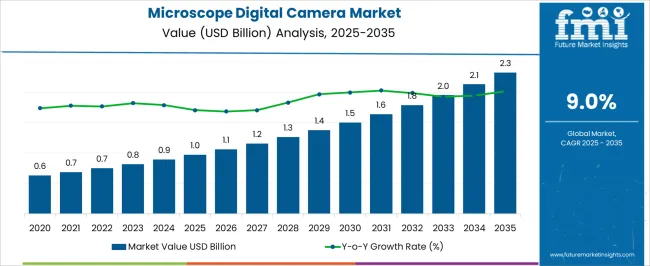

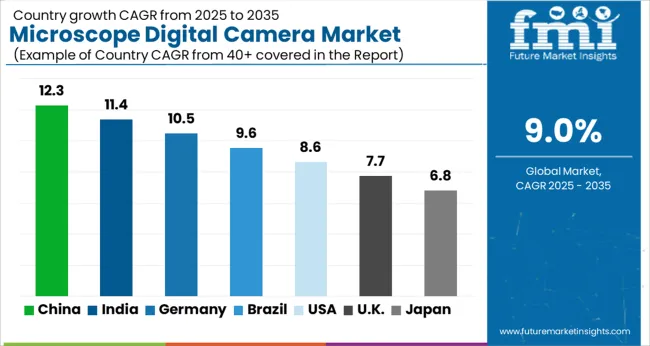

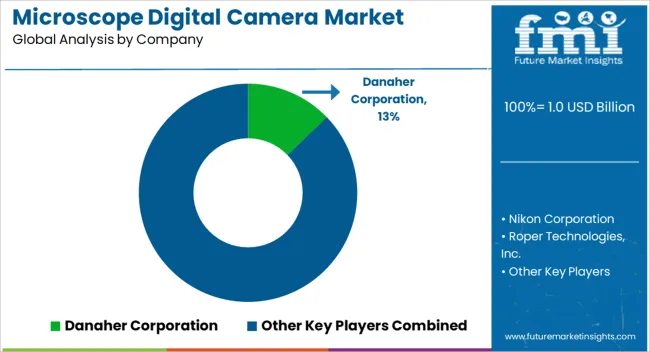

The Microscope Digital Camera Market is estimated to be valued at USD 1.0 billion in 2025 and is projected to reach USD 2.3 billion by 2035, registering a compound annual growth rate (CAGR) of 9.0% over the forecast period.

| Metric | Value |

|---|---|

| Microscope Digital Camera Market Estimated Value in (2025 E) | USD 1.0 billion |

| Microscope Digital Camera Market Forecast Value in (2035 F) | USD 2.3 billion |

| Forecast CAGR (2025 to 2035) | 9.0% |

The microscope digital camera market is expanding, driven by advancements in imaging technology, rising demand for precision diagnostics, and the growing adoption of digital microscopy in life sciences and research. Integration of high-resolution sensors, advanced software interfaces, and image-sharing capabilities has enhanced efficiency in both educational and industrial applications.

Current growth is supported by increased use of microscopy in pathology, biotechnology, and quality control processes. Technological developments in camera sensitivity and connectivity are improving image clarity and data management, aligning with laboratory digitalization trends.

The market outlook remains positive as healthcare, academic, and industrial sectors continue to invest in digital imaging platforms, supported by the demand for improved visualization and real-time analysis capabilities.

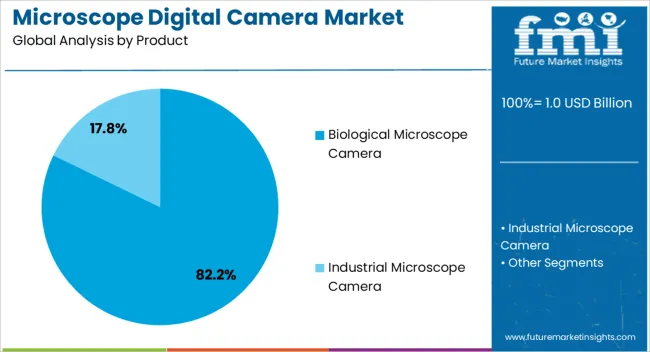

The biological microscope camera segment holds approximately 82.2% share in the product category, reflecting its central role in life science and medical research applications. These cameras provide high sensitivity and clarity, enabling detailed imaging of cells, tissues, and microorganisms.

Their integration with advanced imaging software enhances workflow efficiency, making them a preferred choice in clinical laboratories and academic research institutions. Growth in this segment is reinforced by the rising global demand for accurate diagnostics and research into disease mechanisms.

With ongoing investments in medical infrastructure and biotechnology research, the biological microscope camera segment is expected to retain its dominance.

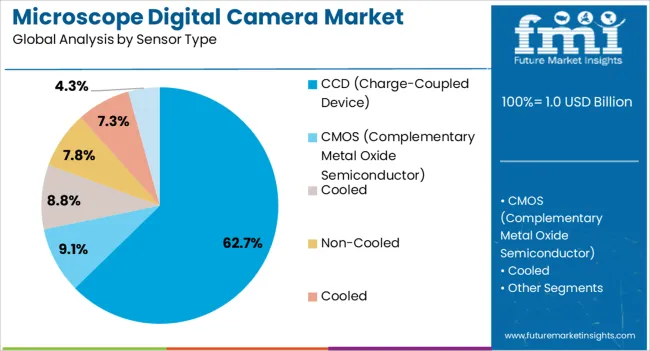

The CCD segment leads the sensor type category with approximately 62.7% share, supported by its superior light sensitivity and low noise performance in microscopy applications. CCD technology offers high image quality and dynamic range, making it particularly valuable in fluorescence and low-light imaging.

Despite the emergence of CMOS sensors, CCDs remain widely used due to their reliability in scientific imaging and established presence in laboratory setups. Continuous improvements in CCD efficiency and resolution have reinforced their relevance.

With demand sustained by applications requiring precision imaging, the CCD segment is projected to maintain a leading position in the microscope digital camera market.

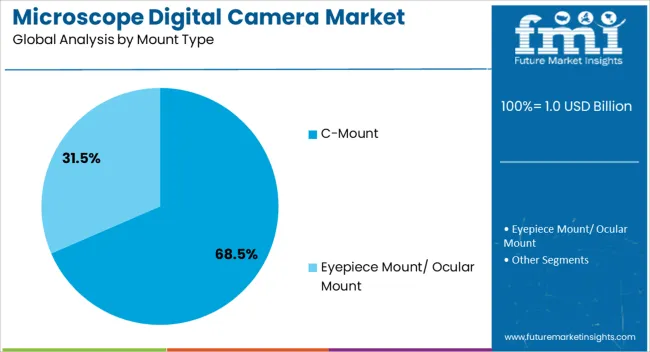

The C-Mount segment dominates the mount type category with approximately 68.5% share, attributed to its compatibility with a wide range of microscopes and imaging devices. C-Mount designs provide flexibility in camera integration, allowing easy attachment and adjustment in laboratory environments.

Their standardized design has made them the preferred choice across diverse applications, from educational use to advanced research. The segment benefits from ease of installation, optical stability, and affordability compared to specialized mount types.

With laboratories prioritizing adaptable and cost-effective imaging solutions, the C-Mount segment is expected to retain its leadership throughout the forecast horizon.

Insights into Growth Drivers Pushing Microscope Digital Camera Demand

An upsurge in nanotechnology research is a prominent trend strengthening the growth of the microscope digital camera industry. With evolutions in nanotechnology research, there is an advancing demand for understanding the materials applied in different sectors. This include food packaging, personal care products, pharmaceuticals, textiles, and automotive components.

This spurred the microscope imaging device demand, which encouraged nanotechnology research. Nanotechnology reinforces research applications and materials that aid multiple research domains. It is slated to create significant expansion for the microscope camera sector.

Deterrents to Growth in Microscope Digital Camera Market

The microscopic digital cameras generally require significant initial investments, like the cost of the camera and supplementary equipment and software. For microscope digital camera vendors, like SMEs, governing the initial costs is an impediment and needs budget resources.

With the intensifying digitization of imaging data, providers must put forward data privacy to shield sensitive data seized by microscope digital imaging cameras. Assuring of strong cybersecurity benchmarks and compliance with data protection rules are predominant in protecting valuable intellectual property and sustaining customer trust. This factor impedes the growth of microscopic digital camera market.

Spotlight on Opportunities of Microscope Camera Market

With the surging demand for high-quality imaging for accurate evaluation and documentation, there is an amplifying demand for microscope digital cameras. These cameras are expected to present color accuracy, superior image resolution, and dynamic array to meet the needs. Funding in research and development to cater to the demands places products as high-end solutions.

The global microscope digital camera market reached USD 0.6 million in 2020. Demand for microscope digital cameras registered a historical CAGR of 9.5% between 2020 and 2025, indicating that the global sales of the microscope digital camera attained USD 1 million in 2025.

From 2020 to 2025, the microscope camera industry observed growth guided by developments in microscopy technology and amplified demand. The microscope digital camera sector saw a boom in the usage of high-resolution cameras with innovative imaging proficiencies.

Looking forward to 2025 to 2035, the sales forecast for microscope imaging devices endures considerable expansion, even though not like the historical period. Key challenges like high initial outlays and compatibility concerns, persevered, could hinder the microscope digital camera market expansion.

The forecast period also has the potential for escalated adoption of digital microscopy solutions. This is typically spurred by innovations, such as the integration of artificial intelligence, machine learning, and digital imaging technologies.

The evolving applications in material science, life sciences, and diagnostics are set to soar the microscopic digital camera market growth. The synthesis of digital cameras with cloud computing and IoT devices augments opportunities.

It is projected to bolster remote access and real-time alliance. Hence, the microscope digital camera industry is on track to witness steady growth and innovation between 2025 and 2035.

Prospect of the microscope digital camera market can be observed in the subsequent tables, which focus on the leading economies like the United States, Germany, the United Kingdom, China, and India. A comprehensive evaluation demonstrates that the United States has considerable opportunities for microscope digital camera industry.

Potent investments in healthcare and life sciences escalate the microscope camera market in the United States. This is due to an emphasis on accuracy and transparency in imaging solutions.

Advancements and a competitive landscape usher constant progress in microscope digital imaging camera offerings. This satisfies the various research demands around academic and industrial activities in the United States.

The stress on quality assurance and regulatory adherence highlights the United States' commitment to sustaining high standards in microscope camera production and adoption. The intensifying usage of digital microscopy in forensic science and material inspection soars the demand for microscope digital cameras in the United States.

Sustainability and earth-friendliness are prioritized in microscope digital imaging production in Germany. This is going well with the commitment to ecological accountability. The robust presence in Germany of the medical and scientific research segments assists a strong demand for microscope cameras, particularly in microscopy and diagnostics.

Export-oriented production activities position Germany as a prominent provider of premium microscope digital imaging cameras. This is encouraged by a concentration on accurate engineering and technical competence.

Focus on automation and digital transformation in manufacturing procedures spurs the sales of microscope digital cameras in industrial sections like automobiles and electronics in Germany.

Corroborative government schemes and funding plans surge research and development initiatives in microscope camera technology. This is stationing the United Kingdom as the core for innovations in imaging solutions.

Accessibility and economics are the catalysts in the United Kingdom’s microscope digital camera market. A concentration on standardizing access to modern imaging technology support this as well.

Swift developments in imaging software and data evaluation tools support the demand for microscopic digital cameras in the United Kingdom. This is encouraging essential insights and spurring inventions.

Heavy funding in healthcare infrastructure strengthens the demand for modern microscopic digital cameras for medical examinations and research in China. The expanding biotechnology and pharmaceutical industries in China are the growth catalysts of microscope digital camera sales.

China’s strong manufacturing industry spurs demand for digital microscope cameras in quality control and inspection usage. The rising interest in STEM education advances the demand for economical and convenient microscope digital cameras for educational institutes in China.

The promising life sciences research segment escalates the demand for microscope digital cameras in India. This is especially for genetic science and drug discovery applications. The broadening healthcare industry presents opportunities for digital microscope cameras in diagnostics and medical research in India.

The amplifying investments in scientific research and development push the sales of microscope digital cameras in educational and research organizations in India. Government schemes stimulating digitalization and breakthroughs in manufacturing thrives the adoption of microscopic digital cameras in the industrial segment of India.

The segmented microscope digital camera market analysis is included in the following subsection. Based on comprehensive studies, the biological microscope camera sector dominates the product category possessing a share of 82.2% in 2025. Likewise, the CCD segment prevails in the sensor type category with a share of 62.7% in 2025.

| Segment | Biological Microscope Camera (Product) |

|---|---|

| Value Share (2025) | 82.2% |

The expanding demand for biological imaging for life sciences and healthcare surges the sales of such professional cameras. The breakthroughs in medical examinations and research upsurge the adoption of biological microscope cameras, escalating the supremacy.

The noteworthy imaging abilities and distinct characteristics of biological microscope cameras make them a favorable alternative. The ongoing improvements and blend of advanced technologies foster the prevalence of biological microscope cameras in the industry.

| Segment | CCD (Sensor Type) |

|---|---|

| Value Share (2025) | 62.7% |

The CCD (Charge-coupled device) segment acquires a significant share of the global microscope digital camera industry in 2025. The ascendancy is because of the booming adoption of CCD sensors owing to the sizable dynamic array, linear response, low noise, and their capacity to click low-light images.

Charge-coupled devices are sensors as per the assortment of passive photodiodes that synthesize charge during the camera exposure time. The CCD sensors present better image uniformity.

Manufacturers pick CCD sensors over others for their dependability and steadiness in acquiring precise data, which is necessary for research. The mature manufacturing procedure of CCD sensors results in economical solutions for bulk purchasing, luring budget-conscious customers.

The market is significantly competitive, with numerous digital microscope camera providers dominating, each aiding technological innovation. Danaher Corporation, Nikon Corporation, Roper Technologies, Inc., Carl Zeiss AG, Olympus Corporation, and Hamamatsu Photonics K.K. are the trailblazers popular for their innovative solutions and dependable performance.

Basler AG, Guangzhou Micro-shot Technology Co., Ltd., BMS microscopes b.v., and Euromex Microscopen bv have a crucial role and provide an array of products serving diverse customer demand for microscope cameras.

Sony Corporation, Dewinter Optical Inc, Teledyne Lumenera, Motic, Jenoptik AG, and Brunel Microscopes Ltd. add depth to the industry, each provider bringing in their expertise and technological abilities.

Microscope digital camera manufacturers catapult the boundaries of innovation, escalating the advancement of microscope cameras. While the emphasis is on high-resolution imaging, others outshine compact frames and intuitive interfaces.

The competitive landscape nurtures a dynamic landscape where research and development flourish, warranting that customers have access to innovations in microscopy imaging. As the prominent microscope digital camera manufacturers carve demands and obstacles, the industry is slated for continuous growth.

Industry Updates

The report consists of key products like biological microscope camera and industrial microscope camera. Biological microscope camera is further bifurcated into automated microscope camera and manual microscope camera.

Automated camera is again divided into integrated camera and individual camera. Similarly, industrial microscope camera is classified into automated microscope camera and manual microscope camera. Automated camera is again divided into integrated camera and individual camera.

Key sensor types present in the industry include CMOS (complementary metal oxide semiconductor) and CCD (charge-coupled device). CMOS bifurcated into cooled and non-cooled type. CCD is also divided into cooled and non-cooled type.

The industry is classified into c-mount and eyepiece mount/ ocular mount.

The report consists of end users like hospitals, research laboratories, pharmaceutical and biotechnology industries, and clinics. The research laboratories segment is further bifurcated into clinical and non-clinical type.

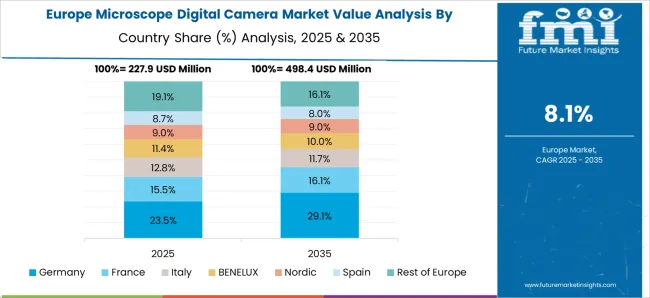

Analysis of the industry has been carried out in key countries of North America, Latin America, East Asia, South Asia and Pacific, Western Europe, Eastern Europe, and the Middle East and Africa.

The global microscope digital camera market is estimated to be valued at USD 1.0 billion in 2025.

The market size for the microscope digital camera market is projected to reach USD 2.3 billion by 2035.

The microscope digital camera market is expected to grow at a 9.0% CAGR between 2025 and 2035.

The key product types in microscope digital camera market are biological microscope camera, _automated microscope camera, _manual microscope camera, industrial microscope camera, _automated microscope camera and _manual microscope camera.

In terms of sensor type, ccd (charge-coupled device) segment to command 62.7% share in the microscope digital camera market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Optical Microscope Market Size and Share Forecast Outlook 2025 to 2035

Ovulation Microscope Market Analysis - Industry Insights & Forecast 2025 to 2035

3D Surgical Microscope Systems Market Size and Share Forecast Outlook 2025 to 2035

LCD Digital Microscope Market Size and Share Forecast Outlook 2025 to 2035

Metallurgical Microscopes Market

Semiconductor Microscopes Market

Laser Scanning Microscopes Market

Super Resolution Microscope Market Insights - Size, Share & Forecast 2025 to 2035

Surgical Operating Microscope Market Forecast and Outlook 2025 to 2035

Robot Assisted Surgical Microscope Market Size and Share Forecast Outlook 2025 to 2035

Digital Health Market Forecast and Outlook 2025 to 2035

Digital Pen Market Forecast and Outlook 2025 to 2035

Digital X-ray Market Size and Share Forecast Outlook 2025 to 2035

Digital Elevation Model Market Size and Share Forecast Outlook 2025 to 2035

Digital Pump Controller Market Size and Share Forecast Outlook 2025 to 2035

Digital Textile Printing Market Size and Share Forecast Outlook 2025 to 2035

Digital Printing Paper Market Size and Share Forecast Outlook 2025 to 2035

Digital Battlefield Market Size and Share Forecast Outlook 2025 to 2035

Digital Product Passport Software Market Size and Share Forecast Outlook 2025 to 2035

Digital Lending Platform Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA