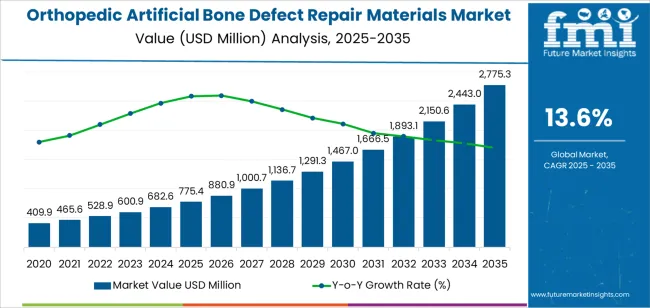

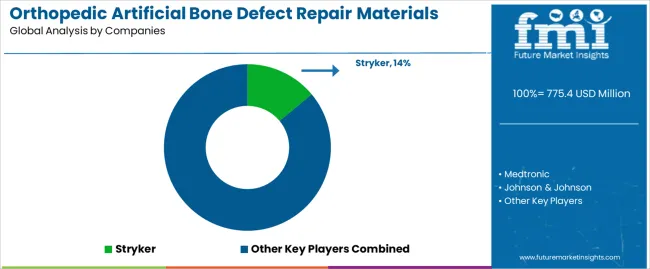

The orthopedic artificial bone defect repair materials market is forecast to grow from USD 775.4 million in 2025 to USD 2,775.3 million by 2035, reflecting a strong CAGR of 13.6%. This impressive growth is primarily driven by the increasing prevalence of bone-related disorders, osteoporosis, and traumatic injuries, as well as the growing demand for biocompatible and durable bone graft substitutes. These materials play a crucial role in orthopedic surgeries, supporting bone regeneration and structural restoration. Advancements in biomaterials science, 3D printing technologies, and tissue engineering have significantly improved the mechanical and biological properties of synthetic bone repair materials, making them a preferred choice over traditional grafts.

The expanding aging population and the growing number of orthopedic procedures globally further support the market’s expansion. Moreover, increased healthcare spending and the availability of minimally invasive surgical options have made orthopedic repairs more accessible. Innovations such as bioactive ceramics, polymeric composites, and calcium phosphate-based materials are enhancing product performance, driving adoption across both hospitals and specialized orthopedic centers. With ongoing clinical advancements and improved regulatory support for new biomaterials, the orthopedic artificial bone defect repair materials market is expected to maintain strong momentum throughout the forecast period.

The Compound Annual Growth Rate (CAGR) of 13.6% reflects the sustained and exponential expansion of the orthopedic artificial bone defect repair materials market over the 10-year forecast period. The CAGR measures the average annual growth rate over this time frame, capturing the compounding effect of year-over-year increases. This means that the market is not growing linearly, but rather accelerating cumulatively each year due to rising demand, technological advancements, and expanded medical applications.

Between 2025 and 2030, the market will rise from USD 775.4 million to USD 1,467 million, nearly doubling in five years, driven by rapid adoption of synthetic graft alternatives and an increasing number of orthopedic surgeries. The period from 2030 to 2035 will witness an even stronger growth phase, with the market soaring from USD 1,467 million to USD 2,775.3 million, signifying compounding growth as innovations in bioengineered bone scaffolds and customized implants become more mainstream. The high CAGR illustrates the market’s shift toward advanced, regenerative, and patient-specific solutions, positioning it as one of the fastest-growing segments in the orthopedic biomaterials industry.

| Metric | Value |

|---|---|

| Market Value (2025) | USD 775.4 million |

| Market Forecast Value (2035) | USD 2,775.3 million |

| Forecast CAGR (2025-2035) | 13.6% |

The orthopedic artificial bone defect repair materials market is expanding due to a rising incidence of bone defects resulting from trauma, surgery, and age-related degeneration. An aging global population and increased life expectancy are elevating the prevalence of bone disorders such as osteoporosis, leading to greater demand for advanced bone graft substitutes. These artificial materials offer advantages over traditional autografts and allografts, such as no donor-site morbidity and better supply consistency, thus supporting market growth.

Technological advancements in biomaterials and scaffold design are further driving market expansion. Manufacturers are developing biocompatible, osteoconductive, and sometimes osteoinductive materials such as calcium phosphate ceramics, bioactive glass, and polymer composites, while also applying 3D-printing techniques to customize implants to patient anatomy. Regulatory emphasis on device safety and the increasing adoption of minimally invasive surgical procedures are reinforcing this trend. However, the cost of specialized materials, strict regulatory pathways, and competition from established graft methods pose challenges.

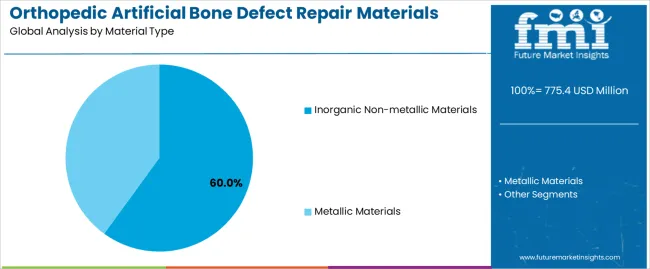

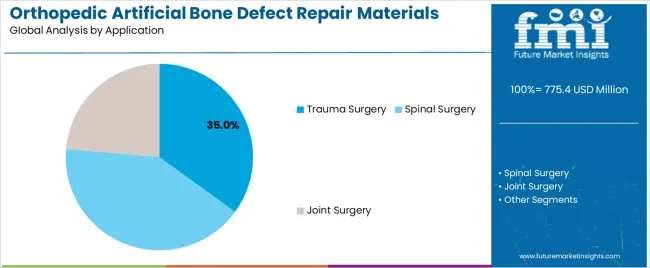

The orthopedic artificial bone defect repair materials market is primarily segmented by material type and application. The leading material type is inorganic non-metallic materials, which account for 60% of the market share. In terms of application, trauma surgery is the dominant segment, holding 35% of the market share. These segments are key drivers of the market, with ongoing advancements in material science and an increasing demand for orthopedic surgeries, particularly in trauma care.

The inorganic non-metallic materials segment leads the orthopedic artificial bone defect repair materials market, capturing 60% of the market share. These materials are primarily used in the form of bioceramics, bioactive glasses, and synthetic bone grafts, which are favored for their compatibility with human bone and their ability to promote natural bone growth and regeneration. Inorganic non-metallic materials are especially important in the repair of bone defects due to their excellent osteoconductive properties, meaning they support bone cell growth on their surface.

The demand for inorganic non-metallic materials is driven by their biocompatibility and their capacity to integrate seamlessly with natural bone tissue, making them ideal for orthopedic applications. They are particularly useful in cases of bone defects caused by trauma, disease, or surgical procedures, where bone regeneration is critical. As the medical field continues to advance, the focus on developing high-performance, bioactive, and biodegradable materials has increased, making inorganic non-metallic materials the preferred choice for many bone defect repair procedures. This trend is expected to continue as research into biomaterials progresses and the demand for more effective and natural bone repair solutions grows.

The trauma surgery application segment is the leading segment in the orthopedic artificial bone defect repair materials market, accounting for 35% of the market share. Trauma surgery often involves the repair of bone fractures, defects, and injuries caused by accidents or physical trauma. In these cases, artificial bone repair materials are used to support healing and restore the function of damaged bones. As trauma-related injuries, including fractures and joint damage, continue to rise globally, the demand for effective bone repair materials is increasing, particularly in emergency and reconstructive surgeries.

The growth of trauma surgery as a key application for orthopedic materials is supported by several factors, including aging populations, increased participation in high-risk physical activities, and a growing incidence of traffic accidents. As the healthcare industry expands, the focus on improving outcomes in trauma care and enhancing the recovery process has led to an increased demand for advanced bone defect repair materials. Trauma surgery is expected to remain a key application in the market as orthopedic treatments continue to evolve, with innovations in material science and surgical techniques driving further growth in this segment.

The orthopedic artificial bone defect repair materials market is growing due to the increasing prevalence of bone-related disorders and injuries, particularly among the aging population. The demand for advanced synthetic and bio-engineered materials such as calcium phosphates, bioactive glasses, and polymer-based scaffolds is driving market expansion. The rise in orthopedic surgeries, including spinal and joint replacements, further boosts the demand for effective bone defect repair solutions. Despite challenges like high costs and stringent regulations, technological advancements and growing adoption of 3D-printed and bioactive scaffolds are expected to shape future market dynamics.

The growth of the orthopedic artificial bone defect repair materials market is primarily driven by the increasing number of traumatic injuries, aging populations, and the prevalence of degenerative bone diseases. Advancements in bone repair technologies, including 3D-printed scaffolds and bioactive materials, have improved the efficacy of treatments and expanded their application. Additionally, the growing adoption of minimally invasive surgical techniques and the rise in orthopedic surgeries, particularly joint replacements and spinal procedures, create a sustained demand for these materials. Regulatory support for innovative orthopedic solutions also plays a role in market growth.

The orthopedic artificial bone defect repair materials market faces several challenges. The high cost of advanced materials, particularly those with bioactive properties or 3D-printed components, may limit their accessibility in price-sensitive markets. Strict regulatory approvals and lengthy product development timelines also pose barriers to market entry. The competition from natural bone grafting options, such as autografts and allografts, remains a significant restraint as these alternatives are still preferred in some medical procedures. Furthermore, limited long-term clinical data on newer materials can reduce market confidence and adoption.

Several emerging trends are shaping the orthopedic artificial bone defect repair materials market. One key trend is the increasing use of patient-specific implants, facilitated by 3D printing technologies, which allow for a more tailored and precise fit. The integration of bioactive molecules and growth factors within scaffolds to enhance bone regeneration is gaining popularity. Additionally, the development of resorbable materials that gradually degrade as new bone forms reduces the need for surgical removal. There is also a growing focus on expanding market access in emerging regions, spurred by advancements in healthcare infrastructure and increasing disposable incomes.

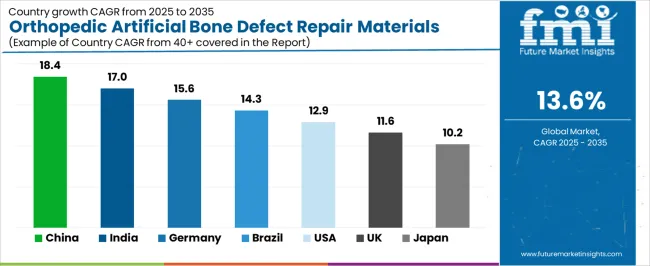

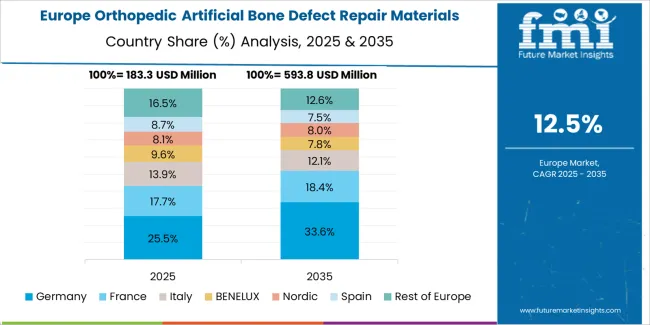

The orthopedic artificial bone defect repair materials market is experiencing significant growth as medical advancements in orthopedic treatments and an aging population drive the demand for artificial bone repair solutions. These materials, such as bone grafts, scaffolds, and synthetic bone substitutes, are critical in treating bone defects, fractures, and degenerative bone conditions. As the global prevalence of bone-related health issues increases, so does the demand for effective repair solutions. Countries with rapidly growing healthcare sectors like China and India are leading the market, while more developed regions such as the U.S. and Germany show steady growth driven by technological advancements, aging demographics, and high healthcare expenditure. This analysis explores how regional factors are influencing the expansion of the orthopedic artificial bone defect repair materials market.

| Country | CAGR (2025-2035) |

|---|---|

| China | 18.4% |

| India | 17% |

| Germany | 15.6% |

| Brazil | 14.3% |

| USA | 12.9% |

| United Kingdom | 11.6% |

| Japan | 10.2% |

China leads the orthopedic artificial bone defect repair materials market with an impressive CAGR of 18.4%. The country’s rapidly growing healthcare infrastructure, increasing prevalence of bone-related diseases, and an aging population are the primary drivers of this growth. China has seen a rise in orthopedic surgeries, especially due to the growing incidence of osteoporosis and bone fractures among its aging population. Additionally, the rapid expansion of the medical device industry and increased healthcare spending contribute to market growth.

China’s government initiatives to improve healthcare access and technological advancements in regenerative medicine and tissue engineering also support the growth of orthopedic repair materials. The availability of affordable healthcare solutions and the expansion of specialized orthopedic care further drive demand for artificial bone repair materials in the country. As China continues to modernize its healthcare system, the market for orthopedic artificial bone repair solutions is expected to continue expanding at a strong pace.

India’s orthopedic artificial bone defect repair materials market is growing at a CAGR of 17.0%. The increasing number of bone surgeries, coupled with a growing awareness of orthopedic care, is driving the demand for advanced bone defect repair solutions in the country. The rise in road accidents, sports injuries, and age-related bone disorders, such as osteoporosis, has contributed to the growth of the orthopedic market.

India's expanding healthcare sector, improved access to medical treatments, and increasing disposable incomes are also key factors fueling this growth. The demand for artificial bone repair materials is further supported by rising medical tourism, with patients from neighboring countries seeking advanced treatment options. As India's healthcare infrastructure continues to improve, the market for orthopedic artificial bone repair materials will continue to expand steadily.

Germany’s orthopedic artificial bone defect repair materials market is projected to grow at a CAGR of 15.6%. The country’s advanced healthcare system, high levels of investment in medical research and development, and an aging population are driving the demand for orthopedic repair materials. Germany has a well-established medical device industry, and its focus on innovative, minimally invasive treatments is increasing the adoption of artificial bone repair materials.

The growing number of elderly individuals, along with a rise in lifestyle-related bone diseases, is contributing to the increasing need for bone defect repairs. Additionally, Germany’s robust healthcare policies and high-quality standards in medical treatments ensure that the market for orthopedic artificial bone defect repair materials continues to thrive. The demand for advanced, cost-effective repair materials will sustain steady market growth in Germany.

Brazil’s orthopedic artificial bone defect repair materials market is expected to grow at a CAGR of 14.3%. The rise in road traffic accidents, sports injuries, and orthopedic surgeries in Brazil has led to an increased demand for bone defect repair materials. The country’s growing middle class, coupled with a greater focus on healthcare infrastructure development, is fueling the adoption of advanced orthopedic solutions.

Brazil is also seeing an increase in the prevalence of bone disorders, such as osteoporosis, particularly among its aging population. This is creating a steady demand for orthopedic surgical procedures and advanced materials. Additionally, the expanding healthcare access in both urban and rural areas, along with government support for healthcare advancements, will continue to drive growth in Brazil’s orthopedic market.

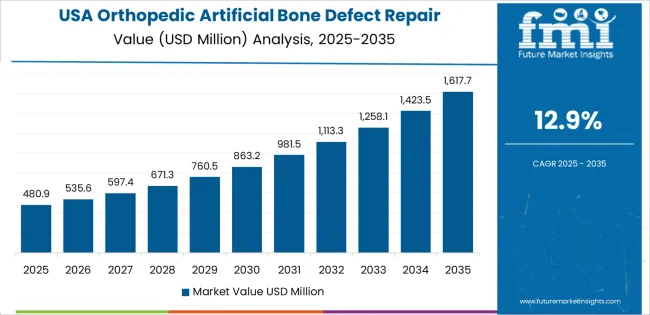

The United States has a projected CAGR of 12.9% for the orthopedic artificial bone defect repair materials market. The U.S. has a large and well-established healthcare market, with significant investments in orthopedic research and technology. The increasing prevalence of bone-related diseases, along with rising surgical procedures for bone defects and fractures, is contributing to the steady demand for artificial bone repair materials.

The growing adoption of minimally invasive techniques, along with advancements in biomaterials and 3D-printed bone substitutes, is fueling innovation in the market. The U.S. healthcare system’s focus on providing high-quality, effective treatments for aging and injury-related bone defects supports continued market growth. As technological advancements continue and demand for high-performance bone repair materials rises, the U.S. market will see continued growth in orthopedic artificial bone defect repair solutions.

The United Kingdom’s orthopedic artificial bone defect repair materials market is projected to grow at a CAGR of 11.6%. The UK’s advanced healthcare system, combined with a growing emphasis on orthopedic care and treatments, is driving demand for artificial bone defect repair materials. The increasing prevalence of bone diseases, especially among the aging population, contributes to the need for high-quality orthopedic solutions.

The UK is also focusing on improving medical research, especially in tissue engineering and bone regeneration, which will fuel the demand for advanced bone defect repair materials. The country’s investment in medical technologies, coupled with increasing awareness about orthopedic health, ensures that the market will continue to grow steadily. The growing number of orthopedic surgeries and treatments will continue to support the demand for these materials.

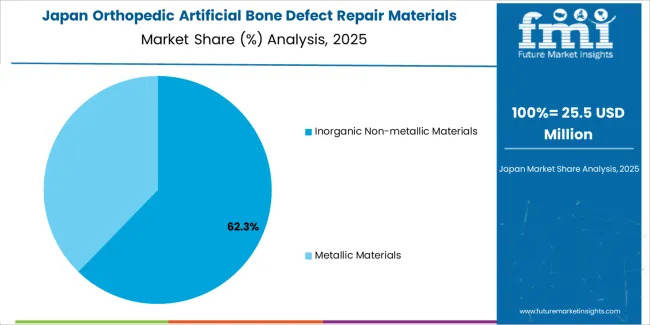

Japan’s orthopedic artificial bone defect repair materials market is expected to grow at a CAGR of 10.2%. Japan’s aging population and the increasing number of orthopedic surgeries for bone fractures and degenerative conditions are key factors driving market growth. The country’s strong focus on medical technology, along with a robust healthcare system, ensures that demand for artificial bone repair solutions remains steady.

Japan is at the forefront of advancing medical technologies, including the development of bioactive and biocompatible materials for bone repair. The growing prevalence of osteoporosis and the country’s dedication to high-quality healthcare further contribute to the market’s expansion. As Japan continues to innovate in orthopedic care, the market for artificial bone defect repair materials is expected to see steady growth.

The orthopedic artificial bone defect repair materials market is being driven by factors such as the rising incidence of bone defects from trauma and disease, growing acceptance of synthetic grafts over autografts or allografts, and expanding adoption of minimally invasive surgical techniques. The global artificial bone repair materials market is projected to grow from approximately USD 1.73 billion in 2024 to about USD 2.85 billion by 2030, yielding a compound annual growth rate of about 8.7%. The market consists of various product types, including bioactive and non-bioactive artificial bone materials, as well as natural bone graft substitutes. Geographically, the Asia-Pacific region is expected to see the fastest growth due to increased healthcare infrastructure investment and a growing unmet need in emerging markets.

Key players in this market are focusing on differentiating themselves through innovations in biomaterial composition, scaffolding structure, and clinical compatibility. Technologies such as 3D-printed scaffolds, improved porosity for better vascularisation and osteointegration, and composite biomaterials combining ceramics and polymers are gaining attention. Manufacturers are also concentrating on obtaining regulatory approvals, surgeon training, and expanding distribution networks in high-growth regions. Some companies emphasize cost-effective standard graft substitutes for high-volume procedures, while others focus on premium biomaterials for complex defects or minimally invasive repairs. Partnerships with hospitals, inclusion in surgeon education programs, and service packages around product use are additional strategic elements. Firms that deliver clinically validated performance, scalable manufacturing, and broad geographic access are likely to capture a larger share of the orthopedic artificial bone defect repair materials market.

| Items | Details |

|---|---|

| Quantitative Units | USD Million |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East & Africa |

| Material Type | Inorganic Non-metallic Materials, Metallic Materials |

| Application | Trauma Surgery, Spinal Surgery, Joint Surgery |

| Key Companies Profiled | Stryker, Medtronic, Johnson & Johnson, Olympus Terumo Biomaterials Corp, NovaBone Products, Biocomposites, Tianjin Sannie Bioengineering Technology, ALLGENS MEDICAL, Jiangsu Yenssen Biotech, Shanghai Rebone Biomaterials, Shanghai Bio-lu Biomaterials, Jiuyuan Gene, Guona Technology, Zhenghai Bio-Tech |

| Additional Attributes | The market analysis includes dollar sales by material type and application categories. It also covers regional adoption trends across major markets such as Asia Pacific, Europe, and North America. The competitive landscape highlights key manufacturers in the orthopedic artificial bone defect repair materials market, with a focus on inorganic non-metallic and metallic materials. Trends in the growing demand for bone defect repair in trauma, spinal, and joint surgeries are explored, along with advancements in biomaterials and tissue engineering. |

The global orthopedic artificial bone defect repair materials market is estimated to be valued at USD 775.4 million in 2025.

The market size for the orthopedic artificial bone defect repair materials market is projected to reach USD 2,775.3 million by 2035.

The orthopedic artificial bone defect repair materials market is expected to grow at a 13.6% CAGR between 2025 and 2035.

The key product types in orthopedic artificial bone defect repair materials market are inorganic non-metallic materials and metallic materials.

In terms of application, trauma surgery segment to command 35.0% share in the orthopedic artificial bone defect repair materials market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Orthopedic Titanium Plate with Loop Market Size and Share Forecast Outlook 2025 to 2035

Orthopedic Prosthetics Market Size and Share Forecast Outlook 2025 to 2035

Orthopedic Braces and Support Market Forecast and Outlook 2025 to 2035

Orthopedic Power Tools Market Size and Share Forecast Outlook 2025 to 2035

Orthopedic Contract Manufacturing Market Size and Share Forecast Outlook 2025 to 2035

Orthopedic Digit Implants Market Size and Share Forecast Outlook 2025 to 2035

Orthopedic Prosthetic Device Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Orthopedic Splints Market Size and Share Forecast Outlook 2025 to 2035

Orthopedic Software Market Size and Share Forecast Outlook 2025 to 2035

Orthopedic Navigation Systems Market Analysis – Trends, Growth & Forecast 2025 to 2035

Orthopedic Trauma Device Market Trends - Size, Share & Forecast 2025 to 2035

Orthopedic Insole Market Analysis – Size & Industry Trends 2025–2035

Orthopedic Shoes Market Growth – Trends & Forecast 2025 to 2035

Orthopedic Oncology Market Growth - Trends & Forecast 2025 to 2035

A Global Brand Share Analysis for Orthopedic Insole Market

Orthopedic Consumables Market Trends – Industry Growth & Forecast 2024 to 2034

3D Orthopedic Scanning Systems Market

Smart Orthopedic Implants Market

Canine Orthopedic Implants Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Orthopedic Drills Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA