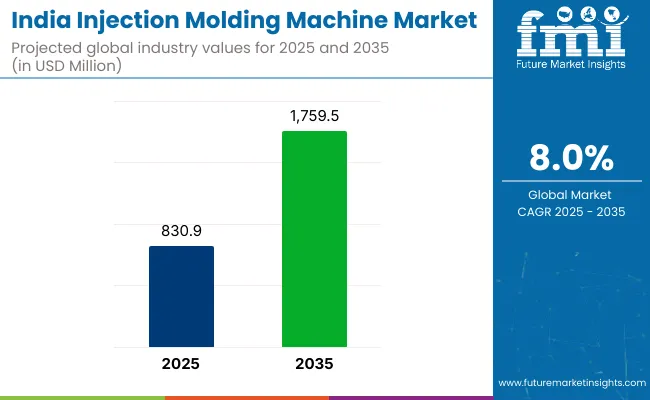

The India injection molding machine market is projected to grow from USD 830.9 million in 2025 to USD 1,759.5 million by 2035, registering a CAGR of 8.0% during the forecast period. Sales in 2024 reached USD 769.3 million. Rapid developments in sectors such as automotive components, medical devices, and consumer durables have contributed to rising equipment installations.

| Metric | Value |

|---|---|

| Industry Value (2025E) | USD 830.9 million |

| Industry Value (2035F) | USD 1,759.5 million |

| CAGR (2025 to 2035) | 8.0% |

Compact design preferences and energy-efficient machines are being adopted in both Tier 1 and Tier 2 cities, driven by localization and increased capital expenditure in the plastics sector. Additionally, government initiatives supporting industrial clusters and Make in India policies have supported production upgrades across verticals.

Significant advancements in servo-hydraulic systems, multi-component molding, and digital monitoring solutions are being adopted to ensure consistency and reduced downtime in production lines. These innovations are increasingly applied across sectors demanding high-output, low-defect parts-especially in food packaging, electronics, and precision medical components.

Automation solutions with real-time process control are gaining traction, notably among SME plastic processors. The government’s PLI scheme and R&D support for tooling industries are also accelerating digital transformation of molding operations across India. Compliance with BIS and other Indian standards has become mandatory, aligning with the broader global push for energy-efficient industrial equipment. This green transition has been supported through subsidies and government tenders focused on eco-design in manufacturing equipment.

India’s growing export capacity in plastic components and OEM manufacturing is expected to elevate the strategic role of injection molding technologies. Incremental opportunities are expected to be captured through automation, digitization, and tooling innovations. Competitive pricing, customizability for multi-cavity operations, and low maintenance costs are being pursued by Indian and multinational players alike.

Regulatory support such as production-linked incentives (PLIs) and tariff protections have enhanced domestic output. Long-term demand is forecast to remain resilient due to rising infrastructure, electronics, and automotive manufacturing. Strategic acquisitions and localization will likely define the competitive edge.

The market is segmented based on automation, clamping force, material type, end use, and region. By automation, the segmentation includes all-electric, hydraulic, and hybrid injection molding machines, each selected for energy efficiency, precision, or high-pressure capabilities. Clamping force categories include machines with less than 2000 KN and more than 2000 KN, tailored for varying mold sizes and product complexities.

Materials processed include plastic, metal, rubber, and ceramic, allowing applications across lightweight components, structural inserts, and specialty molded parts. End-use industries comprise automotive, packaging, electronics, healthcare, consumer goods, building & construction, and others, where demand is driven by mass production needs and precision engineering.

Regionally, the market spans North America, Latin America, East Asia, South Asia & Pacific, Eastern Europe, Western Europe, Oceania, and Middle East & Africa.

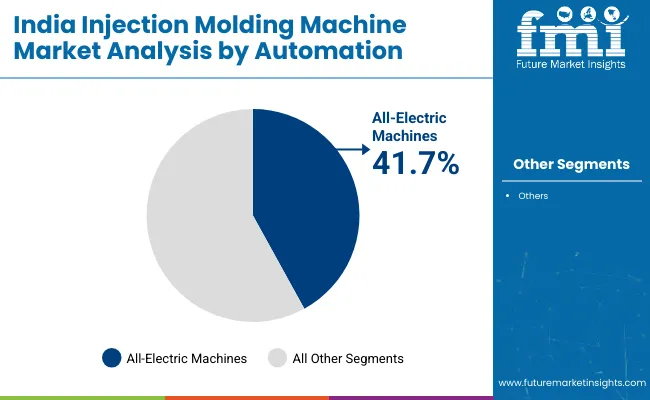

All electric machines are projected to account for 41.7% of the India injection molding machines market in 2025. These systems have been widely adopted for their superior energy efficiency, cleanroom compatibility, and reduced maintenance. In India’s regulated sectors like healthcare and electronics, their low noise and precision output have been prioritized.

Enhanced control over injection speed, clamping force, and shot size has supported their use in high-tolerance applications. Manufacturers across India have integrated all-electric machines to meet rising quality standards in domestic and export markets.

Reduced operating costs and cycle times have improved profitability for mid-sized processors. Environmental compliance mandates have further encouraged a shift from hydraulic to electric systems. Increasing government incentives for energy-efficient machinery have also driven demand across organized sectors.

OEMs and component suppliers in India have scaled up investments in modular and high-speed all-electric platforms. Clean energy compatibility and smart factory integration have aligned with Industry 4.0 goals. Use in diagnostics, pharma, and clean medical molding has increased notably.

Growth in localized medical device manufacturing under the Make in India initiative has further fueled adoption. As labor optimization and automation accelerate in Indian manufacturing, all-electric machines are expected to dominate precision and hygiene-sensitive production zones. The segment’s continued expansion is supported by cost parity improvements, localized manufacturing hubs, and sustainability-linked capital expenditure. Adoption is expected to deepen across Tier I and Tier II cities.

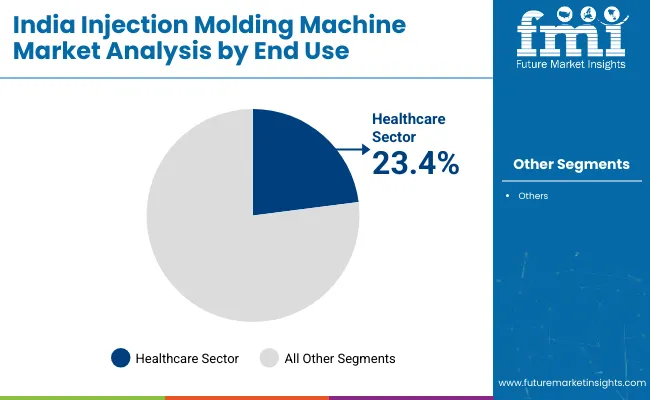

The healthcare industry is estimated to hold a 23.4% share of India’s injection molding machines market by 2025. Growth has been driven by increased demand for diagnostic consumables, medical device housings, and pharma-grade closures. All-electric and hybrid machines have been preferred for their cleanroom compatibility and sterility standards.

Customization of tooling and process control has supported critical-use molding applications. India’s growing investments in medical technology and life sciences innovation have supported machine upgrades. Government programs like PLI schemes for medical devices have expanded manufacturing capacity.

Healthcare clusters in Gujarat, Maharashtra, and Tamil Nadu have shown strong demand for precision molding systems. Surge in single-use diagnostics and vaccine-related equipment has also intensified machine utilization.

Molding units in healthcare have prioritized traceability, quality assurance, and automation readiness. High-speed all-electric systems with SCADA integration have been installed in GMP-certified units. Use of biocompatible resins and multi-cavity tooling has become more prevalent. Healthcare packaging and sterile product markets have contributed significantly to equipment modernization.

With India’s medical device and pharmaceutical exports rising, investment in validated, regulatory-compliant molding systems has accelerated. Strategic collaborations between OEMs and healthcare firms have promoted turnkey solutions. The healthcare end-use segment is expected to remain a key contributor to injection molding equipment growth. Demand will likely intensify as India scales its medical manufacturing ecosystem.

The strong growth in Indian manufacturing and automotive sectors are driving the demand for injection molding machines. According to FMI's analysis, precision molding solutions are becoming more popular and are the go-to option for the production of intricate parts in large quantities. As production is automated in various industries, demand for high-efficiency, high-throughput machines is dramatically increasing.

There is a big impact from the EV boom on demand. Car manufacturers need lightweight and durable plastic components, which injection molding can be trusted to consistently provide. FMI finds that green vehicle and electric mobility incentives drive the growth of machine installations, particularly on interior trims, structural plastic components, and housings with low tolerance needs.

Injection molding is a rapidly evolving technology, with cutting-edge automation and intelligence transformation solution. AI, robotics, and real-time monitoring systems are coming together to significantly increase production consistency while reducing the costs of operation. According to FMI, manufacturers deploying smart systems are already attaining superior energy efficiency, reduced machine downtime, lower rates of defects, and faster cycle times, which allow them to better compete.

The constant fluctuation in the price of raw material is a continuing problem. Polymers, including polypropylene, polyethylene and ABS, are critical to injection molding, but they face unpredictable pressures from the global supply chain. According to FMI, equipment usage rates, and thus expansion plans are thrown off as a result of this kind of disruption, particularly for smaller processors and contract packaging companies.

Regulatory demands for lower emissions and improved efficiency are transforming the way machines are bought. Servo-hydraulic models in particular are gaining popularity among companies to meet sustainability requirements for energy efficient machines. FMI suggests that such government-initiated measures to encourage clean manufacturing, will pave way for increased use of greener injection molding technologies across industry verticals.

Rising demands from packaging, medical devices and consumer electronics sectors are also supporting machine sales. They require high-quantity, high-precision parts produced at low unit cost.

The India injection molding machine value chain comprises of raw material, machine manufacturers/outsourcing and processing, and component manufacturers contributing to hardware solutions demand by all application across various products categories. According to FMI analysis, both global and regional manufacturers are investing in R&D for launching electric and hybrid machines which is in line with India’s cost sensitive manufacturing scenario, but performance oriented as well.

Technology suppliers-predominantly automation and software system integrators-are becoming more critical in the conversion of injection molding into smart manufacturing cells. They also allow for real-time data monitoring, predictive maintenance, and connecting to robotics for pick-and-place and quality control jobs. The intersection of digital intelligence and standard injection molding is bringing transformation that will increase machine uptime and returns for end users over many years.

Investors and private equity firms have been seeing value in mid-sized machinery manufacturers and independent service providers. India’s Make in India & PLI has spurred industrial growth, which has led to inflows of capital into the automation based machine tools and support activities. They are changing the industry dynamics by initiating quick scale-up, consolidation, and collaboration strategies focused on high-growth clusters like automotive hubs and medical device parks.

Regulatory drives towards energy and carbon efficiency are influencing machine specifications and procurement preferences. According to FMI analysis, measures that encourage domestic production of essential machine parts and reduce reliance on imports are strengthening local manufacturing ecosystems and reshoring initiatives.

In the changing world of the injection molding machine industry, the manufacturers are taking a multi-pronged approach to strengthen their positions in the industry. One of the strategies of established players is product innovation which is concentrated on energy-efficient and high precision machinery to meet the rising requirement from industries including automotive and healthcare for sustainable solutions.

Many of them are also broadening their geographic reach, aiming at emerging industries in Asia and Africa, where industrialization is more quickly on the rise. Strategic alliances with local partners provide multinationals with the knowledge needed to overcome barriers to entry and exposure to regional know-how.

Investors are matching their strategies to technological change and sustainability trends. As the investment world zeroes in on environmental, social and governance (ESG) measures, investors are supporting startups and smaller companies that focus on energy-efficient and recyclable materials - seeing the potential returns these innovations could bring as they make their way into wide use over the next few decades. Another focus is on risk diversification, where such capital is distributed among companies located across various regions to mitigate the risk of economic and regulatory uncertainties.

Regulators are increasing scrutiny as part of a global effort for more sustainable industrial practices. To address these risk exposures, they are tightening emissions regulations, and requiring greater energy use disclosure. Favorable policy lobbying, i.e., for tax breaks on the adoption of sustainable technology, is an increasing strategic tool for top firms to fare well through regulatory push.

The end users, namely the automotive and healthcare sectors, are now more than ever keen to find cost effective solutions that meet their quality expectations. Their long-term supply relationships provide them with reliable supply chains to meet high-performance needs in the face of inflation. They are also deploying state of the art automation in their operations to enhance productivity and decrease reliance on manual labor.

Tech providers are leading the digital transformation and creating more advanced injection molding systems with AI and IoT. This allows the manufacturing execution system to track machine status dynamically and minimizes machine downtime and improves quality assurance. Partnering with infrastructure OEMs, tech firms are customizing offerings to ease workflows, to offer a suite of services that span the value chain from operations to maintenance.

Infrastructure players - logistics, and energy providers in particular - will increasingly concentrate on secure and robust supply chains. They’re betting on green technologies and green power to help industries like injection molding meet their sustainable challenges.

Combining these technologies allows these technologies to meet the increased industry need for environmentally-friendly business solutions that are also cost-effective. Working with Regulators no one can escape energy and emissions rules, so helping to still observe them, contributes to the right environment for growth of the industry.

The key success factors driving the injection molding machine industry are technological innovation and sustainability. As industries demand higher precision and efficiency, manufacturers are investing heavily in advanced technologies such as AI, IoT, and automation to enhance machine performance, reduce downtime, and improve production output.

These technological advancements enable companies to cater to increasingly complex and diverse consumer requirements, especially in sectors like automotive, healthcare, and electronics, where precision and efficiency are critical.

Another driving factor is the sustainability trend, as manufacturers and end-users alike are focused on minimizing environmental impact. Companies that prioritize energy-efficient machines and sustainable production processes are gaining a competitive edge.

Moreover, with increasing regulatory pressure to reduce carbon footprints and waste, firms that can innovate to meet these environmental standards not only ensure compliance but also attract environmentally conscious customers and investors. This focus on green technology is expected to continue driving industry growth and industry consolidation.

In terms of automation, the industry is segmented into all-electric, hydraulic, and hybrid.

By clamping force, the industry is segmented into between 1500-2000 and above 2000.

Based on material, the industry is segmented into plastic, metal, rubber, and ceramic.

By end use, the industry is segmented into automotive, packaging, electronics, healthcare, consumer goods, and building & construction.

The growing need for precision manufacturing across industries like automotive, healthcare, and packaging, coupled with advancements in automation and sustainability, drives the demand for injection molding machines in India.

Technological innovations such as AI integration, IoT connectivity, and energy-efficient automation systems are enhancing the efficiency and precision of injection molding machines, making them crucial for sectors demanding high-quality and sustainable production.

Regulatory standards focused on sustainability, emissions control, and product safety are influencing the adoption of energy-efficient and eco-friendly injection molding machines in India, prompting manufacturers to align with green manufacturing practices.

Regions with strong industrial hubs, such as Maharashtra, Tamil Nadu, Gujarat, and Delhi NCR, are expected to see significant growth due to their established automotive, electronics, and packaging sectors.

Manufacturers face challenges such as fluctuating raw material prices, rising energy costs, regulatory compliance, and the need to continuously upgrade technology to meet evolving industry standards and consumer demands.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Europe Injection Molding Machines Market Size and Share Forecast Outlook 2025 to 2035

Sliding Injection Molding Machines Market Size and Share Forecast Outlook 2025 to 2035

India Injection Moulders Market – Demand and Growth Forecast 2025 to 2035

Injection Molding Machine Market Size and Share Forecast Outlook 2025 to 2035

Injection Molding Polyamide 6 Market Growth – Trends & Forecast 2024-2034

Injection Molding Containers Market

Injection Blow Molding Machine Market Size and Share Forecast Outlook 2025 to 2035

Pulp Molding Machines Market Size and Share Forecast Outlook 2025 to 2035

Metal Injection Molding (MIM) Parts Market Size and Share Forecast Outlook 2025 to 2035

India Decorative Veneer Industry Size and Share Forecast Outlook 2025 to 2035

Powder Injection Molding Market Growth – Trends & Forecast 2025 to 2035

Lipstick Molding Machines Market Size and Share Forecast Outlook 2025 to 2035

Plastic Injection Molding Machine For Medtech Market Size and Share Forecast Outlook 2025 to 2035

Ceramic Injection Molding Market Size and Share Forecast Outlook 2025 to 2035

Stretch Blow Molding Machines Market Segmentation based on Technology Type, Orientation Type, End Use, and Region: A Forecast for 2025 and 2035

Market Share Insights of Leading Stretch Blow Molding Machines Providers

Particle Foam Molding Machines Market Size and Share Forecast Outlook 2025 to 2035

Skincare Industry in India – Trends & Growth Forecast 2024-2034

PET Stretch Blow Molding Machines Market Size and Share Forecast Outlook 2025 to 2035

Key Companies & Market Share in PET Stretch Blow Molding Machines Sector

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA