The castor oil-based biopolymer market is estimated to be valued at USD 1280.5 million in 2025 and is projected to reach USD 5457.0 million by 2035, registering a compound annual growth rate (CAGR) of 15.6% over the forecast period.

Between 2020 and 2024, the market grew from USD 620.3 million to 1,107.7 million, marking the early adoption phase. During this period, demand was driven by specialized applications and early commercial trials. Manufacturers focused on small-scale production and niche industries to demonstrate product feasibility. Early adopters, including manufacturers looking for alternatives to traditional polymers, helped establish initial market credibility. This phase laid the groundwork for wider adoption, building awareness of the benefits of castor oil-based biopolymers across different sectors.

From 2025 to 2030, the market enters a scaling phase, expanding from USD 1,280.5 million to approximately 2,643.4 million. Growth accelerates as production capabilities increase and applications diversify into packaging, automotive, and industrial uses. Broader adoption occurs as more companies integrate these biopolymers into their product lines. By 2030, with the market surpassing USD 2,643.4 million, adoption becomes more mainstream, signaling a move toward consolidation. Between 2030 and 2035, the market grows steadily to USD 5,457.0 million, with leading manufacturers consolidating share, optimizing production processes, and stabilizing growth in a mature, high-demand segment of the polymer industry.

| Metric | Value |

|---|---|

| Castor Oil-Based Biopolymer Market Estimated Value in (2025 E) | USD 1280.5 million |

| Castor Oil-Based Biopolymer Market Forecast Value in (2035 F) | USD 5457.0 million |

| Forecast CAGR (2025 to 2035) | 15.6% |

The market is witnessing notable expansion as global industries shift toward sustainable, bio-based alternatives for conventional polymers. Demand is being driven by increased regulatory focus on reducing carbon footprints and the rising cost volatility of petrochemical-based raw materials. Industry communications and corporate sustainability reports have consistently highlighted castor oil’s renewable origin and functional performance, which align with both performance and environmental criteria.

Growth is also being supported by advancements in polymer engineering, allowing castor oil derivatives to meet the mechanical and thermal requirements across industrial applications. In addition, manufacturers are investing in backward integration and localized supply chains to ensure consistent feedstock availability and cost efficiency.

The market outlook appears strong as companies continue to position castor oil-based solutions as alternatives to fossil-based plastics, particularly in sectors that prioritize green certifications and eco-label compliance With the expanding presence of sustainability mandates across automotive, consumer goods, and electronics sectors, the market is well positioned for robust, long-term growth.

The castor oil-based biopolymer market is segmented by type, end use industry, and geographic regions. By type, the market is divided into bio-polyamide, bio-polyurethane, and oleochemicals and derivatives. In terms of end use industry, the market is classified into automotive, electronics, textile, packaging, and others (healthcare, consumer goods, industrial). Regionally, the castor oil-based biopolymer industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The bio-polyamide type segment is projected to account for 46.3% of the market revenue share in 2025, making it the leading type category. This dominant position is being attributed to its strong performance in high-temperature and mechanically demanding environments, as highlighted in product announcements and industrial material testing publications. Bio-polyamides derived from castor oil have been adopted across sectors seeking alternatives to petroleum-based nylons, particularly in automotive and electronics manufacturing.

Their chemical resistance, durability, and lightweight properties have been widely recognized in industry reviews as key differentiators. Furthermore, manufacturers have scaled production capacities for bio-polyamides to meet rising demand while ensuring compliance with international green material certifications.

The segment’s growth has also been aided by the ability to integrate these polymers into existing processing lines with minimal retrofitting These characteristics, combined with the rising emphasis on sustainable sourcing and environmental impact reduction, have positioned bio-polyamides as the preferred biopolymer type in the market.

The automotive end use industry segment is expected to contribute 38.7% of the market revenue share in 2025, maintaining its status as the leading application sector. This growth is being driven by the automotive industry’s ongoing transition toward sustainable materials to meet both regulatory requirements and consumer expectations around environmental responsibility.

Corporate disclosures from auto manufacturers and materials suppliers have indicated that bio-based polymers such as castor oil-derived polyamides are increasingly used in under-the-hood components, fuel lines, and interior parts due to their superior heat resistance and mechanical strength. The segment’s momentum has also been supported by global OEMs aiming to reduce vehicle weight for improved fuel efficiency and lower emissions.

Additionally, partnerships between automotive suppliers and biopolymer producers have accelerated product development timelines and enabled supply chain integration These factors, along with rising adoption of electric vehicles that emphasize sustainable design, have reinforced the automotive sector’s dominant share in the market.

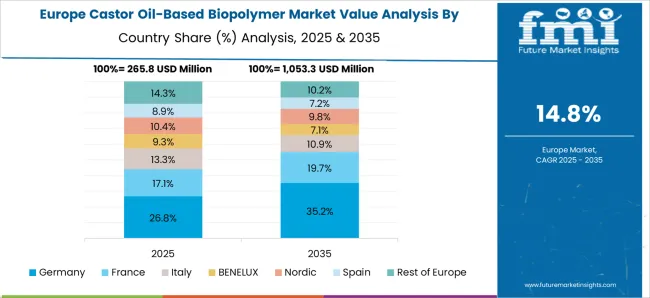

The castor oil-based biopolymer market is growing steadily as industries increasingly adopt sustainable and bio-based alternatives to conventional plastics and polymers. Derived from renewable castor oil, these biopolymers are applied in coatings, adhesives, packaging, automotive, and biomedical applications. North America and Europe lead due to strong environmental regulations and green material adoption, while Asia-Pacific shows rising demand driven by industrial growth and sustainability initiatives. Market expansion is fueled by innovations in polymer formulations, performance enhancement, and biodegradable solutions. Companies are focusing on eco-friendly production, multi-industry applications, and enhanced functional properties to differentiate products and meet rising environmental standards.

Consistent quality and reliable sourcing of castor oil remain key challenges. Variability in oil composition due to geographic origin, cultivation practices, and seasonal factors affects polymer properties such as viscosity, molecular weight, and curing behavior. Lack of standardized extraction and processing protocols can lead to inconsistent product performance, impacting industrial adoption. Manufacturers supplying high-performance applications, such as biomedical or automotive segments, require traceable supply chains, quality certifications, and validated polymer characteristics. Until industry-wide standardization and robust quality control systems are adopted, variability in raw materials continues to constrain market growth and brand differentiation.

Technological advancements are enhancing castor oil-based biopolymer functionality. Innovations in polymerization, cross-linking, and bio-composite formulations improve mechanical strength, thermal stability, and biodegradability. Modified castor oil polymers are increasingly applied in coatings, adhesives, packaging, and 3D printing materials. Research into hybrid biopolymers and nanocomposites enhances durability and broadens industrial applicability. Collaboration with research institutions accelerates development of sustainable, high-performance biopolymer products. These technological improvements enable companies to meet strict industrial standards and environmental requirements, driving adoption across multiple sectors.

The market is strongly influenced by environmental regulations and sustainability policies. Biopolymers must comply with regional standards for biodegradability, chemical safety, and industrial certification (e.g., ASTM, EN, ISO). Non-compliance can limit market access, particularly in the EU and North America, which enforce strict eco-labeling and green material guidelines. Emerging markets are adopting sustainability initiatives, but regulatory clarity may vary. Companies that align product development with recognized eco-certifications, ensure traceable supply chains, and meet safety requirements gain competitive advantage. Until global harmonization of standards occurs, regulatory compliance remains a critical factor in market adoption.

The castor oil-based biopolymer market is moderately competitive, with a mix of established chemical producers and smaller biopolymer innovators. Suppliers face challenges from fluctuating castor oil availability, seasonal crop cycles, and price volatility. Vertical integration, contract farming, and geographic diversification help mitigate raw material risks. Companies differentiate through proprietary formulations, performance enhancements, and sustainable production processes. Supply chain constraints, combined with growing demand from multiple industrial sectors, influence pricing and product availability. Until raw material supply and manufacturing scalability improve, competition and sourcing challenges will continue to shape market growth and adoption across applications.

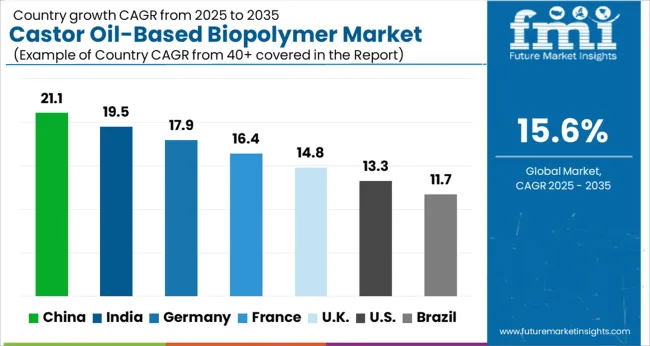

The global market is projected to grow at a CAGR of 15.6% through 2035, supported by increasing applications across packaging, automotive components, and specialty materials. Among BRICS nations, China has been recorded with 21.1% growth, driven by large-scale production and industrial adoption, while India has been observed at 19.5%, supported by rising utilization in biodegradable materials and industrial polymers. In the OECD region, Germany has been measured at 17.9%, where production for automotive and industrial applications has been steadily increased. The United Kingdom has been noted at 14.8%, reflecting consistent use in packaging and specialty products, while the USA has been recorded at 13.3%, with production and adoption in industrial and commercial segments being steadily maintained. This report includes insights on 40+ countries; the top five markets are shown here for reference.

The castor oil-based biopolymer market in China is growing at a CAGR of 21.1%, driven by increasing industrial demand for biodegradable and eco-friendly polymers. China’s rapid expansion in the packaging, automotive, and construction sectors is accelerating the adoption of sustainable alternatives to conventional plastics. Government initiatives supporting green manufacturing and reduced carbon emissions are boosting investments in biopolymer production. Companies are focusing on R&D to improve the performance characteristics of castor oil-based polymers, including tensile strength, thermal stability, and flexibility. The growing preference for environmentally responsible materials among manufacturers and consumers is creating strong market opportunities. As awareness of sustainability rises, both domestic and international suppliers are enhancing production capacity and establishing partnerships with downstream industries to meet the surging demand for biodegradable materials.

The castor oil-based biopolymer market in India is expanding at a CAGR of 19.5%, fueled by rising environmental awareness and demand for sustainable packaging solutions. The automotive, textile, and electronics sectors are adopting bio-based polymers to reduce plastic waste and meet regulatory requirements. India’s castor oil production, primarily in Rajasthan, provides a strong raw material base for biopolymer manufacturing. Manufacturers are focusing on improving the mechanical properties and processability of castor oil-based polymers to meet industrial standards. Government policies encouraging green chemistry, recycling, and reduced reliance on fossil-fuel-derived plastics are further supporting growth. With increasing consumer preference for eco-friendly products, the Indian market is witnessing strong adoption across both B2B and B2C segments, leading to an accelerated expansion of production facilities and distribution networks.

The castor oil-based biopolymer market in Germany is growing at a CAGR of 17.9%, driven by stringent environmental regulations and consumer demand for sustainable products. Manufacturers are increasingly adopting biodegradable polymers to reduce carbon footprint and meet EU directives on plastic reduction. The market is supported by advanced R&D infrastructure, enabling the development of high-performance biopolymers with improved thermal, mechanical, and chemical properties. Germany’s automotive, packaging, and medical industries are significant consumers of castor oil-based polymers, seeking alternatives to petroleum-based plastics. Collaboration between biopolymer producers and industrial end-users is accelerating innovation and deployment. With growing sustainability initiatives and investment in bio-based material technologies, the German market is expected to maintain steady growth while setting benchmarks for environmentally responsible production in Europe.

The castor oil-based biopolymer market in the United Kingdom is expanding at a CAGR of 14.8%, fueled by increasing consumer preference for eco-friendly packaging and industrial materials. The UK government’s sustainability policies, along with initiatives promoting circular economy practices, are encouraging manufacturers to adopt biodegradable alternatives to conventional plastics. Demand is rising in the packaging, automotive, and electronics industries, where companies are seeking biodegradable, high-performance polymers. The market is witnessing collaborations between suppliers, industrial end-users, and research institutions to enhance polymer properties and production efficiency. With rising awareness of environmental responsibility and growing adoption of bio-based materials, the UK market is expected to experience steady growth over the forecast period.

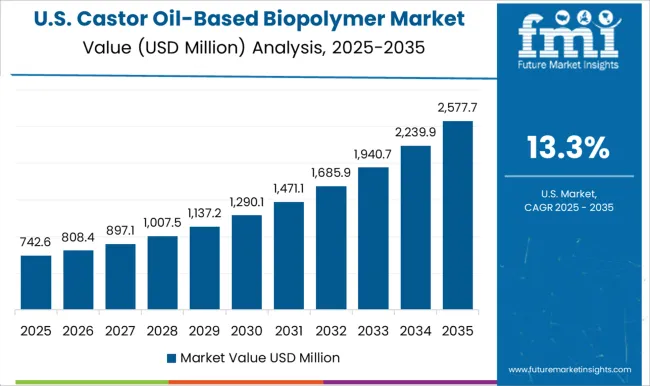

The castor oil-based biopolymer market in the United States is growing at a CAGR of 13.3%, driven by increased adoption of biodegradable materials across packaging, automotive, and consumer goods sectors. Rising awareness of environmental impact and sustainability standards among manufacturers and consumers is encouraging the shift from petroleum-based plastics to bio-based alternatives. Investment in R&D is focused on enhancing thermal, mechanical, and chemical properties of castor oil-based polymers. Regulatory support for eco-friendly materials and initiatives to reduce plastic waste are strengthening market growth. The availability of castor oil as a raw material, coupled with advanced manufacturing technologies, is enabling domestic production of high-performance biopolymers. With steady industrial demand and growing consumer acceptance, the US market is expected to expand steadily over the coming years.

The castor oil-based biopolymer market is driven by growing demand for sustainable and biodegradable materials in packaging, automotive, and specialty applications. Key players focus on innovative formulations, high-performance characteristics, and eco-friendly solutions. Arkema is a major supplier offering bio-based polymers with applications in coatings, adhesives, and plastics. BASF SE and DSM provide a range of biopolymer solutions that combine sustainability with performance. EMS Group and Evonik Industries AG focus on specialty polymers derived from castor oil, catering to high-performance and industrial applications. Envalior and Fulgar SpA develop innovative fibers and materials from castor oil-based polymers for textiles and engineering applications.

Lanxess emphasizes sustainable polymer solutions for industrial applications, while NEUBAU and Nexis Fibers specialize in bio-based materials for niche markets.Solvay S.A and Toray Industries, Inc. supply castor oil-derived polymers that integrate with global industrial applications, offering high-quality, eco-friendly alternatives to conventional plastics. The market is expanding as manufacturers and consumers increasingly prioritize renewable, biodegradable, and high-performance polymer solutions.

| Item | Value |

|---|---|

| Quantitative Units | USD 1280.5 Million |

| Type | Bio-polyamide, Bio-polyurethane, and Oleochemicals and derivatives |

| End Use Industry | Automotive, Electronics, Textile, Packaging, and Others (healthcare, consumer goods, industrial) |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Arkema, BASF SE, DSM, EMS Group, Envalior, Evonik Industries AG, Fulgar SpA, Lanxess, NEUBAU, Nexis Fibers, Solvay S.A, and Toray Industries, Inc |

| Additional Attributes | Dollar sales by type including polyurethanes, polyamides, and epoxy resins, application across automotive, packaging, coatings, and adhesives, and region covering North America, Europe, and Asia-Pacific. Growth is driven by rising demand for sustainable materials, environmental regulations, and increasing adoption in eco-friendly industrial applications. |

The global castor oil-based biopolymer market is estimated to be valued at USD 1,280.5 million in 2025.

The market size for the castor oil-based biopolymer market is projected to reach USD 5,457.0 million by 2035.

The castor oil-based biopolymer market is expected to grow at a 15.6% CAGR between 2025 and 2035.

The key product types in castor oil-based biopolymer market are bio-polyamide, bio-polyurethane and oleochemicals and derivatives.

In terms of end use industry, automotive segment to command 38.7% share in the castor oil-based biopolymer market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Castor Oil Polyol Market Size and Share Forecast Outlook 2025 to 2035

Castor Oil Market Growth – Trends & Forecast 2025 to 2035

Castor Oil Derivatives Market Growth - Trends & Forecast 2025 to 2035

Biopolymer Injection Molders Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Biopolymers Market Size and Share Forecast Outlook 2025 to 2035

Biopolymer Closure Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Biopolymer Films Market Size and Share Forecast Outlook 2025 to 2035

Biopolymer Tubes Market

Renewable Biopolymer Cosmetics Market Size and Share Forecast Outlook 2025 to 2035

Bioplastic and Biopolymer Market Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA