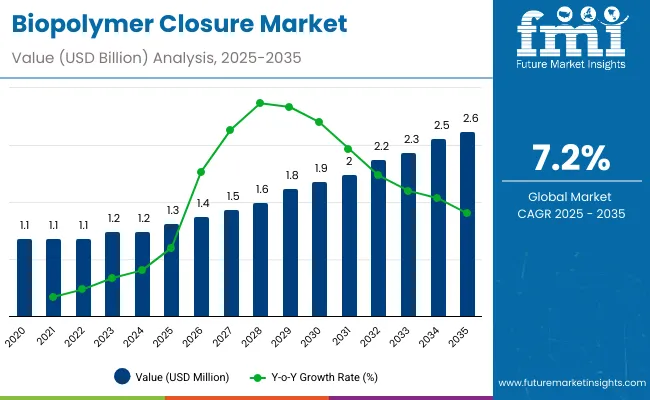

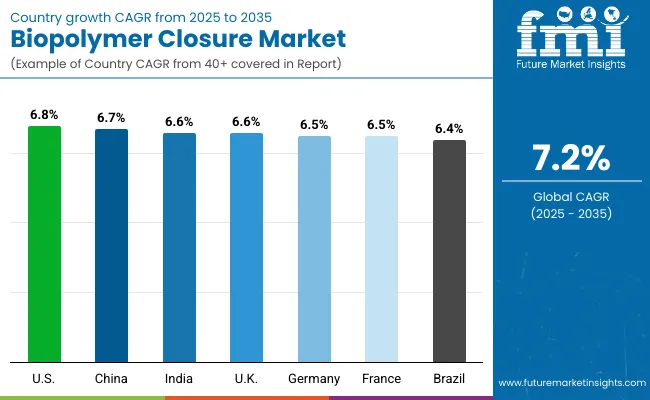

The biopolymer closure market will expand from USD 1.3 billion in 2025 to USD 2.6 billion by 2035, advancing at a CAGR of 7.2%. Growth is driven by bans on petroleum-based plastics, surging demand for sustainable packaging, and adoption in beverages, pharmaceuticals, and cosmetics.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 1.3 billion |

| Industry Value (2035F) | USD 2.6 billion |

| CAGR (2025 to 2035) | 7.2% |

Between 2025 and 2030, the market will add USD 0.5 billion, largely from food and beverage packaging. From 2030 to 2035, another USD 0.8 billion will be added through pharmaceuticals and household products. PLA-based materials and screw closures will anchor global adoption, with Asia-Pacific leading expansion.

From 2020 to 2024, the biopolymer closure market grew steadily as global regulations targeted single-use plastics. PLA and starch-based blends were early choices due to cost efficiency and scalability. Screw and flip-top closures gained traction in beverages and pharmaceuticals, aligning with recyclability and compostability goals.

By 2035, the market will reach USD 2.6 billion at 7.2% CAGR. PLA will remain the leading material due to affordability and widespread adoption. Screw closures will dominate across bottles and jars, aligning with high-volume beverage packaging. Asia-Pacific will lead expansion, while North America and Europe prioritize compliance and sustainable supply chains.

The biopolymer closure market is expanding due to increasing environmental awareness and global regulatory mandates. Food and beverage packaging drives demand, supported by consumer preference for recyclable, compostable, and renewable materials.

Pharmaceuticals and cosmetics also contribute, as companies shift to biopolymer closures for sustainable branding. Advances in PLA and bio-PE enhance durability and shelf-life protection. With global packaging firms prioritizing ESG commitments, biopolymer closures have become essential to balancing sustainability with performance.

The biopolymer closure market is segmented by material, closure type, application, end-use industry, and region. Materials include PLA, PHA, starch blends, cellulose-based biopolymers, bio-PE, and bio-PP. Closure types cover screw, snap-on, flip-top, dispensing, and specialty closures. Applications span bottles, jars, tubes, pouches, and cartons. End-use industries include food and beverages, pharmaceuticals, cosmetics, household, and industrial products across global regions.

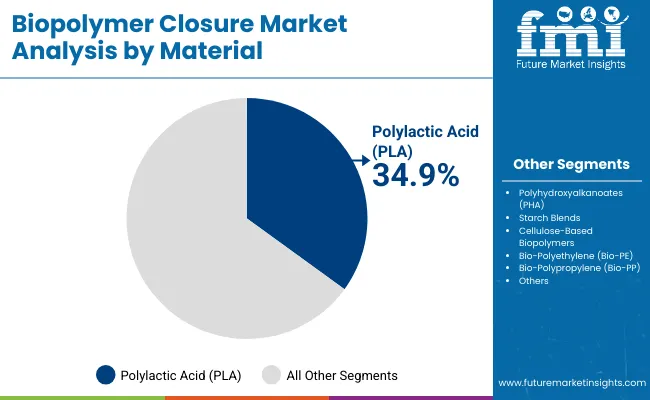

PLA will hold 34.9% share in 2025 due to affordability, biodegradability, and compatibility with bottles and jars. Food and beverages dominate adoption, with manufacturers replacing petroleum plastics. PLA closures also support compostability certifications.

Future growth will benefit from hybrid blends improving barrier properties. Regulatory mandates in Asia-Pacific and Europe will further expand adoption. By 2035, PLA will remain the most widely adopted biopolymer material globally.

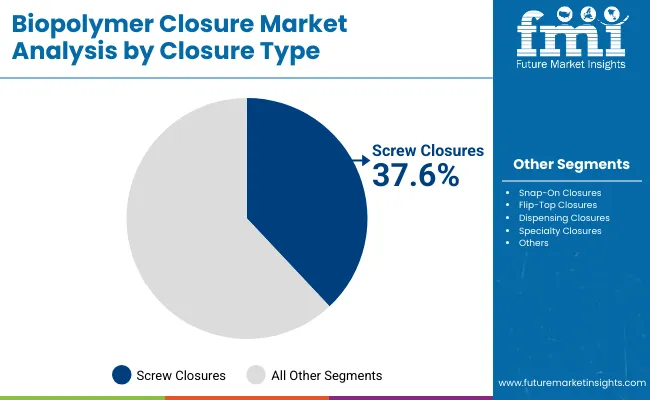

Screw closures will account for 37.6% share in 2025, serving as the most versatile type across beverages, cosmetics, and pharmaceuticals. Their ease of use and cost-effectiveness reinforce demand.

Future growth will be shaped by recyclable and compostable screw closures integrated into glass and bio-plastic bottles. As e-commerce expands, screw closures will dominate as the preferred format.

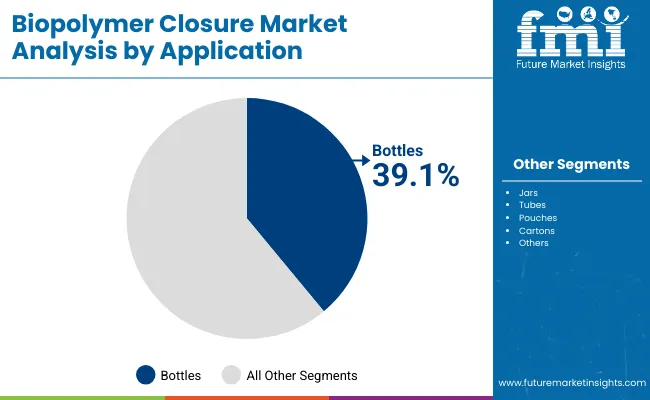

Bottles will represent 39.1% share in 2025, reflecting strong usage in beverages, pharmaceuticals, and personal care. PLA and bio-PE closures ensure compatibility with standard bottle designs.

By 2035, bottle applications will remain dominant as demand for single-serve beverages, liquid medicines, and cosmetics expands. Recyclability features will further reinforce bottle closures as the largest application.

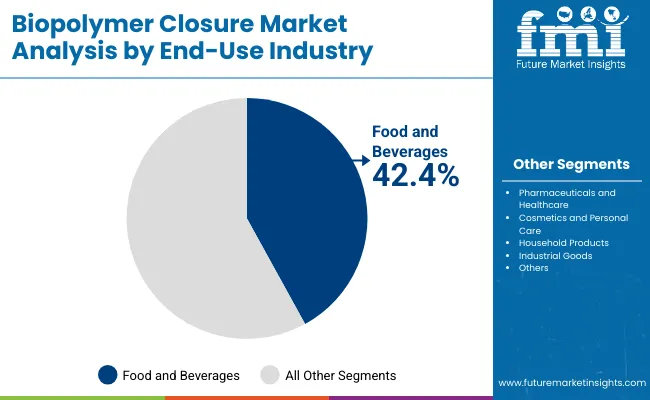

Food and beverages will represent 42.4% share in 2025, reflecting high global packaging volumes. Brands adopt biopolymer closures to strengthen sustainability commitments and comply with EPR mandates.

Future adoption will deepen with rising packaged beverage and dairy consumption. By 2035, food and beverages will remain the leading end-use sector for biopolymer closures worldwide.

Global plastic bans, rising consumer awareness, and expansion of sustainable food packaging drive growth. PLA and starch blends provide scalable alternatives to petroleum plastics. E-commerce further accelerates adoption through recyclable closures. High costs of advanced biopolymers such as PHA and bio-PP restrict penetration. Recycling infrastructure challenges slow transition. Performance limitations in moisture resistance hinder uptake in some sectors.

Healthcare and cosmetics sectors offer significant growth. Premium brands adopt biopolymer closures for sustainable branding. Hybrid composites improve barrier performance, expanding industrial adoption. Trends include integration of compostable closures with bio-based bottles, smart traceability features, and hybrid PLA blends. Partnerships between closure producers and FMCG companies accelerate scaling. Regulatory-driven innovation reinforces growth globally.

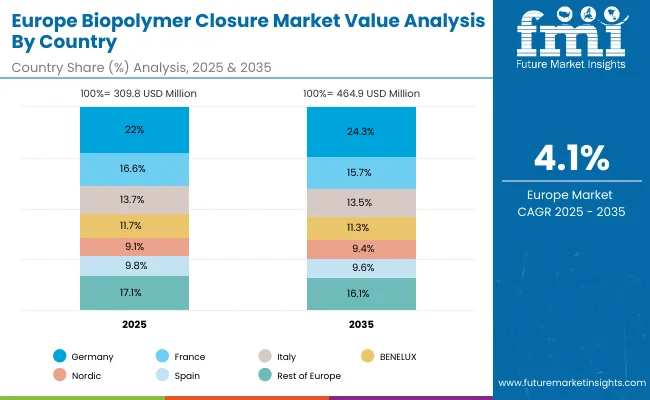

The market is expanding worldwide as sustainability mandates drive adoption. Asia-Pacific leads growth, with South Korea and Japan accelerating usage. North America emphasizes compliance and FMCG packaging, while Europe enforces strict plastic bans.

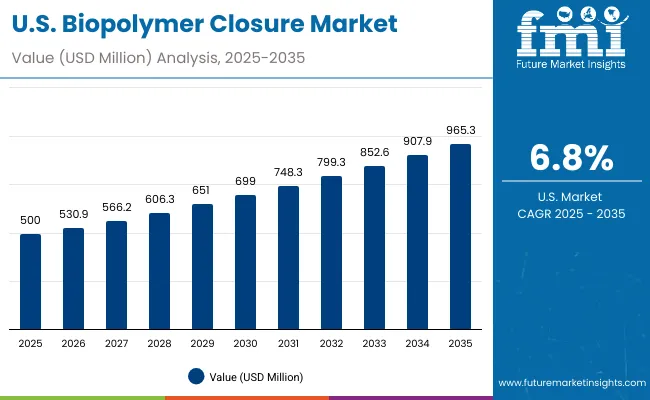

The USA will grow at 6.8% CAGR, driven by beverage and pharmaceutical packaging. Retailers expand eco-friendly offerings. Regulations support adoption.

Germany will expand at 6.5% CAGR under EU mandates. Food and beverage packaging dominates adoption. PLA closures lead growth.

The UK will grow at 6.6% CAGR with plastic taxes in place. FMCG retailers emphasize recyclable closures. Beverages expand adoption.

China will expand at 6.7% CAGR, driven by packaging exports and FMCG. Bio-PE closures gain share.

India will grow at 6.6% CAGR under plastic bans. Bottled water and dairy fuel adoption. PLA closures dominate.

Japan will grow at 7.2% CAGR, supported by premium packaging. Cosmetics and beverages lead adoption. Regulations enforce recyclability.

South Korea will lead with 7.3% CAGR, driven by FMCG and beverages. E-commerce boosts demand. PLA and bio-PP dominate adoption.

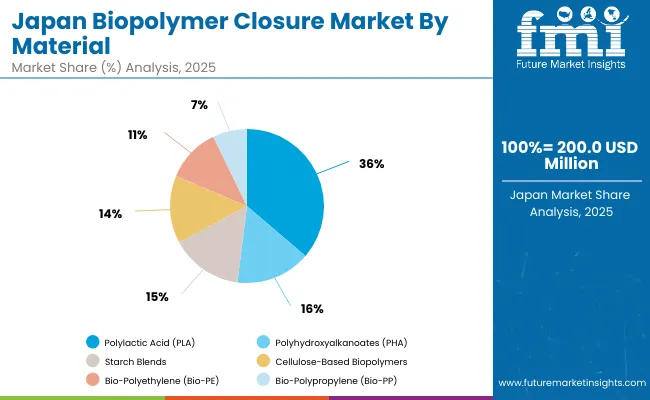

Japan’s biopolymer closure market, worth USD 200 million in 2025, is led by polylactic acid (PLA) with a 34.9% share, supported by its compostability and regulatory compliance. Polyhydroxyalkanoates (PHA) follow with 16.2%, valued for biodegradability and medical-grade packaging use. Starch blends account for 15.1%, offering low-cost eco-friendly alternatives. Cellulose-based biopolymers hold 14.5%, providing strength and recyclability benefits. Bio-polyethylene (Bio-PE) contributes 11.9%, while bio-polypropylene (Bio-PP) adds 7.4%, targeting durable closure applications. Japan’s material segmentation reflects a balanced mix of performance-driven and cost-efficient biopolymers. Rising sustainability targets and food safety standards are pushing wider adoption across FMCG and healthcare packaging.

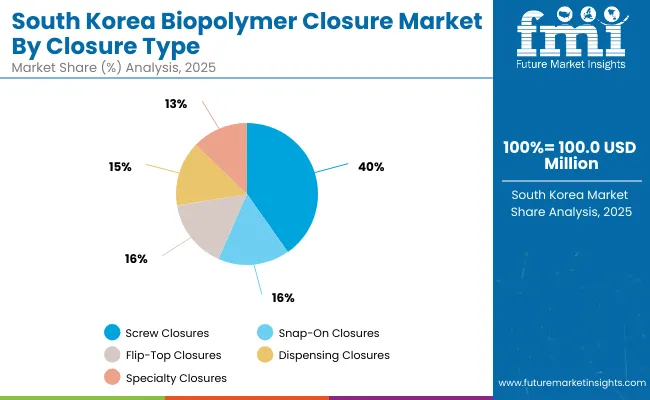

South Korea’s biopolymer closure market, valued at USD 100 million in 2025, is dominated by screw closures with a 39.1% share, due to their wide use in beverages and household packaging. Snap-on closures hold 15.5%, supported by convenience packaging in food and cosmetics. Flip-top closures capture 14.0%, benefiting from demand in personal care and pharmaceutical applications. Dispensing closures contribute 12.7%, designed for hygiene and dosage control, while specialty closures account for 11.4%, serving premium packaging formats. South Korea’s closure segmentation highlights versatility across industries. Market momentum is fueled by eco-friendly consumer preferences and government-led circular economy initiatives.

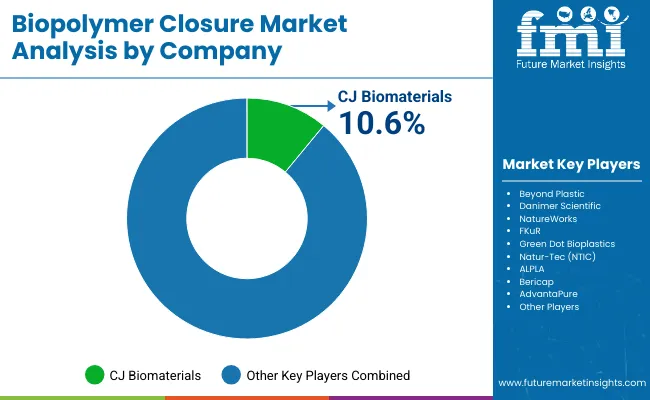

The market is moderately fragmented with global leaders such as CJ Biomaterials, Beyond Plastic, Danimer Scientific, NatureWorks, FKuR, Green Dot Bioplastics, Natur-Tec (NTIC), ALPLA, Bericap, and AdvantaPure. These firms focus on expanding PLA and PHA closures, recyclable designs, and automation compatibility.

NatureWorks and Danimer lead PLA and PHA innovation, while CJ Biomaterials emphasizes industrial scalability. ALPLA and Bericap dominate beverage packaging integration. Smaller firms such as AdvantaPure and Beyond Plastic target niche healthcare and cosmetics markets. Competition centers on sustainability, affordability, and certifications, with Asia-Pacific players scaling fastest under regulatory mandates.

Key Developments of Biopolymer Closure Market

| Item | Value |

|---|---|

| Quantitative Units | USD 1.3 Billion |

| By Material | PLA, PHA, Starch Blends, Cellulose-Based, Bio-PE, Bio-PP |

| By Closure Type | Screw, Snap-On, Flip-Top, Dispensing, Specialty |

| By Application | Bottles, Jars, Tubes, Pouches, Cartons |

| By End-Use Industry | Food & Beverages, Pharmaceuticals, Cosmetics, Household, Industrial Goods |

| Key Companies Profiled | CJ Biomaterials, Beyond Plastic, Danimer Scientific, NatureWorks, FKuR, Green Dot Bioplastics, Natur -Tec (NTIC), ALPLA, Bericap, AdvantaPure |

| Additional Attributes | Growth driven by FMCG packaging, sustainability mandates, and bio-based innovations. |

The market will be valued at USD 1.3 billion in 2025.

The market will reach USD 2.6 billion by 2035.

The market will grow at a CAGR of 7.2% during 2025-2035.

PLA closures will lead with a 34.9% share in 2025.

Screw closures will dominate with a 37.6% share in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Biopolymer Injection Molders Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Biopolymers Market Size and Share Forecast Outlook 2025 to 2035

Biopolymer Films Market Size and Share Forecast Outlook 2025 to 2035

Biopolymer Tubes Market

Renewable Biopolymer Cosmetics Market Size and Share Forecast Outlook 2025 to 2035

Bioplastic and Biopolymer Market Forecast Outlook 2025 to 2035

Castor Oil-Based Biopolymer Market Size and Share Forecast Outlook 2025 to 2035

Enclosure Support Arm Systems Market Size and Share Forecast Outlook 2025 to 2035

Bag Closure Clips Market Size and Share Forecast Outlook 2025 to 2035

Bag Closures Market Size and Share Forecast Outlook 2025 to 2035

Competitive Breakdown of Bag Closure Clip Providers

Case Closures and Sealers Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Tube Closures Market Size and Share Forecast Outlook 2025 to 2035

Heart Closure Devices Market Size and Share Forecast Outlook 2025 to 2035

Cap and Closure Market Trends - Growth & Demand 2025-2035

T-Top Closures Market - Growth & Demand 2025 to 2035

Crown Closures Market Growth & Packaging Innovations 2025 to 2035

Metal Closures Market Report – Key Trends & Forecast 2024-2034

Spout Closures Market

Ribbed Closures Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA