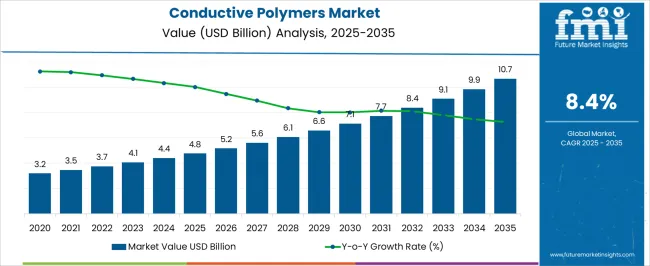

The Conductive Polymers Market is estimated to be valued at USD 4.8 billion in 2025 and is projected to reach USD 10.7 billion by 2035, registering a compound annual growth rate (CAGR) of 8.4% over the forecast period. Over the forecast period, the market is expected to witness substantial growth, driven by the increasing demand for conductive materials in industries like electronics, automotive, and energy storage. From 2025 to 2026, the market will expand by approximately 8.4%, reaching USD 5.2 billion. As applications of conductive polymers in flexible electronics, sensors, and energy storage devices rise, growth continues to gain momentum. This is particularly evident in 2027, where the market is projected to hit USD 6.1 billion, marking a growth rate of 12.8%.

Between 2028 and 2029, the market will experience a more moderate growth rate of 9.8%, with demand for conductive polymers in electric vehicle batteries and printed electronics continuing to fuel expansion. By 2030, the market will surpass USD 7 billion, and a steady increase will continue in the following years. From 2030 to 2035, growth remains steady at around 8-9%, reaching USD 10.7 billion by the end of the forecast period.

| Metric | Value |

|---|---|

| Conductive Polymers Market Estimated Value in (2025 E) | USD 4.8 billion |

| Conductive Polymers Market Forecast Value in (2035 F) | USD 10.7 billion |

| Forecast CAGR (2025 to 2035) | 8.4% |

The conductive polymers market is witnessing accelerated growth due to the rising need for lightweight, flexible, and thermally stable materials across electrical and electronic applications. The market is being influenced by growing investments in miniaturized electronic components, flexible displays, and battery technologies that demand advanced conductive materials with enhanced processability.

Increased focus on reducing EMI and enhancing antistatic properties in packaging and coatings has also contributed to the shift away from traditional metals and carbon-based alternatives toward conductive polymers. These materials offer advantages such as tunable conductivity, chemical resistance, and mechanical strength, which have become crucial in emerging applications including biosensors, wearable devices, and smart packaging.

Additionally, advancements in polymer chemistry and nanocomposite engineering are allowing manufacturers to design materials with precise electrical properties suited to evolving industrial standards Regulatory support for sustainable materials and the reduction of heavy metal content in electronics is expected to further catalyze the adoption of conductive polymers in the coming years.

The conductive polymers market is segmented by conduction mechanism, application, and geographic regions. By conduction mechanism, the conductive polymers market is divided into conducting polymer composites and inherently conductive polymers. In terms of application, the conductive polymers market is classified into Anti-static packaging & coating, Capacitors, Actuators & sensors, Batteries, Solar cells, Electroluminescence, Printed circuit board, and Others. Regionally, the conductive polymers industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

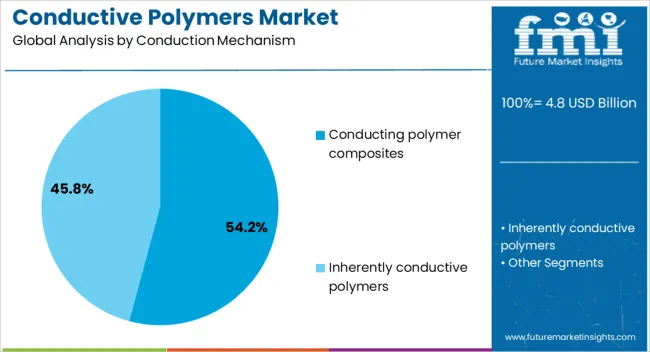

Conducting polymer composites are projected to hold 54.2% of the overall revenue share in the conductive polymers market in 2025. The growth of this segment is being driven by their superior mechanical integrity, ease of fabrication, and enhanced conductivity when combined with functional fillers such as carbon nanotubes, graphene, or metal oxides.

These composites are being increasingly adopted in applications that require a balance between structural performance and electrical functionality, including EMI shielding, sensors, and antistatic components. The ability to tailor composite formulations to specific end-use requirements through adjustable polymer matrices and nanomaterials has enabled broader adoption across sectors.

Their compatibility with scalable processing techniques such as injection molding, extrusion, and 3D printing further supports their use in high-volume industrial production. Additionally, the improved thermal stability and chemical resistance of conducting polymer composites contribute to their reliability in harsh operating environments, which is essential for automotive electronics, energy storage systems, and aerospace components.

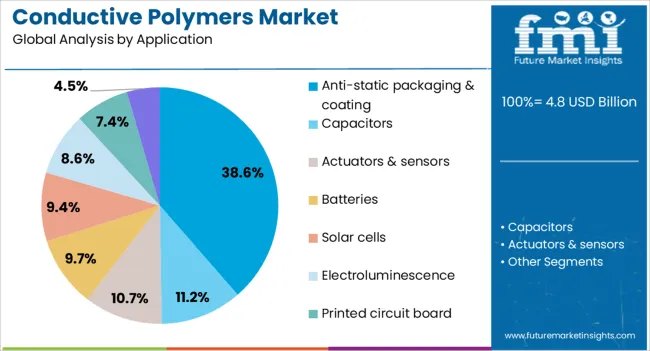

The anti-static packaging and coating segment is expected to contribute 38.6% of the total revenue share in the conductive polymers market by 2025. The increasing demand for static control solutions in electronics manufacturing, semiconductor transport, and sensitive device handling is fueling this growth. Conductive polymers used in anti-static applications offer lightweight, corrosion-free alternatives to conventional metal coatings and conductive fillers.

Their ability to dissipate electrostatic charge without interfering with the performance of delicate components has made them a preferred choice in packaging films, tray systems, and protective coatings. As electronic component density continues to rise, the need for advanced packaging materials that minimize electrostatic damage becomes more critical.

The segment has also gained momentum due to its role in preventing dust attraction and maintaining surface cleanliness in automotive interiors and industrial equipment. The widespread adoption of cleanroom practices and automated material handling systems has further accelerated the integration of conductive polymer-based antistatic solutions in high-tech manufacturing environments.

The conductive polymers market is experiencing growth driven by the increasing demand for advanced materials in electronics, energy storage, and automotive industries. These polymers offer unique properties, including high electrical conductivity, flexibility, and ease of processing, making them ideal for a range of applications such as sensors, capacitors, and anti-static coatings. With the expansion of electronic devices, energy-efficient technologies, and renewable energy systems, the market for conductive polymers is expected to grow. Despite challenges such as high production costs and limited raw material availability, innovations in polymer chemistry continue to drive market growth.

The growth of the optical fiber The primary driver behind the growth of the conductive polymers market is the increasing demand for advanced electronics and energy-efficient technologies. Conductive polymers are increasingly used in the manufacturing of electronic devices such as sensors, displays, and batteries, owing to their unique combination of electrical conductivity and mechanical flexibility. As the global demand for compact, lightweight, and energy-efficient electronics rises, conductive polymers are becoming a preferred choice due to their adaptability and performance in small-scale devices. The expanding use of conductive polymers in energy storage applications, such as in supercapacitors and rechargeable batteries, is driving market growth. The automotive sector's adoption of conductive polymers for applications like anti-static coatings and sensor systems is further contributing to the market’s expansion. The ability of conductive polymers to replace traditional metals in certain applications is also a key factor driving their adoption.connectivity market is primarily driven by the increasing demand for high-speed internet and reliable data transmission. As internet usage continues to rise globally, especially with the growth of streaming services, cloud computing, and IoT devices, the need for faster and more efficient connectivity solutions has become crucial. Optical fiber connectivity, with its high bandwidth and low latency, offers the ideal solution for these needs. Telecommunications companies are increasingly adopting fiber optics to build more efficient communication networks, particularly for 5G backhaul, enabling faster data transmission and improved network performance. The expanding demand for data centers and reliable internet infrastructure further fuels the adoption of optical fiber connectivity.

A significant challenge in the conductive polymers market is the high cost of production, particularly due to the specialized raw materials required for manufacturing. Conductive polymers typically rely on costly monomers and additives, which drive up production expenses. This makes them more expensive than traditional conductive materials like metals, limiting their widespread use in cost-sensitive applications. The availability of raw materials can be limited, as some polymers require rare or specialized chemicals, further contributing to supply chain constraints. Ensuring consistent quality and performance across batches of conductive polymers can also be challenging, as slight variations in material properties can significantly affect the polymer’s conductivity and durability. Manufacturers must continually innovate to lower production costs and improve raw material sourcing to make conductive polymers more commercially viable for a wider range of applications.

The conductive polymers market presents significant opportunities driven by ongoing technological innovations and expanding applications across various industries. Advances in polymer chemistry are enabling the development of more efficient, cost-effective conductive polymers with enhanced properties, such as higher conductivity and greater stability. The growing demand for lightweight and flexible electronic devices, such as wearable technology and flexible displays, is further fueling the market for conductive polymers. The increasing adoption of conductive polymers in energy storage devices, such as batteries and supercapacitors, is opening new growth opportunities, especially with the rise in demand for renewable energy and electric vehicles.The use of conductive polymers in automotive applications, including sensors, fuel cells, and anti-static coatings, provides manufacturers with new avenues for market expansion. The continued growth of the electronics, automotive, and energy sectors presents long-term opportunities for conductive polymers.

A key trend in the conductive polymers market is their increasing integration into smart electronics and green technologies. With the rise of the Internet of Things (IoT) and wearable technology, there is a growing demand for materials that offer both electrical conductivity and mechanical flexibility. Conductive polymers are increasingly being used in the development of flexible sensors, displays, and circuit boards that can be integrated into compact, lightweight, and energy-efficient devices. Furthermore, the growing focus on renewable energy and energy-efficient systems is driving the use of conductive polymers in applications like solar cells, fuel cells, and energy storage devices. Manufacturers are developing polymers that can withstand the environmental challenges of renewable energy systems, making them more suitable for outdoor and long-term use. The push towards greener technologies and the ongoing advancements in polymer design continue to shape the future of conductive polymers in electronics, automotive, and energy applications.

| Country | CAGR |

|---|---|

| China | 11.3% |

| India | 10.5% |

| Germany | 9.7% |

| France | 8.8% |

| UK | 8.0% |

| USA | 7.1% |

| Brazil | 6.3% |

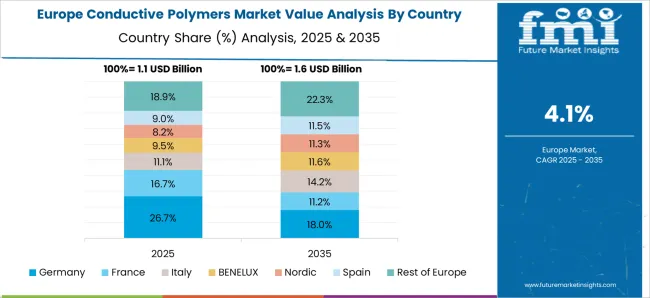

The global conductive polymers market is projected to grow at a CAGR of 8.4% from 2025 to 2035. Among the key markets, China leads with a growth rate of 11.3%, followed by India at 10.5%, and France at 8.8%. The United Kingdom and the United States record more moderate growth rates at 8.0% and 7.1%, respectively. This divergence highlights regional trends: faster growth in emerging markets like China and India, driven by industrial automation, consumer electronics, and electric vehicle advancements. In contrast, developed markets such as the United States and the United Kingdom experience steady demand due to established industries in automotive, energy, and electronics. The analysis spans over 40+ countries, with the leading markets shown below.

China is leading the global conductive polymers market with a projected growth rate of 11.3% CAGR from 2025 to 2035. The country’s rapid industrialization and increasing focus on automation, particularly in manufacturing sectors like automotive, electronics, and robotics, are key factors driving this growth. China’s government policies promoting smart manufacturing are accelerating the adoption of conductive polymers, especially for precision control, speed, and energy efficiency in production processes. The expansion of China’s 3D printing and robotics sectors also demands advanced conductive polymer technologies, increasing market potential.

The conductive polymers market in India is set to grow at a strong pace with a projected CAGR of 10.5% from 2025 to 2035. The growing electronics industry, which is heavily driven by the rise in consumer electronics, automotive, and telecommunications, is fueling the demand for conductive polymers. The increased adoption of advanced materials in electrical components, batteries, and sensors is particularly notable in sectors like automotive, where conductive polymers are used in battery technologies for electric vehicles. Focusing on expanding its manufacturing base and improving infrastructure continues to foster demand for high-performance materials such as conductive polymers, especially in applications requiring energy efficiency.

Demand for conductive polymers in France is projected to grow at a steady pace, with a CAGR of 8.8% from 2025 to 2035. The country’s robust automotive and electronics sectors continue to drive the demand for advanced materials, particularly conductive polymers, which are used in applications such as sensors, coatings, and electronic components. France’s strong focus on energy efficiency is boosting the demand for conductive polymers in energy systems in renewable energy applications. With France’s commitment to electric vehicle development and green technologies, conductive polymers are increasingly being integrated into advanced batteries and energy storage systems, enhancing the market’s growth potential.

The United Kingdom’s conductive polymers market is projected to grow at a CAGR of 8.0% from 2025 to 2035. The increasing adoption of conductive polymers in the UK’s growing electronics sector, especially for applications in sensors, displays, and electrical components, is a major growth driver. The demand for conductive polymers in the automotive and renewable energy sectors is accelerating as the UK continues to focus on electrification. The country’s emphasis on smart grid technologies and energy-efficient solutions is further contributing to the increased usage of conductive polymers in energy storage and management systems, reinforcing the market's expansion.

The conductive polymers market in the United States is projected to grow at a CAGR of 7.1% from 2025 to 2035. The demand for conductive polymers in the US is mainly driven by their use in consumer electronics, automotive applications, and energy-efficient systems. The growing need for lightweight and high-performance materials in electronics, such as flexible displays and conductive coatings, is increasing market demand. The ongoing development of electric vehicles and the shift towards renewable energy technologies are further boosting the adoption of conductive polymers, especially in energy storage, batteries, and conductive films.

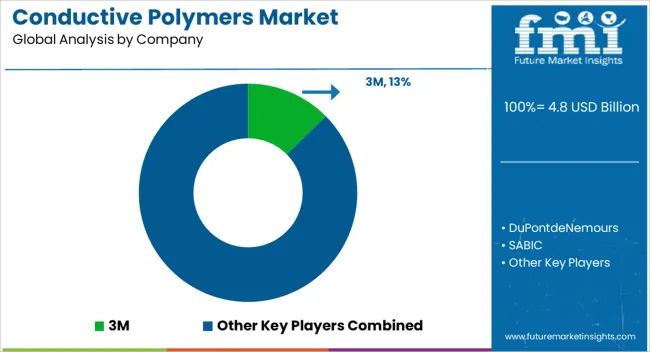

The conductive polymers market is shaped by key global players such as 3M, DuPont de Nemours, SABIC, Agfa-Gevaert, and Covestro AG, which are leading the development of innovative solutions for various applications in electronics, automotive, healthcare, and renewable energy. These companies are investing heavily in research and development to enhance the properties of conductive polymers, especially in the realms of flexible electronics, energy storage, and sensors. Avient Corporation, Celanese Corporation, and Henkel AG provide specialty solutions that cater to specific needs, including coatings, films, and additives used in a variety of industries.

The Lubrizol Corporation focuses on delivering tailored conductive polymer solutions used in automotive, medical, and industrial applications. Companies like Heraeus Holding GmbH, KEMET Corporation, and Westlake Plastics contribute to the market by integrating conductive polymers into critical components for electronics, power systems, and automotive industries. RTP Company, Kenner Material & System, and Premix Oy have established themselves as suppliers of high-performance conductive polymer materials, with specific focus on thermoplastics and elastomers, which have a growing demand across manufacturing sectors.

These companies are not only focused on expanding their product portfolios but are also working on improving the conductivity, stability, and cost-effectiveness of conductive polymers. The rising demand for energy-efficient solutions and advanced materials continues to be a significant driver in this market, alongside the adoption of conductive polymers in emerging applications such as smart textiles, wearables, and flexible displays.

| Item | Value |

|---|---|

| Quantitative Units | USD 4.8 Billion |

| Conduction Mechanism | Conducting polymer composites and Inherently conductive polymers |

| Application | Anti-static packaging & coating, Capacitors, Actuators & sensors, Batteries, Solar cells, Electroluminescence, Printed circuit board, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | 3M, DuPontdeNemours, SABIC, AgfaGevaert, CovestroAG, AvientCorporation, CelaneseCorporation, HenkelAg, TheLubrizolCorporation, HeraeusHoldingGmbH, KEMETCorporation, WestlakePlastics, RTPCompany, KennerMaterial&System, and PremixOy |

| Additional Attributes | Dollar sales by product type (polyaniline, polypyrrole, carbon nanotube-based conductive polymers) and end-use segments (automotive, electronics, renewable energy, healthcare). Demand dynamics are driven by the increasing need for energy-efficient solutions, flexible electronics, and wearable devices, alongside the growing adoption of conductive polymers in electric vehicles, energy storage systems, and smart textiles. Regional trends indicate strong growth in Asia-Pacific, particularly in China and India, driven by the rapid expansion of electronics manufacturing, automotive innovations, and the adoption of renewable energy solutions. North America and Europe show substantial growth due to technological advancements in energy storage, smart devices, and the demand for conductive polymers in high-performance applications. |

The global conductive polymers market is estimated to be valued at USD 4.8 billion in 2025.

The market size for the conductive polymers market is projected to reach USD 10.7 billion by 2035.

The conductive polymers market is expected to grow at a 8.4% CAGR between 2025 and 2035.

In terms of application, anti-static packaging & coating segment to command 38.6% share in the conductive polymers market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Conductive Adhesive Market Size and Share Forecast Outlook 2025 to 2035

Conductive Polymer Coating Market Size and Share Forecast Outlook 2025 to 2035

Conductive Inks Market Size and Share Forecast Outlook 2025 to 2035

Conductive Polymer Packaging Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Conductive Silicone Market Size and Share Forecast Outlook 2025 to 2035

Conductive Fluted Sheets Market Size and Share Forecast Outlook 2025 to 2035

Conductive Cardboard Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Conductive Bags Market from 2025 to 2035

Understanding Market Share Trends in Conductive Inks

Conductive Plastics Market Growth - Trends & Forecast 2025 to 2035

Conductive Foam Market Growth – Trends & Outlook 2024-2034

Conductive Fiber Market Growth – Trends & Forecast 2024-2034

Conductive Ink Printer Market Trends & Industry Growth Forecast 2024-2034

Conductive Textile Market

Transparent Conductive Films Market Size and Share Forecast Outlook 2025 to 2035

Stretchable Conductive Material Analysis by Material, Fillers, Stretching Mechanism, Fabrication, Function, Application, End-User and Region - Forecast for 2025 to 2035

Electrically Conductive Adhesives Market Size and Share Forecast Outlook 2025 to 2035

Electrically Conductive Coating Market Size and Share Forecast Outlook 2025 to 2035

Biopolymers Market Size and Share Forecast Outlook 2025 to 2035

Cast Polymers Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA