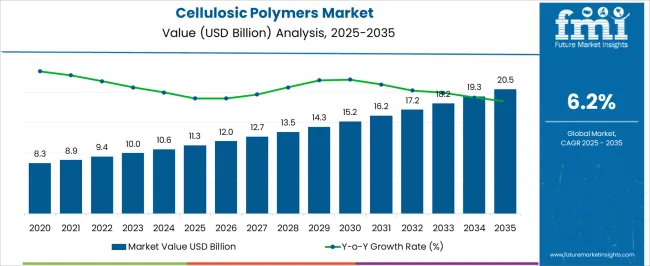

The cellulosic polymers market is projected to grow from USD 11.3 billion in 2025 to USD 20.5 billion by 2035, reflecting a CAGR of 6.2%. During the early adoption phase (2020–2024), manufacturers and end-users gradually explored cellulosic polymers for applications in coatings, films, textiles, and packaging due to their functional properties. By 2025, broader acceptance across multiple sectors will drive market growth. This phase represents the shift from niche usage to wider commercial adoption, as companies expand production capacity and distribution channels, laying the foundation for the scaling phase in the following decade. From 2025 to 2030, the market enters a scaling phase, marked by increased adoption across industrial, consumer, and specialty applications.

The market value is expected to rise from USD 11.3 billion in 2025 as production volumes and integration into diverse applications expand. By 2030, cellulosic polymers are expected to become a standard material choice for many products, paving the way for market consolidation. Between 2030 and 2035, the market is expected to reach USD 20.5 billion, driven by steady CAGR growth. Consolidation occurs as leading producers optimize manufacturing, supply chains, and product portfolios, resulting in a mature and competitive market landscape with stable demand across industries.

| Metric | Value |

|---|---|

| Cellulosic Polymers Market Estimated Value in (2025 E) | USD 11.3 billion |

| Cellulosic Polymers Market Forecast Value in (2035 F) | USD 20.5 billion |

| Forecast CAGR (2025 to 2035) | 6.2% |

The cellulosic polymers market is a significant segment of the broader specialty polymers and biopolymers market. In 2025, cellulosic polymers account for approximately 14% of the total specialty polymers market, reflecting growing adoption across packaging, coatings, films, textiles, and personal care applications. The broader specialty polymers market is projected to grow at a CAGR of around 4–5% during 2025–2035, driven by increasing demand for functional, versatile, and cost-effective polymer solutions across multiple industries.

Within the specialty polymer segment, cellulosic polymers hold an estimated 25% share in 2025, while other polymers including acrylics, polyesters, and polyurethanes account for the remainder. By 2030, scaling adoption is expected to increase the share of cellulosic polymers to nearly 28%, driven by broader integration into industrial, consumer, and specialty applications. Between 2030 and 2035, consolidation is anticipated as leading producers optimize production capacity, distribution networks, and product portfolios. By 2035, cellulosic polymers are projected to account for roughly 29–30% of the specialty polymer segment and approximately 15% of the overall specialty polymers and biopolymers market, solidifying their role as a key growth driver and a reliable contributor to revenue expansion within the parent market.

The cellulosic polymers market is witnessing steady growth, driven by rising adoption in diverse industrial applications due to their biodegradability, non-toxic nature, and functional versatility. Increasing regulatory pressures to reduce synthetic polymer usage, coupled with the push for sustainable raw materials, have accelerated the market’s momentum. Demand is being reinforced by advancements in processing technologies, enabling better performance in coatings, packaging, and specialty applications.

The market is benefiting from robust uptake across both developed and emerging economies, with industry players focusing on expanding production capacities and developing tailored grades for specific end uses. Favorable government initiatives promoting bio-based materials are further influencing adoption trends, while the growing consumer preference for environmentally friendly products supports long-term market prospects.

Strategic collaborations and product innovation are expected to drive penetration into high-value industries, positioning cellulosic polymers as a competitive alternative in multiple sectors. Over the forecast period, stable raw material supply and expanding industrial usage are projected to reinforce market growth potential.

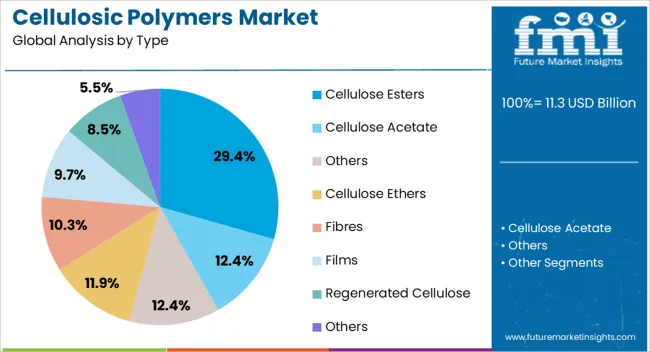

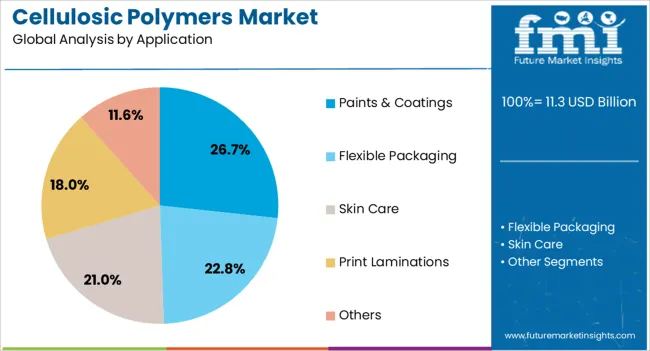

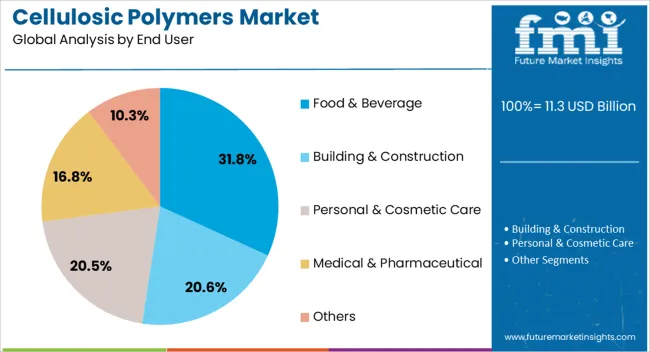

The cellulosic polymers market is segmented by type, application, end user, and geographic regions. By type, cellulosic polymers market is divided into Cellulose Esters, Cellulose Acetate, Others, Cellulose Ethers, Fibres, Films, Regenerated Cellulose, and Others. In terms of application, cellulosic polymers market is classified into Paints & Coatings, Flexible Packaging, Skin Care, Print Laminations, and Others. Based on end user, cellulosic polymers market is segmented into Food & Beverage, Building & Construction, Personal & Cosmetic Care, Medical & Pharmaceutical, and Others. Regionally, the cellulosic polymers industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The cellulose esters segment leads the type category in the cellulosic polymers market, accounting for approximately 29.4% of the total share. This dominance is supported by the segment’s functional benefits, including excellent film-forming capability, high mechanical strength, and enhanced chemical resistance, which make it highly suitable for coatings, plastics, and specialty materials.

Its wide availability and compatibility with various additives have facilitated adoption in multiple industrial applications, ensuring consistent demand across global markets. Technological advancements in cellulose ester production have enabled improved performance characteristics, expanding their scope into high-performance products.

Furthermore, the segment benefits from established manufacturing infrastructure and extensive R&D investments aimed at expanding application areas. With sustainability trends and regulations favoring bio-based materials, cellulose esters are expected to maintain their leadership position, supported by their adaptability in both traditional and advanced material segments.

The paints & coatings segment holds the highest share within the application category, representing around 26.7% of the market. Growth in this segment is driven by the excellent film-forming properties, durability, and chemical resistance of cellulosic polymers, which enhance product performance and surface finish. Their use in paints and coatings is reinforced by the ability to provide superior adhesion, controlled viscosity, and improved environmental compatibility compared to petroleum-based alternatives.

The shift toward low-VOC and eco-friendly formulations in architectural and industrial coatings has further boosted demand for cellulosic polymer-based solutions. Additionally, steady growth in infrastructure development and automotive manufacturing worldwide sustains the segment’s consumption levels.

Manufacturers are increasingly focusing on developing high-purity grades that meet stringent regulatory standards, further strengthening market penetration. With continuous demand from both decorative and protective coating sectors, the paints & coatings segment is expected to retain its dominant position in the application landscape.

The food & beverage segment dominates the end user category in the cellulosic polymers market, contributing approximately 31.8% of the total share. This segment's leadership is attributed to the functional properties of cellulosic polymers as stabilizers, thickeners, and emulsifiers in a wide range of food and drink formulations. Their non-toxic, biodegradable nature aligns with regulatory requirements and consumer demand for clean-label, plant-derived ingredients.

The segment benefits from the versatility of cellulosic polymers in improving texture, shelf life, and processing stability, which are critical for packaged and processed foods. Rising urbanization, growth in the convenience food sector, and increased consumption of ready-to-drink beverages have further driven demand.

Moreover, the ability of cellulosic polymers to replace synthetic additives without compromising performance has strengthened their acceptance in premium and health-focused product lines. With innovation in formulation techniques and expanding global food processing industries, the food & beverage segment is positioned to sustain its leading share over the forecast period.

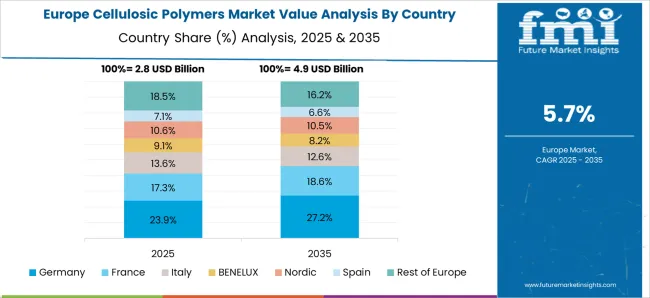

The cellulosic polymers market is expanding due to increasing demand for biodegradable, renewable, and versatile materials across packaging, pharmaceuticals, coatings, and personal care products. North America and Europe lead adoption driven by sustainability regulations, R&D investments, and eco-conscious consumers. Asia-Pacific is growing rapidly due to industrial applications, rising packaging demand, and cost-efficient production. Manufacturers differentiate through viscosity control, solubility, and functional performance. Regional differences in regulatory frameworks, raw material availability, and end-use industries strongly influence adoption, innovation, and global competitiveness.

Increasing demand for sustainable packaging and industrial applications is a major driver for cellulosic polymers. North America and Europe prioritize biodegradable films, coatings, and paper additives to comply with stringent environmental regulations and meet consumer expectations. Asia-Pacific markets adopt polymers in packaging, adhesives, and industrial coatings due to rapid manufacturing expansion and cost-efficiency needs. Differences in end-use industry maturity, environmental regulations, and supply chain infrastructure influence polymer type, viscosity, and functional properties. Leading suppliers provide high-performance, customizable polymers suitable for diverse applications, while regional producers focus on affordable, adaptable solutions. Industrial and packaging application contrasts shape adoption, product design, and competitiveness globally.

Environmental concerns and regulatory pressures are significantly influencing market adoption. North America and Europe implement strict standards promoting biodegradable and renewable polymers, pushing manufacturers to focus on eco-friendly cellulosic products. Asia-Pacific markets follow gradually, balancing cost, production scale, and environmental compliance. Differences in recycling infrastructure, regulatory enforcement, and sustainability awareness drive raw material selection, processing techniques, and product formulation. Leading suppliers invest in cellulose extraction, purification, and functional modification technologies, while regional players focus on cost-effective, locally sourced polymers. Sustainability and regulatory contrasts strongly influence market adoption, operational practices, and competitiveness in global cellulosic polymer markets.

Cellulosic polymers are increasingly used in pharmaceuticals and personal care for drug delivery, film coatings, and stabilizers. North America and Europe focus on high-purity, controlled-viscosity polymers for tablets, capsules, and skincare formulations. Asia-Pacific markets adopt polymers for generic pharmaceuticals, cosmetic creams, and personal care products, balancing cost and functional requirements. Differences in regulatory compliance, formulation complexity, and quality standards influence polymer grade, solubility, and viscosity selection. Leading suppliers provide high-performance, customizable polymers for regulated applications, while regional producers focus on affordable, mid-grade options. Pharmaceutical and personal care application contrasts drive adoption, innovation, and competitiveness globally.

Advances in functional performance, solubility, and material customization are enhancing cellulosic polymer adoption. North America and Europe prioritize high-viscosity, stable polymers with tailored chemical properties for complex applications in coatings, adhesives, and specialty films. Asia-Pacific markets adopt polymers with moderate performance metrics suitable for high-volume, cost-sensitive applications. Differences in processing technologies, end-use requirements, and R&D investments influence polymer grade, functional attributes, and product stability. Leading suppliers provide precision-engineered, high-quality polymers with reproducible performance, while regional players focus on affordable, scalable products. Material innovation contrasts shape adoption, application versatility, and competitiveness in global cellulosic polymer markets.

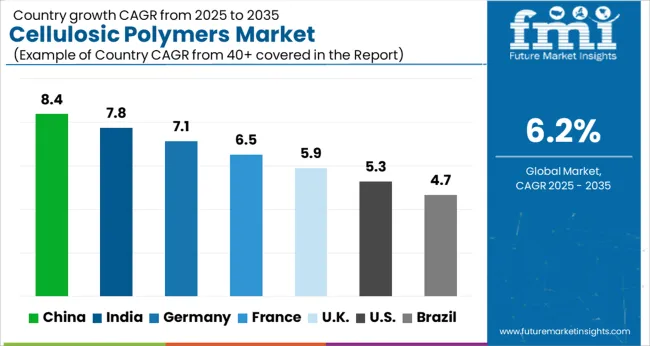

| Country | CAGR |

|---|---|

| China | 8.4% |

| India | 7.8% |

| Germany | 7.1% |

| France | 6.5% |

| UK | 5.9% |

| USA | 5.3% |

| Brazil | 4.7% |

The global cellulosic polymers market is projected to grow at a 6.2% CAGR through 2035, driven by demand in coatings, adhesives, packaging, and specialty applications. Among BRICS nations, China led with 8.4% growth as large-scale production and deployment were executed, while India at 7.8% expanded manufacturing and distribution capacities to meet rising regional and industrial requirements. In the OECD region, Germany at 7.1% maintained steady utilization under strict quality and regulatory standards, while the United Kingdom at 5.9% supported moderate-scale production and application across commercial sectors. The USA, growing at 5.3%, sustained adoption in industrial and specialty applications while complying with federal and state-level regulations. This report includes insights on 40+ countries; the top countries are shown here for reference.

The cellulosic polymers market in China is growing at an 8.4% CAGR, driven by increasing demand from industries such as packaging, textiles, pharmaceuticals, and construction. Rising urbanization and industrialization are fueling the need for sustainable, biodegradable, and high-performance polymer materials. Domestic manufacturers are investing in research and development to enhance polymer properties, including strength, flexibility, and compatibility with various applications. Government regulations promoting environmentally friendly materials and reducing plastic waste are further accelerating adoption. E-commerce and modern retail channels are expanding accessibility for industrial and commercial buyers. Applications in food packaging, coatings, adhesives, and medical products continue to support market growth. Overall, China’s market reflects strong industrial demand, sustainability focus, and technological innovation in polymer production.

India’s cellulosic polymers market is registering a 7.8% CAGR, supported by growing industrial demand and rising awareness of sustainable materials. Sectors such as packaging, coatings, textiles, and pharmaceuticals increasingly rely on cellulosic polymers due to their biodegradability and versatile properties. Domestic manufacturers are expanding production capacities and developing innovative formulations to meet industrial requirements. Government initiatives promoting sustainable materials and reducing plastic consumption further encourage market adoption. E-commerce and modern trade channels are facilitating distribution to commercial buyers and industrial users. Applications in food packaging, medical supplies, and adhesives are driving consistent growth. The market is characterized by increasing investment in production technology, product diversification, and rising demand from end-use industries.

Cellulosic polymers market in Germany is growing at a 7.1% CAGR, driven by strong industrial adoption and environmental sustainability focus. Industries such as packaging, textiles, pharmaceuticals, and construction are increasingly using cellulosic polymers due to their biodegradable and renewable properties. Manufacturers focus on high-quality, performance-enhanced polymers with specialized applications. Regulatory compliance and environmental standards ensure safe and sustainable usage. Industrial buyers prioritize materials that meet strict quality and performance criteria. Technological innovations in polymer processing, coatings, and composites further support growth. The market reflects Germany’s mature industrial landscape, technological sophistication, and growing focus on environmentally friendly materials across various sectors.

The textured vegetable protein market in the United Kingdom is projected to grow at a CAGR of 5.0%, supported by adoption in meat substitutes, processed foods, and ready to eat products. Adoption is being emphasized for proteins that ensure texture, nutritional value, and taste compatibility. Manufacturers are being encouraged to supply reliable, cost effective, and high quality products. Distribution through food processing companies, retail brands, and industrial suppliers is being strengthened. Awareness campaigns highlighting plant based nutrition and health benefits are being conducted. Increasing popularity of vegetarian and vegan diets, growth in processed food consumption, and focus on protein intake are recognized as major contributors to the textured vegetable protein market in the United Kingdom.

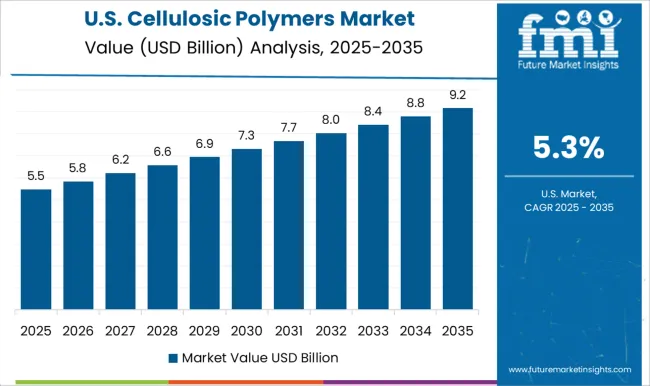

The United States cellulosic polymers market is growing at a 5.3% CAGR, supported by demand from packaging, construction, textiles, and pharmaceutical industries. The need for biodegradable, sustainable, and high-performance materials is encouraging adoption of cellulosic polymers. Manufacturers focus on innovation, enhancing polymer strength, flexibility, and compatibility with industrial processes. Government regulations and environmental standards promote the use of sustainable polymers in packaging and industrial applications. Industrial and commercial buyers are increasingly adopting cellulosic polymers for coatings, adhesives, and food packaging solutions. Technological advancements in polymer processing and formulation are driving product diversification. Overall, the market reflects steady growth supported by sustainability trends, regulatory compliance, and industrial demand.

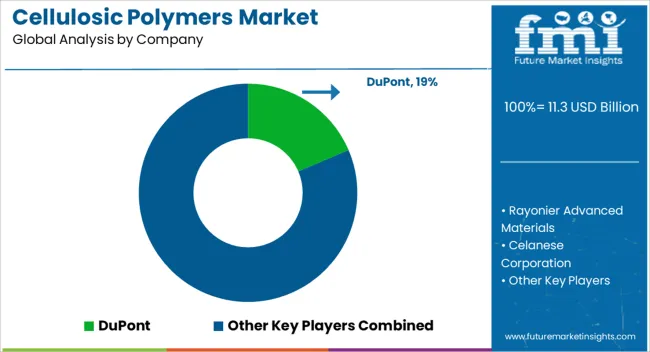

The global cellulosic polymers market is driven by leading suppliers such as DuPont, Rayonier Advanced Materials, Celanese Corporation, Daicel Corporation, Eastman Chemical Company, Borregaard ASA, and Solvay S.A. These companies provide a wide range of cellulose-based products, including cellulose acetate, cellulose ethers, and regenerated cellulose, which are used in industries such as pharmaceuticals, food, textiles, coatings, and packaging. Their offerings are valued for biodegradability, chemical stability, and versatility, allowing manufacturers to develop innovative products with enhanced performance and sustainability. Market leaders focus heavily on research and development to introduce advanced formulations and improve production efficiency. Companies like DuPont and Eastman Chemical Company invest in eco-friendly and high-performance polymers that meet stringent regulatory standards, while Rayonier Advanced Materials and Borregaard ASA emphasize sustainable sourcing of raw materials and renewable cellulose derivatives. Additionally, Celanese Corporation and Daicel Corporation are recognized for their high-quality production capabilities, supporting global supply chains and ensuring consistent product availability for a variety of applications. Sustainability and innovation remain key drivers in the market as demand grows for bio-based, environmentally friendly materials. Suppliers are expanding production capacities, adopting energy-efficient processes, and integrating circular economy principles to reduce environmental impact. By providing technical support, customized solutions, and global distribution networks, leading companies in the cellulosic polymers market maintain competitiveness and meet evolving customer requirements. The combination of advanced technology, product diversity, and sustainability initiatives positions these suppliers at the forefront of the cellulosic polymers industry, addressing both industrial and environmental needs worldwide.

| Item | Value |

|---|---|

| Quantitative Units | USD 11.3 Billion |

| Type | Cellulose Esters, Cellulose Acetate, Others, Cellulose Ethers, Fibres, Films, Regenerated Cellulose, and Others |

| Application | Paints & Coatings, Flexible Packaging, Skin Care, Print Laminations, and Others |

| End User | Food & Beverage, Building & Construction, Personal & Cosmetic Care, Medical & Pharmaceutical, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | DuPont, Rayonier Advanced Materials, Celanese Corporation, Daicel Corporation, Eastman Chemical Company, Borregaard ASA, and Solvay S.A. |

| Additional Attributes | Dollar sales vary by polymer type, including cellulose acetate, cellulose ethers, and cellulose esters; by application, such as coatings, films, adhesives, pharmaceuticals, and textiles; by end-use industry, spanning construction, packaging, automotive, and healthcare; by region, led by North America, Europe, and Asia-Pacific. Growth is driven by demand for biodegradable materials, sustainable alternatives, and versatile industrial applications. |

The global cellulosic polymers market is estimated to be valued at USD 11.3 billion in 2025.

The market size for the cellulosic polymers market is projected to reach USD 20.5 billion by 2035.

The cellulosic polymers market is expected to grow at a 6.2% CAGR between 2025 and 2035.

The key product types in cellulosic polymers market are cellulose esters, cellulose acetate, others, cellulose ethers, fibres, films, regenerated cellulose and others.

In terms of application, paints & coatings segment to command 26.7% share in the cellulosic polymers market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Cellulosic Ethanol Market

Lignocellulosic Biomass Market Analysis - Size, Share, and Forecast Outlook for 2025 to 2035

Biopolymers Market Size and Share Forecast Outlook 2025 to 2035

Cast Polymers Market Size and Share Forecast Outlook 2025 to 2035

Fluoropolymers in Healthcare Market Insights - Size, Trends & Forecast 2025 to 2035

Sulfone Polymers Market Growth - Trends & Forecast 2025 to 2035

Emulsion Polymers Market Size and Share Forecast Outlook 2025 to 2035

Drilling Polymers Market Analysis, Growth, Applications and Outlook 2025 to 2035

Acetal Copolymers Market Growth - Trends & Forecast 2025 to 2035

Specialty Polymers Market Size and Share Forecast Outlook 2025 to 2035

Antiviral Polymers for Packaging Market

Conductive Polymers Market Size and Share Forecast Outlook 2025 to 2035

Ethylene Copolymers Market Analysis by Various Materials, Thickness Capacity Type Through 2035

Polyguanidine Polymers Market Size and Share Forecast Outlook 2025 to 2035

UV-Protecting Polymers Market Size and Share Forecast Outlook 2025 to 2035

Piezoelectric Polymers Market Size and Share Forecast Outlook 2025 to 2035

Cyclic Olefin Polymers (COP) Polymer Syringes Market Size and Share Forecast Outlook 2025 to 2035

Biodegradable Polymers Market Growth 2025 to 2035

Bioresorbable Polymers Market Analysis – Size, Share & Forecast 2025 to 2035

Biocompatible Polymers Market Trend Analysis Based on Product, Polymer, Application, and Region 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA