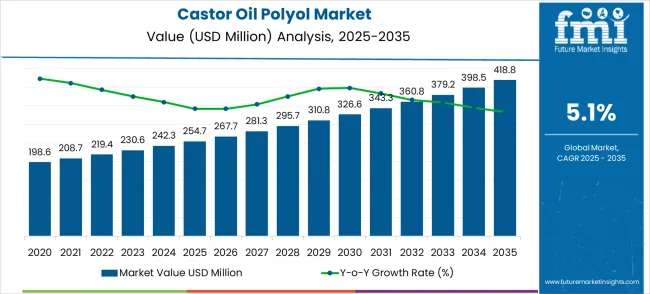

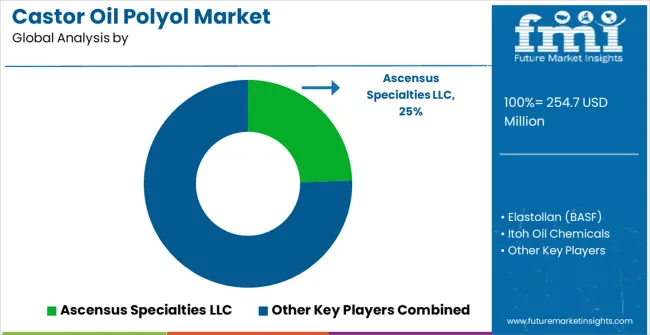

The castor oil polyol market is valued at USD 254.7 million in 2025 and is projected to reach USD 418.8 million by 2035, reflecting a CAGR of 5.1%. The early phase of market growth, from 2021 to 2025, shows gradual increases, starting at USD 198.6 million in 2021 and progressing to USD 254.7 million by 2025. During this period, the market moves through incremental values: USD 208.7 million in 2022, USD 219.4 million in 2023, USD 230.6 million in 2024, and USD 242.3 million in 2025. The growth in the early phase is primarily driven by the increasing adoption of castor oil polyols in the production of bio-based polyurethanes, primarily for applications in the automotive, construction, and coatings industries. The rise in consumer demand for eco-friendly materials plays a significant role in the early market acceleration.

In the late growth phase, from 2026 to 2035, the market enters a phase of more substantial expansion, moving from USD 254.7 million in 2025 to USD 418.8 million by 2035. During this period, the market grows more rapidly, passing through USD 267.7 million in 2026, USD 281.3 million in 2027, and USD 295.7 million in 2028. The late-stage growth is driven by increasing demand for castor oil polyols in high-performance applications, including green construction materials, renewable energy projects, and the automotive sector. Innovations in polyol technology, combined with stronger regulations favoring renewable products, further accelerate the market, leading to a faster-paced expansion and more significant market share gains.

| Metric | Value |

|---|---|

| Market Value (2025) | USD 254.7 million |

| Market Forecast Value (2035) | USD 418.8 million |

| Market Forecast CAGR | 5.1% |

The polyurethane market is the largest contributor, accounting for around 30–35%, as castor oil polyol is a key raw material in the production of bio-based polyurethanes, which are used in applications such as coatings, foams, adhesives, and sealants. The bio-based chemicals market follows with a contribution of approximately 25–30%, driven by the increasing demand for renewable chemical alternatives, with castor oil polyol being an important eco-friendly option.

The construction and building materials market represents about 15–18%, as castor oil polyol is used in the production of insulation materials, flooring, and coatings that offer improved performance and reduced environmental impact. The automotive market accounts for around 10–12%, as castor oil polyol is increasingly used in the manufacturing of lightweight and durable automotive parts, such as interior components and seating systems, which require advanced materials. The personal care and cosmetics market contributes approximately 8–10%, as castor oil polyol is used in formulations for hair care, skin care, and moisturizers due to its natural, nourishing properties.

Market expansion is being supported by the increasing focus on eco-friendly manufacturing practices worldwide and the corresponding need for bio-based chemical intermediates that provide superior environmental performance and regulatory compliance. Modern industrial manufacturing operations rely on renewable raw materials and green production processes to ensure optimal environmental stewardship, including reduced carbon footprint, enhanced biodegradability, and compliance with evolving environmental regulations. Even minor eco-conscious gaps can require comprehensive manufacturing protocol adjustments to maintain optimal environmental standards and regulatory compliance.

The growing complexity of environmental regulations and increasing demand for high-performance bio-based chemical solutions are driving demand for castor oil polyol products from certified manufacturers with appropriate eco-responsible credentials and technical expertise. Chemical manufacturers are increasingly requiring documented environmental performance and renewable content verification to maintain market competitiveness and regulatory compliance. Industry standards and environmental regulations are establishing mandatory eco-friendly procedures that require renewable raw materials and bio-based production technologies.

The accelerating shift toward circular economy principles and eco-efficient manufacturing is significantly contributing to market growth, as industries seek renewable alternatives to petroleum-based chemicals. Government environmental policies worldwide are increasingly supporting bio-based chemical development through incentives and regulatory frameworks that favor renewable materials. The growing consumer awareness of environmental issues and corporate eco-consciousness are driving widespread adoption of bio-based polyols across multiple industrial sectors, creating substantial market opportunities for renewable chemical solutions.

The Castor Oil Polyol market is entering a significant growth phase, driven by demand for eco- friendly chemicals, environmental compliance requirements, and evolving industrial and regulatory standards. By 2035, these pathways together can unlock USD 120–150 million in incremental revenue opportunities beyond baseline growth.

Pathway A -- Environmental Compliance Leadership (VOC-Free Formulations) The VOC-free segment already holds the largest share due to its superior environmental performance and regulatory compliance. Expanding application-specific formulations, enhanced performance characteristics, and integrated green credentials can consolidate leadership. Opportunity pool: USD 35–45 million.

Pathway B -- Chemical Industry Integration (Renewable Intermediates) Chemical industry applications account for the majority of demand. Growing eco-conscious mandates, especially in specialty chemicals and green chemistry initiatives, will drive higher adoption of bio-based polyol intermediates. Opportunity pool: USD 30–40 million.

Pathway C -- Automotive & Transportation Applications Automotive manufacturers are increasingly adopting eco-friendly materials for interior components, coatings, and adhesives. Castor oil polyols designed for automotive applications can capture significant growth in this expanding sector. Opportunity pool: USD 20–25 million.

Pathway D -- Emerging Market Industrial Growth Asia-Pacific, Middle East, and Latin America present growing demand due to expanding industrial manufacturing and increasing environmental awareness. Targeting cost-effective formulations and local supply chains will accelerate adoption. Opportunity pool: USD 15–20 million.

Pathway E -- Construction & Building Materials Green building initiatives and eco-responsible construction materials are driving demand for bio-based polyols in coatings, adhesives, and sealants for construction applications. Opportunity pool: USD 10–15 million.

Pathway F -- Premium Performance Applications High-performance applications in aerospace, marine, and industrial equipment requiring specialized bio-based polyols offer premium positioning opportunities with enhanced technical specifications. Opportunity pool: USD 8–12 million.

Pathway G -- Circular Economy & Recycling Integration: Developing castor oil polyols that support circular economy principles, including recyclability and biodegradability, can capture environmentally conscious market segments. Opportunity pool: USD 6–10 million.

Pathway H -- Technical Services & Application Development Comprehensive technical support, application development services, and eco-conscious consulting create high-margin recurring revenue opportunities with industrial customers. Opportunity pool: USD 4–8 million.

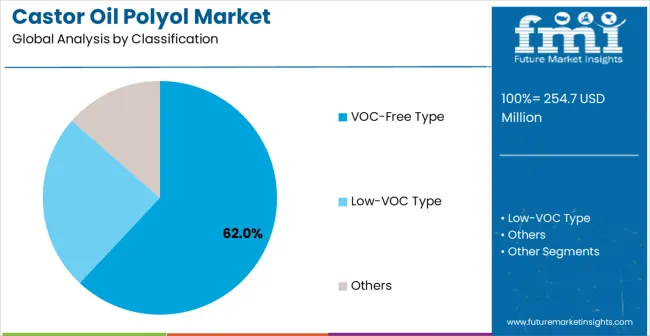

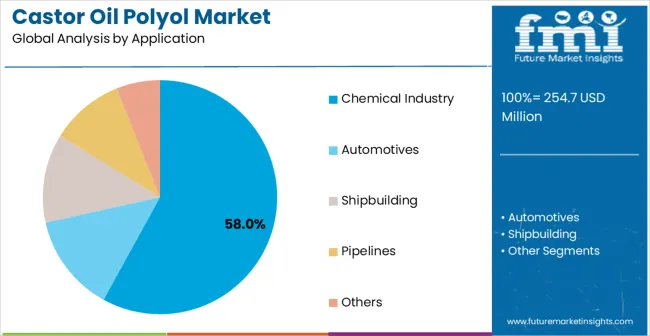

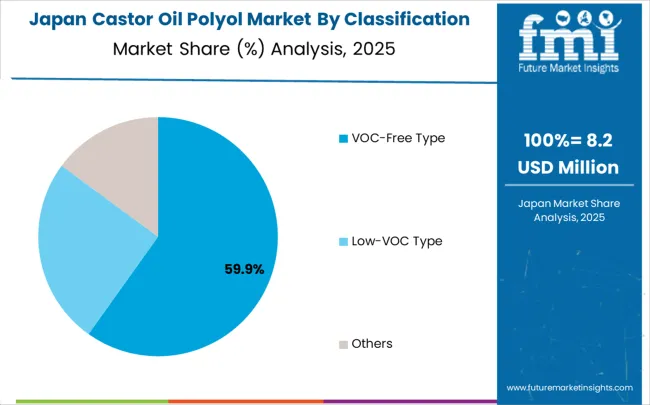

The market is segmented by VOC type, application, and region. By VOC type, the market is divided into VOC-free type, low-VOC type, and others. Based on application, the market is categorized into chemical industry, automotives, shipbuilding, pipelines, and others. Regionally, the market is divided into North America, Europe, East Asia, South Asia & Pacific, Latin America, and Middle East & Africa.

In 2025, the VOC-free type segment is projected to capture around 62% of the total market share, making it the leading product category. This dominance is largely driven by the widespread adoption of environmentally compliant chemical intermediates that deliver superior air quality performance and regulatory compliance, catering to a wide variety of industrial applications with stringent environmental requirements. The VOC-free technology is particularly favored for its ability to provide excellent chemical performance without emitting volatile organic compounds, ensuring operational compliance with environmental regulations and workplace safety standards.

Chemical manufacturers, automotive suppliers, construction companies, and industrial processors increasingly prefer this formulation, as it meets demanding environmental requirements without compromising performance characteristics or operational efficiency. The availability of well-established product lines, along with comprehensive technical support and application engineering assistance from leading chemical manufacturers, further reinforces the segment's market position.

The chemical industry segment is expected to represent 58% of castor oil polyol demand in 2025, highlighting its position as the most significant application sector. This dominance stems from the unique requirements of chemical manufacturing processes, where renewable raw materials and eco-friendly intermediates are increasingly critical to product development, environmental compliance, and market competitiveness. Chemical manufacturing facilities often feature complex production processes that demand reliable and environmentally friendly chemical intermediates capable of delivering consistent performance across diverse formulation requirements.

Castor oil polyols are particularly well-suited to chemical industry applications due to their ability to provide excellent chemical reactivity and processing characteristics while maintaining complete environmental compliance and renewable sourcing credentials. As chemical manufacturers continue to emphasize green production and environmental stewardship, the demand for bio-based polyol intermediates continues to rise steadily. The segment also benefits from heightened regulatory pressure within the chemical industry, where manufacturers are increasingly prioritizing renewable raw materials and environmental compliance as key differentiators to meet regulatory requirements and consumer expectations.

The castor oil polyol market is advancing steadily due to increasing environmental regulations and growing recognition of bio-based chemical advantages over petroleum-based alternatives. The market faces challenges including higher raw material costs compared to conventional petrochemical polyols, need for specialized processing equipment to handle bio-based feedstocks, and varying agricultural supply chain dynamics affecting castor oil availability across different geographic regions. Eco-friendly advancement efforts and cost optimization programs continue to influence product development and market adoption patterns. Market consolidation activities and strategic partnerships between chemical manufacturers and agricultural suppliers are helping address supply chain constraints while improving cost competitiveness. The increasing integration of digital technologies and process optimization systems is enabling more efficient production methods and better quality control throughout the bio-based polyol manufacturing value chain.

The growing development of advanced bio-based polyol production systems is enabling higher performance characteristics with improved processing efficiency and enhanced eco-friendly credentials. Advanced biotechnology processes and optimized chemical conversion technologies provide superior polyol performance while maintaining complete renewable sourcing and environmental compliance requirements. These technologies are particularly valuable for chemical manufacturers who require reliable bio-based performance that can support diverse industrial applications with consistent results and verified eco-conscious credentials. Research and development investments in enzyme technology and catalytic processes are significantly improving conversion efficiency and reducing production costs for castor oil-based polyols. The emergence of hybrid production systems that combine traditional chemical processing with biotechnology approaches is creating new opportunities for enhanced product performance and operational flexibility.

Modern castor oil polyol manufacturers are incorporating advanced eco-conscious monitoring capabilities and environmental performance improvements that enhance product effectiveness and operational efficiency. Integration of lifecycle assessment systems and optimized environmental impact algorithms enables superior eco-efficiency and comprehensive environmental compliance capabilities. Advanced green manufacturing features support operations in diverse industrial environments while meeting various environmental requirements and regulatory specifications, ensuring reliable performance across different manufacturing platforms and application scenarios.

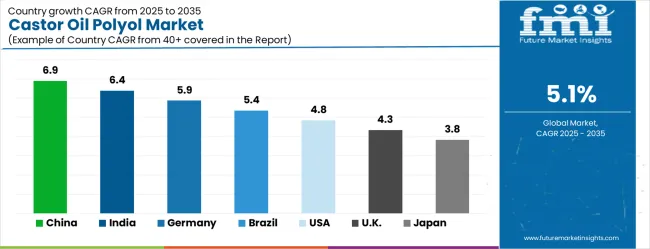

| Country | CAGR (2025-2035) |

|---|---|

| China | 6.9% |

| India | 6.4% |

| Germany | 5.9% |

| Brazil | 5.4% |

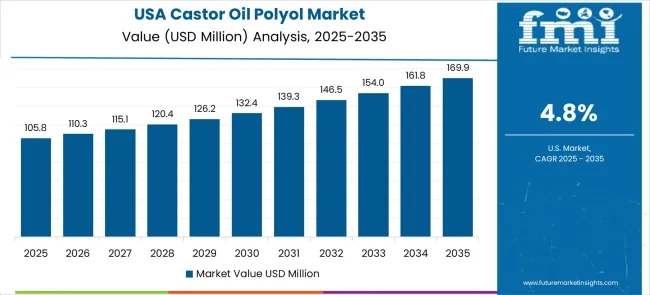

| United States | 4.8% |

| United Kingdom | 4.3% |

| Japan | 3.8% |

The castor oil polyol market is experiencing solid growth globally, with China leading at a 6.9% CAGR through 2035, driven by extensive chemical manufacturing expansion and increasing adoption of sustainable production technologies. India follows closely at 6.4%, supported by growing industrial manufacturing sector and increasing awareness of bio-based chemical benefits. Germany demonstrates strong growth at 5.9%, integrating advanced bio-based technologies into its established chemical manufacturing infrastructure. Brazil records substantial growth at 5.4%, emphasizing sustainable chemical production and renewable raw material utilization. The United States shows steady expansion at 4.8%, focusing on green chemistry initiatives and environmental compliance. The United Kingdom maintains solid progress at 4.3%, driven by sustainability regulations and industrial environmental standards. Japan records consistent growth at 3.8%, concentrating on precision chemical manufacturing and quality optimization.

The report covers an in-depth analysis of 40+ countries with top-performing countries are highlighted below.

The castor oil polyol market in China is projected to exhibit the highest growth rate with a CAGR of 6.9% through 2035, driven by the country's massive chemical manufacturing sector and comprehensive government initiatives promoting sustainable production technologies. China's rapidly expanding chemical industry, combined with substantial investments in green chemistry development and bio-based material innovation, is creating significant demand for renewable chemical intermediates. Major chemical manufacturers and specialty chemical companies are establishing comprehensive production facilities to support the increasing requirements of industrial manufacturers and chemical processors across key manufacturing regions.

Government sustainable development policies and carbon neutrality commitments are supporting establishment of advanced bio-based chemical manufacturing facilities and renewable technology centers, driving demand for environmentally friendly chemical intermediates throughout major industrial and chemical manufacturing zones. National green chemistry development programs are facilitating adoption of bio-based production systems that enhance environmental performance and sustainability standards across chemical manufacturing networks.

Revenue from castor oil polyol in India is expanding at a robust CAGR of 6.4%, supported by rapidly growing industrial manufacturing sector and increasing adoption of sustainable chemical technologies. The country's expanding chemical processing industry and rising environmental awareness are driving demand for bio-based chemical intermediates and renewable raw materials. Chemical manufacturers and industrial processors are gradually implementing sustainable production technologies to meet evolving environmental standards and market requirements.

Industrial sector growth and chemical manufacturing infrastructure development are creating substantial opportunities for bio-based chemical suppliers that can support diverse industrial requirements and cost-effective sustainability solutions. Technical training and chemical engineering programs are building expertise among industry professionals, enabling effective utilization of bio-based polyol technology that meets Indian industrial standards and environmental requirements.

Demand for castor oil polyol in Germany is projected to grow at a solid CAGR of 5.9%, supported by the country's leadership in chemical engineering and commitment to advanced sustainable production technology development. German chemical manufacturers are implementing sophisticated bio-based polyol systems that meet the most stringent environmental requirements and performance specifications in the global industry. The market is characterized by emphasis on technological precision, environmental excellence, and compliance with comprehensive sustainability standards.

Chemical industry investments are prioritizing breakthrough bio-based technologies that demonstrate exceptional environmental performance and chemical efficiency while meeting German engineering excellence and sustainability standards. Professional chemical engineering programs are ensuring comprehensive technical expertise among production engineers, enabling specialized sustainable manufacturing capabilities that support diverse industrial applications and environmental requirements.

The castor oil polyol market in Brazil is growing at a substantial CAGR of 5.4%, driven by increasing sustainable chemical production initiatives and growing emphasis on renewable raw material utilization. The country's expanding bio-based economy and agricultural feedstock availability are gradually supporting advanced chemical manufacturing that incorporates renewable intermediates to enhance environmental performance and market competitiveness. Chemical facilities and industrial manufacturers are investing in bio-based polyol technology to address developing sustainability requirements and environmental standards.

Chemical industry modernization is facilitating adoption of sustainable production technologies that support comprehensive environmental compliance capabilities across manufacturing regions. Professional chemical development programs are enhancing technical capabilities among industry professionals, enabling effective bio-based chemical implementation that meets evolving environmental standards and operational requirements.

Demand for castor oil polyol in the U.S. is expanding at a steady CAGR of 4.8%, driven by established chemical industry leadership and intensive green chemistry development initiatives. Large chemical manufacturers and specialty chemical companies are implementing comprehensive bio-based capabilities to support sustainable production requirements and environmental compliance standards. The market benefits from established chemical supply chains and professional engineering programs that support various industrial sustainability applications.

Chemical industry leadership is enabling standardized bio-based polyol integration across multiple industrial platforms, providing consistent environmental performance and comprehensive sustainability coverage throughout regional chemical markets. Professional development and chemical engineering programs are building specialized technical expertise among production engineers, enabling effective bio-based technology utilization that supports evolving environmental requirements.

The castor oil polyol market in the U.K. is projected to grow at a solid CAGR of 4.3%, supported by established chemical sectors and growing emphasis on environmental compliance capabilities. British chemical manufacturers and industrial processors are implementing bio-based polyol systems that meet industry environmental standards and sustainability requirements. The market benefits from established chemical infrastructure and comprehensive training programs for chemical professionals.

Industrial facility investments are prioritizing sustainable chemical technologies that support diverse applications while maintaining established environmental and performance standards. Professional chemical development programs are building technical expertise among engineering personnel, enabling specialized bio-based polyol integration capabilities that meet evolving environmental requirements and quality standards.

Revenue from castor oil polyol in Japan is growing at a consistent CAGR of 3.8%, driven by the country's focus on precision chemical manufacturing and sustainable technology innovation applications. Japanese chemical manufacturers are implementing advanced bio-based polyol systems that demonstrate superior precision reliability and environmental efficiency. The market is characterized by emphasis on chemical excellence, quality assurance, and integration with established manufacturing workflows.

Chemical technology investments are prioritizing innovative bio-based solutions that combine advanced sustainability characteristics with precision engineering while maintaining Japanese chemical quality and reliability standards. Professional chemical development programs are ensuring comprehensive technical expertise among manufacturing engineers, enabling specialized sustainable production capabilities that support diverse industrial applications and quality requirements.

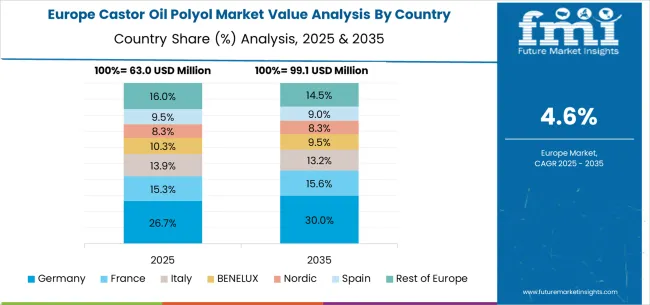

The castor oil polyol market in Europe is forecast to expand from USD 70.5 million in 2025 to USD 115.9 million by 2035, registering a CAGR of 5.1%. Germany will remain the largest market, holding 28.8% share in 2025, maintaining approximately 28.2% by 2035, supported by strong chemical manufacturing infrastructure and advanced sustainability technology adoption. The United Kingdom follows, maintaining around 17.2% throughout the forecast period, driven by environmental compliance regulations and sustainable chemical initiatives.

France is expected to grow from 15.1% to 15.4%, supported by chemical industry innovation and green chemistry development. Italy maintains stability at around 12.3%, supported by industrial manufacturing and specialty chemical production, while Spain grows from 9.8% to 10.2% with expanding sustainable chemical manufacturing and environmental compliance adoption. BENELUX markets remain stable at around 6.1%, while the remainder of Europe grows from 10.7% to 11.5%, balancing emerging Eastern European industrial growth against mature Nordic chemical markets.

The Castor Oil Polyol market is defined by competition among specialized bio-based chemical manufacturers, sustainable chemical companies, and renewable materials solution providers. Companies are investing in advanced bio-based polyol development, sustainable production optimization, environmental performance enhancement, and comprehensive technical support capabilities to deliver reliable, efficient, and environmentally advanced chemical intermediates. Strategic partnerships, sustainable innovation, and industrial market expansion are central to strengthening product portfolios and market presence.

Ascensus Specialties LLC offers comprehensive bio-based polyol solutions with established chemical expertise and industry-leading sustainability capabilities. Elastollan (BASF) provides specialized polyurethane technology with focus on sustainable material performance and environmental compliance. Itoh Oil Chemicals delivers innovative bio-based chemical systems with emphasis on renewable raw materials and advanced processing capabilities. Alberdingk Resins specializes in sustainable coating resins with integrated bio-based applications and technical support.

Gokul offers professional-grade bio-based chemicals with comprehensive industrial integration support capabilities. Eagle Specialty delivers established sustainable chemical solutions with advanced bio-based technologies. Yes Top Applied Materials, Gokul Overseas, Shanghai Shuyu Chemical, and Fucheng Huanyu offer regional manufacturing expertise, sustainable production reliability, and comprehensive product development across global and industrial market segments.

| Item | Value |

|---|---|

| Quantitative Units | USD 254.7 million |

| VOC Type | VOC-Free Type, Low-VOC Type, Others |

| Application | Chemical Industry, Automotives, Shipbuilding, Pipelines, Others |

| Regions Covered | North America, Europe, East Asia, South Asia & Pacific, Latin America, Middle East & Africa |

| Country Covered | China, India, Germany, Brazil, United States, United Kingdom, Japan, and 40+ countries |

| Key Companies Profiled | Ascensus Specialties LLC, Elastollan (BASF), Itoh Oil Chemicals, Alberdingk Resins, Gokul, Eagle Specialty, Yes Top Applied Materials, Gokul Overseas, Shanghai Shuyu Chemical, Fucheng Huanyu |

| Additional Attributes | Dollar sales by VOC type and application segment, regional demand trends across major industrial markets, competitive landscape with established bio-based chemical manufacturers and emerging sustainable technology providers, customer preferences for different polyol formulations and environmental performance characteristics, integration with sustainable manufacturing systems and green chemistry protocols, innovations in bio-based polyol technology and environmental optimization capabilities, and adoption of circular economy features with enhanced sustainability performance for improved industrial workflows. |

The global castor oil polyol market is estimated to be valued at USD 254.7 million in 2025.

The market size for the castor oil polyol market is projected to reach USD 418.8 million by 2035.

The castor oil polyol market is expected to grow at a 5.1% CAGR between 2025 and 2035.

The key product types in castor oil polyol market are voc-free type, low-voc type and others.

In terms of application, chemical industry segment to command 58.0% share in the castor oil polyol market in 2025.

Explore Similar Insights

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA