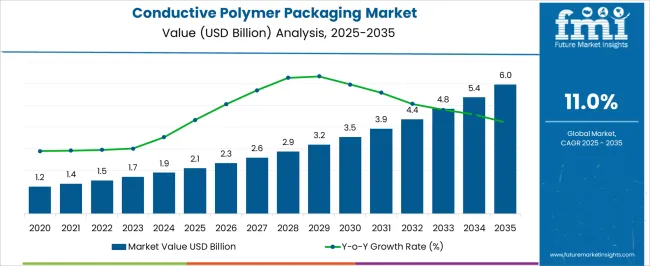

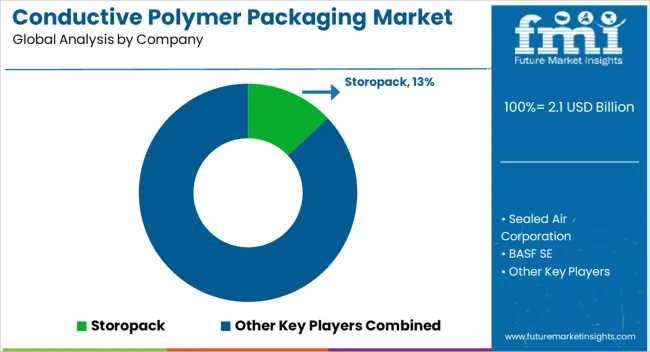

The conductive polymer packaging market is valued at USD 2.1 billion in 2025 and is poised to be worth USD 6.0 billion by 2035, resulting in a total increase of USD 3.9 billion over the forecast decade. This represents a 185.7% total expansion, with the market advancing at a compound annual growth rate (CAGR) of 11.0%. Over ten years, the market grows by a 2.9 multiple.

In the first five years (2025-2030), the market progresses from USD 2.1 billion to USD 3.9 billion, contributing USD 1.8 billion, or 46.2% of total decade growth. This phase is shaped by rising demand for electrostatic discharge protection in semiconductor manufacturing and automotive electronics assembly. Growing electronics production across the Asia-Pacific region reinforces early adoption.

In the second half (2030-2035), the market expands from USD 3.9 billion to USD 6.0 billion, representing an increase of USD 2.1 billion, or 53.8% of the total growth. This acceleration is supported by advanced nanomaterial-enhanced polymers, smart packaging integration, and expanding aerospace applications. Electric vehicle battery packaging and defense electronics create substantial growth opportunities, positioning conductive polymer packaging as critical infrastructure for sensitive electronic components.

| Metric (USD Billion) | Value |

|---|---|

| Conductive Polymer Packaging Market Estimated Value in (2025E) | USD 2.1 Billion |

| Conductive Polymer Packaging Market Forecast Value in (2035F) | USD 6 Billion |

| Forecast CAGR (2025 to 2035) | 11% |

From 2020 to 2024, the conductive polymer packaging market expanded from USD 0.6 billion to USD 1.8 billion, driven by strong demand in electronics manufacturing and automotive component protection. Nearly 60% of revenue came from specialized packaging manufacturers focused on electrostatic discharge prevention and electromagnetic interference shielding. Leading companies emphasized material consistency, surface resistance control, and regulatory compliance across semiconductor and aerospace sectors. Competitive differentiation centered on conductivity uniformity, mechanical durability, and clean room compatibility. Service offerings remained secondary, with most electronics manufacturers prioritizing direct material procurement for high-volume operations.

By 2035, the conductive polymer packaging market will reach USD 6.0 billion, growing at a CAGR of 11.0%, with smart monitoring technologies and biodegradable conductive materials representing over 35% of total value. Competition will intensify as solution providers offer integrated ESD monitoring, real-time conductivity validation, and sustainable polymer alternatives. Established leaders are adapting with hybrid models combining traditional packaging expertise with advanced material science capabilities. Emerging applications in electric vehicle components, renewable energy systems, and medical electronics create new market segments demanding specialized conductive packaging solutions.

The increasing production of sensitive electronic components requiring electrostatic discharge protection is driving growth in the conductive polymer packaging market. These materials provide controlled conductivity levels that safely dissipate static electricity while maintaining mechanical protection. Rising semiconductor manufacturing, electric vehicle production, and aerospace electronics assembly support widespread adoption.

Packaging materials incorporating carbon black, metal fillers, and nanomaterials offer superior shielding against electromagnetic interference while ensuring product integrity during storage and transport. Their compatibility with automated handling systems and clean room environments enhances operational efficiency. Growing regulatory requirements for electronic waste reduction and material traceability align with sustainable conductive polymer development, creating long-term market opportunities.

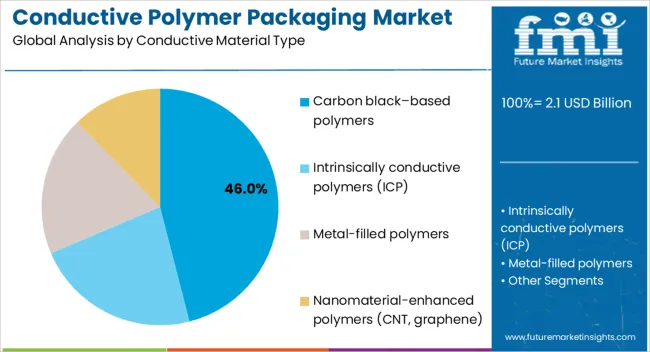

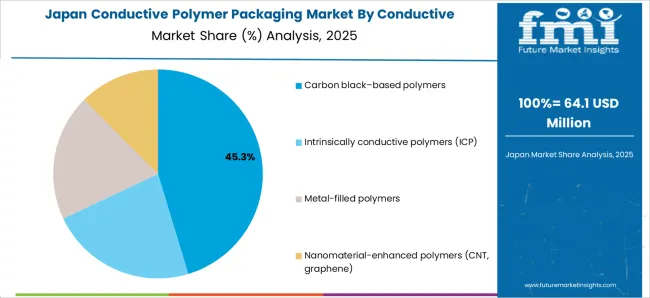

The market is segmented by conductive material type, application, packaging format, and region. Conductive material type includes carbon black-based polymers, intrinsically conductive polymers (ICP), metal-filled polymers, and nanomaterial-enhanced polymers incorporating carbon nanotubes and graphene, each offering specific conductivity ranges and mechanical properties.

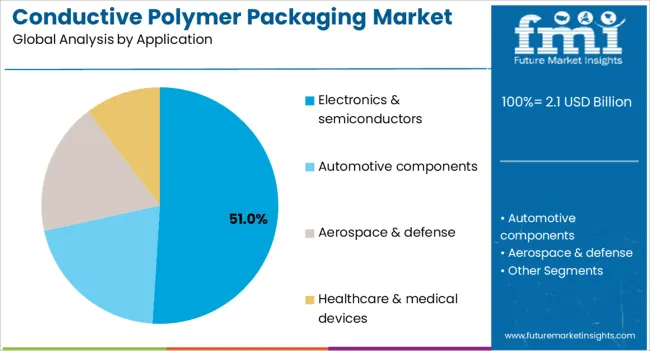

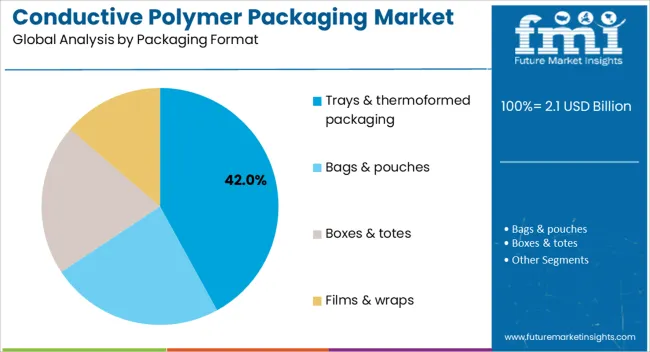

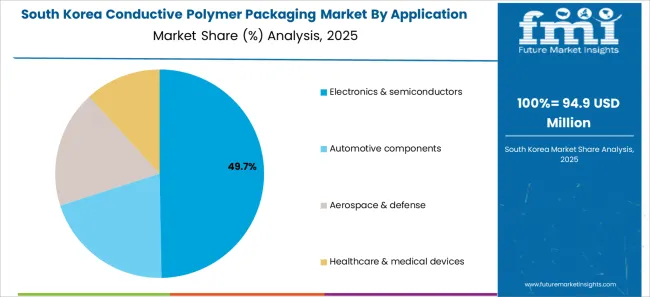

Application segmentation covers electronics & semiconductors, automotive components, aerospace & defense, and healthcare & medical devices, addressing diverse protection requirements. Packaging format includes trays & thermoformed packaging, bags & pouches, boxes & totes, and films & wraps, supporting various product configurations and handling systems. Regionally, the market is segmented into North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa.

Carbon black-based polymers are projected to account for 46.0% of the market in 2025, driven by their proven performance in electronics packaging and manufacturing scalability. These materials provide consistent surface resistance levels between 10^4 and 10^11 ohms per square, making them suitable for most electronic component protection applications. Their established supply chains and regulatory approvals support widespread adoption across semiconductor and automotive sectors.

Manufacturers favor carbon black-based solutions for their compatibility with existing processing equipment and predictable electrical properties. Cost advantages over metal-filled alternatives make them attractive for high-volume applications where moderate conductivity levels meet protection requirements. Ongoing improvements in carbon black dispersion and polymer matrix optimization enhance performance while maintaining economic viability across diverse packaging formats.

Electronics and semiconductors are forecast to represent 51.0% of the market in 2025, reflecting the sector's stringent requirements for electrostatic discharge protection during manufacturing, assembly, and distribution. Semiconductor wafers, integrated circuits, and printed circuit boards require packaging materials with precise conductivity levels to prevent static damage while avoiding electromagnetic interference with sensitive components.

Growing semiconductor production capacity across Asia-Pacific drives substantial demand for specialized packaging materials. Advanced packaging formats for System-in-Package modules and 3D integrated circuits require enhanced protection capabilities. The sector's emphasis on miniaturization and performance creates opportunities for nanomaterial-enhanced polymers offering superior shielding properties in reduced packaging volumes.

Trays and thermoformed packaging are expected to account for 42.0% of the market in 2025, providing secure component positioning and automated handling compatibility in electronics manufacturing. These formats offer precise dimensional control and stackability for efficient storage and transport of sensitive electronic components. Their rigid structure protects against mechanical damage while maintaining consistent electrical properties.

Manufacturing efficiency drives adoption of thermoformed solutions for high-volume electronics assembly operations. Custom cavity designs accommodate specific component geometries while ensuring proper grounding contact. Integration with robotic handling systems and automated inspection equipment supports lean manufacturing practices across semiconductor and automotive electronics production facilities.

The conductive polymer packaging market is expanding as electronics manufacturing requires advanced protection against electrostatic discharge and electromagnetic interference. Rising semiconductor production, electric vehicle electronics, and aerospace applications drive demand for specialized packaging materials. However, material cost premiums and processing complexity challenge broader adoption. Nanomaterial integration, sustainable polymer development, and smart monitoring capabilities represent key innovation trends.

Semiconductor manufacturing expansion creates substantial demand for conductive packaging materials that prevent static discharge damage during wafer handling and component assembly. Electric vehicle production requires specialized protection for battery management systems, power electronics, and sensor components sensitive to electromagnetic interference. Aerospace and defense applications demand materials meeting stringent conductivity specifications while maintaining mechanical integrity under extreme conditions. Growing electronics content in consumer goods, industrial equipment, and medical devices expands addressable markets for conductive polymer packaging across diverse end-use sectors.

Conductive polymers command significant price premiums over conventional packaging materials, limiting adoption in cost-sensitive applications. Processing requires specialized equipment and expertise to achieve consistent electrical properties and surface quality. Meeting industry specifications for surface resistance, electromagnetic shielding, and cleanliness standards adds complexity to manufacturing operations. Limited supplier base for advanced nanomaterial-enhanced polymers creates supply chain constraints. These factors restrict market penetration primarily to applications where electronic protection justifies higher material costs.

Key trends include incorporation of carbon nanotubes and graphene to achieve superior conductivity with reduced filler loading, improving mechanical properties and processability. Biodegradable conductive polymers address environmental concerns while maintaining performance requirements. Smart packaging integration with embedded sensors enables real-time monitoring of electrical properties and environmental conditions. Hybrid materials combining multiple conductive mechanisms offer customized performance profiles for specific applications. These innovations position conductive polymer packaging as a technology platform supporting next-generation electronics manufacturing and protection requirements.

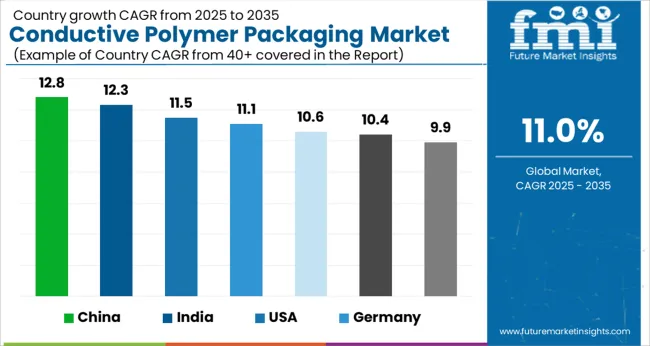

| Countries | CAGR (2025 to 2035) |

|---|---|

| China | 12.80% |

| India | 12.30% |

| USA | 11.50% |

| Germany | 11.10% |

| Japan | 10.60% |

| South Korea | 10.40% |

| Taiwan | 9.90% |

The global conductive polymer packaging market is experiencing robust growth, driven by electronics manufacturing expansion, automotive electrification, and aerospace component protection requirements. Asia-Pacific emerges as the fastest-growing region, with China and India leading adoption due to semiconductor production scaling and electronics assembly investments. Developed markets including the USA, Germany, and Japan focus on advanced materials development, regulatory compliance, and high-performance applications across defense, automotive, and medical electronics sectors.

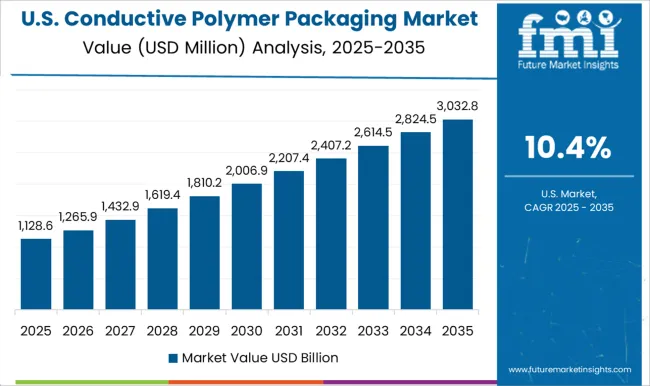

The USA market for conductive polymer packaging is projected to grow at a CAGR of 11.5% from 2025 to 2035, supported by strong aerospace and defense demand, semiconductor fabrication expansion, and electric vehicle production scaling. Electronics manufacturers emphasize advanced packaging materials offering superior electromagnetic interference shielding and electrostatic discharge protection. Defense contractors require materials meeting stringent military specifications for electronic component protection in harsh environments. Semiconductor fabs invest in cleanroom-compatible packaging solutions supporting advanced node production.

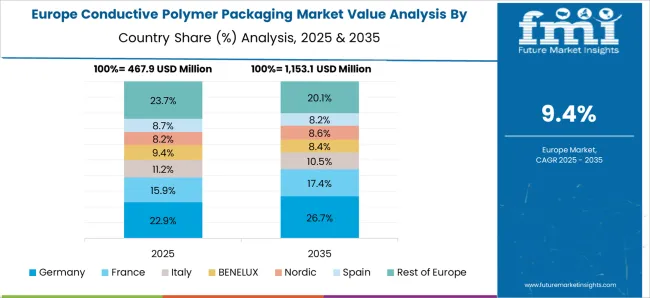

Germany's market for conductive polymer packaging is expected to grow at a CAGR of 11.1%, driven by automotive electronics innovation, Industry 4.0 adoption, and precision manufacturing requirements. Automotive suppliers integrate conductive packaging for electric vehicle battery management systems and autonomous driving sensors. Industrial equipment manufacturers require electromagnetic interference protection for automation components and control systems. Chemical companies develop specialized polymer formulations meeting European Union regulatory requirements while supporting circular economy initiatives.

China's market for conductive polymer packaging is forecast to grow at a CAGR of 12.8%, fueled by expanding electronics manufacturing base, electric vehicle battery packaging requirements, and semiconductor industry development. Domestic electronics manufacturers scale production of consumer devices requiring electrostatic discharge protection during assembly and distribution. Electric vehicle battery producers implement conductive packaging for thermal management systems and power electronics. Semiconductor fabrication facilities adopt cleanroom-compatible materials supporting advanced chip manufacturing processes.

Indian market for conductive polymer is projected to achieve a CAGR of 12.3%, supported by semiconductor assembly investments, electronics manufacturing expansion, and automotive component production growth. Government initiatives promoting electronics manufacturing create demand for specialized packaging materials. Automotive suppliers establish local production capabilities requiring electromagnetic interference protection for electronic control units. Medical device manufacturers adopt conductive packaging for sensitive electronic components in diagnostic and monitoring equipment.

Japan's market for conductive polymer is expected to grow at a CAGR of 10.6%, driven by consumer electronics exports, robotics manufacturing, and automotive electronics innovation. Electronics manufacturers emphasize miniaturization requiring advanced packaging materials with superior electromagnetic shielding properties. Robotics companies integrate conductive packaging for sensor systems and control electronics. Automotive suppliers develop next-generation electric vehicle components demanding specialized protection materials for high-voltage systems.

South Korea's market for conductive polymer packaging is projected to grow at a CAGR of 10.4%, supported by semiconductor packaging scale, electric vehicle ecosystem development, and display manufacturing requirements. Memory chip manufacturers implement advanced packaging materials for high-density storage devices. Electric vehicle battery producers integrate conductive packaging for safety systems and power management electronics. Display manufacturers adopt electromagnetic interference shielding materials for high-resolution screen production and component protection.

The conductive polymer packaging market demonstrates moderate concentration, with specialized materials companies, packaging manufacturers, and chemical producers competing across electronics, automotive, and aerospace applications. Storopack leads with 13.0% market share in 2025, followed by established players including Sealed Air Corporation, BASF SE, and RTP Company, emphasizing material innovation, processing expertise, and regulatory compliance. Strategic focus centers on conductivity consistency, mechanical performance, and clean room compatibility.

Mid-tier companies including Parker Hannifin, Celanese Corporation, and Techflex Inc. support market development through specialized formulations, custom packaging solutions, and application-specific material optimization. These providers focus on automotive electronics, medical device packaging, and industrial component protection, offering tailored solutions for electromagnetic interference shielding and electrostatic discharge prevention across diverse operating environments.

Regional specialists including Miller Packaging, Conductive Containers Inc., and Covestro AG address local market requirements through customized packaging formats, rapid prototype development, and technical support services. Their capabilities include small-batch production, material testing validation, and regulatory compliance assistance, enabling electronics manufacturers to implement conductive packaging solutions efficiently while meeting industry-specific performance and safety requirements.

| Item | Value |

|---|---|

| Quantitative Units | USD 2.1 Billion |

| By Conductive Material Type | Carbon Black-Based Polymers, Intrinsically Conductive Polymers (ICP), Metal-Filled Polymers, Nanomaterial-Enhanced Polymers (CNT, Graphene) |

| By Application | Electronics & Semiconductors, Automotive Components, Aerospace & Defense, Healthcare & Medical Devices |

| By Packaging Format | Trays & Thermoformed Packaging, Bags & Pouches, Boxes & Totes, Films & Wraps |

| Regions Covered | North America, Europe, East Asia, South Asia & Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Germany, India, China, United Kingdom, Japan, Brazil |

| Key Companies Profiled | Storopack, Sealed Air Corporation, BASF SE, RTP Company, Parker Hannifin, Celanese Corporation, Techflex Inc., Miller Packaging, Conductive Containers Inc., Covestro AG |

| Additional Attributes | Dollar sales by conductive material type, application, and packaging format, regional demand trends across North America, Europe, and Asia-Pacific, competitive landscape with established players and emerging startups, buyer preferences for sustainable versus conventional materials, integration with AI-driven design and digital manufacturing platforms, innovations in multi-material packaging capabilities and closed-loop recycling systems, and adoption of smart packaging solutions with embedded sensors, QR codes, and interactive features for enhanced consumer engagement. |

The global conductive polymer packaging market is estimated to be valued at USD 2.1 billion in 2025.

The market size for the conductive polymer packaging market is projected to reach USD 6.0 billion by 2035.

The conductive polymer packaging market is expected to grow at a 11.0% CAGR between 2025 and 2035.

The key product types in conductive polymer packaging market are carbon black–based polymers, intrinsically conductive polymers (icp), metal-filled polymers and nanomaterial-enhanced polymers (cnt, graphene).

In terms of application, electronics & semiconductors segment to command 51.0% share in the conductive polymer packaging market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Conductive Adhesive Market Size and Share Forecast Outlook 2025 to 2035

Conductive Inks Market Size and Share Forecast Outlook 2025 to 2035

Conductive Silicone Market Size and Share Forecast Outlook 2025 to 2035

Conductive Fluted Sheets Market Size and Share Forecast Outlook 2025 to 2035

Conductive Cardboard Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Conductive Bags Market from 2025 to 2035

Understanding Market Share Trends in Conductive Inks

Conductive Plastics Market Growth - Trends & Forecast 2025 to 2035

Conductive Foam Market Growth – Trends & Outlook 2024-2034

Conductive Fiber Market Growth – Trends & Forecast 2024-2034

Conductive Ink Printer Market Trends & Industry Growth Forecast 2024-2034

Conductive Textile Market

Conductive Polymer Coating Market Size and Share Forecast Outlook 2025 to 2035

Conductive Polymers Market Size and Share Forecast Outlook 2025 to 2035

Anisotropic Conductive Liquid Paste Market Size and Share Forecast Outlook 2025 to 2035

Transparent Conductive Films Market Size and Share Forecast Outlook 2025 to 2035

Stretchable Conductive Material Analysis by Material, Fillers, Stretching Mechanism, Fabrication, Function, Application, End-User and Region - Forecast for 2025 to 2035

Electrically Conductive Adhesives Market Size and Share Forecast Outlook 2025 to 2035

Electrically Conductive Coating Market Size and Share Forecast Outlook 2025 to 2035

Polymer Mixing Unit Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA