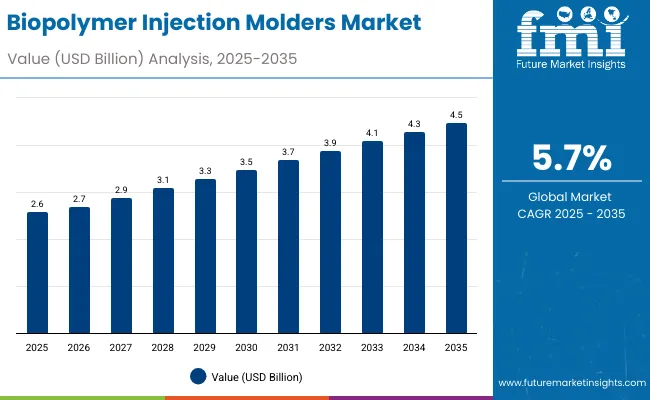

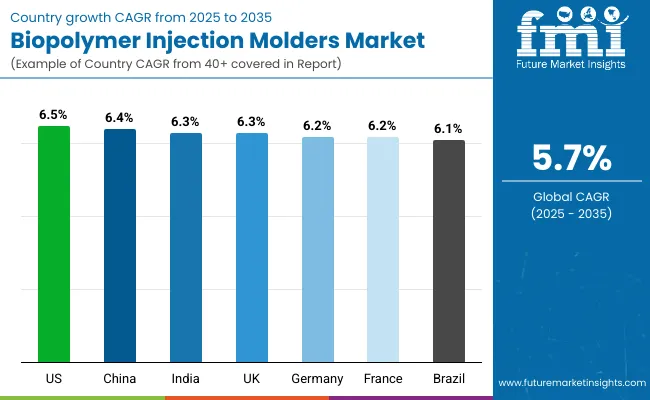

The biopolymer injection molders market will grow from USD 2.6 billion in 2025 to USD 4.5 billion by 2035, advancing at a CAGR of 5.7%. The demand surge stems from increasing bioplastics adoption in packaging, consumer goods, and medical devices. PLA remains the leading material due to process compatibility and biodegradability.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 2.6 billion |

| Industry Value (2035F) | USD 4.5 billion |

| CAGR (2025 to 2035) | 5.7% |

Between 2025 and 2030, market growth of USD 0.9 billion will be driven by packaging and automotive applications. Between 2030 and 2035, another USD 1 billion increase will result from medical-grade biopolymer innovations. Asia-Pacific leads market expansion through large-scale bioplastic production hubs.

From 2020 to 2024, the market expanded as global bans on single-use plastics accelerated demand for biodegradable polymers. Packaging, healthcare, and consumer goods manufacturers increasingly replaced petroleum-based plastics with PLA and PHA alternatives.

By 2035, the market will reach USD 4.5 billion, with Asia-Pacific and Europe leading the transition toward fully compostable molded products. Automation, recyclable molds, and hybrid biopolymer formulations will define the decade’s advancements.

Growth is fueled by sustainability mandates, government incentives, and cost-efficient molding technologies. Manufacturers adopt biopolymers to reduce carbon emissions and comply with extended producer responsibility (EPR) frameworks.

The food packaging sector drives large-scale adoption of compostable molded containers, while medical and automotive sectors adopt bioplastics for regulatory compliance and performance enhancement.

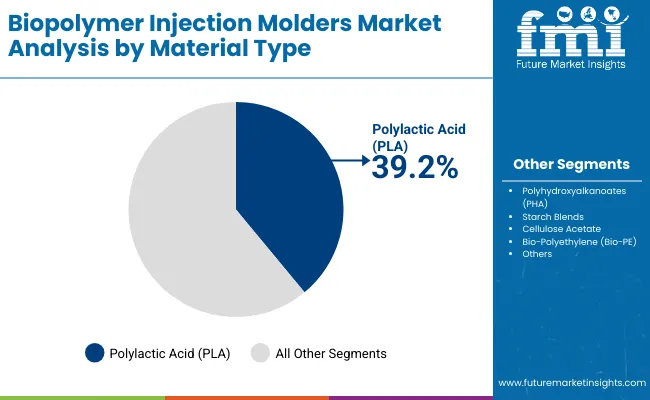

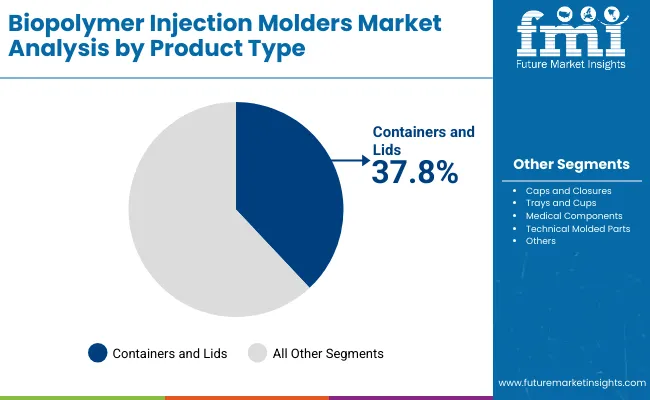

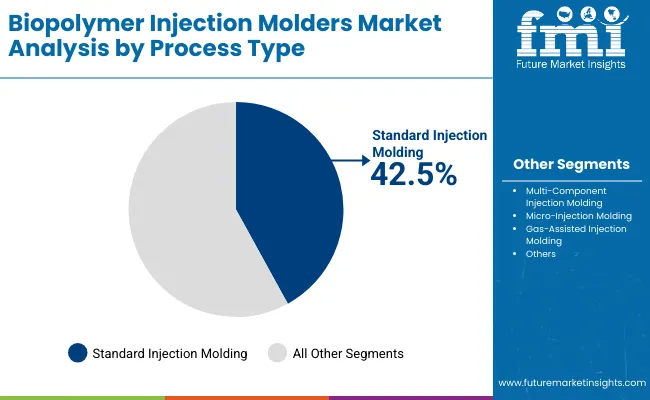

The market is segmented by material, product type, process type, end-use industry, and region. Materials include PLA, PHA, starch blends, cellulose acetate, and bio-polyethylene. Product types include containers, lids, caps, trays, and technical molded parts. Process types comprise standard, multi-component, micro, and gas-assisted injection molding.

PLA will hold 39.2% share in 2025, driven by cost efficiency, availability, and compatibility with standard injection systems. Its strength and clarity make it ideal for packaging, consumer, and disposable medical goods.

By 2035, enhancements in heat resistance and flexibility will strengthen its role across food-grade and automotive applications.

Containers and lids will account for 37.8% share in 2025, widely used in packaging and retail sectors. Demand is driven by compostable alternatives to traditional PET containers.

By 2035, improved durability and shelf-life compatibility will increase their market share, particularly in food packaging.

Standard injection molding will hold 42.5% share in 2025 due to its scalability, cost efficiency, and material adaptability. It supports mass production across food packaging and consumer goods.

Automation integration and bio-based mold design will further improve process sustainability through 2035.

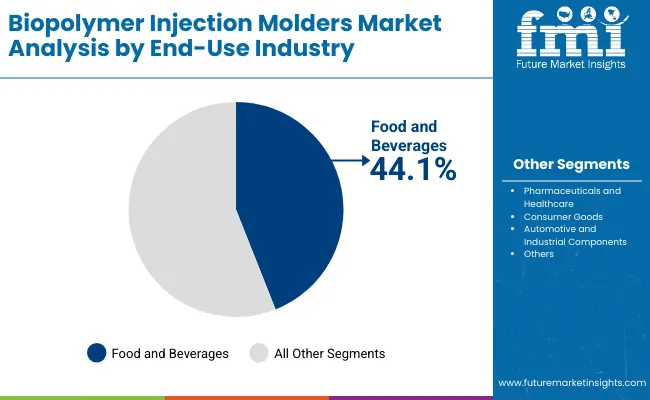

Food and beverages will capture 44.1% share in 2025, supported by stringent packaging sustainability regulations. Compostable biopolymer trays, cups, and cutlery gain strong traction.

Future growth will rely on innovative film-grade resins and improved end-of-life recyclability.

Government regulations banning single-use plastics and increased demand for biodegradable materials drive adoption. PLA and PHA offer eco-friendly alternatives for packaging and healthcare sectors.

High production costs and limited thermal performance hinder full-scale adoption. Limited composting infrastructure also affects disposal rates.

Emerging opportunities lie in micro-molding of medical components and multi-component injection systems for sustainable consumer goods.

Trends include bio-additive integration, mold recyclability, and digital twin simulation for precision molding. Circular economy initiatives enhance material recovery and design optimization.

The global biopolymer injection molders market is expanding rapidly as the packaging, automotive, and consumer goods industries transition to biodegradable materials. Asia-Pacific leads in production and innovation, backed by strong government incentives and large-scale bioplastic manufacturing. Europe focuses on circular economy principles and compliance with stringent sustainability laws, while North America is driving adoption through food packaging and healthcare applications. The market’s growth is anchored in automation, material innovation, and the global shift toward eco-certified manufacturing.

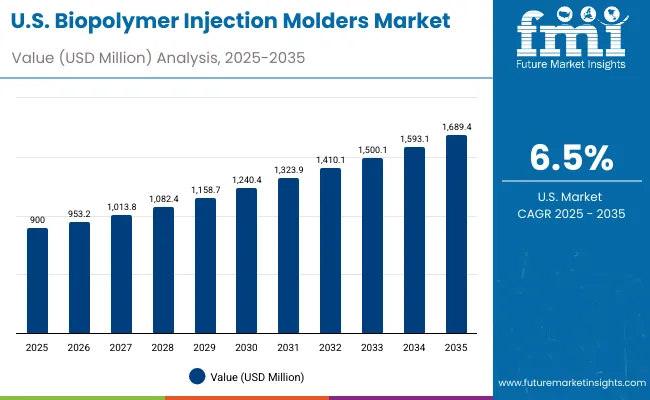

The USA market will grow at a CAGR of 6.5% from 2025 to 2035, supported by increasing regulatory and consumer demand for bioplastic packaging. Compostable containers and foodservice items are driving mass adoption across retail and QSR sectors. Automation in biopolymer injection molding is improving throughput and consistency. Rising use of healthcare-grade biodegradable polymers is expanding opportunities in medical disposables, aligning with federal sustainability targets and circular packaging goals.

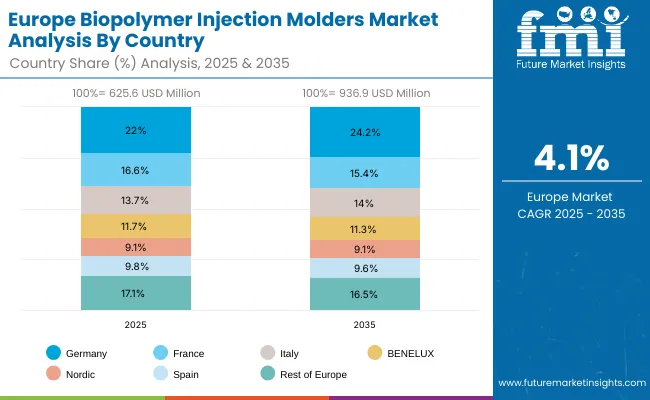

Germany will grow at a CAGR of 6.2%, driven by its leadership in circular manufacturing and EU-wide sustainability mandates. The automotive and electronics industries are adopting biopolymer-based components to reduce carbon footprints. Strong R&D investments in high-performance bio-resins are sustaining technological competitiveness. Germany’s commitment to carbon neutrality and closed-loop material systems continues to make it a key hub for biopolymer molding innovation in Europe.

The UK market will grow at a CAGR of 6.3%, propelled by mandatory sustainable packaging initiatives and growing retailer adoption of biodegradable containers. Investment in bio-based moldingcenters is expanding nationwide. Recyclable and compostable mold technologies are improving operational efficiency for FMCG and logistics packaging. The transition to greener materials is being reinforced by government-backed innovation funds and rising consumer awareness of environmental packaging.

China will grow at a CAGR of 6.4%, supported by national waste control programs and renewable material incentives. The country’s bioplastic exports are increasing, driven by strong production capacity and global demand for cost-effective biodegradable materials. Expansion in consumer goods, foodservice, and e-commerce packaging is strengthening market fundamentals. Local molders are enhancing efficiency through smart automation and precision molding technology.

India will grow at a CAGR of 6.3%, supported by manufacturing startups and local government incentives promoting bio-based production. Food packaging reforms and single-use plastic bans are boosting adoption across FMCG sectors. Supply chain improvements for PLA, PHA, and starch blends are enhancing local material availability. India’s growing export capacity and investment in biopolymer infrastructure position it as a rising hub for sustainable manufacturing in Asia.

Japan will grow at a CAGR of 6.9%, led by R&D advancements in biocompatible materials and high-precision molding systems. Robotics and smart production tools are improving molding accuracy and reducing waste. Demand for hybrid PLA/PHA materials is expanding in packaging, electronics, and healthcare sectors. Government-backed eco-label programs and export-oriented innovation continue to strengthen Japan’s position in advanced sustainable material technologies.

South Korea will lead with a CAGR of 7.0%, driven by strong innovation in bioplastic formulations and digital manufacturing. The country’s OEM partnerships are scaling production for global clients in packaging and consumer goods. Smart mold technology and data-driven automation are improving precision and sustainability performance. South Korea’s emphasis on recyclable, bio-based materials support its emergence as a key biopolymer technology exporter in Asia.

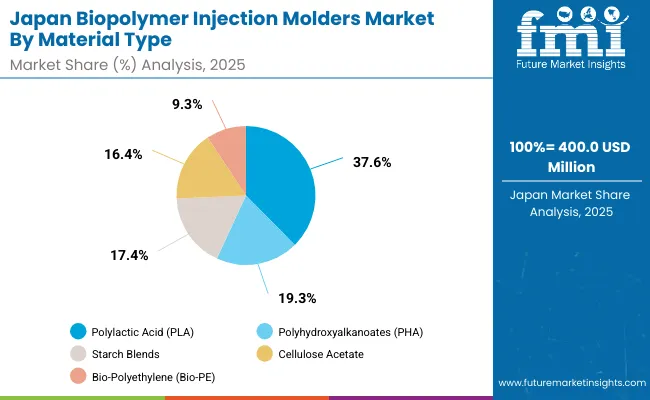

Japan’s biopolymer injection molders market, valued at USD 400.0 million in 2025, is dominated by polylactic acid (PLA), accounting for 37.6% share due to its biodegradability and high compatibility with precision molding applications. Polyhydroxyalkanoates (PHA) and starch blends are gaining traction in sustainable packaging solutions. Cellulose acetate supports growth in optical and consumer goods, while bio-polyethylene (Bio-PE) ensures strength and thermal stability for industrial applications, driving Japan’s green manufacturing initiatives.

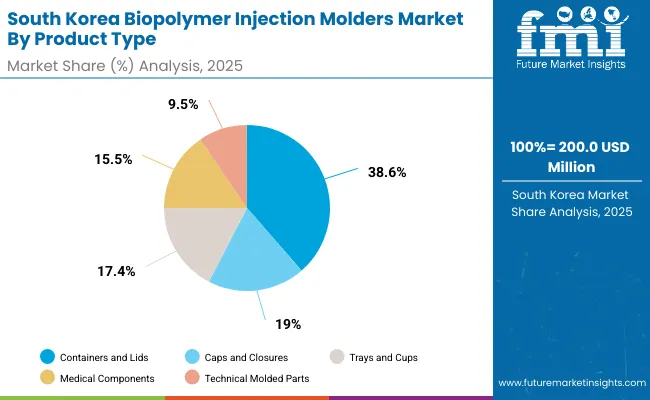

South Korea’s biopolymer injection molders market, valued at USD 200.0 million in 2025, is led by containers and lids, representing 38.6% of total demand, driven by eco-friendly food packaging. Caps and closures follow with expanding use in beverage and personal care industries. Trays and cups dominate quick-service and takeaway packaging, while medical components and technical molded parts highlight the country’s transition toward precision biopolymer engineering across healthcare and electronics sectors.

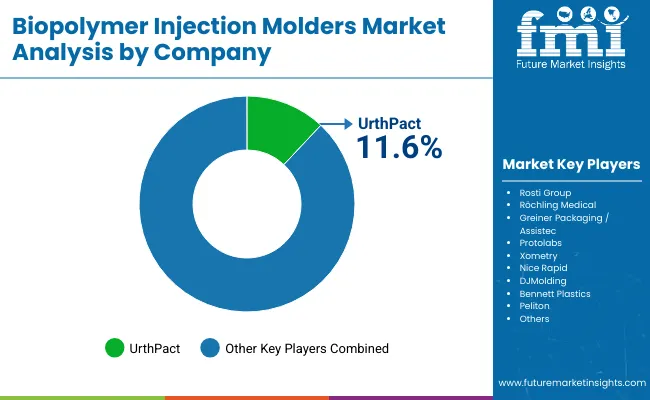

The market is moderately fragmented with key players UrthPact, Rosti Group, Röchling Medical, Greiner Packaging/Assistec, Protolabs, Xometry, Nice Rapid, DJMolding, Bennett Plastics, and Peliton.

UrthPact and Rosti Group lead food-grade biopolymer molding, while Röchling Medical and Greiner Packaging dominate healthcare-grade applications. Xometry and Protolabs focus on rapid prototyping and short-run bioplastic molding. Competitive strategies emphasize precision engineering, recyclability, and global supply chain integration.

Key Developments of Biopolymer Injection Molders Market

| Item | Value |

|---|---|

| Quantitative Units | USD 2.6 Billion |

| By Material | PLA, PHA, Starch Blends, Cellulose Acetate, Bio-PE |

| By Product Type | Containers, Lids, Caps, Trays, Medical, Technical Parts |

| By Process Type | Standard, Multi-Component, Micro, Gas-Assisted Molding |

| By End-Use Industry | Food & Beverages, Healthcare, Consumer Goods, Automotive |

| Key Companies Profiled | UrthPact, Rosti Group, Röchling Medical, Greiner Packaging/ Assistec, Protolabs, Xometry, Nice Rapid, DJMolding, Bennett Plastics, Peliton |

| Additional Attributes | Growth driven by bioplastic adoption, circular economy initiatives, and automation in injection molding. |

The market will be valued at USD 2.6 billion in 2025.

The market will reach USD 4.5 billion by 2035.

The market will grow at a CAGR of 5.7% during 2025-2035.

Polylactic Acid will dominate with a 39.2% share in 2025.

Standard injection molding will lead with a 42.5% share in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Biopolymers Market Size and Share Forecast Outlook 2025 to 2035

Biopolymer Closure Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Biopolymer Films Market Size and Share Forecast Outlook 2025 to 2035

Biopolymer Tubes Market

Renewable Biopolymer Cosmetics Market Size and Share Forecast Outlook 2025 to 2035

Bioplastic and Biopolymer Market Forecast Outlook 2025 to 2035

Castor Oil-Based Biopolymer Market Size and Share Forecast Outlook 2025 to 2035

Injection Epoxy Chemical Anchors Market Size and Share Forecast Outlook 2025 to 2035

Injection Blow Molding Machine Market Size and Share Forecast Outlook 2025 to 2035

Injection Molding Machine Market Size and Share Forecast Outlook 2025 to 2035

Injection Moulding Cosmetic Packaging Market Size and Share Forecast Outlook 2025 to 2035

Injection Molding Machines Industry Analysis in India Size, Share & Forecast 2025 to 2035

Injection Pen Market Insights - Growth, Demand & Forecast 2025 to 2035

Injection Bottles Market Analysis – Size, Demand & Forecast 2025 to 2035

Market Share Distribution Among Injection Moulding Cosmetic Packaging Manufacturers

Injection Molded Plastic Market Trends – Growth & Forecast 2024-2034

Injection Molding Polyamide 6 Market Growth – Trends & Forecast 2024-2034

Injection Molding Containers Market

Lip Injection Market Size and Share Forecast Outlook 2025 to 2035

Fuel Injection System Market Growth - Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA