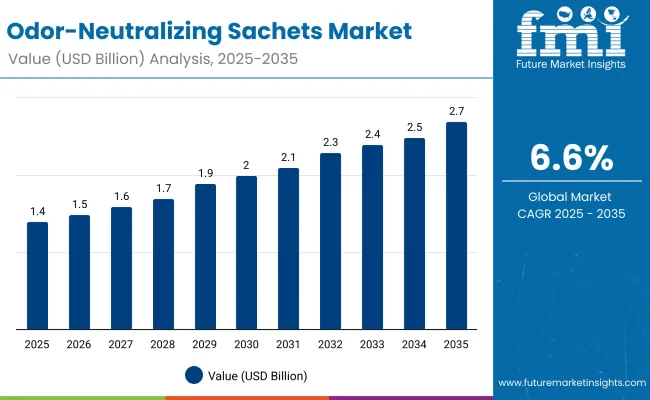

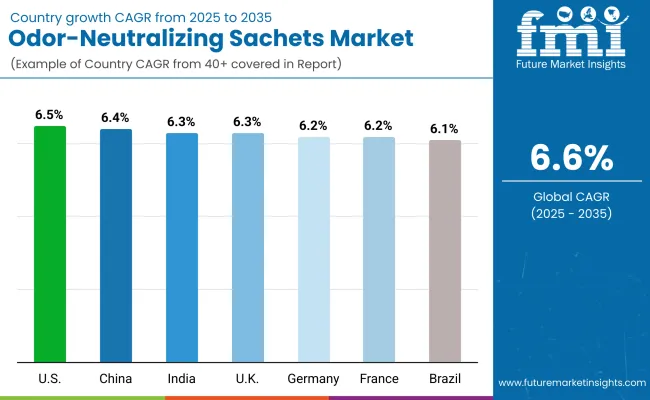

The global odor-neutralizing sachets market will expand from USD 1.4 billion in 2025 to USD 2.7 billion by 2035, at a CAGR of 6.6%. Growth is supported by consumer preference for eco-friendly and chemical-free deodorizing solutions. Non-woven fabrics dominate due to their permeability and recyclability, while activated charcoal remains the most effective neutralizing medium. Rising hygiene standards in food and household storage drive adoption, particularly across Asia-Pacific where demand for sustainable air-care solutions is accelerating.

| Metric | Value |

|---|---|

| Market Value (2025) | USD 1.4 billion |

| Market Forecast (2035) | USD 2.7 billion |

| Growth Rate | 6.6% |

Between 2020 and 2024, consumer preference for sustainable and biodegradable sachets reshaped the packaging sector. Activated charcoal and enzyme-based neutralizers replaced synthetic fragrances, improving efficiency and environmental performance. By 2035, the market will hit USD 2.7 billion as eco-certified materials and automation in sachet production expand scale. Asia-Pacific will maintain leadership, Europe will emphasize recyclability, and North America will sustain steady adoption in retail and household categories.

Market growth is driven by demand for non-toxic air-care, sustainable packaging, and odor-control products in residential and food sectors. Rising awareness of air quality, waste reduction, and freshness preservation boosts adoption. Manufacturers are introducing hybrid sachets using bamboo fiber, bioplastics, and activated charcoal to deliver effective, eco-compliant deodorization.

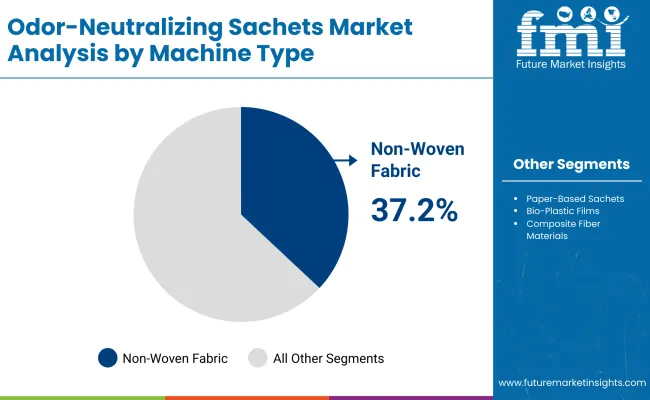

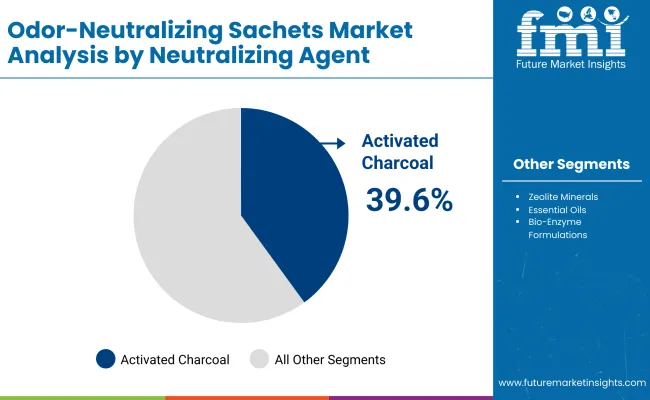

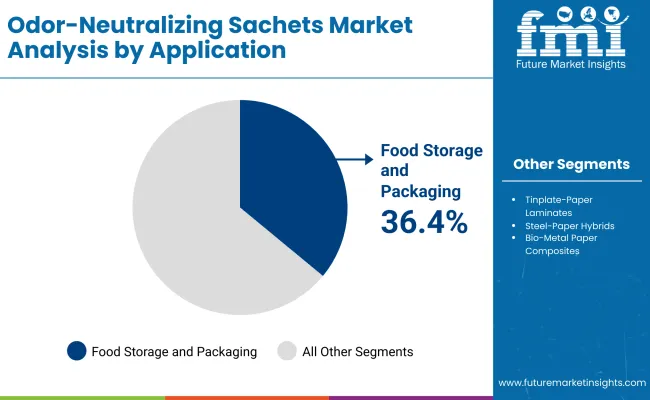

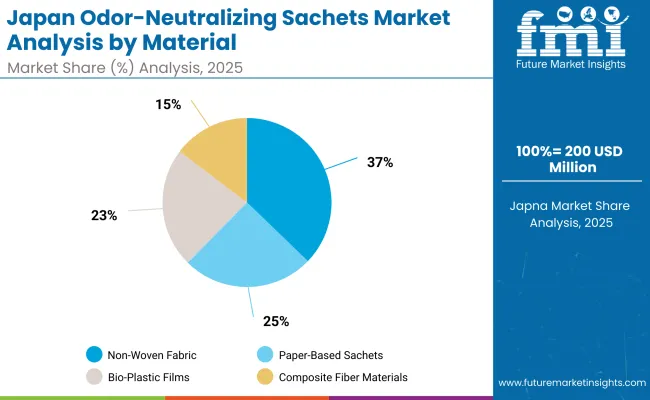

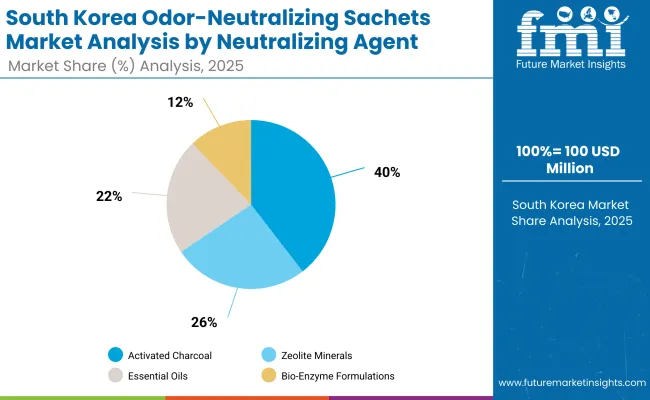

The market is segmented by material, neutralizing agent, application, end-use industry, and region. Material types include non-woven fabrics, paper-based sachets, bio-plastic films, and composite fiber materials. Neutralizing agents comprise activated charcoal, zeolite minerals, essential oils, and bio-enzyme formulations. Applications include food packaging, apparel, and household uses, while key end-use industries span food & beverage, consumer goods, cleaning, and industrial manufacturing.

Non-woven fabric is projected to capture 37.2% of the market in 2025, supported by its superior permeability, flexibility, and recyclability. It provides consistent airflow for controlled odor adsorption, making it ideal for food packaging, apparel, and retail applications. Its lightweight nature and ease of customization further enhance manufacturing efficiency.

The material’s compatibility with biodegradable coatings reinforces sustainability goals across FMCG and logistics sectors. Manufacturers prefer non-woven fabric for its balance of durability and cost-effectiveness. As global packaging transitions toward eco-friendly formats, non-woven materials remain integral to odor-control sachet production.

Activated charcoal is forecast to hold 39.6% of the market in 2025, driven by its exceptional odor-adsorbing and moisture-control capabilities. Its porous structure effectively traps volatile organic compounds, maintaining freshness in stored foods and consumer products.

Adoption is strengthened by the shift toward natural, chemical-free deodorizing agents. Activated charcoal’s longevity and biodegradability make it a preferred component in sustainable packaging. With ongoing innovation in plant-based formulations, it continues to dominate as the key neutralizing agent in odor-control technologies.

The food storage and packaging segment is expected to represent 36.4% of the market in 2025, as odor-neutralizing sachets ensure product integrity and prevent contamination in perishables and ready-to-eat meals. Their use extends shelf life by maintaining optimal humidity and air quality inside packaging.

This segment benefits from growing consumer demand for clean-label, odor-free packaged goods. Integration with recyclable and compostable materials enhances market appeal. As freshness and hygiene remain top priorities in packaged food distribution, sachets for food storage continue to lead application growth.

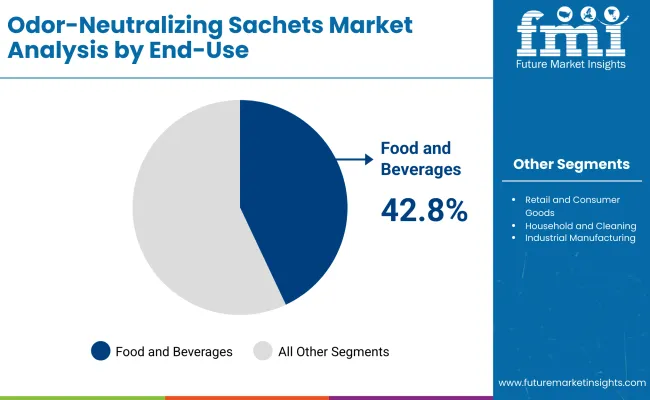

The food and beverages industry is projected to hold 42.8% of the market in 2025, reflecting its reliance on odor-control sachets for storage, transport, and retail packaging. These solutions ensure odor neutrality across product categories ranging from meat and produce to baked goods.

Rising global food trade and retail packaging demand drive large-scale integration of odor-neutralizing technologies. The sector’s focus on quality assurance and eco-compliance further fuels innovation. As consumer expectations for freshness rise, this industry remains the dominant end-use market for odor-control sachets.

The market is driven by eco-friendly packaging mandates and the adoption of non-toxic odor-neutralization solutions. However, higher production costs of biodegradable composites pose challenges to large-scale adoption. Opportunities lie in enzyme-based formulations and refillable sachet designs, fostering sustainable innovation. Emerging trends include hybrid fiber sachets, customizable scents, and recyclable multi-layer film structures enhancing performance and appeal.

The global odor-neutralizing sachets market is expanding steadily, driven by sustainability initiatives, improved indoor air-quality standards, and the shift toward chemical-free odor-control solutions. Asia-Pacific leads global production, supported by large-scale manufacturing and eco-formulation innovation. Europe advances through recyclable and biodegradable air-care materials aligned with environmental directives, while North America focuses on premium, high-performance odor-neutralization systems for retail and household applications. Expanding use in automotive, personal care, and packaging sectors is strengthening long-term market potential.

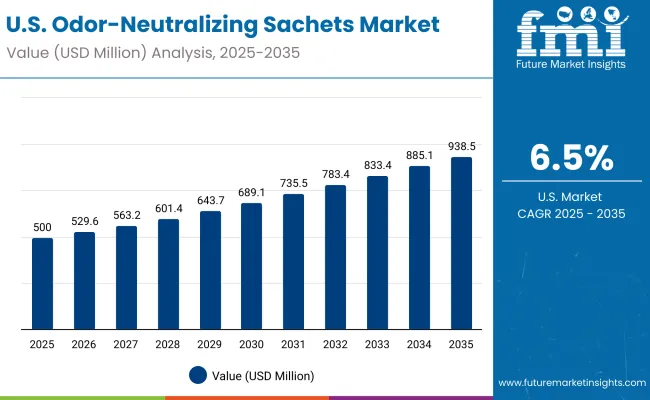

The U.S. will grow at 6.5% CAGR, propelled by innovation in charcoal-based and essential-oil odor-control sachets. Sustainability initiatives and indoor air-quality mandates are enhancing adoption across retail and household categories. The transition toward chemical-free and compostable solutions aligns with expanding eco-packaging supply chains. Premium brands are investing in multi-functional formats combining fragrance and neutralization technologies.

Germany will expand at 6.2% CAGR, led by advanced R&D in biodegradable and recyclable odor-control packaging. EU regulatory support for sustainable materials is spurring adoption across consumer and industrial air-care products. Partnerships between packaging and material science firms are accelerating odor-adsorption technology innovations. Germany’s robust focus on circular economy principles continues to guide market expansion.

The U.K. will grow at 6.3% CAGR, with increasing consumer preference for natural and essential-oil-based odor sachets. Private-label air-care brands and online retailers are expanding eco-friendly product portfolios. Export activity is rising due to global demand for recyclable and luxury air-care formats. Regulatory emphasis on fragrance transparency is further stimulating clean-label innovation.

China will grow at 6.4% CAGR, supported by mass production of biodegradable and enzyme-based odor sachets. Domestic air-purification and household hygiene sectors are experiencing strong growth. Manufacturing clusters are scaling production for global exports of eco-odor-control solutions. Rapid industrial adoption in waste management and logistics is further boosting market penetration.

India will grow at 6.3% CAGR, driven by expanding household cleaning categories and organized retail channels. The entry of small and mid-scale manufacturers into sustainable odor sachets is fostering innovation and affordability. Government-led initiatives promoting biodegradable materials are strengthening domestic production. Rapid retail expansion across Tier-2 cities is enhancing regional market accessibility.

Japan will grow at 6.9% CAGR, emphasizing smart odor-neutralization integration into personal care and packaging applications. Bio-based activated charcoal and hybrid filtration materials are becoming mainstream. Strong demand from automotive and household sectors is boosting production of compact and refillable sachets. Continuous innovation in odor-sensor-enabled packaging supports premium market positioning.

South Korea will lead with 7.0% CAGR, supported by R&D leadership in biodegradable films and compact odor-control designs. Cosmetic and retail packaging industries are major growth contributors. The adoption of AI-assisted material design is enhancing sachet performance and sustainability. Strong export growth to Asia-Pacific markets underscores South Korea’s role in next-generation eco-odor technologies.

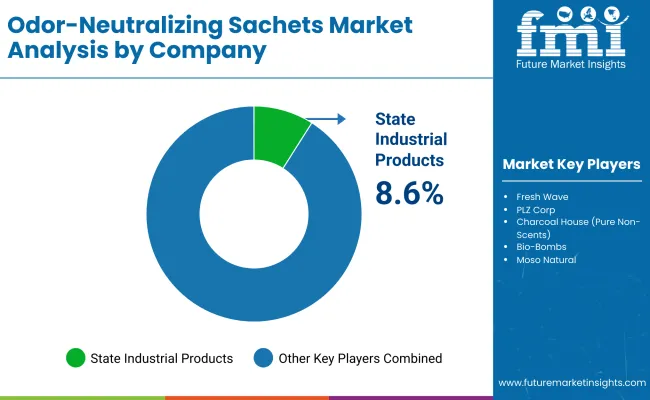

The market is moderately fragmented with key players including State Industrial Products, Fresh Wave (OMI Industries), PLZ Corp, Charcoal House, Moso Natural, ELiX, SmellWell, Bio-Bombs, Zobele Group (KDC/One), and Scented Sachets Ltd. Companies are expanding biodegradable product lines, enhancing enzyme formulations, and establishing regional distribution networks for eco-friendly odor-control solutions.

Key Developments

| Item | Value |

|---|---|

| Quantitative Units | USD 1.4 Billion (2025 baseline) |

| By Material | Non-Woven Fabric, Paper-Based Sachets, Bio-Plastic Films, Composite Fiber Materials |

| By Neutralizing Agent | Activated Charcoal, Zeolite Minerals, Essential Oils, Bio-Enzyme Formulations |

| By Application | Food Storage and Packaging, Footwear & Apparel Packaging, Household Products, Industrial Waste Management |

| By End-Use Industry | Food & Beverages, Retail & Consumer Goods, Household & Cleaning, Industrial Manufacturing |

| Key Companies Profiled | State Industrial Products, Fresh Wave (OMI Industries), PLZ Corp, Charcoal House, Moso Natural, ELiX , SmellWell , Bio-Bombs, Zobele Group (KDC/One), Scented Sachets Ltd |

| Additional Attributes | Market driven by biodegradable materials and eco-air-care packaging innovation |

The market size of the Odor-Neutralizing Sachets Market in 2025 is USD 1.4 billion.

The market size of the Odor-Neutralizing Sachets Market in 2035 is USD 2.7 billion.

The CAGR for 2025 to 2035 for the Odor-Neutralizing Sachets Market is 6.6 percent.

Activated Charcoal (39.6%) leads the market in 2025.

Food Storage and Packaging (36.4%) from the application segment dominates the market.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Snap Sachets Market Size and Share Forecast Outlook 2025 to 2035

Market Share Breakdown of Snap Sachets Manufacturers

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA