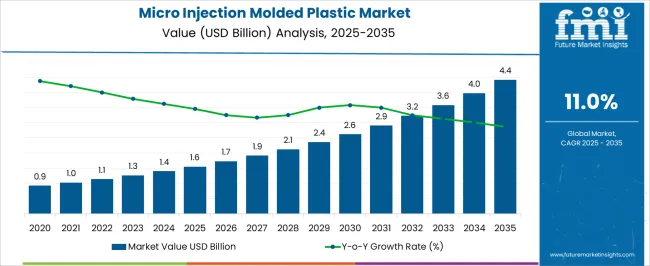

The micro injection molded plastic market is expected to expand from USD 1.6 billion in 2025 to USD 4.4 billion by 2035, growing at a compound annual growth rate of 11.0%. During the early adoption stage (2020–2024), growth was gradual as specialized industries began experimenting with micro injection molding for precise and small-scale components. Market values increased from 0.9 billion USD to 1.4 billion USD, reflecting cautious investment and limited industry awareness.

Early adopters helped define operational standards and supply chains, setting the stage for broader acceptance. This foundational period was critical for building confidence and technical validation across niche applications. Between 2025 and 2030, the market moves into a scaling phase, rising from 1.6 billion USD to around 3.2 billion USD. Wider adoption across industries accelerates production and commercial uptake, while cost advantages and efficiency improvements attract more clients. From 2030 to 2035, the market transitions into consolidation, reaching 4.4 billion USD by 2035. Leading players strengthen their positions, smaller competitors exit or merge, and growth stabilizes. Adoption becomes widespread, with incremental gains driven by optimized manufacturing and expanded market reach.

| Metric | Value |

|---|---|

| Micro Injection Molded Plastic Market Estimated Value in (2025 E) | USD 1.6 billion |

| Micro Injection Molded Plastic Market Forecast Value in (2035 F) | USD 4.4 billion |

| Forecast CAGR (2025 to 2035) | 11.0% |

The micro injection molded plastic market is a specialized segment within several broader parent markets. In 2025, the total market for plastics manufacturing across these sectors is estimated at over 350 billion USD, growing to around 600 billion USD by 2035, representing a CAGR of approximately 5.3%. Micro injection molding currently accounts for a small share, less than 0.5% in 2025, rising to about 0.7% by 2035. Key parent markets include: automotive plastics, consumer electronics, medical devices, packaging, aerospace components, industrial machinery, electrical equipment, precision tools, and 3D printing polymers. Automotive plastics dominate in volume due to lightweighting and fuel efficiency requirements, contributing nearly 25% of the parent market. Consumer electronics and medical devices are the fastest-growing sectors for micro injection applications, representing 15% and 12% of total demand, respectively, due to their need for miniaturized, precise components.

Packaging and aerospace contribute 18% combined, while industrial machinery, electrical equipment, precision tools, and 3D printing polymers account for the remaining 30%. The overall injection molded plastics market grows steadily, but the micro segment outpaces it with an 11.0% CAGR, reflecting increasing adoption in high-precision applications. This growth signals new opportunities for suppliers of specialty polymers, micro-molding machinery, and advanced tooling.

The micro injection molded plastic market is expanding rapidly due to increasing demand for precision components in high performance industries such as medical, electronics, and automotive. Advancements in miniaturization technology and the ability to produce complex micro parts with high dimensional accuracy have positioned micro injection molding as a preferred manufacturing process.

The adoption of engineering polymers with superior strength, chemical resistance, and thermal stability is enhancing the performance and lifespan of micro components. Growing use in minimally invasive surgical devices, wearable electronics, and advanced sensor systems is further supporting market growth.

Regulatory standards that require high quality and defect free production, especially in the medical and healthcare sector, are driving investments in state of the art molding equipment and process automation. The market outlook remains positive as manufacturers continue to innovate with advanced materials and optimize processes to meet evolving industrial and biomedical requirements.

The micro injection molded plastic market is segmented by material type, application, and geographic regions. By material type, the micro injection molded plastic market is divided into Liquid-crystal polymer (LCP), Polyether ether ketone (PEEK), Polycarbonate (PC), Polyethylene (PE), Polyoxymethylene (POM), and Others. In terms of application, micro injection molded plastic market is classified into Medical and healthcare, Automotive, Electronics, Telecommunications, Aerospace and defense, and Others.

Regionally, the micro injection molded plastic industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The liquid crystal polymer segment is expected to account for 38.60% of the total market revenue by 2025 within the material type category, making it the leading segment. Its dominance is driven by exceptional mechanical strength, low moisture absorption, and resistance to a wide range of chemicals, which are essential for high precision applications.

LCP’s dimensional stability at elevated temperatures allows for the production of intricate and miniaturized components used in critical environments. Its compatibility with high-speed molding processes enhances productivity and reduces manufacturing costs.

The combination of performance reliability, process efficiency, and material resilience has solidified the position of liquid crystal polymer as the preferred choice in the micro-injection molded plastic market.

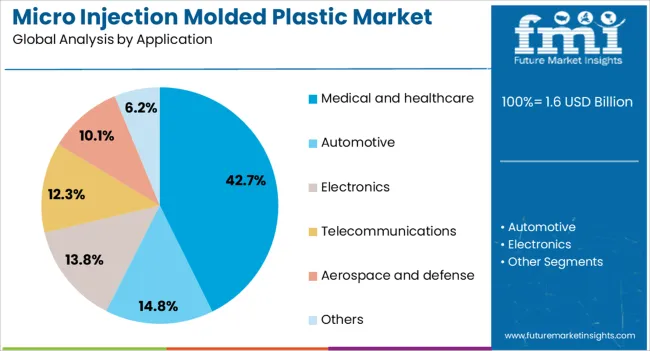

The medical and healthcare segment is projected to hold 42.70% of total market revenue by 2025 under the application category, making it the most prominent application area. This growth is attributed to increasing demand for micro molded components in surgical instruments, diagnostic devices, and implantable systems.

The ability to produce highly precise, biocompatible parts with consistent quality is critical in meeting stringent regulatory and safety standards in the healthcare industry. Rising adoption of minimally invasive procedures and the growing need for microfluidic devices in diagnostics are further driving segment growth.

Continuous innovation in medical device design and the integration of advanced polymers have reinforced the leadership of the medical and healthcare application in the micro injection molded plastic market.

The micro injection molded plastic market is expanding due to rising demand for miniaturized, high-precision plastic components in medical devices, electronics, automotive, and consumer products. North America and Europe lead with advanced molding systems for high-tolerance applications requiring superior surface finish and material performance.

Asia-Pacific shows rapid growth driven by electronics manufacturing, healthcare device production, and automotive miniaturization. Manufacturers differentiate through advanced polymer selection, multi-cavity molds, and precise process control. Regional variations in production expertise, cost structures, and material availability influence adoption and competitive positioning globally.

Adoption of micro injection molded plastics is heavily influenced by the demand for high-precision, miniaturized components. North America and Europe focus on medical devices, electronics connectors, and automotive sensors requiring tight dimensional tolerances and repeatable quality. Asia-Pacific markets emphasize high-volume electronics and consumer product applications, where cost efficiency and production speed are key. Differences in precision requirements and process capabilities affect mold design, material selection, and production methods. Leading suppliers invest in multi-cavity molds, precision tooling, and process monitoring systems, while regional manufacturers provide scalable, cost-effective solutions. Precision and tolerance contrasts shape adoption, product reliability, and competitiveness across global micro injection molded plastic applications.

Material selection and polymer performance are crucial drivers of market adoption. North America and Europe prioritize engineering-grade thermoplastics and specialty polymers for high-temperature, chemically resistant, and biocompatible applications. Asia-Pacific focuses on commodity polymers with functional additives for cost-sensitive electronics, automotive, and consumer applications. Differences in polymer choice affect product performance, durability, and end-use suitability. Leading suppliers provide high-performance polymers, reinforced compounds, and tailored material blends, while regional players deliver practical, economical alternatives. Material and polymer optimization contrasts shape adoption, functional reliability, and competitive positioning in the global micro injection molded plastic market.

Advanced molding equipment and process control systems drive adoption in high-precision applications. North America and Europe emphasize micro injection machines with precise temperature control, multi-axis injection, and automated quality monitoring for consistent output. Asia-Pacific markets adopt reliable yet cost-effective equipment for mass-production electronics and automotive parts. Differences in equipment sophistication affect cycle time, defect rates, and production yield. Leading suppliers invest in real-time monitoring, servo-driven injection, and robotic integration, while regional manufacturers provide durable, practical machines. Equipment and process contrasts shape adoption, production efficiency, and competitiveness in global micro injection molded plastic applications.

Compliance with regulatory standards in medical, automotive, and electronics sectors influences adoption. North America and Europe enforce stringent ISO, FDA, and RoHS guidelines for material safety, precision, and environmental compliance. Asia-Pacific regulations vary; developed regions follow international norms, while emerging markets adopt practical local standards. Differences in regulatory compliance affect product approval, quality assurance, and market access. Suppliers offering certified, regulation-compliant solutions gain higher adoption, while regional manufacturers focus on affordable compliance. Regulatory contrasts shape adoption, product reliability, and competitive positioning in the global micro injection molded plastic market.

| Country | CAGR |

|---|---|

| China | 14.9% |

| India | 13.8% |

| Germany | 12.7% |

| France | 11.6% |

| UK | 10.5% |

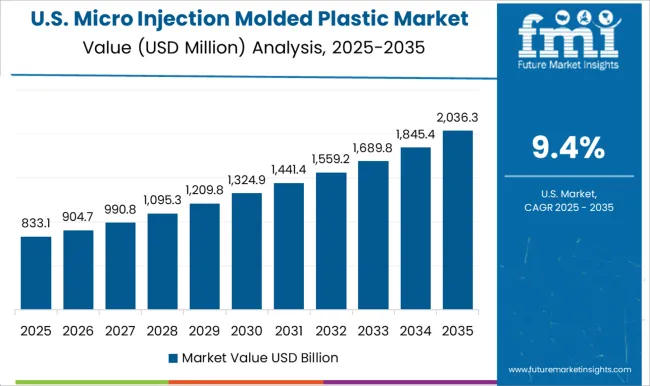

| USA | 9.4% |

| Brazil | 8.3% |

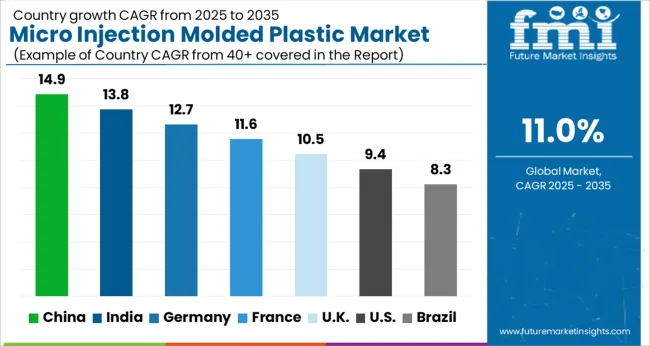

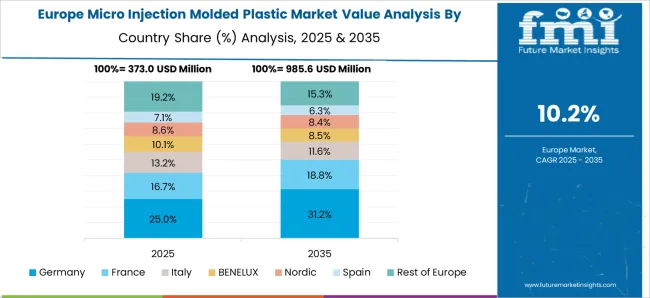

The global micro injection molded plastic market is projected to grow at an 11.0% CAGR through 2035, driven by demand in medical devices, electronics, and precision components. Among BRICS nations, China led with 14.9% growth as large-scale production facilities were commissioned and strict quality standards were enforced, while India at 13.8% growth expanded manufacturing capacity to address rising regional requirements. In the OECD region, Germany at 12.7% sustained substantial output under stringent industrial and regulatory frameworks, while the United Kingdom at 10.5% managed moderate-scale operations supporting medical, automotive, and electronic applications. The USA, growing at 9.4%, supported steady demand across high-precision industrial and consumer components, adhering to federal and state-level safety and quality benchmarks. This report includes insights on 40+ countries; the top five markets are shown here for reference.

The growing electronics and medical device industries are driving the micro injection molded plastic market in China at a 14.9% CAGR. The micro injection molded plastic market is being supported by adoption in high precision components for electronics, medical equipment, and automotive applications. Manufacturers are being encouraged to provide durable, lightweight, and high precision molded parts. Distribution is being strengthened through industrial suppliers, specialized manufacturers, and authorized dealers. Research and development in advanced polymer formulations, micro mold design, and high-speed injection processes is being conducted. Rising industrial production, expansion of electronics and healthcare sectors, and demand for miniaturized components are considered key growth drivers for the micro injection molded plastic market in China.

Rising medical technology and consumer electronics sectors are accelerating the micro injection molded plastic market in India, which is growing at 13.8% CAGR. The micro injection molded plastic market is being supported by demand for miniaturized, precise, and lightweight components in electronics, medical, and automotive devices. Manufacturers are being encouraged to supply cost-efficient, high quality, and reliable products. Distribution through authorized suppliers, industrial partners, and specialized manufacturers is being ensured. Training and technical workshops are being conducted to promote proper handling and usage of micro injection molded plastics. Expanding electronics, medical, and automotive industries are recognized as major contributors to growth in the Indian market.

Germany is seeing the micro injection molded plastic market grow at a CAGR of 12.7% due to precision engineering and industrial automation trends. Adoption in automotive, medical, and electronics applications that require durability, precision, and reliability is being emphasized. Manufacturers are being encouraged to supply lightweight, performance optimized components that comply with strict engineering standards. Distribution through authorized dealers, specialized suppliers, and industrial partners is being maintained. Research into advanced polymer materials, faster injection processes, and micro mold design is being pursued. The growth is further supported by increasing industrial automation, miniaturization trends, and strict quality requirements.

Demand for compact, high precision components is accelerating the micro injection molded plastic market in the United Kingdom, projected to grow at a CAGR of 10.5%. Lightweight and reliable parts are being adopted across electronics, automotive, and medical sectors. Manufacturers are being encouraged to provide high quality, durable, and cost effective products. Distribution through industrial suppliers, authorized dealers, and specialized manufacturers is being strengthened. Awareness programs and technical workshops are being conducted to ensure proper usage. Expanding electronics, medical, and automotive industries are being recognized as major contributors to market growth.

Growing requirements for miniaturized and precise components are supporting the micro injection molded plastic market in the United States, which is expected to reach a CAGR of 9.4%. Adoption in medical devices, consumer electronics, and automotive applications is being emphasized. Manufacturers are being encouraged to deliver advanced, durable, and high precision components. Distribution through industrial partners, authorized suppliers, and specialized manufacturers is being maintained. Research in polymer materials, micro mold technology, and injection efficiency is being conducted. Rising industrial automation, medical device manufacturing, and electronics production are considered key drivers of market growth.

The micro injection molded plastic market has been experiencing significant growth due to rising demand for miniaturized, high-precision plastic components across industries such as medical devices, electronics, automotive, and consumer products. Micro injection molding enables the production of extremely small, complex parts with high dimensional accuracy, repeatability, and cost efficiency. The increasing focus on medical devices, particularly minimally invasive instruments, implants, and drug delivery systems, is a major driver of this market. In electronics, the trend toward smaller connectors, sensors, and micro-components is also fueling demand for advanced micro-molded plastics.

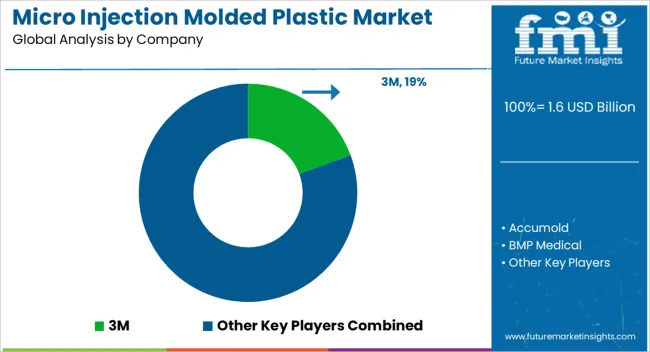

Key players dominating the global micro injection molded plastic market include 3M, Accumold, BMP Medical, Isometric Micro Molding, Makuta Technics, MTD Micro Molding, Paragon Medical, Rapidwerks, Sil-Pro, SMC, and Spectrum Plastics Group. These companies are focusing on producing high-precision, customized micro-components using advanced injection molding technologies. Their product portfolios span multiple sectors, providing solutions for medical, electronics, automotive, and consumer applications. Emphasis is being placed on innovations that allow tighter tolerances, enhanced surface finishes, and complex geometries to meet increasingly stringent industry standards.

| Item | Value |

|---|---|

| Quantitative Units | USD 1.6 Billion |

| Material Type | Liquid-crystal polymer (LCP), Polyether ether ketone (PEEK), Polycarbonate (PC), Polyethylene (PE), Polyoxymethylene (POM), and Others |

| Application | Medical and healthcare, Automotive, Electronics, Telecommunications, Aerospace and defense, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | 3M, Accumold, BMP Medical, Isometric Micro Molding, Makuta Technics, MTD Micro Molding, Paragon Medical, Rapidwerks, Sil-Pro, SMC, and Spectrum Plastics Group |

| Additional Attributes | Dollar sales vary by material type, including thermoplastics, polyether ether ketone (PEEK), liquid crystal polymers (LCP), and others; by application, such as medical devices, electronics, automotive, and micro-optics; by end-use industry, spanning healthcare, consumer electronics, automotive, and telecommunications; by region, led by North America, Europe, and Asia-Pacific. Growth is driven by miniaturization trends, medical innovation, and demand for precision components. |

The global micro injection molded plastic market is estimated to be valued at USD 1.6 billion in 2025.

The market size for the micro injection molded plastic market is projected to reach USD 4.4 billion by 2035.

The micro injection molded plastic market is expected to grow at a 11.0% CAGR between 2025 and 2035.

The key product types in micro injection molded plastic market are liquid-crystal polymer (lcp), polyether ether ketone (peek), polycarbonate (pc), polyethylene (pe), polyoxymethylene (pom) and others.

In terms of application, medical and healthcare segment to command 42.7% share in the micro injection molded plastic market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Micro-Dosing Sachet Fillers Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Microbial Growth Monitoring System Market Size and Share Forecast Outlook 2025 to 2035

Micro Hotel Market Forecast and Outlook 2025 to 2035

Microwave Source Market Size and Share Forecast Outlook 2025 to 2035

Micro-energy Harvesting System Market Size and Share Forecast Outlook 2025 to 2035

Micro CHP Market Size and Share Forecast Outlook 2025 to 2035

Micro Irrigation System Market Size and Share Forecast Outlook 2025 to 2035

Micro Flute Paper Market Size and Share Forecast Outlook 2025 to 2035

Microcrystalline Cellulose Market Size and Share Forecast Outlook 2025 to 2035

Micro Balances Market Size and Share Forecast Outlook 2025 to 2035

Micro Perforated Films Packaging Market Size and Share Forecast Outlook 2025 to 2035

Microbial Coagulants Market Size and Share Forecast Outlook 2025 to 2035

Microserver IC Market Size and Share Forecast Outlook 2025 to 2035

Microplate Handling Instruments Market Size and Share Forecast Outlook 2025 to 2035

Microsclerotherapy Treatment Market Size and Share Forecast Outlook 2025 to 2035

MicroLED Photoluminescence Inspection System Market Size and Share Forecast Outlook 2025 to 2035

Micro-Scale VFFS Modules Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Microscope Digital Camera Market Size and Share Forecast Outlook 2025 to 2035

Micro Guide Catheter Market Size and Share Forecast Outlook 2025 to 2035

Micro Perforation Machines Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA