Acetal Copolymers Market Dynamics Global demand for acetal copolymers is steadily growing across the forecast period of 2025 to 2035. High stiffness, low friction, and chemical resistance give the material its intrinsic mechanical properties making it suitable for precision and engineering applications.

One of the major factors driving the growth of this segment is the growing requirement for lightweight and high-performance materials in the automotive industry as acetal copolymers are utilized in fuel system components, gears, and in various mechanical components that require durability and dimensional stability.

High growth in the automotive industry, along with rising demand for weight reduction for enhancing fuel efficiency and performance, is expected to boost acetal copolymers use in the plastics segment for metal replacement. The increase in need for formed wires for numerous applications including connectors, switches, and insulating components, in the electrical and electronics manufacturing industries further fuels the market.

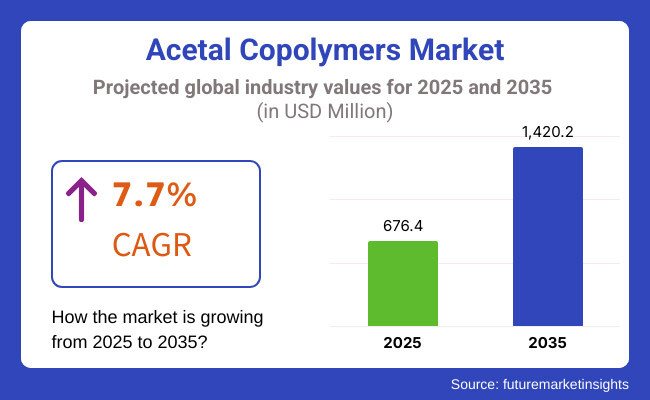

According to this data, it has a forecasted a growth rate of 7.7% CAGR from 2025 to 2035, showing great market potential. Ongoing developments in polymer technology, as well as rising investments in industrial automation and machine tools, are also contributing to the growth of acetal copolymers market. It proves to be a perfect material among industrial applications, because it can withstand extreme environments and is wear resistant.

Growing demand from the automotive, electronics, and industrial machinery sectors is projected to drive the North America acetal copolymers market. North America, particularly the United States and Canada, is currently experiencing a robust demand for lightweight, high-performance plastics to improve vehicle fuel efficiency and enhance the reliability of electronic components.

As manufacturing in the region turns to new sustainable polymer solutions that align with emerging regulatory standards, demand for bioplastics is providing robust growth to drive further market development.

As a result, Europe continues to be one of the lucrative markets for acetal copolymers, primarily as a result of the presence of the automotive and industrial manufacturing sectors. Leading the Way in the Adoption of Advanced Engineering Plastics for High Precision Applications: Germany, France, and Italy.

Increasing demand for hard and wear resistant materials are used with mechanical and electrical applications further fuelling the market growth. The continuous drive for lightweight materials parts used in transportation and industrial automation is elucidated to generate high demand for acetal copolymers in the foreseeable future.

The Asia-pacific region dominates with high demand for acetal copolymers and expected to grow significantly in terms of demand with respect to China, India, Japan, and South Korea. Growing demand for high-performance polymer materials, backed by the booming automotive, consumer electronics, and manufacturing industries, is one of the primary reasons for the regional high-performance polymer material market.

Market growth opportunities include the increasing replacement of metal components with engineered plastics in industrial uses. Investments in advanced material research and polymer processing technologies will also keep the region on track for product innovation and market competitiveness

Fluctuations in Raw Material Prices and Supply Chain Constraints

Raw material price volatility and global supply chain disruptions challenge the growth of the Acetal Copolymers market. Formaldehyde or acetal copolymers derived from formaldehyde or formaldehyde-based resin sensitive towards changing costs of petrochemical-based feedstock prices and regulatory changes and environmental restrictions the supply of key raw materials depends on global supply networks, which in recent years have been strained by geopolitical instability, trade restrictions and logistical bottlenecks.

The impact of these factors on production costs creates uncertainties for manufacturers. Eight of the largest content creators have announced initiatives to solve these issues, investing secondary content sources, more production facilities in the continents and hedging utilizes for forecasting technologies for supply chain resilience.

When do you risk falling behind? Other than developing products based from bio-based materials (obtained from plants or other renewable resources) and workplace recycling initiatives, many companies are exploring production processes that demand less traditional raw materials.

Rising Demand in High-Performance Engineering Applications

As industries like automotive, electronics, and medical devices demanded lightweight, high-performance polymers, the Acetal Copolymers market has an opportunity to grow. For applications demanding excellent mechanical properties, wear resistance, and dimensional stability, these polymers are used in precision components and offer durability and chemical resistance.

The automotive sector is harnessing Acetal Copolymers for metal parts replacements, which make the cars lighter and aid in improving fuel economy. Likewise, the growing usage of electrical and electronic equipment and the trend to miniaturization is fuelling the demand for engineering plastics with enhanced performance.

Top 10 Medical Device Materials Conditionally Acceptable for General Use Medical-grade Acetal Copolymers have also gained momentum because of biocompatibility and sterilization capability. Product innovation, though such as reinforced and specialty grades, will increase the opportunity for companies to capture this growing demand.

Period 2020 to 2024: The Acetal Copolymers market is at rising phase owing to improvement in material continuing for industrial uses. The automotive and aerospace sectors are shifting towards lightweight, high-strength materials driving increased demand.

But manufacturers faced obstacles from supply chain disruptions and inflation in production costs, as well as regulatory hurdles regarding formaldehyde emissions. We were optimizing formulations, looking at alternative manufacturing processes, we were optimizing formulations and investing behind sustainability.

When we start to look forward from 2025 to 2035, we predict a transformation to be happening in market across sustainability, product diversification & performance enhancing auto-tuning. The BioSource Acetal Copolymers and recyclable formulations will thrive because industries are adopting greener manufacturing processes. New polymer blending and reinforcement technologies will expand those applications even further, particularly in high-temperature and chemically aggressive environments.

There will be additional investment to make the market more automated and digitally monitored for better manufacturing processes and reduced wastage. Within the changing Acetal Copolymers market, organizations that adopt smart manufacturing measures, innovate to create sustainable material substitutes, and optimize product customization will continue to outperform.

Market Shifts: A Comparative Analysis (2020 to 2024 vs. 2025 to 2035)

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Compliance with emissions regulations and safety standards |

| Technological Advancements | Introduction of reinforced and high-precision copolymer formulations |

| Industry Adoption | Growth in automotive, electronics, and consumer goods applications |

| Supply Chain and Sourcing | Dependence on petrochemical-based raw materials |

| Market Competition | Dominance of established polymer manufacturers |

| Market Growth Drivers | Demand for lightweight and durable materials in automotive and electronics |

| Sustainability and Energy Efficiency | Initial efforts in reducing production emissions |

| Integration of Smart Monitoring | Early-stage adoption of digital quality control and process automation |

| Advancements in Material Science | Improvements in wear resistance and mechanical properties |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Stricter environmental policies, growth of bio-based and recyclable Acetal Copolymers |

| Technological Advancements | Development of advanced polymer blends with enhanced temperature and chemical resistance |

| Industry Adoption | Expansion into medical, aerospace, and high-performance industrial applications |

| Supply Chain and Sourcing | Increased focus on bio-based alternatives and localized production |

| Market Competition | Rise of new entrants specializing in sustainable and high-performance engineering plastics |

| Market Growth Drivers | Adoption of eco-friendly Acetal Copolymers and smart manufacturing solutions |

| Sustainability and Energy Efficiency | Large-scale implementation of recyclable and biodegradable polymer solutions |

| Integration of Smart Monitoring | Full-scale use of AI-driven process optimization and real-time material performance tracking |

| Advancements in Material Science | Expansion of nanocomposite and self-lubricating Acetal Copolymer formulations |

The USA acetal copolymers market is growing due to the presence of its strong industrial base, especially for the manufacturing of automobiles and electronics. Acetal copolymer lubricating solutions are used in a wide range of applications, due to their durability and low friction properties, from fuel system components, to precision gears, to electrical insulation.

As automakers focus on light-weight material for better fuel economy, metal parts are being replaced with high-performance polymers. Additionally, the next generation of the market will be governed by innovations of polymer blending and advancements of sustainable materials.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 7.9% |

Demand for acetal copolymers from the aerospace, automotive, and medical sectors is pushing the growth of the UK acetal copolymers market. With an increase in the use of sustainable/renewable and high-performance plastics in transportation, the acetal copolymer usage is anticipated to grow in lightweight and wear-resistant components.

The country’s increasing focus on electric vehicles and precision engineering also boosts demand for these polymers. Furthermore, acetal copolymers are increasingly employed in surgical instruments and fluid handling systems, further bolstering market growth due to UK's booming medical device industry.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 7.4% |

The solid industrial sectors of Germany, France, and Italy are powering the EU’s acetal copolymers market. The automotive manufacturing and precision engineering prowess of Germany has resulted in a huge adoption of acetal polymer in gearing, fuel systems and lightweight vehicle components etc.

Demand of high-performance thermoplastics is also propelled by France’s aerospace and medical technology sectors. Italy’s contribution to precision manufacturing and industrial machinery promotes consistent market growth. The EU’s attention to recyclable and bio-based plastics is affecting developments in the marketplace, as well.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 7.6% |

Japan is a major driver market for acetal copolymers due to its highly developed robotics, electronics, and automotive sectors. Combined with a solid demand in electric vehicles, semiconductor manufacturing and automation for high-precision plastic components, the market is growing in the country.

The excellent wear resistance and dimensional stability of acetal copolymers make them indispensable in gears, bearings, and electrical connectors. The expansion of Japan's medical device sector also bolsters increasing adoption in fluid handling and diagnostic instruments.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 7.5% |

Due to the larger semiconductor manufacturing, consumer electronics, and automotive production in South Korea, the country holds a share of the acetal copolymers market. Strong demand is driven by the country’s focus on high-precision engineering plastics in electric vehicles, 5G infrastructure and AI-powered robotics.

Because of excellent mechanical properties, the acetal copolymers are widely used in display technologies and circuit components as well as high-performance gears. The further burgeoning growth of the market can also be attributed to the increased investment of South Korea specifically in advanced polymer processing and sustainability.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 7.8% |

On the basis of functionality, the acetal copolymers market is segmented into industrial and consumer segments, where the industrial segment will hold the most significant share as manufacturers are increasingly minimizing the reliance on high-performance engineering thermoplastics owing to their high efficiency in terms of durability, dimensional stability, and wear resistivity.

Overall, the use of acetal copolymers in these applications increases the durability of products, strengthens mechanical characteristics, and optimizes performance that makes these copolymers a critical component of automotive, electronics, consumer goods and healthcare industries.

Industrial Applications Lead Market Demand as Engineering Plastics Gain Prominence

The key growth opportunities for acetal copolymers market have been identified in their use in the next generation of industrial applications. In contrast to traditional plastics, acetal copolymers offer improved toughness that suit precision components and heavy-duty applications.

Increasing technological advancements in 2 engineering & manufacturing processes, and rising demand for acetal based industrial components in gears, bearings, bushings & conveyor belts are the factors are driving the market. Manufacturers have started to prefer high-performance materials for machinery & industrial equipment. Over 60% of industrial applications using engineering plastics include acetal copolymers, so this segment is expected to have high demand, according to studies.

The growth of speciality acetal copolymer solutions with enhancements including wherein to composites, UV-stable specifications, and electric conductive compositions will further fuel market demand owing to its increased versatility and productivity in manufacturing settings.

This, combined with the incorporation of digital manufacturing & 3D printing technologies using acetal copolymers, has increased the rate of adoption to ensure uninterrupted production along with improved customization of devices in precision engineering.

Developed sustainable acetal copolymer alternatives, with bio-based formulations, better recyclability and a lower environmental footprint, has optimized market growth ensuring alignment with global sustainability initiatives.

Despite its high strength, wear resistance, and chemical stability advantage, the industrial application segment face challenges like high production cost, competition from other alternative engineering plastics, and a limited processing range.

Nonetheless, new developments in advanced polymer processing, hybrid material integration, and digital quality control systems are fostering efficiency, performance, and industry-wide adoption-resulting in sustained market growth for industrial acetal copolymer applications across the globe.

Consumer applications are a major market segment as well, especially in home appliances, sports equipment, and electronic components. Acetal copolymers possess superior mechanical stability, impact resistance, and aesthetic performance compared to commodity plastics, making them suitable for a multitude of consumer products.

Growing demand for lightweight but robust consumer products such as kitchen appliances, zippers and fasteners, and eyewear frames has boosted adoption, keeping high-performance consumer applications sustained. Acetal Copolymer Segment Overview According to studies, more than 50% of engineered plastic consumer goods have acetal copolymers, thus ensuring ongoing demand for this segment.

Increased development of advanced types of acetal copolymers with flame retardant, static control and better surface quality has analysed market demand to meet enhanced performance requirement in consumer product design. Also, the growing use of acetal-based smart materials in electronics, In particular (melded parts with high precision) for mobile devices, connectors, and wearables fuelled adoption, improving product reliability and enabling the miniaturization of consumer electronics.

Introduction of eco grease acetal copolymer formulations having low volatile organic compound (VOC) releases and high biodegradability has enhanced market growth, creating a sustainable environment by promoting sustainability in the production of consumer products.

Furthermore, rising adoption of acetal copolymer in medical applications including drug delivery devices, surgical instruments, and dental applications, to name a few, is likely to fuel the market opportunities. Their chemical inertness, non-toxic, and easy sterilisable properties make them close to the ideals for healthcare use.

Increasing usage of acetal copolymers in the automotive industry in manufacturing fuel system components, safety-critical connectors, and precision mechanical components has supported the growth of the market. They are formed to endure extreme heat, fuel exposure, and mechanical stress, making them crucial in the development of vehicles today.

While it offers advantages in terms of durability, lightweight properties and chemical resistance, the consumer applications segment is hindered by issues such as regulatory restrictions, environmental concerns with polymer waste and volatile raw material prices.

Nevertheless, new advances in polymer recycling, bio-based acetal copolymers, and AI-driven material optimization are enhancing sustainability, efficiency, and market penetration, driving global consumer-oriented acetal copolymer applications to continued growth.

The acetal copolymers market is primarily influenced by growing demand for advanced engineering plastics in automotive, electronics, medical device, and industrial applications. Transformative capabilities, such as enhanced wear resistance, sustainability via bio-based polymers, and accurate melding for high-tolerance applications, are targeted. Plastics: Focus on New Acetal Copolymer Formulations for Better Chemical Resistance, Light weighting and Mechanical Durability

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Celanese Corporation | 18-22% |

| DuPont | 12-16% |

| Polyplastics Co., Ltd. | 10-14% |

| BASF SE | 8-12% |

| Korea Engineering Plastics | 5-9% |

| Other Companies (combined) | 40-50% |

| Company Name | Key Offerings/Activities |

|---|---|

| Celanese Corporation. | Focuses on high performance acetal copolymers for automotive and consumer electronics and industrial applications, with an emphasis on sustainability and durability. |

| DuPont. | Experts in high-performance acetal copolymers with improved friction and wear properties designed for precision engineering applications. |

| Polyplastics Co.Ltd. | Provide customized acetal copolymers that have better mechanical strength for automotive and medical applications |

| BASF SE. | Industrials: Chemical resistant, lightweight advanced acetal copolymers for industrial and electronic components. |

| Korea Engineering Plastics. | Specializes in high-purity acetal copolymers for use in medical devices, electrical components, and precision gears. |

Key Company Insights

Celanese Corporation (18-22%)

Celanese dominates the acetal copolymers with its tailored high-performance materials that are lightweight, durable, and environmentally sustainable.

DuPont (12-16%)

USA based DuPont has high-wear grade acetal copolymers that are low-friction and high-strength polymers that is used in the industry.

Polyplastics Co.Ltd (10-14%)

Polyplastics specializes in tailored acetal copolymers that provide exceptional mechanical strength and stability for automotive and medical applications.

BASF SE (8-12%)

These high-performance acetal copolymers are engineered by BASF to deliver high chemical resistance and mechanical strength for industrial and electronic applications.

Korea Engineering Plastics (5-9%)

Korea Engineering Plastics provides a portfolio of high-purity acetal copolymers engineered for demanding applications in medical and electrical segments.

Other Key Players (40-50% Combined)

Several companies contribute to the acetal copolymers market by offering industry-specific formulations and advanced polymer solutions. These include:

The Acetal Copolymers Market was valued at approximately USD 676.4 million in 2025.

The market is projected to reach USD 1420.2 million by 2035, growing at a compound annual growth rate CAGR) of 7.7% from 2025 to 2035.

The demand for Acetal Copolymers Market is expected to be driven by its increasing use in the agrochemical industry for the synthesis of herbicides, fungicides, and insecticides; its role in the production of dyes and pigments for textiles, paints, and inks; and its applications in advanced materials such as liquid crystals, OLEDs, and semiconductors.

The top 5 countries contributing to the Acetal Copolymers Market are the United States, China, India, Germany, and Japan.

The Industrial and Consumer Applications segment is expected to lead the Acetal Copolymers market, driven by the growing demand for high-performance engineering plastics in automotive, electronics, and industrial manufacturing.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Ethylene Copolymers Market Analysis by Various Materials, Thickness Capacity Type Through 2035

Polypropylene Random Copolymers Market Growth – Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA