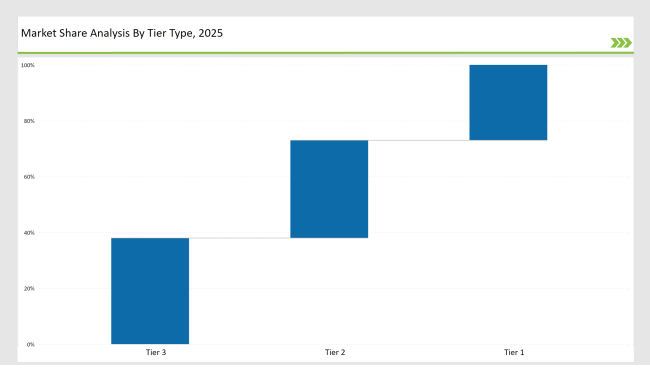

The global Injection Moulding Cosmetic Packaging Market remains highly competitive, with companies strategically positioned across Tier 1, Tier 2, and Tier 3 based on market influence and execution strategies. Leading companies, RPC Group, Albea, and AptarGroup, collectively hold over 27% of the market, leveraging economies of scale, advanced automation, and sustainability-driven innovations to maintain dominance.

Tier 2 players, including Silgan Holdings, HCP Packaging, and Quadpack, account for 35% of the market. These companies differentiate themselves by offering cost-effective, highly customizable, and automated injection moulding solutions tailored to mid-sized enterprises seeking efficient and high-precision cosmetic packaging.

Tier 3 players, consisting of regional manufacturers, private labels, and emerging startups, contribute 38% of the market share. These companies prioritize agility and innovation, focusing on eco-friendly, high-performance, and aesthetically appealing packaging solutions that effectively address niche consumer demands and market gaps with specialized offerings.

Global Market Share by Key Players (2025)

| Category | Market Share (%) |

|---|---|

| Top 3 (RPC Group, Albea, AptarGroup) | 13% |

| Rest of Top 5 (Silgan Holdings, HCP Packaging) | 8% |

| Next 5 of Top 10 (Quadpack, Graham Packaging, Berry Global, Rieke, Lumson) | 6% |

The Injection Moulding Cosmetic Packaging Market serves multiple industries, including

Companies provide a variety of solutions tailored to industry needs

Throughout the year, industry leaders advanced the Injection Moulding Cosmetic Packaging Market by launching sustainable solutions, investing in automation, and expanding market reach.

RPC Group, Albea, AptarGroup, Silgan Holdings, and HCP Packaging played key roles by introducing biodegradable packaging, AI-driven manufacturing, and smart packaging solutions. The market focus on sustainability compliance, luxury aesthetics, and efficient production methods strengthened global supply chains and improved cost-effectiveness.

Year-on-Year Leaders

| Tier Type | Example of Key Players |

|---|---|

| Tier 1 | RPC Group, Albea, AptarGroup |

| Tier 2 | Silgan Holdings, HCP Packaging, Quadpack |

| Tier 3 | Graham Packaging, Berry Global, Rieke, Lumson |

| Manufacturer | Latest Developments |

|---|---|

| RPC Group | Launched 100% recyclable injection-moulded cosmetic packaging (March 2024). |

| Albea | Introduced luxury, eco-friendly cosmetic containers (April 2024). |

| AptarGroup | Developed smart dispensing caps for high-end skincare (May 2024). |

| Silgan Holdings | Expanded travel-friendly, lightweight packaging solutions (July 2024). |

| HCP Packaging | Launched biodegradable lipstick and compact cases (August 2024). |

| Quadpack | Innovated refillable and sustainable makeup packaging (September 2024). |

| Graham Packaging | Developed lightweight and durable injection-moulded cosmetic containers (October 2024). |

| Berry Global | Introduced biodegradable cosmetic packaging solutions (November 2024). |

The Injection Moulding Cosmetic Packaging Market is evolving with eco-friendly materials, AI-driven customization, and smart packaging technologies. Innovations in biodegradable plastics, RFID-enabled refillable containers, and automation-driven manufacturing will define the industry's next phase, balancing sustainability, cost-efficiency, and aesthetics.

Major manufacturers include RPC Group, Albea, AptarGroup, Silgan Holdings, HCP Packaging, and Quadpack.

The top 10 players hold approximately 27% of the global market, with Tier 1 companies leading with over 50%.

Market concentration remains medium, with top players holding 25-60% of total market share.

Increasing regulatory requirements, rising raw material costs, and the demand for sustainable alternatives challenge industry growth and profitability.

AI-driven automation, 3D printing for rapid prototyping, and biodegradable material advancements will play a significant role in market evolution.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Injection Epoxy Chemical Anchors Market Size and Share Forecast Outlook 2025 to 2035

Injection Blow Molding Machine Market Size and Share Forecast Outlook 2025 to 2035

Injection Molding Machine Market Size and Share Forecast Outlook 2025 to 2035

Injection Pen Market Insights - Growth, Demand & Forecast 2025 to 2035

Injection Bottles Market Analysis – Size, Demand & Forecast 2025 to 2035

Injection Molded Plastic Market Trends – Growth & Forecast 2024-2034

Injection Molding Polyamide 6 Market Growth – Trends & Forecast 2024-2034

Injection Molding Containers Market

Injection Molding Machines Industry Analysis in India Size, Share & Forecast 2025 to 2035

Injection Moulding Cosmetic Packaging Market Size and Share Forecast Outlook 2025 to 2035

Lip Injection Market Size and Share Forecast Outlook 2025 to 2035

Fuel Injection System Market Growth - Trends & Forecast 2025 to 2035

Micro Injection Molded Plastic Market Size and Share Forecast Outlook 2025 to 2035

Metal Injection Molding (MIM) Parts Market Size and Share Forecast Outlook 2025 to 2035

India Injection Moulders Market – Demand and Growth Forecast 2025 to 2035

Europe Injection Molding Machines Market Size and Share Forecast Outlook 2025 to 2035

Europe Injection Moulders Market Size and Share Forecast Outlook 2025 to 2035

Powder Injection Molding Market Growth – Trends & Forecast 2025 to 2035

Sliding Injection Molding Machines Market Size and Share Forecast Outlook 2025 to 2035

Plastic Injection Molding Machine For Medtech Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA