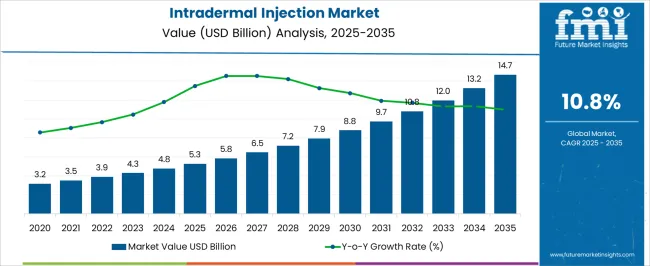

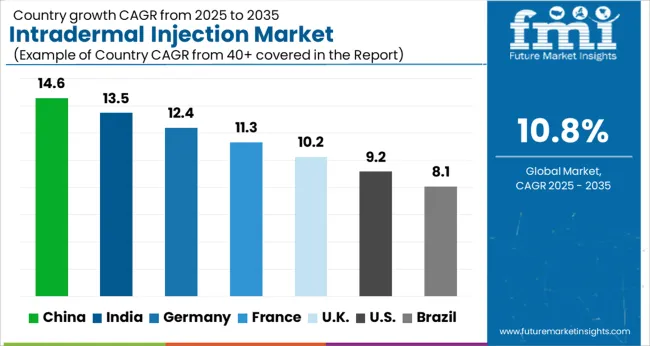

The Intradermal Injection Market is estimated to be valued at USD 5.3 billion in 2025 and is projected to reach USD 14.7 billion by 2035, registering a compound annual growth rate (CAGR) of 10.8% over the forecast period.

| Metric | Value |

|---|---|

| Intradermal Injection Market Estimated Value in (2025 E) | USD 5.3 billion |

| Intradermal Injection Market Forecast Value in (2035 F) | USD 14.7 billion |

| Forecast CAGR (2025 to 2035) | 10.8% |

The intradermal injection market is experiencing sustained expansion driven by advancements in vaccine delivery methods, rising demand for diagnostic skin testing, and increasing adoption of minimally invasive administration techniques. Intradermal delivery offers higher immune response efficiency at lower doses, making it a cost effective and resource efficient alternative to intramuscular or subcutaneous routes.

Growth is being supported by government immunization initiatives, rising incidence of infectious diseases, and growing applications in cosmetic dermatology and allergy testing. The technique’s suitability for dose sparing and local immune response activation is attracting interest in pandemic preparedness and routine immunization programs.

Future prospects remain strong, particularly as global healthcare systems seek scalable solutions that ensure wide access, patient comfort, and effective delivery of vaccines and biologics.

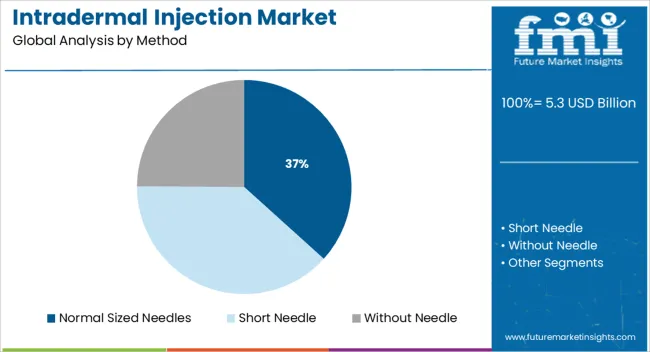

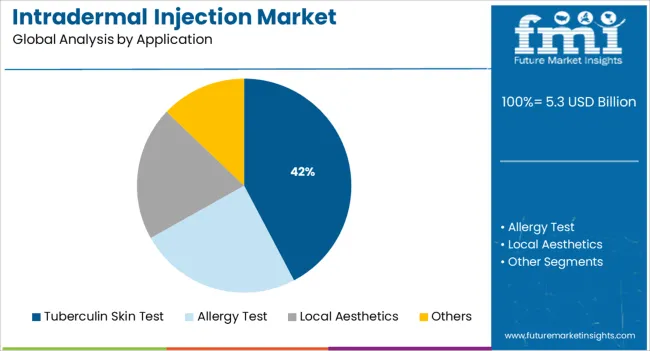

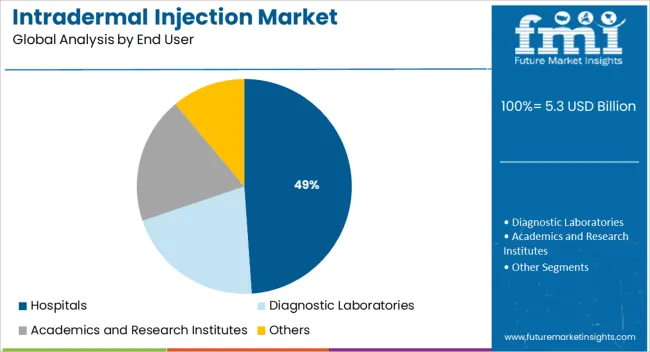

The market is segmented by Method, Application, and End User and region. By Method, the market is divided into Normal Sized Needles, Short Needle, and Without Needle. In terms of Application, the market is classified into Tuberculin Skin Test, Allergy Test, Local Aesthetics, and Others. Based on End User, the market is segmented into Hospitals, Diagnostic Laboratories, Academics and Research Institutes, and Others. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The normal sized needles segment is expected to account for 36.70% of the total market revenue by 2025, emerging as the leading method. This preference is attributed to the widespread availability, cost efficiency, and established use of standard needle systems in intradermal procedures.

These needles are compatible with routine clinical workflows and require minimal training, making them practical for large scale deployment. Their reliability in performing diagnostic tests and delivering fractional vaccine doses has reinforced their acceptance in both public health and private healthcare settings.

While emerging needle free technologies are gaining attention, the familiarity, precision, and affordability of normal sized needles continue to drive their dominant use across global markets.

The tuberculin skin test segment is projected to hold 42.30% of total market revenue by 2025, establishing itself as the primary application within the market. This dominance is driven by its critical role in detecting latent tuberculosis infections across high burden regions and in preventive screening protocols.

The test’s simplicity, accuracy, and widespread recognition by global health organizations have led to consistent adoption in hospitals, clinics, and community health programs. Additionally, the growing emphasis on early tuberculosis diagnosis and monitoring among high risk populations is sustaining demand.

As tuberculosis control remains a global public health priority, the intradermal route continues to be the method of choice for this test, securing its leading position in application use.

The hospitals segment is anticipated to represent 48.90% of total market revenue by 2025, making it the foremost end user in the market. This share is supported by the availability of skilled personnel, access to advanced infrastructure, and high patient footfall in hospital environments.

Hospitals play a central role in vaccine administration, diagnostiC testing, and therapeutic interventions where intradermal injections are routinely utilized. Their involvement in public immunization campaigns, clinical trials, and infectious disease screening further enhances their demand for intradermal delivery solutions.

The operational efficiency, resource availability, and regulatory alignment of hospital settings contribute to their strong adoption and sustained leadership within the market.

Over the past two decades, there has been an increase in the demand for intradermal injections. This is due to the rising incidence of diseases with a simultaneous increase in the use of intradermal vaccination and aesthetic procedures.

Furthermore, the growing burden of chronic diseases has led to a rise in the overall use of syringes, particularly disposable syringes, intradermal jet injectors, microinjections, and ballistic intradermal injection treatment and diagnostic purposes. The global demand for Intradermal Injections is projected to increase at a CAGR of 10.8% during the forecast period between 2025 and 2035, reaching a total of USD 10,814.47 Million in 2035, according to a report from Future Market Insights (FMI). From 2020 to 2024, sales witnessed significant growth, registering a CAGR of 8%.

Growing Prevalence of Chronic Diseases, Increase in Aesthetic Surgical Procedures to Catalyse Intradermal Injection Uptake

The rising prevalence rate of tuberculosis is expected to promote the growth rate of the intradermal injection market. As per the data of WHO, tuberculosis is the 13th leading cause of death, and about 10 million cases of TB have been recorded every year, which resulted in a sudden rise in the diagnostic rate of TB during the last decade. This is one of the major factors that act as one of the leading reasons for increasing the intradermal injection market size of tuberculin syringes.

In addition to this, the number of aesthetic procedures is increasing rapidly in North America and Europe. The intradermal vaccination reduces the potential dose of antigens, improves the immune response, and decreases the anxiety associated with the vaccination. Moreover, aesthetic procedures are the leading segment of local aesthetic procedures, increasing the demand for intradermal injections.

Almost all vaccines require cold chain distribution and storage, which further limits resources or refrigerator space in a healthcare setting. Globally, approximately 17.4 million people are prone to rabies through animal bites annually. It occurs in more than 150 territories and countries, rabies is a viral disease that can cause encephalitis when transmitted to humans. Intradermal injections immensely help in lowering the cost of cell-derived vaccines for pre-exposure to rabies. The cost-savings with intradermal injections for rabies create immense opportunities for the intradermal injections market.

Unfavorable Government Provisions to Hinder Market Growth

Despite the advantages shown through various clinical studies, there are various barriers that hinder the usage of intradermal injections. The major world economies across Europe, the United States, and other developed regions rely on single-dose formats and have government funding or private insurance for vaccination. Emerging markets are anticipated to favor multi-dose formats and are limited by availability and cost of supply.

Increased Prevalence of Diseases to drive the adoption of intradermal Injection

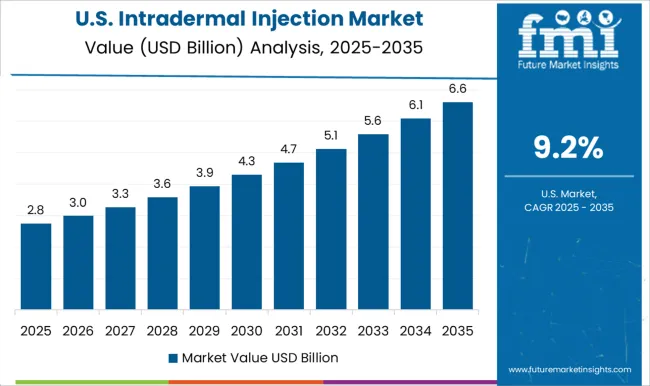

According to the American Cancer Society’s 2025 report, over 5.3 million new cancers are expected to be recorded in the United States in 2025. Also, as per the same source, the risk of having cancer rises dramatically as one gets older, and in the United States, 80% of cancer patients are 55 or older, with 57% being 65 or older. These figures tell that the growing geriatric population is expected to have a significant positive impact on the growth of the market.

Not just this but according to the International Diabetes Federation’s report of December 2024, about 4.8 million people were living with diabetes in the United States in 2024, and this number is estimated to increase to 36.3 million by 2045. This expansion in the diabetes patient pool is expected to boost growth in intradermal injection in the United States.

The Increasing Prevalence of Diabetes is Spurring Demand for Intradermal Injection

As per the International Diabetes Federation (IDF) Diabetes Atlas 2024, the age-adjusted comparative prevalence of diabetes in the United Kingdom for 2024, 2035, and 2045 were estimated as 6.3%, 7.0%, and 7.5% respectively. Therefore, the gradual rise in the prevalence of diabetes is expected to increase the market demand.

Normal Sized Needles to Lead the Method Type of Intradermal Injection

Based on the method, the intradermal injection market is segmented into normal-sized needles, short needles, and without needles. As per our research, normal-sized needles dominate the market, while the short-needle segment is estimated to register considerable growth.

Tuberculin Skin Test Segment is Estimated to Hold the Largest Share

Based on application, the market is segmented into tuberculin skin tests, allergy tests, local aesthetics, and others. The tuberculin skin test segment is estimated to hold the largest share of the market in 2025, accounting for 58% of total demand, while the local aesthetic segment is expected to register the highest CAGR during the forecast period.

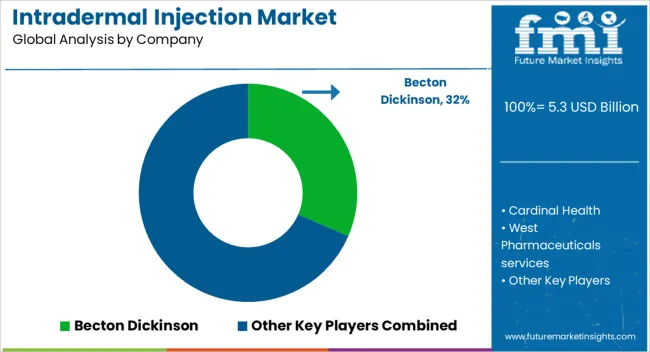

Key players in the Intradermal Injection market are Becton Dickinson, Cardinal Health, West Pharmaceuticals Services, Terumo Corporation, Nanopass, Pharmajet, Idevax, Enusung, Crossject, and Hindustan Syringes and Medical Devices.

| Report Attribute | Details |

|---|---|

| Market Value in 2025 | USD 5.3 billion |

| Market Value in 2035 | USD 14.7 billion |

| Growth Rate | CAGR of 10.8% from 2025 to 2035 |

| Base Year for Estimation | 2024 |

| Historical Data | 2020 to 2024 |

| Forecast Period | 2025 to 2035 |

| Quantitative Units | Revenue in USD Billion and CAGR from 2025 to 2035 |

| Report Coverage | Revenue Forecast, Volume Forecast, Company Ranking, Competitive Landscape, Growth Factors, Trends, and Pricing Analysis |

| Segments Covered | Method, Application, End User, Region |

| Regions Covered | North America; Latin America; Europe; South Asia; East Asia; Oceania; Middle East & Africa |

| Key Countries Profiled | The USA, Canada, Brazil, Mexico, Germany, The United Kingdom, France, Spain, Italy, India, Malaysia, Singapore, Thailand, China, Japan, South Korea, Australia, New Zealand, GCC, South Africa, Israel |

| Key Companies Profiled | Becton Dickinson; Cardinal Health; West Pharmaceuticals Services; Terumo Corporation; Nanopass; Pharmajet; Idevax; Enusung; Crossject; Hindustan Syringes and Medical Devices |

| Customization | Available Upon Request |

The global intradermal injection market is estimated to be valued at USD 5.3 billion in 2025.

The market size for the intradermal injection market is projected to reach USD 14.7 billion by 2035.

The intradermal injection market is expected to grow at a 10.8% CAGR between 2025 and 2035.

The key product types in intradermal injection market are normal sized needles, short needle, _intradermal microinjection, _microneedle arrays, _tattoo devices, without needle, _intradermal liquid jet devices and _ballistic intradermal injectors.

In terms of application, tuberculin skin test segment to command 42.3% share in the intradermal injection market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Injection Epoxy Chemical Anchors Market Size and Share Forecast Outlook 2025 to 2035

Injection Blow Molding Machine Market Size and Share Forecast Outlook 2025 to 2035

Injection Molding Machine Market Size and Share Forecast Outlook 2025 to 2035

Injection Moulding Cosmetic Packaging Market Size and Share Forecast Outlook 2025 to 2035

Injection Molding Machines Industry Analysis in India Size, Share & Forecast 2025 to 2035

Injection Pen Market Insights - Growth, Demand & Forecast 2025 to 2035

Injection Bottles Market Analysis – Size, Demand & Forecast 2025 to 2035

Market Share Distribution Among Injection Moulding Cosmetic Packaging Manufacturers

Injection Molded Plastic Market Trends – Growth & Forecast 2024-2034

Injection Molding Polyamide 6 Market Growth – Trends & Forecast 2024-2034

Injection Molding Containers Market

Lip Injection Market Size and Share Forecast Outlook 2025 to 2035

Fuel Injection System Market Growth - Trends & Forecast 2025 to 2035

Micro Injection Molded Plastic Market Size and Share Forecast Outlook 2025 to 2035

Metal Injection Molding (MIM) Parts Market Size and Share Forecast Outlook 2025 to 2035

India Injection Moulders Market – Demand and Growth Forecast 2025 to 2035

Europe Injection Molding Machines Market Size and Share Forecast Outlook 2025 to 2035

Europe Injection Moulders Market Size and Share Forecast Outlook 2025 to 2035

Powder Injection Molding Market Growth – Trends & Forecast 2025 to 2035

Sliding Injection Molding Machines Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA