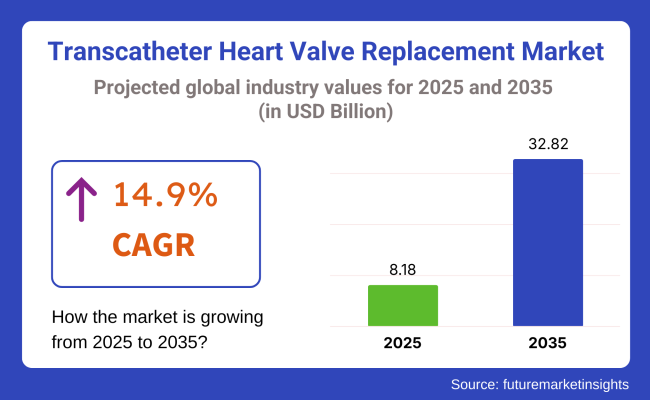

The global transcatheter heart valve replacement (TAVR) market is estimated to be valued at USD 8.18 billion in 2025 and is projected to reach USD 32.82 billion by 2035, registering a compound annual growth rate (CAGR) of 14.9% over the forecast period. The market is expected to witness a robust expansion, fueled by increasing TAVI procedural volumes, expanded indications for low- and intermediate-risk patients, and rising global burden of aortic stenosis among aging populations.

The shift from surgical aortic valve replacement (SAVR) to minimally invasive TAVR is being accelerated by favorable long-term outcome data, improved device safety profiles, and reduced perioperative complications. Innovations in next-generation valve designs, including retrievable, repositionable, and supra-annular devices, are enhancing procedural precision and reducing paravalvular leak risks. Procedural adoption is further supported by streamlined reimbursement pathways, particularly in North America and Europe, which have incentivized both public and private hospital networks to expand TAVR programs.

Key players driving the TAVR market include Edwards Lifesciences, Medtronic, Boston Scientific, Abbott, and JenaValve, who are actively expanding their global portfolios through next-gen valve platforms and clinical data generation. In 2025, Edwards Lifesciences received FDA approval for its Transcatheter aortic valve replacement (TAVR) therapy, the SAPIEN 3 platform, for severe aortic stenosis (AS) patients without symptoms.

"This approval is a powerful opportunity to streamline patient care and improve the efficiency of the healthcare system,” said Larry Wood, Edwards’ Corporate Vice President and Group President, Edwards Lifesciences. “We are proud to partner with leading physicians to advance our knowledge of this deadly disease with high quality science and optimize the treatment pathway for patients.”

One of the key technological developments is the integration of polymer leaflet technology in next-generation TAVR valves. Several manufacturers are advancing polymer-based leaflets that offer superior durability, lower thrombogenicity, and enhanced hemodynamics compared to conventional bovine or porcine pericardial tissue valves.

North America dominates the TAVR market, driven by early regulatory approvals, robust reimbursement coverage, and high procedural volumes across specialized structural heart centers. The 2024 CMS update expanding coverage for low-risk patients has triggered a significant increase in younger patient referrals. Private payers are aligning reimbursement policies with guideline-directed care, supporting rapid procedural expansion across both hospital-based and ambulatory cardiac centers.

Europe represents a rapidly growing TAVR market, supported by widespread adoption across national health systems and expanding indications under evolving ESC guidelines. Germany, France, and the UK are leading adoption, with procedural growth now extending into intermediate-risk and bicuspid cohorts under CE mark approvals. Increasing patient awareness, aging demographics and procedural centralization across high-volume valve centers continue to drive Europe's accelerated TAVR market penetration.

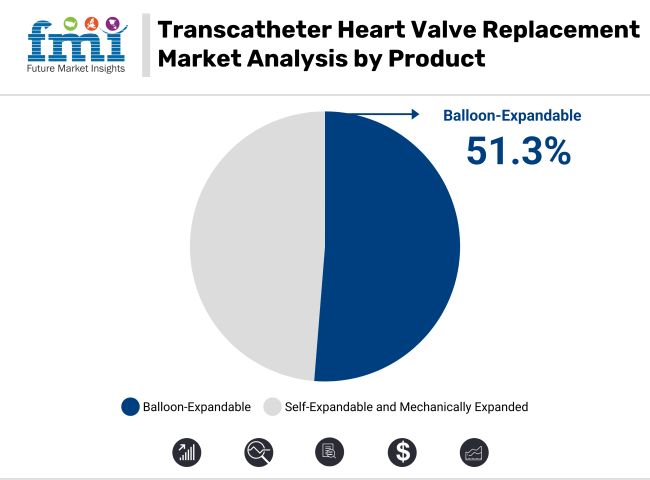

In 2025, balloon-expandable transcatheter aortic valves are expected to capture 51.3% of the revenue share in the TAVR market. This dominance is largely attributed to the proven clinical performance and flexibility of balloon-expandable valves in aortic valve replacement procedures. Balloon-expandable valves offer reliable and durable outcomes, particularly in patients with severe aortic stenosis. The balloon-expandable design allows for precise deployment under balloon inflation, ensuring optimal valve positioning within the aortic annulus.

This design, combined with their versatility in both standard and complex patient anatomies, has made balloon-expandable valves the preferred choice in clinical practice. The growth of this segment has also been driven by the increasing adoption of TAVR as a minimally invasive alternative to open heart surgery, particularly for high-risk patients. Furthermore, advancements in valve technology have further fueled the growth of this segment, solidifying its position as the leading product type in the TAVR market.

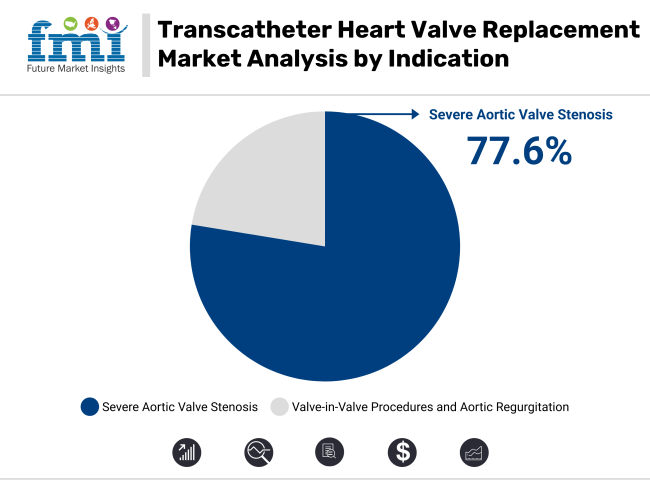

In 2025, severe aortic valve stenosis is projected to account for 77.6% of the revenue share in the TAVR market. This segment’s dominance is driven by the high prevalence of severe aortic stenosis, particularly in aging populations, which makes it a leading indication for TAVR procedures. Severe aortic valve stenosis, characterized by a significant narrowing of the aortic valve, restricts blood flow and can lead to heart failure if untreated.

TAVR has emerged as a preferred treatment option due to its minimally invasive nature, which is particularly advantageous for high-risk patients who may not be candidates for traditional open-heart surgery. The growing number of patients diagnosed with severe aortic stenosis, coupled with improved TAVR device technologies, has significantly driven the demand for transcatheter heart valve replacement procedures. Moreover, increased awareness and the expanding approval of TAVR for intermediate-risk patients have further contributed to the segment’s growth.

Transcatheter Heart Valve Replacement Procedures Have a High Cost

The high cost of transcatheter heart valve replacement compared to surgical valve replacement may render this therapy inaccessible to patients living in low-income and other developing countries. Insurance coverage and reimbursement policies in several nations restrict market access, given that obtaining the treatment can be prohibitive.

Challenges of Regulation and Approval

Hurdles to market entry for novel devices come in the form of strict regulations and protracted approvals for novel transcatheter valve technologies. Regional players who wish to make their footprint and world players who wish toalityto challenge in this domain find there are many opportunities but at the same time it is not easy as the market faces challenges of bio availability, and also variability in terms of healthcare regulations in each sector also varies from country to country.

Potential for Procedure-Related Complications and Long-Term Durability Concerns

Although transcatheter heart valves bring a minimally invasive alternative, they carry worries regarding long-term durability, vein thrombosis risk, and procedural complications, including paravalvular leakages. Scientists are attempting to create next-generation valves with enhanced durability, higher biocompatibility, and a smaller chance of complications.

Technological Progress in Imaging and AI

The use of AI-driven diagnostics and live imaging technologies are improving accuracy in transcatheter heart valve placement, decreasing risk and improving patient care. Merging AI with robotic-assisted cardiac surgeries is further enhancing the precision, efficiency, and recovery times for patients receiving transcatheter interventions.

Increasing Patient Population with Aortic Stenosis Indications

Development of new surgical techniques and devices, as well as advances in transcatheter valve replacement (TAVR), transcatheter mitral valve replacement (TMVR), and transcatheter pulmonary valve replacement (TPVR), are also helping to shape this emerging market. However, expanding indications among younger low risk patients are driving adoption of transcatheter valve therapies in lieu of surgical alternatives.

Next-Generation Valve Materials Development

Recognizing this, companies are investing in biodegradable polymer valves, tissue-engineered valves, and hybrid prosthetic designs that offer prolonged durability and muted immune response. Investigations into regenerative medicine approaches seek to develop self-healing, patient-matched heart valve substitutes.

Expansion of Outpatient and Ambulatory Cardiac Care

Growing numbers of ambulatory surgical centers (ASCs) and outpatient cardiac clinics are bringing transcatheter valve procedures closer to patients and decreasing hospital length of stay and treatment costs. Combining cardiac care follow-ups with telemedicine is helping post-procedure patient monitoring and long-term success.

The United States THVR Market for Trans catheter Heart Valve Replacement is witness to an emergence owing to prevalence of valvar heart disease, increasing acceptance of minimally invasive cardiac procedure and revolutionary Tran's catheter valve technology. According to the American Heart Association (AHA), valvar heart disease (VHD) affects more than 5 million Americans each year, creating a strong need for Tran's catheter aortic valve replacement (TAVR) and Tran's catheter mitral valve replacement (TMVR) procedures.

The rapid increase in TAVR procedures, which have already overtaken traditional open-heart surgery for treating aortic valve stenosis, is one of the key market drivers. Low-risk TAVR in younger adults is also driving procedural volumes, with FDA approvals.

Increasing adoption of next-generation trans catheter mitral and tricuspid valve replacement (TMVR & TTVR) devices is also contributing to the growth of the market, where the likes of Edwards Lifesciences, Medtronic and Abbott are continuing to invest in food durability, AI-enhanced imaging and robotic-assisted delivery systems. Moreover, expanded Medicare & private insurance coverage for TAVR procedures facilitates patient access, while the rise of hybrid operating room (OR) in leading cardiac centres enhances surgical outcomes.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 14.6% |

The United Kingdom Trans catheter Heart Valve Replacement (THVR) Market is expanding at a rapid rate due to the increasing aging population, NHS-supported cardiac care programs, and increasing practice of minimally invasive heart valve replacement surgeries. The elderly population of the UK, where over 12 million are above 65 years of age, is one of the main drivers of TAVR and TMVR procedure demand since aortic stenosis and mitral regurgitation are very prevalent in geriatric patients.

The National Health Service (NHS) is giving priority to early diagnosis and treatment of valvar heart diseases, increasing access to Tran's catheter procedures in large hospitals and cardiac centres. The expansion of AI-supported imaging for valve replacement planning and robotic-assisted TAVR/TMVR procedures is improving the accuracy of surgery and recovery time for patients. In addition, government grants for heart valve replacement research are financing next-generation valve designs with enhanced longevity and biocompatibility.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 14.2% |

The Trans catheter Heart Valve Replacement (THVR) Market in the European Union is growing due to increasing government investments in cardiac healthcare, rising adoption of Trans catheter valve procedures, and strong presence of medical device manufacturers. The EU’s Horizon Europe Program, with €6 billion allocated for cardiovascular research, is supporting the development of next-generation heart valves, robotic-assisted valve replacement, and AI-driven imaging systems.

Germany, France, and Italy are at the forefront of TAVR and TMVR adoption, with hybrid surgical procedures and catheter-based valve implantation procedures provided by specialized heart centres. The growing application of digital twin technology in heart valve simulation is improving pre-procedural planning, lowering complications, and enhancing long-term durability of the valve. Furthermore, stringent EU medical device regulatory structures are fuelling innovation in biocompatible valve materials and non-invasive Tran's catheter delivery systems.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 14.3% |

The Japan Trans catheter Heart Valve Replacement (THVR) Market is expanding as a result of the growing geriatric population, enhanced government incentives for cardiovascular care, and speedy advancements in minimally invasive valve therapies.

Japan has the world's second-largest number of elderly citizens with more than 28% of its population aged over 65 years who contribute to increased prevalence of aortic stenosis and mitral regurgitation. The government of Japan has provided USD 3.5 billion for cardiovascular studies and next-generation heart failure treatments, underpinning next-gen Tran's catheter heart valves.

Implementation of AI-driven heart valve evaluation technology is enhancing the selection of patients for TAVR and TMVR procedures, lowering post-surgical complications and readmissions. The development of bioengineered and polymer-based Tran's catheter valves is providing more durable solutions with better hemodynamic, ensuring improved patient outcomes.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 14.5% |

The South Korea THVR market for Trans catheter Heart Valve Replacement is growing swiftly with a high incidence of heart disease, an upsurge in adoption of robotic valve procedures, and considerable government expenditure in medical device R&D. South Korea's Ministry of Health and Welfare has pledged USD 2 billion to cardiovascular medicine, funding for cutting-edge treatments for heart failure and valve replacement technology.

The use of robotic-assisted TAVR and TMVR procedures is increasing surgical accuracy and decreasing recovery periods, making valve replacement with less invasive techniques available to high-risk patients.

Advances in AI-enhanced cardiac imaging and 3D printing of heart valve models are increasing pre-surgical planning and individualized valve designs to provide improved patient-specific results. In addition, South Korea's dominant role in biomaterials and biotechnology research is also driving the growth of next-generation flexible polymer valves with improved durability.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 14.7% |

Transcatheter Heart Valve Replacement (THVR) market is increasing with an increasing incidence of valvular heart diseases, increased utilization of minimally invasive therapy, and second-generation transcatheter aortic valve replacement (TAVR) technology.

The industry is focusing on AI-driven valve delivery, longer durability, and next-generation material to enhance patient outcome, reduce surgical risk, and optimize long-term valve performance. The industry features top global companies and expert cardiovascular device makers, each developing technologies in percutaneous valve implantation, repositionable heart valves, and AI-enhanced cardiac imaging.

Edwards Lifesciences Corporation (32-38%)

Edwards Lifesciences dominates the THVR market, offering SAPIEN TAVR devices, known for AI-guided valve placement, balloon-expandable technology, and real-time cardiac imaging integration. The company focuses on advanced valve durability and minimally invasive implantation techniques.

Medtronic plc (25-30%)

Medtronic specializes in self-expanding TAVR valves (Evolut series), integrating recapturable, repositionable valve technology for precision placement and long-term structural performance. The company emphasizes next-gen valve durability with advanced hemodynamic flow optimization.

Abbott Laboratories (10-15%)

Abbott provides PORTICO and NAVITOR transcatheter valves, focusing on low-profile, fully retrievable designs for high-risk valve replacement patients. The company integrates 3D valve imaging and AI-powered deployment assistance.

Boston Scientific Corporation (8-12%)

Boston Scientific offers ACURATE neo2 TAVR systems, emphasizing minimally invasive heart valve replacement with precision leaflet technology for optimized valve function.

JenaValve Technology, Inc. (5-9%)

JenaValve develops TAVR solutions tailored for aortic regurgitation and stenosis, expanding TAVR applications beyond standard indications. The company focuses on next-generation heart valve materials and AI-guided deployment strategies.

Other Key Players (20-25% Combined)

Several emerging and established cardiovascular device manufacturers contribute to next-generation TAVR innovations, AI-assisted valve placement, and hybrid heart valve replacement strategies. These include:

The overall market size for Transcatheter Heart Valve Replacement Market was USD 8.18 billion in 2025.

The Transcatheter Heart Valve Replacement Markets expected to reach USD 32.82 billion in 2035.

The demand for transcatheter heart valve replacement will grow due to the rising prevalence of valvular heart diseases, increasing geriatric population, advancements in minimally invasive procedures, and growing preference for transcatheter techniques over traditional surgery, driving improved patient outcomes and faster recovery times.

The top 5 countries which drives the development of Transcatheter Heart Valve Replacement Market are USA, UK, Europe Union, Japan and South Korea.

Self-Expandable and Balloon-Expandable Transcatheter Aortic Valves Drive Market to command significant share over the assessment period.

Table 01: Global Market Value (US$ Million) Analysis, By Product, 2016 to 2033

Table 02: Global Market Value (US$ Million) Analysis, By Indication, 2016 to 2033

Table 03: Global Market Value (US$ Million) Analysis, By End User, 2016 to 2033

Table 04: Global Market Value (US$ Million) Analysis, By Region, 2016 to 2033

Table 05: North America Historical Market Value (US$ Million) Analysis, By Country, 2016 to 2033

Table 06: North America Market Value (US$ Million) Analysis, By Product, 2016 to 2033

Table 07: North America Market Value (US$ Million) Analysis, By Indication, 2016 to 2033

Table 08: North America Market Value (US$ Million) Analysis, By End User, 2016 to 2033

Table 09: Latin America Historical Market Value (US$ Million) Analysis, By Country, 2016 to 2033

Table 10: Latin America Market Value (US$ Million) Analysis, By Product, 2016 to 2033

Table 11: Latin America Market Value (US$ Million) Analysis, By Indication, 2016 to 2033

Table 12: Latin America Market Value (US$ Million) Analysis, By End User, 2016 to 2033

Table 13: Europe Historical Market Value (US$ Million) Analysis, By Country, 2016 to 2033

Table 14: Europe Market Value (US$ Million) Analysis, By Product, 2016 to 2033

Table 15: Europe Market Value (US$ Million) Analysis, By Indication, 2016 to 2033

Table 16: Europe Market Value (US$ Million) Analysis, By End User, 2016 to 2033

Table 17: East Asia Historical Market Value (US$ Million) Analysis, By Country, 2016 to 2033

Table 18: East Asia Market Value (US$ Million) Analysis, By Product, 2016 to 2033

Table 19: East Asia Market Value (US$ Million) Analysis, By Indication, 2016 to 2033

Table 20: East Asia Market Value (US$ Million) Analysis, By End User, 2016 to 2033

Table 21: South Asia Historical Market Value (US$ Million) Analysis, By Country, 2016 to 2033

Table 22: South Asia Market Value (US$ Million) Analysis, By Product, 2016 to 2033

Table 23: South Asia Market Value (US$ Million) Analysis, By Indication, 2016 to 2033

Table 24: South Asia Market Value (US$ Million) Analysis, By End User, 2016 to 2033

Table 25: Oceania Historical Market Value (US$ Million) Analysis, By Country, 2016 to 2033

Table 26: Oceania Market Value (US$ Million) Analysis, By Product, 2016 to 2033

Table 27: Oceania Market Value (US$ Million) Analysis, By Indication, 2016 to 2033

Table 28: Oceania Market Value (US$ Million) Analysis, By End User, 2016 to 2033

Table 29: Middle East and Africa Historical Market Value (US$ Million) Analysis, By Country, 2016 to 2033

Table 30: Middle East and Africa Market Value (US$ Million) Analysis, By Product, 2016 to 2033

Table 31: Middle East and Africa Market Value (US$ Million) Analysis, By Indication, 2016 to 2033

Table 32: Middle East and Africa Market Value (US$ Million) Analysis, By End User, 2016 to 2033

Figure 01: Global Historical Market Value (US$ Million) Analysis, 2016 to 2022

Figure 02: Global Current and Future Market Value (US$ Million), 2023 to 2033 & Y-o-Y Growth Trend Analysis, 2023 to 2033

Figure 03: Global Market Absolute $ Opportunity, 2023 to 2033

Figure 04: Global Market Share Analysis (%), By Product, 2022 to 2033

Figure 05: Global Market Y-o-Y Analysis (%), By Product, 2023 to 2033

Figure 06: Market Attractiveness Analysis By Product, 2022 - 2032

Figure 07: Global Market Share Analysis (%), By Indication, 2022 to 2033

Figure 08: Global Market Y-o-Y Analysis (%), By Indication, 2023 to 2033

Figure 09: Market Attractiveness Analysis By Indication, 2022 - 2032

Figure 10: Global Market Share Analysis (%), By End User, 2022 to 2033

Figure 11: Global Market Y-o-Y Analysis (%), By End User, 2023 to 2033

Figure 12: Market Attractiveness Analysis By End User, 2022 - 2032

Figure 13: Global Market Share Analysis (%), By Region, 2022 to 2033

Figure 14: Global Market Y-o-Y Analysis (%), By Region, 2023 to 2033

Figure 15: Market Attractiveness Analysis By Region, 2022 - 2032

Figure 16: North America Market Share Analysis (%), By Product, 2022 (E)

Figure 17: North America Market Share Analysis (%), By Indication, 2022 (E)

Figure 18: North America Market Share Analysis (%), By End User, 2022 (E)

Figure 19: North America Market Share Analysis (%), By Country, 2022 (E)

Figure 20: North America Historical Market Value (US$ Million) Analysis, 2016 to 2022

Figure 21: North America Current and Future Market Value (US$ Million), 2023 to 2033 & Y-o-Y Growth Trend Analysis, 2023 to 2033

Figure 22: North America Market Share Analysis (%), By Product, 2022 (E)

Figure 23: North America Market Share Analysis (%), By Indication, 2022 (E)

Figure 24: North America Market Share Analysis (%), By End User, 2022 (E)

Figure 25: North America Market Share Analysis (%), By Country, 2022 (E)

Figure 26: USA Market Value Proportion Analysis, 2022

Figure 27: Global Vs USA Y-o-Y Growth Comparison, 2023 to 2033

Figure 28: USA Market Share Analysis (%) By Product, 2022 to 2033

Figure 29: USA Market Share Analysis (%) By Indication, 2022 to 2033

Figure 30: USA Market Share Analysis (%) By End User, 2022 to 2033

Figure 31: Canada Market Value Proportion Analysis, 2022

Figure 32: Global Vs Canada Y-o-Y Growth Comparison, 2023 to 2033

Figure 33: Canada Market Share Analysis (%) By Product, 2022 to 2033

Figure 34: Canada Market Share Analysis (%) By Indication, 2022 to 2033

Figure 35: Canada Market Share Analysis (%) By End User, 2022 to 2033

Figure 36: Latin America Market Share Analysis (%), By Product, 2022 (E)

Figure 37: Latin America Market Share Analysis (%), By Indication, 2022 (E)

Figure 38: Latin America Market Share Analysis (%), By End User, 2022 (E)

Figure 39: Latin America Market Share Analysis (%), By Country, 2022 (E)

Figure 40: Latin America Historical Market Value (US$ Million) Analysis, 2016 to 2022

Figure 41: Latin America Current and Future Market Value (US$ Million), 2023 to 2033 & Y-o-Y Growth Trend Analysis, 2023 to 2033

Figure 42: Latin America Market Share Analysis (%), By Product, 2022 (E)

Figure 43: Latin America Market Share Analysis (%), By Indication, 2022 (E)

Figure 44: Latin America Market Share Analysis (%), By End User, 2022 (E)

Figure 45: Latin America Market Share Analysis (%), By Country, 2022 (E)

Figure 46: Brazil Market Value Proportion Analysis, 2022

Figure 47: Global Vs Brazil Y-o-Y Growth Comparison, 2023 to 2033

Figure 48: Brazil Market Share Analysis (%) By Product, 2022 to 2033

Figure 49: Brazil Market Share Analysis (%) By Indication, 2022 to 2033

Figure 50: Brazil Market Share Analysis (%) By End User, 2022 to 2033

Figure 51: Mexico Market Value Proportion Analysis, 2022

Figure 52: Global Vs Mexico Y-o-Y Growth Comparison, 2023 to 2033

Figure 53: Mexico Market Share Analysis (%) By Product, 2022 to 2033

Figure 54: Mexico Market Share Analysis (%) By Indication, 2022 to 2033

Figure 55: Mexico Market Share Analysis (%) By End User, 2022 to 2033

Figure 56: Argentina Market Value Proportion Analysis, 2022

Figure 57: Global Vs Argentina Y-o-Y Growth Comparison, 2023 to 2033

Figure 58: Argentina Market Share Analysis (%) By Product, 2022 to 2033

Figure 59: Argentina Market Share Analysis (%) By Indication, 2022 to 2033

Figure 60: Argentina Market Share Analysis (%) By End User, 2022 to 2033

Figure 61: Europe Market Share Analysis (%), By Product, 2022 (E)

Figure 62: Europe Market Share Analysis (%), By Indication, 2022 (E)

Figure 63: Europe Market Share Analysis (%), By End User, 2022 (E)

Figure 64: Europe Market Share Analysis (%), By Country, 2022 (E)

Figure 65: Europe Historical Market Value (US$ Million) Analysis, 2016 to 2022

Figure 66: Europe Current and Future Market Value (US$ Million), 2023 to 2033 & Y-o-Y Growth Trend Analysis, 2023 to 2033

Figure 67: Europe Market Share Analysis (%), By Product, 2022 (E)

Figure 68: Europe Market Share Analysis (%), By Indication, 2022 (E)

Figure 69: Europe Market Share Analysis (%), By End User, 2022 (E)

Figure 70: Europe Market Share Analysis (%), By Country, 2022 (E)

Figure 71: UK Market Value Proportion Analysis, 2022

Figure 72: Global Vs UK Y-o-Y Growth Comparison, 2023 to 2033

Figure 73: UK Market Share Analysis (%) By Product, 2022 to 2033

Figure 74: UK Market Share Analysis (%) By Indication, 2022 to 2033

Figure 75: UK Market Share Analysis (%) By End User, 2022 to 2033

Figure 76: Germany Market Value Proportion Analysis, 2022

Figure 77: Global Vs Germany Y-o-Y Growth Comparison, 2023 to 2033

Figure 78: Germany Market Share Analysis (%) By Product, 2022 to 2033

Figure 79: Germany Market Share Analysis (%) By Indication, 2022 to 2033

Figure 80: Germany Market Share Analysis (%) By End User, 2022 to 2033

Figure 81: France Market Value Proportion Analysis, 2022

Figure 82: Global Vs France Y-o-Y Growth Comparison, 2023 to 2033

Figure 83: France Market Share Analysis (%) By Product, 2022 to 2033

Figure 84: France Market Share Analysis (%) By Indication, 2022 to 2033

Figure 85: France Market Share Analysis (%) By End User, 2022 to 2033

Figure 86: Italy Market Value Proportion Analysis, 2022

Figure 87: Global Vs Italy ;Y-o-Y Growth Comparison, 2023 to 2033

Figure 88: Italy Market Share Analysis (%) By Product, 2022 to 2033

Figure 89: Italy Market Share Analysis (%) By Indication, 2022 to 2033

Figure 90: Italy Market Share Analysis (%) By End User, 2022 to 2033

Figure 91: Spain Market Value Proportion Analysis, 2022

Figure 92: Global Vs Spain Y-o-Y Growth Comparison, 2023 to 2033

Figure 93: Spain Market Share Analysis (%) By Product, 2022 to 2033

Figure 94: Spain Market Share Analysis (%) By Indication, 2022 to 2033

Figure 95: Spain Market Share Analysis (%) By End User, 2022 to 2033

Figure 96: Benelux Market Value Proportion Analysis, 2022

Figure 97: Global Vs Benelux Y-o-Y Growth Comparison, 2023 to 2033

Figure 98: Benelux Market Share Analysis (%) By Product, 2022 to 2033

Figure 99: Benelux Market Share Analysis (%) By Indication, 2022 to 2033

Figure 100: Benelux Market Share Analysis (%) By End User, 2022 to 2033

Figure 101: Russia Market Value Proportion Analysis, 2022

Figure 102: Global Vs Russia Y-o-Y Growth Comparison, 2023 to 2033

Figure 103: Russia Market Share Analysis (%) By Product, 2022 to 2033

Figure 104: Russia Market Share Analysis (%) By Indication, 2022 to 2033

Figure 105: Russia Market Share Analysis (%) By End User, 2022 to 2033

Figure 106: East Asia Market Share Analysis (%), By Product, 2022 (E)

Figure 107: East Asia Market Share Analysis (%), By Indication, 2022 (E)

Figure 108: East Asia Market Share Analysis (%), By End User, 2022 (E)

Figure 109: East Asia Market Share Analysis (%), By Country, 2022 (E)

Figure 110: East Asia Historical Market Value (US$ Million) Analysis, 2016 to 2022

Figure 111: East Asia Current and Future Market Value (US$ Million), 2023 to 2033 & Y-o-Y Growth Trend Analysis, 2023 to 2033

Figure 112: East Asia Market Share Analysis (%), By Product, 2022 (E)

Figure 113: East Asia Market Share Analysis (%), By Indication, 2022 (E)

Figure 114: East Asia Market Share Analysis (%), By End User, 2022 (E)

Figure 115: East Asia Market Share Analysis (%), By Country, 2022 (E)

Figure 116: China Market Value Proportion Analysis, 2022

Figure 117: Global Vs China Y-o-Y Growth Comparison, 2023 to 2033

Figure 118: China Market Share Analysis (%) By Product, 2022 to 2033

Figure 119: China Market Share Analysis (%) By Indication, 2022 to 2033

Figure 120: China Market Share Analysis (%) By End User, 2022 to 2033

Figure 121: Japan Market Value Proportion Analysis, 2022

Figure 122: Global Vs Japan Y-o-Y Growth Comparison, 2023 to 2033

Figure 123: Japan Market Share Analysis (%) By Product, 2022 to 2033

Figure 124: Japan Market Share Analysis (%) By Indication, 2022 to 2033

Figure 125: Japan Market Share Analysis (%) By End User, 2022 to 2033

Figure 126: South Korea Market Value Proportion Analysis, 2022

Figure 127: Global Vs South Korea Y-o-Y Growth Comparison, 2023 to 2033

Figure 128: South Korea Market Share Analysis (%) By Product, 2022 to 2033

Figure 129: South Korea Market Share Analysis (%) By Indication, 2022 to 2033

Figure 130: South Korea Market Share Analysis (%) By End User, 2022 to 2033

Figure 131: South Asia Market Share Analysis (%), By Product, 2022 (E)

Figure 132: South Asia Market Share Analysis (%), By Indication, 2022 (E)

Figure 133: South Asia Market Share Analysis (%), By End User, 2022 (E)

Figure 134: South Asia Market Share Analysis (%), By Country, 2022 (E)

Figure 135: South Asia Historical Market Value (US$ Million) Analysis, 2016 to 2022

Figure 136: South Asia Current and Future Market Value (US$ Million), 2023 to 2033 & Y-o-Y Growth Trend Analysis, 2023 to 2033

Figure 137: South Asia Market Share Analysis (%), By Product, 2022 (E)

Figure 138: South Asia Market Share Analysis (%), By Indication, 2022 (E)

Figure 139: South Asia Market Share Analysis (%), By End User, 2022 (E)

Figure 140: South Asia Market Share Analysis (%), By Country, 2022 (E)

Figure 141: India Market Value Proportion Analysis, 2022

Figure 142: Global Vs India Y-o-Y Growth Comparison, 2023 to 2033

Figure 143: India Market Share Analysis (%) By Product, 2022 to 2033

Figure 144: India Market Share Analysis (%) By Indication, 2022 to 2033

Figure 145: India Market Share Analysis (%) By End User, 2022 to 2033

Figure 146: Malaysia Market Value Proportion Analysis, 2022

Figure 147: Global Vs Malaysia Y-o-Y Growth Comparison, 2023 to 2033

Figure 148: Malaysia Market Share Analysis (%) By Product, 2022 to 2033

Figure 149: Malaysia Market Share Analysis (%) By Indication, 2022 to 2033

Figure 150: Malaysia Market Share Analysis (%) By End User, 2022 to 2033

Figure 151: Thailand Market Value Proportion Analysis, 2022

Figure 152: Global Vs Thailand Y-o-Y Growth Comparison, 2023 to 2033

Figure 153: Thailand Market Share Analysis (%) By Product, 2022 to 2033

Figure 154: Thailand Market Share Analysis (%) By Indication, 2022 to 2033

Figure 155: Thailand Market Share Analysis (%) By End User, 2022 to 2033

Figure 156: Indonesia Market Value Proportion Analysis, 2022

Figure 157: Global Vs Indonesia Y-o-Y Growth Comparison, 2023 to 2033

Figure 158: Indonesia Market Share Analysis (%) By Product, 2022 to 2033

Figure 159: Indonesia Market Share Analysis (%) By Indication, 2022 to 2033

Figure 160: Indonesia Market Share Analysis (%) By End User, 2022 to 2033

Figure 161: Oceania Market Share Analysis (%), By Product, 2022 (E)

Figure 162: Oceania Market Share Analysis (%), By Indication, 2022 (E)

Figure 163: Oceania Market Share Analysis (%), By End User, 2022 (E)

Figure 164: Oceania Market Share Analysis (%), By Country, 2022 (E)

Figure 165: Oceania Historical Market Value (US$ Million) Analysis, 2016 to 2022

Figure 166: Oceania Current and Future Market Value (US$ Million), 2023 to 2033 & Y-o-Y Growth Trend Analysis, 2023 to 2033

Figure 167: Oceania Market Share Analysis (%), By Product, 2022 (E)

Figure 168: Oceania Market Share Analysis (%), By Indication, 2022 (E)

Figure 169: Oceania Market Share Analysis (%), By End User, 2022 (E)

Figure 170: Oceania Market Share Analysis (%), By Country, 2022 (E)

Figure 171: Australia Market Value Proportion Analysis, 2022

Figure 172: Global Vs Australia Y-o-Y Growth Comparison, 2023 to 2033

Figure 173: Australia Market Share Analysis (%) By Product, 2022 to 2033

Figure 174: Australia Market Share Analysis (%) By Indication, 2022 to 2033

Figure 175: Australia Market Share Analysis (%) By End User, 2022 to 2033

Figure 176: New Zealand Market Value Proportion Analysis, 2022

Figure 177: Global Vs New Zealand Y-o-Y Growth Comparison, 2023 to 2033

Figure 178: New Zealand Market Share Analysis (%) By Product, 2022 to 2033

Figure 179: New Zealand Market Share Analysis (%) By Indication, 2022 to 2033

Figure 180: New Zealand Market Share Analysis (%) By End User, 2022 to 2033

Figure 181: Middle East and Africa Market Share Analysis (%), By Product, 2022 (E)

Figure 182: Middle East and Africa Market Share Analysis (%), By Indication, 2022 (E)

Figure 183: Middle East and Africa Market Share Analysis (%), By End User, 2022 (E)

Figure 184: Middle East and Africa Market Share Analysis (%), By Country, 2022 (E)

Figure 185: Middle East and Africa Historical Market Value (US$ Million) Analysis, 2016 to 2022

Figure 186: Middle East and Africa Current and Future Market Value (US$ Million), 2023 to 2033 & Y-o-Y Growth Trend Analysis, 2023 to 2033

Figure 187: Middle East and Africa Market Share Analysis (%), By Product, 2022 (E)

Figure 188: Middle East and Africa Market Share Analysis (%), By Indication, 2022 (E)

Figure 189: Middle East and Africa Market Share Analysis (%), By End User, 2022 (E)

Figure 190: Middle East and Africa Market Share Analysis (%), By Country, 2022 (E)

Figure 191: GCC Countries Market Value Proportion Analysis, 2022

Figure 192: Global Vs GCC Countries Y-o-Y Growth Comparison, 2023 to 2033

Figure 193: GCC Countries Market Share Analysis (%) By Product, 2022 to 2033

Figure 194: GCC Countries Market Share Analysis (%) By Indication, 2022 to 2033

Figure 195: GCC Countries Market Share Analysis (%) By End User, 2022 to 2033

Figure 196: Türkiye Market Value Proportion Analysis, 2022

Figure 197: Global Vs Türkiye Y-o-Y Growth Comparison, 2023 to 2033

Figure 198: Türkiye Market Share Analysis (%) By Product, 2022 to 2033

Figure 199: Türkiye Market Share Analysis (%) By Indication, 2022 to 2033

Figure 200: Türkiye Market Share Analysis (%) By End User, 2022 to 2033

Figure 201: South Africa Market Value Proportion Analysis, 2022

Figure 202: Global Vs South Africa Y-o-Y Growth Comparison, 2023 to 2033

Figure 203: South Africa Market Share Analysis (%) By Product, 2022 to 2033

Figure 204: South Africa Market Share Analysis (%) By Indication, 2022 to 2033

Figure 205: South Africa Market Share Analysis (%) By End User, 2022 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Transcatheter Bioprosthesis Market

Transcatheter Mitral Valve Market Overview – Size, Share & Forecast 2024-2034

Heart Pump Device Market Forecast and Outlook 2025 to 2035

Heart Beat Sensor Market Size and Share Forecast Outlook 2025 to 2035

APAC Heart Health Functional Food Market Size and Share Forecast Outlook 2025 to 2035

Heart Closure Devices Market Size and Share Forecast Outlook 2025 to 2035

Heart Block Therapeutics Market Size and Share Forecast Outlook 2025 to 2035

Heart Beat Irregularity Detection Device Market Trends - Growth & Forecast 2025 to 2035

Heart Beat Monitor and Sensor Market

Heart Failure Testing Market

Mobile Heart Monitoring Market

At Home Heart Health Testing Market Analysis - Size & Industry Trends 2025 to 2035

Nitinol Heart Valve Frames Market Analysis Size and Share Forecast Outlook 2025 to 2035

Surgical Heart Valves Market Size and Share Forecast Outlook 2025 to 2035

Rheumatic-Heart Disease Management Market Analysis - Innovations & Outlook 2025 to 2035

Pulmonary Heart Valve Replacement Market Size and Share Forecast Outlook 2025 to 2035

Pediatric Heart Valve Repair and Replacement Analysis by Product, Induction, End Users and Region-2025 to 2035

Structural Heart Devices Market Size and Share Forecast Outlook 2025 to 2035

Prosthetic Heart Valve Market is segmented by product & end user from 2025 to 2035

Total Artificial Heart Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA