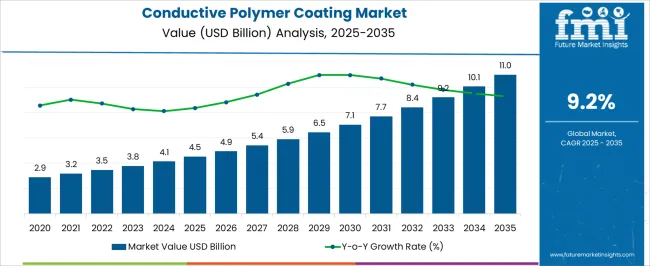

The Conductive Polymer Coating Market is estimated to be valued at USD 4.5 billion in 2025 and is projected to reach USD 11.0 billion by 2035, registering a compound annual growth rate (CAGR) of 9.2% over the forecast period.

| Metric | Value |

|---|---|

| Conductive Polymer Coating Market Estimated Value in (2025 E) | USD 4.5 billion |

| Conductive Polymer Coating Market Forecast Value in (2035 F) | USD 11.0 billion |

| Forecast CAGR (2025 to 2035) | 9.2% |

The conductive polymer coating market is progressing steadily, shaped by rising demand for lightweight, flexible, and highly conductive materials across modern electronics and energy applications. Industry publications and company disclosures have highlighted the increasing integration of conductive coatings in advanced displays, batteries, sensors, and photovoltaic devices, where they enhance performance and durability.

The shift toward miniaturization and flexible electronics has particularly stimulated adoption, as conductive polymers provide both electrical conductivity and mechanical adaptability. Additionally, advancements in nanotechnology and surface engineering have improved coating uniformity, adhesion, and long-term stability, broadening the scope of applications.

Growing R&D investments by electronics manufacturers and partnerships with chemical companies are fueling the commercialization of innovative polymer formulations. Furthermore, sustainability initiatives have encouraged the use of polymers with lower environmental impact compared to heavy metal-based coatings. Looking forward, demand is expected to be driven by next-generation displays, wearable devices, and the continued expansion of the electrical and electronics industries, positioning conductive polymer coatings as a critical enabler of future technologies.

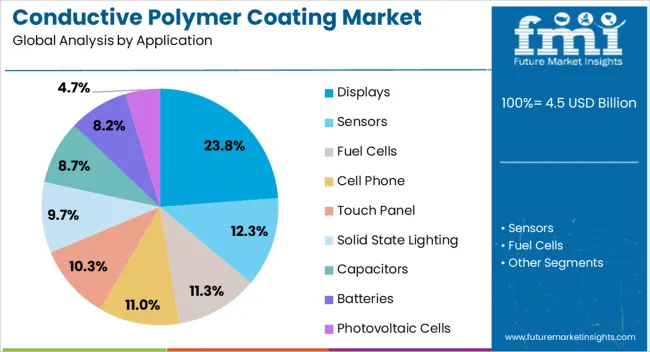

The Displays segment is projected to contribute 23.8% of the conductive polymer coating market revenue in 2025, establishing itself as a major application area. Growth of this segment has been propelled by the increasing demand for high-resolution, energy-efficient, and flexible display technologies across smartphones, tablets, televisions, and wearable devices.

Conductive polymer coatings have been widely adopted in displays due to their ability to enhance transparency, conductivity, and flexibility without compromising image quality. Research in display engineering has emphasized the effectiveness of these coatings in replacing traditional indium tin oxide (ITO), particularly in flexible and curved screens.

Moreover, the rising consumer preference for thinner, lighter devices has supported the adoption of conductive polymers, which enable manufacturers to meet both performance and design goals. As display technologies such as OLED and foldable screens continue to expand, the Displays segment is expected to experience sustained demand, driven by innovation cycles and consumer electronics growth.

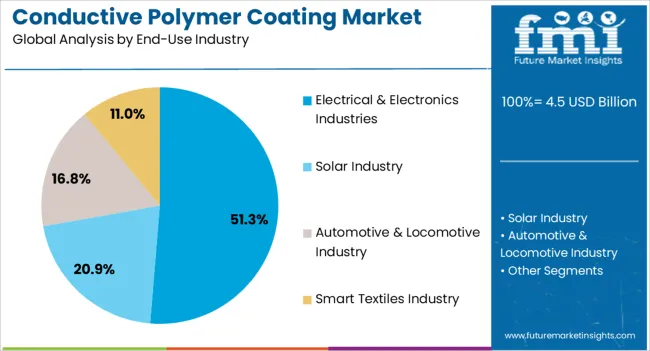

The Electrical & Electronics Industries segment is projected to account for 51.3% of the conductive polymer coating market revenue in 2025, maintaining its position as the leading end-use sector. Growth in this segment has been supported by the widespread application of conductive coatings in semiconductors, printed circuit boards, capacitors, and energy storage systems.

Industry reports and company press releases have highlighted that conductive polymers improve device performance by enhancing conductivity, providing electrostatic discharge protection, and enabling miniaturization of electronic components. Additionally, the surge in demand for consumer electronics, electric vehicles, and renewable energy systems has expanded the usage of conductive coatings in critical components.

Continuous innovation in polymer chemistry and coating techniques has further improved reliability and cost-efficiency, encouraging adoption at scale. With the global electronics industry witnessing rapid advancements and high R&D spending, the Electrical & Electronics Industries segment is expected to remain the dominant consumer of conductive polymer coatings, reinforcing its market leadership.

The rising demand for high-quality performance and durability in electronic devices drives the adoption of conductive polymer coatings. Increasing consumer demand for technologies like 5G and the Internet of Things (IoT) is corresponding to a surge in the need for efficient coatings.

The conductive polymers provide superior conductivity, flexibility, and strength for the complexity and miniaturization of electronic gadgets. Conductive polymers offer a lightweight and customizable option that can adopt multiple shapes and sizes of electronic components. Industries overcome design development challenges and optimize product performance by utilizing this coating.

Conductive polymer coating plays a vital role in organic solar cells by offering efficient charge transport and collection. Global demand for conductive polymer coatings has shifted toward sustainable energy solutions. Hence, organic solar cells ensure a promising avenue for producing renewable energy.

Developmental and Regulatory Impediments

Developing regions encounter obstacles in resource reallocation, hindering the adoption of new technologies. An efficient economy can develop quickly, but inefficient resource allocation leads to sluggish technology adoption, affecting overall growth.

Heterogeneous Firms and Idiosyncratic Shocks

Implementing new technologies is crucial for long-term growth. However, developmental and regulatory barriers hinder this renewal process, leading to income gaps of more than 50% between developed and developing countries. It is essential to address these distortions to maximize the benefits of market reform.

Conductive polymer coatings have several applications, and sensors play an important role in driving their expansion, accounting for an industry share of 21.4%.

Polymer coatings are widely optimal for numerous applications, with sensors are crucial here. These coatings are developed using organic polymer materials that conduct electricity, making them suitable for applications in electrical storage devices and solar cells. They are less toxic and environmentally destructive than metals, making them popular for transparent displays on computers, mobile phones, and tablets.

Medical devices rely on these coatings for electrode sensitivity and signal fidelity, while gas and vapor sensing applications use them to detect a wide range of gases and vapors. They are also used in optical and electronic materials, super-capacitors, bio-implants, and corrosion protection for electrical energy storage.

| Attributes | Details |

|---|---|

| Application | Sensors |

| Industry Share (2025) | 21.4% |

The electrical and electronics industries play a crucial role in driving the growth of the conductive polymer coating sector, commanding an industry share of 31.7%.

Electrically conductive coatings are extensively used in the electronics and electrical sectors for shielding and anti-static purposes. They are made from several types of coatings like acrylics, epoxies, and polyesters, known for their scratch resistance, chemical resistance, and durability.

Polymer coatings also help prevent electrostatic and electromagnetic interferences (EMI). The aerospace sector also utilizes electrically conductive coatings due to technological developments and the increasing demand for safety in electronic boards. The construction sector also adopts these coatings.

| Attributes | Details |

|---|---|

| End-use industry | Electrical & Electronics industries |

| Industry Share (2025) | 31.7% |

The table below depicts an interesting estimate of prospective potential in significant countries. The projection shows the rising demand for conductive polymer coating, especially in China and India. As a result, Asia Pacific is the key industry, with Europe experiencing robust demand and growth.

| Countries | CAGR (2025 to 2035) |

|---|---|

| United State | 5.2% |

| Spain | 7% |

| France | 6.5% |

| China | 10.4% |

| India | 13.9% |

The solar power sector is experiencing significant growth in the United States, with a projected 5.2% CAGR from 2025 to 2035 for the conductive polymer coating market. The vital properties of conductive polymers, such as large charge transfers and electro-catalysis, are essential for solar cells. The increasing investment in research projects within the solar battery industries has driven the demand.

Spain is transitioning to renewable energy sources, with a projected 7% CAGR for its conductive polymer coating market by 2035. Conductive polymers play a crucial role in solar panels and related technologies in Spain. Properties such as lightweight coatings are advantageous for the automotive industry, especially in electric vehicles, where lightweight components drive industry growth.

France is a prominent country in energy-efficient lighting solutions, particularly in electroluminescence and consumer electronics. A 6.5% CAGR is predicted for its conductive polymer coating market by 2035. In France, conductive coatings are utilized in signage, displays, and automotive lighting. In the electronics industry, consumer demand is driving the growth of these coatings, especially in multiple-device touchscreens and other electronic devices, leading to an increase in the demand growth rate.

The conductive polymer coating market in China is expected to register a CAGR of 10.4% over the forecast period. China, a global leader in electronics manufacturing, uses conductive coatings in electronic components such as PCBs, sensors, and connectors. Its solar energy sector is also booming, with efficient solar cell performance being crucial for this industry.

The conductive polymer coating market is set to progress at a CAGR of 13.9% in India for the forecast period. India's rapidly growing electronics industry is attracting polymer coatings for applications like anti-static packaging and PCBs, while the country's increasing focus on affordable solar solutions is driving demand for solar panels and batteries.

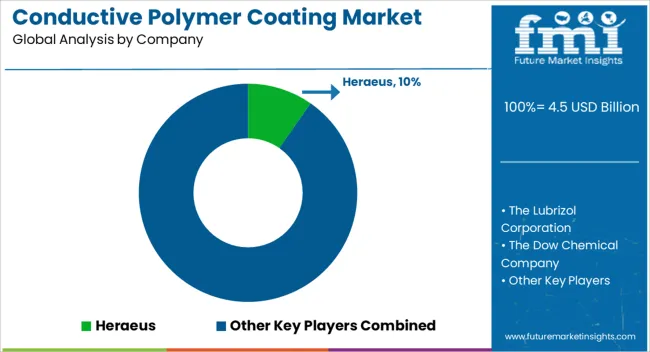

Conductive polymer coatings' global demand is driven by intense competition among key players striving to hold a significant industry share. They are aiming to invest in research and development to enhance the conductivity and properties of these polymer coatings while also exploring new applications. Strategies employed by industry players to enhance their position in the plastic additives industry include:

New Product Launches

Collaboration and Partnerships

Example: Polymer manufacturer collaborating with university's materials science.

Investments in Research and Development

Conductive polymer coatings companies in APAC are among the main players in this sector, including

Recent Developments in the Conductive Polymer Coating Market

Conductive polymer coating find application in sensors, fuel cells, cell phones, displays, touch panels, solid state lighting, displays, capacitors, batteries, and photovoltaic cells.

Top end-use industries consuming these coatings are solar industry, automotive & locomotive industry, electrical & electronics industries, and smart textiles.

Regional analysis of the industry includes North America, Latin America, Asia Pacific, Japan, Western Europe, Eastern Europe, Middle East & Africa

The global conductive polymer coating market is estimated to be valued at USD 4.5 billion in 2025.

The market size for the conductive polymer coating market is projected to reach USD 11.0 billion by 2035.

The conductive polymer coating market is expected to grow at a 9.2% CAGR between 2025 and 2035.

The key product types in conductive polymer coating market are displays, sensors, fuel cells, cell phone, touch panel, solid state lighting, capacitors, batteries and photovoltaic cells.

In terms of end-use industry, electrical & electronics industries segment to command 51.3% share in the conductive polymer coating market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Conductive Polymer Packaging Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Conductive Polymers Market Size and Share Forecast Outlook 2025 to 2035

Fluoropolymer Coating Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Electrically Conductive Coating Market Size and Share Forecast Outlook 2025 to 2035

Corrosion Protection Polymer Coating Market 2022 to 2032

Polymer Mixing Unit Market Size and Share Forecast Outlook 2025 to 2035

Polymeric Brominated Flame Retardants Market Size and Share Forecast Outlook 2025 to 2035

Polymer-based Prefilled Syringe Market Size and Share Forecast Outlook 2025 to 2035

Polymer Modified Bitumen Market Forecast and Outlook 2025 to 2035

Polymer Stabilizers Market Size and Share Forecast Outlook 2025 to 2035

Polymeric Adsorbents Market Size and Share Forecast Outlook 2025 to 2035

Conductive Adhesive Market Size and Share Forecast Outlook 2025 to 2035

Polymerization Initiator Market Size and Share Forecast Outlook 2025 to 2035

Polymer Processing Aid (PPA) Market Size and Share Forecast Outlook 2025 to 2035

Conductive Inks Market Size and Share Forecast Outlook 2025 to 2035

Polymer Feed System Market Size and Share Forecast Outlook 2025 to 2035

Polymer Bearings Market Size and Share Forecast Outlook 2025 to 2035

Coating Pretreatment Market Size and Share Forecast Outlook 2025 to 2035

Polymer Surge Arrester Market Size and Share Forecast Outlook 2025 to 2035

Polymer Nanomembrane Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA