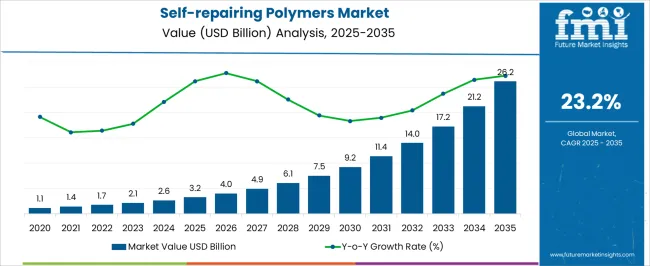

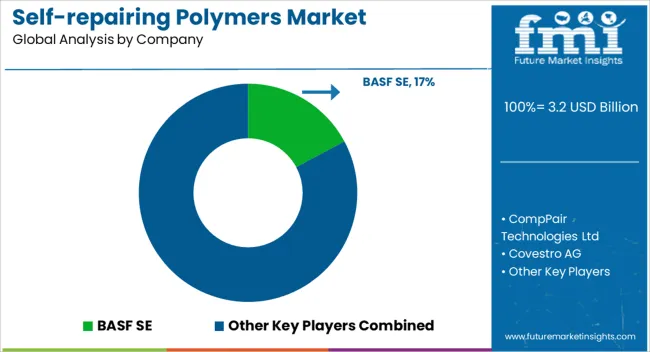

The self-repairing polymers market is estimated to be valued at USD 3.2 billion in 2025 and is projected to reach USD 26.2 billion by 2035, registering a compound annual growth rate (CAGR) of 23.2% over the forecast period.

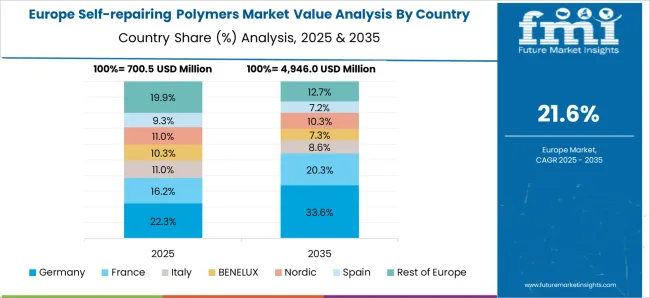

This trajectory highlights the transformative role of self-healing materials across industries such as automotive, aerospace, electronics, and construction. The regional growth pattern indicates an evident imbalance among Asia-Pacific, Europe, and North America. Asia-Pacific is expected to command the largest share of expansion, with rapid industrial manufacturing, strong electronics production, and increasing investment in advanced materials research. The region’s market contribution strengthens from the mid-forecast years onward, supported by adoption in infrastructure and consumer goods applications. Europe, while advancing steadily, relies heavily on regulatory-driven demand, particularly in sustainable materials for transportation and packaging.

Growth is consistent but comparatively slower, restrained by higher compliance costs and limited scaling speed. North America positions itself between the two, with robust uptake in aerospace and defense sectors and substantial R&D activities. Yet, higher initial material costs and adoption barriers may temper its pace of expansion compared to Asia-Pacific. While all three regions are aligned toward adoption, Asia-Pacific emerges as the growth engine, Europe develops steadily under regulatory frameworks, and North America drives innovation with moderate expansion.

| Metric | Value |

|---|---|

| Self-repairing Polymers Market Estimated Value in (2025 E) | USD 3.2 billion |

| Self-repairing Polymers Market Forecast Value in (2035 F) | USD 26.2 billion |

| Forecast CAGR (2025 to 2035) | 23.2% |

The self-repairing polymers market represents a specialized segment within the advanced materials and smart polymers industry, emphasizing durability, resilience, and extended product life. Within the overall smart materials market, it accounts for about 4.2%, driven by applications in coatings, electronics, and automotive components. In the polymer composites sector, it holds nearly 3.7%, reflecting use in structural and functional parts requiring long service life. Across the protective coatings and surface materials category, the segment captures 3.1%, supporting performance in aerospace, marine, and infrastructure. Within the medical devices and healthcare materials market, it represents 2.6%, highlighting potential in implants and wear resistant products. In the electronics and consumer goods materials sector, it secures 2.9%, emphasizing integration in flexible devices and packaging solutions.

Recent developments in this market have focused on autonomous healing mechanisms, microencapsulation, and reversible bonding chemistry. Advances include microvascular and capsule based systems that release healing agents when materials are damaged, and dynamic covalent bonding polymers that restore structural integrity. Key players are collaborating with automotive, aerospace, and electronics manufacturers to design long lasting and low maintenance components. Research into bio inspired self-healing mechanisms is expanding, particularly in polymers that mimic natural tissue repair. The integration of self-repairing polymers in coatings has been gaining momentum to reduce corrosion and extend maintenance cycles. These advancements demonstrate how innovation, performance enhancement, and material intelligence are shaping the self-repairing polymers market.

The self-repairing polymers market is progressing steadily, supported by advancements in smart materials technology and rising demand for extended product lifecycles across industries. Research publications and company innovation briefings have emphasized the role of self-healing materials in reducing maintenance costs, improving durability, and minimizing downtime in applications ranging from automotive to aerospace.

Increasing investment in polymer science and nanotechnology has accelerated the development of self-repairing solutions capable of restoring structural integrity without external intervention. Environmental considerations, including waste reduction and sustainability targets, have further strengthened adoption prospects.

Manufacturers are focusing on scalable production techniques, enabling commercial viability across multiple sectors. As end-use industries prioritize operational efficiency and resource optimization, self-repairing polymers are expected to gain broader acceptance, driven by their potential to enhance product performance and longevity.

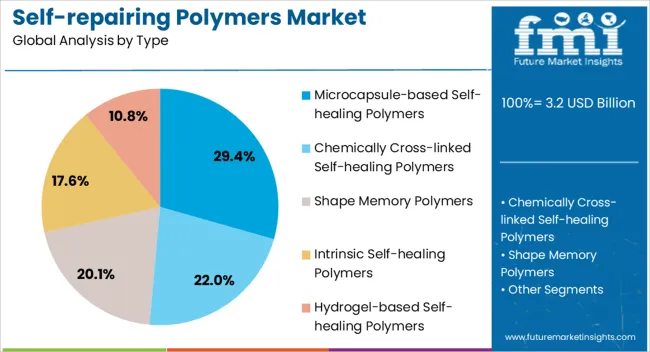

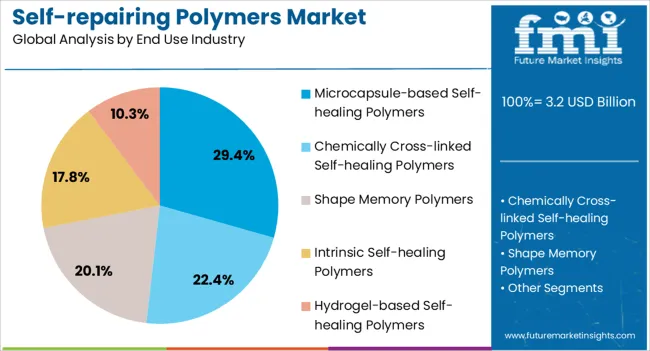

The self-repairing polymers market is segmented by type, end use industry, and geographic regions. By type, self-repairing polymers market is divided into microcapsule-based self-healing polymers, chemically cross-linked self-healing polymers, shape memory polymers, intrinsic self-healing polymers, and hydrogel-based self-healing polymers. In terms of end use industry, self-repairing polymers market is classified into automotive, electronics, medical & healthcare, infrastructure & constructiob, and aerospace & defense. Regionally, the self-repairing polymers industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The microcapsule-based self-healing polymers segment is projected to account for 29.4% of the market revenue in 2025, maintaining its lead among type categories. Growth in this segment has been driven by the effectiveness of microencapsulation techniques, which enable the release of healing agents upon material damage, restoring mechanical integrity. This approach has been widely adopted due to its straightforward fabrication process, scalability, and adaptability across various polymer matrices.

Industry reports have noted that microcapsule-based systems offer consistent performance without requiring external triggers, making them suitable for structural applications where reliability is essential. Additionally, the ability to tailor capsule size, concentration, and agent chemistry has improved material performance across diverse end-use industries.

With continuous advancements in encapsulation methods and cost optimization, the Microcapsule-based segment is expected to remain at the forefront of commercial self-repairing polymer applications.

The automotive segment is projected to hold 28.6% of the self-repairing polymers market revenue in 2025, positioning it as the leading end-use industry. This dominance has been supported by the sector’s strong demand for lightweight, durable, and long-lasting materials that enhance vehicle performance and reduce lifecycle costs. Automakers have increasingly incorporated self-healing coatings and components to address wear, scratches, and microcracks, thereby extending vehicle aesthetics and structural integrity.

Press releases and industry collaborations have highlighted partnerships between polymer developers and automotive manufacturers aimed at scaling self-repairing technologies for exterior and interior applications. Moreover, the push toward electric vehicles has further accelerated interest in advanced materials that improve efficiency and reduce maintenance requirements.

Regulatory pressures on sustainability and consumer preference for longer-lasting products have reinforced the adoption of self-repairing polymers in the automotive industry. As R&D pipelines continue to deliver improved performance materials, the Automotive segment is expected to sustain its leading role in driving market growth.

The market has gained increasing relevance due to the growing demand for advanced materials capable of extending product lifespans, reducing maintenance costs, and improving safety. These polymers possess the ability to autonomously or externally activate repair mechanisms when subjected to mechanical damage such as cracks or scratches. Applications span across automotive, aerospace, construction, electronics, and medical devices, where material resilience and long-term durability are crucial. Industry participants are investing heavily in research aimed at integrating microcapsules, vascular networks, or reversible chemical bonds into polymer matrices.

Aerospace and automotive industries have been among the earliest adopters of self-repairing polymers due to their ability to significantly improve safety and operational efficiency. Aircraft components, such as fuselage panels or interior fittings, benefit from polymers that can autonomously repair minor damages without requiring immediate replacement. In automotive, coatings and structural parts embedded with self-repairing features reduce maintenance expenses while maintaining aesthetic appeal and mechanical strength. These advantages are particularly valuable in lightweight composite applications, where traditional repair methods are costly and time-intensive. Companies are therefore investing in advanced formulations designed to endure extreme temperature variations, high stress, and mechanical fatigue. As demand for reliable and cost-efficient transportation solutions continues to grow, the adoption of self-repairing polymers in these sectors is expected to accelerate further.

Continuous progress in chemical engineering and polymer science has accelerated the development of innovative self-repairing materials. Researchers are focusing on integrating microencapsulation systems that release healing agents upon damage, as well as dynamic covalent bonds that reform after stress. Stimuli-responsive materials, which activate repair mechanisms under light, heat, or pressure, are also advancing. Breakthroughs in nanotechnology have enabled reinforcement of polymer matrices, enhancing their performance in terms of tensile strength and crack resistance. These technological advancements are improving the commercial viability of self-repairing polymers by addressing earlier limitations such as limited repair cycles or reduced efficiency under harsh conditions. Material innovation remains a key driver in expanding the potential of self-healing polymers across sectors, ranging from structural engineering to electronics and healthcare applications.

Growing emphasis on material sustainability and reduction of environmental impact has provided strong momentum to the self-repairing polymers market. Conventional polymers often contribute to waste accumulation due to limited recyclability and short service life. In contrast, self-repairing polymers extend product lifecycles by minimizing premature disposal and reducing the need for frequent replacements. Industries such as consumer electronics and construction view these materials as enablers of circular economy strategies, as they decrease reliance on virgin raw materials. The use of reversible chemical systems in self-repairing polymers enhances recyclability, further contributing to eco-efficient material management. This sustainability dimension is strengthening regulatory and corporate interest in the commercialization of these polymers, aligning with broader global efforts to reduce carbon footprints and promote resource-efficient technologies.

Despite their potential, the widespread commercialization of self-repairing polymers is hindered by high costs and scalability barriers. Manufacturing processes for these polymers often require complex chemical formulations, specialized equipment, and extensive quality control, making them more expensive than conventional alternatives. Scalability becomes particularly challenging in industries requiring mass production, such as packaging or consumer goods. The efficiency of self-repairing mechanisms may diminish after multiple repair cycles, raising concerns about long-term durability in real-world applications. Market participants must also address regulatory approvals and standardization requirements before achieving large-scale deployment. Overcoming these barriers will depend on collaborative innovation, cost-reduction strategies, and targeted applications where the added value of self-repairing properties outweighs initial expenses. This dynamic highlights both the opportunities and limitations shaping the current and future growth trajectory of the market.

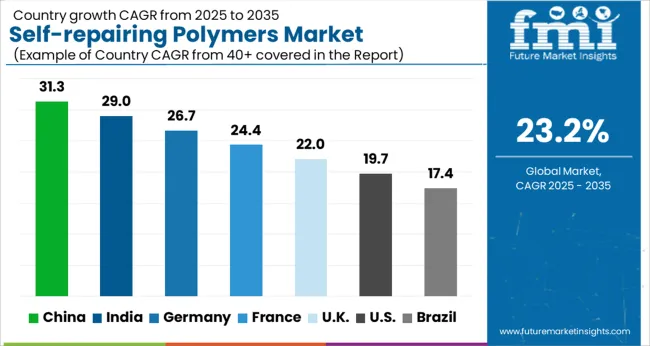

| Country | CAGR |

|---|---|

| China | 31.3% |

| India | 29.0% |

| Germany | 26.7% |

| France | 24.4% |

| UK | 22.0% |

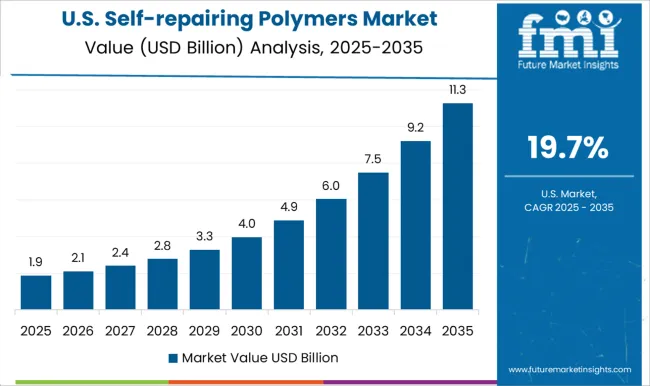

| USA | 19.7% |

| Brazil | 17.4% |

The self-repairing polymers market is projected to expand rapidly as demand for advanced materials in automotive, aerospace, construction, and electronics strengthens. China records the highest growth at 31.3%, supported by large scale industrial adoption and strong investments in material science. India follows with 29.0%, where manufacturing expansion and R&D incentives foster early adoption. Germany achieves 26.7%, driven by strong engineering expertise and integration in high performance sectors. The United Kingdom secures 22.0%, reflecting research collaborations and niche applications across advanced industries. The United States shows 19.7%, supported by development in high value industries and collaborations between material producers and research organizations. Collectively, these countries are creating a dynamic pathway where self-repairing polymers transition from innovative research concepts to commercially scalable solutions. This report includes insights on 40+ countries; the top markets are shown here for reference.

The market in China is projected to grow at a CAGR of 31.3%, making it one of the most dynamic materials sectors in the country. Strong government backing for advanced materials research and industrial innovation is fueling demand. Industries such as automotive, aerospace, and construction are adopting self-healing polymers to reduce maintenance costs and extend product lifecycles. Universities and research institutions are actively collaborating with chemical manufacturers to optimize material properties and achieve scalable production. The government’s emphasis on clean technologies and efficiency improvements is driving adoption. These polymers are also being examined for use in electronics and coatings, further expanding market potential. As domestic industries prioritize durability and performance, the role of self-repairing polymers is set to become increasingly significant.

India is forecast to register a CAGR of 29.0%, reflecting rising interest in advanced materials across industrial applications. The construction and automotive industries are emerging as primary users, as they look to reduce costs linked with wear and damage. Research organizations are collaborating with chemical firms to develop localized production techniques and enhance affordability. The government’s focus on advanced manufacturing and material science is playing a central role in promoting the adoption of self-repairing polymers. Applications in packaging, electronics, and infrastructure projects are also being considered for long-term integration. Industrial demand is supported by the need for lightweight, durable, and sustainable materials. This creates a favorable landscape for technology diffusion and broader adoption across different sectors in India.

The market in Germany is expected to grow at a CAGR of 26.7%, supported by the country’s strong industrial base and focus on innovation. German automotive and aerospace companies are leading early adoption, as self-healing polymers provide efficiency and durability benefits. Research institutions are deeply engaged in developing advanced material compositions, with an emphasis on recyclability and environmental safety. Partnerships between industrial players and academic laboratories are accelerating commercialization. Government-funded programs supporting sustainable material use are enhancing momentum. Applications are not limited to industrial uses but extend to electronics, consumer goods, and specialty coatings. The integration of these polymers into high-performance sectors underlines Germany’s role as a leader in advanced materials development.

The market in the United Kingdom is projected to grow at a CAGR of 22.0%, supported by advanced research and industrial adoption strategies. Universities and technology firms are pioneering the development of self-healing polymers with applications in healthcare, electronics, and infrastructure. The aerospace and defense industries are particularly focused on testing the potential of these materials to reduce long-term maintenance costs. Public and private investments are directed toward pilot projects aimed at scaling production. Policy emphasis on advanced materials research and sustainability is strengthening market dynamics. Collaboration with European research networks is further accelerating knowledge transfer and innovation. The United Kingdom is positioning itself as a hub for commercializing smart materials that enhance durability and efficiency across multiple industries.

The market in the United States is anticipated to grow at a CAGR of 19.7%, reflecting rising demand in high-value industries. Aerospace and automotive sectors are exploring the potential of self-healing materials to improve safety and reduce lifecycle costs. Research institutions and private firms are investing heavily in material science programs, with strong support from federal initiatives promoting innovation. Applications in defense, healthcare devices, and infrastructure are also gaining attention as durability requirements increase. Industrial manufacturers are seeking to commercialize polymers with broader scalability, enabling use across consumer goods and electronics. The focus on sustainability and resource efficiency is driving adoption as industries explore alternatives to conventional materials. The United States is likely to remain a key global hub for advanced polymer innovation.

The market is witnessing strong growth as industries explore advanced materials that can enhance durability, reduce maintenance costs, and extend product lifespans. BASF SE and Covestro AG are at the forefront, leveraging their global chemical expertise to develop innovative self-healing polymers for coatings, automotive, and construction sectors. Evonik Industries Corp. is contributing with material solutions tailored for aerospace, electronics, and packaging, emphasizing improved performance and sustainability. Huntsman International focuses on specialty polymers with self-repairing properties that serve both industrial and consumer applications, showcasing versatility in end-use industries. CompPair Technologies Ltd has emerged as a key innovator, particularly in composites, with solutions that enable in-situ repairs for sectors like wind energy and sports equipment. High Impact Technology, LLC provides defense and aerospace markets with robust self-healing coatings that enhance safety and operational efficiency.

NEI Corp is recognized for its nanotechnology-based self-healing polymer systems, expanding applications in electronics, energy, and protective coatings. Sika AG, known for its strength in adhesives and construction chemicals, is exploring self-repairing polymer technology to address infrastructure resilience and building sustainability. These companies illustrate a market that combines large-scale chemical producers with specialized innovators, highlighting a future where self-healing polymers could redefine material science across industries.

| Item | Value |

|---|---|

| Quantitative Units | USD 3.2 billion |

| Type | Microcapsule-based Self-healing Polymers, Chemically Cross-linked Self-healing Polymers, Shape Memory Polymers, Intrinsic Self-healing Polymers, and Hydrogel-based Self-healing Polymers |

| End Use Industry | Microcapsule-based Self-healing Polymers, Chemically Cross-linked Self-healing Polymers, Shape Memory Polymers, Intrinsic Self-healing Polymers, and Hydrogel-based Self-healing Polymers |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | BASF SE, CompPair Technologies Ltd, Covestro AG, Evonik Industries Corp., High Impact Technology, LLC, Huntsman International, NEI Corp, and Sika AG |

| Additional Attributes | Dollar sales by polymer type and application, demand dynamics across automotive, electronics, and construction sectors, regional trends in advanced material adoption, innovation in healing mechanisms, durability, and performance, environmental impact of extended product lifecycle and reduced waste, and emerging use cases in coatings, medical devices, and aerospace components. |

The global self-repairing polymers market is estimated to be valued at USD 3.2 billion in 2025.

The market size for the self-repairing polymers market is projected to reach USD 26.2 billion by 2035.

The self-repairing polymers market is expected to grow at a 23.2% CAGR between 2025 and 2035.

The key product types in self-repairing polymers market are microcapsule-based self-healing polymers, chemically cross-linked self-healing polymers, shape memory polymers, intrinsic self-healing polymers and hydrogel-based self-healing polymers.

In terms of end use industry, microcapsule-based self-healing polymers segment to command 29.4% share in the self-repairing polymers market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Biopolymers Market Size and Share Forecast Outlook 2025 to 2035

Cast Polymers Market Size and Share Forecast Outlook 2025 to 2035

Fluoropolymers in Healthcare Market Insights - Size, Trends & Forecast 2025 to 2035

Sulfone Polymers Market Growth - Trends & Forecast 2025 to 2035

Emulsion Polymers Market Size and Share Forecast Outlook 2025 to 2035

Drilling Polymers Market Analysis, Growth, Applications and Outlook 2025 to 2035

Acetal Copolymers Market Growth - Trends & Forecast 2025 to 2035

Specialty Polymers Market Size and Share Forecast Outlook 2025 to 2035

Antiviral Polymers for Packaging Market

Cellulosic Polymers Market Size and Share Forecast Outlook 2025 to 2035

Conductive Polymers Market Size and Share Forecast Outlook 2025 to 2035

Ethylene Copolymers Market Analysis by Various Materials, Thickness Capacity Type Through 2035

Polyguanidine Polymers Market Size and Share Forecast Outlook 2025 to 2035

UV-Protecting Polymers Market Size and Share Forecast Outlook 2025 to 2035

Piezoelectric Polymers Market Size and Share Forecast Outlook 2025 to 2035

Cyclic Olefin Polymers (COP) Polymer Syringes Market Size and Share Forecast Outlook 2025 to 2035

Biodegradable Polymers Market Growth 2025 to 2035

Bioresorbable Polymers Market Analysis – Size, Share & Forecast 2025 to 2035

Biocompatible Polymers Market Trend Analysis Based on Product, Polymer, Application, and Region 2025 to 2035

Market Share Distribution Among Cyclic Olefin Polymers Suppliers

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA