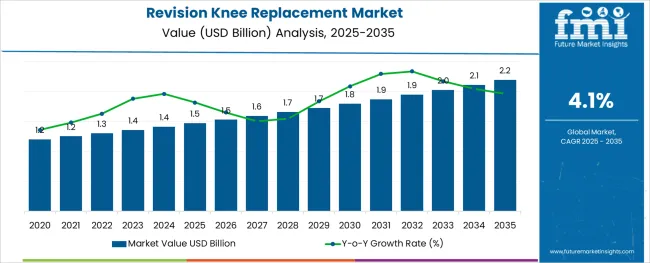

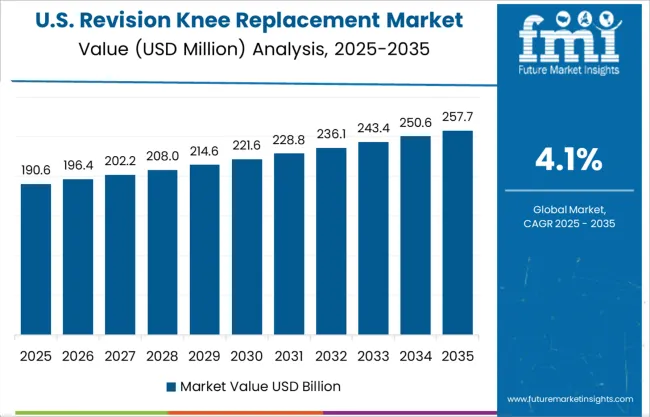

The Revision Knee Replacement Market is estimated to be valued at USD 1.5 billion in 2025 and is projected to reach USD 2.2 billion by 2035, registering a compound annual growth rate (CAGR) of 4.1% over the forecast period.

The revision knee replacement market is advancing steadily, driven by the rising incidence of failed primary knee implants, aging populations, and the global growth in orthopedic surgical procedures. Increasing demand for longer-lasting prosthetics and the need to address complications such as implant loosening, infection, or wear has intensified innovation in revision-specific implant systems.

Surgeons are prioritizing systems that offer modularity, bone preservation, and enhanced joint stability. Manufacturers are responding by introducing designs with improved biomechanical compatibility and better wear resistance. Parallelly, surgical centers are adopting advanced intraoperative navigation systems and personalized cutting guides, enabling higher precision in complex revisions.

Regulatory and clinical focus on improving long-term patient outcomes has also elevated the need for cemented and hybrid fixation techniques. With healthcare systems investing in infrastructure and surgeon training, particularly across high-volume orthopedic centers, future growth is expected to be anchored by advanced implant solutions and efficient fixation techniques suited to complex revision cases.

The market is segmented by Product Type, Fixation Type, and End User and region. By Product Type, the market is divided into Three Compartmental and Uni-compartmental. In terms of Fixation Type, the market is classified into Cemented and Cement less. Based on End User, the market is segmented into Hospitals, Orthopaedic and Prosthetic Clinics, and Others. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

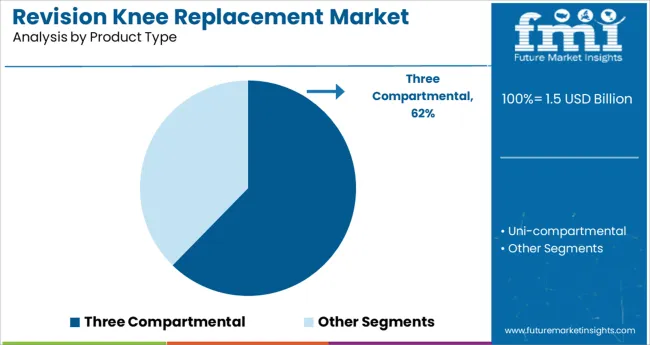

The three compartmental segment is expected to hold a 62.3% share of the total product type revenue in 2025, establishing it as the dominant segment. This leadership is attributed to its suitability for addressing advanced joint degeneration involving the medial, lateral, and patellofemoral compartments.

Three compartmental implants provide comprehensive joint resurfacing, ensuring optimal alignment and kinematics in revision surgeries where bone loss and soft tissue instability are more common. The segment’s dominance has also been supported by improvements in implant material durability and modular component options that accommodate various anatomical and defect scenarios.

Surgeons have preferred these systems for their predictability in restoring function and stability in complex revisions. Additionally, evolving designs now offer better compatibility with modern imaging and robotic-assisted procedures, which further enhances surgical precision and patient outcomes.

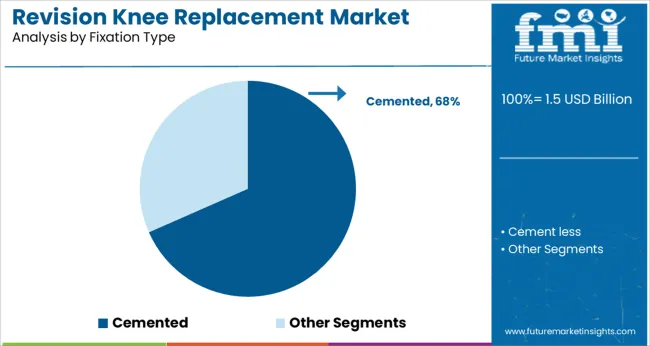

The cemented fixation segment is projected to account for 68.4% of total market revenue in 2025, maintaining its position as the leading fixation method. This dominance is underpinned by the long-standing clinical reliability of cemented techniques in providing immediate fixation and reducing the risk of implant micromotion.

Cemented fixation has shown consistent success in older and osteoporotic patients, where bone quality may be insufficient to support cementless alternatives. Furthermore, advancements in bone cement formulations, including antibiotic-loaded options, have added infection control benefits in high-risk revision scenarios.

The procedural familiarity among orthopedic surgeons and lower revision rates associated with cemented implants have reinforced its preference in both academic and community hospital settings. The ability to achieve stable fixation even in cases of bone loss or prior implant failure continues to sustain the segment’s leadership in revision knee arthroplasty.

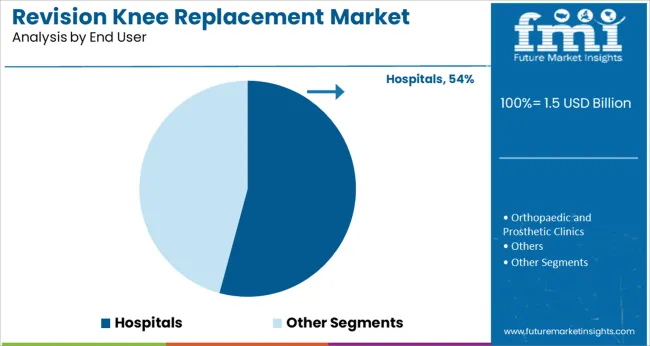

The hospitals segment is forecast to capture 54.2% of total revenue by 2025 in the end user category, securing its position as the primary site of care for revision knee procedures. This leadership stems from the comprehensive infrastructure hospitals provide, including access to advanced imaging, intraoperative technologies, multidisciplinary surgical teams, and intensive postoperative care.

Revision procedures often involve higher complexity and risk, making hospitals the preferred choice due to their specialized orthopedic departments and rehabilitation capabilities. Additionally, hospitals are more likely to participate in joint registry programs and follow evidence-based surgical protocols, supporting better long-term patient outcomes.

Investment in surgical robotics, navigation systems, and infection prevention protocols has further elevated the capacity of hospitals to manage complex revision cases. Their ability to handle high case volumes, manage complications, and support coordinated care pathways has firmly established them as the cornerstone of the revision knee replacement market.

The revision of knee replacement market opportunities is expected to grow due to the increasing rate of old age diseases like obesity, arthritis, sports-related injuries, osteoporosis, and diabetes. These opportunities are likely to raise the revised knee replacement market share during the forecast period.

However, existing and upcoming advancements such as minimally invasive surgery and better implant materials are expected to drive the revision knee replacement market demand globally. Increasing investment in the healthcare sector is also expected to supplement the revision knee replacement market size during the forecast period.

Despite the widely used procedures for curing diseases by the revision knee replacement, it is facing challenges, including economic slowdown. This can restrain the revision knee replacement market growth to some degree. High-cost surgery and growing non-surgical treatment methods such as exercise, walking aids, and weight loss may also affect the revision knee replacement market trends.

Also, some patients reconsider elective surgeries during conservative medical treatments such as visco-supplementation to ease the pain. This option has also emerged as another factor that may decline the revision knee replacement market share in the future.

North America dominates the global revision knee replacement market by acquiring 46.4% of the total share in the current year, 2025.

Due to high patient awareness, increasing healthcare expenditure, and advancements in technology, the revision knee replacement market opportunities have increased over these years. As per the revised knee replacement market survey, the market is predicted to strengthen during the forecast period with import restrictions placed by regional countries around the globe.

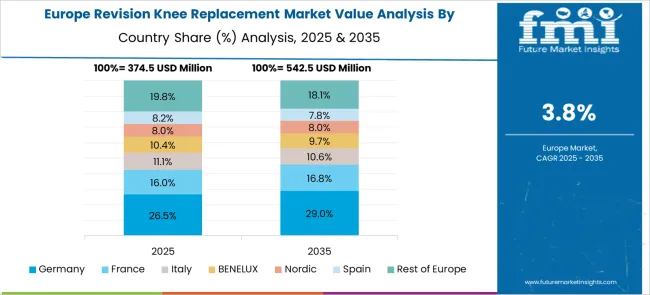

The net worth of the Europe revision knee replacement market acquired 28.6% of the global share as per the revision knee replacement market report.

The Europe region is estimated to be the second largest revision knee replacement market size after North America. Due to the increasing prevalence and rapid booming in the medical tourism industry are rising the revision knee replacement market growth in the region.

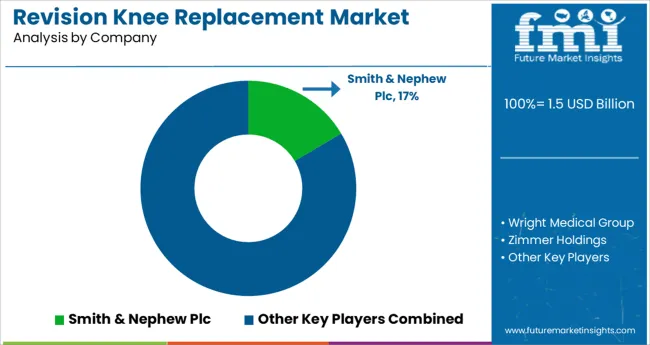

Some of the key players in the Revision Knee Replacement Market are Smith & Nephew Plc, Wright Medical Group, Inc, Zimmer Holdings, Biomet, Inc., Exactech, Stryker Corporation, DePuy Companies, Inc, B. Braun Melsungen AG, DJO Global, Ortho Development, LimaCorporate S.p.a., SURGICAL INTERNATIONAL, and BEZNOSKA among others.

Whereas some regional players also have a significant presence in the revision knee replacement market.

The revision knee replacement start-up companies are using various new innovative equipment for painless surgeries. Day by day their innovation are surging up in the medical field with their fast and secure treatments.

The key playing industries are focusing on their goal of using various appropriate tactics to expand the revision knee replacement market growth. Some of the methods are mergers, acquisitions, product launches, acquisitions, and partnerships among others.

Recent Developments in the Revision Knee Replacement Market are:

One orthopedic start-up company named Monogram is reinventing surgical robots and implants. The company uses its advanced technology by leveraging excellent imaging, machine learning, pre-operative plans, and 3D-printed implants with the help of advanced surgical robots.

| Report Attribute | Details |

|---|---|

| Growth Rate | CAGR of 4.1% from 2025 to 2035 |

| Base Year for Estimation | 2024 |

| Historical Data | 2020 to 2024 |

| Forecast Period | 2025 to 2035 |

| Quantitative Units | Revenue in million and CAGR from 2025 to 2035 |

| Report Coverage | Revenue Forecast, Volume Forecast, Company Ranking, Competitive Landscape, Growth Factors, Trends, and Pricing Analysis |

| Segments Covered | Product Type, Fixation Type, End Users, Region |

| Regions Covered | North America; Latin America; Europe; East Asia; South Asia; Oceania; Middle East and Africa |

| Key Countries Profiled | United States of America, Canada, Brazil, Argentina, Germany, United Kingdom, France, Spain, Italy, Nordics, BENELUX, Australia & New Zealand, China, India, ASIAN, GCC Countries, South Africa |

| Key Companies Profiled | Smith & Nephew Plc; Wright Medical Group, Inc; Zimmer Holdings; Biomet, Inc.; Exactech; Stryker Corporation; DePuy Companies, Inc; B. Braun Melsungen AG; DJO Global; Ortho Development; Limacorporate S.p.a.; SURGIVAL INTERNATIONAL; BEZNOSKA |

| Customization | Available Upon Request |

The global revision knee replacement market is estimated to be valued at USD 1.5 billion in 2025.

It is projected to reach USD 2.2 billion by 2035.

The market is expected to grow at a 4.1% CAGR between 2025 and 2035.

The key product types are three compartmental and uni-compartmental.

cemented segment is expected to dominate with a 68.4% industry share in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Knee Walker Market Size and Share Forecast Outlook 2025 to 2035

Knee Hyaluronic Acid Injections Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Knee Reconstruction Devices Market Growth – Trends & Forecast 2025 to 2035

Knee Arthrodesis Implant Market

Knee Replacement Market Size and Share Forecast Outlook 2025 to 2035

Total Knee Replacement Market Size and Share Forecast Outlook 2025 to 2035

Hip and Knee Reconstructive Market Analysis – Size, Demand & Forecast 2025-2035

Below-the-knee Implants Market

3D Printed Hip and Knee Implants Market Size and Share Forecast Outlook 2025 to 2035

Replacement Sheets Market Analysis - Size, Share & Forecast 2025 to 2035

Egg Replacement Ingredient Market Analysis - Size, Share & Forecast 2025 to 2035

Meal Replacement Bars Market Size, Growth, and Forecast for 2025 to 2035

Meal Replacement Products Market Analysis by Product type, source, application and region Through 2035

Skin Replacement Market Growth - Trends & Forecast 2024 to 2034

Meal Replacement Shake Market Trends - Powder & Liquid Analysis

Joint Replacement Market Trends - Growth & Forecast 2025 to 2035

Metal Replacement Market Growth – Trends & Forecast 2024-2034

Enzyme Replacement Therapy Market Insights - Size & Forecast 2025 to 2035

Hormone Replacement Therapy Market Insights – Growth & Demand 2025–2035

UK Meal Replacement Products Market Trends – Growth, Demand & Forecast 2025-2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA