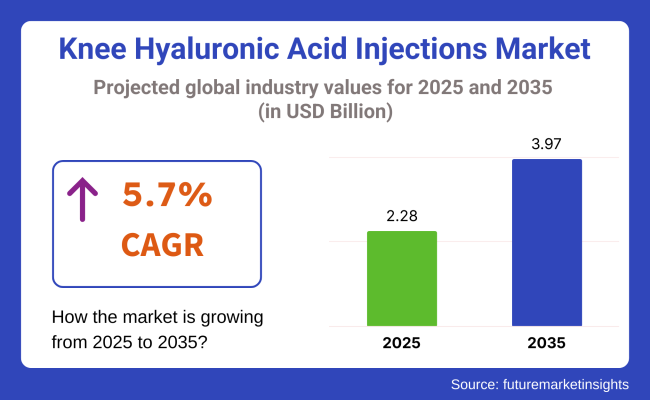

The knee hyaluronic acid injections market is expected to grow from USD 2.28 billion in 2025 to USD 3.97 billion by 2035, registering a compound annual growth rate (CAGR) of 5.7% during the forecast period. The demand for knee hyaluronic acid injections is being driven by the increasing prevalence of osteoarthritis, particularly in aging populations.

These injections, known for their ability to relieve pain and improve joint mobility, are becoming a key solution for individuals suffering from knee osteoarthritis, a condition that affects millions globally.

One of the primary drivers for this market’s expansion is the growing awareness of non-surgical treatment options for knee osteoarthritis. As patients seek alternatives to invasive surgeries, hyaluronic acid injections have gained popularity due to their effectiveness in providing long-term pain relief and improving joint function.

Additionally, the ease of administering these injections in outpatient settings has made them more accessible to a wider patient demographic. This trend is expected to continue as more healthcare providers adopt hyaluronic acid injections as part of their treatment protocols.

A notable recent development in the market is the advancement in the formulations of hyaluronic acid injections, which are now being designed to offer improved efficacy and longer-lasting effects. Companies in the market are focusing on developing high-quality hyaluronic acid-based treatments that can cater to different severity levels of knee osteoarthritis, providing patients with personalized solutions. This has been a significant factor in the increasing adoption of these treatments.

On December 5, 2023, Bioventus Inc. announced a nationwide contract with Aetna Medicare Advantage plans, effective January 1, 2024. This agreement provides over 3 million Aetna members with access to DUROLANE, a single-injection hyaluronic acid-based treatment for knee osteoarthritis (OA) pain.

DUROLANE aims to alleviate joint pain by supplementing the natural synovial fluid in the knee joint. This collaboration underscores Bioventus' commitment to enhancing patient access to effective non-surgical pain management options for knee OA.

As the market continues to evolve, increasing healthcare access and further advancements in treatment formulations are set to drive significant growth in the knee hyaluronic acid injections market, providing substantial opportunities for both patients and healthcare providers.

The table below indicates the CAGR the market of knee hyaluronic acid injections globally would record between different semi-annual periods running from 2025 to 2035. Business during H1 from 2024 through 2035 will record a growth of CAGR at 5.9%. It then peaks a bit in H2, where CAGR during the same decade shall have reached 6.3%.

| Particular | Value CAGR |

|---|---|

| H1 | 5.9% (2024 to 2035) |

| H2 | 6.3% (2024 to 2035) |

| H1 | 5.7% (2025 to 2035) |

| H2 | 6.4% (2025 to 2035) |

In the following term, H1 2025-H2 2035 the CAGR should go down low at 5.7 in the first and pick up fairly high at 6.4% in the second half period. In half of the years H1 The market increased its -20.00 BPS, whereas H2 saw an opposite decline, the market has reduced its figures at 13.00 BPS.

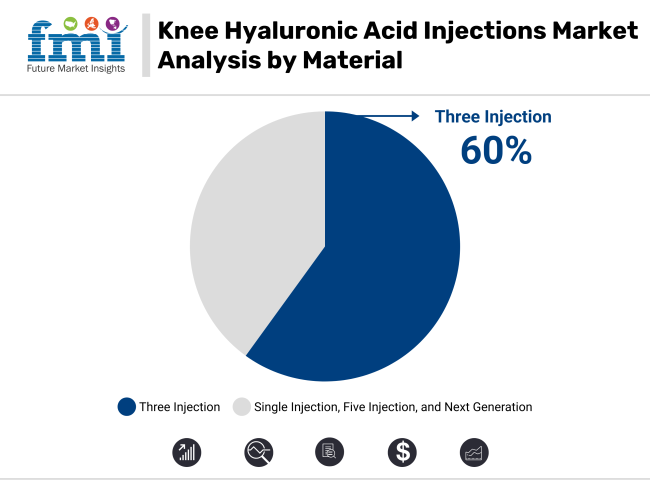

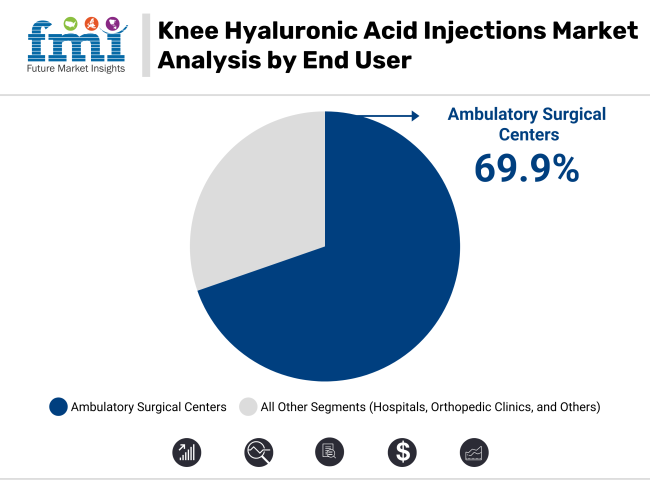

The global knee hyaluronic acid injections market is projected to grow significantly from 2025 to 2035. Major segments include three-injection products and ambulatory surgical centers, driven by rising demand for minimally invasive procedures and the increasing prevalence of osteoarthritis. Leading players in the field, such as Zimmer Biomet and Sanofi, are expanding their product portfolios to address the growing market demand.

The three-injection knee hyaluronic acid injections segment is expected to dominate with a 60.0% market share in 2025. This growth is fueled by the convenience and effectiveness of the treatment, which provides longer-lasting relief for patients with knee osteoarthritis.

The popularity of three-injection regimens is rising due to their ability to reduce inflammation and improve mobility without the need for surgery. Key players like Zimmer Biomet and Sanofi have contributed to this segment's growth by offering advanced formulations that provide effective and prolonged relief for patients. Furthermore, the segment benefits from the increasing focus on non-invasive treatments for chronic joint conditions.

In addition, advancements in injection techniques and the growing adoption of digital health technologies, such as telemedicine and real-time monitoring, are enhancing the patient experience and driving demand. The growing aging population and the rising prevalence of knee-related disorders further contribute to the success of this product type in the market.

Ambulatory surgical centers (ASCs) are expected to account for 69.9% of the knee hyaluronic acid injections market share in 2025, driven by the growing preference for outpatient procedures. ASCs offer a more cost-effective and convenient alternative to traditional hospital settings, attracting both patients and healthcare providers. ASCs provide patients with quick recovery times, shorter wait periods, and lower treatment costs, making them an increasingly popular choice for knee osteoarthritis treatments.

Additionally, advancements in medical equipment and minimally invasive surgical techniques have enabled ASCs to provide high-quality care while reducing patient recovery times. The increasing number of specialized knee treatment centers and the adoption of cost-effective healthcare solutions are expected to further support the dominance of ASCs in this market. L

eading companies such as Medline Industries and HCA Healthcare are capitalizing on this trend by expanding their outpatient services and forming partnerships with medical professionals to cater to growing demand.

Increasing Demand for Outpatient Treatment Is Driving the Growth for Knee Hyaluronic Acid Injections Market.

The increasing trend towards outpatient care is highly driving the knee hyaluronic acid The injections market is experiencing investment by governments and private healthcare operators in the establishment of ambulatory surgical centers (ASCs) and specialized orthopedic care centers. Healthcare infrastructure upgrades in developed and emerging markets are also making hyaluronic acid injections in the knee more accessible and affordable.

According to the Centers for Medicare and Medicaid Services, trends in hospital revenue illustrate increased reliance on outpatient services, based on expectations that demand for outpatient services among those aged 55 and above will continue growing by 16.9% through 2025, following the projected general population growth of 12.6%. Overall, the outpatient sector is expected to grow at a 9 percent annual rate, more swiftly than the 6 percent a year expected for inpatient care.

Some of the factors that are propelling this trend include the desire for price transparency, which will ensnare patients into looking for cheaper but high-value treatments, and the fast pace of technological advancement, which allows various orthopedic procedures to be done in an outpatient setting. Increased preference by patients for minimally invasive, quicker recovery, and the need for hospitals to incentivize activities that are profitable for them drives this further, thus increasing demand for knee hyaluronic acid injections to join the general embrace of outpatient care.

The Rapid Growth of the Aging and Obese Population Is a Key Factor Driving the Adoption of Knee Hyaluronic Acid Injections as A Standard Treatment for Knee Osteoarthritis (OA).

With an increased number of patients in their elder age group along with being obese, there has been an enhanced requirement for hyaluronic acid injections as a first non-surgical procedure in knee OA. Increasing lifestyle diseases like longer living ages with diet disorders and inactive life cycles lead to massive OA cases worldwide. This situation needs effective treatment; viscosupplementation (injecting hyaluronic acid into the knee) becomes one of the trusted alternatives in treating this for relief in pain and for greater mobility.

The WHO observes that the older population, people aged 60 and above will nearly double; from 12% in 2015 up to 22% by 2050. By 2030, more than one sixth of the total world population is expected to age over 60. Aging thus being the single most cause for OA, increasing demand for these injections is the expected result in this demographic drift.

The condition of obesity further increases the requirement for OA treatments. According to the CDC, the obesity prevalence in adults aged 40-59 was 44.3%, while among adults 60 and older, it was 41.5%. According to studies, obesity has a high association with the following percentage of OA, which is 22.9% in patients of obesity surgery. Global demand to enhance the growth of knee hyaluronic acid injection therapeutics will emerge from an obese population.

The evolution in knee hyaluronic acid (HA) injections is going to result in an enormous market expansion opportunity.

Most prominent manufacturers are investing a lot in the advanced formulation viscosupplementation therapies that promise more efficacy and duration of treatment for mild to moderate knee osteoarthritis. Improved formulations, along with combinations with anti-inflammatory agents, produce greater pain relief and improved function in the involved joint.

The growth in treatment pipeline related to osteoarthritis, coupled with branching out in newer technology and continued patent filing, contributes significantly to the market growth. Funding through industry and governments for the scientific research as well as clinical validation of HA-based injections, accelerate regulatory approvals and broaden the base of product adoption. In addition, integration of novel drug delivery mechanisms and biocompatible materials further strengthen the market outlook.

A third example in this category of innovation is Anika Therapeutics' Cingal. This next-generation HA injection uniquely combines HA with a corticosteroid to provide both lubrication and immediate anti-inflammatory effects. It is approved in Europe and Canada and is under clinical trials in the USA for FDA approval, therefore exhibiting the hope for greater market expansion. With further research and development efforts, next-generation HA injections are expected to gain a growing share of the market, and industry players can seize this lucrative opportunity to differentiate their offerings and expand their global footprint.

The Declining Reimbursement Coverage for Knee Hyaluronic Acid (HA) Injections in Key Markets Is a Significant Restraint Impacting Market Growth

The stable reimbursement landscape, to which orthopedic providers have grown accustomed, is increasingly subject to more stringent scrutiny and less generous coverage. Healthcare systems now seek greater efficiency, which reduces the availability of reimbursement for such elective procedures as knee HA injections, thus further limiting patients' access to such care.

The overall effect is that Medicare and Medicaid continue to pay for reimbursement, while private insurance providers hold the final say in coverage. Leading private insurers now use pre-authorization based on medical necessity and appropriateness reviews, making it increasingly likely that insurance companies will deny these procedures. Further, treatment guidelines lately published by the American Academy of Orthopedic Surgeons (AAOS) and the Osteoarthritis Research Society International (OARSI) downplayed the effectiveness of injections of HA for knee OA, further influencing the approach of payers.

Besides the United States, challenges in the area of reimbursement exist in other important markets as well, with health insurers limiting coverage due to the existence of over-the-counter alternatives and online procurement of HA injections. Reduced insurance support and tighter clinical guidelines are likely to influence adoption rates going forward, which would affect the rest of the players in the market since they seek to expand patient access and sustain growth in the market for knee HA injections.

Tier 1 companies include market leaders with a high share of 47.0% in the global market. Such companies make strategic partnerships and acquisitions as part of their product portfolio extension along with access to new technologies. It also conducts extensive clinical investigations to show how well and safe the products are. Tier 1 also includes such companies as Sanofi S.A., Bioventus LLC, and Ferring B.V.; Zimmer Biomet; Seikagaku Corporation; and Fidia Farmaceutici s.p.a.

Tier 2 companies include mid-size players having presence in specific regions and highly influencing the local market and holds around 32.8% market share. They typically pursue partnerships with multispecialty hospitals and research organizations to leverage emerging technologies and expedite product development.

These companies often emphasize agility and adaptability, allowing them to quickly bring new products to market, additionally targeting specific types medical needs. Also, they emphasize low-cost production processes to provide competitive prices. Major players in tier 2 are Anika Therapeutics, Inc., LG Chem, OrthogenRx, Hanmi Pharm.Co.,Ltd., Chugai Pharmaceutical Co., Ltd. and Haohai Biological Technology.

Lastly, Tier 3 businesses like Meiji Seika Pharma co. ltd, Hangzhou Singclean Medical Products Co., Ltd, TRB Chemedica International SA, Bioiberica S.A.U. and many more. They deal in niche products and serve niche markets, introducing diversity to the sector.

Overall, while Tier 1 companies are the primary drivers of the market, Tier 2 and 3 companies also make significant contributions, ensuring the knee hyaluronic acid injections sales remains dynamic and competitive.

The section below covers the knee hyaluronic acid injections industry analysis for different countries. Research on the market demand as pertains to the key countries of different regions of the world, which includes among others North America, Latin America, East Asia, South Asia & Pacific, Western Europe, Eastern Europe and Middle Ease & Africa.

The most significant influence in North America will be exercised by the United States, which is expected to maintain a higher market share through 2035. By that same year, China would strategize to secure a CAGR of 9.3% in South Asia & Pacific.

| Country | Value CAGR (2025 to 2035) |

|---|---|

| United States | 3.7% |

| Germany | 3.9% |

| Japan | 8.8% |

| China | 9.3% |

| India | 8.0% |

| Canada | 6.6% |

| UK | 5.1% |

| South Korea | 5.8% |

The United States market is likely to grow at a CAGR of 3.7% from 2025 to 2035. The market share currently held in the North American market is the highest.

Rising incidences of knee OA in the USA remain one of the prime forces that drive the USA market for HA injections into the knee. According to CDC records, the USA is besieged with the problem wherein more than 32.5 million adults have had to suffer with OA and most are diagnosed as having a knee OA diagnosis. These figures are due to both increased ageing in population groups as well as escalating levels of obesity within a particular group- the main two OA-developing causes.

The increase in the number of elderly and obese people necessitates that many more patients must be provided with effective, non-surgical options to manage their pain and promote joint mobility. HA injections have become one of the most sought-after surgical alternatives for patients who are either ineligible or unwilling to undergo knee replacement surgery. There is adequate demand for HA injections based on wide out-patient accessibility and evolution of the clinical advance, thus making them a preferred choice in the USA market to manage knee OA.

China is likely to have the second-highest market share for knee hyaluronic acid injections in Eastern Europe, which it currently has; the market for this segment in China is going to have a CAGR of 9.3% in the period of 2025-2035.

An established pharmaceutical production sector in China is the hub driver of the market for knee hyaluronic acid (HA) injections. In this context, several domestic companies have been able to manufacture HA injections on a large scale at relatively cheaper prices, including Shandong Freda Biotechnology, Shanghai Jingfeng Pharmaceutical, and Bloomage Biotechnology. These companies have expanded their portfolios with innovative products, improved formulations, and research and development to make treatment more effective.

The strong local manufacturing base will ensure that HA injections are readily available throughout the region and decrease dependency on expensive imports, making treatments more affordable to patients. Additionally, government support for local biopharmaceutical production speeds up market growth. As the need for non-surgical OA treatment increases, the ability of China to produce quality HA injections at competitive prices establishes it as an important supplier on the world scale. This domestic production advantage, with growing healthcare availability, is paving the way for rapid adoption of HA injections in China's urban and rural markets.

The Japanese market is waiting to experience an 8.8% CAGR between 2025 and 2035. It is presently the largest in the South Asia & Pacific region, and this trend is expected to continue during the forecast period.

Japan actually possesses one of the world's most rapidly aging populations, as reported by the World Bank statistics, where over 28% of residents are over 65 years old. Such population trends have demonstrated a marked rise in age-related degenerative diseases, particularly knee OA, which has serious implications for mobility and quality of life. Consequently, with an increasing elderly population, there are increased demands for effective and non-surgical management such as HA injections.

Since the average life span goes beyond 84 years, the only issue is managing chronic joint conditions; an HA injection that reduces pain and improves functions at a site is recommended by many physicians to delay invasive procedures like replacement of the knee. Given that the Japanese healthcare system also favors preventive care and minimally invasive treatments, adoption of HA injections is strongly promoted, hence HA injections should be a part of the strategy in dealing with the increasing OA burden in Japan.

The market players use strategies such as product differentiation by innovative formulations, strategic partnerships with healthcare providers for distribution. Among the key strategic focuses of the companies are their active searches for strategic partners for bolstering the product portfolios and expanding the global market presence.

Recent Industry Developments in Knee Hyaluronic Acid Injections Market:

| Report Attributes | Details |

|---|---|

| Current Total Market Size (2025) | USD 2.28 billion |

| Projected Market Size (2035) | USD 3.97 billion |

| CAGR (2025 to 2035) | 5.7% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | USD billion for dollar sales |

| Product Types Analyzed (Segment 1) | Single Injection Knee Hyaluronic Acid Injections, Three Injection Knee Hyaluronic Acid Injections, Five Injection Knee Hyaluronic Acid Injections, Next Generation (Steroid Combination) |

| End-users Analyzed (Segment 2) | Hospitals, Ambulatory Surgical Centers, Orthopedic Clinics, Retail Pharmacies, Online Sales |

| Regions Covered | North America, Latin America, Western Europe, Eastern Europe, South Asia & Pacific, East Asia, Middle East & Africa (MEA) |

| Countries Covered | United States, Canada, Mexico, Brazil, Argentina, Germany, France, United Kingdom, Italy, Spain, Netherlands, China, India, Japan, South Korea, ANZ, GCC Countries, South Africa |

| Key Players influencing the Knee Hyaluronic Acid Injections Market | Sanofi S.A., Bioventus LLC, Ferring B.V., Zimmer Biomet, Seikagaku Corporation, Fidia Farmaceutici s.p.a., Anika Therapeutics, Inc., LG Chem, OrthogenRx, Hanmi Pharm. Co., Ltd., Chugai Pharmaceutical Co., Ltd., Haohai Biological Technology, Meiji Seika Pharma Co., Ltd., Hangzhou Singclean Medical Products Co., Ltd. |

| Additional Attributes | dollar sales, CAGR trends, product type segmentation, end-user demand shifts, competitor dollar sales & market share, regional adoption trends, online vs offline sales growth |

The global knee hyaluronic acid injections market is projected to witness CAGR of 5.7% between 2025 and 2035.

The global knee hyaluronic acid injections industry stood at USD 2,167.2 million in 2024.

The global market is anticipated to reach USD 3.97 billion by 2035 end.

India is set to record the highest CAGR of 6.1% in the assessment period.

The key players operating in the global market for knee hyaluronic acid injections include Sanofi S.A., Bioventus LLC, Ferring B.V., Zimmer Biomet, Seikagaku Corporation, Fidia Farmaceutici s.p.a., Anika Therapeutics, Inc, LG Chem, OrthogenRx, Hanmi Pharm.Co.,Ltd., Chugai Pharmaceutical Co., Ltd., Haohai Biological Technology, Meiji Seika Pharma co. ltd and Hangzhou Singclean Medical Products Co.,Ltd.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (Units) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 4: Global Market Volume (Units) Forecast by Product, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 6: Global Market Volume (Units) Forecast by End User, 2018 to 2033

Table 7: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 8: North America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 9: North America Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 10: North America Market Volume (Units) Forecast by Product, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 12: North America Market Volume (Units) Forecast by End User, 2018 to 2033

Table 13: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 14: Latin America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 15: Latin America Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 16: Latin America Market Volume (Units) Forecast by Product, 2018 to 2033

Table 17: Latin America Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 18: Latin America Market Volume (Units) Forecast by End User, 2018 to 2033

Table 19: Western Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 20: Western Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 21: Western Europe Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 22: Western Europe Market Volume (Units) Forecast by Product, 2018 to 2033

Table 23: Western Europe Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 24: Western Europe Market Volume (Units) Forecast by End User, 2018 to 2033

Table 25: Eastern Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: Eastern Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 27: Eastern Europe Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 28: Eastern Europe Market Volume (Units) Forecast by Product, 2018 to 2033

Table 29: Eastern Europe Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 30: Eastern Europe Market Volume (Units) Forecast by End User, 2018 to 2033

Table 31: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 32: South Asia and Pacific Market Volume (Units) Forecast by Country, 2018 to 2033

Table 33: South Asia and Pacific Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 34: South Asia and Pacific Market Volume (Units) Forecast by Product, 2018 to 2033

Table 35: South Asia and Pacific Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 36: South Asia and Pacific Market Volume (Units) Forecast by End User, 2018 to 2033

Table 37: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 38: East Asia Market Volume (Units) Forecast by Country, 2018 to 2033

Table 39: East Asia Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 40: East Asia Market Volume (Units) Forecast by Product, 2018 to 2033

Table 41: East Asia Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 42: East Asia Market Volume (Units) Forecast by End User, 2018 to 2033

Table 43: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 44: Middle East and Africa Market Volume (Units) Forecast by Country, 2018 to 2033

Table 45: Middle East and Africa Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 46: Middle East and Africa Market Volume (Units) Forecast by Product, 2018 to 2033

Table 47: Middle East and Africa Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 48: Middle East and Africa Market Volume (Units) Forecast by End User, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Product, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by End User, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 4: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 5: Global Market Volume (Units) Analysis by Region, 2018 to 2033

Figure 6: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 7: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 8: Global Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 9: Global Market Volume (Units) Analysis by Product, 2018 to 2033

Figure 10: Global Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 11: Global Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 12: Global Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 13: Global Market Volume (Units) Analysis by End User, 2018 to 2033

Figure 14: Global Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 15: Global Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 16: Global Market Attractiveness by Product, 2023 to 2033

Figure 17: Global Market Attractiveness by End User, 2023 to 2033

Figure 18: Global Market Attractiveness by Region, 2023 to 2033

Figure 19: North America Market Value (US$ Million) by Product, 2023 to 2033

Figure 20: North America Market Value (US$ Million) by End User, 2023 to 2033

Figure 21: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 22: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 23: North America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 24: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 25: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 26: North America Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 27: North America Market Volume (Units) Analysis by Product, 2018 to 2033

Figure 28: North America Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 29: North America Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 30: North America Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 31: North America Market Volume (Units) Analysis by End User, 2018 to 2033

Figure 32: North America Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 33: North America Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 34: North America Market Attractiveness by Product, 2023 to 2033

Figure 35: North America Market Attractiveness by End User, 2023 to 2033

Figure 36: North America Market Attractiveness by Country, 2023 to 2033

Figure 37: Latin America Market Value (US$ Million) by Product, 2023 to 2033

Figure 38: Latin America Market Value (US$ Million) by End User, 2023 to 2033

Figure 39: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 40: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 41: Latin America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 42: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 43: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 44: Latin America Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 45: Latin America Market Volume (Units) Analysis by Product, 2018 to 2033

Figure 46: Latin America Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 47: Latin America Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 48: Latin America Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 49: Latin America Market Volume (Units) Analysis by End User, 2018 to 2033

Figure 50: Latin America Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 51: Latin America Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 52: Latin America Market Attractiveness by Product, 2023 to 2033

Figure 53: Latin America Market Attractiveness by End User, 2023 to 2033

Figure 54: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 55: Western Europe Market Value (US$ Million) by Product, 2023 to 2033

Figure 56: Western Europe Market Value (US$ Million) by End User, 2023 to 2033

Figure 57: Western Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 58: Western Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 59: Western Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 60: Western Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 61: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 62: Western Europe Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 63: Western Europe Market Volume (Units) Analysis by Product, 2018 to 2033

Figure 64: Western Europe Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 65: Western Europe Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 66: Western Europe Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 67: Western Europe Market Volume (Units) Analysis by End User, 2018 to 2033

Figure 68: Western Europe Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 69: Western Europe Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 70: Western Europe Market Attractiveness by Product, 2023 to 2033

Figure 71: Western Europe Market Attractiveness by End User, 2023 to 2033

Figure 72: Western Europe Market Attractiveness by Country, 2023 to 2033

Figure 73: Eastern Europe Market Value (US$ Million) by Product, 2023 to 2033

Figure 74: Eastern Europe Market Value (US$ Million) by End User, 2023 to 2033

Figure 75: Eastern Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 76: Eastern Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 77: Eastern Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 78: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 79: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 80: Eastern Europe Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 81: Eastern Europe Market Volume (Units) Analysis by Product, 2018 to 2033

Figure 82: Eastern Europe Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 83: Eastern Europe Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 84: Eastern Europe Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 85: Eastern Europe Market Volume (Units) Analysis by End User, 2018 to 2033

Figure 86: Eastern Europe Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 87: Eastern Europe Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 88: Eastern Europe Market Attractiveness by Product, 2023 to 2033

Figure 89: Eastern Europe Market Attractiveness by End User, 2023 to 2033

Figure 90: Eastern Europe Market Attractiveness by Country, 2023 to 2033

Figure 91: South Asia and Pacific Market Value (US$ Million) by Product, 2023 to 2033

Figure 92: South Asia and Pacific Market Value (US$ Million) by End User, 2023 to 2033

Figure 93: South Asia and Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 94: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 95: South Asia and Pacific Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 96: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 97: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 98: South Asia and Pacific Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 99: South Asia and Pacific Market Volume (Units) Analysis by Product, 2018 to 2033

Figure 100: South Asia and Pacific Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 101: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 102: South Asia and Pacific Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 103: South Asia and Pacific Market Volume (Units) Analysis by End User, 2018 to 2033

Figure 104: South Asia and Pacific Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 105: South Asia and Pacific Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 106: South Asia and Pacific Market Attractiveness by Product, 2023 to 2033

Figure 107: South Asia and Pacific Market Attractiveness by End User, 2023 to 2033

Figure 108: South Asia and Pacific Market Attractiveness by Country, 2023 to 2033

Figure 109: East Asia Market Value (US$ Million) by Product, 2023 to 2033

Figure 110: East Asia Market Value (US$ Million) by End User, 2023 to 2033

Figure 111: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 112: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 113: East Asia Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 114: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 115: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 116: East Asia Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 117: East Asia Market Volume (Units) Analysis by Product, 2018 to 2033

Figure 118: East Asia Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 119: East Asia Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 120: East Asia Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 121: East Asia Market Volume (Units) Analysis by End User, 2018 to 2033

Figure 122: East Asia Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 123: East Asia Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 124: East Asia Market Attractiveness by Product, 2023 to 2033

Figure 125: East Asia Market Attractiveness by End User, 2023 to 2033

Figure 126: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 127: Middle East and Africa Market Value (US$ Million) by Product, 2023 to 2033

Figure 128: Middle East and Africa Market Value (US$ Million) by End User, 2023 to 2033

Figure 129: Middle East and Africa Market Value (US$ Million) by Country, 2023 to 2033

Figure 130: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 131: Middle East and Africa Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 132: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 133: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 134: Middle East and Africa Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 135: Middle East and Africa Market Volume (Units) Analysis by Product, 2018 to 2033

Figure 136: Middle East and Africa Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 137: Middle East and Africa Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 138: Middle East and Africa Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 139: Middle East and Africa Market Volume (Units) Analysis by End User, 2018 to 2033

Figure 140: Middle East and Africa Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 141: Middle East and Africa Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 142: Middle East and Africa Market Attractiveness by Product, 2023 to 2033

Figure 143: Middle East and Africa Market Attractiveness by End User, 2023 to 2033

Figure 144: Middle East and Africa Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Knee Replacement Market Size and Share Forecast Outlook 2025 to 2035

Knee Walker Market Size and Share Forecast Outlook 2025 to 2035

Knee Reconstruction Devices Market Growth – Trends & Forecast 2025 to 2035

Knee Arthrodesis Implant Market

Total Knee Replacement Market Size and Share Forecast Outlook 2025 to 2035

Hip and Knee Reconstructive Market Analysis – Size, Demand & Forecast 2025-2035

Revision Knee Replacement Market Size and Share Forecast Outlook 2025 to 2035

Below-the-knee Implants Market

3D Printed Hip and Knee Implants Market Size and Share Forecast Outlook 2025 to 2035

Hyaluronic Viscosupplementation Market Size and Share Forecast Outlook 2025 to 2035

Hyaluronic Acid Boosters Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Hyaluronic Acid Products Market Insights - Demand, Growth & Forecast 2025 to 2035

Hyaluronic Acid Supplement Market Product, Type, Application, Distribution Channel and Others Through 2035

Hyaluronic Acid Personal Care Products Market Overview - Growth & Forecast 2025 to 2035

Hyaluronic Acid Market Growth – Trends & Forecast 2024-2034

Non-Hyaluronic Acid Dermal Filler Market Size and Share Forecast Outlook 2025 to 2035

USA Hyaluronic Acid Products Market Insights – Growth, Demand & Forecast 2025-2035

Vegan Hyaluronic Acid Market Size and Share Forecast Outlook 2025 to 2035

Japan Hyaluronic Acid Products Market Analysis – Growth, Applications & Outlook 2025-2035

Brazil Hyaluronic Acid Products Market Outlook – Share, Growth & Forecast 2025-2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA