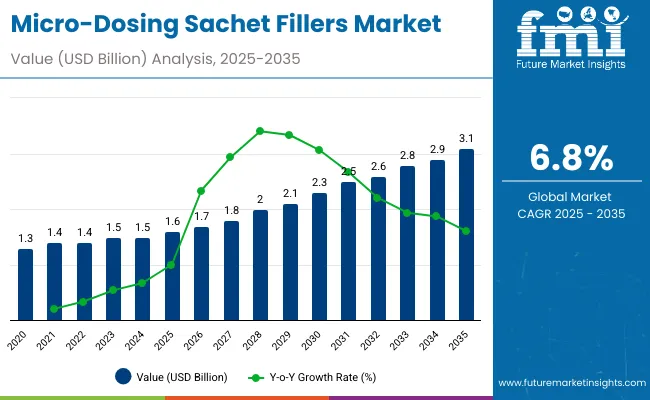

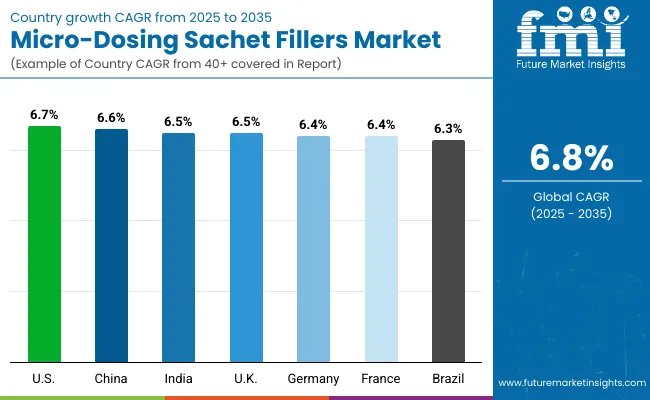

The micro-dosing sachet fillers market will expand from USD 1.6 billion in 2025 to USD 3.1 billion by 2035, at a CAGR of 6.8%. Growth is propelled by rising demand for precision filling systems across pharmaceutical, nutraceutical, and cosmetics industries. Multi-lane sachet fillers remain the preferred technology due to their efficiency and ability to handle fine powders and micro-granules. Powder-based formulations dominate market share owing to their versatility in dosage control and product stability. Asia-Pacific leads with manufacturing scalability, while Europe and the U.S. focus on automation and compliance with pharmaceutical packaging regulations.

Between 2020 and 2024, growing miniaturization in pharmaceutical packaging and advancements in automation led to significant efficiency improvements. Multi-lane and piston-based fillers evolved to accommodate variable product viscosity and particle size. By 2035, the market will reach USD 3.1 billion, driven by precision dosing needs and sustainable packaging innovations. Asia-Pacific will dominate production with expanding manufacturing capacity in South Korea, Japan, and India, while North America and Europe will continue prioritizing regulatory compliance and high-speed automation systems.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 1.6 billion |

| Industry Value (2035F) | USD 3.1 billion |

| CAGR (2025 to 2035) | 6.8% |

The market’s expansion is driven by demand for accurate, contamination-free, and cost-effective filling solutions. These systems enable precision packaging for pharmaceuticals, food additives, and personal care products. The shift toward flexible, single-dose packaging formats supports adoption across global consumer markets. Integration of robotics and sensor-based automation further enhances performance and consistency in micro-dosing operations.

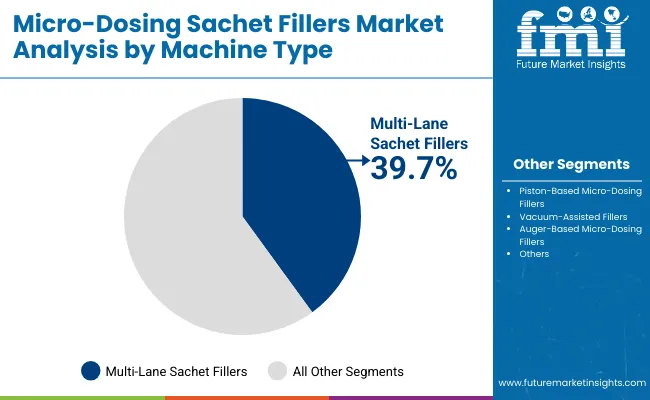

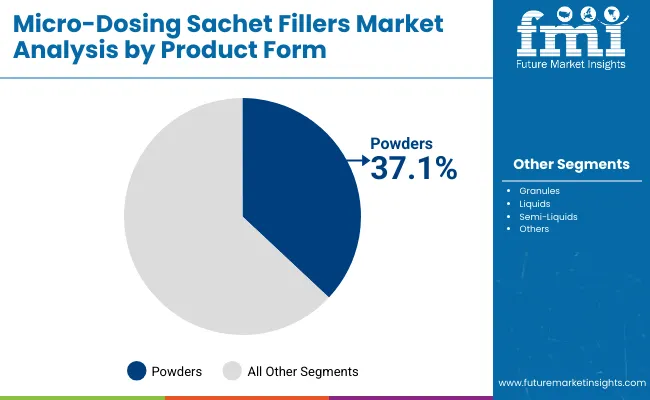

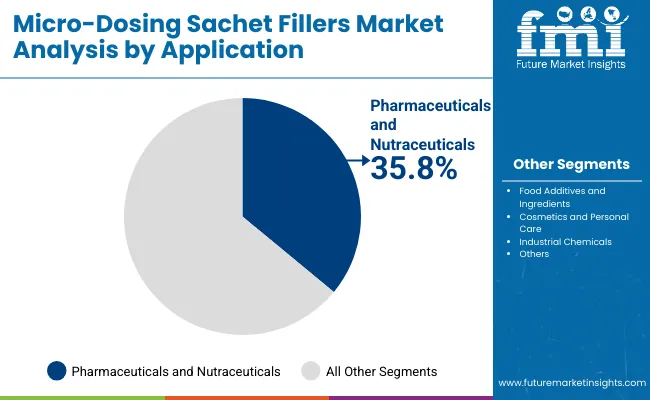

The market is segmented by machine type, product form, application, and region. Machine types include multi-lane sachet fillers, piston-based micro-dosing fillers, vacuum-assisted fillers, and auger-based systems. Product forms include powders, granules, liquids, and semi-liquids. Applications span pharmaceuticals & nutraceuticals, food additives, cosmetics & personal care, and industrial chemicals. Regionally, the market covers North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa.

Multi-lane sachet fillers are projected to account for 39.7% of the market in 2025, offering exceptional flexibility for high-speed, multi-format packaging. These machines allow simultaneous filling of multiple sachets, optimizing throughput while maintaining precision in powder and granule handling. Their adaptability supports pharmaceutical, nutraceutical, and cosmetic product lines.

Advanced servo control and dosing systems ensure accuracy across varying fill weights. Integration with vision inspection and sealing modules enhances consistency and reduces waste. As manufacturers prioritize automation and productivity, multi-lane sachet fillers continue to dominate machine selection for precision packaging.

Powder-based products are forecast to hold 37.1% of the market in 2025, driven by their superior stability, lightweight nature, and ease of controlled dosing. They remain critical in unit-dose pharmaceutical formulations, dietary supplements, and cosmetic powders where precision and shelf life are essential.

Automation advancements in micro-dosing enhance accuracy and reduce contamination risk during packaging. The segment’s strength lies in its compatibility with single- and multi-lane filling systems. As health and personal care markets expand, powder formulations continue to lead micro-dosing applications.

The pharmaceuticals and nutraceuticals segment is expected to represent 35.8% of the market in 2025, reflecting global focus on dosage uniformity, patient safety, and compliance with GMP standards. Sachet packaging ensures tamper-evidence and controlled delivery for sensitive formulations.

Automation and data-integrated filling systems enhance precision while reducing manual error in regulated environments. Adoption is further strengthened by increasing demand for portable, single-serve supplement formats. As personalized health solutions expand, pharmaceuticals and nutraceuticals remain the dominant application driving micro-dosing sachet filler deployment.

The market is driven by rising automation in pharmaceutical packaging and increasing demand for high-precision dosing to enhance product accuracy and safety. However, high equipment costs and technical challenges in handling multiple viscosities hinder wider adoption. Opportunities exist in smart dosing sensors, machine learning integration, and aseptic filling innovations. Key trends include the growth of single-dose sachets, IoT-enabled monitoring systems, and sustainable flexible packaging solutions improving operational efficiency.

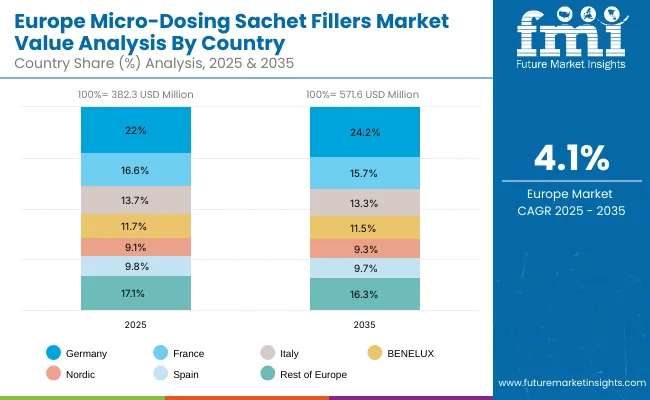

The global micro-dosing sachet fillers market is advancing as precision manufacturing and digitalized filling technologies gain momentum. Asia-Pacific dominates through automation-driven production scaling, particularly in pharmaceuticals and nutraceuticals. North America continues to prioritize technology-led efficiency and integration of digital monitoring systems to enhance accuracy, while Europe focuses on GMP compliance, hygienic machinery design, and eco-friendly material adaptation. Expanding applications in personal care, dietary supplements, and medical packaging are reinforcing global adoption, supported by smart automation and high-speed filling advancements.

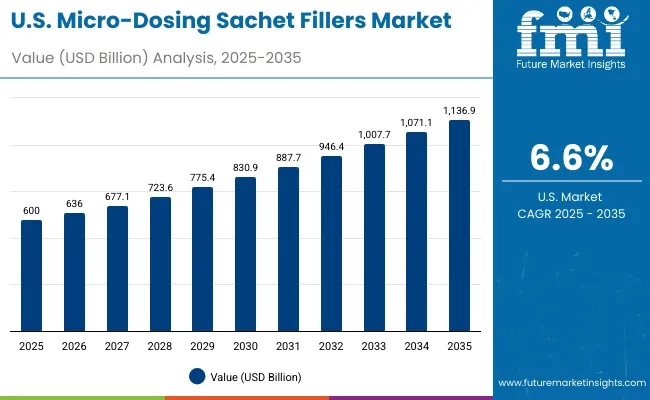

The USA will grow at 6.6% CAGR, driven by increased demand in pharmaceutical, healthcare, and nutraceutical packaging. Contract manufacturing for single-dose formulations continues to expand, supported by FDA-compliant automation. The integration of digital monitoring and vision systems improves accuracy and operational traceability. Domestic manufacturers are investing in compact, smart fillers to serve both mass and niche markets.

Germany will expand at 6.4% CAGR, emphasizing GMP-compliant, hygienic, and energy-efficient filling systems. The country’s advanced automation and precision engineering capabilities sustain its strong machinery export base. Rising adoption in nutraceutical and powdered product packaging enhances versatility. Government-backed sustainability goals further encourage innovation in eco-friendly filler systems.

The UK will grow at 6.3% CAGR, with increasing focus on micro-packaging for personal care, wellness, and dietary supplements. The development of small-batch, flexible filling systems supports the rise of agile contract manufacturing. Automation upgrades in compact filler machinery improve precision and reduce waste across product lines.

China will grow at 6.6% CAGR, led by expansion in high-volume pharmaceutical and nutraceutical filling capacity. Automation incentives and precision engineering programs are propelling manufacturing upgrades. Domestic suppliers are becoming globally competitive through innovation in high-speed, low-waste fillers. Government support for industrial modernization strengthens large-scale adoption.

India will grow at 6.5% CAGR, supported by rapid expansion in pharmaceutical contract packaging and healthcare applications. Demand for low-dose sachets in nutraceutical and OTC segments is increasing. Under the "Make in India" initiative, local machinery production and export competitiveness are improving, while digital automation enhances operational efficiency.

Japan will grow at 7.1% CAGR, leading in compact, high-speed filler systems with robotics-enabled dosing precision. The integration of real-time monitoring and advanced quality control ensures accuracy in cosmetics and healthcare packaging. Continuous innovation in space-saving filler design supports the nation’s dominance in next-generation automated packaging.

South Korea will lead with 7.2% CAGR, driven by rapid automation in pharmaceutical and nutraceutical filling lines. R&D in digital twin and smart precision control systems enhances equipment efficiency and performance. Strong export growth in multi-lane and piston-based fillers positions South Korea as a technology leader in the APAC region.

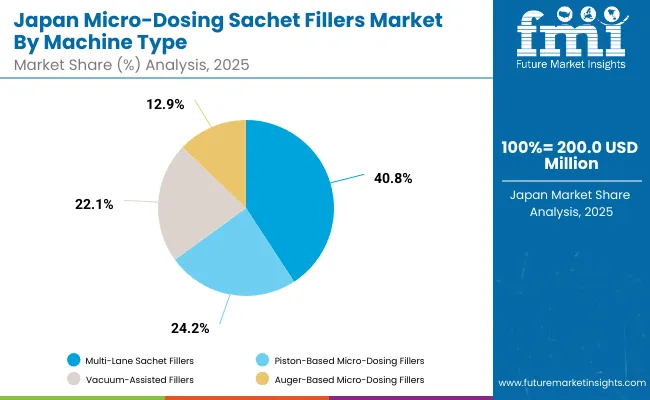

Japan’s micro-dosing sachet fillers market, valued at USD 200.0 million in 2025, is dominated by multi-lane sachet fillers, accounting for 38.7% share due to their speed and precision in pharmaceutical and nutraceutical packaging. Piston-based micro-dosing fillers support viscous formulations, while vacuum-assisted fillers enable air-free sealing. Auger-based dosing systems are increasingly adopted for powdered and granular ingredient dosing in the food and personal care sectors.

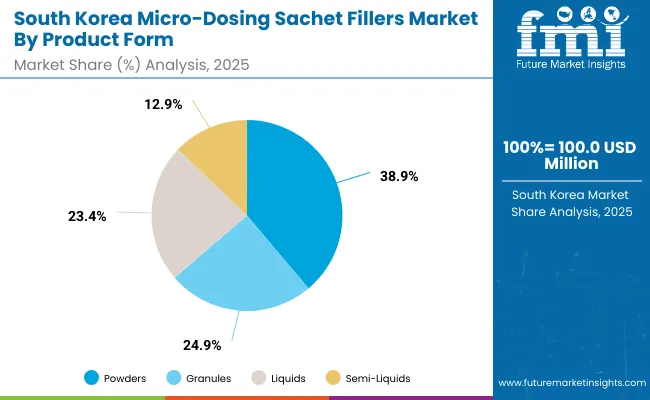

South Korea’s micro-dosing sachet fillers market, worth USD 100.0 million in 2025, is led by powder-based packaging, holding 35.3% share driven by pharmaceutical and instant nutrition products. Granule sachets are used for supplements and agrochemical dosing, while liquid and semi-liquid forms gain momentum in cosmetic and oral care formulations. Precision dosing demand and automated machinery integration are propelling South Korea’s market growth.

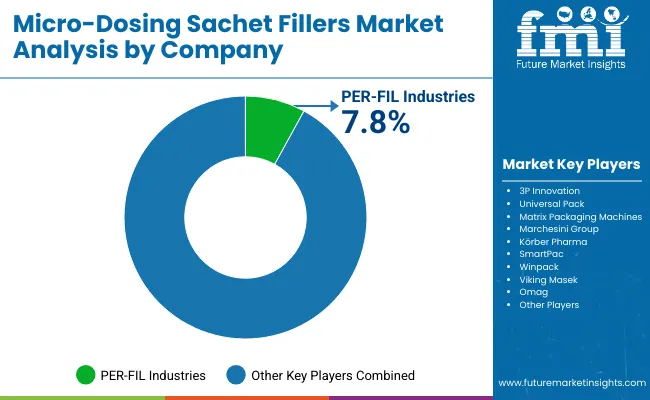

The market is moderately consolidated with key players including PER-FIL Industries, 3P Innovation, Universal Pack, Matrix Packaging Machines, Marchesini Group, Körber Pharma, SmartPac, Winpack, Viking Masek, and Omag. Companies focus on developing flexible, high-speed filling systems with enhanced digital control and sustainability integration.

Key Developments

| Item | Value |

|---|---|

| Quantitative Units | USD 1.6 Billion (2025 baseline) |

| By Machine Type | Multi-Lane, Piston-Based, Vacuum-Assisted, Auger-Based Fillers |

| By Product Form | Powders, Granules, Liquids, Semi-Liquids |

| By Application | Pharmaceuticals & Nutraceuticals, Food Additives, Cosmetics & Personal Care, Industrial Chemicals |

| Key Companies Profiled | PER-FIL Industries, 3P Innovation, Universal Pack, Matrix Packaging Machines, Marchesini Group, Körber Pharma, SmartPac, Winpack, Viking Masek, Omag |

| Additional Attributes | Market driven by precision automation, sustainability, and single-dose format adoption |

The market size of the Micro-Dosing Sachet Fillers Market in 2025 is USD 1.6 billion.

The market size of the Micro-Dosing Sachet Fillers Market in 2035 is USD 3.1 billion.

The CAGR of the Micro-Dosing Sachet Fillers Market 6.8%.

Multi-Lane Sachet Fillers with 39.7% share leads the market in 2025.

Powders with 37.1% share dominates the market.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Sachet Packaging Market Size and Share Forecast Outlook 2025 to 2035

Sachet Filler Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Sachet Packaging Machines Market Analysis - Size, Share, and Forecast 2025 to 2035

Sachet Packaging Industry Analysis in Asia Pacific - Size, Share, and Forecast 2025 to 2035

Market Leaders & Share in the Sachet Packaging Machines Industry

Competitive Overview of Sachet Packaging Market Share

Sachet and Pouch Handling Systems Market

USA Sachet Packaging Market Report – Trends, Demand & Industry Outlook 2025-2035

Snap Sachets Market Size and Share Forecast Outlook 2025 to 2035

Market Share Breakdown of Snap Sachets Manufacturers

ASEAN Sachet Packaging Market Analysis – Size, Share & Forecast 2025-2035

Japan Sachet Packaging Market Outlook – Share, Growth & Forecast 2025-2035

Germany Sachet Packaging Market Trends – Size, Share & Growth 2025-2035

Sanitizer Sachet Market Size and Share Forecast Outlook 2025 to 2035

Key Companies & Market Share in Sanitizer Sachet Industry

Single Dose Sachet Market

Asia Pacific Sachet Packaging Machines Market Size and Share Forecast Outlook 2025 to 2035

Aluminium Foil Sachet Market

Odor-Neutralizing Sachets Market Size and Share Forecast Outlook 2025 to 2035

Middle East & Africa Sachet Packaging Machines Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA