The Dust Suppressant Market is estimated to be valued at USD 1.9 billion in 2025 and is projected to reach USD 3.2 billion by 2035, registering a compound annual growth rate (CAGR) of 5.6% over the forecast period.

| Metric | Value |

|---|---|

| Dust Suppressant Market Estimated Value in (2025 E) | USD 1.9 billion |

| Dust Suppressant Market Forecast Value in (2035 F) | USD 3.2 billion |

| Forecast CAGR (2025 to 2035) | 5.6% |

The Dust Suppressant market is experiencing strong growth due to the increasing demand for air quality management and environmental protection in industrial and construction activities. The market is primarily driven by stringent regulations on dust emissions, heightened awareness of occupational health and safety, and the need to protect surrounding communities and ecosystems.

Rising mining, infrastructure development, and road construction activities globally are contributing to a consistent demand for effective dust control solutions. Advances in material science have enabled the development of chemical and polymer-based dust suppressants that offer longer-lasting effectiveness, improved adhesion, and better environmental compliance.

The market outlook is favorable as industries increasingly seek solutions that reduce operational downtime, minimize environmental impact, and ensure regulatory compliance Innovations in sustainable and biodegradable dust suppressants are expected to create further opportunities, while increasing urbanization and industrialization continue to drive investments in large-scale dust management programs.

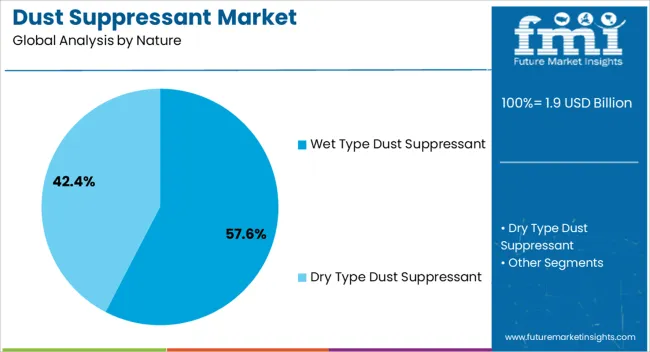

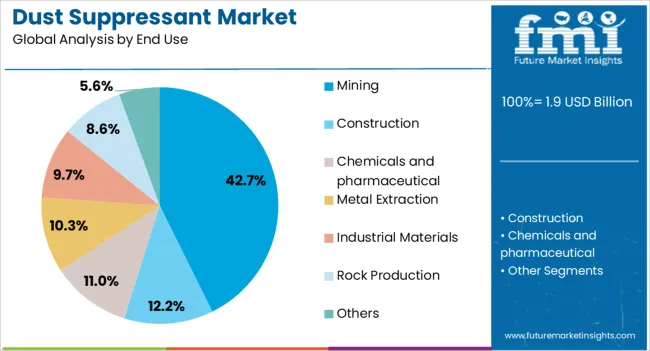

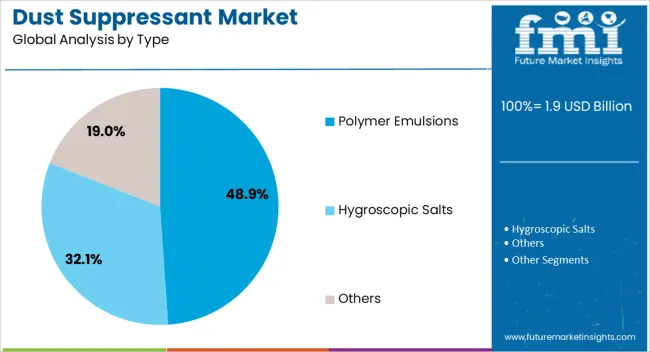

The dust suppressant market is segmented by nature, end use, type, and geographic regions. By nature, dust suppressant market is divided into Wet Type Dust Suppressant and Dry Type Dust Suppressant. In terms of end use, dust suppressant market is classified into Mining, Construction, Chemicals and pharmaceutical, Metal Extraction, Industrial Materials, Rock Production, and Others. Based on type, dust suppressant market is segmented into Polymer Emulsions, Hygroscopic Salts, and Others. Regionally, the dust suppressant industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The Wet Type Dust Suppressant segment is projected to hold 57.60% of the Dust Suppressant market revenue in 2025, establishing it as the leading nature category. This dominance is being driven by the efficiency of wet dust suppression methods in controlling airborne particles on roads, mining sites, and construction areas.

Wet solutions provide immediate dust suppression and allow for uniform coverage over large areas, which is critical in high-traffic or high-dust-generating operations. The segment’s growth has been reinforced by the increased adoption of automated spraying and irrigation systems that maximize the performance of wet dust suppressants while reducing water consumption.

In addition, wet type formulations are compatible with various additives that enhance adhesion and prolong dust suppression effects, offering significant operational advantages As industries continue to prioritize regulatory compliance and environmental stewardship, the demand for wet type dust suppressants is expected to maintain its leading position in the market.

The Mining end-use industry is expected to account for 42.70% of the Dust Suppressant market revenue in 2025, emerging as the largest end-use segment. Mining operations generate substantial amounts of airborne dust, posing health risks to workers and environmental hazards to surrounding communities.

The growth of this segment has been driven by regulatory mandates requiring dust control in open-pit and underground mining operations, along with a focus on improving worker safety and operational efficiency. Dust suppressants are employed in haul roads, stockpiles, and processing areas to reduce dust emissions and prevent equipment wear.

The adoption of advanced dust control technologies that integrate polymer and chemical additives has further strengthened the segment’s growth As global mining activities expand and sustainability initiatives intensify, the Mining segment is expected to continue leading the market due to the critical need for efficient and compliant dust mitigation strategies.

The Polymer Emulsions segment is anticipated to hold 48.90% of the Dust Suppressant market revenue in 2025, establishing it as the leading type category. This growth has been driven by the ability of polymer emulsions to form durable protective layers over soil and dust-prone surfaces, significantly reducing particle dispersion over extended periods.

The segment has benefited from increasing adoption in high-traffic industrial and construction zones, where long-term suppression performance is essential. Polymer emulsions also offer advantages such as ease of application, reduced water usage, and compatibility with automated spraying systems.

Environmental sustainability is a key factor contributing to the preference for polymer-based solutions, as these formulations often meet biodegradability and low-toxicity requirements With industrial activities and infrastructure projects continuing to expand globally, polymer emulsions are expected to remain a dominant solution in the Dust Suppressant market due to their proven efficiency and adaptability across multiple applications.

Dust suppressant chemicals are used to control dust in places such as roads, the cement industry and the mining industry. They can range from water to palliative materials including saline solutions based on magnesium chloride (MgCl2), calcium chloride (CaCl2) and sodium chloride (NaCl). Also, asphalt emulsions and lignin, as well as plant oils and natural clays may also be used as dust suppressant materials. Chloride-based dust suppressants are the most commonly used dust controllers; however, water is also commonly used as a dust suppressant. Water is used as a temporary dust suppressant on roads and building construction sites as well as gravel pits and quarries.

However, water must be applied regularly to maintain adequate moisture as it is moisture that binds fine particles to prevent dust. Other than water, the two commonly used dust suppressants are magnesium chloride and calcium chloride, which are hygroscopic in nature. Dust suppressant materials are generally hygroscopic, which absorb moisture from air and allow small dust particles to combine and increase in size, making them less prone to become airborne.

The dust suppressant is generally added to water and sprayed through a sprinkler. Dust suppressants aid in controlling dust at the time of loading, unloading, transferring and belt conveying, stack-out, crushing, reclaiming and other critical operations at locations.

Dust suppressants increase the surface area of the water droplet, enabling it to cover more area, thereby preventing dust to become airborne. They also carry an ionic charge that aids to attract dust molecules as well as repel water droplets, facilitating a better spread to the sprayed water to cover more area.

The global dust suppressant market is expected to grow significantly over the forecast period. Increasing awareness related to dust suppressant chemicals in manufacturing and mining industries as well as growth in investments in civil infrastructure are some of the crucial aspects influencing the global dust suppressant market positively.

Dust can raise numerous challenges such as harmful effects on health. Apart from health, cross-contamination and dust reclamation are the other challenges boosting the demand for dust suppressants in various industries. As dust suppressants are crucial to industries such as cement, construction and mining, the growth of these end-use industries is expected to drive the growth of the dust suppressant market.

However, dust suppressant operations are labour-oriented tasks and a shortage of skilled labour and low awareness among the general population are anticipated to restrain the growth of the global dust suppressant market. Despite these challenges, the current trend to use new and better technologies for superior results is expected to surge the demand for global dust suppressants over the forecast period.

Asia Pacific holds a significant share in the global dust suppressant market, owing to the presence of manufacturing sector in the region. The market for dust suppressants in Asia Pacific is expected to register higher consumption, owing to the higher demand form mining and metallurgical industries. Investments in the construction industry in Asia Pacific are also expected to boost the dust suppressant market over the forecast period.

Europe, North America is the Asia Pacific is expected to hold more than half of the market share of the global dust suppressant market. MEA is projected to exhibit high growth in the dust suppressant market, owing to the substantial growth in the construction sector in the region. The rest of the world is estimated to account for a relatively small share of the dust suppressant market.

The report is a compilation of first-hand information, qualitative and quantitative assessment by industry analysts, inputs from industry experts and industry participants across the value chain. The report provides in-depth analysis of parent market trends, macro-economic indicators and governing factors along with market attractiveness as per segments. The report also maps the qualitative impact of various market factors on market segments and geographies.

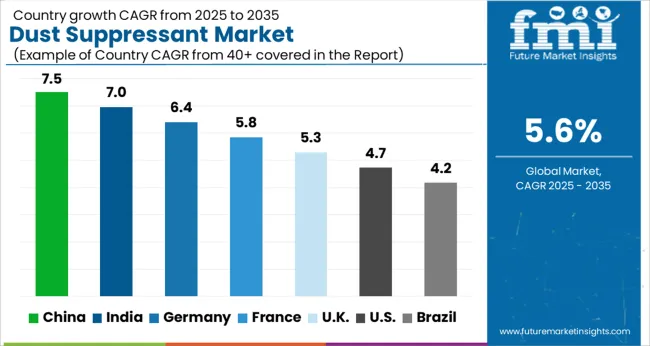

| Country | CAGR |

|---|---|

| China | 7.5% |

| India | 7.0% |

| Germany | 6.4% |

| France | 5.8% |

| UK | 5.3% |

| USA | 4.7% |

| Brazil | 4.2% |

The Dust Suppressant Market is expected to register a CAGR of 5.6% during the forecast period, exhibiting varied country level momentum. China leads with the highest CAGR of 7.5%, followed by India at 7.0%. Developed markets such as Germany, France, and the UK continue to expand steadily, while the USA is likely to grow at consistent rates. Brazil posts the lowest CAGR at 4.2%, yet still underscores a broadly positive trajectory for the global Dust Suppressant Market. In 2024, Germany held a dominant revenue in the Western Europe market and is expected to grow with a CAGR of 6.4%. The USA Dust Suppressant Market is estimated to be valued at USD 674.0 million in 2025 and is anticipated to reach a valuation of USD 1.1 billion by 2035. Sales are projected to rise at a CAGR of 4.7% over the forecast period between 2025 and 2035. While Japan and South Korea markets are estimated to be valued at USD 87.0 million and USD 47.9 million respectively in 2025.

| Item | Value |

|---|---|

| Quantitative Units | USD 1.9 Billion |

| Nature | Wet Type Dust Suppressant and Dry Type Dust Suppressant |

| End Use | Mining, Construction, Chemicals and pharmaceutical, Metal Extraction, Industrial Materials, Rock Production, and Others |

| Type | Polymer Emulsions, Hygroscopic Salts, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

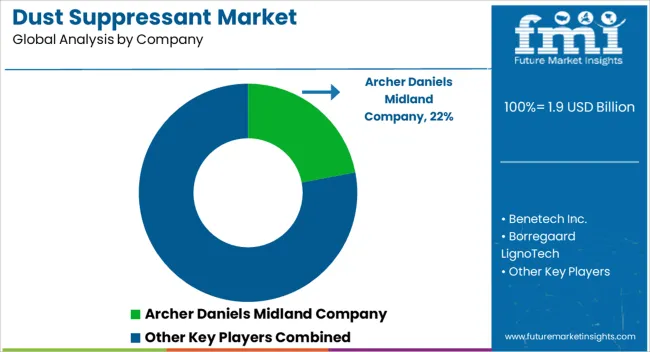

| Key Companies Profiled | Archer Daniels Midland Company, Benetech Inc., Borregaard LignoTech, Cargill Incorporated, Chemtex Speciality Limited, DowDuPont Inc., GelTech Solutions, Huntsman International LLC, and Hexion Inc. |

The global dust suppressant market is estimated to be valued at USD 1.9 billion in 2025.

The market size for the dust suppressant market is projected to reach USD 3.2 billion by 2035.

The dust suppressant market is expected to grow at a 5.6% CAGR between 2025 and 2035.

The key product types in dust suppressant market are wet type dust suppressant and dry type dust suppressant.

In terms of end use, mining segment to command 42.7% share in the dust suppressant market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Dust Control System Market Size and Share Forecast Outlook 2025 to 2035

Dust Extractor Market Growth – Trends & Forecast 2025 to 2035

Dust Covers Market

Industrial Dust Treatment System Market Size and Share Forecast Outlook 2025 to 2035

Industrial Vertical Washing Tower Market Size and Share Forecast Outlook 2025 to 2035

Industrial Electronics Packaging Market Forecast and Outlook 2025 to 2035

Industrial Absorbent Market Forecast and Outlook 2025 to 2035

Industrial Furnace Industry Analysis in Europe Forecast and Outlook 2025 to 2035

Industrial Denox System Market Size and Share Forecast Outlook 2025 to 2035

Industrial Electronic Pressure Switch Market Size and Share Forecast Outlook 2025 to 2035

Industrial WiFi Module Market Size and Share Forecast Outlook 2025 to 2035

Industrial Security System Market Forecast Outlook 2025 to 2035

Industrial Film Market Forecast Outlook 2025 to 2035

Industrial Floor Mat Market Forecast Outlook 2025 to 2035

Industrial Insulation Market Forecast and Outlook 2025 to 2035

Industrial Process Water Coolers Market Forecast and Outlook 2025 to 2035

Industrial Grade Ammonium Hydrogen Fluoride Market Forecast and Outlook 2025 to 2035

Industrial Grade Sodium Bifluoride Market Forecast and Outlook 2025 to 2035

Industrial Evaporative Condenser Market Size and Share Forecast Outlook 2025 to 2035

Industrial Power Supply Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA