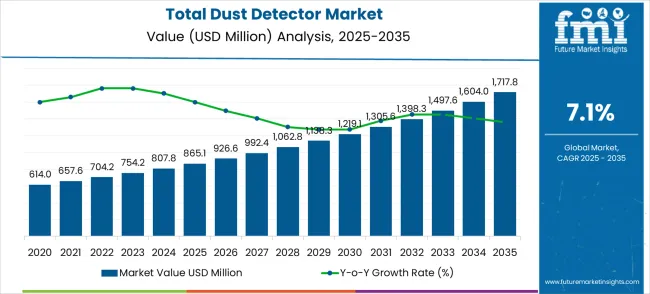

The global total dust detector market is projected to grow from USD 865 million in 2025 to approximately USD 1,718 million by 2035, recording an absolute increase of USD 852.7 million over the forecast period. This translates into a total growth of 98.6%, with the market forecast to expand at a CAGR of 7% between 2025 and 2035. The market size is expected to grow by nearly 1.99X during the same period, supported by increasing environmental regulations for air quality monitoring, rising awareness about occupational health hazards, and growing demand for real-time dust concentration measurement across industrial applications.

| Metric | Value |

|---|---|

| Estimated Value in (2025E) | USD 865 million |

| Forecast Value in (2035F) | USD 1,718 million |

| Forecast CAGR (2025 to 2035) | 7% |

From 2030 to 2035, the market is forecast to grow from USD 1,219.0 million to USD 1,718 million, adding another USD 498.8 million, which constitutes 58.5% of the ten-year expansion. This period is expected to be characterized by expansion of smart monitoring systems, integration of IoT connectivity in dust detection equipment, and development of advanced sensor technologies. The growing adoption of Industry 4.0 principles and automated environmental monitoring will drive demand for sophisticated dust detector instruments with enhanced accuracy and remote monitoring capabilities.

Between 2020 and 2025, the total dust detector market experienced steady expansion, driven by increasing environmental awareness and growing emphasis on occupational health and safety standards. The market developed as regulatory agencies strengthened air quality monitoring requirements and industrial facilities recognized the need for continuous dust concentration measurement. COVID-19 pandemic concerns about airborne particles further emphasized the importance of comprehensive dust monitoring systems across various applications.

Market expansion is being supported by the increasing implementation of environmental regulations worldwide and the corresponding demand for accurate dust concentration monitoring systems across industrial, commercial, and residential applications. Modern industries are increasingly focused on compliance with air quality standards that require continuous monitoring of particulate matter concentrations to ensure worker safety and environmental protection. Dust detector instruments provide essential capabilities for real-time measurement, data logging, and alarm systems that enable immediate response to hazardous dust concentration levels.

The growing emphasis on occupational health and safety is driving demand for portable and fixed dust monitoring systems that can accurately measure respirable dust particles and provide early warning of dangerous concentration levels. Industrial facilities face increasing liability concerns and regulatory requirements that mandate comprehensive dust monitoring programs for worker protection and environmental compliance. The rising awareness of health impacts associated with long-term dust exposure is creating opportunities for advanced monitoring solutions that provide accurate, continuous measurement capabilities.

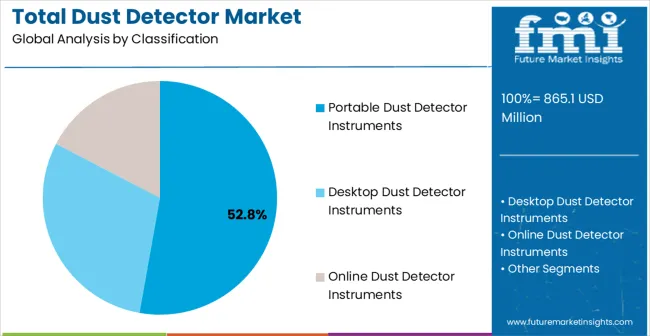

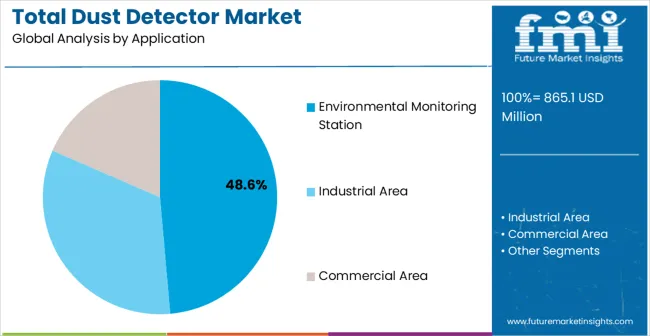

The market is segmented by product type, end-use, and region. By product type, the market is divided into portable dust detector instruments, desktop dust detector instruments, and online dust detector instruments. By end-use, the market is categorized into environmental monitoring stations, industrial areas, and commercial areas. Regionally, the market is divided into North America, Europe, East Asia, South Asia & Pacific, Latin America, and Middle East & Africa.

Portable dust detector instruments are projected to account for 52.8% of the total dust detector market in 2025. This leading share is supported by widespread adoption across diverse applications including workplace safety monitoring, environmental compliance assessments, and field surveys where mobility and ease of use are essential requirements. Portable instruments provide versatility for spot-checking dust concentrations, personal exposure monitoring, and rapid assessment of air quality conditions across different locations and work environments. The segment benefits from technological advancements in miniaturization, battery life improvement, and sensor accuracy that enable reliable measurements comparable to fixed monitoring systems.

Modern portable dust detectors incorporate advanced features including real-time display, data logging capabilities, wireless connectivity, and compliance with international measurement standards that ensure accuracy and reliability across diverse applications. These instruments serve multiple user categories including environmental consultants, industrial hygienists, facility managers, and regulatory inspectors who require accurate dust measurement capabilities in field conditions. The segment demonstrates superior market appeal through cost-effectiveness, operational flexibility, and comprehensive measurement capabilities that address diverse monitoring requirements across industrial, commercial, and environmental applications.

Construction industry adoption drives substantial demand for portable dust monitoring systems that enable compliance with occupational exposure limits and environmental regulations during demolition, excavation, and material handling activities. Mining operations require portable instruments for personal exposure monitoring and area surveillance in underground and surface mining environments where dust control is critical for worker safety. Environmental consulting firms utilize portable detectors for air quality assessments, emission source testing, and compliance verification activities that require accurate, documented measurements across diverse locations and conditions.

Environmental monitoring stations are expected to represent 48.6% of total dust detector demand in 2025. This dominant share reflects widespread adoption of continuous monitoring systems for ambient air quality assessment, regulatory compliance, and public health protection across urban and industrial areas. Environmental monitoring stations provide comprehensive dust concentration measurement capabilities that enable long-term trend analysis, real-time air quality reporting, and early warning systems for hazardous particle concentration events. The segment provides essential functionality for regulatory compliance, scientific research, and public information services that require accurate, continuous measurement of particulate matter concentrations.

Modern environmental monitoring stations incorporate sophisticated measurement technologies, automated calibration systems, and comprehensive data management capabilities that ensure measurement accuracy and regulatory compliance across diverse environmental conditions. These installations serve governmental agencies, research institutions, and environmental organizations that require reliable, long-term monitoring of air quality parameters including PM10, PM2.5, and TSP concentrations. The segment benefits from increasing regulatory requirements for ambient air quality monitoring and growing public awareness of air pollution health impacts that drive demand for comprehensive monitoring networks.

Government environmental agencies drive substantial demand for monitoring station networks that enable compliance with national and international air quality standards while providing public information services. Urban areas require comprehensive monitoring systems that track particulate matter concentrations from traffic, industrial sources, and natural dust events that affect public health and environmental quality. Industrial facilities utilize boundary monitoring stations to demonstrate compliance with emission limits and environmental permit requirements while providing early warning of potential air quality impacts.

Online dust detector instruments represent an emerging opportunity segment driven by industrial automation trends, real-time monitoring requirements, and growing emphasis on continuous process optimization across manufacturing and industrial applications. This segment demonstrates strong growth potential through integration with plant control systems, automated response capabilities, and comprehensive data analysis systems that enable proactive dust management and process control. Online instruments provide continuous measurement capabilities that enable immediate response to changing dust concentration conditions while supporting predictive maintenance and process optimization initiatives.

The segment benefits from Industry 4.0 adoption trends that emphasize real-time monitoring, automated control systems, and comprehensive data analytics for operational optimization and compliance assurance. Online dust detectors enable integration with existing plant infrastructure, automated alarm systems, and environmental management systems that provide comprehensive dust control capabilities across diverse industrial applications. Advanced features including remote monitoring, predictive analytics, and automated calibration systems enhance operational efficiency while reducing maintenance requirements and operational costs.

Manufacturing facilities require online monitoring systems that provide continuous dust concentration measurement for process control, worker protection, and environmental compliance across production operations. Power generation plants utilize online detectors for emission monitoring, equipment protection, and regulatory compliance in coal handling, ash handling, and flue gas treatment applications. Cement and mining operations implement online systems for process optimization, equipment protection, and environmental compliance in material handling, grinding, and processing operations that generate substantial dust concentrations.

The total dust detector market is advancing steadily due to increasing environmental regulations worldwide and growing recognition of dust monitoring importance for occupational health and safety compliance across industrial, commercial, and environmental applications. Government agencies are implementing stricter air quality standards that require continuous monitoring of particulate matter concentrations, driving demand for accurate measurement systems that provide real-time data and comprehensive documentation capabilities. Industrial facilities face increasing liability concerns related to worker exposure to airborne particles, creating demand for sophisticated monitoring systems that ensure compliance with occupational exposure limits and provide early warning of hazardous concentration levels. Environmental awareness among the general public drives demand for comprehensive air quality monitoring networks that provide transparent information about particle pollution levels and health risks.

The market faces significant challenges including high initial equipment costs that can limit adoption among smaller facilities and organizations with limited budgets, substantial calibration and maintenance requirements that increase operational complexity and ongoing costs, and technical complexity of advanced measurement systems that require specialized training and expertise for proper operation and data interpretation. Measurement accuracy challenges in harsh industrial environments with extreme temperatures, humidity, and interference from other airborne substances can affect instrument reliability and performance. Competition from alternative monitoring approaches including gravimetric sampling methods and remote sensing technologies may limit market adoption in certain applications where cost considerations outweigh real-time monitoring benefits.

Key trends indicate accelerating adoption of smart monitoring technologies including IoT connectivity, cloud-based data management, and mobile device integration that enhance operational efficiency and enable remote monitoring capabilities across diverse applications. Sensor technology advancement enables improved measurement accuracy, extended operational life, and reduced maintenance requirements that enhance cost-effectiveness and operational reliability. Market expansion is driven by increasing regulatory requirements, growing environmental awareness, and technological advancement in measurement capabilities, though economic uncertainty and budget constraints could challenge equipment adoption rates in certain market segments over the forecast period.

The growing deployment of IoT-connected dust monitoring systems is enabling comprehensive data collection, remote monitoring capabilities, and automated response systems that enhance operational efficiency while reducing maintenance requirements and operational costs. Advanced connectivity features including wireless communication, cloud data storage, and mobile device integration provide real-time access to monitoring data and enable immediate response to changing environmental conditions. These technologies prove particularly valuable for large-scale monitoring networks and remote locations where traditional data collection methods are impractical or cost-prohibitive.

Modern dust detector manufacturers are incorporating artificial intelligence algorithms and predictive analytics capabilities that improve measurement accuracy, enable automated calibration procedures, and provide advanced data analysis features for trend identification and forecasting. Machine learning systems can identify measurement patterns, predict equipment maintenance needs, and optimize monitoring system performance while reducing operational complexity and costs. Advanced analytics capabilities also support regulatory reporting requirements and enable comprehensive environmental management programs that demonstrate compliance and environmental stewardship.

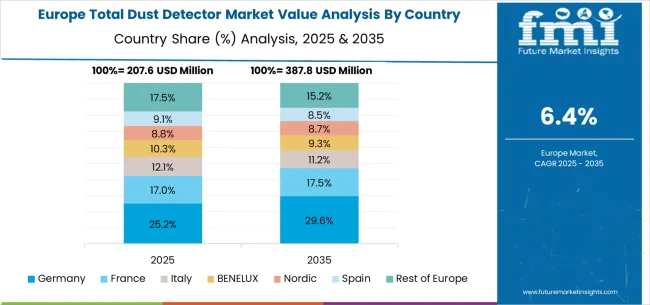

The total dust detector market in Europe is projected to grow from USD 198.2 million in 2025 to USD 365.4 million by 2035, registering a CAGR of 6.3% over the forecast period. Germany is expected to maintain its leadership with a commanding 28.7% share in 2025, rising slightly to 29.2% by 2035, supported by its advanced manufacturing industry, comprehensive environmental regulations, and strong emphasis on occupational safety standards that drive demand for sophisticated dust monitoring equipment across industrial applications. The German market benefits from established equipment manufacturing capabilities, advanced measurement technology development, and comprehensive regulatory frameworks that support market growth.

The UK accounts for 19.8% of the European market in 2025, with a share expected to remain stable at 19.6% by 2035, driven by environmental monitoring requirements, industrial safety regulations, and growing awareness of air quality health impacts that support dust monitoring adoption across diverse applications. France represents 17.2% market share in 2025, projected to maintain 17.0% through 2035, supported by comprehensive environmental protection programs and industrial safety requirements that drive monitoring equipment adoption.

Italy holds a 13.1% share in 2025, expected to grow to 13.4% by 2035, benefiting from manufacturing industry expansion and environmental compliance requirements that support dust monitoring adoption. The Rest of Europe region accounts for a 21.2% share in 2025, expected to expand to 20.8% by 2035, representing opportunities in Eastern European markets and Nordic countries where environmental regulations and industrial safety standards continue to develop.

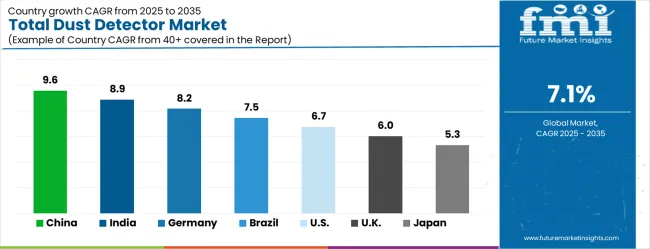

| Country | CAGR (2025-2035) |

|---|---|

| China | 9.6% |

| India | 8.9% |

| Germany | 8.2% |

| Brazil | 7.5% |

| USA | 6.7% |

| UK | 6% |

| Japan | 5.3% |

The total dust detector market is experiencing robust growth globally, with China leading at a 9.6% CAGR through 2035, driven by rapid industrialization, strengthening environmental regulations, and growing emphasis on occupational safety standards across manufacturing and construction industries. India follows at 8.9%, supported by industrial expansion, increasing environmental awareness, and government initiatives for air quality monitoring and workplace safety improvement. Germany records 8.2%, emphasizing advanced measurement technology, comprehensive regulatory compliance, and industrial safety excellence.

The report covers an in-depth analysis of 40+ countries; seven top-performing countries are highlighted below.

Demand for total dust detectors in China is projected to exhibit the highest growth rate with a CAGR of 9.6% through 2035, driven by rapid industrial expansion, strengthening environmental regulations, and comprehensive government initiatives for air quality monitoring and occupational safety improvement across manufacturing, construction, and mining industries. The country's massive industrial infrastructure and growing emphasis on environmental protection create unprecedented demand for dust monitoring equipment that can provide accurate measurement and compliance documentation across diverse applications. Major industrial facilities and environmental monitoring agencies are establishing comprehensive dust measurement programs to serve growing regulatory compliance requirements and worker safety standards throughout urban and industrial regions.

China's commitment to environmental protection and air quality improvement drives substantial investment in monitoring infrastructure including ambient air quality networks, industrial emission monitoring, and workplace safety programs that require sophisticated dust detection capabilities. The government's focus on industrial development and worker protection creates favorable conditions for dust monitoring equipment adoption across diverse industries including steel production, cement manufacturing, coal processing, and construction activities that generate significant particulate matter emissions. Technological advancement in domestic manufacturing capabilities and international technology transfer supports comprehensive equipment availability and cost-effective solutions.

Revenue from total dust detectors in India is expanding at a CAGR of 8.9%, supported by rapid industrial development, increasing environmental awareness, and government initiatives for air quality monitoring and occupational safety improvement across manufacturing, mining, and construction industries. The country's expanding industrial infrastructure and growing emphasis on worker safety and environmental protection create significant demand for dust monitoring equipment that provides accurate measurement capabilities and regulatory compliance documentation. Government programs and private sector initiatives are gradually establishing comprehensive monitoring systems to serve growing industrial safety and environmental protection requirements.

India's industrial growth trajectory and increasing environmental consciousness drive demand for dust monitoring solutions that address workplace safety requirements and air quality concerns across diverse industrial sectors. The country's emphasis on manufacturing expansion through initiatives like Make in India creates opportunities for dust monitoring equipment adoption in new industrial facilities and existing operations seeking compliance with strengthened environmental and safety regulations. Growing awareness of occupational health impacts and environmental quality concerns supports market development across industrial and commercial applications.

Demand for total dust detectors in Germany is projected to grow at a CAGR of 8.2%, supported by the country's emphasis on advanced measurement technology, comprehensive environmental regulations, and strict occupational safety standards that drive demand for sophisticated dust monitoring equipment across industrial and environmental applications. German industrial facilities and environmental agencies implement comprehensive dust monitoring programs that meet stringent accuracy requirements and provide detailed documentation for regulatory compliance and worker protection. The market is characterized by focus on technological excellence, measurement precision, and comprehensive compliance with environmental protection and occupational safety regulations.

Germany's leadership in precision instrumentation and environmental technology extends to dust monitoring equipment development, with companies investing heavily in sensor technology advancement, measurement accuracy improvement, and automated monitoring system development. The country's emphasis on environmental protection and occupational safety drives demand for dust monitoring systems that provide superior accuracy, reliability, and comprehensive data management capabilities. Industrial facilities prioritize advanced monitoring solutions that demonstrate compliance with strict environmental and safety standards while supporting operational efficiency and worker protection objectives.

The total dust detectors in Brazil is growing at a CAGR of 7.5%, driven by industrial expansion, environmental regulation development, and increasing awareness of air quality monitoring requirements across manufacturing, mining, and urban areas. The country's substantial mining and industrial sectors create significant demand for dust monitoring equipment that addresses occupational safety requirements and environmental compliance needs. Government environmental agencies and industrial facilities are investing in monitoring systems to address growing environmental protection requirements and worker safety standards across diverse industrial applications.

Brazil's mining industry expansion and industrial development create opportunities for dust monitoring equipment adoption in operations that generate substantial particulate matter emissions and require comprehensive monitoring for worker protection and environmental compliance. The country's emphasis on development and environmental protection drives adoption of monitoring systems that provide accurate measurement capabilities and support regulatory compliance initiatives. Growing environmental awareness and industrial safety consciousness support market development across mining, manufacturing, and construction applications.

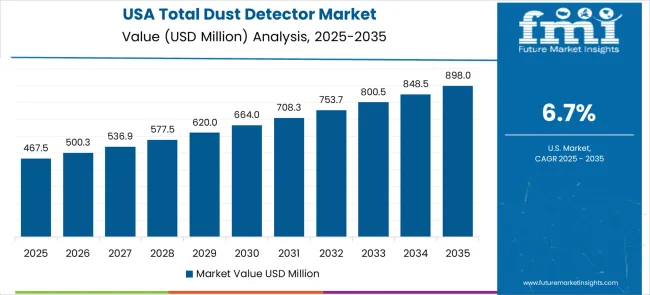

Demand for total dust detectors in the USA is expanding at a CAGR of 6.7%, driven by comprehensive occupational safety regulations, environmental protection requirements, and industrial facility emphasis on worker safety and environmental compliance across manufacturing, construction, and mining applications. American industrial facilities face stringent regulatory requirements for dust exposure monitoring and environmental emission control that create substantial demand for accurate, reliable monitoring equipment. The market benefits from established regulatory frameworks, comprehensive enforcement programs, and industrial facility commitment to worker safety and environmental protection.

The United States market demonstrates advanced adoption of dust monitoring technologies through established industrial safety programs, environmental protection initiatives, and comprehensive regulatory compliance requirements that drive continuous monitoring system implementation. Industrial facilities prioritize advanced monitoring solutions that provide accurate measurement capabilities, comprehensive documentation, and automated compliance reporting that support regulatory requirements and worker protection objectives. Growing emphasis on predictive analytics and automated monitoring systems enhances operational efficiency while ensuring regulatory compliance.

In the UK, total dust detectors are projected to grow at a CAGR of 6% through 2035, supported by comprehensive environmental monitoring programs, occupational safety regulations, and industrial facility' emphasis on worker protection and environmental compliance across diverse applications. British industrial facilities and environmental agencies implement dust monitoring systems that provide accurate measurement capabilities and support regulatory compliance requirements while addressing growing public concern about air quality and health impacts. The market benefits from established regulatory frameworks, advanced measurement technology adoption, and comprehensive environmental protection programs.

The UK's emphasis on environmental protection and occupational safety drives demand for dust monitoring systems that provide reliable measurement capabilities and support comprehensive environmental management programs. Industrial facilities prioritize monitoring solutions that demonstrate compliance with environmental protection requirements while providing worker safety assurance and operational efficiency benefits. Growing integration with environmental management systems and automated reporting capabilities enhances monitoring effectiveness while reducing operational complexity.

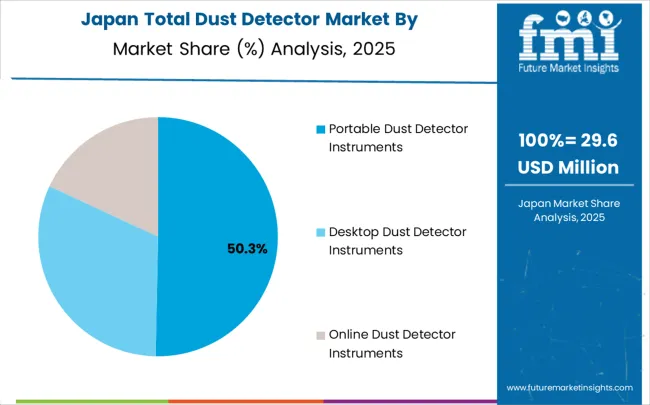

Revenue from total dust detectors in Japan is projected to grow at a CAGR of 5.3% through 2035, driven by the country's strong focus on measurement technology advancement, precision instrumentation development, and comprehensive quality standards that emphasize accuracy and reliability across dust monitoring applications. Japanese industrial facilities consistently demand high-performance monitoring equipment that delivers precise measurement capabilities while maintaining long-term stability and operational reliability. The market is characterized by advanced technology integration, comprehensive quality control, and emphasis on measurement precision that supports industrial excellence and environmental protection objectives.

Japan's leadership in precision instrumentation and sensor technology development extends to dust monitoring equipment innovation, with companies investing substantially in measurement accuracy improvement, sensor miniaturization, and automated calibration systems. The country's focus on manufacturing excellence and environmental protection drives demand for monitoring solutions that provide superior accuracy and reliability while supporting comprehensive environmental management and worker protection programs. Advanced integration with industrial control systems and data management platforms enhances operational efficiency while ensuring measurement accuracy and regulatory compliance.

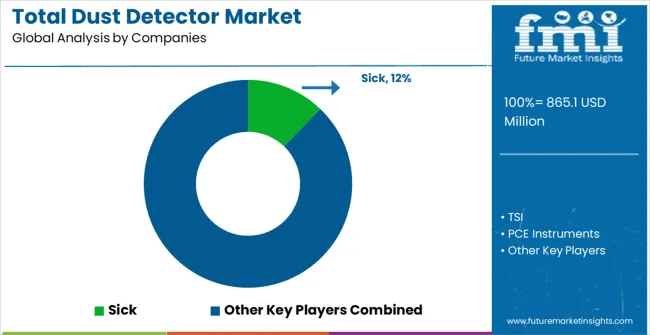

The total dust detector market is characterized by competition among established instrumentation manufacturers, environmental monitoring specialists, and industrial equipment providers who compete primarily on measurement accuracy, product reliability, and comprehensive service support rather than price-based strategies that could compromise quality standards or measurement precision. Market structure includes approximately 30-35 meaningful players globally, with moderate concentration as the top 10 companies control roughly 45-50% of total market value through comprehensive product portfolios and established customer relationships.

Market leaders including Sick, TSI, and Thermo Fisher Scientific leverage advanced sensor technologies, comprehensive measurement expertise, and established distribution networks to maintain competitive advantages through proven measurement accuracy and reliable performance across diverse applications. These companies benefit from economies of scale in manufacturing, extensive research and development capabilities, and comprehensive service support that ensures customer satisfaction and long-term relationships. Advanced technology platforms, comprehensive calibration services, and regulatory compliance expertise provide differentiated value that supports premium positioning and market leadership.

Challenger companies such as PCE Instruments, Kanomax, and Met One Instruments compete through specialized product offerings, regional market focus, and innovative measurement technologies that address specific application requirements or market segments. These companies emphasize cost-effective solutions, rapid product development, and flexible customer support that appeals to price-sensitive customers and specialized applications. Emerging specialists and regional manufacturers focus on niche applications, local service support, and customized solutions that provide differentiated value through application expertise and responsive customer service.

Competition increasingly centers on measurement accuracy, product reliability, and comprehensive service support that enable customers to achieve regulatory compliance and operational objectives while minimizing total cost of ownership. Market dynamics favor companies with established measurement expertise, proven product reliability, and comprehensive service capabilities rather than new entrants facing significant barriers including regulatory compliance requirements, measurement accuracy validation, and customer relationship development.

Total dust detectors represent essential environmental monitoring and occupational safety equipment that measures airborne particulate matter concentrations across industrial, commercial, and environmental applications. With the market projected to grow from USD 865 million in 2025 to USD 1,718 million by 2035 at a 7% CAGR, scaling adoption requires coordinated action across regulatory agencies, industry standards organizations, equipment manufacturers, end-user facilities, and financial institutions to address high equipment costs, calibration complexity, and measurement accuracy requirements across portable instruments (52.8% share) and environmental monitoring stations (48.6% share).

How Regulatory Agencies Could Strengthen Environmental Protection and Safety Standards?

Comprehensive Air Quality Standards and Enforcement: Establish stringent particulate matter monitoring requirements for industrial facilities, construction sites, and urban areas, while implementing standardized measurement protocols that ensure consistent dust concentration monitoring and regulatory compliance across diverse applications and geographic regions.

Occupational Safety and Health Regulations: Mandate continuous dust exposure monitoring in high-risk industries including mining, construction, manufacturing, and materials handling, while establishing clear exposure limits, monitoring frequency requirements, and response protocols that protect worker health and ensure regulatory compliance.

Equipment Certification and Performance Standards: Develop comprehensive certification programs for dust detection equipment that validate measurement accuracy, reliability, and environmental compatibility, while establishing performance benchmarks that ensure consistent quality and enable reliable supplier comparison across different technology platforms.

Data Reporting and Transparency Requirements: Implement mandatory reporting systems for dust concentration measurements that provide real-time public access to air quality data, while establishing standardized data formats and communication protocols that enable comprehensive environmental monitoring and public health protection.

International Standards Harmonization: Coordinate with global regulatory agencies to develop unified dust monitoring standards that facilitate international equipment trade and technology transfer, while ensuring consistent measurement protocols and quality requirements across different markets and applications.

How Industry Standards Organizations Could Advance Measurement Excellence and Market Development?

Technical Standards and Calibration Protocols: Establish comprehensive measurement standards for dust detection equipment including accuracy specifications, calibration procedures, and quality control requirements that ensure reliable performance across diverse environmental conditions and application requirements.

Professional Training and Certification Programs: Develop specialized training curricula for dust monitoring equipment operators, maintenance technicians, and data interpretation specialists, while establishing certification programs that validate technical competency and ensure consistent measurement quality across different industries and applications.

Best Practices and Application Guidelines: Create comprehensive application guides that optimize dust detector selection, installation procedures, and operational protocols for specific industries and monitoring requirements, while developing standardized methodologies that maximize measurement accuracy and operational efficiency.

Technology Advancement and Innovation Support: Coordinate research initiatives that advance dust detection technology including sensor development, wireless connectivity, and automated calibration systems, while facilitating collaboration between equipment manufacturers, research institutions, and end-user organizations.

Quality Assurance and Performance Verification: Develop testing protocols and performance verification procedures that validate equipment reliability and measurement accuracy, while establishing inter-laboratory comparison programs that ensure consistent measurement standards across different facilities and geographic regions.

How Equipment Manufacturers Could Enhance Technology and Market Penetration?

Advanced Sensor Technology and Measurement Accuracy: Invest in next-generation sensor technologies including optical scattering, beta attenuation, and gravimetric measurement systems that provide superior accuracy and reliability, while developing multi-parameter instruments that simultaneously measure different particle size ranges and concentration levels with enhanced precision.

IoT Integration and Smart Monitoring Systems: Incorporate wireless connectivity, cloud-based data management, and mobile device integration that enable remote monitoring and automated data collection, while developing predictive analytics capabilities that optimize maintenance scheduling and enhance operational efficiency across diverse monitoring networks.

Portable and Modular Equipment Design: Create lightweight, battery-powered instruments with extended operational life and ruggedized construction that withstand harsh environmental conditions, while developing modular system architectures that enable customization for specific applications and easy upgrade capabilities.

Automated Calibration and Quality Control: Implement automated calibration systems and self-diagnostic capabilities that reduce maintenance requirements and ensure measurement accuracy, while developing quality assurance features that provide real-time validation of instrument performance and measurement reliability.

Comprehensive Service and Support Networks: Establish global service networks with technical support, calibration services, and rapid repair capabilities that maximize instrument uptime and customer satisfaction, while providing training programs and technical documentation that support optimal equipment utilization.

How End-User Facilities Could Optimize Monitoring Programs and Compliance?

Comprehensive Monitoring Strategy Development: Implement systematic dust monitoring programs that integrate portable instruments, fixed monitoring stations, and automated data collection systems to provide complete coverage of workplace and environmental exposure risks, while establishing clear protocols for data collection, analysis, and response procedures.

Real-Time Monitoring and Alert Systems: Deploy continuous monitoring systems with automated alert capabilities that provide immediate notification of hazardous dust concentration levels, while implementing rapid response procedures that protect worker safety and minimize environmental impact during dust emission events.

Data Management and Regulatory Reporting: Establish comprehensive data management systems that collect, analyze, and archive dust concentration measurements for regulatory compliance and trend analysis, while implementing automated reporting capabilities that streamline compliance documentation and reduce administrative burden.

Integration with Environmental Management Systems: Connect dust monitoring equipment with broader environmental management platforms that coordinate air quality monitoring, emission control, and compliance management across multiple environmental parameters and regulatory requirements.

Performance Optimization and Continuous Improvement: Implement systematic performance evaluation programs that assess monitoring system effectiveness, identify optimization opportunities, and support continuous improvement in dust control and environmental protection practices.

How Financial Institutions Could Support Market Growth and Technology Access?

Equipment Financing and Leasing Programs: Provide specialized financing solutions for dust monitoring equipment purchases including flexible payment terms, performance-based contracts, and leasing options that reduce capital barriers and enable technology access for smaller facilities and organizations with limited budgets.

Environmental Compliance Investment Support: Develop financing products that help facilities meet environmental monitoring requirements and regulatory compliance obligations, while supporting comprehensive environmental management system implementation and upgrades that include advanced dust monitoring capabilities.

Technology Innovation and Development Funding: Support research and development investments in advanced dust detection technologies including sensor innovation, wireless connectivity, and artificial intelligence integration that improve measurement accuracy, operational efficiency, and cost-effectiveness.

Market Development and International Expansion: Finance market development initiatives including demonstration projects, technology validation programs, and international market entry strategies that accelerate dust monitoring technology adoption in emerging markets and new application segments.

Risk Management and Performance Assurance: Provide risk mitigation solutions including equipment performance guarantees, compliance insurance, and technology obsolescence protection that reduce customer investment risks and encourage adoption of advanced dust monitoring systems across diverse industries and applications.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD 865 million |

| Product Type | Portable dust detector instruments, desktop dust detector instruments, online dust detector instruments |

| End-Use | Environmental monitoring stations, industrial areas, and commercial areas |

| Measurement Range | Low-range detectors, medium-range detectors, high-range detectors |

| Technology | Optical scattering, beta attenuation, gravimetric measurement systems |

| Regions Covered | North America, Europe, East Asia, South Asia & Pacific, Latin America, Middle East & Africa |

| Countries Covered | United States, Canada, United Kingdom, Germany, France, China, Japan, South Korea, India, Brazil, Australia and 40+ countries |

| Key Companies Profiled | Sick, TSI, PCE Instruments, Kanomax, Acoem, Dynoptic, Matsushima Measure Tech Co, SKC, Sintrol, Sibata, Helmut Hund GmbH, Met One Instruments, Aeroqual, Envea, Trolex, Thermo Fisher Scientific, Ioner (Ramen), Laftech, Afriso, Siemens, Turnkey Instruments, GRIMM (Durag Group), Guangzhou Luftmy, Hunan Rika |

| Additional Attributes | Dollar sales by measurement technology and accuracy range, regional demand trends across North America, Europe, and Asia-Pacific, competitive landscape with established instrumentation manufacturers and emerging technology providers, customer preferences for portable versus fixed monitoring systems, integration with environmental management and industrial control systems, innovations in sensor technology and wireless connectivity features, and development of comprehensive monitoring solutions with predictive analytics and automated calibration capabilities for enhanced measurement accuracy and operational efficiency. |

The global total dust detector market is estimated to be valued at USD 865.1 million in 2025.

The market size for the total dust detector market is projected to reach USD 1,717.8 million by 2035.

The total dust detector market is expected to grow at a 7.1% CAGR between 2025 and 2035.

The key product types in total dust detector market are portable dust detector instruments, desktop dust detector instruments and online dust detector instruments.

In terms of application, environmental monitoring station segment to command 48.6% share in the total dust detector market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Industrial Dust Detector Instruments Market Size and Share Forecast Outlook 2025 to 2035

Dust Control System Market Size and Share Forecast Outlook 2025 to 2035

Total Reflection X-Ray Fluorescence Spectrometer Market Size and Share Forecast Outlook 2025 to 2035

Total Aflatoxin Test Kit Market Size and Share Forecast Outlook 2025 to 2035

Dust Suppressant Market Size and Share Forecast Outlook 2025 to 2035

Total Knee Replacement Market Size and Share Forecast Outlook 2025 to 2035

Total Hydrocarbon Analyzers Market Size and Share Forecast Outlook 2025 to 2035

Total Carbon Analyzers Market Growth - Trends & Outlook 2025 to 2035

Dust Extractor Market Growth – Trends & Forecast 2025 to 2035

Total Artificial Heart Market

Total Iron-Binding Capacity Reagents Market

Dust Covers Market

Industrial Grade Electrochemical CO Sensor Market Size and Share Forecast Outlook 2025 to 2035

Industrial Bench Scale Market Size and Share Forecast Outlook 2025 to 2035

Industrial Low Profile Floor Scale Market Size and Share Forecast Outlook 2025 to 2035

Industrial Sand Mill Market Size and Share Forecast Outlook 2025 to 2035

Industrial Control Network Modules Market Size and Share Forecast Outlook 2025 to 2035

Industrial Precision Oven Market Size and Share Forecast Outlook 2025 to 2035

Industrial Water Chiller for PCB Market Size and Share Forecast Outlook 2025 to 2035

Industrial & Commercial HVLS Fans Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA