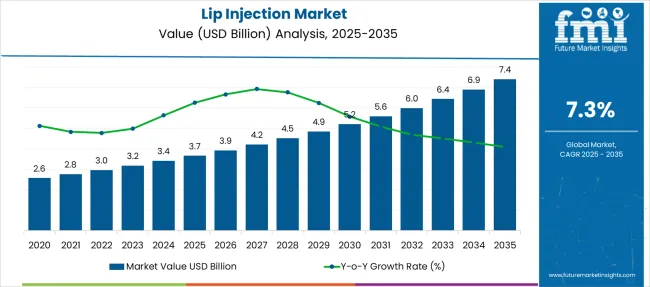

The Lip Injection Market is estimated to be valued at USD 3.7 billion in 2025 and is projected to reach USD 7.4 billion by 2035, registering a compound annual growth rate (CAGR) of 7.3% over the forecast period. The market growth is fueled by procedural adoption and premium product penetration. Unlike exponential markets, the industry exhibits linear compounding, adding USD 0.3–0.4 billion annually between 2025 and 2028, accelerating to USD 0.6 billion per year post-2031.

5-Year Block Analysis indicates 2025–2029 adding USD 1.2 billion, while 2030–2034 contributes USD 1.8 billion, signifying higher elasticity in later phases. Despite a modest CAGR, consistency in incremental growth reflects durability against market shocks, appealing to capital-intensive players seeking stable margins. YoY growth rates exhibit initial peaks in 2028, driven by rising cosmetic procedures in emerging economies, before gradually tapering toward 2035, necessitating portfolio diversification to dermal fillers and anti-aging solutions for sustained revenue streams. The segment’s mid-range CAGR emphasizes risk-hedged positioning over speculative investments, targeting Latin America and APAC as demand hotspots.

Lifestyle shifts and non-surgical preferences increasingly drive aesthetic medicine, and the lip injection market reflects this behavioral trend. The appeal lies in procedures that require short recovery times while delivering visible, customizable results, positioning injectables as a mainstream beauty service rather than a luxury intervention.

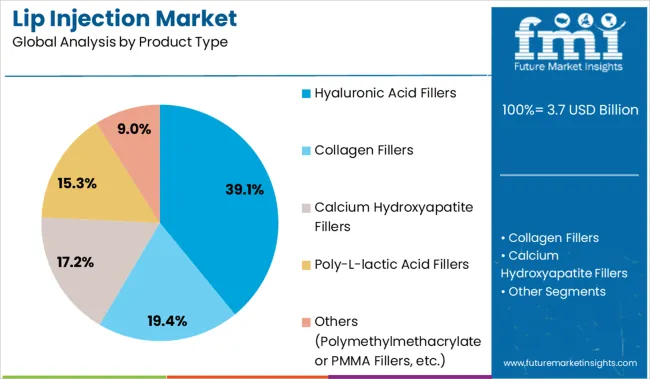

Hyaluronic acid-based fillers hold 39.1% share due to their safety profile, reversibility, and compatibility with natural lip tissue. Their adaptability for both subtle enhancement and volume restoration makes them the preferred choice across demographics. The surge in procedure acceptance among millennials and Gen Z, amplified by social media visibility, has accelerated market penetration. North America dominates with a mature aesthetics ecosystem and high consumer spend, while Asia-Pacific shows rising momentum, driven by increasing affordability and beauty-conscious populations. The next phase of growth will hinge on advancements in bioengineered fillers with extended longevity, reduced allergenic risk, and integrated lidocaine for comfort.

| Metric | Value |

|---|---|

| Lip Injection Market Estimated Value in (2025E) | USD 3.7 billion |

| Lip Injection Market Forecast Value in (2035F) | USD 7.4 billion |

| Forecast CAGR (2025 to 2035) | 7.3% |

The lip injection market is undergoing rapid transformation due to increasing demand for aesthetic enhancement, rising influence of social media beauty standards, and the growing accessibility of non-surgical cosmetic procedures. With more individuals seeking minimally invasive treatments, lip augmentation has become a mainstream offering across dermatology and aesthetic clinics globally.

The popularity of quick, reversible procedures has made injectables the preferred method of enhancement, particularly among younger demographics. Technological improvements in formulation stability, fine needle precision, and post-procedure recovery have further encouraged adoption.

Favorable regulatory support for hyaluronic acid-based injectables and evolving clinical guidelines promoting safe aesthetic practices have strengthened market expansion. As disposable income rises and patient awareness around cosmetic dermatology increases, the market is expected to continue its strong growth trajectory, particularly in urban centers and medical spa environments offering personalized treatment options.

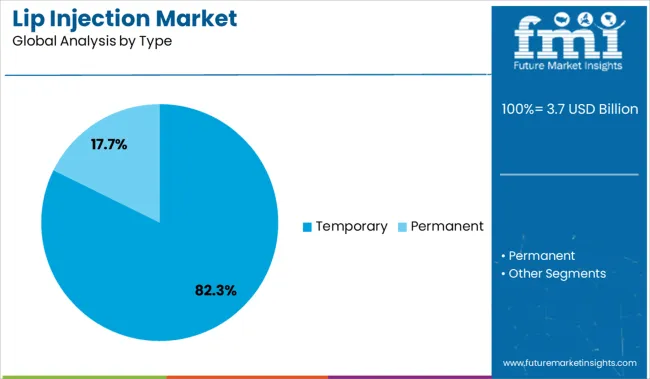

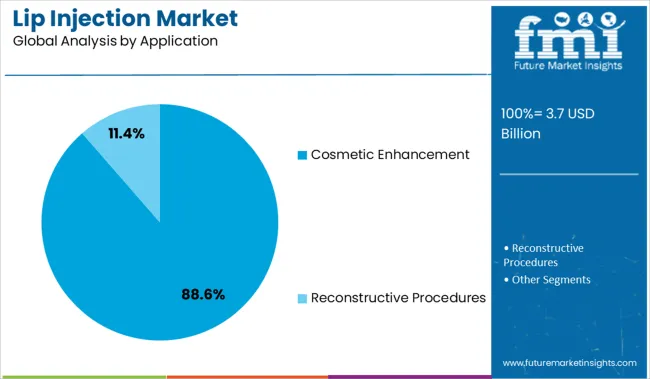

The lip injection market is segmented by product type, type, application, end use, distribution channel, and region. By product type, it includes hyaluronic acid fillers, collagen fillers, calcium hydroxyapatite fillers, poly-L-lactic acid fillers, and others such as polymethylmethacrylate (PMMA) fillers. In terms of type, the segmentation comprises temporary and permanent fillers, catering to varied patient preferences and treatment durations. Based on application, the market is divided into cosmetic enhancement and reconstructive procedures. By end use, it includes specialty and dermatology clinics, hospitals and clinics, beauty salons or spa centers, and other facilities such as surgical centers.

Distribution channels include offline networks, drug stores, retail pharmacy stores, other physical outlets, and online platforms for broader accessibility. Regionally, the market spans North America, Latin America, Western and Eastern Europe, Balkan and Baltic countries, Russia and Belarus, Central Asia, East Asia, South Asia and Pacific, and the Middle East and Africa.

The hyaluronic acid fillers segment is expected to account for 39.1% of total revenue in 2025 under the product type category, establishing it as the leading product. This dominance is due to the biocompatibility, reversibility, and natural-looking volumizing effects offered by hyaluronic acid.

The substance’s ability to retain moisture and provide immediate, subtle enhancement has made it the preferred material for lip augmentation procedures. Additionally, reduced risk of allergic reactions and the availability of FDA-approved formulations have supported widespread use by dermatologists and plastic surgeons.

Clinics have also favored hyaluronic acid due to its adjustability and patient satisfaction levels, enabling tailored treatments with lower complication rates. Ongoing R&D into longer-lasting variants and enhanced viscosity products is expected to further reinforce its position as the material of choice in lip injection procedures.

The temporary filler type segment is projected to hold 82.3% of the total lip injection market revenue in 2025, making it the most dominant category. This high share is attributed to patient preference for non-permanent aesthetic changes and the flexibility to modify or reverse outcomes based on evolving beauty expectations.

Temporary fillers offer the benefit of gradual absorption by the body, ensuring lower long-term risk and less psychological commitment compared to permanent solutions. They also allow for periodic adjustments and help maintain a fresh, youthful appearance without undergoing surgery.

Healthcare providers have increasingly adopted temporary solutions as they align with safety protocols and reduce liability concerns. Furthermore, marketing efforts emphasizing short-term enhancements with minimal downtime have resonated with a broad consumer base, sustaining the segment’s leadership in lip augmentation.

The cosmetic enhancement segment is anticipated to represent 88.6% of market revenue in 2025 within the application category, solidifying its dominance. This is being driven by rising demand for facial harmonization, lip symmetry, and volume restoration as part of broader aesthetic goals. A growing number of individuals are seeking non-invasive enhancements that improve facial appeal while maintaining natural expressions.

Clinics and practitioners have focused on offering subtle, tailored cosmetic outcomes, which has amplified demand for lip injections as a cornerstone procedure. Increasing societal acceptance of aesthetic treatments and influencer-driven trends have normalized cosmetic enhancement, particularly among millennials and Gen Z consumers.

The ease of treatment, low recovery time, and visible before-and-after results have further contributed to the strong uptake in this segment. As technology and practitioner skillsets advance, cosmetic enhancement is expected to remain the central application for lip injections across global markets.

Injectable fillers, especially those containing hyaluronic acid, are increasingly preferred for volume restoration and contouring. Clinics, medspas, and dermatology centers are expanding lip enhancement offerings through branded filler products, loyalty programs, and combination treatments with skin-tightening procedures.

Branded campaigns and digital consultations have helped normalize aesthetic procedures across wider demographics. Hyaluronic acid’s reversibility, tissue compatibility, and smooth integration have made it the leading component in injectable solutions.

Increased preference for quick, outpatient cosmetic enhancements has led to the widespread adoption of lip injection procedures. Hyaluronic acid-based fillers have gained acceptance due to their low allergenic risk, adjustable volume effect, and natural integration into lip tissue.

The demand has been influenced by social media trends, celebrity aesthetics, and increased acceptance of aesthetic enhancement among all age groups. Clinics have begun bundling lip fillers with facial harmonization services to create repeat engagement.

Regulations in major markets have supported safety labeling, batch traceability, and practitioner certification. The use of cannula-based techniques, topical numbing protocols, and microdroplet injection strategies has reduced patient discomfort and bruising. Lip contouring has evolved into a routine enhancement rather than a niche treatment, further expanding patient demographics and procedure frequency.

Growth opportunities in the lip injection sector stem from product diversification, digital outreach, and service accessibility. Manufacturers are introducing long-lasting lip filler formulations with advanced cross-linking technologies that maintain elasticity and shape retention.

Clinics are adopting digital platforms for pre-treatment consultation, aesthetic previewing, and post-care monitoring, enabling remote engagement. Influencer-driven campaigns, virtual events, and AI-based facial symmetry apps are being leveraged to educate consumers and build comfort with cosmetic interventions.

Partnerships between dermatology brands and online beauty retailers are making information and booking tools widely available. In addition, expansion into secondary cities and medical tourism zones is being supported by traveling specialists and franchised aesthetic centers. Loyalty programs, monthly filler subscription models, and mobile medspa units are creating recurring revenue streams and broader patient retention across competitive geographies.

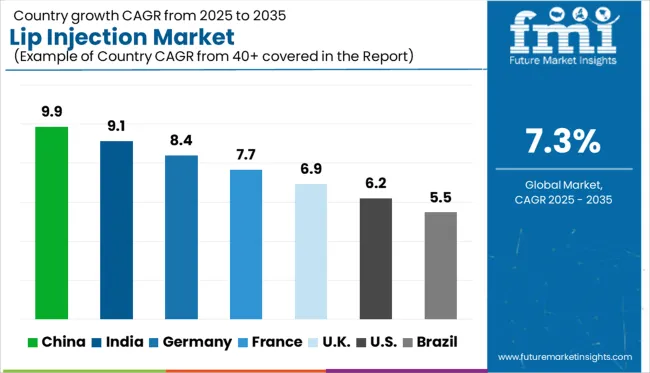

| Countries | CAGR |

|---|---|

| China | 9.9% |

| India | 9.1% |

| Germany | 8.4% |

| France | 7.7% |

| UK | 6.9% |

| USA | 6.2% |

| Brazil | 5.5% |

The global lip injection market is projected to grow at a CAGR of 7.3% from 2025 to 2035, fueled by increased procedure frequency, cross-border aesthetic tourism, and the expansion of injectable filler portfolios. China leads with a 9.9% CAGR, driven by premium clinic expansion, influencer-led demand, and a growing market for hyaluronic acid-based formulations.

India follows at 9.1%, supported by affordability-driven procedures, training academies for aesthetic professionals, and rising demand from Tier I and Tier II cities. Germany records 8.4%, reflecting clinical sophistication, customized lip contouring protocols, and multi-product filler availability. France posts 7.7% CAGR, shaped by dermo-cosmetic convergence and the rise of minimally invasive aesthetics.

The United Kingdom grows at 6.9%, focused on medically supervised injectables, regulatory standardization, and high retention in repeat treatments. These five countries represent a diverse mix of procedure-driven growth and product-led innovation across 40+ nations.

Demand for lip injections in China is projected to grow at a CAGR of 9.9%, driven by the proliferation of aesthetic clinics, premium filler portfolios, and social media influence on beauty standards. Clinics are offering package-based injectable services, often combined with facial contouring or anti-aging treatments.

Hyaluronic acid-based fillers dominate, with growing preference for natural texture and hydration-enhancing results. Local filler brands are competing with global leaders by emphasizing price-to-performance value.

Influencer marketing and live-streamed procedures have normalized aesthetic enhancements, especially among younger adults. Medical professionals with dermatology backgrounds are increasingly leading filler procedures to meet rising expectations around safety and technique.

Sales of lip injections in India is expected to expand at a CAGR of 9.1%, supported by increased access to trained injectors, affordability-led offerings, and bundled cosmetic services. Clinics are offering entry-level lip enhancements as part of broader facial rejuvenation packages.

Certification programs have raised the bar for clinical precision and patient safety. Non-surgical cosmetic demand continues to rise across regions, with injectable lip contouring gaining visibility through digital content. Payment plans and introductory offers are being adopted to build client retention. Product choices vary by viscosity and crosslinking, with lighter fillers preferred for first-time procedures and short-term aesthetic goals.

The demand lip injection in Germany is forecast to grow at a CAGR of 8.4%, with emphasis placed on procedural safety, anatomical precision, and clinician-guided filler protocols. Clinics utilize high-viscosity fillers for enhanced definition and stability in lip architecture.

Medical-grade products with low inflammatory response and consistent volume retention have gained preference. Patient consultations prioritize proportion, symmetry, and customized injection mapping. German aesthetic professionals have adopted multi-layered injection techniques for both contour and volume restoration.

Educational forums and peer-reviewed journals are being used to promote standards of care in injectable treatments, reinforcing the country’s position in regulated cosmetic dermatology.

United Kingdom lip injection market is projected to grow at a CAGR of 6.9%, shaped by the rise of medically operated aesthetic clinics, standardization of service protocols, and increased procedural transparency. Injectables are being offered with informed-consent documentation and structured aftercare consultations.

The transition toward safety-regulated providers has raised demand for clinician-administered lip fillers. Minimalist enhancement styles dominate preferences, particularly for subtle plumping and defined vermilion borders. Clinics are investing in loyalty schemes and automated appointment platforms to maintain high retention among returning patients. Multi-treatment packages focused on facial proportion are being adopted across regulated practices.

United Kingdom lip injection market is projected to grow at a CAGR of 6.9%, shaped by the rise of medically operated aesthetic clinics, standardization of service protocols, and increased procedural transparency. Injectables are being offered with informed-consent documentation and structured aftercare consultations. The transition toward safety-regulated providers has raised demand for clinician-administered lip fillers.

Minimalist enhancement styles dominate preferences, particularly for subtle plumping and defined vermilion borders. Clinics are investing in loyalty schemes and automated appointment platforms to maintain high retention among returning patients. Multi-treatment packages focused on facial proportion are being adopted across regulated practices.

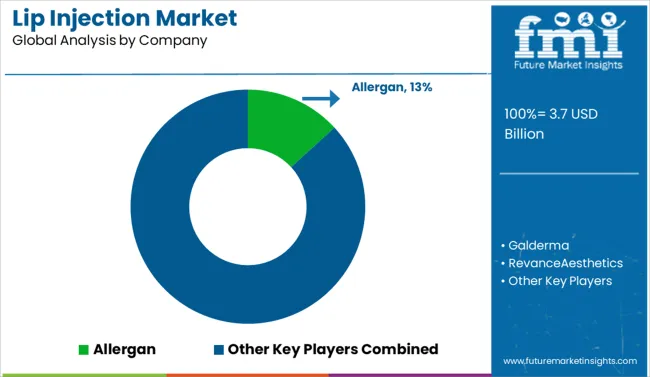

The lip injection industry is led by Allergan, holding a 13.2% market share through its Juvéderm product line, which remains a top choice for hyaluronic acid-based dermal fillers targeting lip augmentation. Galderma and Revance Aesthetics maintain strong positions with Restylane and the RHA Collection, known for their tailored gel textures and durability.

Merz Pharma and Vivacy have built traction by emphasizing controlled cross-linking methods to improve shape retention and treatment precision. Sinclair and Hugel continue to expand their geographic reach by offering regulatory-cleared fillers for aesthetic professionals in Europe and Asia.

Companies like Hyamed and Bioplus cater to price-sensitive clinics by offering reliable OEM solutions. Current competition revolves around better integration with tissue, extended effect duration, and practitioner-preferred delivery technologies that support precise application.

In March 2024, Allergan Aesthetics announced FDA approval and nationwide availability of JUVÉDERM® VOLUMA® XC, the first HA filler approved for treating moderate to severe temple hollowing in adults.

| Item | Value |

|---|---|

| Quantitative Units | USD 3.7 Billion |

| Product Type | Hyaluronic Acid Fillers, Collagen Fillers, Calcium Hydroxyapatite Fillers, Poly-L-lactic Acid Fillers, and Others (Polymethylmethacrylate or PMMA Fillers, etc.) |

| Type | Temporary and Permanent |

| Application | Cosmetic Enhancement and Reconstructive Procedures |

| End Use | Specialty & Dermatology Clinics, Hospitals & Clinics, Beauty Salons/Spa Centers, and Others (Surgical centers, etc.) |

| Distribution Channel | Offline, Drug Stores, Retail Pharmacy Stores, Others, and Online |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Allergan, Galderma, RevanceAesthetics, MerzPharma, Vivacy, Sinclair, Hugel, SunevaMedical, Hyamed, Bioplus, Ipsen, and Medtox |

| Additional Attributes | Dollar sales for lip injection are segmented by filler type hyaluronic acid, calcium hydroxylapatite, and poly-L-lactic acid with hyaluronic acid accounting for the lion’s share. Demand is rising for long-duration, natural-looking volumization with added collagen stimulation. OEMs and CDMOs support turnkey production of pre-filled syringes. Adoption is strongest in North America and Europe, driven by aesthetic trend growth and non-surgical preference. |

The global lip injection market is estimated to be valued at USD 3.7 billion in 2025.

The market size for the lip injection market is projected to reach USD 7.4 billion by 2035.

The lip injection market is expected to grow at a 7.3% CAGR between 2025 and 2035.

The key product types in lip injection market are hyaluronic acid fillers, collagen fillers, calcium hydroxyapatite fillers, poly-l-lactic acid fillers and others (polymethylmethacrylate or pmma fillers, etc.).

In terms of type, temporary segment to command 82.3% share in the lip injection market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Liposuction Market Size and Share Forecast Outlook 2025 to 2035

Lipstick Molding Machines Market Size and Share Forecast Outlook 2025 to 2035

Lip Filler Market Analysis Size and Share Forecast Outlook 2025 to 2035

Lip Plumping and Filler Creams Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Lip Care Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Lipid-Based Vitamin C Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Liposomal Doxorubicin Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Lip Oils Market Size and Share Forecast Outlook 2025 to 2035

Lip Care Packaging Market Size and Share Forecast Outlook 2025 to 2035

Lipase Testing Reagents Market Size and Share Forecast Outlook 2025 to 2035

Lip Gloss Tube Market Analysis by Product Type, Material, Capacity, and Region Through 2025 to 2035

The Liposuction Surgery Devices Market is segmented By Technology and End User from 2025 to 2035

Lipase Market Size, Growth, and Forecast for 2025 to 2035

Lip Powder Market Analysis by Form, End-User, Sales Channel and Region from 2025 to 2035

Lipid Nanoparticles Market Insights - Growth & Forecast 2025 to 2035

Industry Share Analysis for Lip Gloss Tube Providers

Lipids Market Growth - Key Drivers & Sales Trends

Lip Balm Tube Market Trends & Industry Growth Forecast 2024-2034

Lipstick Market

Lipolyzed Butter Fat Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA