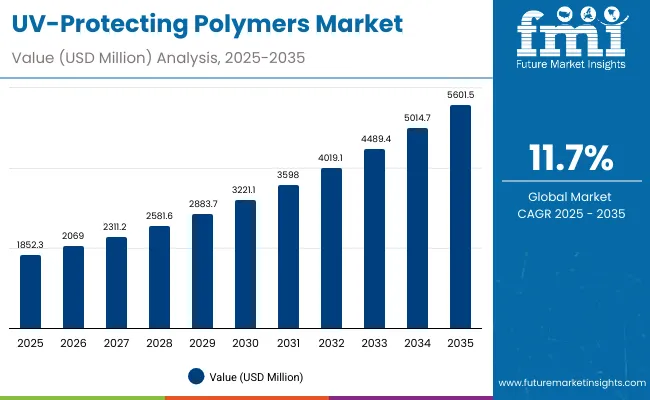

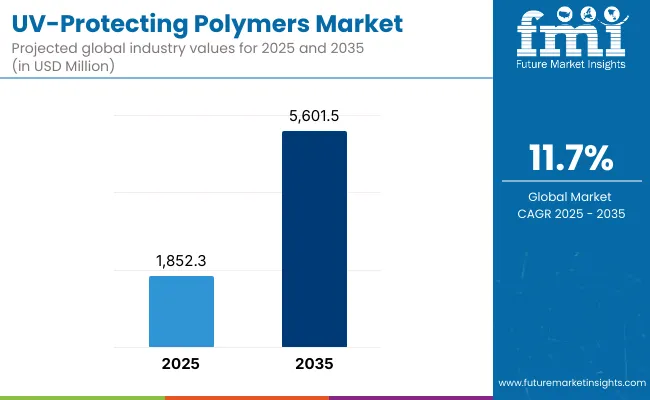

The UV-Protecting Polymers Market is anticipated to achieve a valuation of USD 1,852.3 million in 2025, with the size projected to reach USD 5,601.5 million by 2035. This expansion represents an absolute gain of nearly USD 3,749.2 million over the ten-year period, equal to a growth of more than 3X.

UV-Protecting Polymers Market Key Takeaways

| Metric | Value |

|---|---|

| UV-Protecting Polymers Market Estimated Value in (2025E) | USD 1,852.3 million |

| UV-Protecting Polymers Market Forecast Value in (2035F) | USD 5,601.5 million |

| Forecast CAGR (2025 to 2035) | 11.70% |

The market trajectory reflects an 11.7% CAGR across the assessment timeline, supported by increasing consumer awareness of photo-aging risks, the regulatory prioritization of UV safety, and the integration of UV protection into daily-use formulations. The scale-up demonstrates not only rising penetration across regions but also the embedding of UV-defense features into a broader spectrum of skincare and cosmetic routines.

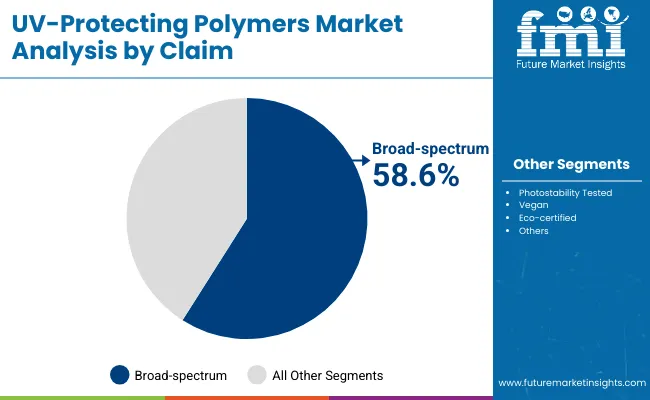

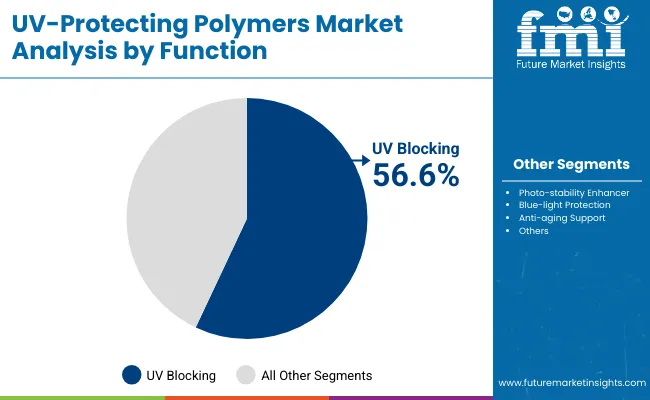

From 2025 to 2030, market revenue is expected to increase from USD 1,852.3 million to USD 3,221.1 million, adding nearly USD 1,368.8 million in value. This five-year phase will account for 37% of the decade’s growth, driven primarily by broad-spectrum protection formats that already lead with a 58.6% share in 2025, and by UV-blocking polymers that command 56.6% share of functional demand. The adoption is likely to be supported by dermocosmetic positioning, the influence of e-commerce channels, and rising health-conscious spending in developed markets.

The second half of the decade, spanning 2030 to 2035, is projected to contribute USD 2,380.4 million, or 63% of the total growth, as the market climbs from USD 3,221.1 million to USD 5,601.5 million. This acceleration will be powered by premium skincare adoption in Asia, rapid expansion in India and China, and the layering of vegan, eco-certified, and blue-light claims. Broader diffusion into daily moisturizers and makeup bases is anticipated to further strengthen recurring demand.

From 2020 to 2024, the market gained steady momentum as UV safety narratives expanded beyond sun creams into daily-use personal care. By 2025, demand is projected at USD 1,852.3 million, and growth is expected to accelerate toward USD 5,601.5 million by 2035, reflecting a shift from seasonal application to year-round, routine-driven usage. During this period, competitive activity will be shaped by specialty polymer producers and formulation innovators, with leading companies differentiating through photostability, blue-light defense, and eco-certified claims.

The competitive environment is projected to remain fragmented, with the top player holding 8.6% share in 2025, while the remainder is spread across niche providers. The advantage is expected to move away from simple UV shielding capacity toward integrated skin health propositions, including hybrid skincare-makeup products and dermatology-backed endorsements. Regional acceleration in Asia, particularly China and India, will outpace Western markets, supported by rising SPF literacy, digital retail penetration, and premium skincare aspirations. The outlook suggests that brand–supplier collaboration and consumer trust in efficacy will determine market leadership.

Growth in the UV-Protecting Polymers Market is being propelled by rising consumer awareness of skin damage caused by prolonged sun exposure, blue light, and photo-aging. Increasing emphasis on preventive skincare is expected to elevate demand for polymers that ensure long-lasting UV-blocking performance and photostability. Regulatory frameworks mandating broad-spectrum protection have further accelerated adoption, as formulations with superior coverage continue to gain preference among dermatology professionals and consumers alike. Expanding middle-class populations in Asia, particularly in China and India, are projected to drive accelerated consumption as daily-use moisturizers, makeup, and haircare incorporate UV shields as standard. Advances in eco-certified and vegan polymer technologies are expected to enhance trust and align with sustainability-driven purchasing behaviors. The integration of UV protection into multifunctional cosmetics and hybrid skincare formats is anticipated to unlock recurring demand throughout the year, ensuring that long-term growth remains both robust and resilient across developed and emerging markets.

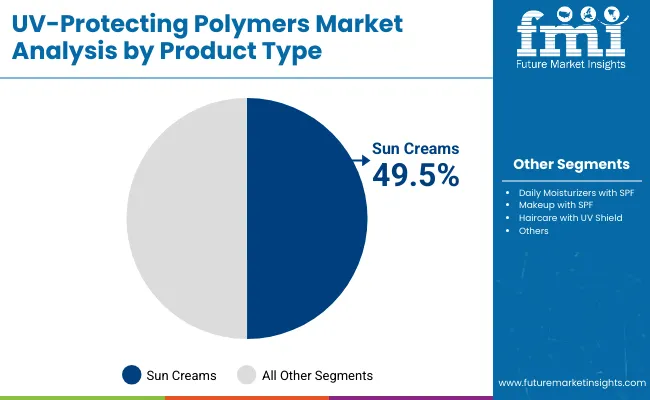

The UV-Protecting Polymers Market has been segmented across multiple dimensions to provide a deeper understanding of demand trends and value distribution. The segmentation highlights consumer preferences based on claims, functions, and product types, each shaping adoption patterns differently. Broad-spectrum claims are being emphasized as awareness of comprehensive sun protection grows, while UV-blocking functions represent the technical foundation behind polymer adoption. At the same time, sun creams remain the most recognizable and widely used product type, providing a core entry point for consumers engaging with UV protection. Each of these segments reflects not only current consumer priorities but also the evolution of preventive skincare behaviors, regulatory standards, and innovation in polymer performance. Together, these categories provide insight into how the market is structured in 2025 and how it is expected to evolve through 2035.

| Segment | Market Value Share, 2025 |

|---|---|

| Broad-spectrum | 58.6% |

| Others | 41.4% |

The claim segment is expected to be dominated by broad-spectrum formulations, which account for 58.6% share in 2025, equal to USD 1,083.8 million. This leadership reflects growing consumer and regulatory demand for products that provide protection against both UVA and UVB radiation. Rising awareness of long-term photo-aging and skin cancer prevention is driving preference for broad-spectrum claims, particularly in developed markets where professional guidance and dermatologist recommendations influence purchasing. Formulators are anticipated to strengthen marketing around broad-spectrum benefits, while continuous improvements in polymer stability under sunlight are expected to reinforce trust. As health-conscious consumers seek preventive solutions, broad-spectrum claims are projected to remain the backbone of UV-protecting polymers through 2035.

| Segment | Market Value Share, 2025 |

|---|---|

| UV blocking | 56.6% |

| Others | 43.4% |

Within functional classifications, UV-blocking polymers are expected to command 56.6% share in 2025, equivalent to USD 1,046.5 million. This dominance stems from the clear, evidence-backed role of UV blockers in providing primary skin defense. Consumers are increasingly associating visible results, such as reduced pigmentation and wrinkle prevention, with UV-blocking efficacy. Investment in advanced polymer technologies designed for higher transparency and improved compatibility with cosmetic bases is expected to further support adoption. Meanwhile, demand for multifunctional polymers combining UV blocking with antioxidant or barrier-strengthening properties is anticipated to accelerate penetration across daily skincare. The segment’s leadership will continue to be reinforced by strong scientific validation and alignment with medical recommendations.

| Segment | Market Value Share, 2025 |

|---|---|

| Sun creams | 49.5% |

| Others | 50.5% |

Sun creams are expected to maintain a 49.5% share in 2025, valued at USD 915.2 million, making them the core adoption format within UV-protecting polymers. Despite strong growth in daily moisturizers, makeup with SPF, and other hybrid products, sun creams remain the foundational entry point for UV protection. Their widespread use during outdoor activities, reinforced by public health campaigns and dermatologist advice, ensures stable recurring demand. The segment benefits from continued innovation in non-greasy textures, water resistance, and sensitive-skin suitability. Over the decade, growth is anticipated to extend into complementary product types, yet sun creams are expected to retain their pivotal role in building consumer trust and driving overall category penetration.

Evolving skincare expectations, regulatory mandates, and innovation in multifunctional formulations are reshaping the UV-Protecting Polymers Market, even as concerns regarding input sustainability, formulation costs, and consumer scrutiny of chemical safety continue to shape competitive and strategic outcomes.

Integration of Hybrid Skincare-Cosmetic Functions

A key growth driver is anticipated to emerge from the integration of UV-protecting polymers into hybrid skincare-cosmetic products. These polymers are increasingly being engineered to deliver invisible UV shields that can blend seamlessly with color cosmetics and barrier-repair actives. As consumers prioritize multifunctionality in daily routines, the ability to incorporate UV-blocking polymers without compromising texture or aesthetic appeal is expected to redefine purchasing choices. This dynamic not only accelerates adoption in mature markets but also broadens entry points in emerging regions where skincare and cosmetic budgets remain limited. The capacity of UV-protecting polymers to support multifunctional formats positions them as an essential enabler of premium product development and everyday skincare adoption.

Transition Toward Eco-Certified and Biopolymer Solutions

A critical trend shaping the market outlook is the shift toward eco-certified and biopolymer-based UV shields. Regulatory scrutiny and consumer skepticism of petrochemical-derived filters are expected to intensify, creating opportunities for sustainable polymer alternatives. Bio-based polymers and eco-certified formulations are increasingly viewed as credibility anchors, enabling brands to signal environmental responsibility while retaining efficacy. This transition reflects a broader realignment of industry innovation pipelines toward circular chemistry and transparent sourcing. As global sustainability standards tighten and eco-labeling gains influence, UV-protecting polymers designed with green chemistry principles are anticipated to secure premium positioning and long-term loyalty.

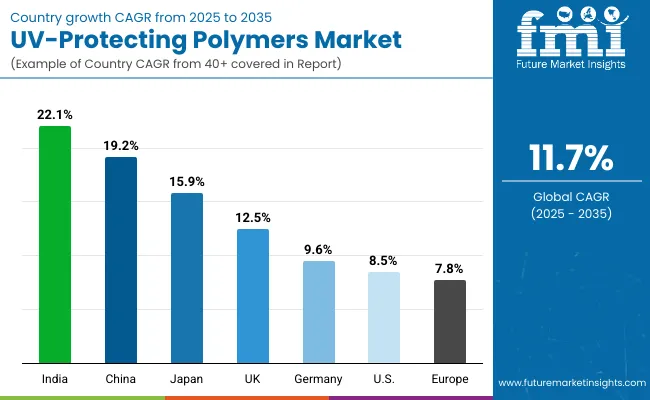

| Country | CAGR |

|---|---|

| China | 19.2% |

| USA | 8.5% |

| India | 22.1% |

| UK | 12.5% |

| Germany | 9.6% |

| Japan | 15.9% |

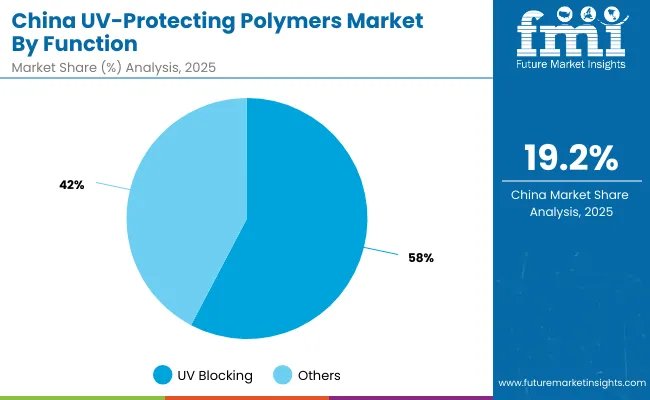

The UV-Protecting Polymers Market demonstrates varied growth dynamics across leading economies, shaped by consumer awareness, regulatory frameworks, and innovation in multifunctional skincare. India is projected to emerge as the fastest-expanding market with a 22.1% CAGR (2025-2035), supported by rising middle-class consumption, digital retail penetration, and the normalization of daily SPF use in urban households. China, advancing at 19.2% CAGR, is expected to consolidate its role as a global demand hub, driven by regulatory focus on UVA/UVB safety, consumer preference for high-performance skincare, and strong adoption of hybrid beauty products.

Japan is forecast to grow at 15.9% CAGR, underpinned by its cultural emphasis on anti-aging and superior texture formulations, where UV protection is viewed as central to long-term skin health. The UK is projected at 12.5% CAGR, reflecting momentum in premium skincare and the influence of dermatology-backed endorsements. Germany, with a 9.6% CAGR, remains a stronghold for functional efficacy and compliance-driven adoption, although growth will be slower relative to Asia. The USA, advancing at 8.5% CAGR, represents a mature yet profitable market, where innovation is expected to focus on expanding multifunctional claims and dermatologist-recommended products.

Overall, Asia is projected to lead global acceleration, while Western markets will maintain steady growth anchored in premium and compliance-driven segments.

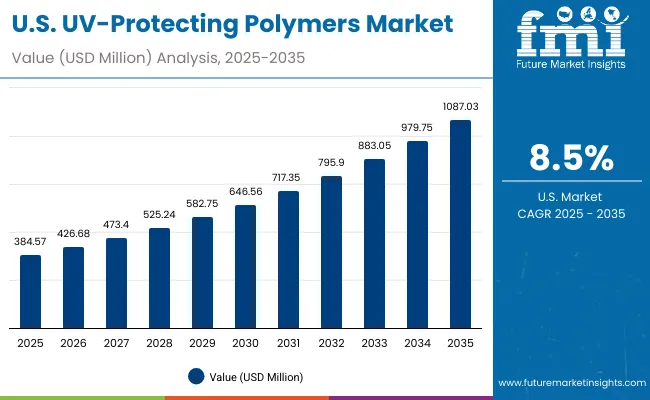

| Year | USA UV- Protecting Polymers Market (USD Million) |

|---|---|

| 2025 | 384.57 |

| 2026 | 426.68 |

| 2027 | 473.40 |

| 2028 | 525.24 |

| 2029 | 582.75 |

| 2030 | 646.56 |

| 2031 | 717.35 |

| 2032 | 795.90 |

| 2033 | 883.05 |

| 2034 | 979.75 |

| 2035 | 1,087.03 |

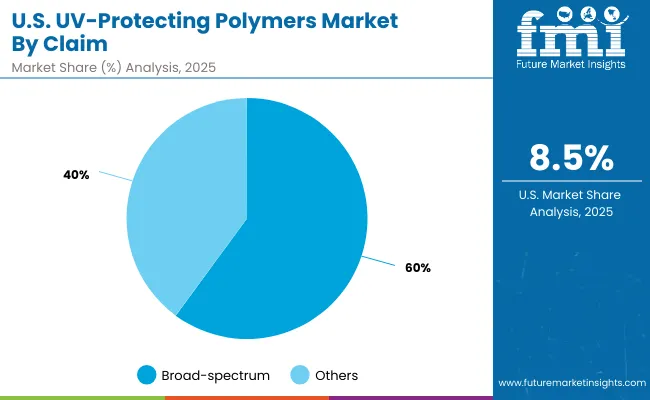

The UV-Protecting Polymers Market in the United States is projected to expand at a CAGR of 8.5% from 2025 to 2035, reflecting steady long-term growth. This trajectory underscores the rising importance of broad-spectrum and UV-blocking claims in dermatology-led recommendations and the strong demand for multifunctional personal care products. A combination of higher consumer health awareness, strict regulatory compliance, and channel expansion across pharmacies and e-commerce is expected to sustain momentum.

Significant opportunities are anticipated in premium skincare categories where dermatologist-backed endorsements and eco-certified labels align with consumer trust. The transition toward hybrid daily moisturizers and makeup products with integrated UV shields is expected to broaden adoption beyond seasonal sun creams. Moreover, advancements in polymer technology designed to enhance transparency, non-greasy textures, and water resistance are forecast to reinforce consumer loyalty.

The UV-Protecting Polymers Market in the United Kingdom is projected to grow at a CAGR of 12.5% between 2025 and 2035, reflecting solid momentum supported by premium skincare adoption and evolving consumer health priorities. Increasing dermatology-backed endorsements are expected to position broad-spectrum claims as the leading driver of growth, while functional demand is anticipated to shift toward hybrid skincare-cosmetic offerings. The expansion of digital retail and strong consumer affinity for ethical and eco-certified products are projected to reinforce sustained demand across all channels.

The UV-Protecting Polymers Market in India is forecast to expand at a CAGR of 22.1% during 2025-2035, positioning it as the fastest-growing market globally. Rising middle-class incomes, urbanization, and increased awareness of photo-aging risks are projected to accelerate adoption. Daily-use moisturizers and makeup with SPF are expected to drive recurring demand, while premium dermocosmetic positioning is anticipated to gain ground in urban centers. Regulatory support for sun-safety campaigns and expanded digital distribution are likely to further accelerate penetration.

The UV-Protecting Polymers Market in China is expected to achieve a CAGR of 19.2% from 2025 to 2035, consolidating its role as a global demand hub. Regulatory mandates prioritizing UVA/UVB protection, coupled with high consumer preference for multifunctional and hybrid products, are projected to sustain strong growth. Broad-spectrum and UV-blocking claims are anticipated to anchor the category, while e-commerce and influencer-driven campaigns are expected to broaden penetration across Tier-2 and Tier-3 cities. Premiumization trends are likely to elevate recurring demand and reinforce the country’s leadership role in global adoption.

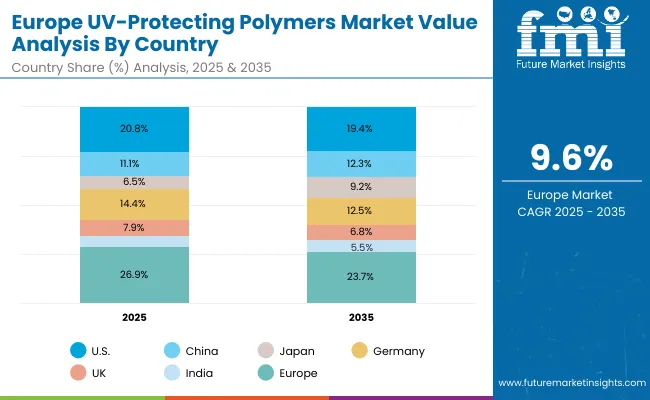

| Country | 2025 |

|---|---|

| USA | 20.8% |

| China | 11.1% |

| Japan | 6.5% |

| Germany | 14.4% |

| UK | 7.9% |

| India | 5.0% |

| Country | 2035 |

|---|---|

| USA | 19.4% |

| China | 12.3% |

| Japan | 9.2% |

| Germany | 12.5% |

| UK | 6.8% |

| India | 5.5% |

The UV-Protecting Polymers Market in Germany is projected to register a CAGR of 9.6% between 2025 and 2035, reflecting moderate yet resilient growth driven by compliance-focused skincare preferences. Strong adherence to dermatology standards and regulatory alignment is expected to ensure consistent adoption of broad-spectrum and photostability-tested claims. Pharmacies and specialty retail are anticipated to remain dominant distribution channels, while e-commerce will play an increasing role in expanding consumer reach. Demand for eco-certified polymers is expected to be a differentiating factor in brand choice.

| Segment | Market Value Share, 2025 |

|---|---|

| Broad-spectrum | 60.1% |

| Others | 39.9% |

The UV-Protecting Polymers Market in the United States is projected at USD 384.6 million in 2025. Broad-spectrum claims contribute 60.1% (USD 231.2 million), while other claims account for 39.9% (USD 153.4 million), underlining the strong preference for comprehensive UVA/UVB coverage. This dominance is being reinforced by regulatory guidance, dermatologist recommendations, and consumer trust in scientifically validated protection. The prioritization of broad-spectrum claims highlights a structural shift toward evidence-led efficacy, where transparency in labeling and safety testing plays a decisive role in adoption.

The demand for “other” claims, including blue-light and photostability-focused solutions, continues to complement growth by addressing emerging concerns linked to digital exposure and environmental aggressors. These claims are expected to gain further importance as consumers adopt multi-layered skincare routines. Advancements in polymer design that integrate high transparency and compatibility with lightweight textures are projected to support both claim categories.

| Segment | Market Value Share, 2025 |

|---|---|

| UV blocking | 57.7% |

| Others | 42.3% |

The UV-Protecting Polymers Market in China is estimated at USD 205.1 million in 2025, with UV blocking functions leading at 57.7% share (USD 118.3 million). This leadership reflects strong consumer trust in visible efficacy, where polymers offering measurable sun defense are positioned as essential in skincare. Regulatory emphasis on safety and broad UVA/UVB coverage is expected to further reinforce the adoption of UV-blocking functions as the core of product positioning.

The “others” category, holding 42.3% share (USD 86.9 million), includes polymers designed for advanced benefits such as blue-light protection, anti-aging support, and photostability. These functions are gaining traction as urban consumers face digital exposure and rising environmental stressors. Demand for multifunctional claims is projected to complement UV-blocking polymers, allowing brands to cater to diverse skincare routines.

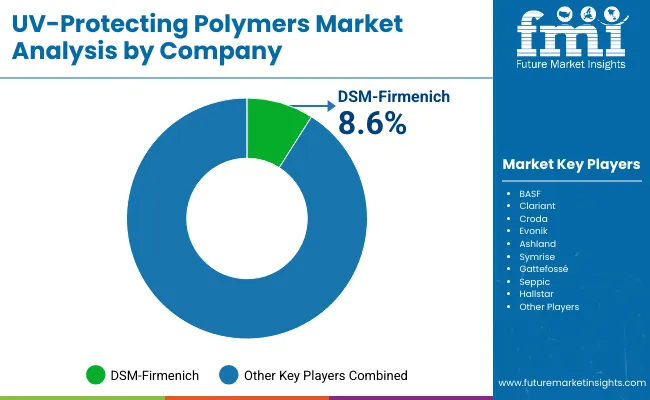

| Company | Global Value Share 2025 |

|---|---|

| DSM-Firmenich | 8.6% |

| Others | 91.4% |

The UV-Protecting Polymers Market is moderately fragmented, with global leaders, mid-sized innovators, and niche-focused specialists competing to capture growth across diverse product categories and geographies. Global leaders such as DSM-Firmenich, BASF, Clariant, Croda, Evonik, and Ashland hold significant market presence, leveraging strong R&D pipelines, established distribution networks, and collaborative formulation partnerships with personal care brands. Their strategies are increasingly being shaped by eco-certified polymer portfolios, transparent safety data, and hybrid UV solutions that integrate seamlessly into multifunctional skincare and cosmetics.

Mid-sized players, including Symrise, Gattefossé, Seppic, and Hallstar, are expanding relevance through flexible innovation models. Their strengths lie in portable product development cycles and targeted launches, which cater to specialized needs such as blue-light defense, water resistance, and premium sensorial attributes. These companies are expected to gain traction by offering differentiated solutions that combine efficacy with consumer-centric claims.

Specialty-focused providers are anchoring competitiveness through niche positioning in natural, vegan, and biopolymer-based UV shields. Their agility in addressing sustainability expectations and regulatory shifts is projected to support incremental market penetration.

Competitive differentiation is moving away from singular efficacy claims and toward integrated ecosystems of broad-spectrum efficacy, sustainability credentials, and compatibility with hybrid skincare formats. The long-term outlook suggests that partnerships with dermocosmetic brands and transparent product labeling will be decisive in shaping leadership.

Key Developments in UV-Protecting Polymers Market

| Item | Value |

|---|---|

| Quantitative Units | USD 1,852.3 million (2025); USD 5,601.5 million (2035); CAGR 11.7% (2025-2035) |

| Segment Families | Claim; Function; Product Type; Channel; Country |

| Claim | Broad-spectrum (58.6% |

| Function | UV blocking (56.6% |

| Product Type | Sun creams (49.5% |

| Channel | E-commerce; Pharmacies; Mass retail; Specialty retail |

| Regions Covered | North America; Europe; Asia-Pacific; Latin America; Middle East & Africa |

| Countries Covered | United States; China; India; Japan; Germany; United Kingdom |

| Country Growth Benchmarks (CAGR 2025-2035) | India 22.1%; China 19.2%; Japan 15.9%; UK 12.5%; Germany 9.6%; USA 8.5% |

| USA Market Outlook | USD 384.57 million (2025) → USD 1,087.03 million (2035) |

| China Market Note (Function, 2025) | UV blocking 57.7% |

| Leading 2025 Claim | Broad-spectrum leadership at 58.6% share |

| Key Companies Profiled | DSM-Firmenich; BASF; Clariant; Croda; Evonik; Ashland; Symrise; Gattefossé; Seppic; Hallstar |

| Competitive Snapshot (2025) | DSM-Firmenich 8.6% global value share; Others 91.4% |

| Additional Attributes | Dollar sales by claim, function, and product type; premiumization via broad-spectrum and photostability claims; recurring demand from daily-wear skincare and makeup with SPF; growth acceleration in Asia (India/China); pharmacy & e-commerce channel strength; sustainability shift toward eco-certified/biopolymer solutions; texture transparency and water resistance improvements. |

The global UV-Protecting Polymers Market is estimated to be valued at USD 1,852.3 million in 2025.

The market size for the UV-Protecting Polymers Market is projected to reach USD 5,601.5 million by 2035.

The UV-Protecting Polymers Market is expected to expand at a CAGR of 11.7% between 2025 and 2035.

The key product types in the UV-Protecting Polymers Market are sun creams, daily moisturizers with SPF, makeup with SPF, and haircare with UV shield.

In terms of function, the UV blocking segment is projected to command 56.6% share (USD 1,046.5 million) in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Biopolymers Market Size and Share Forecast Outlook 2025 to 2035

Cast Polymers Market Size and Share Forecast Outlook 2025 to 2035

Fluoropolymers in Healthcare Market Insights - Size, Trends & Forecast 2025 to 2035

Sulfone Polymers Market Growth - Trends & Forecast 2025 to 2035

Emulsion Polymers Market Size and Share Forecast Outlook 2025 to 2035

Drilling Polymers Market Analysis, Growth, Applications and Outlook 2025 to 2035

Acetal Copolymers Market Growth - Trends & Forecast 2025 to 2035

Specialty Polymers Market Size and Share Forecast Outlook 2025 to 2035

Antiviral Polymers for Packaging Market

Cellulosic Polymers Market Size and Share Forecast Outlook 2025 to 2035

Conductive Polymers Market Size and Share Forecast Outlook 2025 to 2035

Ethylene Copolymers Market Analysis by Various Materials, Thickness Capacity Type Through 2035

Polyguanidine Polymers Market Size and Share Forecast Outlook 2025 to 2035

Piezoelectric Polymers Market Size and Share Forecast Outlook 2025 to 2035

Cyclic Olefin Polymers (COP) Polymer Syringes Market Size and Share Forecast Outlook 2025 to 2035

Biodegradable Polymers Market Growth 2025 to 2035

Bioresorbable Polymers Market Analysis – Size, Share & Forecast 2025 to 2035

Biocompatible Polymers Market Trend Analysis Based on Product, Polymer, Application, and Region 2025 to 2035

Market Share Distribution Among Cyclic Olefin Polymers Suppliers

Liquid Crystal Polymers Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA