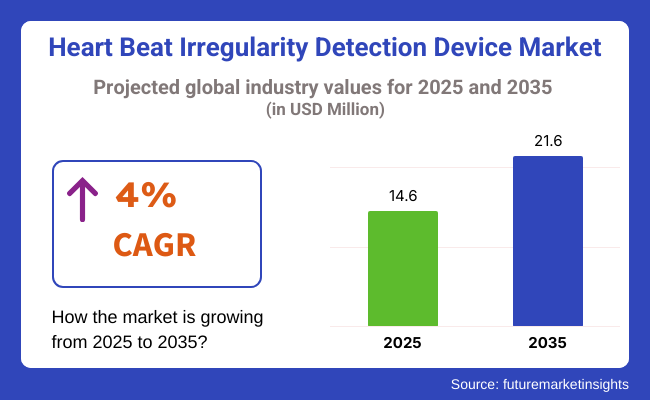

The heart beat irregularity detection device market is set to hit USD 14.6 Million by 2025 and may expand to USD 21.6 Million by 2035. This represents an average growth rate of 4% over the coming years. Digital health systems are growing, and more ECG and PPG sensors are being added to everyday gadgets. The use of AI in heart care is also on the rise. People are becoming more aware of heart conditions like AFib, which is helping the market grow. So, the future of the industry looks promising.

The heartbeat irregularity detection device market will likely grow a lot from 2025 to 2035. This is due to more people having heart problems. Also, more folks use gadgets to check their health, and AI tech to spot heart issues is getting better. These tools are key in spotting problems early, keeping track of heart beats, and watching patients from afar. This helps to lower the risk of things like strokes and heart attacks.

North America is set to lead the market for heartbeat irregularity detection device. This is due to many heart problems, greater use of smart wearables, and many tech health firms. The USA and Canada are at the front of this growth. They have more telehealth services, more mobile ECGs, and government steps to catch heart issues early.

The rise of AI in spotting heart issues in gadgets, more cloud-based remote check-ups, and more heart monitors for older folks push the market up. Furthermore, FDA approves enhanced digital ECGs and smartwatches with integrated heart checks are accelerating industry expansion.

Europe dominates a significant portion of the heartbeat irregularity detection device market. Countries like Germany, the UK, France, and Italy are strong leaders in heart studies, new health gadgets, and state-led heart health plans. The EU's push for telehealth, more money in smart computer heart checks, and more people wanting wearables that track heartbeats are growing the market.

The rise of home ECG devices, more use of arrhythmia finders in tests, and wider health insurance for remote heart checks are setting market trends. Also, Europe's aim for early AFib spot checks and stopping heart failure sparks new products.

The Asia-Pacific area will see the highest growth in the heartbeat irregularity detection device market. This is due to more old people, an increase in heart diseases linked to lifestyle, and more use of digital health tools. China, Japan, India, and Australia are leading in the creation of wearable ECGs, the use of telemedicine, and the spread of AI-based heart screening.

China is pushing growth with its healthcare AI sector, more government money for heart disease prevention, and more mobile health platforms (mHealth). In India, the need for cheap heart monitoring tools and more use of wearable health trackers, along with government help for digital health, are boosting growth. Japan and Australia are leading with smart medical tools and AI-powered ECG reading, helping the market grow in the area.

Challenges

Data Privacy Concerns and Accuracy of Consumer-Grade Devices

Data privacy and security are big issues in the market for heartbeat irregularity detection devices. Clouds store important patient data, which concerns users. Wearables for consumers tend not to be as accurate as clinical-grade ECG devices. This can lead to false alerts or missed detection of heart issues.

Getting approvals for AI-powered heart detection software is complex. Compliance with FDA, CE, and other global standards is mandatory. This can make the entry of new companies into the market very tough.

Opportunities

AI-Enabled Predictive Analytics, Wearable ECGs, and Home-Based Cardiac Care

Despite hurdles, the heartbeat irregularity detection device market holds big growth chances. AI-driven prediction tools help find heart rhythm issues faster. This tech, which uses constant checking and smart computer methods, is making heart problem diagnoses better.

Wearable ECG and PPG heart devices like smartwatches, chest patches, and smart clothes are growing. They give digital health companies new ways to earn. More people are using home-based heart check tools. These let patients watch their heart rhythms from home and get quick warnings. This trend is likely to push more people to use these tools.

Personal heart care systems that combine AI insights, remote doctor talks, and early heart problem finding are also on the rise. This will likely speed up market growth.

From 2020 to 2024, the market for heartbeat irregularity detection device grew a lot. People became more aware of heart issues. Wearable tech for health got better. More used telemedicine too. Smartwatches with ECG, AI for heart issues, and small ECG patches became popular. Governments pushed early heart check-ups and made health care easier to get. But, some problems slowed market growth. Data privacy worries, rules, and high costs of new devices stopped full spread in some places.

Looking to the future from 2025 to 2035, the market for heartbeat irregularity detection device will change a lot. New tech like AI for figuring out problems and tiny sensors will help. Plus, 5G will allow doctors to check on patients from far away. New sensors that use very little power and don't hurt to use will help find problems early. Smart programs on the cloud will help offer custom care. Also, healthcare will change with blockchain making sharing safe and AI for finding issues right away. As keeping people healthy and watching remotely become key, new devices will change heart care all over the world.

Market Shifts: A Comparative Analysis 2020 to 2024 vs. 2025 to 2035

| Market Shift | 2020 to 2024 |

|---|---|

| Regulatory Landscape | Compliance with medical device safety and FDA/EU approvals. |

| Technological Advancements | Introduction of smartwatch ECG features and wearable heart monitors. |

| Industry Applications | Primarily used in personal health monitoring and clinical diagnosis. |

| Adoption of Smart Equipment | Limited AI-based arrhythmia detection and manual ECG interpretation. |

| Sustainability & Cost Efficiency | High costs of wearable ECG devices and professional monitoring services. |

| Data Analytics & Predictive Modeling | Basic arrhythmia detection algorithms with cloud storage options. |

| Production & Supply Chain Dynamics | Dependence on traditional medical device manufacturers and healthcare distributors. |

| Market Growth Drivers | Demand driven by rising heart disease cases, aging populations, and digital health adoption. |

| Market Shift | 2025 to 2035 |

|---|---|

| Regulatory Landscape | Stricter AI validation standards, real-time health monitoring regulations, and patient data security mandates. |

| Technological Advancements | Development of AI-driven, nanotechnology-based biosensors with continuous real-time monitoring capabilities. |

| Industry Applications | Expansion into AI-powered predictive cardiac care, emergency response systems, and decentralized patient management. |

| Adoption of Smart Equipment | Full integration of AI diagnostics, blockchain -secured health records, and real-time remote cardiology services. |

| Sustainability & Cost Efficiency | Cost-effective, battery-free biosensors with telemedicine integration for global accessibility. |

| Data Analytics & Predictive Modeling | AI-powered predictive modeling for early risk detection, real-time analytics, and personalized treatment recommendations. |

| Production & Supply Chain Dynamics | Shift toward decentralized production, 3D-printed biosensors, and blockchain -enabled supply chain transparency. |

| Market Growth Drivers | Growth fueled by AI-powered diagnostics, nanotechnology advancements, and personalized cardiac care solutions. |

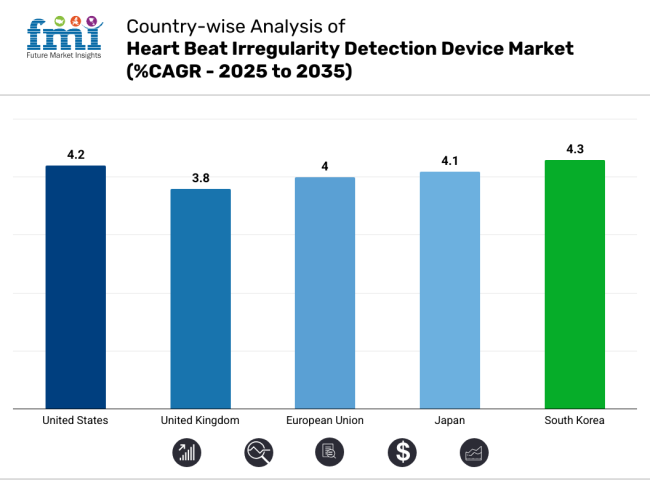

The heartbeat irregularity detection device market in the USA is growing well. This is because more people have heart problems, and more people use wearable heart monitors. Also, new AI-powered ECG gadgets help. The FDA and AHA set rules for device safety and checks.

Smartwatches and fitness trackers with ECG features are booming. More folks want to monitor health from afar. AI helping spot heart issues faster is another boost. New wireless and cloud-based heart tech also changes the game for this market.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 4.2% |

The market for heartbeat irregularity detection devicein the UK is growing. This is due to more money being spent on healthcare, greater awareness of heart issues like AFib, and NHS programs pushing for early heart issue detection. The MHRA and NICE check if the devices are safe and effective.

Growth in home heart monitoring, more AI use in heart tests in primary care, and telehealth services with real-time heart tracking are boosting the market. Also, new flexible and patch-based ECG devices are shaping trends in the industry.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 3.8% |

The heartbeat irregularity detection devicemarket in the EU is growing strong. Strict EU rules on medical device safety are a key reason. More people want wearable heart monitors like ECG and Holter. Also, heart disease is on the rise. The EMA and the European Society of Cardiology set rules for device approvals and heart disease checks.

Germany, France, and Italy lead in using AI to find irregular heartbeats. They are using more mobile ECG patches for long checks. Insurance for remote heart checks is also growing. More research in real-time prediction with AI is helping the market grow too.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 4.0% |

The market for heartbeat irregularity detection devicein Japan is growing. This growth is because of more old people, money put into digital health tech, and strong government actions to prevent heart diseases. The Japanese Ministry of Health, Labour, and Welfare (MHLW) and the Japan Cardiology Society (JCS) oversee device safety and telemedicine use.

Japanese companies are putting money into small ECG sensors, making smart mobile heart monitors, and making real-time ECG alert systems for caring for old people. Also, new ultra-thin wearable ECG patches and implantable loop recorders for constant monitoring are shaping the industry.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 4.1% |

The market for heartbeat irregularity detection devicein South Korea is growing fast. More people use smart wears for health. There's a lot of money going into new health tech companies. The government is helping expand telehealth too. The Ministry of Food and Drug Safety and the Korea Health Industry Development Institute handle rules for devices and digital health policies.

AI combined with ECG monitoring is on the rise. People want mobile recorders for heart issues more and more. Real-time heart tracking in smart hospitals is also becoming big. Plus, funds are flowing into cloud and AI ECG tools for finding heart problems early.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 4.3% |

The heartbeat irregularity detection device market is growing fast. Increased instances of heart disease, remote monitoring of patients, and the rise of smart technology drive this surge. Holter monitors lead the pack in 2025, grabbing around 42% market share. They offer all-day, gentle heart check-ups to spot issues early.

Holter monitors are common tools for checking heart activity, finding early signs of irregular heartbeats, and recording long-term ECG data. They let doctors see heart patterns over time, capture events live, and link to online health systems. These devices always track heart data and are key to finding occasional beat problems.

The use of Holter monitors is rising because more people know about early arrhythmia detection, heart diseases are increasing, and home heart care is growing. Plus, advances in AI for ECG analysis, wireless Holter monitors, and storing heart data in the cloud are making diagnoses more accurate and easier for patients.

Though Holter monitors have benefits, they come with some issues like giving too much data to doctors, possible patient discomfort over long periods, and missing short arrhythmias. But new AI for predicting arrhythmias, lighter wearable monitors, and smart sensors are likely to boost use and improve diagnosis.

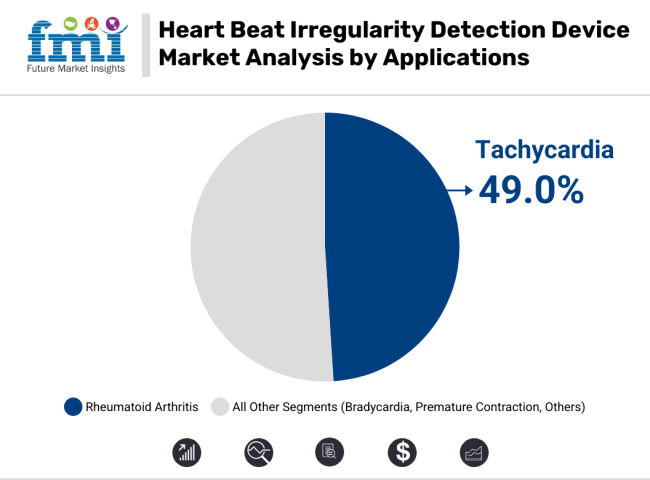

The need for heartbeat irregularity detection device is mainly because of special health needs. Detecting fast heartbeats will be the top section in 2025. It is expected to have about 49% of the market because many people with certain heart issues, like atrial fibrillation, high blood pressure, and heart disease, have it.

Tachycardia Detection devices are now common for high-risk heart patients, emergency heart watching, and post-surgery heart care. They give real-time heart checks, alert on odd heartbeats, and smart risk guessing. These tools allow quick doctor action to stop problems like stroke and heart failure.

More need for heart watching comes from more cases of atrial and ventricular fast heart, more focus on stopping heart issues, and growing use of wearable heart tech. New work in smart heart classifying, remote heart checking, and guesswork by machines boosts spot-on checks and treatment plans.

But, issues like false alarms, high cost of top monitors, and patients not sticking to always-on heart checks exist. New ideas in real-time smart sorting of heartbeats, tracking personal heart rate changes, and linking with video doctor visits should raise use and make health care better.

The market for heartbeat irregularity detection device is growing. More people want to catch heart problems early with gadgets they can wear. This market is growing because more people have heart rhythm problems. There's been progress in real-time heart monitoring and remote check-ups.

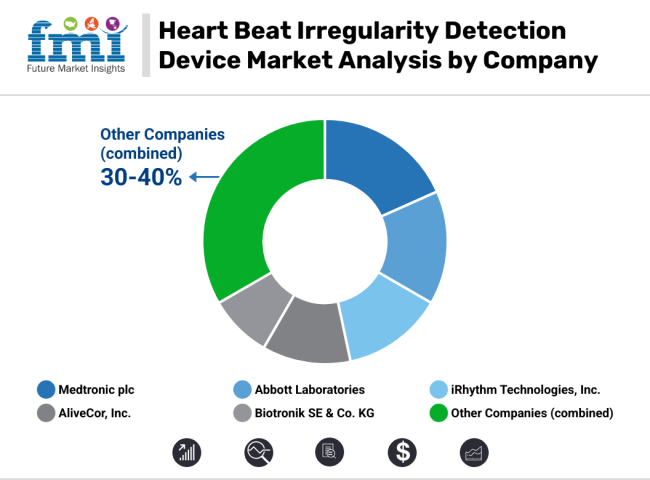

Companies are focusing on making these gadgets smart with AI, wireless, and small designs. They want to make the devices more accurate, easy to use, and good for doctors. Big players in the market include medical device makers, digital health companies, and tech firms. They are all working on new ECG patches, smartwatches, and portable monitors with AI to spot heart rhythm issues.

Market Share Analysis by Company

| Company Name | Key Offerings/Activities |

|---|---|

| Medtronic plc | In 2024, launched next-gen implantable cardiac monitors with AI-based arrhythmia detection for long-term heart monitoring. |

| Abbott Laboratories | In 2025, introduced wireless ECG patches with real-time data transmission and remote monitoring capabilities. |

| iRhythm Technologies, Inc. | In 2024, expanded Zio wearable ECG monitor services with enhanced AI algorithms for faster arrhythmia detection. |

| AliveCor, Inc. | In 2025, unveiled a new generation of FDA-approved smartphone-connected ECG devices for home-based cardiac screening. |

| Biotronik SE & Co. KG | In 2024, enhanced its remote heart monitoring solutions with cloud-based AI analysis and predictive health insights. |

Key Company Insights

Medtronic plc (18-22%)

Medtronic leads the heartbeat irregularity detection market, offering implantable and wearable cardiac monitoring devices for high-risk patients.

Abbott Laboratories (14-18%)

Abbott specializes in wireless, AI-powered ECG patches, ensuring real-time heart rhythm analysis and remote patient monitoring.

iRhythm Technologies, Inc. (12-16%)

iRhythm focuses on AI-integrated wearable ECG monitors, optimizing data accuracy and physician workflow efficiency.

AliveCor, Inc. (10-14%)

AliveCor develops smartphone-compatible ECG devices, ensuring easy accessibility and affordability for at-home cardiac screening.

Biotronik SE & Co. KG (6-10%)

Biotronik provides cloud-based remote cardiac monitoring, enhancing predictive analytics and real-time patient insights.

Other Key Players (30-40% Combined)

Many digital health startups, medical device makers, and makers of wearable tech help move forward tiny, smart, and remote heart checks. These include:

The overall market size for the heartbeat irregularity detection device market was USD 14.6 Million in 2025.

The heartbeat irregularity detection device market is expected to reach USD 21.6 Million in 2035.

Rising prevalence of cardiovascular diseases, increasing adoption of wearable health monitoring devices, and advancements in AI-driven ECG and heart rhythm detection technologies will drive market growth.

The USA, Germany, China, Japan, and the UK are key contributors.

Wearable ECG monitors are expected to dominate due to their convenience, continuous monitoring capabilities, and growing integration with smartwatches and mobile health apps.

Table 01: Global Market Value (US$ Million) Analysis and Forecast 2017 to 2033, by Device

Table 02: Global Market Volume (Units) Analysis and Forecast 2017 to 2033, by Device

Table 03: Global Market Value (US$ Million) Analysis and Forecast 2017 to 2033, by Application

Table 04: Global Market Value (US$ Million) Analysis and Forecast 2017 to 2033, by End User

Table 05: Global Market Value (US$ Million) Analysis and Forecast 2017 to 2033, by Region

Table 06: North America Market Value (US$ Million) Analysis 2017 to 2022 and Forecast 2023 to 2033, by Country

Table 07: North America Market Value (US$ Million) Analysis and Forecast 2017 to 2033, by Device

Table 08: North America Market Volume (Units) Analysis and Forecast 2017 to 2033, by Device

Table 09: North America Market Value (US$ Million) Analysis and Forecast 2017 to 2033, by Application

Table 10: North America Market Value (US$ Million) Analysis and Forecast 2017 to 2033, by End User

Table 11: Latin America Market Value (US$ Million) Analysis 2017 to 2022 and Forecast 2023 to 2033, by Country

Table 12: Latin America Market Value (US$ Million) Analysis and Forecast 2017 to 2033, by Device

Table 13: Latin America Market Volume (Units) Analysis and Forecast 2017 to 2033, by Device

Table 14: Latin America Market Value (US$ Million) Analysis and Forecast 2017 to 2033, by Application

Table 15: Latin America Market Value (US$ Million) Analysis and Forecast 2017 to 2033, by End User

Table 16: Europe Market Value (US$ Million) Analysis 2017 to 2022 and Forecast 2023 to 2033, by Country

Table 17: Europe Market Value (US$ Million) Analysis and Forecast 2017 to 2033, by Device

Table 18: Europe Market Volume (Units) Analysis and Forecast 2017 to 2033, by Device

Table 19: Europe Market Value (US$ Million) Analysis and Forecast 2017 to 2033, by Application

Table 20: Europe Market Value (US$ Million) Analysis and Forecast 2017 to 2033, by End User

Table 21: South Asia Market Value (US$ Million) Analysis 2017 to 2022 and Forecast 2023 to 2033, by Country

Table 22: South Asia Market Value (US$ Million) Analysis and Forecast 2017 to 2033, by Device

Table 23: South Asia Market Volume (Units) Analysis and Forecast 2017 to 2033, by Device

Table 24: South Asia Market Value (US$ Million) Analysis and Forecast 2017 to 2033, by Application

Table 25: South Asia Market Value (US$ Million) Analysis and Forecast 2017 to 2033, by End User

Table 26: East Asia Market Value (US$ Million) Analysis 2017 to 2022 and Forecast 2023 to 2033, by Country

Table 27: East Asia Market Value (US$ Million) Analysis and Forecast 2017 to 2033, by Device

Table 28: East Asia Market Volume (Units) Analysis and Forecast 2017 to 2033, by Device

Table 29: East Asia Market Value (US$ Million) Analysis and Forecast 2017 to 2033, by Application

Table 30: East Asia Market Value (US$ Million) Analysis and Forecast 2017 to 2033, by End User

Table 31: Oceania Market Value (US$ Million) Analysis 2017 to 2022 and Forecast 2023 to 2033, by Country

Table 32: Oceania Market Value (US$ Million) Analysis and Forecast 2017 to 2033, by Device

Table 33: Oceania Market Volume (Units) Analysis and Forecast 2017 to 2033, by Device

Table 34: Oceania Market Value (US$ Million) Analysis and Forecast 2017 to 2033, by Application

Table 35: Oceania Market Value (US$ Million) Analysis and Forecast 2017 to 2033, by End User

Table 36: Middle East and Africa Market Value (US$ Million) Analysis 2017 to 2022 and Forecast 2023 to 2033, by Country

Table 37: Middle East and Africa Market Value (US$ Million) Analysis and Forecast 2017 to 2033, by Device

Table 38: Middle East and Africa Market Volume (Units) Analysis and Forecast 2017 to 2033, by Device

Table 39: Middle East and Africa Market Value (US$ Million) Analysis and Forecast 2017 to 2033, by Application

Table 40: Middle East and Africa Market Value (US$ Million) Analysis and Forecast 2017 to 2033, by End User

Figure 01: Global Market Volume (Units), 2017 to 2022

Figure 02: Global Market Volume (Units) & Y-o-Y Growth (%) Analysis, 2023 to 2033

Figure 03: Pricing Analysis per unit (US$), in 2023

Figure 04: Pricing Forecast per unit (US$), in 2033

Figure 05: Global Market Value (US$ Million) Analysis, 2017–2022

Figure 06: Global Market Forecast & Y-o-Y Growth, 2023 to 2033

Figure 07: Global Market Absolute $ Opportunity (US$ Million) Analysis, 2022–2033

Figure 08: Global Market Value Share (%) Analysis 2023 and 2033, by Device

Figure 09: Global Market Y-o-Y Growth (%) Analysis 2022 to 2033, by Device

Figure 10: Global Market Attractiveness Analysis 2023 to 2033, by Device

Figure 11: Global Market Value Share (%) Analysis 2023 and 2033, by Application

Figure 12: Global Market Y-o-Y Growth (%) Analysis 2022 to 2033, by Application

Figure 13: Global Market Attractiveness Analysis 2023 to 2033, by Application

Figure 14: Global Market Value Share (%) Analysis 2023 and 2033, by End User

Figure 15: Global Market Y-o-Y Growth (%) Analysis 2022 to 2033, by End User

Figure 16: Global Market Attractiveness Analysis 2023 to 2033, by End User

Figure 17: Global Market Value Share (%) Analysis 2023 and 2033, by Region

Figure 18: Global Market Y-o-Y Growth (%) Analysis 2022 to 2033, by Region

Figure 19: Global Market Attractiveness Analysis 2023 to 2033, by Region

Figure 20: North America Market Value (US$ Million) Analysis, 2017 to 2022

Figure 21: North America Market Value (US$ Million) Forecast, 2023 to 2033

Figure 22: North America Market Value Share, by Device (2023 E)

Figure 23: North America Market Value Share, by Application (2023 E)

Figure 24: North America Market Value Share, by End User (2023 E)

Figure 25: North America Market Value Share, by Country (2023 E)

Figure 26: North America Market Attractiveness Analysis by Device, 2023 to 2033

Figure 27: North America Market Attractiveness Analysis by Application, 2023 to 2033

Figure 28: North America Market Attractiveness Analysis by End User, 2023 to 2033

Figure 29: North America Market Attractiveness Analysis by Country, 2023 to 2033

Figure 30: USA Market Value Proportion Analysis, 2022

Figure 31: Global Vs. USA Growth Comparison

Figure 32: USA Market Share Analysis (%) by Device, 2022 & 2033

Figure 33: USA Market Share Analysis (%) by Application, 2022 & 2033

Figure 34: USA Market Share Analysis (%) by End User, 2022 & 2033

Figure 35: Canada Market Value Proportion Analysis, 2022

Figure 36: Global Vs. Canada. Growth Comparison

Figure 37: Canada Market Share Analysis (%) by Device, 2022 & 2033

Figure 38: Canada Market Share Analysis (%) by Application, 2022 & 2033

Figure 39: Canada Market Share Analysis (%) by End User, 2022 & 2033

Figure 40: Latin America Market Value (US$ Million) Analysis, 2017 to 2022

Figure 41: Latin America Market Value (US$ Million) Forecast, 2023 to 2033

Figure 42: Latin America Market Value Share, by Device (2023 E)

Figure 43: Latin America Market Value Share, by Application (2023 E)

Figure 44: Latin America Market Value Share, by End User (2023 E)

Figure 45: Latin America Market Value Share, by Country (2023 E)

Figure 46: Latin America Market Attractiveness Analysis by Device, 2023 to 2033

Figure 47: Latin America Market Attractiveness Analysis by Application, 2023 to 2033

Figure 48: Latin America Market Attractiveness Analysis by End User, 2023 to 2033

Figure 49: Latin America Market Attractiveness Analysis by Country, 2023 to 2033

Figure 50: Mexico Market Value Proportion Analysis, 2022

Figure 51: Global Vs Mexico Growth Comparison

Figure 52: Mexico Market Share Analysis (%) by Device, 2022 & 2033

Figure 53: Mexico Market Share Analysis (%) by Application, 2022 & 2033

Figure 54: Mexico Market Share Analysis (%) by End User, 2022 & 2033

Figure 55: Brazil Market Value Proportion Analysis, 2022

Figure 56: Global Vs. Brazil. Growth Comparison

Figure 57: Brazil Market Share Analysis (%) by Device, 2022 & 2033

Figure 58: Brazil Market Share Analysis (%) by Application, 2022 & 2033

Figure 59: Brazil Market Share Analysis (%) by End User, 2022 & 2033

Figure 60: Argentina Market Value Proportion Analysis, 2022

Figure 61: Global Vs Argentina Growth Comparison

Figure 62: Argentina Market Share Analysis (%) by Device, 2022 & 2033

Figure 63: Argentina Market Share Analysis (%) by Application, 2022 & 2033

Figure 64: Argentina Market Share Analysis (%) by End User, 2022 & 2033

Figure 65: Europe Market Value (US$ Million) Analysis, 2017 to 2022

Figure 66: Europe Market Value (US$ Million) Forecast, 2023 to 2033

Figure 67: Europe Market Value Share, by Device (2023 E)

Figure 68: Europe Market Value Share, by Application (2023 E)

Figure 69: Europe Market Value Share, by End User (2023 E)

Figure 70: Europe Market Value Share, by Country (2023 E)

Figure 71: Europe Market Attractiveness Analysis by Device, 2023 to 2033

Figure 72: Europe Market Attractiveness Analysis by Application, 2023 to 2033

Figure 73: Europe Market Attractiveness Analysis by End User, 2023 to 2033

Figure 74: Europe Market Attractiveness Analysis by Country, 2023 to 2033

Figure 75: United Kingdom Market Value Proportion Analysis, 2022

Figure 76: Global Vs. United Kingdom Growth Comparison

Figure 77: United Kingdom Market Share Analysis (%) by Device, 2022 & 2033

Figure 78: United Kingdom Market Share Analysis (%) by Application, 2022 & 2033

Figure 79: United Kingdom Market Share Analysis (%) by End User, 2022 & 2033

Figure 80: Germany Market Value Proportion Analysis, 2022

Figure 81: Global Vs. Germany Growth Comparison

Figure 82: Germany Market Share Analysis (%) by Device, 2022 & 2033

Figure 83: Germany Market Share Analysis (%) by Application, 2022 & 2033

Figure 84: Germany Market Share Analysis (%) by End User, 2022 & 2033

Figure 85: Italy Market Value Proportion Analysis, 2022

Figure 86: Global Vs. Italy Growth Comparison

Figure 87: Italy Market Share Analysis (%) by Device, 2022 & 2033

Figure 88: Italy Market Share Analysis (%) by Application, 2022 & 2033

Figure 89: Italy Market Share Analysis (%) by End User, 2022 & 2033

Figure 90: France Market Value Proportion Analysis, 2022

Figure 91: Global Vs France Growth Comparison

Figure 92: France Market Share Analysis (%) by Device, 2022 & 2033

Figure 93: France Market Share Analysis (%) by Application, 2022 & 2033

Figure 94: France Market Share Analysis (%) by End User, 2022 & 2033

Figure 95: Spain Market Value Proportion Analysis, 2022

Figure 96: Global Vs Spain Growth Comparison

Figure 97: Spain Market Share Analysis (%) by Device, 2022 & 2033

Figure 98: Spain Market Share Analysis (%) by Application, 2022 & 2033

Figure 99: Spain Market Share Analysis (%) by End User, 2022 & 2033

Figure 100: Russia Market Value Proportion Analysis, 2022

Figure 101: Global Vs Russia Growth Comparison

Figure 102: Russia Market Share Analysis (%) by Device, 2022 & 2033

Figure 103: Russia Market Share Analysis (%) by Application, 2022 & 2033

Figure 104: Russia Market Share Analysis (%) by End User, 2022 & 2033

Figure 105: BENELUX Market Value Proportion Analysis, 2022

Figure 106: Global Vs BENELUX Growth Comparison

Figure 107: BENELUX Market Share Analysis (%) by Device, 2022 & 2033

Figure 108: BENELUX Market Share Analysis (%) by Application, 2022 & 2033

Figure 109: BENELUX Market Share Analysis (%) by End User, 2022 & 2033

Figure 110: East Asia Market Value (US$ Million) Analysis, 2017 to 2022

Figure 111: East Asia Market Value (US$ Million) Forecast, 2023 to 2033

Figure 112: East Asia Market Value Share, by Device (2023 E)

Figure 113: East Asia Market Value Share, by Application (2023 E)

Figure 114: East Asia Market Value Share, by End User (2023 E)

Figure 115: East Asia Market Value Share, by Country (2023 E)

Figure 116: East Asia Market Attractiveness Analysis by Device, 2023 to 2033

Figure 117: East Asia Market Attractiveness Analysis by Application, 2023 to 2033

Figure 118: East Asia Market Attractiveness Analysis by End User, 2023 to 2033

Figure 119: East Asia Market Attractiveness Analysis by Country, 2023 to 2033

Figure 120: China Market Value Proportion Analysis, 2022

Figure 121: Global Vs. China Growth Comparison

Figure 122: China Market Share Analysis (%) by Device, 2022 & 2033

Figure 123: China Market Share Analysis (%) by Application, 2022 & 2033

Figure 124: China Market Share Analysis (%) by End User, 2022 & 2033

Figure 125: Japan Market Value Proportion Analysis, 2022

Figure 126: Global Vs. Japan Growth Comparison

Figure 127: Japan Market Share Analysis (%) by Device, 2022 & 2033

Figure 128: Japan Market Share Analysis (%) by Application, 2022 & 2033

Figure 129: Japan Market Share Analysis (%) by End User, 2022 & 2033

Figure 130: South Korea Market Value Proportion Analysis, 2022

Figure 131: Global Vs South Korea Growth Comparison

Figure 132: South Korea Market Share Analysis (%) by Device, 2022 & 2033

Figure 133: South Korea Market Share Analysis (%) by Application, 2022 & 2033

Figure 134: South Korea Market Share Analysis (%) by End User, 2022 & 2033

Figure 135: South Asia Market Value (US$ Million) Analysis, 2017 to 2022

Figure 136: South Asia Market Value (US$ Million) Forecast, 2023 to 2033

Figure 137: South Asia Market Value Share, by Device (2023 E)

Figure 138: South Asia Market Value Share, by Application (2023 E)

Figure 139: South Asia Market Value Share, by End User (2023 E)

Figure 140: South Asia Market Value Share, by Country (2023 E)

Figure 141: South Asia Market Attractiveness Analysis by Device, 2023 to 2033

Figure 142: South Asia Market Attractiveness Analysis by Application, 2023 to 2033

Figure 143: South Asia Market Attractiveness Analysis by End User, 2023 to 2033

Figure 144: South Asia Market Attractiveness Analysis by Country, 2023 to 2033

Figure 145: India Market Value Proportion Analysis, 2022

Figure 146: Global Vs. India Growth Comparison

Figure 147: India Market Share Analysis (%) by Device, 2022 & 2033

Figure 148: India Market Share Analysis (%) by Application, 2022 & 2033

Figure 149: India Market Share Analysis (%) by End User, 2022 & 2033

Figure 150: Indonesia Market Value Proportion Analysis, 2022

Figure 151: Global Vs. Indonesia Growth Comparison

Figure 152: Indonesia Market Share Analysis (%) by Device, 2022 & 2033

Figure 153: Indonesia Market Share Analysis (%) by Application, 2022 & 2033

Figure 154: Indonesia Market Share Analysis (%) by End User, 2022 & 2033

Figure 155: Malaysia Market Value Proportion Analysis, 2022

Figure 156: Global Vs. Malaysia Growth Comparison

Figure 157: Malaysia Market Share Analysis (%) by Device, 2022 & 2033

Figure 158: Malaysia Market Share Analysis (%) by Application, 2022 & 2033

Figure 159: Malaysia Market Share Analysis (%) by End User, 2022 & 2033

Figure 160: Thailand Market Value Proportion Analysis, 2022

Figure 161: Global Vs. Thailand Growth Comparison

Figure 162: Thailand Market Share Analysis (%) by Device, 2022 & 2033

Figure 163: Thailand Market Share Analysis (%) by Application, 2022 & 2033

Figure 164: Thailand Market Share Analysis (%) by End User, 2022 & 2033

Figure 165: Oceania Market Value (US$ Million) Analysis, 2017 to 2022

Figure 166: Oceania Market Value (US$ Million) Forecast, 2023 to 2033

Figure 167: Oceania Market Value Share, by Device (2023 E)

Figure 168: Oceania Market Value Share, by Application (2023 E)

Figure 169: Oceania Market Value Share, by End User (2023 E)

Figure 170: Oceania Market Value Share, by Country (2023 E)

Figure 171: Oceania Market Attractiveness Analysis by Device, 2023 to 2033

Figure 172: Oceania Market Attractiveness Analysis by Application, 2023 to 2033

Figure 173: Oceania Market Attractiveness Analysis by End User, 2023 to 2033

Figure 174: Oceania Market Attractiveness Analysis by Country, 2023 to 2033

Figure 175: Australia Market Value Proportion Analysis, 2022

Figure 176: Global Vs. Australia Growth Comparison

Figure 177: Australia Market Share Analysis (%) by Device, 2022 & 2033

Figure 178: Australia Market Share Analysis (%) by Application, 2022 & 2033

Figure 179: Australia Market Share Analysis (%) by End User, 2022 & 2033

Figure 180: New Zealand Market Value Proportion Analysis, 2022

Figure 181: Global Vs New Zealand Growth Comparison

Figure 182: New Zealand Market Share Analysis (%) by Device, 2022 & 2033

Figure 183: New Zealand Market Share Analysis (%) by Application, 2022 & 2033

Figure 184: New Zealand Market Share Analysis (%) by End User, 2022 & 2033

Figure 185: Middle East & Africa Market Value (US$ Million) Analysis, 2017 to 2022

Figure 186: Middle East & Africa Market Value (US$ Million) Forecast, 2023 to 2033

Figure 187: Middle East & Africa Market Value Share, by Device (2023 E)

Figure 188: Middle East & Africa Market Value Share, by Application (2023 E)

Figure 189: Middle East & Africa Market Value Share, by End User (2023 E)

Figure 190: Middle East & Africa Market Value Share, by Country (2023 E)

Figure 191: Middle East & Africa Market Attractiveness Analysis by Device, 2023 to 2033

Figure 192: Middle East & Africa Market Attractiveness Analysis by Application, 2023 to 2033

Figure 193: Middle East & Africa Market Attractiveness Analysis by End User, 2023 to 2033

Figure 194: Middle East & Africa Market Attractiveness Analysis by Country, 2023 to 2033

Figure 195: GCC Countries Market Value Proportion Analysis, 2022

Figure 196: Global Vs GCC Countries Growth Comparison

Figure 197: GCC Countries Market Share Analysis (%) by Device, 2022 & 2033

Figure 198: GCC Countries Market Share Analysis (%) by Application, 2022 & 2033

Figure 199: GCC Countries Market Share Analysis (%) by End User, 2022 & 2033

Figure 200: Türkiye Market Value Proportion Analysis, 2022

Figure 201: Global Vs. Türkiye Growth Comparison

Figure 202: Türkiye Market Share Analysis (%) by Device, 2022 & 2033

Figure 203: Türkiye Market Share Analysis (%) by Application, 2022 & 2033

Figure 204: Türkiye Market Share Analysis (%) by End User, 2022 & 2033

Figure 205: South Africa Market Value Proportion Analysis, 2022

Figure 206: Global Vs. South Africa Growth Comparison

Figure 207: South Africa Market Share Analysis (%) by Device, 2022 & 2033

Figure 208: South Africa Market Share Analysis (%) by Application, 2022 & 2033

Figure 209: South Africa Market Share Analysis (%) by End User, 2022 & 2033

Figure 210: North Africa Market Value Proportion Analysis, 2022

Figure 211: Global Vs North Africa Growth Comparison

Figure 212: North Africa Market Share Analysis (%) by Device, 2022 & 2033

Figure 213: North Africa Market Share Analysis (%) by Application, 2022 & 2033

Figure 214: North Africa Market Share Analysis (%) by End User, 2022 & 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

APAC Heart Health Functional Food Market Size and Share Forecast Outlook 2025 to 2035

Heart Block Therapeutics Market Size and Share Forecast Outlook 2025 to 2035

Heart Failure Testing Market

Heart Pump Device Market Forecast and Outlook 2025 to 2035

Heart Closure Devices Market Size and Share Forecast Outlook 2025 to 2035

Heart Beat Sensor Market Size and Share Forecast Outlook 2025 to 2035

Heart Beat Monitor and Sensor Market

Mobile Heart Monitoring Market

Nitinol Heart Valve Frames Market Analysis Size and Share Forecast Outlook 2025 to 2035

At Home Heart Health Testing Market Analysis - Size & Industry Trends 2025 to 2035

Surgical Heart Valves Market Size and Share Forecast Outlook 2025 to 2035

Pulmonary Heart Valve Replacement Market Size and Share Forecast Outlook 2025 to 2035

Rheumatic-Heart Disease Management Market Analysis - Innovations & Outlook 2025 to 2035

Pediatric Heart Valve Repair and Replacement Analysis by Product, Induction, End Users and Region-2025 to 2035

Prosthetic Heart Valve Market is segmented by product & end user from 2025 to 2035

Structural Heart Devices Market Size and Share Forecast Outlook 2025 to 2035

Transcatheter Heart Valve Replacement Market Analysis - Trends & Forecast 2025 to 2035

Total Artificial Heart Market

Radiation-Free Fetal Heart Rate Monitor Market Size and Share Forecast Outlook 2025 to 2035

Device-Embedded Biometric Authentication Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA