive surgical techniques, all of which will drive the demand for orthopedic bone defect repair materials.

| Metric | Value |

|---|---|

| Market Value (2025) | USD 1.6 billion |

| Market Forecast Value (2035) | USD 4.2 billion |

| Forecast CAGR (2025-2035) | 10.4% |

The orthopedic bone defect repair materials market is experiencing significant growth due to the rising incidence of bone fractures, degenerative bone diseases, and the increasing demand for advanced orthopedic treatments. Bone defect repair materials, such as bone grafts, scaffolds, and synthetic bone substitutes, play a crucial role in healing bone defects and enhancing bone regeneration. With an aging population and an increasing number of trauma-related injuries, the demand for these materials is expanding across hospitals and orthopedic clinics worldwide.

Technological advancements in the development of biocompatible and bioactive bone repair materials are driving market growth. Innovations such as 3D-printed bone scaffolds, collagen-based materials, and stem cell-based therapies are improving the efficiency and effectiveness of bone defect treatments. These advancements not only improve healing times but also offer better long-term outcomes, which is encouraging the adoption of these materials by healthcare providers.

The growing awareness of orthopedic health, coupled with the rise in sports-related injuries and lifestyle-related conditions such as osteoporosis, is also contributing to the market's growth. An increasing focus on minimally invasive surgical techniques and personalized treatment options is further driving demand for advanced bone defect repair materials. Challenges such as the high cost of advanced materials and regulatory hurdles in some regions may limit market growth in the short term. Despite these challenges, the market is expected to continue expanding due to the ongoing advancements in treatment options and materials.

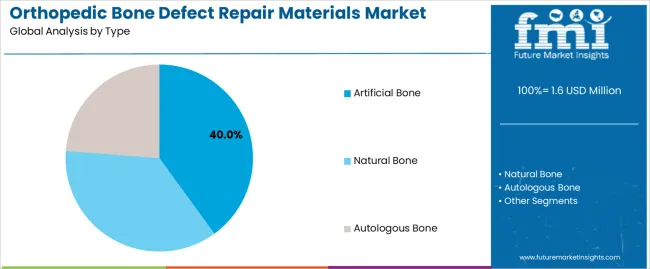

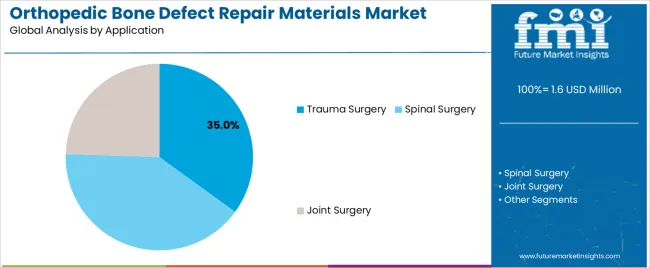

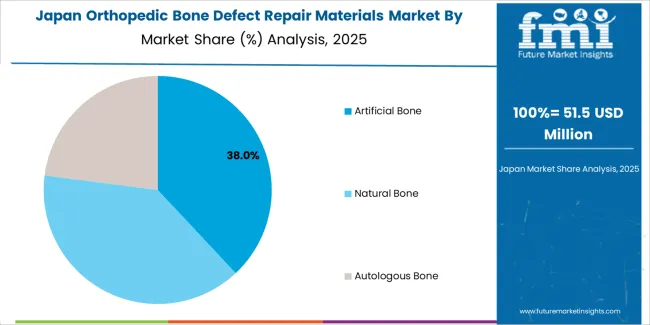

The market is segmented by type, application, and region. By type, the market is divided into artificial bone, natural bone, and autologous bone, with artificial bone leading the market. Based on application, the market is categorized into trauma surgery, spinal surgery, and joint surgery, with trauma surgery representing the largest segment in terms of market share. Regionally, the market is divided into North America, Europe, Asia Pacific, and other key regions.

The artificial bone segment leads the orthopedic bone defect repair materials market, accounting for approximately 40.0% of the total market share. This growth is primarily driven by advancements in materials science and technology, which have enabled the development of highly durable and bio-compatible synthetic bones. Artificial bone materials, including ceramics, polymers, and composites, offer excellent mechanical properties, making them ideal for repairing large bone defects, especially in trauma and joint surgeries.

Another key factor contributing to the growth of artificial bone materials is their ability to mimic the mechanical and biological properties of natural bone. This enhances the healing process, reduces the risk of complications, and provides greater stability in the repaired area. The increasing prevalence of bone-related disorders, along with a growing aging population, has expanded the demand for artificial bone materials in orthopedic surgeries, further propelling the growth of this segment.

The trauma surgery segment holds a dominant share in the orthopedic bone defect repair materials market, accounting for 35.0% of the total market share. This segment’s growth is driven by the high number of traumatic injuries, including fractures, accidents, and other orthopedic conditions that require bone defect repair. Trauma surgeries often involve the use of both artificial and natural bone materials to restore function and promote healing.

The rise in road traffic accidents, sports injuries, and falls, particularly among aging populations, has significantly increased the demand for orthopedic bone defect repair materials in trauma surgeries. Advances in surgical techniques, improved patient outcomes, and the availability of advanced biomaterials also contribute to the growth of the trauma surgery segment. As the demand for effective and efficient trauma management solutions increases, the trauma surgery segment is expected to continue to lead the orthopedic bone defect repair materials market.

The market is expanding due to the increasing demand for effective and reliable bone defect repair materials in orthopedic, trauma and spinal surgery applications. These materials offer features like structural support, biological scaffolding and enhanced bone regeneration. Key drivers include rising incidence of bone injuries and sophisticated surgical interventions, while restraints stem from high costs of advanced materials and complex regulatory requirements.

The orthopedic bone defect repair materials market is shifting toward advanced biomaterials and synthetic substitutes that better replicate the natural bone structure. These materials are designed to integrate more efficiently with bone tissue, support load-bearing applications, and facilitate faster healing. There is a significant rise in the adoption of minimally invasive techniques, with injectable scaffolds and modular implant systems gaining popularity. These materials simplify the implantation process, reducing trauma and recovery times for patients. The market is also seeing innovations such as 3D‑printed porous implants, bioactive coatings, and hybrid grafts, which are designed to improve bone regeneration. Customization is another growing trend, with patient-specific implants tailored to the unique geometry of bone defects, enabled by advancements in digital planning and imaging technologies. This trend reflects the broader movement toward personalized medicine, where treatment is increasingly focused on delivering optimal outcomes and improving recovery times for patients.

Growth in the orthopedic bone defect repair materials market is being driven by the rising incidence of bone injuries and defects due to trauma, degenerative diseases, and increasing surgeries for tumor resections. As populations age, the demand for spinal fusion procedures and reconstructive surgeries also rises, further fueling the need for bone defect repair solutions. The push for faster recovery times and improved post‑surgical outcomes is driving the adoption of advanced materials such as bioactive bone grafts and synthetic substitutes. There is also a significant increase in healthcare expenditure, which is enhancing access to advanced surgical treatments, especially in emerging economies. As patients demand more effective and efficient treatments, manufacturers are innovating to provide materials that reduce complications, promote better integration, and enhance performance. Combined with the need for personalized healthcare solutions, these drivers are creating strong demand for next‑generation repair materials in orthopedics.

Despite promising growth, the orthopedic bone defect repair materials market faces several challenges. One of the biggest barriers is the high cost of advanced biomaterials and technologies, making them less accessible in cost-sensitive healthcare systems. The expensive procedures, materials, and required technologies can limit adoption, particularly in emerging markets. Another challenge is the complex regulatory process for approval of novel biomaterials and implants, which can slow market entry and increase time-to-market. The lack of long‑term clinical data on the effectiveness and safety of newer implants can reduce confidence among surgeons and healthcare providers. Potential complications, such as graft rejection, infection, and variability in clinical outcomes, may also hinder adoption. In less developed regions, the limited availability of trained specialists and advanced surgical infrastructure may further slow the uptake of these materials. These factors combined with the higher cost of implementation create significant hurdles for the market to overcome.

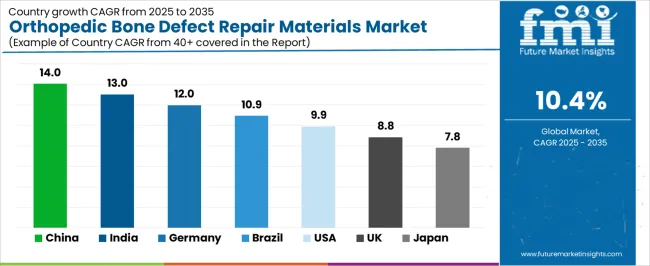

| Country | CAGR (%) |

|---|---|

| China | 14.0% |

| India | 13.0% |

| Germany | 12.0% |

| Brazil | 10.9% |

| USA | 9.9% |

| UK | 8.8% |

| Japan | 7.8% |

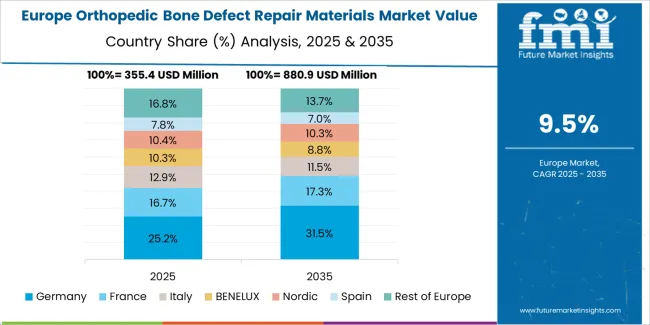

The global orthopedic bone defect repair materials market is growing at a strong pace, with China leading at a 14.0% CAGR, driven by the country’s expanding healthcare sector, aging population, and increasing prevalence of bone-related diseases. India follows with a 13.0% CAGR, fueled by the rising demand for advanced healthcare services, a growing middle class, and a high incidence of bone defects related to trauma and aging. Germany shows a 12.0% CAGR, supported by its advanced medical infrastructure and a strong focus on orthopedic advancements. Brazil experiences a 10.9% CAGR, driven by increasing healthcare investments and rising awareness of bone health. The USA grows at a 9.9% CAGR, with an emphasis on innovative treatments for bone defects and a large population requiring orthopedic care. The UK is experiencing a steady growth of 8.8% CAGR, with rising demand for advanced bone repair materials in the healthcare system. Japan, with a 7.8% CAGR, continues to see demand for advanced orthopedic solutions as its elderly population increases.

China leads the orthopedic bone defect repair materials market with a 14.0% CAGR. The rapid growth in the country’s healthcare infrastructure and increasing focus on advanced medical treatments are key drivers of this growth. China’s aging population, combined with rising rates of bone-related injuries from accidents and a growing incidence of osteoporosis, is creating significant demand for orthopedic bone defect repair materials. The country’s expanding medical tourism industry and the increasing adoption of innovative orthopedic technologies are contributing further to the market expansion.

China’s investment in research and development in biomaterials and orthopedic devices is driving innovation, enabling the development of more effective bone defect repair solutions. As the healthcare sector becomes more advanced, the demand for biocompatible, durable, and cost-effective repair materials for fractures and bone defects is growing. China’s growing focus on improving the quality of its healthcare system and expanding access to orthopedic surgeries ensures that the orthopedic bone defect repair materials market will continue to grow robustly in the coming years.

India is experiencing strong growth in the orthopedic bone defect repair materials market, with a 13.0% CAGR. The country’s rapidly expanding healthcare sector, coupled with a large population susceptible to bone-related injuries and conditions, is driving this growth. India’s increasing aging population and the rise in road traffic accidents, sports-related injuries, and lifestyle diseases like osteoporosis and arthritis contribute to the demand for effective orthopedic repair materials. These materials are crucial for enhancing bone regeneration and enabling faster recovery.

The growing focus on medical infrastructure development and the government’s push toward affordable healthcare are helping expand access to advanced treatments. Innovations in orthopedic technologies, such as bioactive ceramics, scaffolds, and 3D printing of bone defect repair materials, are also driving the market. As healthcare accessibility improves in both urban and rural areas, the demand for bone defect repair materials will continue to rise. The expanding middle class, along with increasing awareness about advanced orthopedic treatments, ensures continued growth in India’s orthopedic bone defect repair materials market.

Germany is experiencing steady growth in the orthopedic bone defect repair materials market, with a 12.0% CAGR. The country’s advanced healthcare system and strong medical research capabilities contribute significantly to the growth of this market. Germany’s aging population, coupled with increasing cases of osteoporosis, fractures, and joint diseases, is driving the demand for effective bone defect repair materials. The country’s well-established medical device and biomaterials industries also play a key role in developing innovative solutions for bone regeneration and repair.

Germany’s commitment to healthcare innovation, supported by extensive research and development in the orthopedic sector, is contributing to advancements in material science, leading to the development of more efficient and durable bone defect repair solutions. Moreover, the increasing prevalence of traumatic injuries and the rise in orthopedic surgeries, including joint replacements and spinal procedures, contribute to the growing demand for repair materials. As Germany continues to focus on quality healthcare and expanding its advanced orthopedic procedures, the demand for these materials is expected to grow steadily.

Brazil is witnessing steady growth in the orthopedic bone defect repair materials market with a 10.9% CAGR. The country’s growing healthcare infrastructure and the rising number of orthopedic surgeries due to aging, injuries, and lifestyle-related diseases are key factors contributing to the market’s expansion. Brazil’s focus on improving healthcare access in both urban and rural areas, along with government support for affordable medical treatments, is driving demand for orthopedic bone defect repair materials. The increased prevalence of road traffic accidents and sports injuries further fuels the need for effective treatment solutions.

Brazil’s increasing investment in research and development, particularly in orthopedic technologies, is leading to the development of advanced bone repair materials that offer better biocompatibility, faster healing, and enhanced functionality. The rising awareness of bone health and advancements in minimally invasive orthopedic procedures also contribute to market growth. With the expanding middle class and the push for better healthcare solutions, Brazil’s orthopedic bone defect repair materials market is expected to continue its growth trajectory.

The USA is experiencing steady growth in the orthopedic bone defect repair materials market, with a 9.9% CAGR. As one of the largest healthcare markets globally, the USA’s demand for advanced orthopedic treatments, driven by an aging population and increasing cases of bone diseases, fractures, and joint disorders, is fueling the growth of this market. The increasing incidence of sports injuries and lifestyle-related bone conditions further contributes to the demand for orthopedic bone defect repair materials.

The USA’s strong research and development sector, along with technological advancements in the field of bone regeneration, such as the use of 3D-printed scaffolds, bioactive ceramics, and synthetic graft materials, is leading to the development of more effective and durable repair solutions. The growing focus on personalized medicine and minimally invasive surgery techniques, which are reducing recovery times and improving clinical outcomes, is also driving demand. With continued advancements in medical technology and increasing healthcare access, the USA’s market for orthopedic bone defect repair materials is set to continue growing.

The UK is witnessing steady growth in the orthopedic bone defect repair materials market with a 8.8% CAGR. The country’s aging population and the increasing prevalence of bone-related conditions, such as osteoarthritis and osteoporosis, are driving the demand for advanced orthopedic repair materials. The UK’s well-established healthcare system and the growing number of orthopedic surgeries, including joint replacements and spinal surgeries, are contributing to this market growth.

The country’s emphasis on healthcare innovation, along with advances in material science and regenerative medicine, has led to the development of more efficient bone defect repair solutions. The increasing focus on minimally invasive orthopedic procedures, which require specialized materials for bone regeneration and healing, is further driving the demand for orthopedic materials. As the UK continues to expand its healthcare offerings and focus on improving patient outcomes, the orthopedic bone defect repair materials market is expected to grow steadily.

Japan is experiencing moderate growth in the orthopedic bone defect repair materials market with a 7.8% CAGR. The country’s aging population, coupled with the high incidence of bone diseases such as osteoporosis and fractures, is contributing significantly to the demand for advanced orthopedic bone defect repair materials. The need for more efficient and durable solutions for bone regeneration is driving the adoption of innovative materials, including bioactive glass and ceramic-based scaffolds.

Japan’s strong focus on technological advancements in healthcare, combined with increasing research in regenerative medicine, is contributing to the development of better bone repair materials. The growing preference for minimally invasive surgeries, which require specialized materials for faster recovery and reduced surgical risks, is also driving market growth. As Japan’s healthcare system continues to adapt to the needs of its aging population, the demand for orthopedic materials to treat bone defects and injuries is expected to continue expanding.

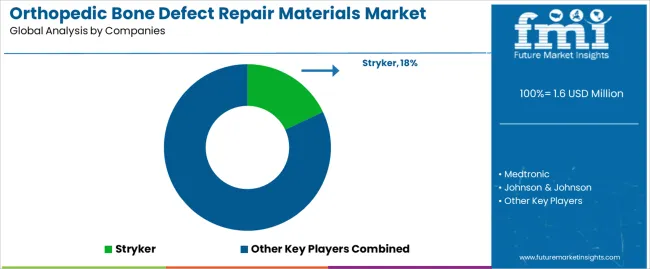

The orthopedic bone defect repair materials market is driven by key players offering innovative solutions designed to promote bone healing and support orthopedic procedures. Stryker leads the market with an 18% share, recognized for its comprehensive portfolio of advanced bone repair materials and surgical products. Stryker's focus on cutting-edge technology, product efficacy, and strong global presence makes it a dominant player in the market.

Other major competitors in the market include Medtronic, Johnson & Johnson, and Olympus Terumo Biomaterials Corp. Medtronic offers a range of orthopedic repair products, focusing on improving patient outcomes and surgical efficiency. Johnson & Johnson, through its subsidiary DePuy Synthes, provides an extensive portfolio of bone defect repair solutions, including biomaterials, devices, and instruments. Olympus Terumo Biomaterials Corp is known for producing high-quality biomaterials for orthopedic applications, especially in bone regeneration and healing.

Emerging players like NovaBone Products, Biocomposites, and Tianjin Sannie Bioengineering Technology are making strides in the market by focusing on specialized bone repair products. NovaBone Products offers advanced bone graft substitutes, while Biocomposites specializes in biodegradable bone repair materials. Tianjin Sannie Bioengineering Technology focuses on creating biologically active bone repair materials, targeting improved healing outcomes.

Regional players like ALLGENS MEDICAL, Jiangsu Yenssen Biotech, Shanghai Rebone Biomaterials, and Shanghai Bio-lu Biomaterials also contribute to the market, providing cost-effective solutions and advancing localized research. The competition in the orthopedic bone defect repair materials market is shaped by factors such as product innovation, material biocompatibility, effectiveness in bone regeneration, and the ability to meet the needs of healthcare professionals and patients.

| Items | Values |

|---|---|

| Quantitative Units | USD Million |

| Type | Artificial Bone, Natural Bone, Autologous Bone |

| Application | Trauma Surgery, Spinal Surgery, Joint Surgery |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East & Africa |

| Countries Covered | China, Japan, South Korea, India, Australia & New Zealand, ASEAN, Rest of Asia Pacific, Germany, United Kingdom, France, Italy, Spain, Nordic, BENELUX, Rest of Europe, United States, Canada, Mexico, Brazil, Chile, Rest of Latin America, Kingdom of Saudi Arabia, Other GCC Countries, Turkey, South Africa, Other African Union, Rest of Middle East & Africa |

| Key Companies Profiled | Stryker, Medtronic, Johnson & Johnson, Olympus Terumo Biomaterials Corp, NovaBone Products, Biocomposites, Tianjin Sannie Bioengineering Technology, ALLGENS MEDICAL, Jiangsu Yenssen Biotech, Shanghai Rebone Biomaterials, Shanghai Bio lu Biomaterials, Jiuyuan Gene, Guona Technology |

| Additional Attributes | Dollar sales by type and application categories, market growth trends, market adoption by classification and application segments, regional adoption trends, competitive landscape, advancements in orthopedic bone defect repair materials, integration with surgical practices and medical technologies. |

The global orthopedic bone defect repair materials market is estimated to be valued at USD 1.6 million in 2025.

The market size for the orthopedic bone defect repair materials market is projected to reach USD 4.3 million by 2035.

The orthopedic bone defect repair materials market is expected to grow at a 10.4% CAGR between 2025 and 2035.

The key product types in orthopedic bone defect repair materials market are artificial bone, natural bone and autologous bone.

In terms of application, trauma surgery segment to command 35.0% share in the orthopedic bone defect repair materials market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Orthopedic Artificial Bone Defect Repair Materials Market Size and Share Forecast Outlook 2025 to 2035

Orthopedic Titanium Plate with Loop Market Size and Share Forecast Outlook 2025 to 2035

Orthopedic Prosthetics Market Size and Share Forecast Outlook 2025 to 2035

Orthopedic Braces and Support Market Forecast and Outlook 2025 to 2035

Orthopedic Power Tools Market Size and Share Forecast Outlook 2025 to 2035

Orthopedic Contract Manufacturing Market Size and Share Forecast Outlook 2025 to 2035

Orthopedic Digit Implants Market Size and Share Forecast Outlook 2025 to 2035

Orthopedic Prosthetic Device Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Orthopedic Splints Market Size and Share Forecast Outlook 2025 to 2035

Orthopedic Software Market Size and Share Forecast Outlook 2025 to 2035

Orthopedic Navigation Systems Market Analysis – Trends, Growth & Forecast 2025 to 2035

Orthopedic Trauma Device Market Trends - Size, Share & Forecast 2025 to 2035

Orthopedic Insole Market Analysis – Size & Industry Trends 2025–2035

Orthopedic Shoes Market Growth – Trends & Forecast 2025 to 2035

Orthopedic Oncology Market Growth - Trends & Forecast 2025 to 2035

A Global Brand Share Analysis for Orthopedic Insole Market

Orthopedic Consumables Market Trends – Industry Growth & Forecast 2024 to 2034

3D Orthopedic Scanning Systems Market

Smart Orthopedic Implants Market

Canine Orthopedic Implants Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA