The gasoline direct injection (GDI) market will grow substantially in the next decade on account of increasing demand for fuel-efficient vehicles, stricter emission laws, and improved technology for automotive engines.

The gasoline direct injection industry, valued at USD 12.63 billion in 2025, is projected to grow to USD 30.21 billion by 2035, with a striking CAGR of 9.1% during the said period. The reasonably good growth curve implies that GDI systems are steadily adopted in the automotive industry as a prime solution for improving engine performance, optimizing fuel combustion, and decreasing environmental impact.

One of the main forces behind the growing industry includes tightening emission regulations around the world. Governments and environmental bodies in regions such as Europe, North America, and Asia-Pacific have all been imposing strict standards on the transport sector to minimize vehicular pollution and fulfill climate goals. Under such regulatory regimes, OEMs are also under increasing stress to minimize fleet-wide emissions.

GDI technology is thus adopted in fast-growing popularity with internal combustion engines to achieve compliance while not sacrificing vehicle power or efficiency. Also, GDI engines promote hybridization, making them extremely important in hybrid electric vehicles (HEVs) that are also enjoying increased acceptance amongst consumers.

Elevated fuel economy for consumers is yet another major factor behind the growth of GDI systems. With fuel prices rising and consciousness about the environment increasing today\'s buyers attach much importance to vehicles with better mileage and reduced carbon footprint. GDI engines, by stimulating more thorough combustion and minimizing fuel wastage, very much respond to this demand; thus, OEMs and aftermarket players are investing in advanced injection technologies.

Technocentric innovation is moving further to new heights in the animate world. The advancements in the GDI system, which include things like multi-hole injectors and high-pressure fuel pumps along with turbocharging compatibility, have made engines operate with great efficiency and responsiveness.

These features are most sought after in "drive" and "luxury" vehicles, where performance and emissions compliance are critical. Besides this, GDI engines are emerging as part of the turbocharged engine, propelling even more opportunities for the industry to grow.

Asia Pacific is fast establishing itself as the leading region in this GDI global pot since the sheer automotive production volume of countries like China, Japan, and South Korea drives the numbers. Hectic industrialization and rapid urbanization coupled with considerably higher disposable incomes have brought about increased vehicle ownership in this region, thereby turning it into a promising industry for advanced engine technologies.

North America and Europe, however, remain a crucial part of the evolving automotive Gasoline Direct Injection market, as both have mature automotive sectors, extensive R&D capacity, and well-established emission regulations to propel GDI systems.

Market Metrics

| Metrics | Values |

|---|---|

| Industry Size (2025E) | USD 12.63 billion |

| Industry Value (2035F) | USD 30.21 billion |

| CAGR (2025 to 2035) | 9.1% |

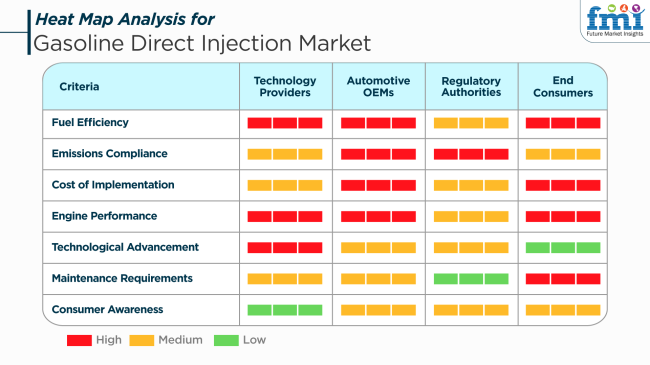

Fueling consumer demands for fuel-efficient vehicles and setting world emissions standards for lower vehicle emissions have swiftly led to the evolution of the industry. Technology providers are dedicated to such advancements as infusion technology innovations in fuel injector systems, advanced control units, and pressure optimization technologies. One of their priorities is the improvement of fuel-burning efficiency and the performance of engines while managing technical and economic feasibility over a wide spectrum of various car segments.

Automotive Original Equipment Manufacturers (OEMs) are integrators and mass adopters of GDI systems. Typical concerns of the OEM regarding GDI system installation have more to do with the stringent emission standards, the importance of engine performance, and cost control. All these challenges are then multiplied, with that of GDI installation into a vehicle design without any significant cost increases during vehicle manufacture while ensuring or even enhancing the reliability and drivability of vehicles.

The regulatory authorities shape the environmental and fuel economy standards, according to which several stringent regulations are enforced against the automakers; this holds an important place in the adoption of the GDI system. CO2 and particulate emissions reduction is what they are more interested in, which makes them not negotiable clauses for a manufacturer toward compliance. Not only do these authorities define the speed and scale of GDI deployment, but they also influence the direction of technology through incentives, punitive measures, and long-term policy frameworks.

While being unaware of the technical details of GDI systems, end consumers can reap the direct benefits of enhanced fuel efficiency and responsiveness with vehicles. However, increased maintenance, especially as it relates to carbon buildup in intake systems, arises as a concern, which makes cost and long-term reliability the main drivers toward customer satisfaction.

The future relevance of GDI systems will be extended even more by the increasing consumer preference for hybrid cars since, in practice, these systems are often installed to work in combination with an electric drivetrain to optimize power and efficiency.

Between 2020 and 2024, the Gasoline Direct Injection market is expected to expand significantly due to the growing demand from the automotive industry to enhance fuel economy and meet stringent emission regulations. The industry developed more and more GDI techniques to ensure good engine efficiency and minimize carbon emissions. This era also saw advancements such as high-pressure fuel pumps, fuel injectors, and electronic control units - all of which worked in concert to optimize the efficiency of the vehicle system. Scaling up was, however, limited by systems costs and maintenance complexity.

Expected future growth, 2025 to 2035, predicts further development of the industry, in particular, due to the increasing production of electric and hybrid vehicles (EV).

While there is a gradual transition to EVs, there will be a place for high-performance internal combustion engines as GDI technology advances, particularly in automotive segments for which EV infrastructure is limited. Unlike earlier designs of low-emission technology, whether it be injector technology or innovations, the GDI systems will now be cost-effective and contribute to fuel efficiencies, as past limitations will not be present. The integration of artificial intelligence and machine learning will also disrupt the real-time engine optimization industry.

Comparative Market Shift Analysis (2020 to 2024 vs. 2025 to 2035)

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Aiming to achieve emission standards, increase fuel economy, and improve engine performance. | Hybridization focus, downsizing, and ultra-low emission regulations (ULEVs, Euro 7, etc.). |

| Fuel injectors at high pressure, fuel stratification strategies, turbocharging integration. | Intelligent fuel delivery with AI-enabled engine mapping, injector calibration using machine learning, and ultra-fine mist atomization. |

| Higher production and maintenance costs, carbon deposits on intake valves. | Integration with other fuels, reducing NOx and particulate emissions, and cost-effectiveness at scale. |

| Emphasis on CO₂ reduction through catalytic converters and EGR systems. | Real-time emissions analysis, predictive maintenance on particulate filters, and intelligent NOx monitoring. |

| Primarily passenger cars and some commercial trucks. | Expansion to light-duty trucks, hybrids, and performance cars requiring fuel flexibility and conformity. |

| Limited electric platform compatibility; early-stage hybrid take-up. | Heavy emphasis on hybrid vehicle platforms and range extenders, with GDI in a secondary role in hybrid drivetrain efficiency. |

| Stainless steel and ceramic-coated injector components for longevity. | High-performance alloys, graphene coating, and nanomaterials for improved thermal resistance and longer life cycle of GDI components. |

| Basic performance tuning, emissions compliance, durability of the system. | Automated diagnostics, adaptive injector control, predictive modeling of engine behavior using AI. |

| High demand in Europe, North America, and some regions of Asia-Pacific because of regulatory push and fuel efficiency demands. | Asia-Pacific leads with domestic OEMs ramping up volumes; North America and Europe migrate towards high-efficiency hybrid + GDI variants. |

The Gasoline Direct Injection market has proven to be one of the vibrant segments with enormous business growth that still harbors threats from a slew of strategic and operational risks in its further texture. The adoption of electric vehicles (EVs) constitutes one of the leading threats to the demand for internal combustion engine technologies such as GDI. Resistance pressures global and regional governments for electrification through incentives and regulatory mandates, thus restricting the long-term prospects of GDI systems.

Another topical issue is the relatively high capital and maintenance costs associated with GDI systems. This is because GDI systems are costlier than normal fuel injection systems. After all, they are made using cutting-edge advanced manufacture, quite precise calibrating, and components that can meet high quality. This cost burden may limit the industry in price-sensitive places or segments of entry-level vehicles.

There are some risks of regulations whereby governments usually tighten their emissions standards. Although improvements have been made in fuel efficiency with GDI technology requirements, this also produces considerably more particulate emissions than through port fuel injection, resulting in the need for additional components like particulate filters at an extra cost. Therefore, this may complicate compliance and cost the manufacturers high amounts.

Technological risks include an alarming pace of innovative development in alternative propulsion systems. All hybrid systems are proliferating quickly, hydrogen fuel cells, battery electric drivetrain applications, and may leapfrog any of the incremental internal combustion engine improvements possibly being made, e.g., GDI. The risks from disruption in the supply chain, especially in the high-precision components, also impact production timeliness and cost control.

Finally, different cultures in regions regarding their policy make things even more complicated: Asia Pacific is now the leading industry, but inconsistent demand patterns resulting from various environmental policies and economic conditions may affect global strategy and investment flows.

The Gasoline Direct Injection market is certainly looking for growth in the short-to-medium term on account of performance and fuel efficiencies; uncertainties regarding its future are rising with cost pressures, environmental regulations, and a rapidly closing shift towards electrified transportation. Stakeholders need to balance innovation with risk mitigation strategies in order to remain competitive.

The Gasoline Direct Injection market's strong skewness in the year 2025 is towards 4-stroke engines, which account for about 88% of the industry, whereas 2-stroke engines hold 12% of the industry share.

The adoption of 4-stroke engines is largely ascribed to the benefits of efficiency, reduction of carbon emissions, and improved combustion control. The GDI system's design for direct injection of fuel into the combustion chamber is considered more thermally efficient and has a good performance under various driving conditions. For their prestige engine lineups, Ford, General Motors, Hyundai, Toyota, and Volkswagen have all turned to 4-stroke GDI engines.

For example, the Ford EcoBoost engine family powers several Ford models, including Escape, Focus, and F-150, using GDI to augment performance while reducing fuel economy. Implementations on such platforms have also been apparent in Dynamic Force from Toyota and Theta III series from Hyundai, underscoring the continued transition of 4-stroke GDI engines engineered in compliance with global emission norms such as Euro 6d and BS6 Phase 2.

In spite of this, 2-stroke engines have managed to compose just 12% of the Gasoline Direct Injection (GDI) market in 2025, with primary applications comprising somewhat specialized areas such as two-wheeled applications, marine outboard engines, snowmobiles, and compact utility vehicles. Traditionally thought to be less efficient with fuel and more polluting than their 4-stroke counterparts, the performance of 2-stroke engines has improved significantly with modernization in GDI technology.

Direct injection helps improve combustion efficiencies, reduces the amounts of oil consumed, and minimizes exhaust emissions with specific reference to acronyms such as those in the USA EPA and CARB, large inches to GDI in 2-stroke platforms. Exceptional examples of this are BRP through its outboard engines, Evinrude E-TEC, and KTM in its exceptionally high-performing off-road motorcycles. Because GDI for 2-stroke is rarely used in cooperative products along the mentioned lines to have limited customers, the category will continue to be a small component of the entire GDI engine industry.

In 2025, yearly GDI sales worldwide by vehicle type will mostly cover compact and mid-sized vehicles. Compact vehicles have the highest share of about 28%, closely followed by mid-sized vehicles with a share of 25%.

The increased efficiency of fuel consumption and affordability of passenger cars in extremely populated urban cities across the globe in Asia-Pacific, Europe, and Latin America have shifted global consumers towards compact vehicles. Automakers such as Hyundai, Honda, Kia, and Peugeot feature popular compact models like the Hyundai Elantra, Honda Civic, Kia Forte, and Peugeot 308 that use advanced 4-stroke GDI engines designed to give a balance between performance and very low emissions.

These cars enjoy high thermal efficiency, turbocharging compatibility, and lean combustion strategies because of direct injection technology. They also form some of the compact GDI powertrains: Suzuki's Baleno and Volkswagen's Polo, which represent performance needs in a compact space while being compliant with stringent emission legislation like Euro 6d and India's BS-VI.

Mid-sized vehicles form 25% of the share in the Gasoline Direct Injection market. It also enjoys substantial benefits from the GDI technology, especially considering the performance demands and the utility of mid-sized vehicles for daily commuting, ridesharing, and family travel. Engine manufacturers include Toyota, Nissan, Ford, and Mazda, with GDI in the model lineup like Toyota's Camry Dynamic Force engine, Nissan's VC-Turbo engine in the Altima, Ford's EcoBoost engine in the Fusion, and Mazda's Skyactiv-G engine in the Mazda6.

Furthermore, Skoda (with the Octavia) and Renault (with the Talisman) also implement GDI systems such as high power density and responsive engines for urban and highway use. The said systems allow for torque improvements associated with quicker throttle response and efficient fuel atomization that make these GDI systems suitable for naturally aspirated engines as well as turbocharged ones.

| Countries | CAGR (2025 to 2035) |

|---|---|

| USA | 5.2% |

| UK | 4.3% |

| France | 4.1% |

| Germany | 4.6% |

| Italy | 4% |

| South Korea | 4.8% |

| Japan | 4.2% |

| China | 6.4% |

| Australia | 3.9% |

| New Zealand | 3.5% |

The USA GDI industry is anticipated to experience a CAGR of 5.2% from 2025 to 2035. Increasing demand for effective internal combustion engines, especially for light-duty vehicles, is driving the uptake of GDI. The stringent Corporate Average Fuel Economy (CAFE) standards and the ongoing prevalence of SUVs and trucks are also propelling the widespread adoption of GDI systems.

Large automotive OEMs such as General Motors, Ford Motor Company, and Stellant is are already implementing high-pressure GDI systems on future engine platforms. Large component suppliers such as BorgWarner, Continental, and Delphi Technologies are focusing on precision injectors, combustion optimization, and mild hybrid system integration.

The UK GDI industry will grow at a CAGR of 4.3% between 2025 and 2035, driven by continued emission-reducing policies and the vehicle industry's push towards cleaner means of propulsion. While as much of the industry as possible is moving towards electrification, hybrid powertrains with GDI engines continue to be a dominant part of fleet strategies still.

Automakers such as Jaguar Land Rover, Bentley Motors, and Vauxhall are launching GDI technology in hybrid variants to meet Euro 7 regulations. Suppliers such as Bosch, Denso, and Continental are enhancing product efficiency with multi-hole injectors, low-friction pumps, and engine downsizing solutions.

France will register a CAGR of 4.1% in the GDI industry through 2035. The mass production of GDI systems in mid-size and compact cars is being prompted by emissions-control regulations and auto R&D initiatives backed by the government. Low-particulate emissions with optimized injection pressure management and timing are what OEMs are emphasizing.

Large home OEMs such as Renault and Peugeot are applying GDI with turbocharged engines. Leading suppliers such as Valeo and Bosch are facilitating industry growth with new injector architecture, particulate filters, and high-response fuel delivery systems optimized for French urban driving conditions.

Germany's GDI industry is likely to record growth at a 4.6% CAGR during the forecast period. Automotive engineering supremacy and stringent EU emission regulations are fueling the widespread use of GDI in hybrid and performance cars. Aggressive R&D in thermal efficiency and emission control is also aiding the industry.

Big OEMs such as BMW, Audi, and Mercedes-Benz are using high-pressure direct injection systems to boost output power and reduce CO₂ emissions. Suppliers such as Robert Bosch GmbH, Continental AG, and Mahle Group are making investments in injector precision, multi-event injection cycles, and carbon management technologies to maximize system efficiency overall.

Italy is likely to register a CAGR of 4% from 2025 to 2035 in the industry. The industry is fueled by growing demand for low-emission, fuel-efficient urban vehicles and a gradual hybridization transition. Demand from end-users for smaller, more fuel-efficient cars is driving GDI demand.

Volume and performance segments are where OEMs such as Fiat and Ferrari are launching GDI systems. Component suppliers such as Magneti Marelli and Bosch are driving innovation in injection timing optimization, combustion management, and cylinder pressure control to meet shifting regional emission requirements.

South Korea is set to grow at a CAGR of 4.8% during the 2025 to 2035 GDI industry period. Domestic producers are adopting GDI technology as part of the wider efficiency program as they seek to meet world fuel economy and emissions regulations. GDI technologies are being applied to turbo and hybrid vehicle models.

Hyundai Motor Group and Kia Corporation are employing more advanced GDI configurations on new models more and more. Large suppliers such as Hyundai Kefico and LG Innotek are developing next-generation injectors and fuel rails that offer better atomization and combustion stability to serve local and export car programs.

Japan will account for a CAGR of 4.2% during the forecast period within the industry. Prioritization in the country of hybrid propulsion and maximizing the compactness of engines is promoting the use of GDI across a wide variety of vehicle forms. Technical advancement and government regulation are the primary drivers of industry growth.

OEMs like Toyota, Honda, and Subaru are launching direct injection systems in green powertrains to deliver optimal thermal efficiency. Industry leaders like Denso Corporation and Hitachi Astemo are focusing on injector design, fuel delivery stability, and emission control strategy to provide compliant and high-power GDI systems.

China is projected to lead global growth in the industry with a projected CAGR of 6.4% from 2025 to 2035. Middle-class demand for gasoline-efficient cars and emissions and fuel economy regulations are fueling GDI system penetration strongly. Mild and plug-in hybrid integration is a significant trend.

High-end OEMs like Geely, BYD, and SAIC Motor deploy GDI technology in the compact and mid-size segments. Participants like United Automotive Electronic Systems and Bosch China are streamlining high-pressure pump efficiency, injector tuning, and particulate emissions control to achieve local as well as global regulatory norms.

The Australian gasoline direct injection industry is expected to grow at a 3.9% CAGR from 2025 to 2035. Although it has a less extensive domestic manufacturing sector, rising GDI-ready vehicle imports and rising consumer demand for fuel efficiency are in favor of industry development. Harmonization of regulation with the Euro norm is favoring demand.

These are comprised of international brands, such as Toyota, Hyundai, and Mazda, which control the bulk industry with products that incorporate GDI. All these rely massively on global entities such as Denso and Bosch for component supplies, with much emphasis placed on system durability, fuel quality compliance, and particulate matter exhaust for New Zealand driving.

New Zealand is anticipated to grow at a rate of CAGR 3.5% in the industry over the forecast period. Rising demand for GDI-imported vehicles and stringent emissions regulations rule the industry. Clients' increasing need for lower fuel consumption with higher engine power is increasingly influencing purchasing behavior.

Industry share is accounted for by brands such as Subaru, Toyota, and Nissan. Technologically advanced GDI components are sourced from global value chains. Opportunities for growth are associated with the proliferation and penetration of hybrid cars and the application of GDI engines in new imports and replacement programs for fleets in the nation.

The GDI industry is molded according to fuel economy, emissions reduction, and controlled precision injection. Major players like Robert Bosch GmbH, Denso Corporation, and Continental AG are working on high-pressure fuel injection systems, AI-based management of the engine, and hybrid integration for engine performance enhancement. With stricter emission standards becoming a reality, the quest for an enhanced fuel economy propels manufacturers to invest in next-generation injectors and ECU optimization.

Strategic partnerships and technological innovations characterize the industry. Delphi Automotive and Magneti Marelli are investing in GDI fuel rail systems, electronic fuel injectors, and smart fuel, which will allow us to measure fuel with precision for better atomization. On the other hand, Renesas Electronics Corporation and Infineon Technologies AG are developing advanced microcontrollers and power semiconductor solutions to optimize fuel delivery and combustion efficiency. The integration of AI-based fuel mapping, as well as real-time engine diagnostics, is pushing the performance matrix further for GDI systems.

Industry competition goes a step further by differentiating fuel atomization, pressure control, and multi-stage injection technologies. Eaton Corporation is concentrating on supercharger-integrated fuel injection systems, while STMicroelectronics and TI Group Automotive Systems aim at sensor-based combustion control for fuel-air mix efficiency. The advancements increase engine responsiveness by minimizing knocking and particulate emissions, thus positioning companies strategically.

Hybrid and turbocharged engine applications are also changing the landscape of this industry. Companies are trying to stabilize GDI technologies with electrified powertrains, AI-assisted adaptive fuel injection, and real-time ECU recalibration. This trend has begun pushing investments into smart fuel injectors, high-speed processors for engine control, and ultra-high-pressure direct injection systems, clearly reconfiguring the competitive landscape.

Market Share Analysis by Company

| Company Name | Market Share (%) |

|---|---|

| Robert Bosch GmbH | 18-22% |

| Denso Corporation | 15-19% |

| Continental AG | 12-16% |

| Delphi Automotive Plc | 10-14% |

| Magneti Marelli S.p.A. | 8-12% |

| Combined Others | 25-35% |

| Company Name | Offerings & Activities |

|---|---|

| Robert Bosch GmbH | High-pressure fuel injection, AI-driven ECU, as well as real-time combustion optimization. |

| Denso Corporation | Advanced fuel injectors, hybrid-compatible GDI systems, and electronic fuel control modules. |

| Continental AG | Smart fuel injection technologies, adaptive pressure regulators, and AI-enhanced combustion efficiency. |

| Delphi Automotive Plc | Precision fuel rail systems, electronic fuel injectors, and smart fuel metering. |

| Magneti Marelli S.p.A. | Multi-stage injection solutions, integrated turbo-GDI components, and high-pressure fuel delivery. |

Key Company Insights

Robert Bosch GmbH (18-22%)

Bosch leads in high-pressure fuel injection, AI-assisted ECU optimization, and ultra-fine atomization technology, ensuring efficient combustion and emissions compliance.

Denso Corporation (15-19%)

Denso integrates electronic fuel control modules, hybrid-compatible GDI systems, and AI-driven injection timing, optimizing fuel economy and performance.

Continental AG (12-16%)

Continental focuses on adaptive fuel injection technologies, smart pressure regulators, and real-time combustion analytics, enhancing engine efficiency and regulatory compliance.

Delphi Automotive Plc (10-14%)

Delphi pioneers precision fuel rail systems, smart fuel injectors, and AI-enhanced fuel metering, improving fuel-air mixture control for lower emissions.

Magneti Marelli S.p.A. (8-12%)

Magneti Marelli specializes in multi-stage injection solutions, integrated turbo-GDI components, and advanced high-pressure fuel delivery systems, supporting performance-driven vehicle applications.

Other Key Players

By stroke type, the industry is segmented into 2 stroke and 4 stroke.

By vehicle type, the industry is categorized into compact vehicle, mid-sized vehicle, premium vehicle, luxury vehicle, commercial vehicle, and heavy commercial vehicle.

By sales channel, the industry is divided into OEM and aftermarket.

By region, the industry is segmented into North America, Latin America, Europe, Asia Pacific, and Middle East and Africa (MEA).

The industry is expected to be valued at USD 12.63 billion in 2025.

By 2035, the industry is projected to reach USD 30.21 billion.

China is leading the industry growth with a projected CAGR of 6.4%, fueled by automotive production expansion and stricter emissions regulations.

The market is dominated by 4-stroke engines equipped with GDI systems, offering improved power output and reduced fuel consumption.

Key players include Robert Bosch GmbH, Denso Corporation, Continental AG, Delphi Automotive Plc, Magneti Marelli S.p.A., Renesas Electronics Corporation, Eaton Corporation Plc, Infineon Technologies AG, STMicroelectronics NV, and TI Group Automotive Systems, LLC.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (Units) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Stroke Type, 2018 to 2033

Table 4: Global Market Volume (Units) Forecast by Stroke Type, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Vehicle Type, 2018 to 2033

Table 6: Global Market Volume (Units) Forecast by Vehicle Type, 2018 to 2033

Table 7: Global Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 8: Global Market Volume (Units) Forecast by Sales Channel, 2018 to 2033

Table 9: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 10: North America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Stroke Type, 2018 to 2033

Table 12: North America Market Volume (Units) Forecast by Stroke Type, 2018 to 2033

Table 13: North America Market Value (US$ Million) Forecast by Vehicle Type, 2018 to 2033

Table 14: North America Market Volume (Units) Forecast by Vehicle Type, 2018 to 2033

Table 15: North America Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 16: North America Market Volume (Units) Forecast by Sales Channel, 2018 to 2033

Table 17: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 18: Latin America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 19: Latin America Market Value (US$ Million) Forecast by Stroke Type, 2018 to 2033

Table 20: Latin America Market Volume (Units) Forecast by Stroke Type, 2018 to 2033

Table 21: Latin America Market Value (US$ Million) Forecast by Vehicle Type, 2018 to 2033

Table 22: Latin America Market Volume (Units) Forecast by Vehicle Type, 2018 to 2033

Table 23: Latin America Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 24: Latin America Market Volume (Units) Forecast by Sales Channel, 2018 to 2033

Table 25: Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 27: Europe Market Value (US$ Million) Forecast by Stroke Type, 2018 to 2033

Table 28: Europe Market Volume (Units) Forecast by Stroke Type, 2018 to 2033

Table 29: Europe Market Value (US$ Million) Forecast by Vehicle Type, 2018 to 2033

Table 30: Europe Market Volume (Units) Forecast by Vehicle Type, 2018 to 2033

Table 31: Europe Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 32: Europe Market Volume (Units) Forecast by Sales Channel, 2018 to 2033

Table 33: Asia Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 34: Asia Pacific Market Volume (Units) Forecast by Country, 2018 to 2033

Table 35: Asia Pacific Market Value (US$ Million) Forecast by Stroke Type, 2018 to 2033

Table 36: Asia Pacific Market Volume (Units) Forecast by Stroke Type, 2018 to 2033

Table 37: Asia Pacific Market Value (US$ Million) Forecast by Vehicle Type, 2018 to 2033

Table 38: Asia Pacific Market Volume (Units) Forecast by Vehicle Type, 2018 to 2033

Table 39: Asia Pacific Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 40: Asia Pacific Market Volume (Units) Forecast by Sales Channel, 2018 to 2033

Table 41: MEA Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 42: MEA Market Volume (Units) Forecast by Country, 2018 to 2033

Table 43: MEA Market Value (US$ Million) Forecast by Stroke Type, 2018 to 2033

Table 44: MEA Market Volume (Units) Forecast by Stroke Type, 2018 to 2033

Table 45: MEA Market Value (US$ Million) Forecast by Vehicle Type, 2018 to 2033

Table 46: MEA Market Volume (Units) Forecast by Vehicle Type, 2018 to 2033

Table 47: MEA Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 48: MEA Market Volume (Units) Forecast by Sales Channel, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Stroke Type, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Vehicle Type, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 5: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 6: Global Market Volume (Units) Analysis by Region, 2018 to 2033

Figure 7: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 8: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 9: Global Market Value (US$ Million) Analysis by Stroke Type, 2018 to 2033

Figure 10: Global Market Volume (Units) Analysis by Stroke Type, 2018 to 2033

Figure 11: Global Market Value Share (%) and BPS Analysis by Stroke Type, 2023 to 2033

Figure 12: Global Market Y-o-Y Growth (%) Projections by Stroke Type, 2023 to 2033

Figure 13: Global Market Value (US$ Million) Analysis by Vehicle Type, 2018 to 2033

Figure 14: Global Market Volume (Units) Analysis by Vehicle Type, 2018 to 2033

Figure 15: Global Market Value Share (%) and BPS Analysis by Vehicle Type, 2023 to 2033

Figure 16: Global Market Y-o-Y Growth (%) Projections by Vehicle Type, 2023 to 2033

Figure 17: Global Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 18: Global Market Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 19: Global Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 20: Global Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 21: Global Market Attractiveness by Stroke Type, 2023 to 2033

Figure 22: Global Market Attractiveness by Vehicle Type, 2023 to 2033

Figure 23: Global Market Attractiveness by Sales Channel, 2023 to 2033

Figure 24: Global Market Attractiveness by Region, 2023 to 2033

Figure 25: North America Market Value (US$ Million) by Stroke Type, 2023 to 2033

Figure 26: North America Market Value (US$ Million) by Vehicle Type, 2023 to 2033

Figure 27: North America Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 28: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 29: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 30: North America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 31: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 32: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 33: North America Market Value (US$ Million) Analysis by Stroke Type, 2018 to 2033

Figure 34: North America Market Volume (Units) Analysis by Stroke Type, 2018 to 2033

Figure 35: North America Market Value Share (%) and BPS Analysis by Stroke Type, 2023 to 2033

Figure 36: North America Market Y-o-Y Growth (%) Projections by Stroke Type, 2023 to 2033

Figure 37: North America Market Value (US$ Million) Analysis by Vehicle Type, 2018 to 2033

Figure 38: North America Market Volume (Units) Analysis by Vehicle Type, 2018 to 2033

Figure 39: North America Market Value Share (%) and BPS Analysis by Vehicle Type, 2023 to 2033

Figure 40: North America Market Y-o-Y Growth (%) Projections by Vehicle Type, 2023 to 2033

Figure 41: North America Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 42: North America Market Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 43: North America Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 44: North America Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 45: North America Market Attractiveness by Stroke Type, 2023 to 2033

Figure 46: North America Market Attractiveness by Vehicle Type, 2023 to 2033

Figure 47: North America Market Attractiveness by Sales Channel, 2023 to 2033

Figure 48: North America Market Attractiveness by Country, 2023 to 2033

Figure 49: Latin America Market Value (US$ Million) by Stroke Type, 2023 to 2033

Figure 50: Latin America Market Value (US$ Million) by Vehicle Type, 2023 to 2033

Figure 51: Latin America Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 52: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 53: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 54: Latin America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 55: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 56: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 57: Latin America Market Value (US$ Million) Analysis by Stroke Type, 2018 to 2033

Figure 58: Latin America Market Volume (Units) Analysis by Stroke Type, 2018 to 2033

Figure 59: Latin America Market Value Share (%) and BPS Analysis by Stroke Type, 2023 to 2033

Figure 60: Latin America Market Y-o-Y Growth (%) Projections by Stroke Type, 2023 to 2033

Figure 61: Latin America Market Value (US$ Million) Analysis by Vehicle Type, 2018 to 2033

Figure 62: Latin America Market Volume (Units) Analysis by Vehicle Type, 2018 to 2033

Figure 63: Latin America Market Value Share (%) and BPS Analysis by Vehicle Type, 2023 to 2033

Figure 64: Latin America Market Y-o-Y Growth (%) Projections by Vehicle Type, 2023 to 2033

Figure 65: Latin America Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 66: Latin America Market Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 67: Latin America Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 68: Latin America Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 69: Latin America Market Attractiveness by Stroke Type, 2023 to 2033

Figure 70: Latin America Market Attractiveness by Vehicle Type, 2023 to 2033

Figure 71: Latin America Market Attractiveness by Sales Channel, 2023 to 2033

Figure 72: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 73: Europe Market Value (US$ Million) by Stroke Type, 2023 to 2033

Figure 74: Europe Market Value (US$ Million) by Vehicle Type, 2023 to 2033

Figure 75: Europe Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 76: Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 77: Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 78: Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 79: Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 80: Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 81: Europe Market Value (US$ Million) Analysis by Stroke Type, 2018 to 2033

Figure 82: Europe Market Volume (Units) Analysis by Stroke Type, 2018 to 2033

Figure 83: Europe Market Value Share (%) and BPS Analysis by Stroke Type, 2023 to 2033

Figure 84: Europe Market Y-o-Y Growth (%) Projections by Stroke Type, 2023 to 2033

Figure 85: Europe Market Value (US$ Million) Analysis by Vehicle Type, 2018 to 2033

Figure 86: Europe Market Volume (Units) Analysis by Vehicle Type, 2018 to 2033

Figure 87: Europe Market Value Share (%) and BPS Analysis by Vehicle Type, 2023 to 2033

Figure 88: Europe Market Y-o-Y Growth (%) Projections by Vehicle Type, 2023 to 2033

Figure 89: Europe Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 90: Europe Market Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 91: Europe Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 92: Europe Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 93: Europe Market Attractiveness by Stroke Type, 2023 to 2033

Figure 94: Europe Market Attractiveness by Vehicle Type, 2023 to 2033

Figure 95: Europe Market Attractiveness by Sales Channel, 2023 to 2033

Figure 96: Europe Market Attractiveness by Country, 2023 to 2033

Figure 97: Asia Pacific Market Value (US$ Million) by Stroke Type, 2023 to 2033

Figure 98: Asia Pacific Market Value (US$ Million) by Vehicle Type, 2023 to 2033

Figure 99: Asia Pacific Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 100: Asia Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 101: Asia Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 102: Asia Pacific Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 103: Asia Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 104: Asia Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 105: Asia Pacific Market Value (US$ Million) Analysis by Stroke Type, 2018 to 2033

Figure 106: Asia Pacific Market Volume (Units) Analysis by Stroke Type, 2018 to 2033

Figure 107: Asia Pacific Market Value Share (%) and BPS Analysis by Stroke Type, 2023 to 2033

Figure 108: Asia Pacific Market Y-o-Y Growth (%) Projections by Stroke Type, 2023 to 2033

Figure 109: Asia Pacific Market Value (US$ Million) Analysis by Vehicle Type, 2018 to 2033

Figure 110: Asia Pacific Market Volume (Units) Analysis by Vehicle Type, 2018 to 2033

Figure 111: Asia Pacific Market Value Share (%) and BPS Analysis by Vehicle Type, 2023 to 2033

Figure 112: Asia Pacific Market Y-o-Y Growth (%) Projections by Vehicle Type, 2023 to 2033

Figure 113: Asia Pacific Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 114: Asia Pacific Market Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 115: Asia Pacific Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 116: Asia Pacific Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 117: Asia Pacific Market Attractiveness by Stroke Type, 2023 to 2033

Figure 118: Asia Pacific Market Attractiveness by Vehicle Type, 2023 to 2033

Figure 119: Asia Pacific Market Attractiveness by Sales Channel, 2023 to 2033

Figure 120: Asia Pacific Market Attractiveness by Country, 2023 to 2033

Figure 121: MEA Market Value (US$ Million) by Stroke Type, 2023 to 2033

Figure 122: MEA Market Value (US$ Million) by Vehicle Type, 2023 to 2033

Figure 123: MEA Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 124: MEA Market Value (US$ Million) by Country, 2023 to 2033

Figure 125: MEA Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 126: MEA Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 127: MEA Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 128: MEA Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 129: MEA Market Value (US$ Million) Analysis by Stroke Type, 2018 to 2033

Figure 130: MEA Market Volume (Units) Analysis by Stroke Type, 2018 to 2033

Figure 131: MEA Market Value Share (%) and BPS Analysis by Stroke Type, 2023 to 2033

Figure 132: MEA Market Y-o-Y Growth (%) Projections by Stroke Type, 2023 to 2033

Figure 133: MEA Market Value (US$ Million) Analysis by Vehicle Type, 2018 to 2033

Figure 134: MEA Market Volume (Units) Analysis by Vehicle Type, 2018 to 2033

Figure 135: MEA Market Value Share (%) and BPS Analysis by Vehicle Type, 2023 to 2033

Figure 136: MEA Market Y-o-Y Growth (%) Projections by Vehicle Type, 2023 to 2033

Figure 137: MEA Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 138: MEA Market Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 139: MEA Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 140: MEA Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 141: MEA Market Attractiveness by Stroke Type, 2023 to 2033

Figure 142: MEA Market Attractiveness by Vehicle Type, 2023 to 2033

Figure 143: MEA Market Attractiveness by Sales Channel, 2023 to 2033

Figure 144: MEA Market Attractiveness by Country, 2023 to 2033

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Gasoline Gensets Market Size and Share Forecast Outlook 2025 to 2035

Gasoline Turbochargers Market Insights – Growth & Forecast 2025 to 2035

Gasoline Generator Market - Growth & Demand 2025 to 2035

E Gasoline Market Size and Share Forecast Outlook 2025 to 2035

Single Phase Gasoline Gensets Market Size and Share Forecast Outlook 2025 to 2035

Asia Pacific Gasoline Injection Technologies Market Size and Share Forecast Outlook 2025 to 2035

Pygas (Pyrolysis Gasoline) Market

Direct Liquid Cooling IGBT Module Market Size and Share Forecast Outlook 2025 to 2035

Direct Fast Dyes Market Size and Share Forecast Outlook 2025 to 2035

Direct Thermal Printing Film Market Size and Share Forecast Outlook 2025 to 2035

Directional Drilling Service Market Forecast Outlook 2025 to 2035

Direct Methanol Fuel Cell Market Size and Share Forecast Outlook 2025 to 2035

Direct Operated Poppet Valve Market Forecast and Outlook 2025 to 2035

Direct to Garment Printing Market Size and Share Forecast Outlook 2025 to 2035

Direct Burial Fiber Optic Cable Market Size and Share Forecast Outlook 2025 to 2035

Directed Energy Weapons Market Size and Share Forecast Outlook 2025 to 2035

Direct To Chip Liquid Cooling Market Size and Share Forecast Outlook 2025 to 2035

Direct Write Semiconductor Market Size and Share Forecast Outlook 2025 to 2035

Direct Oral Anticoagulants Market Size and Share Forecast Outlook 2025 to 2035

Direct Thermal Linerless Labels Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA