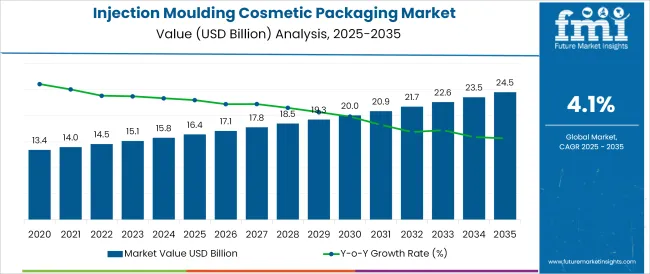

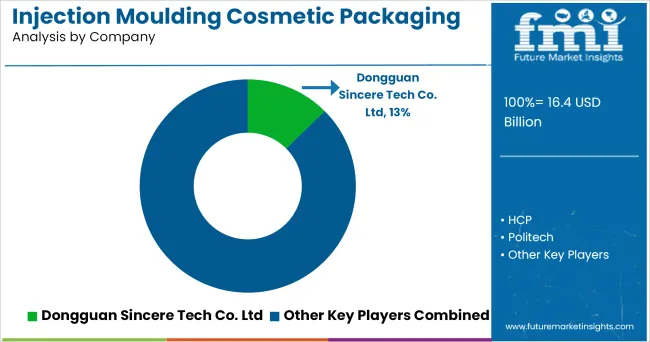

The Injection Moulding Cosmetic Packaging Market is estimated to be valued at USD 16.4 billion in 2025 and is projected to reach USD 24.5 billion by 2035, registering a compound annual growth rate (CAGR) of 4.1% over the forecast period.

The injection moulding cosmetic packaging market is witnessing significant growth, propelled by rising consumer expectations for precision, durability, and aesthetic consistency in beauty product packaging. As the cosmetics industry expands across both mass and premium segments, demand for customizable, high-finish packaging components has surged. Injection moulding technology is being increasingly adopted due to its ability to produce complex geometries with high repeatability and minimal waste.

Global beauty brands are also turning toward automated moulding techniques to meet accelerated product launch cycles and sustainability goals. The integration of recyclable and lightweight materials into moulding processes is enabling brands to meet evolving environmental standards without compromising on visual appeal. Moreover, the preference for personalized and travel-sized beauty solutions has intensified the need for compact, accurately manufactured packaging parts.

As a result, the market is positioned for continued innovation in tooling design, multi-material integration, and high-speed production systems.

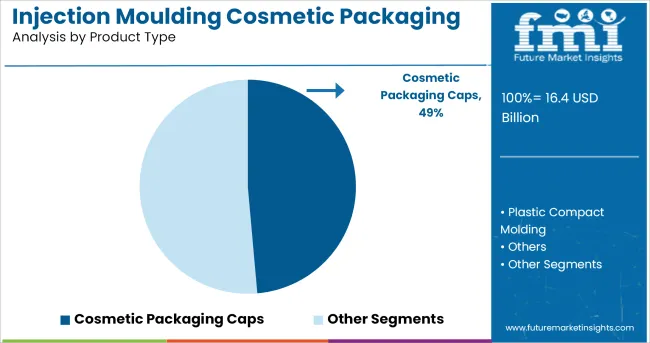

The cosmetic packaging caps segment is projected to account for 48.60% of total market revenue by 2025, establishing it as the leading product type. This dominance is attributed to the consistent demand for secure, functional, and visually refined closure systems in cosmetic applications. Caps play a critical role in preserving product integrity, preventing leakage, and delivering user convenience, particularly in lotions, serums, and foundations.

The compatibility of injection moulding with intricate cap designs and brand-specific aesthetics has made it the preferred manufacturing approach. Additionally, high-volume production efficiency and cost-effectiveness have further strengthened the segment’s position.

The role of caps in enhancing shelf appeal and supporting brand differentiation, coupled with the rise of refillable and travel-friendly formats, has reinforced their widespread adoption, making them the most commercially significant product category in the injection moulding cosmetic packaging market.

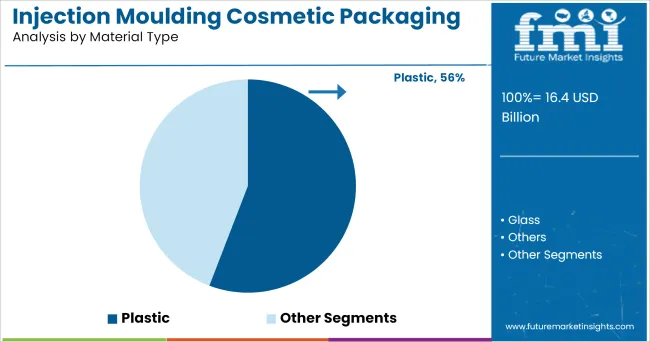

The plastic material type segment is expected to command 55.80% of market revenue by 2025, reflecting its prominence in injection moulding cosmetic packaging. This preference stems from plastic’s versatility, lightweight properties, and cost-effectiveness, which make it suitable for producing intricate, durable, and visually appealing packaging components.

Plastic’s compatibility with a range of finishes, colors, and barrier technologies allows brands to tailor packaging to both functional and aesthetic needs. Additionally, the material supports rapid prototyping and scalable manufacturing, which are critical for the fast-paced cosmetics industry.

The growing use of recyclable and bio-based plastics has further elevated its relevance, aligning with sustainability mandates without sacrificing performance. These advantages have made plastic the material of choice for a wide array of packaging formats, including caps, closures, and compact containers, cementing its leadership in the material type segment.

Cosmetics are quite valuable, but they are also very perishable. It's important to note that the preservation of a packed product is dependent on the features of the packing material as well as suitable packaging, transport, storage, and distribution conditions.

Sustainably produced raw materials are being introduced into the cosmetics industry not only as cosmetic ingredients but also as packaging materials. The market is expanding due to a rise in cosmetic product use. As the demand for eco-friendly cosmetic packaging grows, customers anticipate sustainable packaging in cosmetics items.

Furthermore, the market is being driven by an increased focus on innovation and appealing packaging. Cosmetic firms are using novel packaging solutions such as recyclable plastic and compostable and biodegradable plastics in response to rising consumer demand for practical and user-friendly dispensing systems and products.

To fulfil diverse packaging needs, cosmetic packaging comprises a range of glass and plastic cosmetic jars. The demand for skincare product packaging is increasing as there are a variety of packaging solutions for cosmetic products to fit diverse product forms and compositions.

Furthermore, injection moulding cosmetic packing sales are also being driven by technological advancements such as airless skincare packaging and 3-D printing technologies.

Advanced and prominent printing methods, such as hot-stamp foil printing and flexo-offset printing, are allowing manufacturers to create unique and eye-catching skincare packaging for their cosmetic brands, which is driving the injection moulding cosmetic packing market forward.

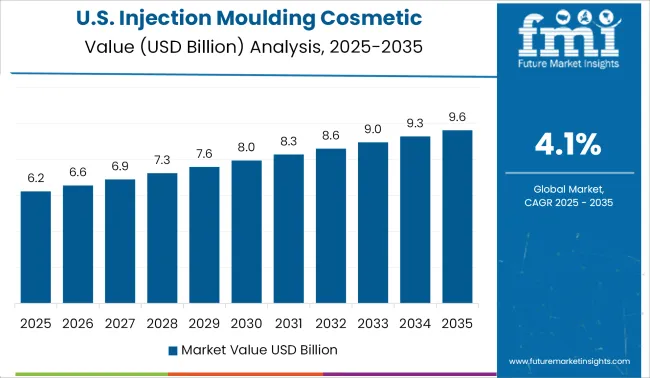

As per the regional analysis in North America, the USA account for a noteworthy share of the market. Ongoing health and sustainability trends that expand customer interest in personal care goods are some of the factors supporting the injection moulding cosmetic packaging industry's expansion in the region.

In addition, following the worldwide trend, the cosmetics market is seeing an increase in demand for premiumization. As a result, the demand for innovative and premium packaging is increasing.

Skincare, on the other hand, is a need-based and high-penetration category with items that produce regular and continuous usage, which serves to shield the category to some extent. Growing awareness of cleanliness and rising aspects such as self-care will drive demand for injection moulding cosmetic packaging in the United States and Canada.

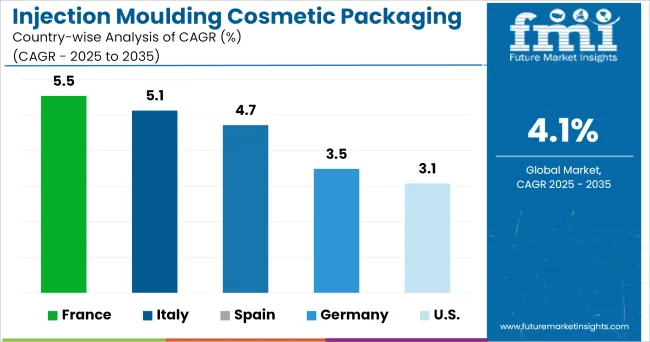

Some of the important factors driving market expansion in the region are the increasing usage of innovative technology for cosmetic packaging and the growing trends in skincare and beauty goods. In recent years, the European cosmetics market has been one of the fastest-growing sectors, owing to an increasingly engaged customer base.

The selling of luxury cosmetic packaging increased significantly in the European market. As a result, Cosmetics packaging manufacturers in the region are continuously investing in the creation of sustainable caps and closures, which will aid the entire industry's long-term success.

Aptar Beauty + Home, for example, announced the debut of a dispensing cap in the European market in February 2020. This seal is made up of 50% post-consumer recycled resin (PCR), which will help the company maintain a stronghold in the steadily rising cosmetic packaging market.

Some of the leading manufacturers and suppliers of injection moulding cosmetic packing include

The report is a compilation of first-hand information, qualitative and quantitative assessments by industry analysts, and inputs from industry experts and industry participants across the value chain.

The report provides an in-depth analysis of parent market trends, macro-economic indicators and governing factors along with market attractiveness as per segments. The report also maps the qualitative impact of various market factors on market segments and geographies.

The global injection moulding cosmetic packaging market is estimated to be valued at USD 16.4 billion in 2025.

The market size for the injection moulding cosmetic packaging market is projected to reach USD 24.5 billion by 2035.

The injection moulding cosmetic packaging market is expected to grow at a 4.1% CAGR between 2025 and 2035.

The key product types in injection moulding cosmetic packaging market are cosmetic packaging caps, plastic compact molding and others.

In terms of material type, plastic segment to command 55.8% share in the injection moulding cosmetic packaging market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Market Share Distribution Among Injection Moulding Cosmetic Packaging Manufacturers

Injection Epoxy Chemical Anchors Market Size and Share Forecast Outlook 2025 to 2035

Injection Blow Molding Machine Market Size and Share Forecast Outlook 2025 to 2035

Injection Molding Machine Market Size and Share Forecast Outlook 2025 to 2035

Injection Molding Machines Industry Analysis in India Size, Share & Forecast 2025 to 2035

Injection Pen Market Insights - Growth, Demand & Forecast 2025 to 2035

Injection Bottles Market Analysis – Size, Demand & Forecast 2025 to 2035

Injection Molded Plastic Market Trends – Growth & Forecast 2024-2034

Injection Molding Polyamide 6 Market Growth – Trends & Forecast 2024-2034

Injection Molding Containers Market

Lip Injection Market Size and Share Forecast Outlook 2025 to 2035

Fuel Injection System Market Growth - Trends & Forecast 2025 to 2035

Micro Injection Molded Plastic Market Size and Share Forecast Outlook 2025 to 2035

Metal Injection Molding (MIM) Parts Market Size and Share Forecast Outlook 2025 to 2035

India Injection Moulders Market – Demand and Growth Forecast 2025 to 2035

Europe Injection Molding Machines Market Size and Share Forecast Outlook 2025 to 2035

Europe Injection Moulders Market Size and Share Forecast Outlook 2025 to 2035

Powder Injection Molding Market Growth – Trends & Forecast 2025 to 2035

Sliding Injection Molding Machines Market Size and Share Forecast Outlook 2025 to 2035

Plastic Injection Molding Machine For Medtech Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA