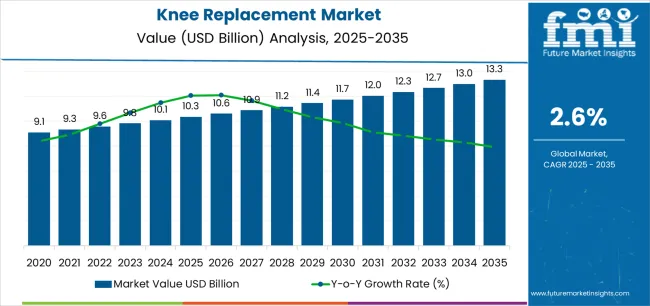

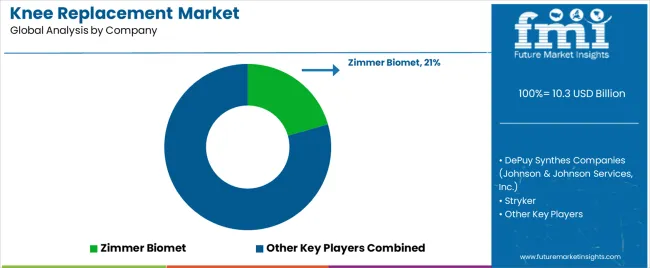

The Knee Replacement Market is estimated to be valued at USD 10.3 billion in 2025 and is projected to reach USD 13.3 billion by 2035, registering a compound annual growth rate (CAGR) of 2.6% over the forecast period.

The knee replacement market is experiencing robust growth driven by the increasing prevalence of osteoarthritis, rising geriatric population, and continuous advancements in implant materials and surgical techniques. Market expansion is being supported by growing patient awareness, improved healthcare accessibility, and favorable reimbursement policies in both developed and emerging economies. The introduction of minimally invasive procedures and robotic-assisted surgeries has enhanced precision and recovery outcomes, further accelerating adoption.

Demand is also being stimulated by lifestyle-related joint deterioration and the growing incidence of sports-related injuries. Manufacturers are focusing on product customization, biocompatible materials, and digital integration for postoperative monitoring to enhance long-term implant performance.

The future outlook remains optimistic, as healthcare systems continue to invest in orthopedic infrastructure and expand surgical capabilities Collectively, these factors are positioning the knee replacement market for sustained growth with increasing procedural volumes and higher acceptance among both patients and healthcare professionals.

| Metric | Value |

|---|---|

| Knee Replacement Market Estimated Value in (2025 E) | USD 10.3 billion |

| Knee Replacement Market Forecast Value in (2035 F) | USD 13.3 billion |

| Forecast CAGR (2025 to 2035) | 2.6% |

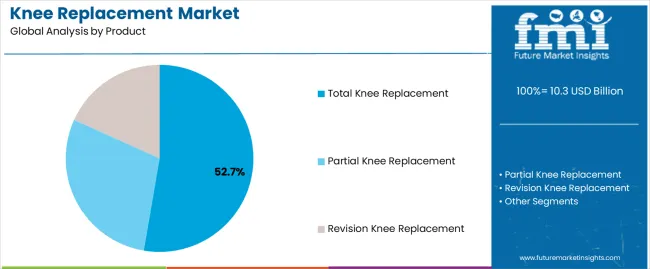

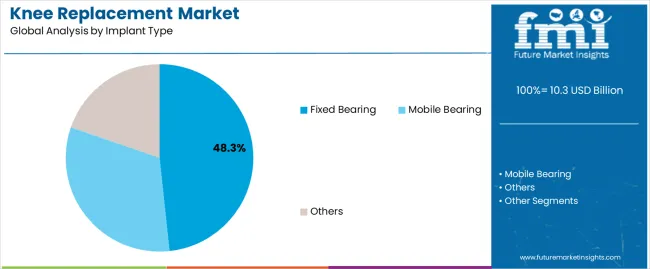

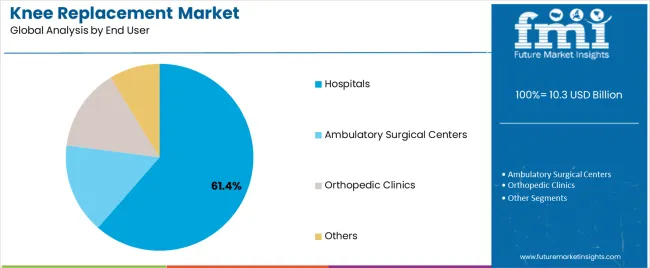

The market is segmented by Product, Implant Type, and End User and region. By Product, the market is divided into Total Knee Replacement, Partial Knee Replacement, and Revision Knee Replacement. In terms of Implant Type, the market is classified into Fixed Bearing, Mobile Bearing, and Others. Based on End User, the market is segmented into Hospitals, Ambulatory Surgical Centers, Orthopedic Clinics, and Others. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The total knee replacement segment, accounting for 52.70% of the product category, has maintained dominance due to its proven clinical effectiveness and widespread applicability in treating severe degenerative joint conditions. Its leadership has been supported by strong surgical outcomes, long implant life cycles, and consistent improvement in design technology.

Adoption has been further encouraged by advancements in minimally invasive surgical techniques that reduce recovery time and postoperative complications. Hospitals and orthopedic centers continue to prefer total knee replacement procedures because of standardized protocols and well-documented success rates.

Continuous innovation in implant geometry and materials is enhancing patient mobility and comfort, reinforcing trust among surgeons and patients As aging populations expand globally, this segment is expected to sustain its leading position with steady procedural demand and rising adoption in outpatient orthopedic settings.

The fixed bearing segment, representing 48.30% of the implant type category, has been leading the market owing to its mechanical stability, cost-effectiveness, and reliable long-term performance. Its dominance is supported by lower wear rates, reduced risk of component loosening, and high surgeon familiarity with the design.

Fixed bearing implants are widely used in both primary and revision surgeries, contributing to consistent procedural adoption. Technological advancements in polyethylene materials and surface coatings have improved durability, reducing revision rates and enhancing clinical outcomes.

Hospitals and specialty clinics continue to favor this implant type due to ease of implantation and predictable biomechanics As healthcare systems aim to optimize costs without compromising outcomes, the fixed bearing segment is anticipated to retain a strong position, especially in cost-sensitive and high-volume healthcare markets.

The hospitals segment, holding 61.40% of the end user category, has emerged as the leading channel due to comprehensive infrastructure, skilled orthopedic professionals, and advanced surgical facilities. Hospitals serve as primary centers for both elective and complex knee replacement procedures, offering integrated preoperative and postoperative care.

Their dominance is further supported by favorable insurance coverage, multidisciplinary medical support, and access to high-precision surgical equipment. The presence of dedicated orthopedic departments and rehabilitation units enhances patient outcomes and accelerates recovery.

Increasing investments in robotic and navigation-assisted systems within hospitals are further improving surgical precision and patient satisfaction With the growing demand for high-quality orthopedic care, hospitals are expected to remain the preferred setting for knee replacement surgeries, ensuring sustained procedural growth and consistent market leadership over the forecast period.

Continuous rise in the knee replacements per year worldwide is expected to contribute to the market’s growth over the forecast period. The market is analyzed by FMI analysts to showcase a CAGR of 2.70% over the assessment period.

The column below offers a broad picture of the emerging opportunities and recent trends spotted in the knee replacement market and related markets. For this study, the knee reconstruction device market and below-the-knee implant market are taken.

The below-the-knee implant industry is predicted to steal the limelight, as the market is expected to record a greater CAGR than the market peers. This market is expected to exhibit a CAGR of 5.20% through 2035. Driving factors for this industry are the development of smart implants and the surging use of modular implants.

Knee reconstruction device market and knee replacement market are predicted to follow the below-the-knee implant market in terms of growth.

Knee Replacement Market:

| Attributes | Knee Replacement Market |

|---|---|

| CAGR (2025 to 2035) | 2.70% |

| Growth Factor | Increasing geriatric population |

| Opportunity | Surging investments by players in new technologies |

| Key Trends | Rising government initiatives |

Knee Reconstruction Device Market:

| Attributes | Knee Reconstruction Device Market |

|---|---|

| CAGR (2025 to 2035) | 4.3% |

| Growth Factor | Accelerating hip and knee joint reconstruction surgeries |

| Opportunity | Rising government investments to develop healthcare infrastructure |

| Key Trends | Upsurge in the funding for research and development |

Below-the-knee Implant Market:

| Attributes | Below-the-knee Implant Market |

|---|---|

| CAGR (2025 to 2035) | 5.20% |

| Growth Factor | Growing prevalence of peripheral vascular disease |

| Opportunity | Surging utilization of biodegradable implants made of materials that can be absorbed by the body over time |

| Key Trends | Increasing use of patient-specific implants |

| Leading Product | Total Knee Replacement |

|---|---|

| Value Share (2025) | 42.0% |

Based on product, the total knee replacement segment is projected to acquire a market share of 42% in 2025. Key factors that are contributing to the segment’s growth are as follows:

| Leading End User | Hospitals |

|---|---|

| Value Share (2025) | 34.0% |

Hospitals are expected to be a prominent end user of knee replacement services. Top factors that are supporting the hospital segment are:

| Countries | Forecast CAGR (2025 to 2035) |

|---|---|

| Canada | 2.00% |

| Spain | 2.10% |

| India | 4.80% |

| Thailand | 4.20% |

| Malaysia | 3.80% |

The knee replacement market in Canada is projected to register a CAGR of 2% through 2035. Key factors that are shaping the market dynamics are as follows:

Spain is a key knee replacement market in Europe. The country is set to record a CAGR of 2.10% through 2035. Market forces that are backing the knee replacement surgery industry’s growth are:

The knee replacement market in India is estimated to expand at a consistent CAGR of 4.80% over the next 10 years. Factors responsible for market growth are as follows:

The Thailand knee replacement market is projected to report growth of 4.2% from 2025 to 2035. Over the forecast period, following factors are driving the market growth:

Knee replacement market in Malaysia is anticipated to expand at a CAGR of 3.8% through 2035. The market is forecast to be driven by following factors:

Leading companies in the market are continuously innovating to develop knee replacement implants with improved functionality, patient outcomes, and durability. This is achieved by including materials like 3D printing technology and wear-resistant surfaces. Players are further investing in latest technologies like robotics and digital due to increased traction, especially for robotics knee replacement surgeries.

Leading players are increasingly focusing on emerging markets with rising populations and expanding demand for knee replacements. Industry participants are further developing minimally invasive surgical techniques to offer reduced pain and faster recovery times.

Companies are exploring ways to cut down on costs related to procedures and implants while ensuring product quality to increase accessibility to healthcare providers and patients. Additionally, players are offering comprehensive patient care solutions and training programs to encourage surgeons to adopt their offerings.

Players are expected to expand product portfolios, combine resources, and gain a larger market share by merging and acquiring other players.

Latest Developments Taking Place in the Knee Replacement Market

The global knee replacement market is estimated to be valued at USD 10.3 billion in 2025.

The market size for the knee replacement market is projected to reach USD 13.3 billion by 2035.

The knee replacement market is expected to grow at a 2.6% CAGR between 2025 and 2035.

The key product types in knee replacement market are total knee replacement, partial knee replacement and revision knee replacement.

In terms of implant type, fixed bearing segment to command 48.3% share in the knee replacement market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Total Knee Replacement Market Size and Share Forecast Outlook 2025 to 2035

Revision Knee Replacement Market Size and Share Forecast Outlook 2025 to 2035

Knee Walker Market Size and Share Forecast Outlook 2025 to 2035

Knee Hyaluronic Acid Injections Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Knee Reconstruction Devices Market Growth – Trends & Forecast 2025 to 2035

Replacement Sheets Market Analysis - Size, Share & Forecast 2025 to 2035

Knee Arthrodesis Implant Market

Egg Replacement Ingredient Market Analysis - Size, Share & Forecast 2025 to 2035

Meal Replacement Bars Market Size, Growth, and Forecast for 2025 to 2035

Meal Replacement Products Market Analysis by Product type, source, application and region Through 2035

Skin Replacement Market Growth - Trends & Forecast 2024 to 2034

Meal Replacement Shake Market Trends - Powder & Liquid Analysis

Joint Replacement Market Trends - Growth & Forecast 2025 to 2035

Metal Replacement Market Growth – Trends & Forecast 2024-2034

Enzyme Replacement Therapy Market Insights - Size & Forecast 2025 to 2035

Hormone Replacement Therapy Market Insights – Growth & Demand 2025–2035

UK Meal Replacement Products Market Trends – Growth, Demand & Forecast 2025-2035

Hip and Knee Reconstructive Market Analysis – Size, Demand & Forecast 2025-2035

USA Meal Replacement Products Market Insights – Size, Share & Forecast 2025-2035

Below-the-knee Implants Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA