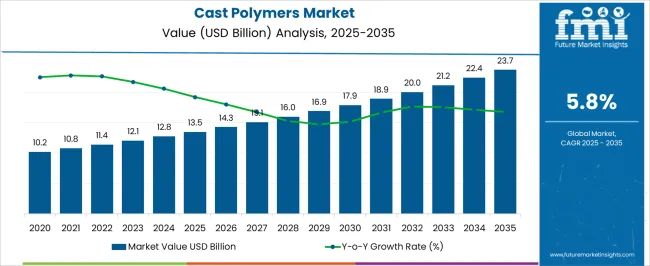

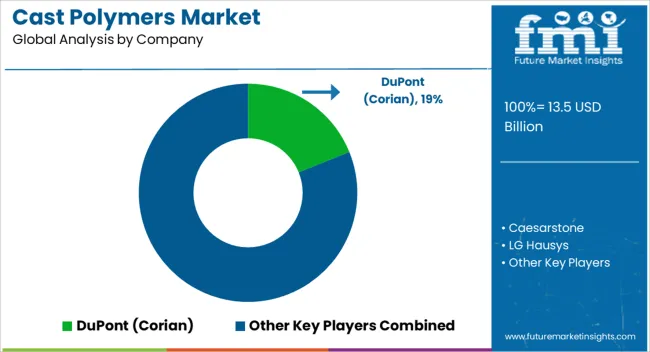

The cast polymers market is estimated to be valued at USD 13.5 billion in 2025 and is projected to reach USD 23.7 billion by 2035, registering a compound annual growth rate (CAGR) of 5.8% over the forecast period.

The cast polymers market, valued at USD 13.5 billion in 2025 and projected to reach USD 23.7 billion by 2035 with a CAGR of 5.8%, demonstrates a growth trajectory characteristic of a market in the growth-to-maturity transition phase. Early adoption was driven by the need for durable, lightweight, and versatile polymer materials in construction, interior design, and industrial applications. By 2025, the market reflects a consolidation of early adopter and early majority segments, indicating broader acceptance of cast polymer solutions across both commercial and residential sectors. The moderate yet steady growth from USD 13.5 billion in 2025 to USD 23.7 billion in 2035 suggests that the market is entering the maturity stage of the adoption lifecycle, where incremental innovations, product differentiation, and cost optimization are key drivers.

Adoption has been influenced by enhanced material properties, customization capabilities, and integration with complementary surface finishing technologies. Manufacturers focus on improving production efficiency, reducing cycle times, and enhancing aesthetic versatility to appeal to a wider consumer base. Market penetration varies regionally, with mature markets exhibiting slower growth rates as adoption reaches saturation, while emerging regions continue to see expanding uptake. The market reflects a lifecycle characterized by steady adoption, gradual saturation, and emphasis on incremental innovation, positioning it as a mature but dynamically evolving sector within the broader polymer materials industry.

| Metric | Value |

|---|---|

| Cast Polymers Market Estimated Value in (2025 E) | USD 13.5 billion |

| Cast Polymers Market Forecast Value in (2035 F) | USD 23.7 billion |

| Forecast CAGR (2025 to 2035) | 5.8% |

The cast polymers market represents a specialized segment within the global synthetic materials and construction products industry, emphasizing durability, aesthetic versatility, and chemical resistance. Within the broader polymers and resins sector, it accounts for about 5.3%, driven by demand in architectural surfaces, countertops, and sanitary applications. In the engineered materials segment, it secures 4.7%, reflecting adoption in industrial components, decorative panels, and custom molding applications. Across the construction and interior design materials market, the share is 4.1%, supporting use in flooring, wall cladding, and furniture. Within the solid surface and composite materials category, it represents 3.8%, highlighting high-performance applications that require non-porous, seamless finishes.

In the specialized manufacturing and fabrication sector, it contributes about 3.4%, emphasizing precision casting and tailored product designs for both functional and aesthetic requirements. Recent developments in this market have focused on formulation innovation, surface finishing, and application diversity. Innovations include UV-stable, scratch-resistant, and antibacterial cast polymer surfaces for residential, commercial, and healthcare environments. Key players are collaborating with interior design firms, industrial manufacturers, and construction companies to expand applications and introduce custom-colored, textured, and lightweight options.

Adoption of sustainable and low-VOC resins, advanced molding techniques, and seamless installation methods is gaining traction to meet environmental standards and aesthetic demands. 3D casting and CNC machining integration is being deployed to create intricate designs and customized solutions. These trends demonstrate how durability, versatility, and technological advancement are shaping the market.

The cast polymers market is experiencing steady growth driven by increasing demand for durable, aesthetically versatile, and low-maintenance surfacing materials across residential and commercial projects. Rising consumer preference for premium finishes and the ability of cast polymers to replicate natural stone while offering superior performance characteristics are fueling adoption.

Technological advancements in resin formulations and manufacturing processes have enhanced product durability, stain resistance, and design flexibility. Sustainability considerations are also influencing the market, with manufacturers integrating recycled content and eco-friendly resins.

Expanding construction activities, particularly in emerging economies, coupled with renovation trends in developed regions, are further supporting market expansion. The outlook remains strong as the sector continues to benefit from shifting design trends, performance enhancements, and growing acceptance of engineered materials in high-traffic and high-moisture environments.

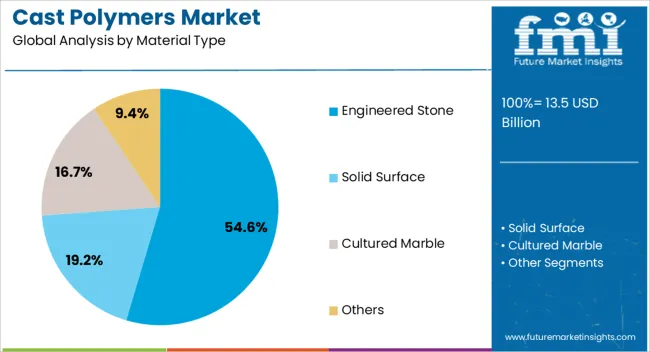

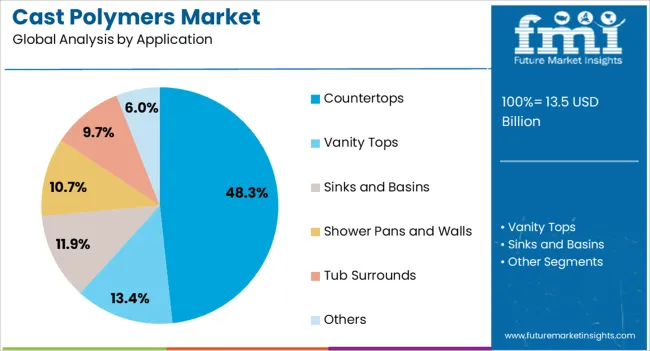

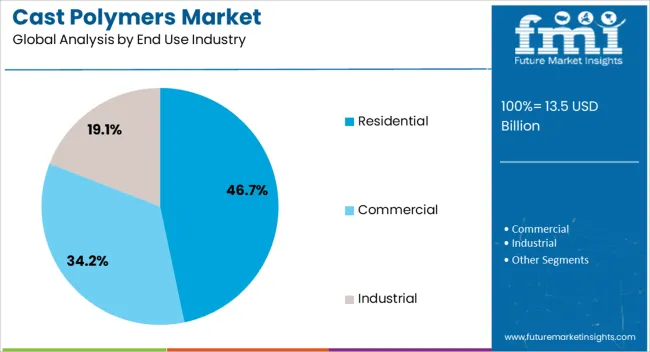

The cast polymers market is segmented by material type, application, end use industry, and geographic regions. By material type, cast polymers market is divided into engineered stone, solid surface, cultured marble, and others. In terms of application, cast polymers market is classified into countertops, vanity tops, sinks and basins, shower pans and walls, tub surrounds, and others. Based on end use industry, cast polymers market is segmented into residential, commercial, and industrial. Regionally, the cast polymers industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The engineered stone segment is expected to hold 54.6% of the total market revenue by 2025, positioning it as the leading material type. Its dominance is supported by superior durability, low porosity, and a consistent aesthetic that meets modern design preferences.

Engineered stone offers high resistance to stains, scratches, and heat, making it suitable for demanding applications. The material’s flexibility in colors and patterns, along with lower maintenance requirements compared to natural stone, has expanded its adoption in residential and commercial interiors.

Continuous innovation in manufacturing processes and the introduction of recycled content have further strengthened its market position.

The countertops segment is projected to account for 48.3% of total market revenue by 2025, making it the most prominent application category. This growth is driven by rising kitchen and bathroom remodeling activities, increased urban housing development, and heightened consumer demand for functional yet visually appealing surfaces.

Cast polymer countertops offer customization in design, ease of installation, and a balance of durability with cost-effectiveness.

Their compatibility with a variety of interior styles and the growing popularity of open kitchen layouts have reinforced their leadership within the application segment.

The residential segment is forecasted to contribute 46.7% of the total market revenue by 2025, positioning it as the largest end use industry. This growth is being fueled by expanding residential construction, urbanization, and the surge in home improvement projects.

Homeowners are increasingly opting for materials that combine luxury aesthetics with practical benefits, and cast polymers fit this requirement effectively. Enhanced performance features such as moisture resistance and ease of cleaning are particularly valued in residential kitchens and bathrooms.

As disposable incomes rise and personalization in home design becomes more prominent, the residential sector is expected to maintain its leading role in market demand.

The market has expanded significantly due to their use in architectural, decorative, industrial, and sanitary applications. Cast polymers, created through molding techniques, offer superior durability, corrosion resistance, and design flexibility compared to conventional materials. Their adoption has been driven by rising construction activity, renovation projects, and the preference for aesthetic and functional surfaces in residential, commercial, and industrial spaces. Increasing demand for countertops, sinks, bathtubs, and decorative panels has fueled market growth. Manufacturers are investing in advanced molding technologies, high-performance resins, and color customization to meet evolving design and durability requirements.

Cast polymers are widely utilized in architectural and interior design projects due to their adaptability, visual appeal, and functional benefits. Countertops, wall cladding, sinks, bathtubs, and decorative panels are fabricated from high-quality cast polymers that provide seamless finishes and resistance to impact, heat, and chemicals. Customizable colors, textures, and finishes allow designers to achieve aesthetic objectives while maintaining material performance. In commercial spaces, such as hotels, offices, and retail establishments, cast polymers have been increasingly used for durable, low-maintenance surfaces. Rising consumer preference for visually appealing, long-lasting materials, combined with expanding construction and renovation activity, continues to support demand in this sector.

The use of cast polymers in industrial and infrastructure projects is rising due to their chemical resistance, structural integrity, and lightweight properties. Applications include chemical storage tanks, industrial countertops, laboratory benches, and architectural facades. Resistance to corrosion, UV exposure, and environmental degradation makes cast polymers suitable for harsh operational conditions. Additionally, prefabricated cast polymer components are employed in modular construction and infrastructure projects, reducing installation time and maintenance costs. Increasing awareness of long-term operational efficiency, coupled with the need for durable and reliable materials in industrial and public infrastructure, has strengthened their adoption and broadened market opportunities.

Advances in casting technologies, polymer chemistry, and processing techniques have improved the performance, durability, and design potential of cast polymers. Innovations such as vacuum casting, compression molding, and rotational molding have allowed for complex geometries, consistent quality, and defect reduction. High-performance resins and composites have enhanced resistance to impact, chemicals, and thermal stress. Surface finishing techniques, including polishing, texturing, and color integration, have expanded aesthetic applications. Additionally, integration with sustainable materials and eco-friendly resins is gaining traction, enabling manufacturers to align with environmental regulations while meeting performance and design requirements. Continuous technological improvements are critical for expanding applications and maintaining competitive differentiation in the market.

Despite growth, the cast polymers market faces challenges due to fluctuations in raw material prices, primarily polymers and resins, which affect production costs. Environmental regulations concerning volatile organic compounds, polymer recyclability, and sustainable manufacturing practices have imposed additional compliance requirements. Energy-intensive manufacturing processes and chemical usage also raise operational and regulatory scrutiny. Market participants must balance cost efficiency with environmental compliance while maintaining material quality and performance. Investments in research for alternative materials, recycling processes, and energy-efficient production methods are essential to overcome these challenges. Addressing these factors is critical to ensure long-term market sustainability and competitiveness.

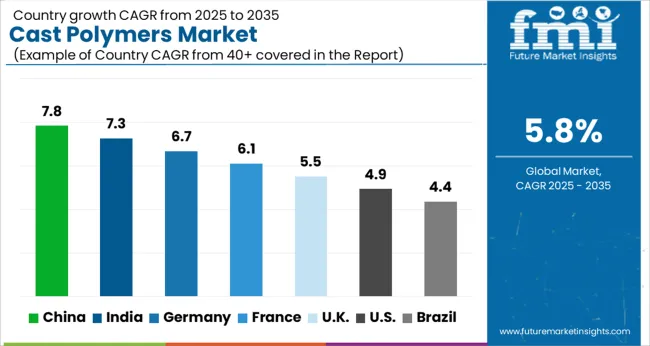

| Country | CAGR |

|---|---|

| China | 7.8% |

| India | 7.3% |

| Germany | 6.7% |

| France | 6.1% |

| UK | 5.5% |

| USA | 4.9% |

| Brazil | 4.4% |

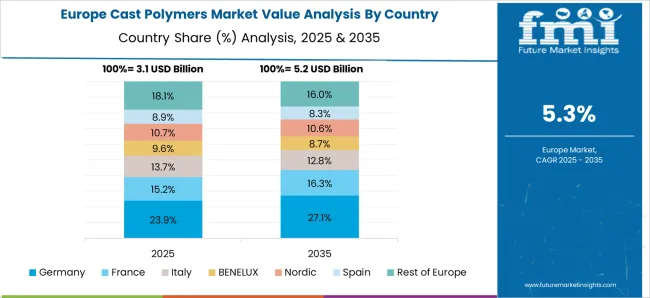

The market is anticipated to expand at a CAGR of 5.8% between 2025 and 2035, driven by rising adoption in construction, countertops, and decorative applications. Germany reached 6.7%, supported by integration of advanced polymer technologies in architectural and industrial projects. India recorded 7.3%, fueled by growing construction activities and rising demand for durable surfaces. China led with 7.8%, reflecting extensive manufacturing capabilities and large-scale application in residential and commercial spaces. The United Kingdom accounted for 5.5%, with steady adoption in interior and infrastructure projects. The United States registered 4.9%, where innovation in sustainable and high-performance polymer materials sustained market activity. These countries shape the global production, deployment, and technological advancement landscape in cast polymers. This report includes insights on 40+ countries; the top markets are shown here for reference.

China is projected to grow at a CAGR of 7.8%, driven by rising construction, bathroom fixtures, and industrial applications. Adoption has been reinforced by domestic manufacturers offering high quality, corrosion resistant, and customizable cast polymer products for sinks, countertops, and sanitary ware. Export demand from Asia Pacific and Europe further contributes to market growth. Integration of automated production technologies and focus on design innovation support efficiency and product differentiation. Urban infrastructure projects and commercial construction contribute to steady adoption across regions.

India is expected to expand at a CAGR of 7.3%, supported by demand from residential and commercial construction, hotels, and high end interiors. Adoption has been reinforced by domestic manufacturers offering corrosion resistant, customizable, and decorative cast polymer products. Government initiatives to improve construction quality and increased private sector investment in luxury housing boost demand. Imports of premium materials complement domestic production for advanced designs.

Germany is projected to grow at a CAGR of 6.7%, driven by demand for high quality sanitary fixtures, countertops, and industrial applications. Adoption has been reinforced by strict European standards for material durability, aesthetics, and corrosion resistance. Domestic manufacturers focus on advanced finishing, eco-friendly processes, and premium designs. Exports of German engineered products to EU and non EU countries further enhance market potential.

The United Kingdom is expected to grow at a CAGR of 5.5%, supported by adoption in high end residential, commercial, and hospitality projects. Imports dominate supply of premium products, while domestic manufacturers focus on niche decorative and functional cast polymer applications. Demand is reinforced by renovation projects and commercial fit outs requiring durable and aesthetically appealing materials.

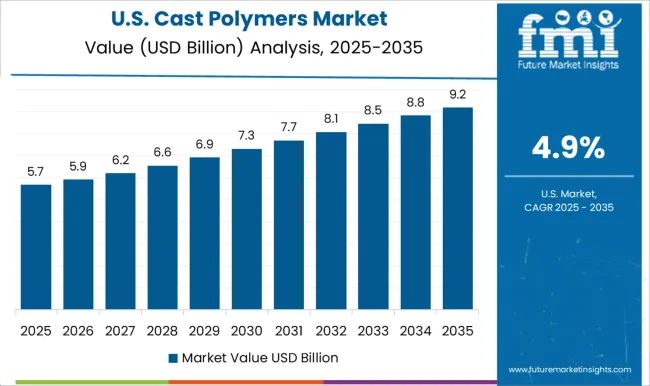

The United States is projected to grow at a CAGR of 4.9%, driven by adoption in residential and commercial construction, bathroom fixtures, countertops, and industrial applications. Domestic manufacturers focus on high performance, corrosion resistant, and design intensive cast polymer products. Imports complement domestic supply for premium designs. Market growth is supported by construction of luxury homes, office spaces, and renovation of commercial properties.

The market is driven by manufacturers specializing in engineered surfaces, decorative panels, and solid-surface countertops for residential, commercial, and industrial applications. DuPont’s Corian remains a market benchmark, offering versatile, durable, and aesthetically customizable solid surfaces widely adopted in architecture and interior design projects. Caesarstone and Silestone, part of Cosentino Group, focus on quartz-based cast surfaces with high resistance to scratches and stains, targeting premium residential and hospitality sectors. LG Hausys and Hanwha L&C (Hanex) deliver innovative cast polymer solutions emphasizing design flexibility and environmental compliance, combining aesthetic appeal with functional durability.

Wilsonart, Formica, and Viatera provide a balance between cost-efficiency and performance, catering to mid-market residential and commercial projects. Cambria and Swanstone focus on high-end, non-porous, and seamless surfaces for kitchens, bathrooms, and healthcare settings, while Breton S.p.A. integrates advanced manufacturing technologies to enhance surface precision and material consistency. Eastern Surfaces, US Marble, Inc., and AGCO, Inc. supplement the competitive landscape with niche solutions emphasizing customization, specialty colors, and patterns. Market competition is largely driven by product innovation, surface durability, design variety, and brand reputation, with increasing emphasis on eco-friendly production and sustainable material sourcing. Players differentiate through proprietary resin blends, fabrication technology, and partnerships with architects and designers to expand market penetration.

| Item | Value |

|---|---|

| Quantitative Units | USD 13.5 billion |

| Material Type | Engineered Stone, Solid Surface, Cultured Marble, and Others |

| Application | Countertops, Vanity Tops, Sinks and Basins, Shower Pans and Walls, Tub Surrounds, and Others |

| End Use Industry | Residential, Commercial, and Industrial |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | DuPont (Corian), Caesarstone, LG Hausys, Wilsonart, Viatera, Cambria, Silestone, Formica, Hanwha L&C (Hanex), Breton S.p.A., Swanstone, AGCO, Inc., Cosentino Group (Dekton, Sensa), Eastern Surfaces, and US Marble, Inc. |

| Additional Attributes | Dollar sales by polymer type and application, demand dynamics across construction, interior design, and industrial sectors, regional trends in decorative and functional material adoption, innovation in durability, aesthetic finishes, and moldability, environmental impact of production and disposal, and emerging use cases in countertops, wall cladding, and custom architectural components. |

The global cast polymers market is estimated to be valued at USD 13.5 billion in 2025.

The market size for the cast polymers market is projected to reach USD 23.7 billion by 2035.

The cast polymers market is expected to grow at a 5.8% CAGR between 2025 and 2035.

The key product types in cast polymers market are engineered stone, solid surface, cultured marble and others.

In terms of application, countertops segment to command 48.3% share in the cast polymers market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Casting Mold Market Size and Share Forecast Outlook 2025 to 2035

Cast Stretch Films Market Size and Share Forecast Outlook 2025 to 2035

Casted Automotive Components Market Size and Share Forecast Outlook 2025 to 2035

Casting Multi-stage Centrifugal Blower Market Size and Share Forecast Outlook 2025 to 2035

Castor Oil Polyol Market Size and Share Forecast Outlook 2025 to 2035

Cast Resin Transformer Market Size and Share Forecast Outlook 2025 to 2035

Cast Aluminum Heating Board Market Size and Share Forecast Outlook 2025 to 2035

Casters Market Size and Share Forecast Outlook 2025 to 2035

Castor Oil-Based Biopolymer Market Size and Share Forecast Outlook 2025 to 2035

Cast Acrylic Sheets Market Size and Share Forecast Outlook 2025 to 2035

Castor Oil Market Growth – Trends & Forecast 2025 to 2035

Castration-Resistant Prostate Cancer (CRPC) Treatment Market Insights - Demand, Size & Industry Trends 2025 to 2035

Castor Oil Derivatives Market Growth - Trends & Forecast 2025 to 2035

Precast Concrete Market Size and Share Forecast Outlook 2025 to 2035

Podcasting Market Size and Share Forecast Outlook 2025 to 2035

Die Cast Toys Market Size and Share Forecast Outlook 2025 to 2035

Die Casting Services Market Analysis - Growth & Forecast 2025 to 2035

Gray Cast Iron Rod Market Size and Share Forecast Outlook 2025 to 2035

Grid Casting Machine Market Size and Share Forecast Outlook 2025 to 2035

Broadcast Switchers Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA