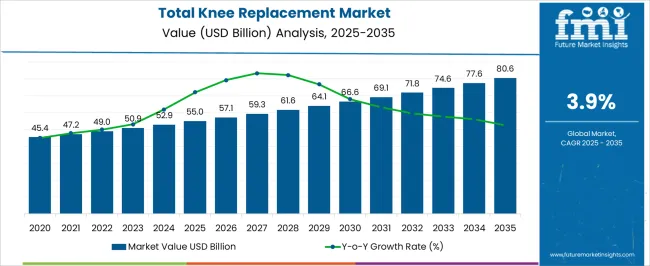

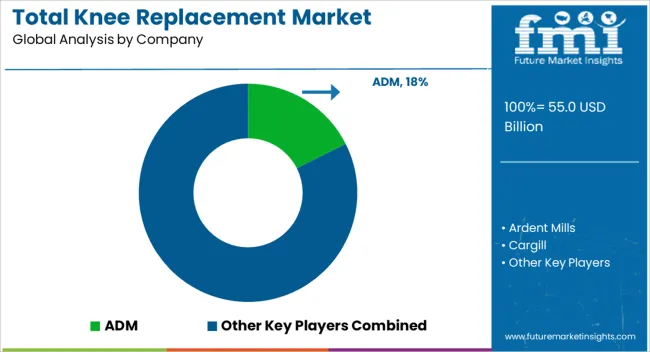

The Total Knee Replacement Market is estimated to be valued at USD 55.0 billion in 2025 and is projected to reach USD 80.6 billion by 2035, registering a compound annual growth rate (CAGR) of 3.9% over the forecast period. Between 2025 and 2030, the market is expected to rise from USD 55.0 billion to USD 66.6 billion, driven by increasing aging populations, advancements in surgical techniques, and rising demand for joint replacement procedures.

Year-on-year analysis shows consistent growth, with values reaching USD 57.1 billion in 2026 and USD 59.3 billion in 2027, supported by technological innovations in implant materials and minimally invasive surgery. By 2028, the market is forecasted to hit USD 61.6 billion, advancing to USD 64.1 billion in 2029 and USD 66.6 billion by 2030.

Growth is expected to be further fueled by improving healthcare access, rising healthcare expenditure, and better post-surgery rehabilitation options. Manufacturers are focusing on developing more durable and personalized implants, as well as robotic-assisted surgery systems, to enhance patient outcomes and recovery time. These factors position total knee replacement as a key segment in orthopedic care, with growing adoption across global healthcare systems.

| Metric | Value |

|---|---|

| Total Knee Replacement Market Estimated Value in (2025 E) | USD 55.0 billion |

| Total Knee Replacement Market Forecast Value in (2035 F) | USD 80.6 billion |

| Forecast CAGR (2025 to 2035) | 3.9% |

The total knee replacement market is witnessing accelerated expansion due to aging global populations, increasing obesity rates, and rising cases of osteoarthritis. Improvements in implant materials, minimally invasive surgical procedures, and advanced robotic-assisted systems have improved patient outcomes and shortened recovery time, driving adoption.

Healthcare infrastructure upgrades across emerging markets, combined with favorable reimbursement policies, have increased procedural volumes and expanded access to knee arthroplasty. Hospitals and orthopedic centers are increasingly investing in digital navigation and 3D printing technologies to enhance implant precision and long-term mobility for patients.

As the demand for pain-relieving interventions grows among active aging adults, the market is expected to benefit from consistent innovation, better surgeon training, and patient education efforts encouraging early-stage diagnosis and treatment.

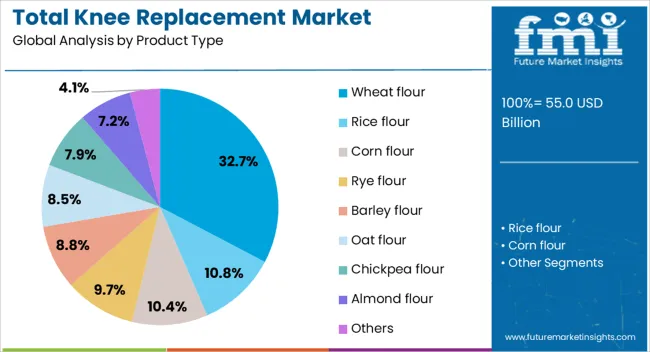

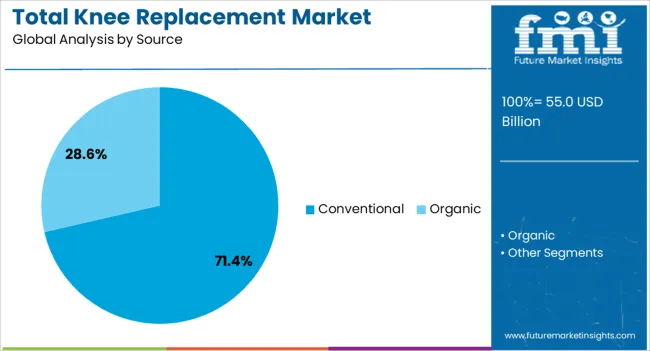

The total knee replacement market is segmented by product type, source, application, distribution channel, and geographic regions. By product type, the total knee replacement market is divided into Wheat flour, Rice flour, Corn flour, Rye flour, Barley flour, Oat flour, Chickpea flour, Almond flour, and Others. In terms of the source of the total knee replacement market, it is classified into Conventional and Organic.

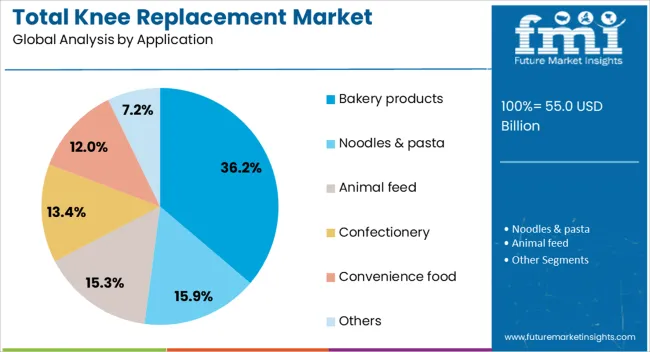

The total knee replacement market is segmented into Bakery products, Noodles & pasta, Animal feed, Confectionery, Convenience food, and Others. The distribution channel of the total knee replacement market is segmented into Supermarkets & hypermarkets, Convenience stores, Online retail, and Direct sales.

Regionally, the total knee replacement industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Wheat flour-based implants are expected to hold 32.7% of the market revenue share in 2025, making them the leading product type segment. Their dominance is being driven by high biocompatibility, favorable integration with existing anatomical structures, and consistent mechanical strength.

The processing versatility of wheat flour-derived biomaterials has allowed manufacturers to optimize implant density and shape while maintaining cost-effectiveness. These implants have also gained clinical support for reducing inflammation and improving osseointegration rates.

With a growing preference for biodegradable and plant-based options in surgical materials, wheat flour formulations continue to gain favor in both developed and developing healthcare systems.

Conventional sourcing methods are projected to contribute 71.4% of total market revenue in 2025, sustaining their position as the primary supply mode. This segment's leadership stems from well-established procurement, long-standing clinical validation, and compatibility with widely accepted manufacturing workflows.

The cost-efficiency and scalability of conventional raw materials make them highly suitable for large-volume surgical centers aiming to deliver affordable care.

Technological consistency, streamlined approval pathways, and ease of integration with existing implant lines have further solidified the dominance of conventional sources in the total knee replacement landscape.

Bakery products are anticipated to represent 36.2% of the total knee replacement market revenue by 2025, ranking them as the top application segment. Their prominence arises from increasing demand in functional food formulations aimed at improving joint health post-surgery.

These products are often enriched with therapeutic ingredients or supplements to aid in recovery and long-term mobility. The inclusion of bakery formats enables ease of consumption for elderly patients and supports compliance with post-operative dietary recommendations.

Food-grade innovations targeting joint regeneration and inflammation reduction have made bakery products a strategic channel for both nutritionists and orthopedic care providers, focusing on holistic patient rehabilitation.

The total knee replacement (TKR) market is experiencing growth driven by the rising aging population and increasing prevalence of joint-related disorders. In 2024 and 2025, growth drivers include the demand for advanced, more durable knee prosthetics. Opportunities exist in the expansion of minimally invasive surgeries and 3D-printed implants. Emerging trends include personalized knee implants and improved surgical techniques. However, market restraints like high procedural costs and post-surgical complications are limiting widespread adoption, especially in developing regions.

A primary growth driver in the total knee replacement market is the increasing aging population and rising prevalence of joint disorders. In 2024 and 2025, the number of elderly individuals with osteoarthritis and related knee issues continues to rise, driving the demand for knee replacement surgeries. Additionally, lifestyle factors contributing to joint wear and tear have led to greater reliance on knee implants to restore mobility. The growing need for effective, long-lasting joint solutions has significantly boosted market growth.

Opportunities in the TKR market are emerging with the rise of minimally invasive surgeries and 3D-printed implants. In 2025, advancements in 3D printing technology enabled the production of customized knee implants, providing better fit and functionality for patients. These developments, coupled with minimally invasive techniques, reduced recovery times and improved surgical outcomes. The demand for more personalized treatment options is expected to expand the market, offering new growth avenues for manufacturers and healthcare providers.

An emerging trend in the TKR market is the shift towards personalized knee implants and advanced surgical techniques. In 2024, there was growing interest in implants tailored to individual anatomical needs, offering improved functionality and patient satisfaction. Additionally, robotic-assisted surgeries gained traction as they provide higher precision and reduced human error, enhancing recovery times. These trends highlight the increasing focus on improving patient outcomes and optimizing surgical procedures, thus driving the demand for advanced knee replacement technologies.

Key market restraints include the high costs associated with knee replacement surgeries and post-surgical complications. In 2024 and 2025, knee replacement procedures remained expensive, particularly in developed markets, limiting accessibility for some patients. Additionally, complications such as infections, implant loosening, and stiffness after surgery presented challenges to long-term success. These issues led to higher healthcare costs and emphasized the need for improved surgical outcomes and cost-effective solutions to increase the accessibility and acceptance of TKR procedures.

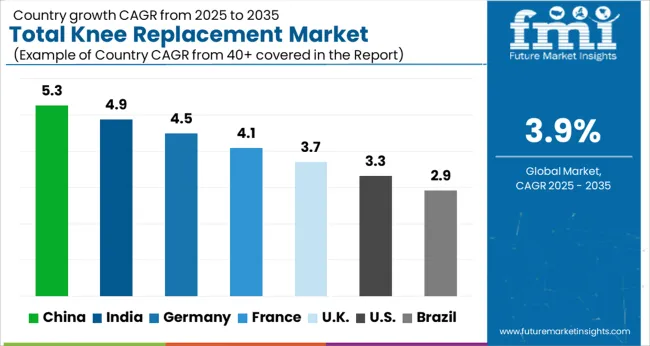

The global total knee replacement market is projected to grow at 3.9% CAGR from 2025 to 2035. China leads with 5.3% CAGR, driven by an aging population, increasing awareness of knee joint health, and rising demand for orthopedic procedures in the country. India follows at 4.9%, supported by the country’s expanding healthcare infrastructure and increasing prevalence of knee-related ailments. France records 4.1% CAGR, reflecting steady demand for knee replacement surgeries driven by an aging population and improved access to healthcare. The United Kingdom grows at 3.7%, while the United States posts 3.3%, reflecting stable demand in mature markets with a focus on advanced surgical techniques and implant technologies. Asia-Pacific leads in growth due to demographic changes, while Europe and North America focus on technological advancements and treatment accessibility.

The total knee replacement market in China is forecasted to grow at 5.3% CAGR, driven by the country’s aging population and the increasing prevalence of osteoarthritis and knee joint disorders. The expanding healthcare sector and improved access to medical facilities also contribute to the growth of knee replacement surgeries. Additionally, the growing demand for high-quality implants and surgical procedures further accelerates market growth, supported by government investments in healthcare infrastructure.

The total knee replacement market in India is projected to grow at 4.9% CAGR, fueled by the increasing prevalence of knee osteoarthritis and the rise in orthopedic procedures. The country’s expanding healthcare infrastructure, coupled with government efforts to make healthcare more accessible, supports the market's growth. Additionally, the growing awareness of joint health and the increasing demand for minimally invasive surgeries contribute to the adoption of knee replacement procedures.

The total knee replacement market in France is expected to grow at 4.1% CAGR, supported by an aging population and rising demand for joint replacement procedures. As France’s population continues to age, the prevalence of osteoarthritis and knee-related issues increases, driving the need for knee replacement surgeries. The country’s strong healthcare system, along with innovations in implant technology and surgical techniques, further boosts the demand for knee replacements.

The total knee replacement market in the United Kingdom is projected to grow at 3.7% CAGR, driven by the aging population and increasing knee-related ailments in the country. With a strong focus on improving surgical outcomes and enhancing patient recovery, there is a growing demand for advanced knee implants and minimally invasive procedures. The UK’s well-established healthcare system, coupled with government support for elderly care, further supports the market for total knee replacements.

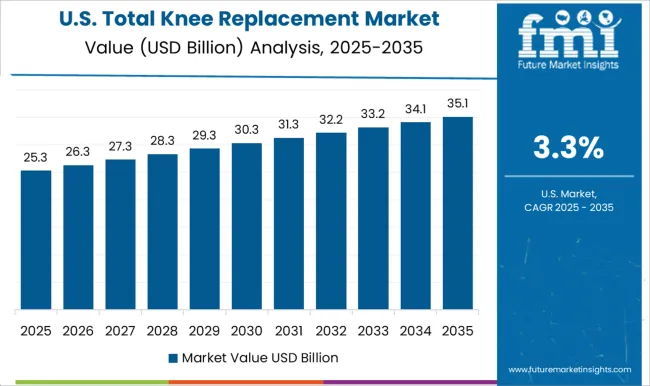

The total knee replacement market in the United States is projected to grow at 3.3% CAGR, reflecting steady demand in a mature healthcare market. The USA remains a leader in advanced knee replacement technologies, with a growing focus on personalized treatments and customized knee implants. Rising healthcare costs and a growing emphasis on improving patient outcomes further promote the demand for advanced surgical techniques. Additionally, the increasing aging population and higher rates of joint disorders support continued growth in knee replacement procedures.

The total knee replacement market is dominated by DePuy Synthes (Johnson & Johnson), which leads with its extensive range of innovative knee implant systems designed for enhanced mobility, durability, and pain relief for patients with knee joint issues. DePuy Synthes’ dominance is supported by its strong R&D capabilities, global presence, and focus on offering personalized, patient-specific solutions.

Key players such as Zimmer Biomet, Stryker Corporation, Smith & Nephew, and B. Braun maintain significant market shares by offering high-performance knee replacement products with advanced materials like cobalt-chromium, titanium, and polyethylene for optimal wear resistance. These companies focus on providing state-of-the-art implants, surgical tools, and post-surgery care to improve patient outcomes.

Emerging players like Amplitude Ortho (Amplitude Surgical), Medacta International, MicroPort Scientific Corporation, Corin Group, Exactech, and Waldemar LINK are expanding their market presence by offering innovative, cost-effective knee replacement solutions, often focusing on minimally invasive techniques, customized implants, and patient-specific surgery planning.

Their strategies include enhancing implant longevity, developing advanced robotic-assisted surgery technologies, and expanding distribution networks in emerging markets. Market growth is driven by the rising aging population, increasing healthcare access, and growing awareness of joint health. Technological innovations in implant design, 3D printing, and post-operative rehabilitation are expected to shape competitive dynamics in the global total knee replacement market.

| Item | Value |

|---|---|

| Quantitative Units | USD 55.0 Billion |

| Product Type | Wheat flour, Rice flour, Corn flour, Rye flour, Barley flour, Oat flour, Chickpea flour, Almond flour, and Others |

| Source | Conventional and Organic |

| Application | Bakery products, Noodles & pasta, Animal feed, Confectionery, Convenience food, and Others |

| Distribution Channel | Supermarkets & hypermarkets, Convenience stores, Online retail, and Direct sales |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | ADM, Ardent Mills, Cargill, Conagra Brands, General Mills, Grain Craft, Hodgson Mill, Ingredion, King Arthur Baking Company, and North Dakota Mill |

| Additional Attributes | Dollar sales by implant type and procedure, demand dynamics across hospitals, outpatient clinics, and orthopedic centers, regional trends in knee replacement surgeries, innovation in implant materials and robotic-assisted surgery, impact of regulatory standards on medical device safety, and emerging use cases in minimally invasive procedures and personalized implants. |

The global total knee replacement market is estimated to be valued at USD 55.0 billion in 2025.

The market size for the total knee replacement market is projected to reach USD 80.6 billion by 2035.

The total knee replacement market is expected to grow at a 3.9% CAGR between 2025 and 2035.

The key product types in total knee replacement market are wheat flour, rice flour, corn flour, rye flour, barley flour, oat flour, chickpea flour, almond flour and others.

In terms of source, conventional segment to command 71.4% share in the total knee replacement market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Knee Replacement Market Size and Share Forecast Outlook 2025 to 2035

Revision Knee Replacement Market Size and Share Forecast Outlook 2025 to 2035

Total Reflection X-Ray Fluorescence Spectrometer Market Size and Share Forecast Outlook 2025 to 2035

Total Dust Detector Market Size and Share Forecast Outlook 2025 to 2035

Total Aflatoxin Test Kit Market Size and Share Forecast Outlook 2025 to 2035

Knee Walker Market Size and Share Forecast Outlook 2025 to 2035

Total Hydrocarbon Analyzers Market Size and Share Forecast Outlook 2025 to 2035

Knee Hyaluronic Acid Injections Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Total Carbon Analyzers Market Growth - Trends & Outlook 2025 to 2035

Knee Reconstruction Devices Market Growth – Trends & Forecast 2025 to 2035

Replacement Sheets Market Analysis - Size, Share & Forecast 2025 to 2035

Total Artificial Heart Market

Total Iron-Binding Capacity Reagents Market

Knee Arthrodesis Implant Market

Egg Replacement Ingredient Market Analysis - Size, Share & Forecast 2025 to 2035

Meal Replacement Bars Market Size, Growth, and Forecast for 2025 to 2035

Meal Replacement Products Market Analysis by Product type, source, application and region Through 2035

Skin Replacement Market Growth - Trends & Forecast 2024 to 2034

Meal Replacement Shake Market Trends - Powder & Liquid Analysis

Joint Replacement Market Trends - Growth & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA