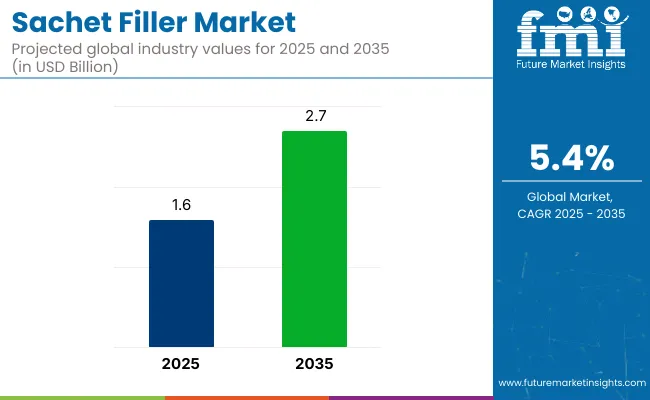

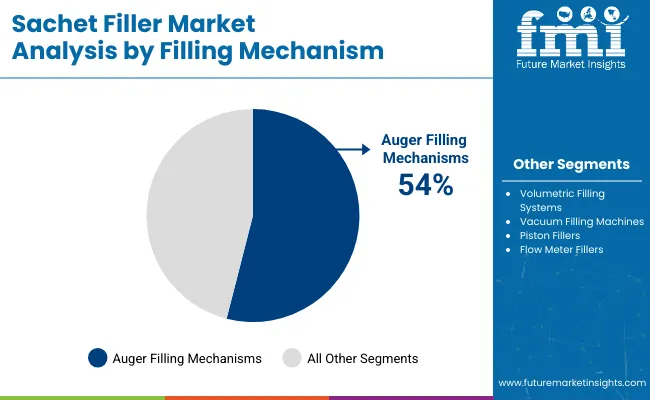

The global sachet filler market is expected to grow from a valuation of USD 1.6 billion in 2025 to USD 2.7 billion by 2035 at a CAGR of 5.4% between 2025 and 2035. Industry growth is expected to be largely driven by the increasing adoption of Auger filling technology, which is anticipated to capture approximately 54% of the industry share in 2025.

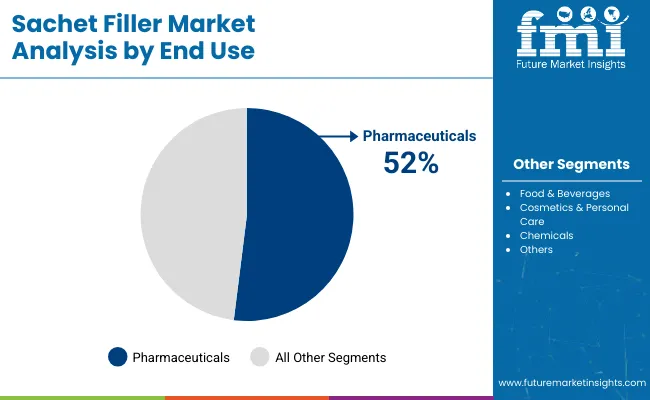

This filling mechanism is widely preferred for its efficiency in handling powdered and granulated products with precise dosing and minimal contamination risks, making it ideal for pharmaceutical packaging operations. The Pharmaceuticals end-use segment is forecast to retain its leadership position, holding nearly 52% of the total industry share in 2025, primarily due to the rising demand for single-dose sachets used for powders, oral rehydration salts, antibiotics, and nutraceutical supplements. These segments are expected to drive substantial demand for reliable sachet fillers and influence industry expansion during the forecast period.

Independent packaging trade news published on May 20, 2025, confirms that leading machinery makers-especially from Taiwan-have begun embedding AI-powered vision systems into sachet and small-format packet filling machines. These advanced systems integrate high-resolution cameras with auger or volumetric fillers to conduct real-time inspections of fill accuracy, seal integrity, and foreign particle detection.

This technological leap is significantly enhancing product quality assurance, minimizing waste generation, and improving adherence to strict food, nutraceutical, and pharmaceutical safety and hygiene standards. This development is fully verified and widely reported across trusted packaging industry sources.

Additionally, sachet filler manufacturers are focusing on incorporating IoT-enabled auger filling machines equipped with smart diagnostics, real-time performance monitoring, and predictive maintenance capabilities. These advancements are supporting production efficiency, reducing downtime, and aligning with global industry trends toward automation, and enhanced compliance in pharmaceutical manufacturing processes.

Auger filling mechanisms, pharmaceuticals end use, automatic sachet fillers, and plastic films are expected to lead the industry in 2025, driven by precision filling and rising healthcare packaging needs.

Auger filling mechanisms are projected to dominate the filling mechanism segment with a 54% share in 2025, owing to their precision in handling powder and granule products, especially in pharmaceuticals and food. This mechanism ensures consistency in weight, essential for medical and dietary supplement sachets.

Pharmaceuticals will remain the dominant end-use category with a 52% share in 2025, driven by demand for precise, contamination-free filling of powders, tablets, and granules into unit-dose sachets. The segment benefits from increasing OTC and prescription drug consumption globally, requiring safe, tamper-evident packaging.

Automatic sachet fillers are projected to dominate with the largest share in 2025, due to their ability to deliver high-speed, consistent filling and sealing operations crucial for mass production in pharmaceuticals and FMCG sectors. These systems reduce manual labor, improve accuracy, and minimize contamination risks.

Plastic films are expected to account for the highest market share in 2025, as they offer excellent sealing, flexibility, and durability required for pharmaceutical and food sachets. Their low cost and printability make them ideal for high-volume sachet production, especially in regions with growing consumer goods demand.

Convenience-driven demand and environmental concern are shaping the sachet filler industry. Manufacturers are deploying format versatility and eco-friendly materials to meet hygiene standards, regulatory shifts, and consumer expectations.

Surging Demand for Portion-Controlled and Hygiene-Focused Packaging

Consumer preference for single-serve sachets has increased significantly. Foods, beverages, cosmetics, and pharmaceuticals are being packaged in sachets for convenience and hygiene. For example, condiments in food-service outlets and personal-care sachets in travel kits are now standard. This trend is being supported by automated sachet machines using horizontal and vertical form-fill-seal technology.

Manufacturers report ease of scaling operations and reduced contamination risks. Sachets help reduce waste and support on-the-go lifestyles. Industry adoption is strong, especially among small and midsize brands. As cleanliness and convenience remain priorities, sachet format continues expanding in diverse industries.

Material Innovation Driving Eco-Friendly Designs

Environmental scrutiny is reshaping sachet filler industry. Single-use plastics are being challenged by recyclable mono-material films and biodegradable options. For instance, brands are deploying compostable film in food-grade sachets. Machinery providers now offer compatibility with eco-films, including paper-based and plant-derived materials.

Compliance with eco-packaging regulations and consumer expectations is being prioritized. Sachet fillers are being upgraded with gentle heat seals to protect novel materials. This transition is promoting circular economy models. Producers are investing in R&D to ensure shelf-life and barrier performance.

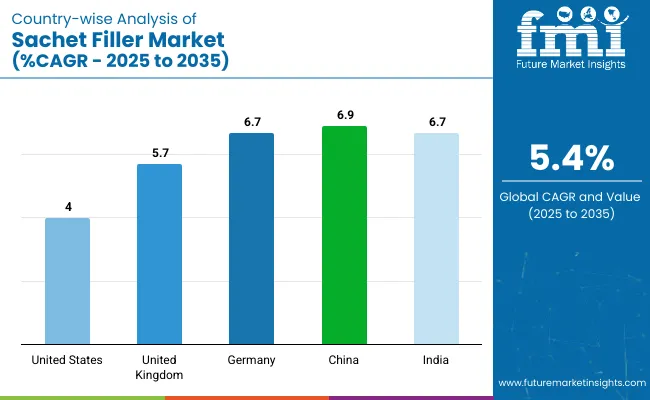

The Sachet Filler Industry study identifies emerging trends across the world, focusing on leading nations where packaging technology and consumer convenience drive industry dynamics. Manufacturers of sachet fillers in these top-performing countries are leveraging advancements in automation, material innovation, and flexible packaging solutions to cater to the evolving demands of food, personal care, and pharmaceutical sectors.

| Countries | CAGR (2025 to 2035) |

|---|---|

| United States | 4.0% |

| United Kingdom | 5.7% |

| Germany | 6.7% |

| China | 6.9% |

| India | 6.7% |

The United States sachet filler industry, poised for a 4.0% CAGR growth from 2025 to 2035, is powered by advancements in eco-friendly materials and increasing demand for convenience packaging across food, beverage, and personal care sectors. The industry’s evolution reflects the country's broader trend toward lightweight, and easy-to-use packaging formats.

With a projected CAGR of 5.7% between 2025 and 2035, the United Kingdom sachet filler industry demonstrates robust growth due to clean-label product preferences and flexible packaging adoption. The rise in demand for on-the-go consumables, especially within the cosmetics, nutraceuticals, and ready-to-drink sectors, is shaping the landscape.

Sachet filler market in Germany is forecast to grow at a 6.7% CAGR from 2025 to 2035, thanks to the country's reputation for engineering excellence and industrial automation. The integration of precision filling systems and high-speed machinery allows German producers to meet rising demand from food, pharmaceutical, and chemical industries.

China leads the global sachet filler market with the highest projected CAGR of 6.9% during 2025 to 2035. This rapid growth is supported by the country's vast consumer base, urbanization trends, and booming e-commerce sector.

Sachet filler industry in India is expected to witness a 6.7% CAGR between 2025 and 2035, driven by expanding fast-moving consumer goods (FMCG) and pharmaceutical sectors. The affordability and versatility of sachets appeal strongly to rural and urban populations alike, catering to unit-level packaging for shampoos, spices, and oral rehydration solutions.

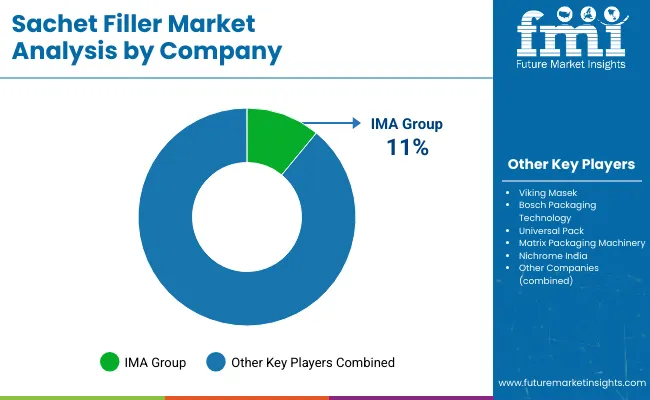

The industry is shaped by both dominant and emerging players, each employing unique strategies to capture market share. Leading companies like Gloex Products, R.A Jones Group, and Universal Pack have established themselves through continuous product innovation, strategic partnerships, and strong global distribution networks.

For instance, R.A Jones Group has focused on enhancing its product range with high-speed sachet fillers designed to cater to diverse industries, while companies like Matrix Packaging Machinery, Inc. have increased their emphasis on sustainable and energy-efficient machines. These companies typically rely on research and development (R&D) to ensure their offerings remain competitive and meet evolving market needs, particularly in food and pharmaceutical sectors.

Smaller players, such as Mentpack and Foshan Land Packaging Machinery Co. Ltd., are carving out a niche with cost-effective solutions and region-specific offerings. However, high entry barriers such as significant capital investments in machinery, technical expertise, and the need for certifications in sectors like pharmaceuticals present challenges. The market remains moderately fragmented, with consolidation occurring through acquisitions and partnerships as leading players strive to expand their footprints.

Recent Sachet Filler Industry News

In May 2025, Nichrome India officially launched its Wing 120 VFFS sachet machine at the IndusFood Manufacturing 2025 event in Delhi. Designed for packaging powdered and granular products like milk powder, spices, and instant coffee in 5-10g stick packs, the machine addresses growing demand for compact and hygienic filling solutions. This development was confirmed by Packaging South Asia and Nichrome India’s official LinkedIn post

| Report Attributes | Details |

|---|---|

| Market Size (2025) | USD 1.6 billion |

| Projected Market Size (2035) | USD 2.7 billion |

| CAGR (2025 to 2035) | 5.4% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | USD billion for value and thousand units for volume |

| Filling Mechanisms Analyzed (Segment 1) | Auger Filling Mechanisms, Volumetric Filling Systems, Vacuum Filling Machines, Piston Fillers, Flow Meter Fillers |

| End Uses Analyzed (Segment 2) | Pharmaceuticals, Food & Beverages, Cosmetics & Personal Care, Chemicals, Others |

| Automation Levels Analyzed (Segment 3) | Automatic, Semi-Automatic, Manual Sachet Fillers |

| Materials Analyzed (Segment 4) | Plastic Films, Aluminum Foil, Paper Laminates, Biodegradable Films |

| Regions Covered | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

| Countries Covered | United States, Canada, Germany, United Kingdom, France, Italy, Spain, China, India, Japan, South Korea, Australia, Brazil, Mexico, Argentina, Saudi Arabia, UAE, South Africa |

| Key Players influencing the industry | Gloex Products, R.A Jones Group, Powder and Packaging Machine, Universal Pack, The Sachet Company, FlexFill Packet, Foshan Land Packaging Machinery Co. Ltd, Matrix Packaging Machinery, Inc., Mentpack, and Mespack. |

| Additional Attributes | Dollar sales, share by filling mechanism and end use, growing demand for single-serve packaging in food and cosmetics, advancements in biodegradable film sachets, regional packaging automation trends |

The sachet filler industry is segmented by filling mechanism into auger filling mechanisms, volumetric filling systems, vacuum filling machines, piston fillers, and flow meter fillers.

By end use, the industry is classified into pharmaceuticals, food & beverages, cosmetics & personal care, chemicals, and others.

By automation level, the industry is segmented into automatic, semi-automatic, and manual sachet fillers.

By material, the industry comprises plastic films, aluminum foil, paper laminates, and biodegradable films.

By region, the industry is categorized into North America, Europe, Asia Pacific, Latin America, and Middle East & Africa.

The industry is valued at approximately USD 1.6 billion in 2025.

It’s forecast to reach USD 2.7 billion by 2035, growing at a CAGR of 5.4%.

Key companies include Gloex Products, R.A Jones Group, Powder and Packaging Machine, Universal Pack, The Sachet Company, FlexFill Packet, Foshan Land Packaging Machinery Co. Ltd, Matrix Packaging Machinery, Inc., Mentpack, and Mespack.

Food & beverage, personal care, and pharmaceutical industries are major demand drivers due to their reliance on single-serve and portioned packaging.

Increasing emphasis on flexible packaging, automation is shaping industry growth.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Micro-Dosing Sachet Fillers Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Sachet Packaging Machines Market Size and Share Forecast Outlook 2025 to 2035

Filler and Extender Cosmetics Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Sachet Packaging Market Size and Share Forecast Outlook 2025 to 2035

Fillers & Extenders Market Size and Share Forecast Outlook 2025 to 2035

Sachet Packaging Industry Analysis in Asia Pacific - Size, Share, and Forecast 2025 to 2035

Market Leaders & Share in the Sachet Packaging Machines Industry

Competitive Overview of Sachet Packaging Market Share

Sachet and Pouch Handling Systems Market

Lip Filler Market Analysis Size and Share Forecast Outlook 2025 to 2035

USA Sachet Packaging Market Report – Trends, Demand & Industry Outlook 2025-2035

Cup Filler Market

Sack Fillers Market Size and Share Forecast Outlook 2025 to 2035

Snap Sachets Market Size and Share Forecast Outlook 2025 to 2035

Market Share Breakdown of Snap Sachets Manufacturers

Pouch Filler Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Auger Filler Market Growth - Trends & Forecast 2025 to 2035

ASEAN Sachet Packaging Market Analysis – Size, Share & Forecast 2025-2035

Japan Sachet Packaging Market Outlook – Share, Growth & Forecast 2025-2035

Global Wound Filler Market Analysis – Size, Share & Forecast 2024-2034

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA